Global Dental Imaging Market By Type (Extraoral Imaging (Panoramic Systems, Dental Cone Beam Computed Tomography (CBCT), and Panoramic & Cephalometric Systems) and Intraoral Imaging (X-ray Systems, Intraoral Cameras, Intraoral Photostimulable Phosphor Systems, Intraoral Scanners, and Intraoral Sensors)), By Application (Endodontics, Implantology, Oral & Maxillofacial Surgery, Orthodontics, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 2025

- Report ID: 141476

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

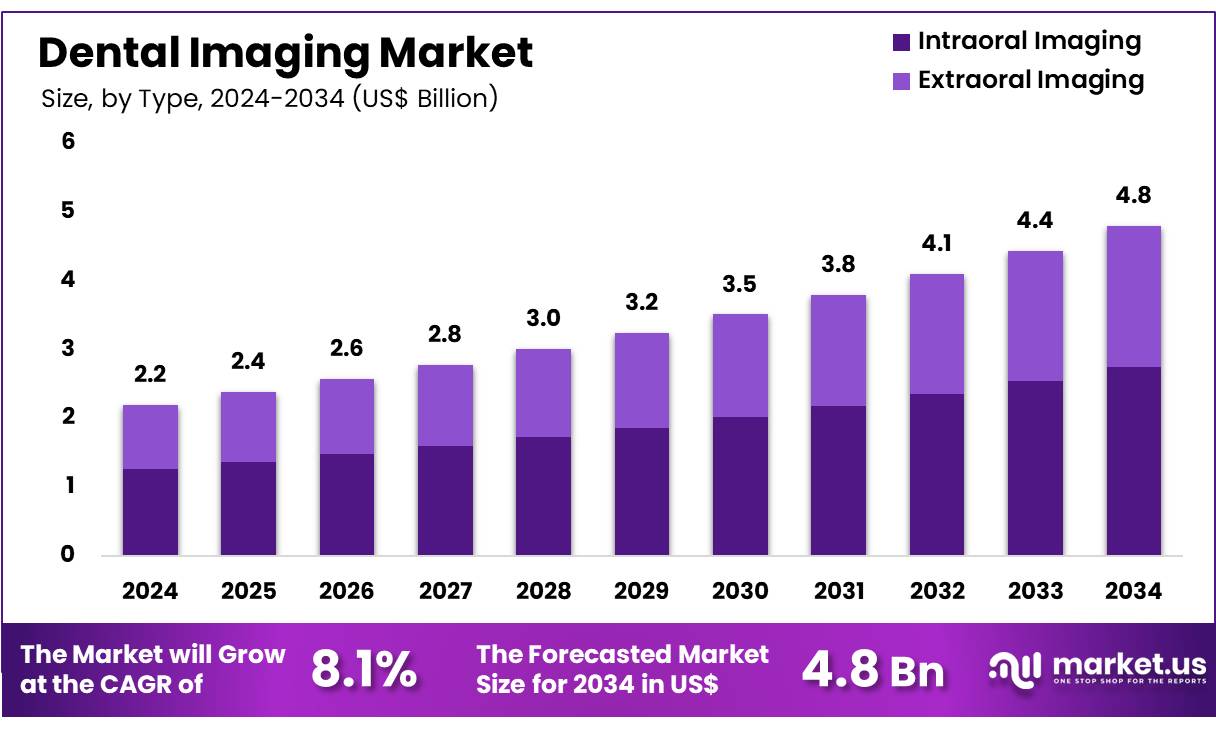

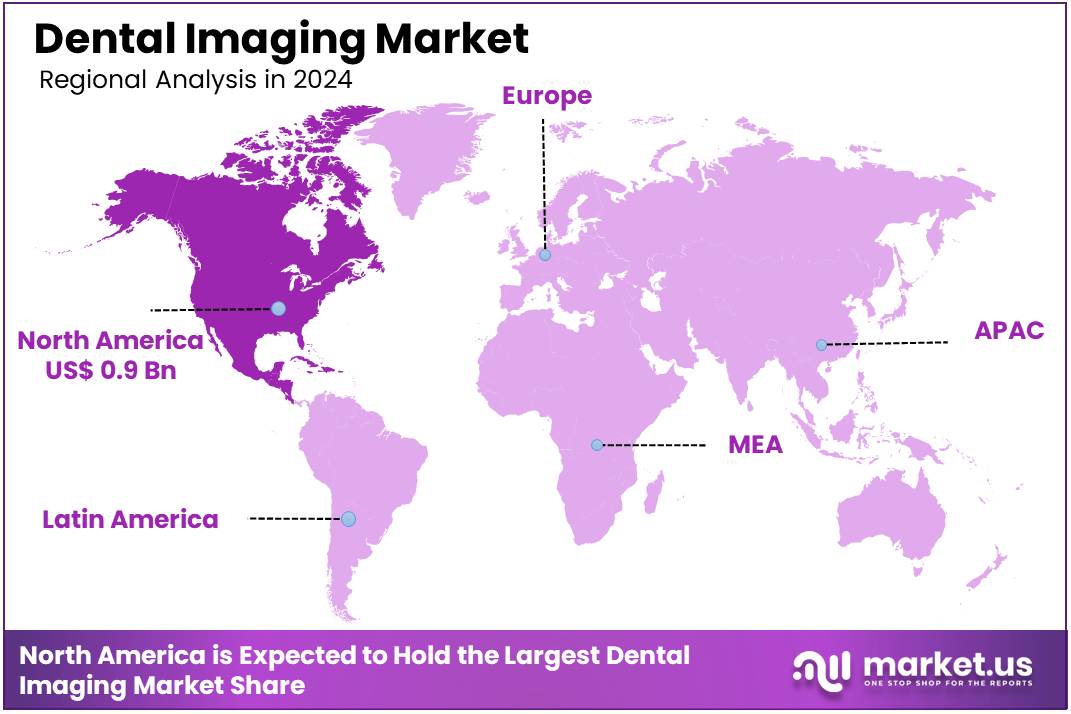

Global Dental Imaging Market size is expected to be worth around US$ 4.8 billion by 2034 from US$ 2.2 billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.6% share with a revenue of US$ 0.9 Billion.

Increasing demand for advanced dental imaging solutions has driven innovation in diagnostic tools for accurate detection of oral diseases. Dentists rely on high-resolution imaging systems to improve treatment planning for conditions like cavities, periodontal disease, and jaw disorders. In November 2023, Global Dental Services secured a USD 50 million investment from the Qatar Investment Authority (QIA) to expand its network and develop innovative oral healthcare solutions.

Digital imaging technologies such as cone-beam computed tomography (CBCT) and intraoral scanners enhance precision in orthodontics, implantology, and endodontics. Artificial intelligence improves image analysis, enabling early diagnosis and better patient outcomes. The rise of teledentistry has increased demand for cloud-based imaging platforms that streamline remote consultations..

Research focuses on reducing radiation exposure while maintaining clarity for safer diagnostics. Integration of 3D printing has accelerated the development of custom prosthetics and aligners. Wireless and AI-powered devices optimize workflow efficiency and data accessibility. As technology advances, dental imaging continues to transform modern dentistry with enhanced accuracy and patient care.

Key Takeaways

- In 2024, the market for Dental Imaging generated a revenue of US$ 2.2 billion, with a CAGR of 8.1%, and is expected to reach US$ 4.8 billion by the year 2033.

- The type segment is divided into extraoral imaging and intraoral imaging, with intraoral imaging taking the lead in 2023 with a market share of 57.4%.

- Considering application, the market is divided into endodontics, implantology, oral & maxillofacial surgery, orthodontics, and others. Among these, implantology held a significant share of 38.6%.

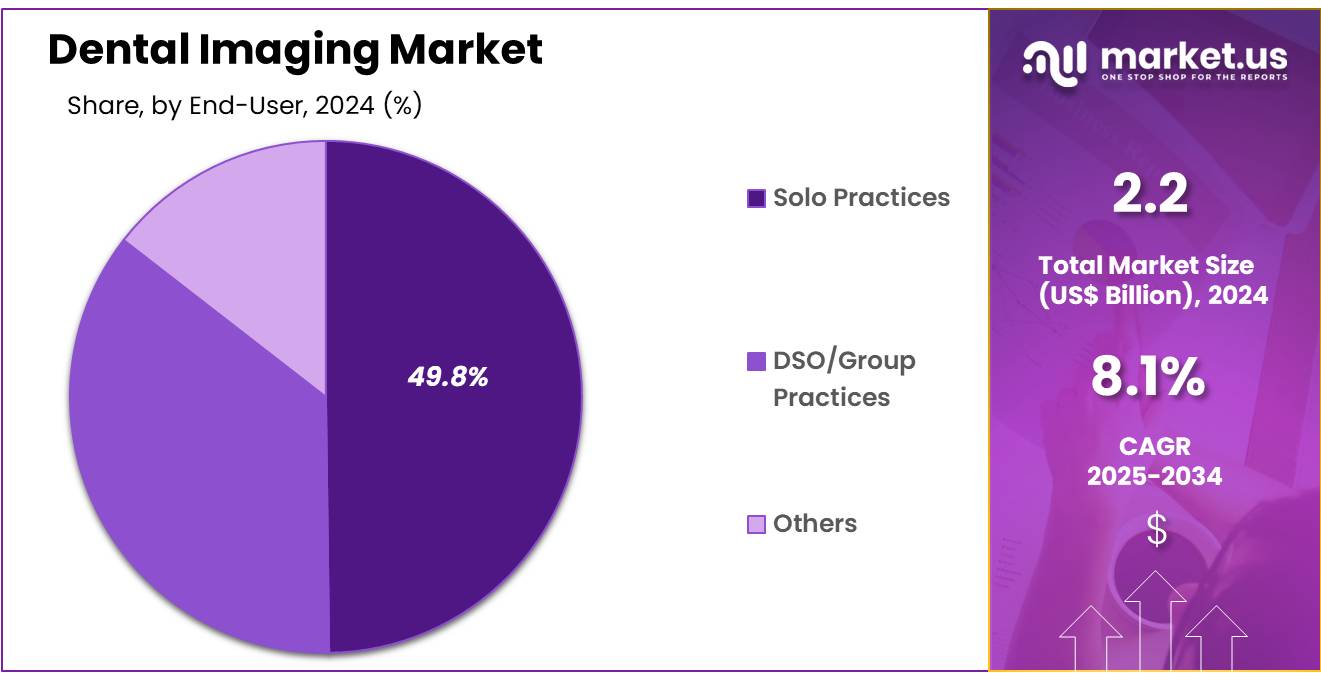

- Furthermore, concerning the end-user segment, the market is segregated into solo practices, DSO/group practices, and others. The solo practices sector stands out as the dominant player, holding the largest revenue share of 49.8% in the Dental Imaging market.

- North America led the market by securing a market share of 39.6% in 2023.

Type Analysis

The intraoral imaging segment led in 2023, claiming a market share of 57.4% owing to its increasing application in dental diagnostics and treatment planning. Intraoral imaging systems, such as digital X-rays, offer high-resolution, detailed images of the teeth and surrounding tissues, which help dentists detect cavities, infections, and other dental conditions with greater precision. The demand for these systems is likely to rise as they allow for less radiation exposure compared to traditional X-ray systems, making them safer for patients.

Additionally, the integration of intraoral cameras with digital platforms enables more efficient communication between dentists and patients, leading to improved treatment outcomes. The market for intraoral imaging is anticipated to benefit from the growing preference for minimally invasive treatments and advancements in diagnostic technology.

Application Analysis

The implantology held a significant share of 38.6% due to as dental implants become a more popular option for patients seeking long-term solutions to tooth loss. Advanced imaging technologies such as cone beam computed tomography (CBCT) play a crucial role in implant planning by providing detailed, three-dimensional images of the jaw and surrounding structures.

This allows dental professionals to accurately assess bone density and implant placement, reducing complications and improving success rates. As the number of implant procedures increases globally, the demand for precise diagnostic imaging in implantology is projected to continue rising, driven by factors such as the aging population and growing awareness of dental aesthetics.

End-user Analysis

The solo practices segment had a tremendous growth rate, with a revenue share of 49.8% owing to the increasing number of independent dental practitioners adopting advanced imaging technologies. Solo practices, which tend to offer personalized services and direct patient care, are expected to invest in high-quality dental imaging equipment to enhance diagnostic accuracy and patient experience.

As patients demand more efficient, accurate, and comprehensive care, solo practices are likely to adopt innovations such as digital radiography and intraoral cameras to stay competitive. This trend is anticipated to be driven by technological advancements, cost-effective equipment options, and the growing emphasis on preventive dental care in individual dental practices.

Key Market Segments

Type

- Extraoral Imaging

- Panoramic Systems

- Dental Cone Beam Computed Tomography (CBCT)

- Panoramic & Cephalometric Systems

- Intraoral Imaging

- X-ray Systems

- Intraoral Cameras

- Intraoral Photostimulable Phosphor Systems

- Intraoral Scanners

- Intraoral Sensors

Application

- Endodontics

- Implantology

- Oral & Maxillofacial Surgery

- Orthodontics

- Others

End-user

- Solo Practices

- DSO/Group Practices

- Others

Drivers

Growing Prevalence of Dental Problems Driving the Dental Imaging Market

Rising cases of oral diseases are anticipated to drive the demand for advanced dental imaging systems as the need for accurate diagnostics increases. An April 2021 report by the American Hospital of Paris found that nearly 50% of children under 15 in France suffer from gum inflammation. This high prevalence of pediatric gingivitis is expected to drive a surge in hospital visits, increasing demand for modern dental imaging equipment in the region. Poor oral hygiene, increased sugar consumption, and tobacco use contribute to rising dental problems worldwide.

The growing incidence of periodontitis and cavities is prompting dentists to adopt advanced imaging technologies for early detection. Cone-beam computed tomography (CBCT) scanners are becoming more common in dental clinics due to their superior imaging capabilities. The shift toward minimally invasive dentistry is accelerating the adoption of digital radiography and 3D imaging solutions. Governments are introducing oral health awareness programs that emphasize regular screenings, fueling demand for diagnostic tools.

The aging population, which faces a higher risk of tooth decay and bone loss, is increasing the need for imaging-guided treatment planning. Advancements in artificial intelligence (AI) are enhancing the precision of dental image analysis, improving diagnostic accuracy. The expansion of dental tourism, particularly in regions offering affordable treatment, is driving the installation of cutting-edge imaging devices.

The emergence of mobile and portable imaging units is making dental diagnostics more accessible in remote locations. Increased investments in research and development are leading to the continuous evolution of imaging modalities, further strengthening market growth.

Restraints

High Cost of Advanced Imaging Systems is Restraining the Market

Growing concerns over the affordability of dental imaging equipment are expected to limit adoption, particularly in cost-sensitive regions. High-end CBCT and panoramic imaging systems require substantial initial investments, making them inaccessible to small clinics and solo practitioners. The maintenance and software upgrades associated with digital imaging technologies add to operational costs.

In many developing countries, inadequate reimbursement policies discourage dentists from investing in expensive diagnostic tools. Some dental professionals hesitate to adopt new imaging solutions due to the learning curve and training required to operate sophisticated devices. Regulatory approvals for new imaging systems can be time-consuming and complex, delaying market entry for innovative technologies.

Limited awareness about the benefits of advanced imaging solutions in certain regions slows adoption rates. Patients in low-income populations may avoid dental imaging procedures due to high out-of-pocket costs, reducing market penetration in underserved areas.

Opportunities

Technological Advancements as an Opportunity for the Dental Imaging Market

Rising innovation in imaging technologies is expected to drive new growth opportunities by improving diagnostic precision and treatment outcomes. As of July 2024, Dental Imaging Technologies Corporation introduced the ORTHOPANTOMOGRAPH OP 3D LX, a state-of-the-art dental imaging system with customizable field-of-view options ranging from 5×5 cm to 15×20 cm. This advanced unit is designed to support a broad spectrum of dental treatments, from routine examinations to intricate surgical planning.

AI-powered software solutions are enhancing image interpretation, reducing diagnostic errors, and improving workflow efficiency. The integration of cloud-based storage in dental imaging is streamlining data management and accessibility for professionals. Portable and handheld X-ray devices are expanding diagnostic capabilities in non-clinical settings, improving access to dental care.

Augmented reality (AR) and virtual reality (VR) are being incorporated into imaging solutions for better treatment planning and patient education. Innovations in radiation-free imaging techniques, such as near-infrared transillumination, are emerging as safer alternatives for diagnostics. The expansion of teledentistry and remote consultation services is fueling demand for digital imaging solutions that facilitate virtual diagnosis.

The growing adoption of 3D printing in dentistry is driving demand for precise imaging technologies used in prosthetic and orthodontic treatments. The increased focus on personalized dentistry is accelerating the need for imaging solutions that offer high-resolution, patient-specific insights.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors heavily influence the dental imaging market. On the positive side, rising healthcare expenditures and a growing focus on dental care contribute to the market’s expansion, particularly in emerging economies where access to advanced healthcare is increasing. The prevalence of dental disorders, coupled with a higher awareness of oral health, drives demand for advanced imaging technologies. Additionally, innovations in imaging systems and increased adoption of preventive care across the globe foster market growth.

However, economic downturns or reduced healthcare budgets can limit spending on expensive diagnostic tools, especially in public healthcare systems. Geopolitical factors such as international trade barriers and regulatory discrepancies across regions can disrupt the supply chain, leading to increased costs for dental imaging equipment. Despite these challenges, the rising demand for high-quality, accurate dental diagnostic tools, combined with continuous advancements in technology, ensures sustained market growth.

Latest Trends

Integration of AI & ML Driving the Dental Imaging Market

Rising integration of artificial intelligence (AI) and machine learning (ML) is a recent trend driving the dental imaging market. High demand for more accurate, efficient, and automated diagnostic processes has led to the adoption of AI and ML technologies in dental imaging solutions. These technologies are expected to enhance image clarity, detect dental conditions with greater precision, and enable faster diagnosis, improving patient outcomes.

Increasing use of AI-powered software in dental practices is likely to streamline workflow and reduce human error, making imaging procedures more efficient and cost-effective. AI and ML tools also allow for predictive analytics, helping dentists identify potential oral health issues before they become more serious. As AI and ML technologies continue to evolve, the market is projected to experience significant growth.

As of July 2024, XpectVision Technology Co., Ltd. unveiled a cutting-edge intraoral sensor that leverages photon-counting technology to enhance dental imaging accuracy. This innovation minimizes distortion, providing clearer diagnostic images and improving precision in dental assessments. As these technological advancements continue to transform the dental imaging landscape, the market will likely expand, driven by the growing demand for precision and efficiency in dental care.

Regional Analysis

North America is leading the Dental Imaging Market

North America dominated the market with the highest revenue share of 39.6% owing to advancements in digital radiography and increasing adoption of AI-powered diagnostic tools. Planmeca OY’s partnership with Benevis in February 2024, aimed at integrating advanced imaging solutions across 120 clinics in 13 U.S. states and Washington, D.C., underscored the region’s commitment to improving diagnostic accuracy and patient care.

The growing demand for minimally invasive procedures fueled the adoption of 3D imaging and cone-beam computed tomography (CBCT), enabling precise treatment planning. The increasing prevalence of dental disorders, including periodontitis and cavities, contributed to higher demand for diagnostic imaging. Expanding dental insurance coverage in the U.S. and Canada encouraged more patients to seek preventive dental care, further driving market growth.

Additionally, the integration of cloud-based imaging software allowed for seamless data storage and remote collaboration among dental professionals. Collaborations between dental equipment manufacturers and service providers strengthened access to high-quality imaging solutions, reinforcing North America’s leadership in dental diagnostics.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to technological innovation and expanding dental care infrastructure. Ori Dental’s launch of its next-generation intraoral scanner in November 2022 marked a shift toward digital alternatives to traditional impression techniques, improving diagnostic accuracy and patient comfort. Rising awareness of oral health and the increasing prevalence of dental issues in countries like China, India, and Japan are likely to boost demand for high-resolution imaging technologies.

Government initiatives promoting preventive dental care and improved access to modern clinics are anticipated to support market expansion. Collaborations between global dental technology firms and regional healthcare providers are expected to enhance service quality and affordability. The growing adoption of AI-powered diagnostic tools and 3D printing for dental prosthetics is projected to further drive the industry.

Additionally, the expansion of dental tourism in Asia Pacific, supported by cost-effective yet high-quality treatments, is likely to attract international patients, strengthening the market’s growth trajectory.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the dental imaging market focus on advancing 3D imaging, AI-driven diagnostics, and digital radiography to improve accuracy and efficiency in dental procedures. Companies invest in research and development to enhance imaging resolution, reduce radiation exposure, and integrate cloud-based solutions for seamless data management. Strategic partnerships with dental clinics and hospitals help expand product adoption and improve accessibility.

Geographic expansion into emerging markets with growing demand for advanced dental diagnostics supports further growth. Many players also emphasize affordability and user-friendly designs to encourage widespread use among dental professionals.

Dentsply Sirona is a leading company in this market, offering innovative imaging solutions such as the Orthophos series, which provides high-quality panoramic and 3D imaging. The company focuses on technological advancements and strong collaborations with dental professionals to improve diagnostic capabilities. Dentsply Sirona’s commitment to precision and innovation establishes it as a key player in the industry.

Top Key Players

- PLANMECA OY

- Owandy Radiology

- Ningbo Runyes Medical Instrument Co. Ltd

- Midmark Corporation

- Envista Holdings Corporation

- Carestream Dental LLC

- Asahi Roentgen Co. Ltd

- ACTEON Group

Recent Developments

- In January 2024, Align Technology, Inc. launched the iTero Lumina intraoral scanner, designed to improve digital imaging in dentistry. The device features a significantly smaller and lighter scanning wand with an expanded field of capture, enabling faster and more precise scanning for better treatment planning.

- In March 2023, COLOGNE introduced its latest innovation, the PANDA Smart intraoral scanner, at IDS 2023. This compact and highly efficient device offers enhanced imaging capabilities, providing dental professionals with a user-friendly solution for digital impressions.

Report Scope

Report Features Description Market Value (2024) US$ 2.2 billion Forecast Revenue (2034) US$ 4.8 billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Extraoral Imaging (Panoramic Systems, Dental Cone Beam Computed Tomography (CBCT), and Panoramic & Cephalometric Systems) and Intraoral Imaging (X-ray Systems, Intraoral Cameras, Intraoral Photostimulable Phosphor Systems, Intraoral Scanners, and Intraoral Sensors)), By Application (Endodontics, Implantology, Oral & Maxillofacial Surgery, Orthodontics, and Others), By End-user (Solo Practices, DSO/Group Practices, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PLANMECA OY, Owandy Radiology, Ningbo Runyes Medical Instrument Co. Ltd, Midmark Corporation, Envista Holdings Corporation, Carestream Dental LLC, Asahi Roentgen Co. Ltd, and ACTEON Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PLANMECA OY

- Owandy Radiology

- Ningbo Runyes Medical Instrument Co. Ltd

- Midmark Corporation

- Envista Holdings Corporation

- Carestream Dental LLC

- Asahi Roentgen Co. Ltd

- ACTEON Group