Global Enteric Disease Testing Market By Disease Type-Bacterial Enteric Disease, Viral Enteric Disease-(Rotavirus, Norovirus)Parasitic Enteric Disease, By Technology-(Traditional, Rapid, Convenience-based, Polymerase chain reaction (PCR), Immunoassay, Other Technologies) By End User-(Hospitals, Pharmaceutical and Biotechnology Companies, Academic and Research Institutes) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: July 2024

- Report ID: 13965

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

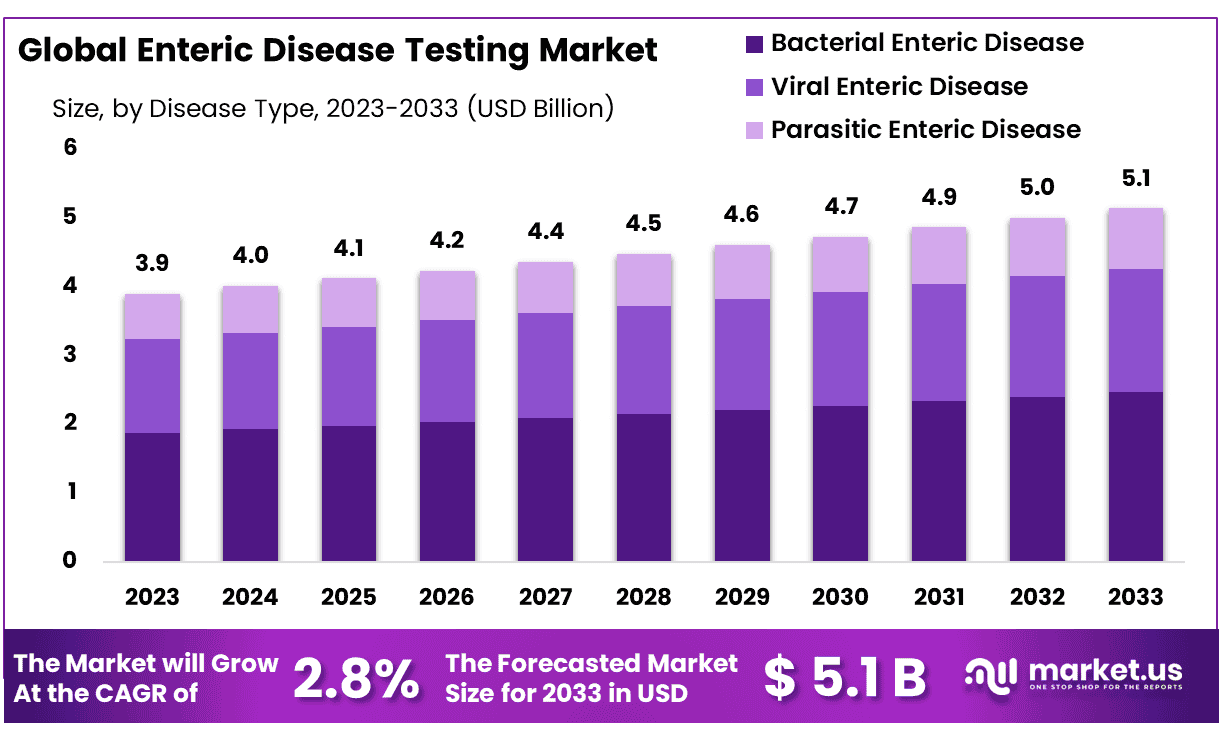

The Global Enteric Disease Testing Market size is expected to be worth around USD 5.1 Billion by 2033 from USD 3.9 Billion in 2023, growing at a CAGR of 2.8% during the forecast period from 2024 to 2033.

Enteric Disease Testing Market projections predict strong expansion from 2024-2033 due to increasing consumption of frozen and ready-to-eat meals, along with rising disease incidence caused by bacteria, viruses, parasites, or microorganisms that enter through contaminated food or beverages and spread person to person.

Enteric infections like norovirus are projected to play a significant role in global morbidity and mortality rates, especially cognitive function impairment. Industry revenues should experience growth due to an emphasis on developing cost-effective treatments for treating enteric disease infections in low- and middle-income countries.

By 2033, molecular diagnostic testing methods are projected to lead the enteric disease testing market in terms of testing methods. This trend can be attributed to the rapid rise of real-time and high-throughput PCR technologies that aid identification of bacterial and viral enteric illness. Furthermore, genomic and genetic information have led to widespread adoption of molecular diagnostic alternatives across healthcare settings – something which should only increase revenue during this period.

Key Takeaways

- Market Size & Growth: Enteric Disease Testing Market size is expected to be worth around USD 5.1 Billion by 2033 from USD 3.9 Billion in 2023, growing at a CAGR of 2.8%.

- Disease Type Analysis: bacteria enteric disease accounted for 48% of the market’s revenue share in 2023.

- Technology Analysis: In technology Analysis traditional segment accounted for 38% share in 2023.

- End-Use Analysis: In 2023, hospital segment led the market with 43% revenue share.

- Regional Analysis: North America region was the dominant 40% of the global market share and holding a USD 1.5 Million value.

- Data Privacy and Ethical Considerations: Data privacy and security considerations as well as ethical implications regarding genetic data present a number of challenges in the market, so finding a balance between technological innovation and ethical standards must remain an aim of company activity.

- Focused Research and Development: Companies on the market place an emphasis on research and development to foster continuous innovation, advance enteric disease testing technologies and advance diagnostic capabilities. This emphasis contributes to advancements of diagnostic capabilities.

Disease Type Analysis

The key segments are divided by disease type. These bacteria can cause various diseases, including C. difficile, E. coli Shigella Salmonella, and Campylobacter. These bacteria enteric disease accounted for 48% of the market’s revenue share in 2023, while the viral enteric disease testing market accounted for a substantial portion. Parasitic disease testing will see significant growth over the next seven years due to the rising incidence of these infections and the emergence of new parasitic strains.

Child Health Epidemiology Research Group, (CHERG) has found that enteric pathogens like Rotavirus, Salmonella spp., and V. cholera cause more deaths than any other enteric disease. Therefore, the WHO committee has made it a priority to develop new and better vaccines for these pathogens.

Although some viruses can be found everywhere, like rotavirus which affects approximately 90 percent of the world’s children under five years old, infections are often caused by environmental factors. These include restricted geographical and seasonal patterns, as well as hygiene and access to clean water.

Technology Analysis

In technology Analysis traditional segment accounted for 38% share in 2023. Enteric Disease Testing Market has witnessed phenomenal advances in diagnostic technologies to increase accuracy and efficiency when diagnosing enteric infections. Real-time PCR and Nucleic Acid Amplification Technologies (NAATs), especially Real Time Multiplex PCR/NAATs play an integral part in providing rapid identification of both viral and bacterial enteric pathogens; they feature high sensitivity as well as multiplexing capabilities for comprehensive screening capabilities.

The cultural method was the traditional way to diagnose enteric diseases. This required skilled personnel and was time-consuming. This market for disease testing has seen a significant shift in the past decade with the advent of molecular diagnostics. These conditions are increasing mortality and the high cost of technically advanced diagnostic systems will drive demand for initial diagnosis.

Immunoassay technologies such as Enzyme-Linked Immunosorbent Assay (ELISA) and rapid immunoassay tests contribute significantly to healthcare environments with their high specificity and rapid results, making them suitable for various healthcare settings. Genomic data utilization involves applying genomic sequencing or Next-Generation Sequencing (NGS) techniques to study enteric pathogen genetic characteristics – providing more insight into their biology while aiding outbreak investigations.

End User Analysis

In Enteric disease testing market hospital laboratories, pharmaceutical and biotechnology companies and academic and research institutes playing vital role. Notably in 2023, hospital segment led the market with 43% revenue share; this can be attributed to increasing healthcare coverage for hospital-based treatments as well as an upsurge in admissions that resulted in an increased preference for services provided by hospital laboratories.

Anticipatedly, this segment will experience the highest compound annual growth rate over its forecast period. This upward trajectory can be attributed to increasing focus on diagnosing enteric diseases within hospital laboratories and greater awareness regarding regular body checkups conducted there – both trends which emphasize hospital laboratories as a critical contributor in shaping dynamics within the enteric disease testing market.

Маrkеt Ѕеgmеntѕ

Disease Type

Bacterial Enteric Disease

Viral Enteric Disease

- Rotavirus

- Norovirus

Parasitic Enteric Disease

Technology

- Traditional

- Rapid

- Convenience-based

- Polymerase chain reaction (PCR)

- Immunoassay

- Other Technologies

End User

- Hospitals

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

Driver

Growing Global Burden

Enteric disease testing market growth can be directly attributed to its increasing global prevalence. Contaminated food and water resources, poor sanitation practices and traveling increase incidences of infections caused by enteric diseases that require effective testing methods for timely diagnosis and treatment.

Improved Awareness, Screening, and Programs

Growing awareness of screening and early detection for enteric illnesses has driven demand for screening programs in areas with the highest disease burden, aiding market expansion by encouraging regular testing to detect early symptoms of illness and stop outbreaks.

Trends

Advances in Molecular Diagnostics

Market research for Enteric Disease Testing Market has seen an upsurge in adoption of modern molecular diagnostic techniques such as real-time PCR and Nucleic Acid Amplification Technology (NAATs) techniques as they offer faster and more precise diagnoses of enteric pathogens leading to more efficient and targeted treatments.

Proliferation of POC Testing

In recent years, there has been an exponential rise in point of care testing to detect enteric diseases. With rapid developments of immunoassays and nucleic acids technology that enables amplification on-site tests allowing rapid diagnosis in clinical settings as well as faster results turnaround.

Restraint

Privacy Concerns

Security and privacy challenges for data are major barriers in this Enteric Disease Testing market. As sensitive medical information must be collected in order to facilitate diagnosis, protecting patient confidentiality becomes key in protecting themselves against breaches or unauthorised access of their medical records is of utmost importance both for healthcare professionals and patients alike.

Ethical Issues

Integral to testing for enteric diseases can be ethics concerns surrounding genomic and genetic information usage. Finding a balance between sophisticated diagnostics and ethical considerations such as informing consent and responsible use of data are essential to uphold trust in this industry, in order to maintain ethical standards.

Opportunity

Expanding access to healthcare in developing nations

Emerging regions present an enormous opportunity to expand testing at the point-of-care for gastrointestinal diseases in emerging regions. Utilizing rapid testing techniques in environments with limited resources can increase access to prompt diagnosis, improve healthcare quality, and meet the needs of those without access to health facilities.

Innovative Technological Solutions for Affordable Living

Technological advances that emphasize affordability present market players with opportunities. Producing cost-effective testing solutions like accessible diagnostic tools that are user friendly will help bridge gaps in healthcare systems while creating positive change for areas with limited healthcare resources; creating an all-round win-win outcome for healthcare providers as well as patients alike.

Regional Analysis

North America region was the dominant 40% of the global market share and holding a USD 1.5 Million value for the Enteric Disease Testing Market. It is expected to continue growing at a CAGR in excess of 5 % during the estimated period.

The most attractive regions are located in developing countries like India and China. This promotes Asia Pacific’s fastest growth. Due to increasing awareness and increased infections, Asia Pacific will be able to capture the global market by 2033.

Germany has a significant share of Europe’s market for enteric disease testing, mainly due to its elderly population. The increased geriatric population poses problems due to the increased risk of enteric disease and decreased immunity. This demographic is well-served by point-of-care diagnostic devices and rapid diagnostic techniques.

Brazil holds strong market growth opportunities. Brazil has experienced positive economic growth due to political stability and economic growth. The Unified Health System (SUS) is a system that provides free healthcare to all citizens of all ages. The SUS provides a mix of private and public healthcare services.

Kеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Companies

The Enteric Disease Testing Market comprises several key companies that play crucial roles in developing advanced diagnostic technologies, assuring accurate disease detection methods, and supporting the market overall. Here is an analysis of some key players:

Маrkеt Рlауеrѕ

- Abbott Laboratories

- Becton Dickinson & Company

- Bio-Rad Laboratories, Inc.

- Meridian Bioscience Inc.

- Biomerieux SA

- Trinity Biotech

- Cepheid, Inc.

- Quest Diagnostics Incorporated

- Biomerica

- Coris BioConcept

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 5.1 Billion CAGR (2024-2033) 2.8% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Disease Type-Bacterial Enteric Disease, Viral Enteric Disease-(Rotavirus, Norovirus)Parasitic Enteric Disease, Technology-(Traditional, Rapid, Convenience-based, Polymerase chain reaction (PCR), Immunoassay, Other Technologies)End User-(Hospitals, Pharmaceutical and Biotechnology Companies, Academic and Research Institutes) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Abbott Laboratories, Becton Dickinson & Company, Bio-Rad Laboratories, Inc., Meridian Bioscience Inc., Biomerieux SA, Trinity Biotech, Cepheid, Inc., Quest Diagnostics Incorporated, Biomerica, Coris BioConcept Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Enteric Disease Testing?Enteric Disease Testing involves diagnostic procedures to identify infections and diseases affecting the intestines, often caused by bacteria, viruses, or parasites. It plays a crucial role in ensuring timely and accurate diagnosis for effective treatment.

How big is the Enteric Disease Testing Market?The global Enteric Disease Testing Market size was estimated at USD 3.9 Billion in 2023 and is expected to reach USD 5.1 Billion in 2033.

What is the Enteric Disease Testing Market growth?The global Enteric Disease Testing Market is expected to grow at a compound annual growth rate of 2.8%. From 2024 To 2033

Who are the key companies/players in the Enteric Disease Testing Market?Some of the key players in the Enteric Disease Testing Markets are Abbott Laboratories, Becton Dickinson & Company, Bio-Rad Laboratories, Inc., Meridian Bioscience Inc., Biomerieux SA, Trinity Biotech, Cepheid, Inc., Quest Diagnostics Incorporated, Biomerica, Coris BioConcept

Why is Enteric Disease Testing Important?Enteric Disease Testing is vital for early detection of infections in the gastrointestinal tract, facilitating prompt medical intervention. Timely diagnosis helps prevent the spread of diseases, enables targeted treatment, and contributes to better patient outcomes.

What Are Common Methods Used in Enteric Disease Testing?Common methods include Traditional, Rapid, Convenience-based, Polymerase chain reaction (PCR) and immunoassay technologies. These methods help identify specific pathogens responsible for enteric diseases.

Who Benefits from Enteric Disease Testing?Healthcare providers, laboratories, and patients benefit from Enteric Disease Testing. Healthcare providers can make informed treatment decisions, laboratories play a key role in conducting tests, and patients receive timely and accurate diagnoses.

Enteric Disease Testing MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Enteric Disease Testing MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Becton Dickinson & Company

- Bio-Rad Laboratories, Inc.

- Meridian Bioscience Inc.

- Biomerieux SA

- Trinity Biotech

- Cepheid, Inc.

- Quest Diagnostics Incorporated

- Biomerica

- Coris BioConcept