Mammography Market by Product Type (Film Screen Systems, Digital Systems, 3D Systems), By Technology (Digital Mammography, Breast Tomosynthesis), By End-user, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 102289

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

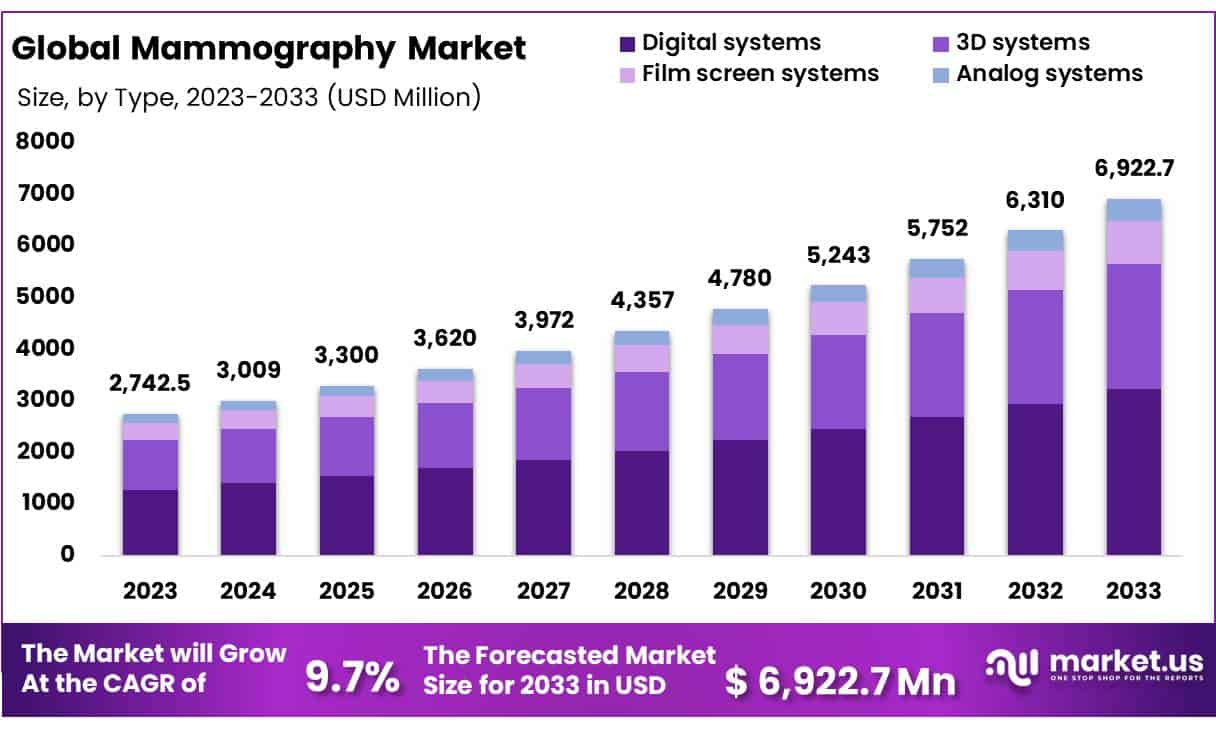

Global Mammography Market size is expected to be worth around USD 6,922.7 Million by 2033 from USD 2,742.5 Million in 2023, growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

An X-ray picture of the breast is known as a mammogram. It can screen for breast cancer in women with no symptoms. Screening mammography is the name given to this type of mammogram.

These mammograms often include two or more X-ray images of breasts. X-ray pictures can frequently detect tumors that cannot be touched. Microcalcifications (small calcium deposits) found during screening mammography can sometimes signal the presence of breast cancer. This method is frequently used to screen for breast cancer after discovering a lump or other sign or symptom of the illness. This category of mammography technique is known as diagnostic mammography.

The rising elderly population, the increase in the prevalence of breast cancer, and proactive efforts by medical care groups to promote awareness regarding early diagnosis of breast cancer are key factors expected to fuel market expansion. Furthermore, increased government funding for breast cancer R&D and technological advancements in breast tomosynthesis fuel interest in mammography systems.

Key Takeaways

- Market Size: Mammography Market size is expected to be worth around USD 6,922.7 Million by 2033 from USD 2,742.5 Million in 2023.

- Market Growth: The market growing at a CAGR of 9.7% during the forecast period from 2024 to 2033.

- Product Type Analysis: Digital systems accounts 46.8% market share in mammography market in 2023.

- Technology Analysis: Digital mammography dominate 80.9% market share in 2023.

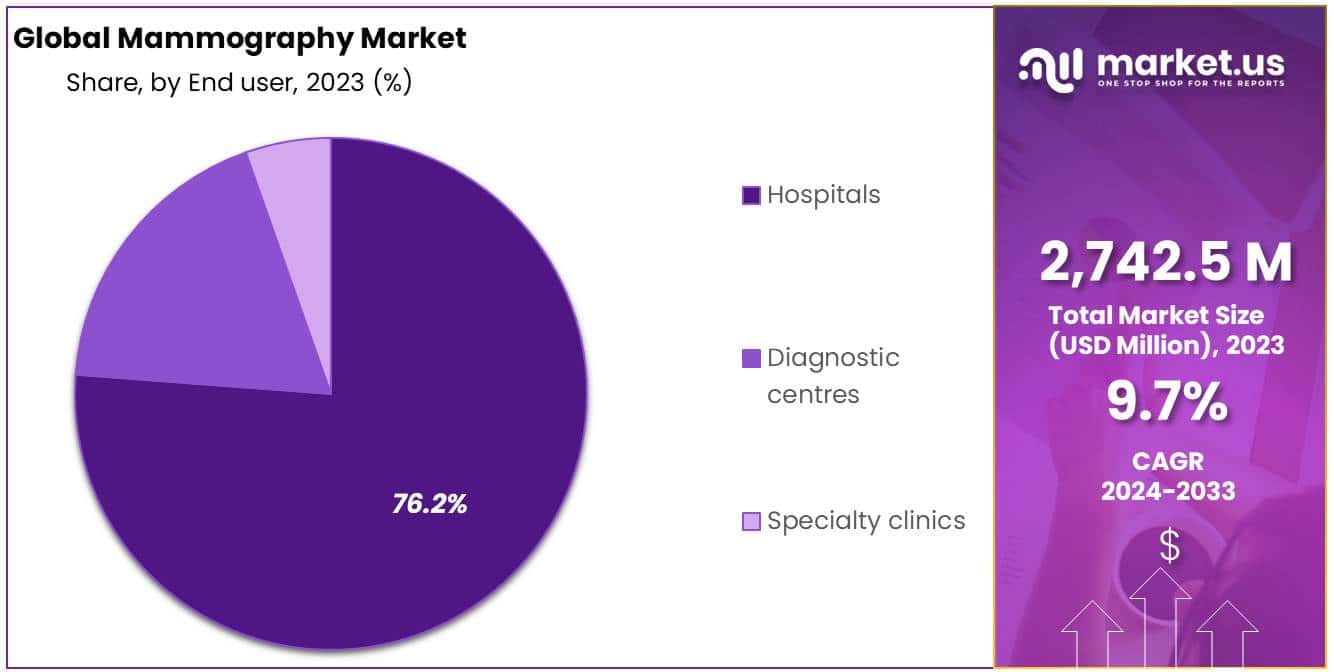

- End-Use Analysis: Mammography devices in hospital settings accounts 76.2% market share

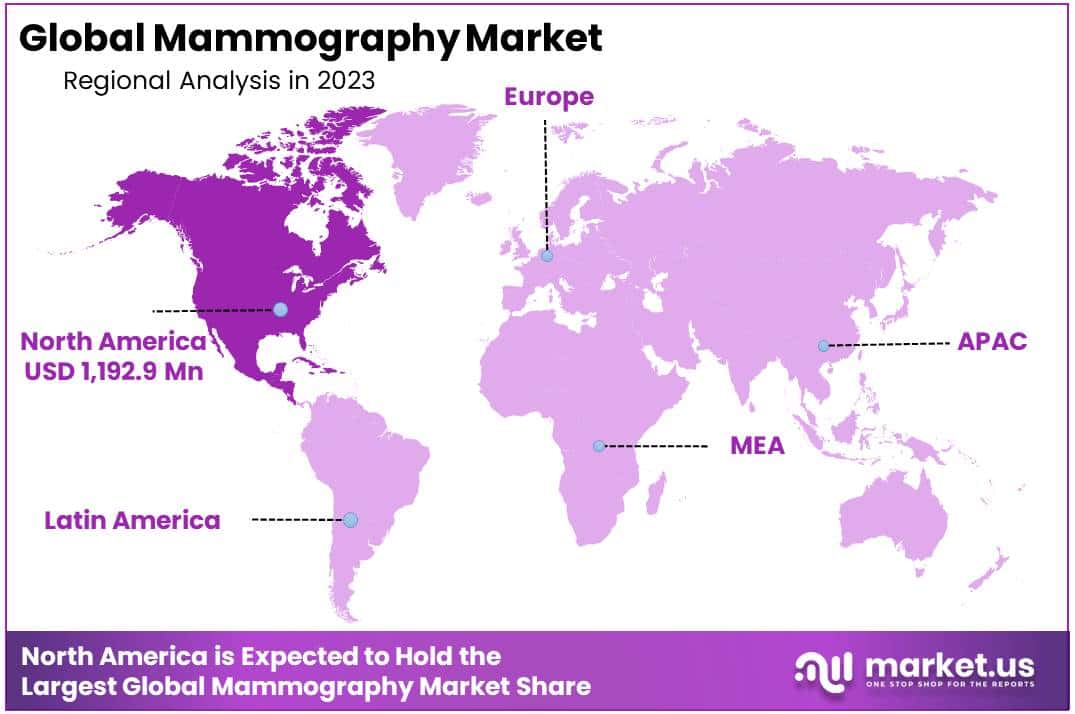

- Regional Analysis: The North American region is anticipated to hold the largest share of 43.5%, with a revenue of USD 1,192.9 million in the market.

- Rising Incidence of Breast Cancer: Mammography market growth can be directly tied to rising incidence rates for breast cancer worldwide and their consequent need for early detection and diagnosis.

- Heightening Awareness: Campaigns and government initiatives promoting breast screenings have successfully raised public and patient awareness, leading to market expansion.

Driving Factors

Rising prevalence of breast cancer

Breast cancer has increased to a great extent worldwide. Breast cancer is the most frequent type of cancer in women. It is the most common cancer among women in 140 of the world’s 184 countries. In 2020, the number of women diagnosed with breast cancer worldwide was around 2.3 million, with 685,000 dying. Every 14 seconds, a woman is diagnosed with breast cancer. According to the World Health Organization (WHO), in 2020, new breast cancer cases of up to 2 billion were estimated to be detected in women worldwide.

In the U.S., more women are affected due to breast cancer in comparison to other cancer types. Every year, it accounts for one-third of all new female malignancies. In the U.S., in 2023, 55,720 women will be diagnosed with non-invasive (in situ) breast cancer, and more than 290000 women will suffer due to an invasive version of breast cancer. Invasive breast cancer cases have risen by about 0.5 % annually since the early 2000s. Thus, due to the high prevalence of breast cancer, demand for mammography devices is anticipated to rise significantly throughout the forecasted period.

Technological Advancements

The mammography technique has progressed to a multi-image platform digital breast tomosynthesis (DBT) format from the single-emulsion film. Image quality has improved throughout this progression, and radiologists have become increasingly adept at detecting tumors. Machine learning (ML) and Artificial intelligence (AI) have lately emerged and offer significant potential in improving the precision and accuracy of mammographic screening procedures while decreasing reading times.

In this vital and evolving sector, applications in detection algorithms, AI-driven computer-aided diagnostic (CAD), and breast ultrasonography (US) are technologies to keep an eye on. Such technological advancements are expected to stimulate the market’s growth during the projected time period.

Investment In Breast Cancer Research

Several governments and private organizations are heavily investing in breast cancer research initiatives. The Breast Cancer Research Foundation (BCRF) announced US$ 47.5 million in breast cancer research funding for 2021-22 in October 2021, supporting 250 scientists at renowned academic and medical institutions worldwide across 14 nations.

It covers the full cancer spectrum, from investigating the most fundamental biology of a cancer cell to finding novel treatments and increasing the quality of life. Every year, the organization invests heavily in metastatic breast cancer research, which accounts for over 40% of BCRF’s research portfolio, sponsoring 76 projects in 2021 alone. Therefore, such important investments in breast cancer research are expected to accelerate the growth of the market over the forecast period.

Restraining Factors

Errors in Mammography

Mammography has long been the primary screening method for breast cancer. Despite significant technical advancements, large error rates have persisted. According to Asian Pacific Journal for Cancer Prevention, there is a possibility that a radiologist may miss about 10% and 30% of malignancies, whereas 80% of women recalled for additional views had normal outcomes, with 40% of biopsied lesions being benign. According to research, most tumors ignored are apparent but either go unreported or are judged benign.

Human-related features that result in contributory search, perception, and decision-making behaviors are causal agents for these errors. Technical, patient, and lesion aspects are also crucial, as are the kind and subtype of the disease itself, with traits such as triple-negative tumors being difficult to identify on screening. Thus, significant chances of errors may restrain the market growth during the projected time period.

High cost of equipment

Digital mammography devices are more expensive, which is one of their major drawbacks. Also, as the cost of replacing a failed detector is high, it adds to the expense of digital instruments. Moreover, all mammography equipment has wearable elements that need to be replaced. If a part is difficult to locate, it will almost always cost extra to purchase. Some X-ray tubes, for example, are only accessible from the original equipment manufacturer. OEM parts are frequently the most expensive. Therefore, the high cost of mammography equipment may limit the market growth during the forecast period.

By Product Type Analysis

Digital Systems are the demanding product

Demand for mechanically advanced breast cancer screening systems will likely drive segment growth. Digital systems accounts 46.8% market share in mammography market in 2023. Moreover, the launch of innovative products is expected to impact the growth of the segment positively. For example, in April 2021, the “Harmony” version of Innovality mammography equipment developed by Fujifilm Europe was introduced in Germany. AMULET Innovality is a Full Field of Digital Mammography (FFDM) that employs Fujifilm’s unique and cutting-edge technology to provide the best photos while exposing the patient to the least amount of radiation.

On the other hand, the 3D systems segment is expected to witness high growth during the estimated time period. This is because hospitals and diagnostic service providers are transitioning to 3D systems since 2D systems are frequently inadequate in identifying every indication of cancer, raising the need for additional screenings, which, in turn, increases the whole diagnostic cost.

Furthermore, the broad adoption of 3D systems is due to technological advantages such as better breast cancer detection rates, managing larger operation volumes, and a more favorable reimbursement scenario. Furthermore, some countries have instituted public mammography screening in recent years. 3D mammography machines are used in these programs to attain the best accuracy in detecting breast cancer. As a result, the aforementioned elements are expected to contribute to the growth of the segment in the next years.

By Technology Analysis

Digital Mammography dominates the market

Digital mammography dominate 80.9% market share in 2023. The radiographic image is obtained with digital detectors and electronically captured in a digital format with this technique. The image is further processed and rendered as a grayscale image that can be displayed in various forms. When compared to conventional film-screen mammography, digital mammography has various advantages.

Image acquisition, display, and storage are all substantially faster. Image manipulation allows radiologists to gain superior views by adjusting the chosen parts’ contrast, brightness, and magnification. This technology improves the ability to detect and diagnose breast carcinoma. It is a key factor likely to drive the demand for digital mammography systems throughout the projection period.

Also, the breast tomosynthesis segment is expected to grow over the forecast period. Digital breast tomosynthesis employs X-rays to create a 3-dimensional image of the breast. It is a novel tool for early-stage breast cancer detection. Digital breast tomosynthesis is highly beneficial in analyzing dense breasts and can improve the ability to identify breast cancer. It reduces the chances of false-positive readings and the need for a biopsy.

By End-User

Hospitals account for the largest share

The high prevalence of breast cancer has led to a rise in demand for mammography devices in hospital settings accounts 76.2% market share . Also, many multispecialty hospitals usually comprise in-house mammography facilities. This is likely to contribute to the growth of the segment significantly. Moreover, rising investments by several hospitals in providing advanced treatment services are anticipated to boost the growth of the segment.

Because of increased awareness about breast cancer, the diagnostic center segment is likely to rise significantly during the forecast period. This has increased the need for mammography treatments for breast cancer detection, treatment planning, and prevention. The availability of sophisticated mammography services in diagnostic centers in major and growing economies such as the United States, Germany, the United Kingdom, Japan, China, and India will likely drive overall market growth.

Market Segments

By Product Type

- Film Screen Systems

- Digital Systems

- Analog Systems

- 3D Systems

By Technology

- Digital Mammography

- Breast Tomosynthesis

- CAD Mammography

By End-user

- Hospitals

- Specialty Clinics

- Diagnosis Centers

- Other end-users

Growth Opportunity

Breast cancer initiatives

Various governments across the globe are implementing many initiatives for the prevention and treatment of breast cancer. An Australian government project named Breast Screen Australia aims to reduce suffering, illness, and death caused due to breast cancer through early disease detection. Women aged above 40 years are offered free mammography screening every two years, and women between the ages of 50 and 74 are actively encouraged to screen.

Also, the Goa government announced the launch of a free breast cancer screening initiative for 1 lakh women in October 2021. Breast cancer screenings will be conducted at 35 Goa Health Centers as part of this initiative. Such breast cancer initiatives implemented by several governments are anticipated to fuel the demand for mammography devices and open many opportunities for the market in the coming years.

Latest Trends

Demand for 2D/3D Combination Mammography Systems

When paired with 2D or synthetic 2D mammography, 3D mammography can detect more breast cancer cases than 2D mammography alone. According to a January 2022 paper published in the Egyptian Journal of Radiology and Nuclear Medicine, combining digital breast tomosynthesis (DBT) with digital mammography (DM) resulted in increased diagnostic accuracy, sensitivity, and positive predictive value (PPV).

According to the same source, 2D mammography alone detected 313 masses, but 2D and 3D mammography together detected 361 lesions, demonstrating that the combination of 2D/3D mammography improved lesion visualization. It is a promising trend expected to positively impact market growth in the upcoming years.

Regional Analysis

The North American region is anticipated to hold the largest share of 43.5%, with a revenue of USD 1,192.9 million in the market. The key drivers of the market in the North America region are the rising prevalence of breast cancer, considerable R&D investment in breast cancer medicines, and breakthroughs in breast imaging modalities. For example, in January 2022, the American Cancer Society estimated that around one in every three women are diagnosed with breast cancer in the U.S.

According to the American Cancer Society, about 2,87,850 new invasive breast cancer cases will be detected in women in the U.S. in 2022. According to data from the Canadian Cancer Society, in May 2022, an estimated 28,600 Canadian women will be diagnosed with breast cancer. The high burden of breast cancer in North American countries will likely fuel the demand for mammography equipment during the forecast period.

Also, the Asia Pacific region is expected to witness high growth during the estimated time period. Increasing incidence of breast cancer, rising awareness of early breast cancer screening, rising government funding for carcinoma therapy, rising technological advancements in breast scanning methods, and growing awareness of preventive breast cancer screening are key factors driving demand for mammography devices in the region.

Moreover, beneficial rules, government policies, and investments are critical to accelerating market growth in the region. Furthermore, high R&D spending, increased technological developments, and modernization in the healthcare sector will open up new chances for the mammography devices market over the estimated time period. Moreover, the increased availability of breast cancer screening systems and new government initiatives to enhance clinical interpretation will likely support the market’s growth.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Mammography market can be considered highly competitive. The market is growing rapidly due to rising demand for advanced mammography equipment for breast cancer treatment. Also, strategic initiatives promoting awareness regarding breast cancer by governments are one of the main factors boosting competition among key market players. Additionally, new strategic agreements and the launch of new and advanced products by key market players are likely to positively impact market growth in the upcoming years.

Top Key Players

- GE Healthcare

- Siemens Healthcare

- Fujifilm Holdings Corporation

- Analogic Corp

- Koninklijke Philips NV

- Canon Medical Systems Corp

- Metaltronica SpA

- Hologic Inc.

- Toshiba Medical Systems

- Planmed Oy

- Other key players

Recent Developments

- July 2023: Analogic Corp Introduced theSelenia Dimensions 3D mammography system with a new generation detector for enhanced image quality and dose reduction.

- August 2023: Fujifilm Holdings Corporation Collaborated with Kheiron Medical to develop AI-based solutions for breast cancer risk assessment and personalized screening strategies.

- September 2023: Hologic Inc. Launched the 3Dimensions mammography system with a new compression paddle for improved patient comfort and image quality.

- November 2023: Siemens Healthineers Received FDA clearance for its AI-powered Mammography Performance Index (MPI) software, which helps radiologists assess image quality and optimize workflow.

Report Scope

Report Features Description Market Value (2022) USD 2,742.5 Million Forecast Revenue (2033) USD 6,922.7 Million CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type- Film Screen Systems, Digital Systems, Analog Systems, 3D Systems, By Technology – Digital Mammography, Breast Tomosynthesis, CAD Mammography; and by End-user – Hospitals, Specialty Clinics, Diagnosis Centers, and Other end-users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GE Healthcare, Siemens Healthcare, Fujifilm Holdings Corporation, Analogic Corp, Koninklijke Philips NV, Canon Medical Systems Corp, Metaltronica SpA, Hologic Inc., Toshiba Medical Systems, Planmed Oy, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GE Healthcare

- Siemens Healthcare

- Fujifilm Holdings Corporation

- Analogic Corp

- Koninklijke Philips NV

- Canon Medical Systems Corp

- Metaltronica SpA

- Hologic Inc.

- Toshiba Medical Systems

- Planmed Oy

- Other key players