Global Wood Fencing Market Size, Share and Report Analysis By Product (Picket, Rail And Post, Vertical Board, Others), By Species (Cedar, Douglas fir, Redwood, Whitewood, Others), By Coating (Stained, Non-Stained), By Application (Residential, Agricultural, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175477

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

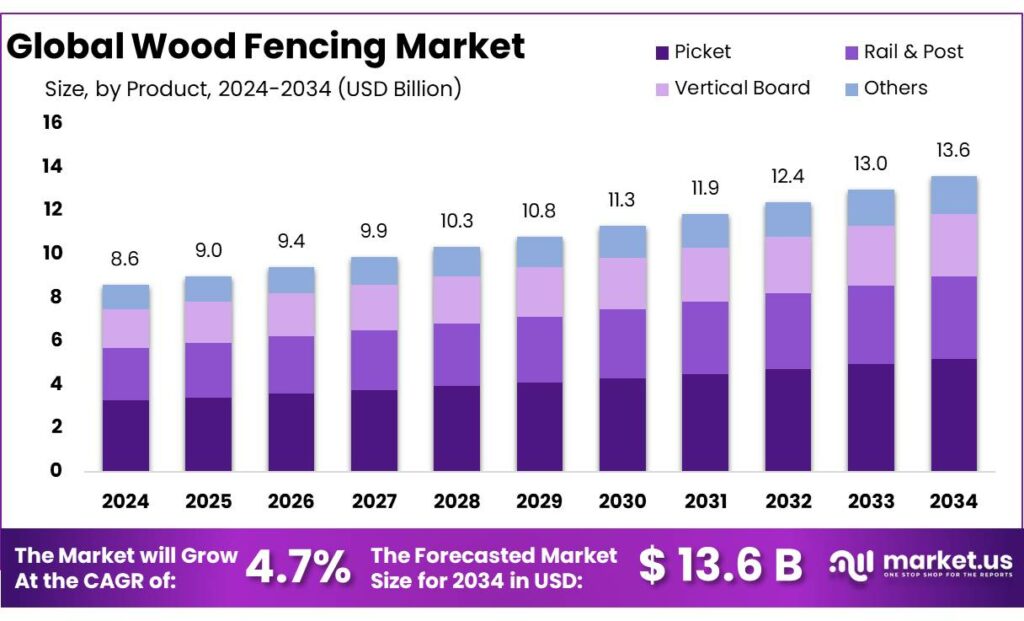

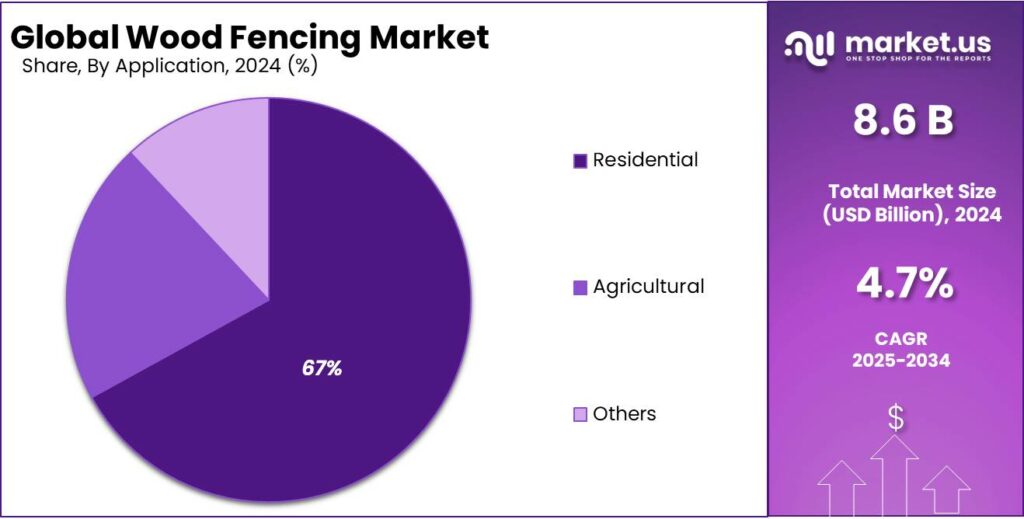

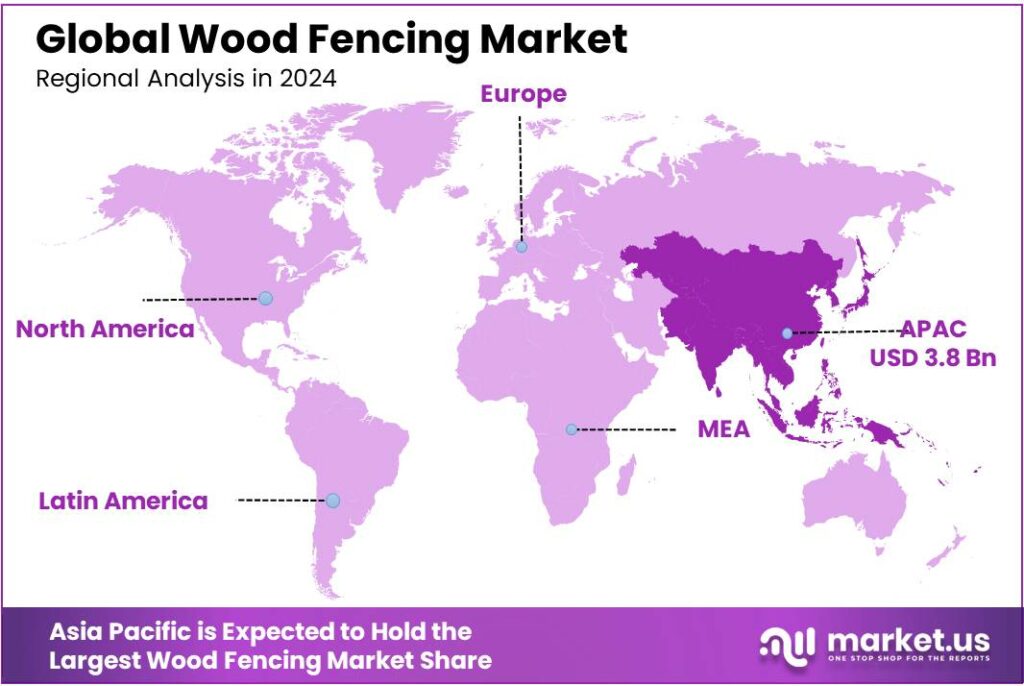

Global Wood Fencing Market size is expected to be worth around USD 13.6 Billion by 2034, from USD 8.6 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 44.7% share, holding USD 3.8 Billion in revenue.

Wood fencing sits at the intersection of residential construction, outdoor living, and the broader forest-products value chain. It remains a mainstream boundary and privacy solution because it is familiar, repairable, and design-flexible across budgets—from simple picket layouts to taller privacy fences and decorative screens. At the upstream level, the industry depends on a steady flow of roundwood; global roundwood removals have been about 4 billion m³ per year in recent years, which underlines how closely fencing demand ties back to forestry supply, processing capacity, and responsible sourcing expectations.

From an industry scenario perspective, wood fencing demand typically tracks two large spend pools: new homebuilding and repair/remodeling. In the U.S., privately owned housing starts in October 2025 ran at a seasonally adjusted annual rate of 1,246,000 units, while permits were 1,412,000—a leading indicator for near-term construction activity. In parallel, the renovation cycle remains structurally supportive: Harvard’s Joint Center for Housing Studies notes homeowner remodeling spending is expected to reach $524 billion in early 2026, suggesting continued momentum for replacement fences, upgrades tied to curb appeal, and outdoor living improvements.

Key driving factors include stay-put behavior that shifts budgets from moving to improving, the steady normalization of outdoor living spaces, and the need for privacy, safety, and pet containment in higher-density suburban layouts. Material availability and pricing are also shaped by the wider wood-products economy: FAO reports global exports of wood and paper products increased 1.4% to $486 billion in 2024, signaling improving trade flows that can influence input availability and cost stability across wood-based categories used in fencing.

At the same time, fencing benefits when homeowners choose to improve rather than move; Harvard’s Joint Center for Housing Studies increased its projection for the U.S. remodeling market size in 2025 by $30 billion to about $509 billion, reinforcing the steady addressable base for backyard and perimeter upgrades. In the United States, for example, official construction indicators show continued activity: privately owned housing starts were running at a seasonally adjusted annual rate of about 1,246,000 in October 2025, while permits were about 1,412,000, signaling an ongoing pipeline for exterior projects that often include fences.

Key Takeaways

- Wood Fencing Market size is expected to be worth around USD 13.6 Billion by 2034, from USD 8.6 Billion in 2024, growing at a CAGR of 4.7%.

- Picket held a dominant market position, capturing more than a 38.5% share.

- Cedar held a dominant market position, capturing more than a 42.6% share.

- Stained held a dominant market position, capturing more than a 59.1% share.

- Residential held a dominant market position, capturing more than a 67.2% share.

- Asia Pacific Dominates the Wood Fencing Market with 44.7%, Valued at USD 3.8 Bn.

By Product Analysis

Picket Wood Fencing Leads the Market with a Strong 38.5% Share in 2024

In 2024, Picket held a dominant market position, capturing more than a 38.5% share, driven by its classic look, durability, and ability to blend easily with both modern and traditional home designs. Homeowners continued choosing picket fencing as it offers both boundary definition and visual appeal without fully blocking views. Rising renovation activities in residential areas further pushed its adoption, especially across the U.S., Canada, and parts of Europe where wooden aesthetic themes remained popular.

By Species Analysis

Cedar Wood Fencing Leads the Market with a Strong 42.6% Share in 2024

In 2024, Cedar held a dominant market position, capturing more than a 42.6% share, mainly because of its natural resistance to moisture, insects, and decay. Homeowners favored cedar for its long lifespan, warm appearance, and ability to maintain structural integrity without heavy chemical treatments. The rise in residential renovations and outdoor landscaping projects further supported its strong adoption, especially in regions with variable weather conditions where durability is a key buying factor.

By Coating Analysis

Stained Wood Fencing Dominates the Market with a Strong 59.1% Share in 2024

In 2024, Stained held a dominant market position, capturing more than a 59.1% share, as homeowners increasingly preferred stained coatings for their ability to enhance wood grains while offering long-lasting protection. Stained finishes provide a balance of beauty and durability, helping fences withstand sunlight, moisture, and seasonal weather changes. This made stained wood a top choice for residential landscaping projects, especially in regions with high humidity or harsh summers where untreated wood ages faster.

By Application Analysis

Residential Applications Lead the Wood Fencing Market with a Strong 67.2% Share in 2024

In 2024, Residential held a dominant market position, capturing more than a 67.2% share, driven by rising home renovations, outdoor improvement trends, and increasing investments in privacy and security solutions. Homeowners continued to choose wood fencing for its natural look, affordability, and ability to blend seamlessly with different architectural styles. Suburban expansion and growing property ownership, particularly in North America and parts of Europe, further boosted demand for wood fencing in residential landscapes.

Key Market Segments

By Product

- Picket

- Rail & Post

- Vertical Board

- Others

By Species

- Cedar

- Douglas fir

- Redwood

- Whitewood

- Others

By Coating

- Stained

- Non-Stained

By Application

- Residential

- Agricultural

- Others

Emerging Trends

Growing city gardens and local food projects are shaping a new trend in wood fencing use, tied to food systems and waste reduction

One of the latest trends in the wood fencing market is its growing role around urban agriculture, community gardens, and local food production spaces — a shift that blends landscaping with food access and sustainability efforts in towns and cities. This trend is not just about aesthetics anymore; it reflects how communities are rethinking outdoor spaces to support growing, distributing, and protecting food closer to where people live.

Urban agriculture has expanded beyond occasional backyard plots into organized community gardens, school farms, and shared green spaces. The U.S. Department of Agriculture (USDA) actively supports urban and innovative food production through grants, technical help, and program guidance aimed at small-scale and community growers. These include Urban Agriculture and Innovative Production programs that assist rooftop farms, community gardens, and outdoor growing areas with tools, planning assistance, and sometimes infrastructure support.

The food system context around this trend matters, too. Globally, countries are increasingly focused on food loss and waste as part of wider sustainability goals. For example, in the United States alone, USDA estimates that roughly 30–40 percent of food produced is lost or wasted across retail and consumer stages of the supply chain. This amounts to hundreds of billions of pounds of food that never gets eaten each year, creating environmental strain and economic loss.

Drivers

Homeowners’ renovation boom is pushing wood fencing demand, with remodeling spending projected at $608 billion in 2025

A major driver for the wood fencing market is the steady wave of home improvement and “stay-put” remodeling. When families upgrade a backyard, add a patio, improve curb appeal, or refresh property boundaries, fencing often becomes a practical add-on—especially for privacy, pets, and child safety. What makes this driver powerful is the scale of renovation activity. Harvard’s Joint Center for Housing Studies tracks the US remodeling market and shows it surged to $611 billion in 2022, stayed high at $603 billion in 2024, and is expected to remain above $600 billion in 2025, forecast at $608 billion.

In 2024, homeowners continued putting money into improvements because moving is costly and housing stock is aging. The same Harvard report notes the country has 145 million homes, which naturally increases ongoing repair and upgrade needs—from exterior touch-ups to full backyard refreshes. In simple terms: older homes need more work, and outdoor projects tend to come in “bundles.”

Another layer supporting this same driver is repair spending tied to severe weather. The Harvard report shows homeowner spending for disaster repairs totaled $49 billion in 2022–2023 (inflation-adjusted), reflecting higher repair activity after events like storms and flooding. Fences are often among the first outdoor structures damaged, so repair cycles can create a steady stream of replacement and reinforcement projects.

Restraints

Rising Lumber Prices and Inflation Push Up Costs, Slowing Wood Fencing Adoption

One major restraining factor for the wood fencing market is the continued rise in lumber and construction material costs, which has made wood fencing less affordable for many homeowners and small builders. Over the past few years, sharp price increases in key inputs like softwood lumber have put pressure on budgets, encouraging some to delay projects or choose alternative materials such as vinyl or metal. This trend is rooted in broader shifts in supply and demand that extend across the construction sector, including the housing market and food industries that also grapple with material and transportation cost inflation.

In simple terms, when basic materials cost more, people build less—or choose cheaper options. Lumber is a foundational material for wood fencing, and its price has seen significant volatility. According to data from the U.S. Bureau of Labor Statistics (BLS), the Producer Price Index (PPI) for lumber and wood products rose dramatically in recent years, reflecting tight supply and high demand. For example, the PPI for lumber was around 698.3 in early 2022, surged over the next couple of years, and remained elevated compared to historical norms through 2024 and into 2025. Higher index numbers mean producers are paying more for raw materials and passing some of those costs on to consumers.

Households feeling the pinch from inflationary pressures have also cut back on discretionary spending, which includes outdoor improvement projects like fencing. The U.S. Consumer Price Index (CPI) showed that, by 2024, overall inflation had risen significantly compared to pre-pandemic levels. For example, the CPI for all items was up roughly 3.4% year-over-year by the end of 2024, even after monetary policy efforts to slow inflation. Higher prices for everyday goods like food, fuel, and energy mean less leftover budget for home upgrades, including installing or replacing wood fences.

Opportunity

Urban farming and local food projects are opening a new growth lane for wood fencing, backed by USDA funding

A major growth opportunity for the wood fencing market is the steady expansion of urban agriculture and local food systems. As more cities invest in community gardens, small urban farms, school gardens, and neighborhood growing spaces, the need for safe, clearly marked boundaries grows too. In real life, these projects often face the same issues: keeping out stray animals, reducing vandalism, managing foot traffic, and protecting crops. Wood fencing fits well here because it is easy to install, repair, and customize for small plots—without making the space feel industrial.

This opportunity becomes stronger because it is being supported by public programs tied to food access and local production. In 2024, USDA opened applications for its Urban Agriculture and Innovative Production (UAIP) grants, encouraging projects that build or expand urban growing efforts. In 2025, USDA went further and announced a total of $14.4 million in grants and technical assistance funding for urban agriculture and innovative production. Within that, USDA noted $2.5 million available for UAIP grants and highlighted that the office had invested $53.7 million in UAIP grant projects since 2020.

The same growth lane is visible in the wider local food economy, where more producers are selling closer to home and building small-scale, customer-facing spaces that require clean, welcoming boundaries. USDA data on direct farm sales shows U.S. local food sales across channels at $9 billion, including direct-to-consumer sales of $2.9 billion. Within those direct-to-consumer sales, on-farm stores and farmers markets accounted for $1.7 billion.

Regional Insights

Asia Pacific Dominates the Wood Fencing Market with 44.7%, Valued at USD 3.8 Bn

In 2024, Asia Pacific led the wood fencing market, supported by rapid residential expansion, strong renovation activity, and ongoing public investment in housing and local infrastructure. The region hosts a massive and still-growing urban base—UN-Habitat notes that more than 2.2 billion people live in urban areas across Asia, and urban population is projected to keep rising sharply over the long term, which steadily lifts demand for boundary, privacy, and safety solutions around homes and community spaces.

A second support layer is government-backed housing delivery that pushes fencing needs in new settlements and upgraded neighborhoods. In India, the government has extended PMAY-Urban completion timelines to 31 December 2025 for houses sanctioned under the earlier phase, keeping urban housing execution active through 2025. On the rural side, an official government release reported 2.82 crore houses completed under PMAY-Gramin as of August 2025, indicating continued construction momentum where fencing is commonly used for plot definition and livestock/pet control.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Jacksons Fencing is a sizeable UK fencing manufacturer with the scale to serve large domestic and commercial jobs. Latest filed figures show 291 employees and annual turnover of £36.84M, supported by total assets of £29.49M and cash of £6.16M. That balance-sheet strength helps it invest in stock availability, treatment quality, and faster lead times when demand spikes.

Treeway Fencing operates as a focused, mid-sized UK player, typically strong in repeat trade orders and local project supply. Recent financial snapshot data shows 48 employees, total assets of £3.58M, net assets of £1.21M, and cash in bank of £788.24K (period ended 31 Mar 2025). Its lean size can support quicker decision-making and flexible production planning.

Travis Perkins brings distribution muscle that supports fencing demand through timber and building-material channels. In 2024, it reported revenue of £4,607m and adjusted operating profit of £152m. The group operates at national scale with around c.1,400 branches and c.17,000 employees, helping it serve both trade and repair/renovation buyers with consistent availability and logistics reach.

Top Key Players Outlook

- Jacksons Fencing

- Treeway Fencing Ltd

- Wilfirs

- Travis Perkins

- Bekaert

- Seven Trust

- Sierra Pacific Industries

- Mendocino Forest Products Company, LLC (MFP)

- Redwood Empire Sawmill

- L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench

- BarretteWood

- SPEC Wood Inc.

Recent Industry Developments

In September 30, 2024, the parent company H.S. Jackson & Son (Fencing) Limited reported a turnover of £36.84 million, with 291 employees, £6.16 million cash in bank, and £29.49 million in total assets, reflecting a slight reduction in sales but growth in net assets year-on-year.

In 31 December 2024, Travis Perkins plc reported total revenue of £4,607 million (about a 4.7% decrease versus 2023) in its full-year financial results, reflecting broader construction market weakness that also affects demand for fencing and landscaping materials.

Report Scope

Report Features Description Market Value (2024) USD 8.6 Bn Forecast Revenue (2034) USD 13.6 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Picket, Rail And Post, Vertical Board, Others), By Species (Cedar, Douglas fir, Redwood, Whitewood, Others), By Coating (Stained, Non-Stained), By Application (Residential, Agricultural, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Jacksons Fencing, Treeway Fencing Ltd, Wilfirs, Travis Perkins, Bekaert, Seven Trust, Sierra Pacific Industries, Mendocino Forest Products Company, LLC (MFP), Redwood Empire Sawmill, L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench, BarretteWood, SPEC Wood Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Jacksons Fencing

- Treeway Fencing Ltd

- Wilfirs

- Travis Perkins

- Bekaert

- Seven Trust

- Sierra Pacific Industries

- Mendocino Forest Products Company, LLC (MFP)

- Redwood Empire Sawmill

- L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench

- BarretteWood

- SPEC Wood Inc.