Global Urinalysis Market By Product (Consumables and Instruments), By Test Type (Biochemical Urinalysis, Sediment Urinalysis, and Other Test Types), By Application, By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 50995

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

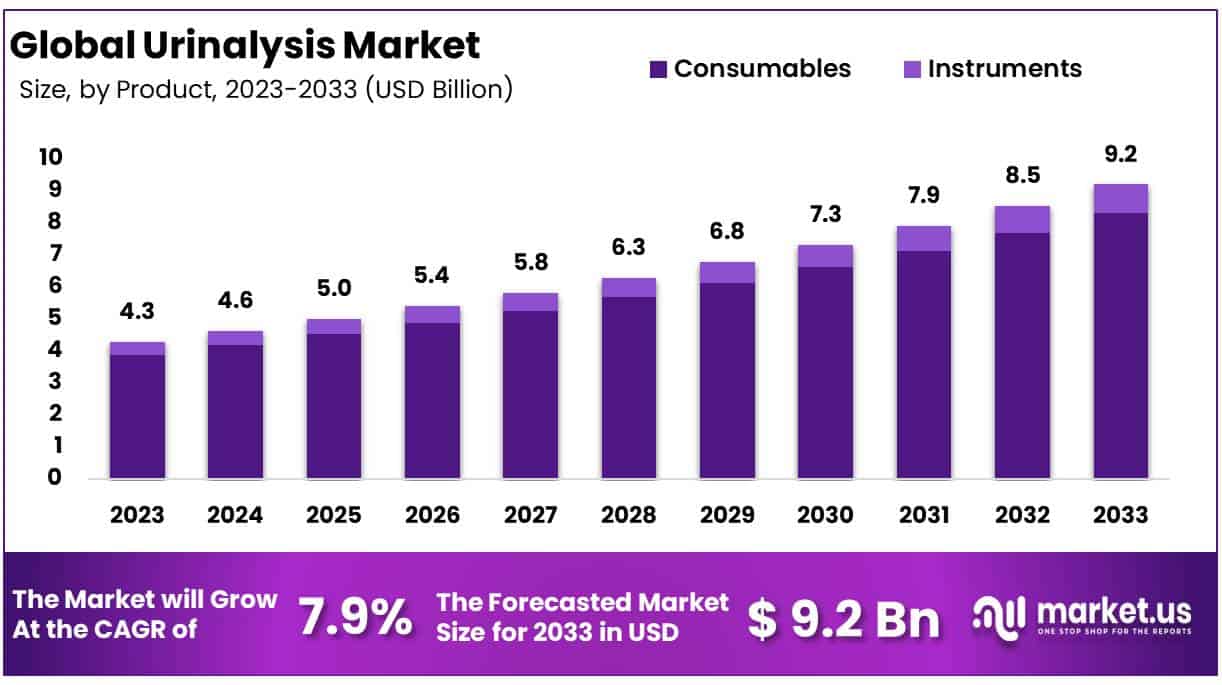

The Global Urinalysis Market size is expected to be worth around USD 9.2 Billion by 2033 from USD 4.3 Billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

A urine test, also called urinalysis, is a procedure that examines the urine for chemical, visual, and microscopic characteristics to determine if a patient is in good health. Healthcare providers often use urine tests to monitor and diagnose specific health conditions, kidney damage, and urinary tract infections. The industry will grow in the coming years due to the rising incidence of chronic diseases and increased awareness about routine medical checkups in developed countries.

The testing volume is expected to be driven by the need to protect and promote women’s health during pregnancy. Women at higher risk of developing a urinary tract infection due to hormone changes during pregnancy are at greater risk. UTIs can also cause severe complications in pregnancy, such as premature birth, high blood pressure, and low birth weight. Therefore, the future growth of the urinalysis market will be boosted by the recommendations and preferences of healthcare professionals regarding urine testing during pregnancy.

Key Takeaways

- Market Size: Urinalysis Market size is expected to be worth around USD 9.2 Billion by 2033 from USD 4.3 Billion in 2023.

- Market Growth: The market growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

- Product Analysis: The consumables segment held the highest market share of 90.3% in 2023.

- Test Type Analysis: Biochemical Urinalysis dominated the market by 60.8% in 2023.

- Application Analysis: The disease screening segment was dominate 75.4% market share in the urinalysis market.

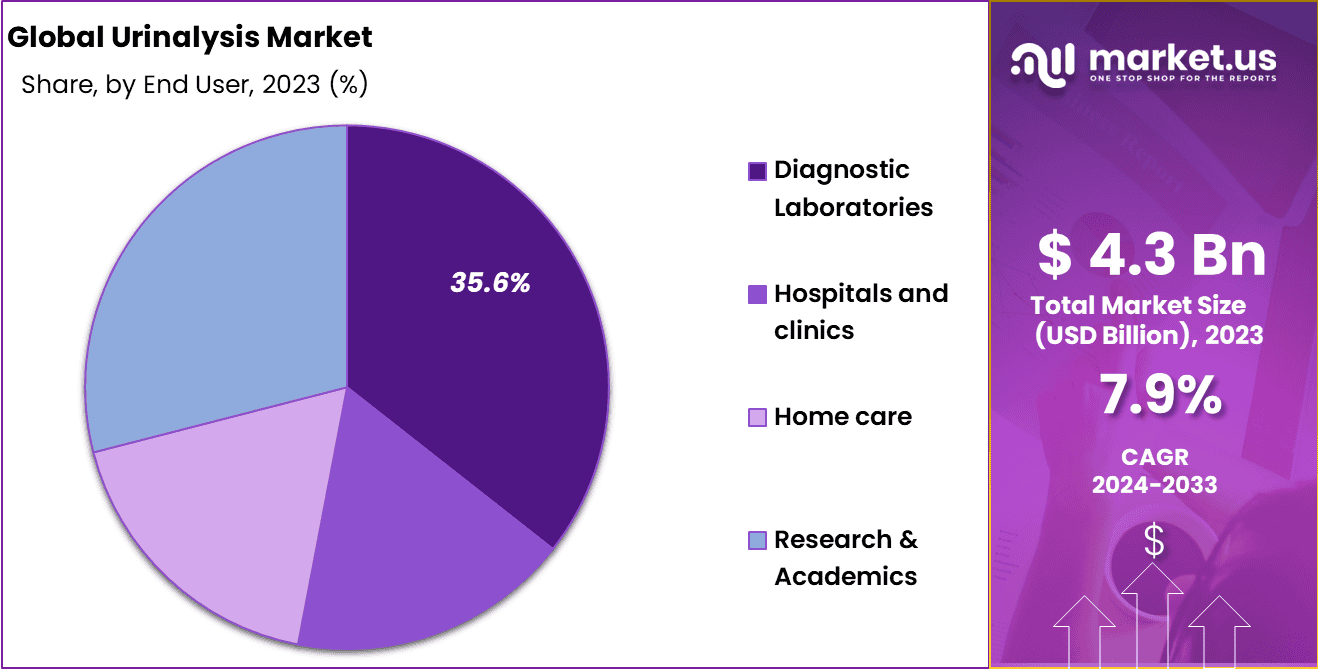

- End-Use Analysis: The largest revenue share of 35.6% was held by diagnostic laboratories in 2023.

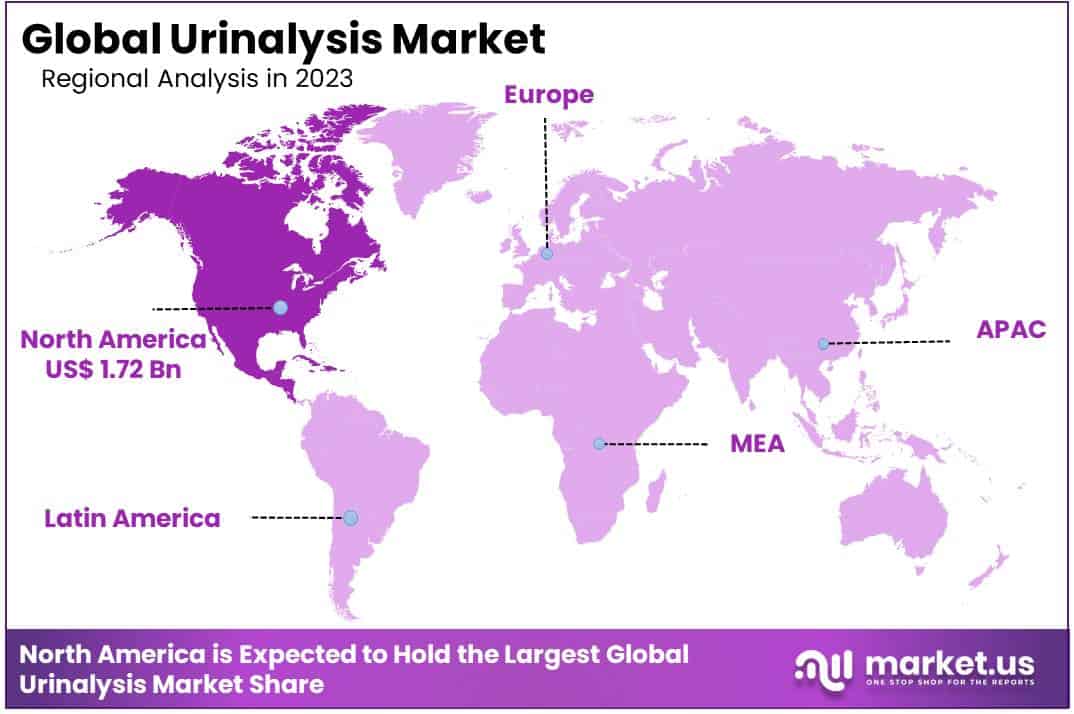

- Regional Analysis: North America was the dominant region in the market, accounting for 40.1% share of the total market revenue.

- Rise of Chronic Conditions: Chronic diseases like diabetes and hypertension require regular monitoring; thus increasing demand for urinalysis as a tool to manage and track these conditions.

- Early Disease Detection: Urinalysis plays a vital role in early disease detection for kidney ailments and other medical issues, providing timely intervention and treatment solutions.

- Self-Monitoring Devices: At-home urinalysis devices make self-monitoring of health more straightforward, encouraging proactive healthcare management and prompting individuals to monitor themselves more frequently and easily.

By Product Analysis

The consumable segment dominated the market

Based on product, the urinalysis market is segmented into consumables and instruments. The consumables include the sub-segments such as automated urine sediment analyzers, point-of-care urine analyzers, and biochemical urine analyzers. On the other hand, the instruments include sub-segments such as dipsticks, reagents, disposables, and pregnancy and fertility kits.

Among these segments, The consumables segment held the highest market share of 90.3% in 2023. This dominance can be attributed to increasing demand and frequent purchases of reagents and dipsticks by clinical and hospital laboratories. In addition, many leading players, such as F. Hoffmann-La Roche Ltd., Abbott, and Siemens Healthcare GmBH., provide high-quality consumables for urinalysis testing. Thus, this segment is expected to grow more.

During the forecast period, the instruments segment is anticipated to grow considerably. The automation of urinalysis has been improved by product developments, allowing for accurate results even in serious and complicated illnesses. In the future, the sector’s growth potential will be boosted by infrastructure development that allows for the adoption of advanced instruments.

By Test Type

The biochemical urinalysis segment held the largest revenue share in 2022

Based on test type, the urinalysis market is divided into biochemical urinalysis, sediment urinalysis, and other test types. The sediment urinalysis is subdivided into sediment, microscopic, and flow cytometric. Biochemical Urinalysis dominated the market by 60.8% in 2023 and is expected to grow at an impressive CAGR over the forecast period. This is mainly because biochemical Urinalysis is essential in diagnosing, evaluating, and managing various clinical problems. Sediment urinalysis segment growth is driven because the urine sediment can alert health care professionals to kidney disease’s presence or potential complications. It also provides diagnostic information, often identifying the area of kidney injury.

By Application Analysis

The disease screening segment dominated the market in 2022

The urinalysis market is classified into disease screening, disease screening, pregnancy & fertility, and other applications based on application. In addition, the disease screening is further sub-classified into UTIs, diabetes, kidney disease, hypertension, liver disease, and others. In 2023, the disease screening segment was dominate 75.4% market share in the urinalysis market. This is due to rising geriatric populations and age-related diseases, emerging economies offering significant growth opportunities, and increased adoption of POC diagnosis, which includes urinalysis for quick and convenient results.

Due to rising UTIs in the world, the dominant sub-segment of the market was the urinary tract infections segment. It accounted for 27.0% of the total revenue share in 2022. The National Library of Medicine estimates that around 150 million people are affected by urinary tract infections yearly. The diabetes segment is expected to grow at an impressive CAGR over the forecast period. A screening test that can detect diabetes is the urinalysis. The CDC estimates that diabetes will affect 38 million Americans by 2022. Around 29 million people are diagnosed with diabetes, while 8.7 million remain undiagnosed. Therefore, a growing number of diabetes patients is a key market driver.

During the forecast period, the segment of pregnancy and fertility products is expected to grow at a CAGR of 5.1%. Market growth is expected to be driven by the rising incidence of infertility and the increase in the first pregnancy age.

By End-User

The diagnostic laboratories dominated the market with the highest revenue share in 2022

Based on end-user, the global urinalysis market is divided into hospitals & clinics, diagnostic laboratories, home care, research and academics, and other end-users. The largest revenue share of 35.6% was held by diagnostic laboratories in 2023. Factors like an increase in age-related diseases, increased use of POC analyzers, and favorable regulatory guidelines & reimbursement situations in developed countries such as North America and Europe.

Due to the increased availability of UTI testing kits at home, the home care market is expected to increase CAGR over the forecast period significantly.

Key Market Segments

Based on Product

- Consumables(Automated Urine Sediment Analyzers, Point-Of-Care Urine Analyzers, and Biochemical Urine Analyzers)

- Instruments (Dipsticks, Reagents, Disposables, and Pregnancy And Fertility Kits)

Based on Test Types

- Biochemical Urinalysis

- Sediment Urinalysis

- Other Tests

Based on Applications

- Disease Screening (UTIs, Diabetes, Kidney disease, Hypertension, Liver disease, and Others)

- Pregnancy & Fertility

- Other Applications

By End-User

- Hospitals & Clinics

- Diagnostics Laboratories

- Home Care

- Research And Academics

- Other End-Users

Driving Factors

Increased adoption of automated urinalysis in diagnostic laboratories, hospitals, and clinics and rapid technological advancements in urinalysis methods for the early diagnosis of kidney diseases and urinary infections.

Automated urine microscopy analyzers based on pattern recognition and urine particle flow cytometers (UFCs), which have significantly reduced the labor intensity of urinalysis and opened up new feasible options and technical possibilities, have been made possible by informatics and computer technology advancements. Consequently, major market players have brought such instruments to market over the past ten years.

UTIs, diabetes, and other liver & kidney diseases are becoming more common

Urinalysis is widely used to diagnose and treat liver and kidney diseases. The ability to analyze the levels of chemical compounds in urine allows clinicians to make an accurate diagnosis. These factors will fuel market growth.

Restraining Factors

High availability of refurbished urine analyzers

People in developing countries are more price sensitive and prefer inexpensive instruments with similar functions. Low-quality or refurbished products can flood the market without a solid regulatory framework.

Sample contamination caused by a lack of qualified medical professionals and improper urine collection methods

In order to perform a thorough urinalysis, skilled personnel must operate complex instruments in central processing areas that can handle thousands of samples simultaneously. Many microscopy tests can take a lot of time due to the need for culture and physical assessment. This strategy is costly due to the high number of negative results. In addition, it might be difficult for urine samples to be stored and transported to testing facilities. Transporting samples, including test strips, can also lead to degrading targets of interest. Sample contamination can also occur due to poor collection techniques. These factors will likely limit market revenue growth over the forecast period.

Growth Opportunities

Infrastructure development, the active presence of key players, and increasing chronic diseases

Key players in the market for urinalysis are likely to see growth opportunities in developing countries like South Korea, Brazil, and India. This is due to an increasing number of chronic diseases, improved healthcare infrastructure, and a large patient population. In addition, the technological advancement in urine analyzers will also be a potential factor for creating the opportunity for market growth in the future. The automation of urinalysis has been improved by product developments, allowing for accurate results even in serious and complicated illnesses. In the future, the sector’s growth potential will be boosted by infrastructure development that allows for the adoption of advanced instruments.

Regional Analysis

The North America region dominated the market in 2023

Based on region, the global urinalysis market is classified into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2023, North America was the dominant region in the market, accounting for 40.1% share of the total market revenue. One factor behind this is that the key players have taken strategic initiatives to increase their business footprint, such as licensing agreements.

The Asia Pacific market is expected to grow at the fastest rate over the forecast period due to the existence of domestic manufacturers of urine analyzers, such as VSI Electronics Pvt. The growth of the Asia Pacific market is due to several factors, including the increasing use of advanced urine analyzers, the growing adoption of these analyses, and the large patient base with unmet clinical needs.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the limited number of players operating both globally and locally, the Urinalysis market is relatively competitive. To increase their market share in the urinalysis industry, companies are taking strategic steps such as partnerships, collaborations, advancement in testing procedures, new product launches, and further mergers & acquisitions. These steps togetherly aid in portfolio expansion, forming a competitive landscape and positively driving the market towards growth.

Market Key Players

Listed below are some of the most prominent urinalysis market players.

- Abbott

- Sysmex Corporation

- Siemens Healthcare Gmbh

- ACON Laboratories, Inc.

- ARKRAY, Inc.

- Bio-Rad Laboratories, Inc.

- Quidel Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Beckman Coulter, Inc.

- Hoffmann-La Roche Ltd.

- Cardinal Health.

- Other Key Players

Recent Developments

- January 2024: ACON Laboratories, Inc. launched the Mission® U500 Urine Analyzer, a compact and user-friendly device for high-volume urine testing. This product aims to meet the demands of both clinical laboratories and point-of-care settings with its efficient and reliable performance.

- February 2024: Sysmex Corporation acquired a minority stake in a leading AI-based diagnostics startup, Deep Bio. This strategic acquisition aims to integrate AI technologies into Sysmex’s urinalysis systems, enhancing the accuracy and efficiency of urine testing.

- March 2024: Abbott launched the i-STAT Alinity urinalysis system, featuring rapid and accurate urine testing capabilities for point-of-care diagnostics. This new product aims to enhance clinical decision-making by providing healthcare professionals with reliable and timely urine analysis results.

- April 2024: Siemens Healthcare GmbH introduced the CLINITEK Novus XL, an advanced urinalysis analyzer with improved throughput and connectivity features. This new product is designed to streamline laboratory workflows and provide precise urine analysis results for better patient management.

- May 2024: ARKRAY, Inc. announced the merger with another diagnostics company, Japan Diagnostics Co., Ltd., to expand its product portfolio and market reach. This merger aims to strengthen ARKRAY’s position in the urinalysis market by combining expertise and resources.

Report Scope

Report Features Description Market Value (2023) USD 4.3 Billion Forecast Revenue (2033) USD 9.2 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product – Consumables and Instruments; By Test Type – Biochemical Urinalysis, Sediment Urinalysis, and Other Test Types; By Application – Disease Screening, Pregnancy & Fertility, and Other Applications; By End User – Hospitals & Clinics, Diagnostics Laboratories, Home Care, Research And Academics, and Other End-Users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott, Sysmex Corporation, Siemens Healthcare Gmbh, ACON Laboratories, Inc., ARKRAY, Inc., Bio-Rad Laboratories, Inc., Quidel Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Beckman Coulter, Inc., F. Hoffmann-La Roche Ltd., Cardinal Health., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the key drivers of growth in the urinalysis market?The urinalysis market is driven by factors such as the increasing prevalence of kidney diseases, the growing aging population, and the adoption of automated urinalysis systems.

How big is the Urinalysis Market?The global Urinalysis Market size was estimated at USD 4.3 Billion in 2023 and is expected to reach USD 9.2 Billion in 2033.

What is the Urinalysis Market growth?The global Urinalysis Market is expected to grow at a compound annual growth rate of 7.9%. From 2024 To 2033

Who are the key companies/players in the Urinalysis Market?Some of the key players in the Urinalysis Markets are Abbott, Sysmex Corporation, Siemens Healthcare Gmbh, ACON Laboratories, Inc., ARKRAY, Inc., Bio-Rad Laboratories, Inc., Quidel Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Beckman Coulter, Inc., F. Hoffmann-La Roche Ltd., Cardinal Health., and Other Key Players.

How does technology impact the urinalysis market?Advancements in technology have led to the development of automated urinalysis systems, enabling faster and more accurate test results, which is driving market growth.

What is the outlook for the urinalysis market in the near future?The urinalysis market is expected to witness continued growth due to the increasing awareness of preventive healthcare and the need for early detection of renal disorders.

How important is data analytics in urinalysis?Data analytics plays a crucial role in interpreting urinalysis results, helping healthcare professionals identify patterns, trends, and potential health issues.

-

-

- Abbott

- Sysmex Corporation

- Siemens Healthcare Gmbh

- ACON Laboratories, Inc.

- ARKRAY, Inc.

- Bio-Rad Laboratories, Inc.

- Quidel Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Beckman Coulter, Inc.

- Hoffmann-La Roche Ltd.

- Cardinal Health.

- Other Key Players