Global Colorectal Cancer Screening Market By Screening Tests (Stool Tests, Colonoscopy, Flexible Sigmoidoscopy, and Others), By End-user (Hospitals, Specialty Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2034

- Published date: Feb 2024

- Report ID: 139990

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

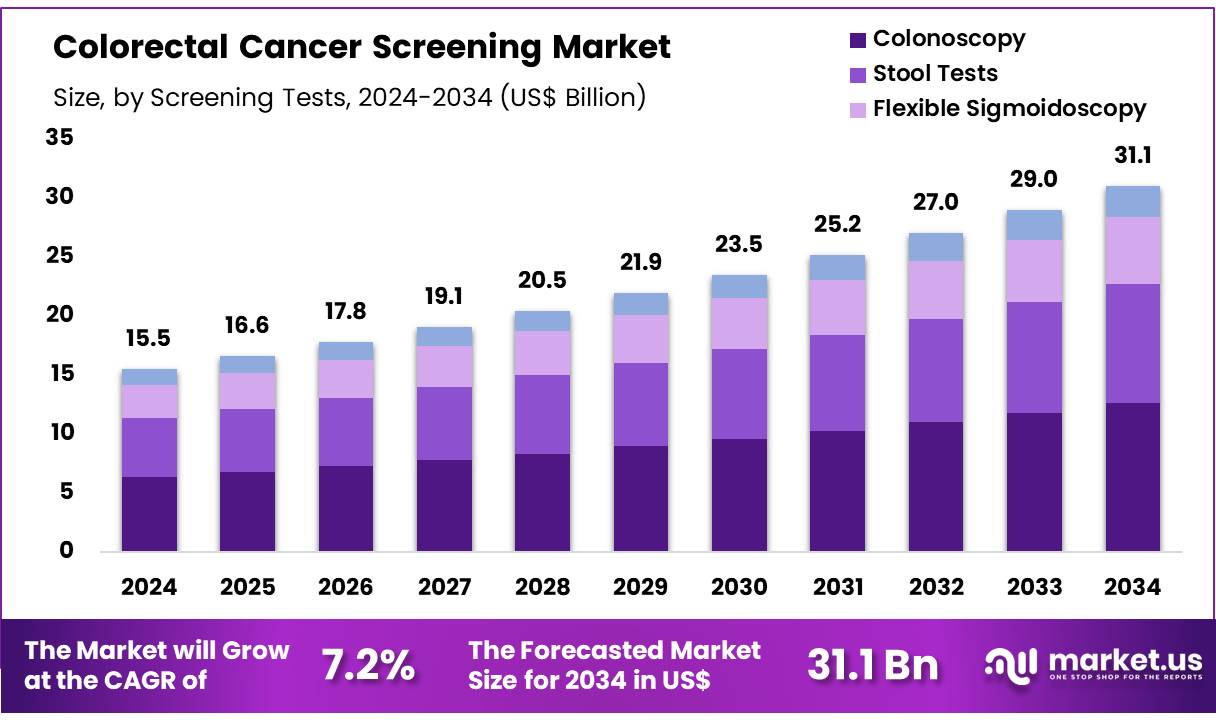

Global Colorectal Cancer Screening Market size is expected to be worth around US$ 31.1 billion by 2034 from US$ 15.5 billion in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.1% share with a revenue of US$ 6.2 Billion.

Growing awareness of the importance of early detection in reducing colorectal cancer (CRC) mortality is driving the expansion of the colorectal cancer screening market. Screening methods, including colonoscopy, stool-based tests, and blood tests, play a crucial role in identifying cancer at its early stages, improving treatment outcomes and survival rates.

The increasing prevalence of CRC and the rising focus on preventative healthcare have significantly contributed to market growth, with more individuals seeking regular screenings to detect potential risks. In December 2022, Guardant Health, Inc. announced the successful results of its ECLIPSE study, which involved over 20,000 participants and assessed the performance of a blood test designed to detect colorectal cancer (CRC) in individuals at average risk.

This study highlights the growing trend toward non-invasive screening methods, particularly blood tests, which offer a less cumbersome, more accessible alternative to traditional procedures like colonoscopies. Additionally, advancements in liquid biopsy and the use of circulating tumor DNA (ctDNA) as biomarkers for CRC detection present significant opportunities for market growth.

Recent trends also show increasing adoption of personalized screening programs, which tailor tests to individual risk factors, further enhancing the precision and effectiveness of early detection efforts. As new technologies continue to emerge, the colorectal cancer screening market is poised for further innovation, providing more efficient and patient-friendly solutions for early CRC detection.

Key Takeaways

- In 2024, the market for colorectal cancer screening generated a revenue of US$ 15.5 billion, with a CAGR of 7.2%, and is expected to reach US$ 31.1 billion by the year 2033.

- The screening tests segment is divided into stool tests, colonoscopy, flexible sigmoidoscopy, and others, with colonoscopy taking the lead in 2024 with a market share of 40.7%.

- Considering end-user, the market is divided into hospitals, specialty clinics, and others. Among these, hospitals held a significant share of 55.2%.

- North America led the market by securing a market share of 40.1% in 2024.

By Screening Tests Analysis

The colonoscopy segment led in 2024, claiming a market share of 40.7% owing to its established role as the gold standard in detecting colorectal cancer and precancerous lesions. Colonoscopies provide the most comprehensive visual examination of the colon, allowing for the detection of early-stage cancer and polyps, which can be removed before turning cancerous. The increasing awareness about the importance of early detection, especially among individuals over the age of 50, is anticipated to drive demand for colonoscopies.

Additionally, the rising prevalence of colorectal cancer, along with improvements in colonoscopy technology, such as enhanced imaging and the development of less invasive techniques, is projected to further contribute to the growth of this segment. As more individuals opt for preventive screening to reduce their cancer risk, colonoscopy is expected to remain a key method in the early detection and management of colorectal cancer.

By End-User Analysis

The hospitals held a significant share of 55.2% due to their ability to provide comprehensive diagnostic services, including screening, diagnosis, and treatment. Hospitals are likely to remain the primary end-users for colorectal cancer screening due to their advanced infrastructure, skilled medical professionals, and capacity for performing complex diagnostic procedures such as colonoscopies. The rising number of colorectal cancer cases, combined with growing awareness and national screening programs, is expected to boost the demand for screening services in hospitals.

Additionally, as more hospitals integrate cutting-edge technologies and improve access to screenings, they are likely to serve as key locations for early detection initiatives. The growing focus on preventive healthcare and patient-centered approaches is anticipated to further drive the demand for colorectal cancer screening in hospitals, reinforcing their role as primary providers of these essential services.

Key Market Segments

By Screening Tests

- Stool Tests

- Colonoscopy

- Flexible Sigmoidoscopy

- Others

By End-user

- Hospitals

- Specialty Clinics

- Others

Drivers

Growing Prevalence of Colorectal Cancer Driving the Colorectal Cancer Screening Market

Growing prevalence of colorectal cancer is anticipated to drive the colorectal cancer screening market significantly. According to the World Health Organization, 1.9 million new cases of colorectal cancer were reported globally in 2023, along with nearly 930,000 deaths. This alarming rise in cases underscores the urgent need for early detection and effective screening programs.

Healthcare providers increasingly adopt advanced diagnostic tools to identify precancerous conditions and reduce disease progression. Technological advancements in non-invasive screening methods, such as stool DNA tests and liquid biopsies, improve patient compliance and diagnostic accuracy. Rising awareness campaigns emphasize the importance of regular screenings, especially among high-risk groups. Pharmaceutical and diagnostic companies collaborate to develop innovative tests that offer faster results with higher sensitivity.

Governments in developed and emerging economies expand funding for screening initiatives to lower cancer-related mortality rates. Integration of screening programs into primary healthcare systems enhances accessibility and convenience for patients. Early diagnosis through effective screening significantly reduces treatment costs and improves survival rates. These factors highlight the growing role of advanced diagnostic solutions in addressing the global burden of colorectal cancer.

Restraints

High Costs Are Restraining the Colorectal Cancer Screening Market

High costs associated with colorectal cancer screening are restraining the market. Advanced diagnostic tools, including colonoscopy and molecular tests, require significant investment in equipment and reagents, making them expensive for healthcare providers and patients. In low-income countries, limited healthcare budgets restrict the adoption of these technologies, creating accessibility gaps. Insurance coverage for screening procedures varies, leaving many individuals unable to afford these tests.

The need for skilled professionals to perform invasive procedures such as colonoscopy adds to operational expenses for healthcare facilities. Inconsistent reimbursement policies further discourage patients from undergoing regular screenings. Addressing these challenges requires cost-effective diagnostic innovations and expanded insurance coverage to make screening programs more accessible to all population segments.

Opportunities

Increasing Government Initiatives as an Opportunity for the Colorectal Cancer Screening Market

Increasing government initiatives are anticipated to create significant opportunities for the colorectal cancer screening market. In 2021, BioMed Central Ltd reported that the National Cancer Screening Program (NCSP) in the Republic of Korea offers free colorectal cancer screenings to its population. Such initiatives promote early detection and significantly reduce cancer-related mortality rates. Governments worldwide are prioritizing funding for public health programs to enhance the accessibility of advanced diagnostic tools.

Awareness campaigns driven by public health agencies encourage individuals to undergo regular screenings. Partnerships between government bodies and private healthcare providers improve the infrastructure for implementing large-scale screening programs. Subsidized screenings for low-income populations ensure equitable access to diagnostic services.

Expanding policies that integrate colorectal cancer screening into routine healthcare checks strengthen early detection efforts. These trends highlight the growing role of government-supported programs in advancing the adoption of colorectal cancer screening technologies globally.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant influence on the colorectal cancer screening market. On the positive side, increasing investments in healthcare infrastructure, especially in emerging markets, drive the adoption of early cancer detection tools, including screening tests. The rising prevalence of colorectal cancer and growing awareness of the importance of early detection further contribute to market growth.

However, economic downturns can lead to reduced healthcare budgets, limiting access to screening services and diagnostic technologies, particularly in low-income regions. Geopolitical factors, such as trade restrictions or regulatory changes, may disrupt the supply chain for screening products and affect market availability.

Additionally, varying healthcare policies and reimbursement practices across countries create challenges for market penetration. Despite these obstacles, the increasing focus on preventative healthcare and advancements in diagnostic technologies provide a promising outlook for the colorectal cancer screening market.

Latest Trends

Integration of AI Driving the Colorectal Cancer Screening Market:

Rising integration of artificial intelligence (AI) is playing a key role in driving the colorectal cancer screening market. High advancements in AI technologies are expected to enhance the accuracy, speed, and efficiency of screening procedures, making early detection more accessible and reliable. AI applications in image recognition, data analysis, and predictive analytics are anticipated to revolutionize colorectal cancer screening by improving diagnostic capabilities.

In August 2023, United Digestive, a leader in GI management, introduced a colonoscopy service utilizing the GI Genius endoscopy module from Medtronic plc. The GI Genius module employs artificial intelligence to identify colorectal polyps, offering physicians an innovative tool to improve the detection and treatment of colorectal cancer. As AI continues to evolve, its integration into screening tools is likely to further enhance the precision of colorectal cancer diagnostics, driving market growth.

Regional Analysis

North America is leading the Colorectal Cancer Screening Market

North America dominated the market with the highest revenue share of 40.1% owing to rising colorectal cancer incidence, increased awareness about the importance of early detection, and advancements in screening technologies. The American Cancer Society estimated that 153,020 people in the U.S. were diagnosed with colorectal cancer, and 52,550 people lost their lives to the disease. These alarming statistics underscore the critical need for regular screening to identify the disease at its earliest and most treatable stage.

The growing emphasis on preventive healthcare, along with the development of non-invasive and more accurate screening methods, such as at-home fecal immunochemical tests (FIT) and blood-based tests, has made screening more accessible.

Moreover, healthcare initiatives promoting screening for individuals aged 45 and older, in line with updated guidelines, have contributed to the market’s growth. As healthcare providers and patients alike increasingly recognize the value of early detection, the colorectal cancer screening market in North America is expected to continue expanding.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing incidence of colorectal cancer, a growing focus on preventive healthcare, and improvements in screening infrastructure. According to a research article published by the National Center for Biotechnology Information (NCBI) in 2023, the incidence of colorectal cancer in Japan was approximately 26.7 cases per 100,000 men and 22.7 cases per 100,000 women, both in the 40 to 44 age group.

These figures highlight the growing need for widespread screening in the region. As governments and healthcare systems in Asia Pacific improve their focus on cancer prevention, screening programs and policies are likely to expand. Increased awareness about colorectal cancer risk factors, along with the rising demand for non-invasive and cost-effective screening methods, is expected to drive market growth.

Additionally, growing investments in healthcare infrastructure, along with the increasing availability of advanced diagnostic technologies, will likely accelerate the adoption of colorectal cancer screening in the region. As awareness of the importance of early detection continues to grow, the market for colorectal cancer screening in Asia Pacific is anticipated to expand rapidly.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the colorectal cancer screening market focus on developing non-invasive diagnostic tests and advanced biomarker-based assays to enhance early detection accuracy. Companies invest in R&D to innovate solutions such as stool DNA tests and blood-based screenings that improve patient compliance. Collaborations with healthcare providers and government agencies help expand awareness and increase access to screening programs.

Geographic expansion into regions with rising cancer prevalence and healthcare investments drives market growth. Many players also emphasize affordability and adherence to regulatory standards to ensure widespread adoption and trust.

Exact Sciences Corporation is a prominent company in this market, known for its flagship product Cologuard, a non-invasive stool DNA test for colorectal cancer detection. The company combines cutting-edge technology with a strong focus on patient-centric solutions to improve early diagnosis rates. Exact Sciences’ commitment to innovation and global distribution solidifies its leadership in the cancer diagnostics field.

Top Key Players

- Thermo Fischer Scientific

- Exact Sciences Corporation

- GE Healthcare

- Epigenomics AG

- Dickinson and Company

- BioMerieux SA

- BGI Genomics

- Abbott Laboratories

Recent Developments

- In November 2023, Guardant Health, a leader in precision oncology, announced the launch of Shield, a blood-based test for colorectal cancer screening, in collaboration with Samsung Medical Center in South Korea.

- In March 2023, BGI Genomics introduced COLOTECT 1.0 in Slovakia through its partnership with Zentya. Zentya, a Slovak healthcare solutions provider, aims to offer patients access to advanced genetic screening technologies for diagnosing and accelerating treatment of hereditary diseases.

Report Scope

Report Features Description Market Value (2024) US$ 15.5 billion Forecast Revenue (2034) US$ 31.1 billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Screening Tests (Stool Tests, Colonoscopy, Flexible Sigmoidoscopy, and Others), By End-user (Hospitals, Specialty Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fischer Scientific, Exact Sciences Corporation, GE Healthcare, Epigenomics AG, Dickinson and Company, BioMerieux SA, BGI Genomics, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Colorectal Cancer Screening MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Colorectal Cancer Screening MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fischer Scientific

- Exact Sciences Corporation

- GE Healthcare

- Epigenomics AG

- Dickinson and Company

- BioMerieux SA

- BGI Genomics

- Abbott Laboratories