Global Cannabis Testing Market By Services (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing, Residual Solvent Screening and Others), By End-use (Cannabis Cultivators, Cannabis Drug Manufacturers and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132568

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

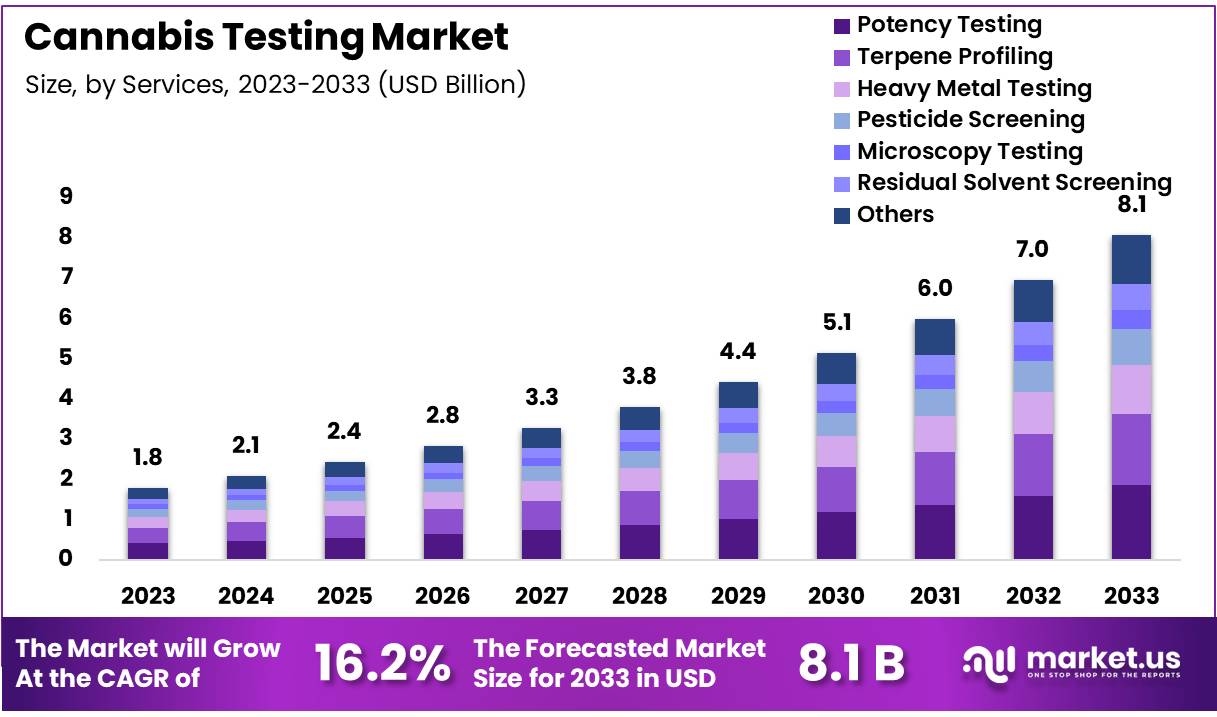

Global Cannabis Testing Market size is expected to be worth around US$ 8.1 Billion by 2033 from US$ 1.8 Billion in 2023, growing at a CAGR of 16.2% during the forecast period from 2024 to 2033.

The global cannabis testing market is experiencing significant growth, driven by the increasing legalization of cannabis for medical and recreational purposes across various regions. The demand for accurate and reliable testing methods to ensure product safety, potency, and compliance with stringent regulatory standards has surged. Technological advancements in analytical instruments, including chromatography and spectroscopy, are enhancing the precision and efficiency of testing processes.

Additionally, the rising awareness of cannabis-derived products and their therapeutic applications has amplified the need for quality control and testing services. The market is further supported by the expansion of cannabis cultivation and production, necessitating robust testing solutions to meet diverse regulatory requirements.

- In March 2021, France initiated a two-year medical cannabis pilot program involving approximately 3,000 patients with conditions such as epilepsy, neuropathic pain, and multiple sclerosis. This program aimed to assess the therapeutic benefits and feasibility of medical cannabis within the French healthcare system.

- According to the National Conference of State Legislatures of April 2023, 38 U.S. states, the District of Columbia, and three territories have legalized cannabis for medical purposes.

Key Takeaways

- The global cannabis testing market was valued at USD 1.8 billion in 2023 and is anticipated to register substantial growth of USD 8.1 billion by 2033, with a 16.2% CAGR.

- In 2023, the potency testing segment took the lead in the global market, securing 23% of the total revenue share.

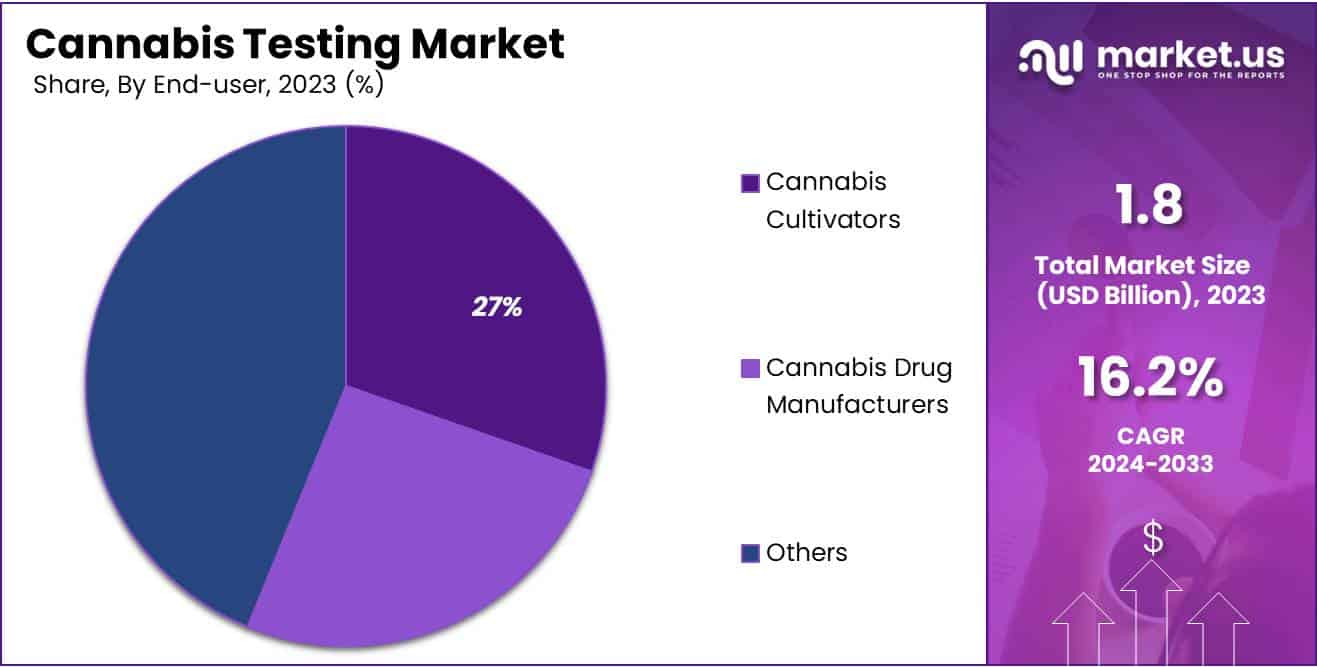

- Among end-user segments, cannabis cultivators emerged as the dominant segment, capturing 61% of the total revenue.

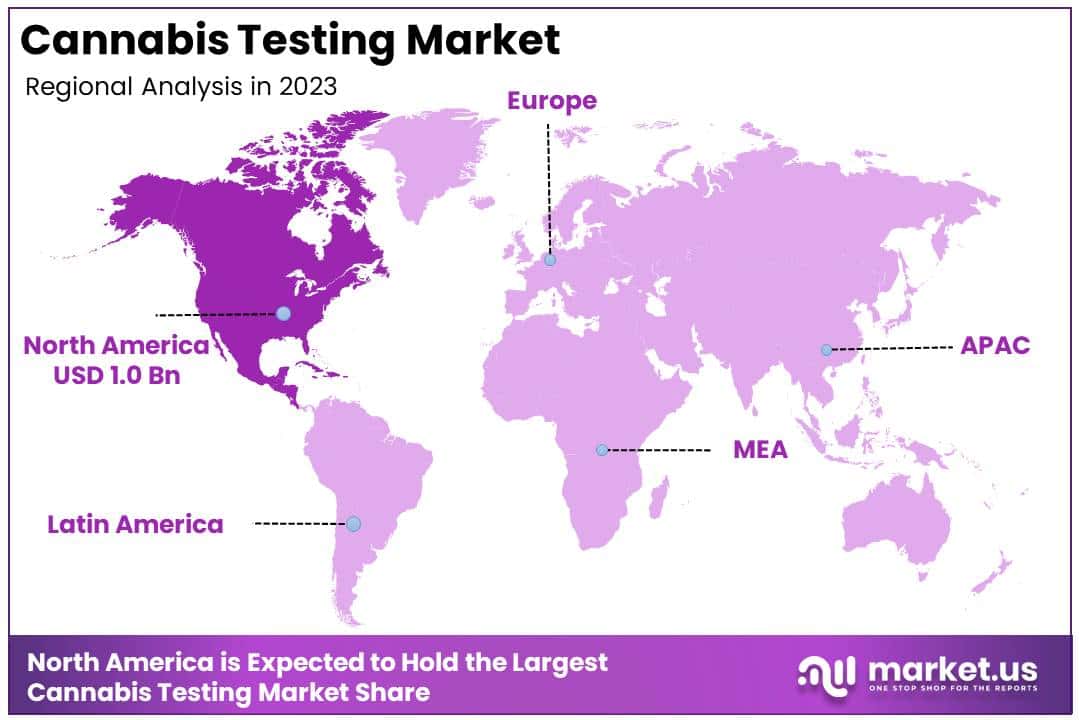

- North America maintained its leading position in the global market with a share of over 61% of the total revenue.

By Services Analysis

Based on service the market is fragmented into potency testing, terpene profiling, heavy metal testing, pesticide screening, microscopy testing, residual solvent screening and others. Amongst these, potency testing dominated the global cannabis testing market capturing a significant market share of 23% in 2023. Potency testing involves the quantification of cannabinoids such as tetrahydrocannabinol (THC) and cannabidiol (CBD), which are the primary active compounds in cannabis.

The growing demand for accurate labelling of cannabinoid concentrations, particularly in medical and recreational cannabis products, has heightened the importance of potency testing. Regulatory bodies worldwide have mandated stringent testing requirements to protect consumers and maintain product standards, further fuelling the demand for potency analysis.

In addition, consumers are increasingly seeking precise information about the strength and effects of cannabis products, particularly in the context of therapeutic use where dosage accuracy is critical. Furthermore, cannabis growers are expanding their facilities to cater to growing demand, and the introduction of new cannabis cultivation facilities drives the market growth.

- For instance, in March 2024, Minnesota’s first cannabis cultivating facility on sovereign land is under construction, just behind Grand Casino Mille Lacs in Onamia. The facility, which spans 50,000 square feet, is expected to yield around 1,600 pounds of cannabis monthly while offering job opportunities for Band of Ojibwe members.

By End-user Analysis

Based on the end-user, the market fractionates into cannabis cultivators, cannabis drug manufacturers and others. An indispensable role is performed by the cannabis cultivators segment apprehending a large market revenue share of 61% in the year 2023. Cannabis cultivators have emerged as dominant players in the global cannabis testing market due to their pivotal role in ensuring product quality and regulatory compliance throughout the cultivation process.

As the primary producers of raw cannabis materials, cultivators are responsible for meeting stringent regulatory standards governing their products’ safety, potency, and purity. These requirements have driven a growing reliance on third-party and in-house testing services to verify that cannabis products are free from contaminants such as pesticides, heavy metals, and microbial impurities.

Key Segments Analysis

By Services

- Potency Testing

- Terpene Profiling

- Heavy Metal Testing

- Pesticide Screening

- Microscopy Testing

- Residual Solvent Screening

- Others

By End-user

- Cannabis Cultivators

- Cannabis Drug Manufacturers

- Others

Growing Legalization of Cannabis

The growing legalization of cannabis globally is driven by shifting societal attitudes, increasing recognition of its medical benefits, and the economic potential of a regulated cannabis market. Countries and states are progressively legalizing cannabis for medical and recreational purposes, aiming to curb illegal markets, enhance consumer safety, and generate tax revenue.

Medical cannabis legalization is supported by evidence of its efficacy in treating conditions such as chronic pain, epilepsy, and multiple sclerosis.

- In August 2024, Ukraine legalized medical cannabis, allowing its cultivation for medical, industrial, and scientific purposes. This legislation aims to assist approximately six million Ukrainians, particularly those suffering from oncological diseases and post-traumatic stress disorder (PTSD). Access to medical cannabis requires a prescription, and sales are strictly regulated by the government.

Market Restraints

Lack of Standardization

The lack of standardization in the cannabis market is a significant barrier to its growth, impacting product quality, safety, and consumer trust. Inconsistent regulations across regions create disparities in testing requirements, labelling, and permissible cannabinoid levels, complicating compliance for producers and hindering market expansion.

This regulatory fragmentation limits the ability of companies to scale operations and enter new markets efficiently. Additionally, the absence of universally accepted testing protocols for contaminants, potency, and purity results in variable product quality, undermining consumer confidence and raising safety concerns. The lack of standardization also impedes research and development, as inconsistent data from non-standardized studies complicates the validation of cannabis’s medical efficacy.

Market Opportunities

Increasing R&D Activities

The increase in research and development (R&D) activities focused on cannabis and its medicinal properties is driving significant advancements in the healthcare industry. Extensive studies are being conducted to explore the therapeutic potential of cannabinoids in treating various conditions, including chronic pain, epilepsy, and multiple sclerosis.

These efforts have led to the development of novel pharmaceutical formulations and delivery mechanisms, enhancing the efficacy and safety profiles of cannabis-based products. In addition, growing awareness among consumers about the medicinal benefits of cannabis has fuelled demand.

- For instance, in February 2024, in Canada, researchers at the University of British Columbia conducted a new clinical trial to investigate the use of cannabidiol in the treatment of bipolar depression.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the cannabis market, shaping its growth and stability. Economic conditions, such as inflation, interest rates, and consumer spending, affect both production costs and demand for cannabis products. High inflation can increase operational expenses, including cultivation, distribution, and regulatory compliance, while dampened consumer purchasing power may reduce discretionary spending on recreational cannabis.

Geopolitical factors, including trade policies and international relations, also play a critical role. For instance, restrictions on cross-border cannabis trade due to varying legalization frameworks limit market expansion and investment opportunities.

Additionally, geopolitical instability can disrupt supply chains, impacting the availability of raw materials and production inputs. On a regulatory level, differing national policies and the lack of international consensus on cannabis legalization create market fragmentation and compliance challenges for global operators. These macroeconomic and geopolitical dynamics underscore the complex landscape in which the cannabis industry must navigate to sustain growth.

Latest Trends

The global cannabis testing market is experiencing significant growth, driven by several key trends. The increasing legalization of cannabis for medical and recreational use across various regions has heightened the demand for rigorous testing to ensure product safety and compliance with regulatory standards.

Advancements in analytical technologies, such as high-performance liquid chromatography (HPLC) and mass spectrometry, have enhanced the accuracy and efficiency of testing processes. Additionally, the adoption of Laboratory Information Management Systems (LIMS) is streamlining laboratory workflows, improving data management, and ensuring traceability.

The emergence of standardized testing protocols and certification programs is further promoting consistency and reliability in test results. Moreover, the diversification of cannabis products, including edibles, concentrates, and topicals, necessitates comprehensive testing for potency, contaminants, and formulation analysis, thereby broadening the scope of testing services.

Collectively, these trends underscore the critical role of cannabis testing in safeguarding consumer health and maintaining industry integrity.

Regional Analysis

North America held a large share of 61% of the global cannabis testing market in the year 2023. North America accounted for a significant share of the global cannabis testing market, driven by the increasing legalization of medical and recreational cannabis across key regions, including the United States and Canada.

The robust regulatory frameworks established in these countries mandate rigorous testing for safety, potency, and quality assurance, thereby boosting the demand for advanced analytical instruments and testing services.

Furthermore, the presence of well-established market players, coupled with continuous advancements in testing technologies such as chromatography and spectroscopy, has further solidified North America’s dominant position in the market. The growth is also supported by rising consumer awareness regarding the safety and efficacy of cannabis products, which has prompted manufacturers to ensure compliance with stringent quality standards.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The cannabis testing market is consolidated in nature with a strong presence of established players. In addition to established players, a growing number of specialized testing laboratories are entering the market, offering tailored services for potency testing, pesticide screening, and microbial analysis. Strategic partnerships, acquisitions, and technological innovations are prevalent, enabling companies to expand their market presence and improve service efficiency.

Furthermore, the increasing legalization of cannabis globally and the rising demand for high-quality, safe products continue to intensify competition, fostering further innovation and market consolidation.

Top Key Players

- Saskatchewan Research Council

- SC Labs

- SGS Société Générale de Surveillance SA

- Robert Shrewsbury & the UNC Eshelman School of Pharmacy

- GREEN LEAF LAB

- Eurofins Scientific

- PhytoVista Laboratories

- BRITISH CANNABIS

- ADACT Medical Ltd.

- Laboratorium Dr. Liebich

- AZ Biopharm GmbH

Recent Developments

- In January 2024: The Ontario Cannabis Store introduced a temporary THC testing program. Under the program, the provincial cannabis wholesaler has been choosing cultivars with high THC content to arrive at its warehouse for secondary testing.

- In October 2023: Nova Analytic Labs (Nova) and Certified Testing & Data (CTND) collaborated and launched a new cannabis testing lab in New York.

- In August 2022: ACS Laboratory, a Florida-based cannabis testing company, unveiled its nationwide hemp compliance testing panel. The panel facilitates the testing of hemp samples for 18 cannabinoids, 105 pesticides, 24 heavy metals, 55 probable residual solvents, 17 distinct microbes, and all essential mycotoxins at parts per billion, as well as moisture content, water activity, and terpenes.

- In July 2022: Nova Analytic Labs (Nova) and Certified Testing & Data (CTND) collaborated and launched a new cannabis testing lab in New York.

Report Scope

Report Features Description Market Value (2023) US$ 1.8 billion Forecast Revenue (2033) US$ 8.1 billion CAGR (2024-2033) 16.2% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Potency Testing, Terpene Profiling, Heavy Metal Testing, Pesticide Screening, Microscopy Testing, Residual Solvent Screening and Others), By End-use (Cannabis Cultivators, Cannabis Drug Manufacturers and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Saskatchewan Research Council, SC Labs, SGS Société Générale de Surveillance SA, Dr. Robert Shrewsbury & the UNC Eshelman School of Pharmacy, GREEN LEAF LAB, Eurofins Scientific, PhytoVista Laboratories, BRITISH CANNABIS, ADACT Medical Ltd., Laboratorium Dr. Liebich and AZ Biopharm GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Saskatchewan Research Council

- SC Labs

- SGS Société Générale de Surveillance SA

- Robert Shrewsbury & the UNC Eshelman School of Pharmacy

- GREEN LEAF LAB

- Eurofins Scientific

- PhytoVista Laboratories

- BRITISH CANNABIS

- ADACT Medical Ltd.

- Laboratorium Dr. Liebich

- AZ Biopharm GmbH