Global Veterinary Infectious Disease Diagnostics Market By Technology (Immunodiagnostics (Lateral Flow Assays, ELISA Test and Others), Molecular Diagnostics and Other Technologies), By Animal (Companion Animals and Livestock), By Infection Type (Bacterial, Viral, Parasitic and Others), By End User (Reference Laboratories, Veterinary Hospitals & Clinics, and Point-of-Care/In-House Testing), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153993

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

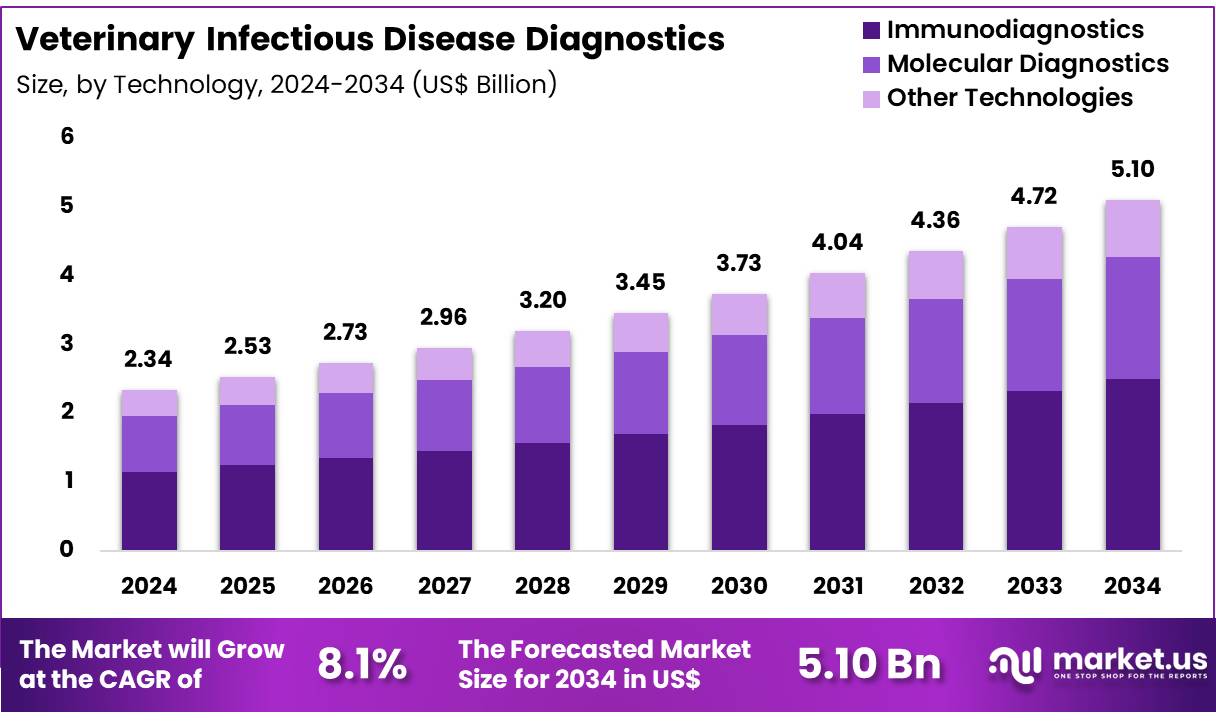

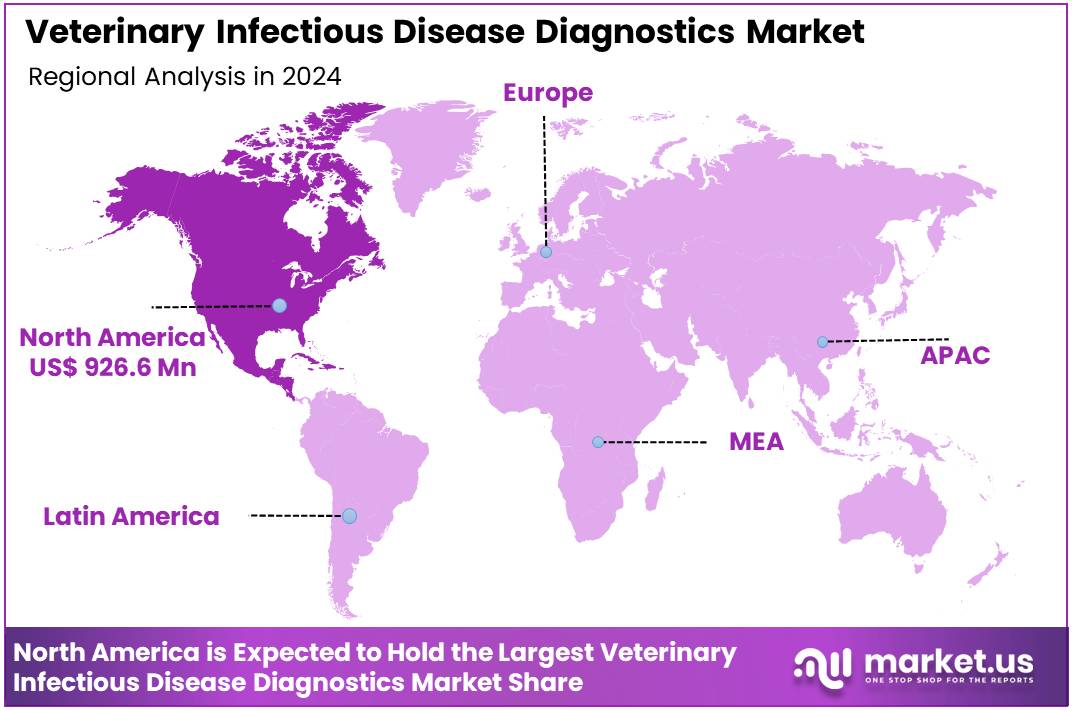

Global Veterinary Infectious Disease Diagnostics Market size is expected to be worth around US$ 5.10 Billion by 2034 from US$ 2.34 Billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 926.6 Billion.

Veterinary diagnostic laboratories offer a broad range of tests for infectious agents, often with multiple testing options for specific pathogens. Selecting the right test, determining the optimal sample type, and identifying the appropriate animal to sample are essential for accurate diagnosis. Each diagnostic test comes with its own sensitivity and specificity, and in many cases, multiple tests are needed for accurate interpretation.

When large populations, such as animals in shelters, farms, or breeding colonies, require testing, the cost of diagnostics becomes a significant concern. Therefore, understanding when and how to use aggregate or composite samples is crucial. A clinical examination is the primary and most important diagnostic step, setting the foundation for choosing the appropriate laboratory tests.

The Veterinary Infectious Disease Diagnostics Market is experiencing significant growth driven by rising concerns over animal health and increasing demand for accurate diagnostic solutions. Technological advancements in diagnostic methods, including PCR, immunodiagnostics, and molecular diagnostics, are enhancing the ability to detect a wide range of infectious diseases in both companion animals and livestock.

The market is expanding due to the growing adoption of these technologies in veterinary clinics, reference laboratories, and point-of-care testing settings. Increasing pet ownership, as well as the need to prevent zoonotic diseases in livestock, has spurred demand for early detection methods. Additionally, governments and regulatory bodies are pushing for the implementation of stricter disease control measures, further fueling market growth.

However, the high cost of diagnostic equipment and reagents remains a significant challenge, particularly in emerging economies. Despite this, advancements in point-of-care testing and AI integration present substantial opportunities for market expansion in the coming years.

Veterinary diagnostics are advancing rapidly, with AI offering the potential to make tests faster, smarter, and more accurate. Innovations like Vetscan OptiCell and Vetscan Imagyst are revolutionizing blood analysis and imaging. In September 2024, Zoetis Inc., the global leader in animal health, is preparing to launch its new hematology analyzer, Vetscan OptiCell™.

This cartridge-based, AI-powered diagnostic tool offers advanced Complete Blood Count (CBC) analysis. Set to debut in the U.S. later this year, the analyzer marks a major technological advancement, providing significant time, cost, and space savings for veterinary care teams. Its introduction aims to improve patient outcomes and enhance clinic workflows, promoting greater efficiency in veterinary practices.

AI is also contributing to advancements in urinalysis and imaging. By integrating AI into diagnostic platforms, veterinary practices can ease the workload on staff while improving their capacity to diagnose and treat a broader array of conditions. Furthermore, connectivity solutions are enhancing data accessibility, ensuring that veterinarians have immediate access to crucial information for making timely and effective clinical decisions.

Key Takeaways

- In 2024, the market for Veterinary Infectious Disease Diagnostics generated a revenue of US$ 2.34 billion, with a CAGR of 8.1%, and is expected to reach US$ 5.10 billion by the year 2034.

- The technology segment is divided into Immunodiagnostics (Lateral Flow Assays, ELISA Test and Others), Molecular Diagnostics, and Other Technologies with Immunodiagnostics taking the lead in 2024 with a market share of 49.1%.

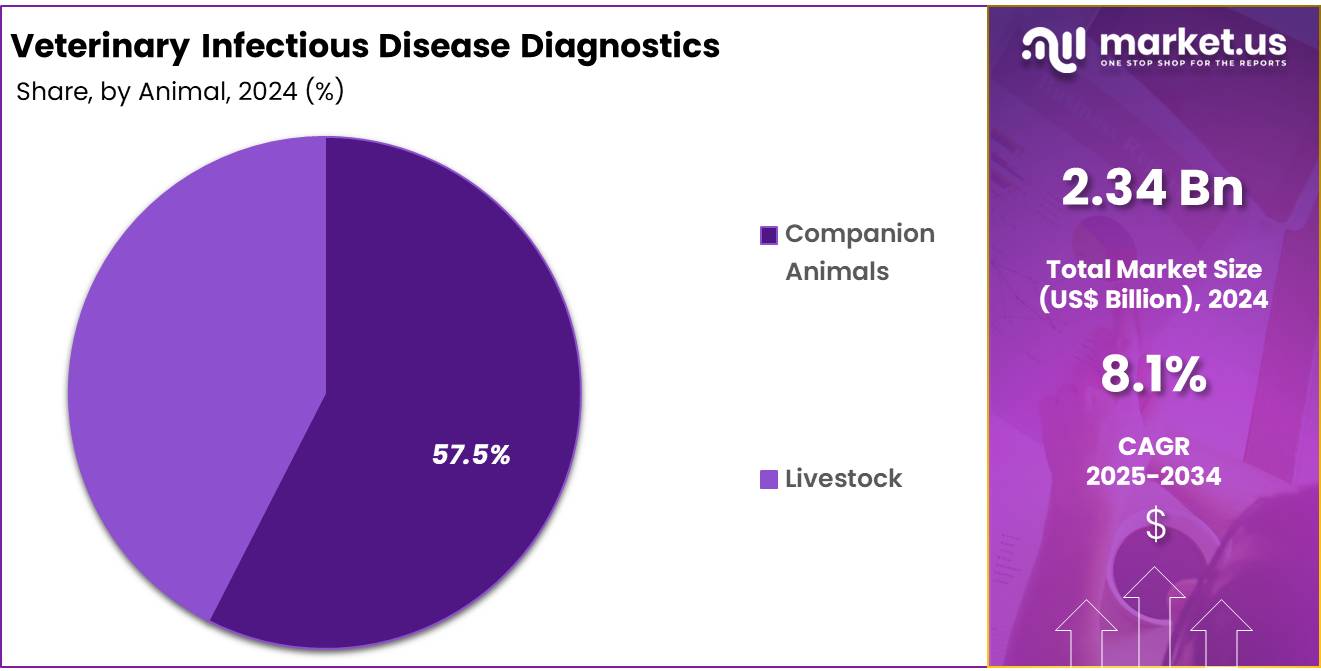

- By Animal, the market is bifurcated into Companion Animals, and Livestock, with Companion Animals leading the market with 57.5% of market share.

- Furthermore, concerning the Infection Type segment, the market is segregated into Bacterial, Viral, Parasitic, and Others. Bacterial infections stands out as the dominant segment, holding the largest revenue share of 39.8% in the Veterinary Infectious Disease Diagnostics market.

- Additionally, the end user segment is classified into Reference Laboratories, Veterinary Hospitals & Clinics, and Point-of-Care/In-House Testing, with Reference Laboratories taking the lead in 2024 with 46.8% market share.

- North America led the market by securing a market share of 39.6% in 2024.

Technology Analysis

In the Veterinary Infectious Disease Diagnostics Market, the Immunodiagnostics segment is currently the dominant segment accounting for 49.1% market share in 2024, largely due to its widespread use, cost-effectiveness, and rapid results. Immunodiagnostic techniques, such as enzyme-linked immunosorbent assays (ELISA) and lateral flow assays, are popular for detecting specific antibodies or antigens associated with infectious diseases in animals.

These methods are particularly effective for diagnosing bacterial and viral infections, offering quick results with minimal equipment requirements. Immunodiagnostics is favored by veterinary clinics and laboratories due to its ease of use, speed, and affordability compared to more complex techniques like molecular diagnostics.

The segment’s dominance is further supported by its ability to detect a variety of pathogens in both companion animals and livestock, making it suitable for widespread use in rural and low-resource settings. While molecular diagnostics, such as PCR, are gaining traction due to their higher sensitivity, immunodiagnostics remains the preferred choice for many due to its proven effectiveness and lower cost.

As a result, the immunodiagnostics segment is expected to continue leading the market in terms of market share and adoption rates. In March 2025, VolitionRx Limited, a global leader in epigenetics, has announced the expansion of its Nu.Q Vet Cancer Test supply agreement with Fujifilm Vet Systems Co. Ltd in Japan. The updated agreement will now include Volition’s chemiluminescent immunoassay (ChLIA) version of the test, which will be available through the Immunodiagnostic Systems (IDS) i10® automated analyzer platform. This extension marks the beginning of a new five-year initial term for the agreement.

Animal Analysis

In the Veterinary Infectious Disease Diagnostics Market, the Companion Animals segment is the dominant category accounting for 57.5% market share. This is driven by the increasing ownership of pets and the growing awareness of their health needs. Companion animals, including dogs, cats, and horses, are often treated with a high degree of care, with pet owners becoming more proactive in seeking veterinary diagnostics for disease prevention and treatment.

Additionally, the rise of pet insurance and an increasing focus on animal welfare further boost the demand for diagnostic solutions. In September 2023, Ceva Santé Animale (Ceva), the fifth-largest global animal health company with a presence in 110 countries, is excited to announce the launch of its highly anticipated 2024 “Call for Projects.” This global initiative is designed to identify and support innovative solutions aimed at enhancing the well-being and care of companion animals and their pet owners.

Immunodiagnostic tests, molecular diagnostics, and rapid diagnostic tests are frequently employed to detect infections in companion animals, particularly with the increasing concern over zoonotic diseases. As companion animal care becomes more advanced and owners become more invested in maintaining their pets’ health, this segment is expected to continue dominating the market.

The growing need for advanced diagnostic facilities that provide rapid and accurate testing is driving the expansion of the companion animal diagnostics market during the forecasted period. Market growth is further fueled by approvals and new product launches from key industry players to meet the rising demand. Companies are actively working to develop innovative devices to capitalize on the market’s significant growth potential.

Infection Type Analysis

The Bacterial infection segment held the dominant position in the Veterinary Infectious Disease Diagnostics Market with 39.8% of market share. Bacterial infections are among the most common in both companion animals and livestock, making early and accurate diagnosis critical for effective treatment and disease control. According to a study published on NCBI in August 2022, a total of 3,135 bacteria were isolated from various specimens, including diarrheal stool, skin, urine, and respiratory samples, during a nationwide surveillance study on sick dogs visiting veterinary hospitals.

Bacterial isolation was most frequent in diarrheal stool and skin samples, accounting for 90.8% of all recoveries. When comparing bacterial prevalence across different age groups, the highest prevalence was observed in two age groups (1–5 years and 6–10 years), with an overall prevalence of 66.5%. Notably, the proportion of bacteria recovered from respiratory samples remained consistent across all age groups of dogs.

Diseases like bovine mastitis, kennel cough, and salmonella in poultry are widespread, prompting veterinarians to invest in diagnostic solutions capable of detecting bacterial pathogens quickly. Diagnostic methods such as PCR, ELISA, and lateral flow assays are commonly used for bacterial infection detection. The significant impact of bacterial infections on animal health and the agricultural economy drives the strong demand for diagnostic tools in this segment. As the veterinary field continues to prioritize infection prevention and management, bacterial infections are expected to remain the most commonly diagnosed infectious diseases in animals, leading this market segment.

End User Analysis

The Reference Laboratories segment is the dominant category in the Veterinary Infectious Disease Diagnostics Market which held 46.8% of market share. These laboratories play a critical role in conducting advanced diagnostic tests for a wide range of animal diseases, particularly for complex or rare infections that may require specialized testing. Reference laboratories are equipped with the latest diagnostic technologies, including PCR, molecular diagnostics, and immunodiagnostic assays, to provide high-precision results.

Veterinarians and research institutions rely on these laboratories for comprehensive disease analysis, outbreak surveillance, and epidemiological studies. As these laboratories maintain their critical position in diagnosing severe and complex veterinary diseases, their continued expansion and technological advancements make this segment the leading one in the market. Furthermore, regulatory agencies often mandate diagnostic results from reference labs, further reinforcing their dominance in this space.

Key Market Segments

By Technology

- Immunodiagnostics

- Lateral Flow Assays

- ELISA Test

- Others

- Molecular Diagnostics

- Other Technologies

By Animal

- Companion Animals

- Livestock

By Infection Type

- Bacterial

- Viral

- Parasitic

- Others

By End User

- Reference Laboratories

- Veterinary Hospitals & Clinics

- Point-of-Care/In-House Testing

Drivers

Increasing Animal Health Awareness

The growing awareness about animal health and the need for timely diagnostics is one of the primary drivers of the Veterinary Infectious Disease Diagnostics Market. This surge in awareness can be attributed to the increasing global demand for livestock and companion animals, leading to a rise in the incidence of infectious diseases. As pet ownership continues to grow, owners are becoming more conscious of the importance of early disease detection, prompting veterinarians to adopt advanced diagnostic technologies.

This heightened awareness also extends to the livestock industry, where preventing the spread of diseases like avian influenza, bovine tuberculosis, and swine flu is critical for both animal welfare and economic stability. The increasing emphasis on the prevention of zoonotic diseases, which can transfer from animals to humans, has further strengthened the demand for effective veterinary diagnostic solutions.

Governments and organizations are increasingly implementing regulatory measures, incentivizing the use of diagnostic tests to control outbreaks. This driver is expected to accelerate the adoption of technologies like PCR, immunodiagnostics, and molecular diagnostics, further expanding the market.

Restraints

High Cost of Diagnostic Equipment

One of the key restraints hindering the growth of the Veterinary Infectious Disease Diagnostics Market is the high cost of diagnostic equipment and reagents. Diagnostic instruments, especially those using advanced technologies like PCR and molecular diagnostics, often require significant upfront investments. Smaller veterinary practices, especially in developing regions, face challenges in affording these high-tech solutions.

The costs associated with maintaining and calibrating sophisticated equipment also contribute to the financial burden. Additionally, reagents and consumables, which are essential for running diagnostic tests, can be costly, especially for high-volume testing. The need for specialized staff to operate these diagnostic systems further raises operational costs. These financial challenges can deter smaller veterinary clinics, especially in rural or low-income areas, from adopting cutting-edge diagnostic tools.

As a result, the market’s growth potential may be limited in regions where economic constraints hinder access to modern diagnostic technologies. Although advancements in diagnostic devices are becoming more affordable, the initial cost remains a significant restraint to widespread adoption. For instance, a typical X-ray machine for a veterinary clinic costs approximately $25,000; more advanced digital systems can range between $20,000 and $100,000 depending on features and technology.

Opportunities

Advancements in Point-of-Care Testing

The rise of point-of-care (POC) diagnostic testing represents a significant opportunity in the Veterinary Infectious Disease Diagnostics Market. POC testing offers a convenient, fast, and cost-effective way for veterinarians to diagnose infectious diseases without the need for centralized laboratory testing. This is particularly valuable in rural areas or remote locations where access to laboratory services is limited.

POC devices, such as rapid diagnostic kits and portable PCR machines, allow veterinarians to obtain results quickly, which is crucial for making timely decisions about treatment and management. This technology is increasingly being integrated into veterinary practices, enabling more efficient and immediate care for both companion animals and livestock. As POC testing becomes more affordable and reliable, its adoption is expected to increase, particularly in emerging markets.

Furthermore, POC testing’s ability to detect a wide range of infectious diseases with minimal training requirements provides a substantial opportunity for market growth. For instance, in January 2023, GE HealthCare and Sound Technologies, a global leader in veterinary imaging, announced a distribution agreement for the Vscan Air™. This advanced, wireless, pocket-sized ultrasound device offers high-quality imaging, comprehensive whole-patient scanning capabilities, and user-friendly software. The device will be made available to veterinary practices across the United States.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors, such as economic growth, inflation rates, and disposable income, directly impact the demand for veterinary diagnostics. In times of economic prosperity, pet ownership increases, and there is a higher expenditure on animal healthcare, including diagnostics. The rise in disposable income also enables pet owners to seek more advanced diagnostic options for their animals.

Conversely, during economic downturns, reduced spending on healthcare may hinder the adoption of high-cost diagnostic solutions, especially in emerging markets where budget constraints are more prevalent. Additionally, the costs of reagents, diagnostic kits, and equipment are sensitive to inflation, which can increase the overall cost of veterinary diagnostics, limiting accessibility in lower-income regions.

Geopolitical factors play a crucial role in shaping the market as well. Trade policies, tariffs, and geopolitical tensions can impact the supply chain for diagnostic materials, particularly in countries reliant on imported reagents and equipment. For instance, disruptions caused by trade wars or sanctions could lead to increased costs or shortages of essential diagnostic tools.

Furthermore, geopolitical instability, such as outbreaks of diseases in livestock, can lead to heightened demand for diagnostic services to prevent the spread of infectious diseases. Governments may implement stricter regulations and funding to improve veterinary disease control programs, boosting the demand for diagnostic technologies.

Latest Trends

Integration of Artificial Intelligence (AI) in Diagnostics

A notable trend in the Veterinary Infectious Disease Diagnostics Market is the integration of artificial intelligence (AI) and machine learning (ML) technologies in diagnostic tools. AI-powered platforms are being increasingly used to analyze diagnostic data, offering faster and more accurate results than traditional methods. AI can assist in automating the interpretation of complex test results, reducing human error, and speeding up the decision-making process. In particular, AI-driven algorithms can be used to analyze patterns in veterinary disease outbreaks, predict disease spread, and even suggest preventive measures based on historical data.

The integration of AI into diagnostic equipment also allows for more precise detection of infectious agents, enhancing the effectiveness of veterinary diagnostics. Additionally, AI tools are being used to enhance molecular diagnostics, improving sensitivity and specificity for a variety of pathogens. As the healthcare sector increasingly embraces AI for diagnostics, veterinary practices are also following suit, integrating AI solutions to improve accuracy, efficiency, and outcomes.

In June 2025, Zoetis Inc., the global leader in animal health, introduced AI Masses, the latest addition to the Vetscan Imagyst analyzer. AI Masses accurately detects potentially neoplastic cells, helping veterinary professionals make informed decisions while streamlining diagnoses and clinic workflows. This new indication enhances Zoetis’ digital cytology offerings by providing fast and precise AI analysis of lymph node and skin/subcutaneous masses, delivering results within minutes.

Regional Analysis

North America is leading the Veterinary Infectious Disease Diagnostics Market

The market in North America is poised for significant growth with majority share of the market of 39.6%, driven by high pet ownership rates: over 67% of U.S. households own pets, leading to increased demand for veterinary services and diagnostics.

Advanced Veterinary Infrastructure: The presence of state-of-the-art veterinary clinics and diagnostic laboratories facilitates the adoption of advanced diagnostic technologies. Programs aimed at controlling zoonotic diseases and promoting animal health contribute to market growth. In November 2022, VolitionRx Limited, a multinational epigenetics company, announced the launch of its Nu.Q Vet Cancer Screening Test in the U.S., with a forthcoming launch in Europe. This will be facilitated through Heska Corporation, a leading global provider of advanced veterinary diagnostics, via Heska’s veterinary diagnostic laboratories.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Veterinary Infectious Disease Diagnostics market includes IDEXX Laboratories, Inc., Zoetis Inc., Thermo Fisher Scientific Inc., bioMérieux S.A., Neogen Corporation, Virbac, Randox Laboratories Ltd., INDICAL Bioscience GmbH, IDvet, Heska Corporation, QIAGEN N.V., Antech Diagnostics, Eurofins Technologies, QuidelOrtho, Fujifilm Wako Pure Chemical Corporation, Mindray Bio-Medical Electronics Co., Ltd., BioNote, Inc., Agrolabo S.p.A., Abbott Laboratories, Danaher Corporation, and Other key players.

IDEXX Laboratories, Inc. is a leader in veterinary diagnostics, offering a broad range of diagnostic tests, including immunodiagnostics, molecular diagnostics, and point-of-care tools. Their popular platforms like SNAP tests and VetTest provide rapid, accurate results. IDEXX serves companion animals, livestock, and poultry, offering diagnostic solutions to improve disease management. Zoetis Inc. is a major player in animal health, providing diagnostic solutions for both companion animals and livestock.

The company’s offerings include molecular diagnostics, immunodiagnostic assays, and diagnostic reagents. Known for tests on diseases like avian influenza and canine parvovirus, Zoetis also integrates diagnostic solutions with practice management software, enabling faster decision-making.

Thermo Fisher Scientific Inc. is a global provider of diagnostic tools for veterinary infectious disease detection. Their portfolio includes molecular diagnostics such as PCR-based tests, enabling precise detection of diseases in animals. Thermo Fisher’s advanced technologies are used across livestock, poultry, and companion animal diagnostics.

Top Key Players

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- bioMérieux S.A.

- Neogen Corporation

- Virbac

- Randox Laboratories Ltd.

- INDICAL Bioscience GmbH

- IDvet

- Heska Corporation

- QIAGEN N.V.

- Antech Diagnostics

- Eurofins Technologies

- QuidelOrtho

- Fujifilm Wako Pure Chemical Corporation

- Mindray Bio-Medical Electronics Co., Ltd.

- BioNote, Inc.

- Agrolabo S.p.A.

- Abbott Laboratories

- Danaher Corporation

- Other Prominent Players

Recent Developments

- In May 2025, Zoetis Inc., the global leader in animal health, has announced the opening of its newest and largest diagnostics reference laboratory at the UPS Healthcare Labport facility at Louisville Muhammad Ali International Airport. The ribbon-cutting ceremony, attended by Kentucky Governor Andy Beshear and state representatives, marked this strategic expansion. This milestone reflects Zoetis’ continued investment in diagnostics innovation, designed to enhance animal care by providing faster, more precise, and accessible testing services for veterinarians and pet owners across the United States.

- In January 2025, IDEXX Laboratories, Inc., a global leader in pet healthcare innovation announced the launch of IDEXX Cancer Dx, a groundbreaking diagnostic panel designed for the early detection of lymphoma in dogs, particularly targeting the 20 million dogs in North America at higher risk for cancer. IDEXX Cancer Dx is an affordable and accessible blood test that can be added to existing panels for sick pets or included in annual wellness screenings, priced as low as US$15. The test provides veterinarians in the U.S. with actionable results within 2–3 days.

- In September 2023, Mars, Incorporated announced the completion of its acquisition of the assets of SYNLAB Vet from SYNLAB Group. SYNLAB Vet is now part of Mars Petcare’s Science & Diagnostics division, enhancing the company’s diagnostic and technology capabilities. This acquisition will accelerate research and development, as well as expand global access to pet healthcare solutions.

Report Scope

Report Features Description Market Value (2024) US$ 2.34 Billion Forecast Revenue (2034) US$ 5.10 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Immunodiagnostics (Lateral Flow Assays, ELISA Test and Others), Molecular Diagnostics and Other Technologies), By Animal (Companion Animals and Livestock), By Infection Type (Bacterial, Viral, Parasitic and Others), By End User (Reference Laboratories, Veterinary Hospitals & Clinics, and Point-of-Care/In-House Testing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IDEXX Laboratories, Inc., Zoetis Inc., Thermo Fisher Scientific Inc., bioMérieux S.A., Neogen Corporation, Virbac, Randox Laboratories Ltd., INDICAL Bioscience GmbH, IDvet, Heska Corporation, QIAGEN N.V., Antech Diagnostics, Eurofins Technologies, QuidelOrtho, Fujifilm Wako Pure Chemical Corporation, Mindray Bio-Medical Electronics Co., Ltd., BioNote, Inc., Agrolabo S.p.A., Abbott Laboratories, Danaher Corporation, and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Infectious Disease Diagnostics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Infectious Disease Diagnostics MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IDEXX Laboratories, Inc.

- Zoetis Inc.

- Thermo Fisher Scientific Inc.

- bioMérieux S.A.

- Neogen Corporation

- Virbac

- Randox Laboratories Ltd.

- INDICAL Bioscience GmbH

- IDvet

- Heska Corporation

- QIAGEN N.V.

- Antech Diagnostics

- Eurofins Technologies

- QuidelOrtho

- Fujifilm Wako Pure Chemical Corporation

- Mindray Bio-Medical Electronics Co., Ltd.

- BioNote, Inc.

- Agrolabo S.p.A.

- Abbott Laboratories

- Danaher Corporation

- Other Prominent Players