Global Vehicle Intrusion Detection Market Size, Share, Growth Analysis By Component (Hardware, Software, Services), By Technology (Radar-Based Intrusion Detection, Ultrasonic-Based Intrusion Detection, Infrared-Based Intrusion Detection, LIDAR-Based Intrusion Detection, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application (Active Vehicle Protection Systems, Remote Vehicle Monitoring, Emergency Vehicle Systems, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142713

- Number of Pages: 282

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

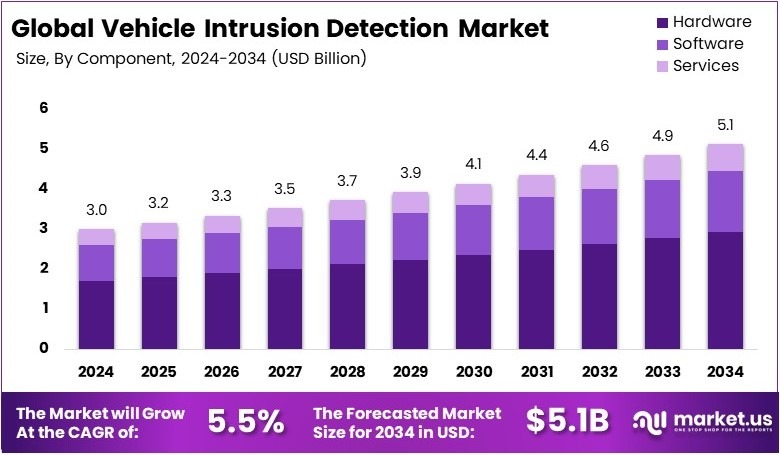

The Global Vehicle Intrusion Detection Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 3.0 Billion in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Vehicle Intrusion Detection is a security system that identifies unauthorized access or cyber threats in vehicles. It monitors networks, sensors, and software to detect hacking attempts or physical break-ins. This technology is essential for protecting modern vehicles, including connected and autonomous cars, from cyberattacks and theft.

The Vehicle Intrusion Detection Market includes companies and technologies that develop security solutions for vehicles. It is growing due to the rise of connected cars and increasing cybersecurity threats. Automakers and tech firms invest in intrusion detection systems to enhance vehicle security, protect user data, and comply with regulations.

According to Upstream’s 2025 Global Automotive & Smart Mobility Cybersecurity Report, cyber threats in the automotive sector surged in 2024. Notably, 60% of incidents had high or massive-scale impacts. Furthermore, massive-scale attacks tripled, rising from 5% in 2023 to 19% in 2024. As vehicles become more connected, security risks increase.

Vehicle intrusion detection systems help prevent cyberattacks by identifying unauthorized access in real time. With growing cybersecurity threats, automakers are investing in advanced detection technologies. Moreover, governments are enforcing stricter security regulations. For example, the U.S. Department of Commerce’s BIS rule, effective March 17, 2025, restricts transactions involving vehicle connectivity hardware from specific foreign entities.

The market for vehicle intrusion detection is expanding due to rising cybersecurity concerns. Automakers and fleet operators prioritize securing vehicle networks. Additionally, smart mobility platforms and EV charging stations face growing threats, driving demand for robust security systems. Consequently, investments in AI-driven threat detection are increasing to enhance real-time monitoring and risk mitigation.

As the industry grows, market saturation levels vary. Developed markets like North America and Europe have widespread adoption, while emerging regions show increasing demand. Furthermore, competition is rising, with cybersecurity firms collaborating with automakers to develop cutting-edge solutions. In contrast, companies without advanced security capabilities risk losing market share to tech-focused competitors.

On a broader scale, enhanced vehicle cybersecurity protects critical infrastructure and reduces financial losses from cyberattacks. Additionally, stronger security measures prevent disruptions in transportation systems and smart mobility services. In contrast, failure to implement strict cybersecurity protections could lead to widespread vehicle vulnerabilities, impacting millions of users and causing economic damage.

Key Takeaways

- The Vehicle Intrusion Detection Market was valued at USD 3.0 billion in 2024 and is expected to reach USD 5.1 billion by 2034, with a CAGR of 5.5%.

- In 2024, Hardware led the component segment with 57.4% due to the demand for advanced security devices.

- In 2024, Radar-Based Intrusion Detection held 43.8% share, benefiting from its high accuracy and reliability.

- In 2024, Passenger Vehicles dominated with 66.6% share due to increased consumer demand for security solutions.

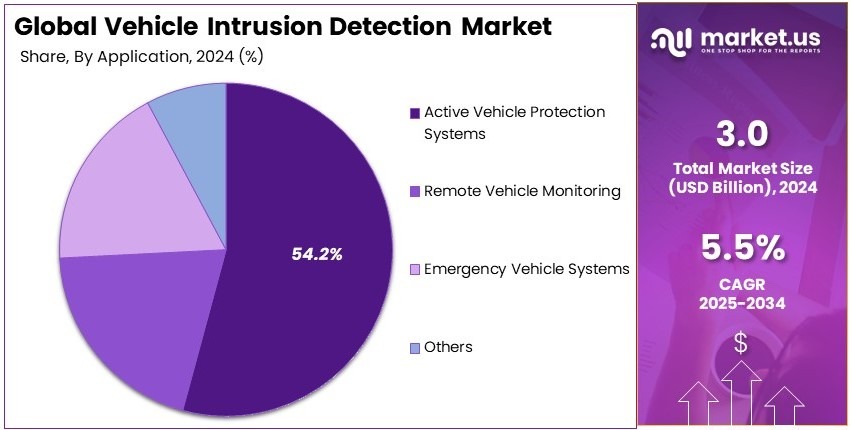

- In 2024, Active Vehicle Protection Systems accounted for 54.2%, driven by stringent safety regulations.

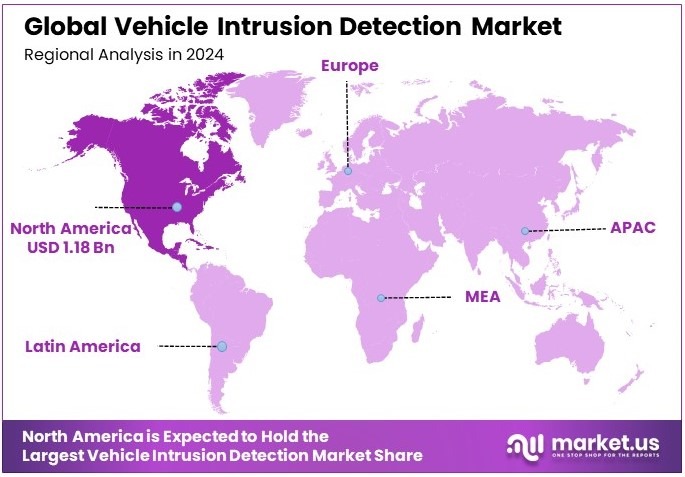

- In 2024, North America led with 38.8% market share, valued at USD 1.18 billion, due to strong automotive cybersecurity initiatives.

Component Analysis

Hardware dominates with 57.4% due to its essential role in system functionality.

In the Vehicle Intrusion Detection Market, the Component segment is fundamental, with Hardware standing out by capturing a substantial 57.4% market share. This significant presence is due to the crucial role that hardware components, like sensors and cameras, play in the functionality of intrusion detection systems. These components are the primary tools for detecting unauthorized access, making them indispensable in vehicle security systems.

Software and Services are also vital sub-segments. Software enables the interpretation of data collected by hardware, enhancing the system’s ability to accurately detect and respond to threats. Services, including installation, maintenance, and updates, ensure that intrusion detection systems remain effective and up-to-date, contributing to overall market growth.

Technology Analysis

Radar-Based Intrusion Detection dominates with 43.8% due to its accuracy and reliability.

Technology within the Vehicle Intrusion Detection Market is a key area, with Radar-Based Intrusion Detection leading with a 43.8% share. This technology’s dominance is attributed to its high accuracy and reliability in detecting movements or intrusions, even under adverse weather conditions, making it highly dependable for vehicle security.

Other technologies like Ultrasonic-Based, Infrared-Based, and LIDAR-Based Intrusion Detection each play crucial roles. Ultrasonic systems are great for close-range detection, while Infrared excels in night-time applications. LIDAR offers precise detection capabilities, although at a higher cost, affecting its market share slightly.

Vehicle Type Analysis

Passenger Vehicles dominate with 66.6% due to their large market base and high demand for security.

In the segmentation by Vehicle Type, Passenger Vehicles lead significantly with a 66.6% market share. This dominance is largely because these vehicles represent a massive portion of the automotive market, where security concerns are increasingly prioritized by consumers looking to protect their vehicles against theft and unauthorized access.

Commercial Vehicles also contribute to the market but to a lesser extent. These vehicles often require customized security solutions tailored to their specific needs, which include cargo protection and fleet management security features.

Application Analysis

Active Vehicle Protection Systems dominate with 54.2% due to their critical role in immediate vehicle safety.

Lastly, in the Application segment of the Vehicle Intrusion Detection Market, Active Vehicle Protection Systems hold the majority share of 54.2%. Their dominance is primarily due to the essential role they play in providing immediate responses to intrusion attempts, crucial for preventing theft and ensuring passenger safety in real-time.

Other applications like Remote Vehicle Monitoring and Emergency Vehicle Systems also play essential roles by allowing remote access control and enhancing the capability to respond to emergencies effectively, respectively. These applications enrich the market’s diversity and help cater to a broad range of consumer needs, driving further adoption of intrusion detection technologies.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Technology

- Radar-Based Intrusion Detection

- Ultrasonic-Based Intrusion Detection

- Infrared-Based Intrusion Detection

- LIDAR-Based Intrusion Detection

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

By Application

- Active Vehicle Protection Systems

- Remote Vehicle Monitoring

- Emergency Vehicle Systems

- Others

Driving Factors

Cyber Threats and AI-Driven Analysis Drive Market Growth

The growing risk of cyber threats in connected vehicles is a major factor driving the demand for vehicle intrusion detection systems. As cars become more connected, they are increasingly vulnerable to hacking, data breaches, and unauthorized access.

Criminals can exploit weaknesses in vehicle networks to steal personal data or even control car functions remotely. For this reason, automakers are integrating advanced intrusion detection solutions to protect vehicles from cyber risks.

Additionally, artificial intelligence (AI)-driven behavioral analysis plays a key role in enhancing security. AI algorithms can analyze driving patterns and detect unusual activity, helping prevent unauthorized access in real time. This technology ensures a proactive security approach, allowing vehicles to identify threats before they escalate.

Governments worldwide are also enforcing strict regulations that require advanced security features in modern vehicles. These mandates push automakers to invest in robust intrusion detection technologies, ensuring compliance and enhancing consumer trust.

At the same time, biometric security systems, such as fingerprint or facial recognition, are gaining traction. These features add an extra layer of protection, ensuring that only authorized users can start or access the vehicle.

Restraining Factors

High Costs and Complexity Restrain Market Growth

Despite strong demand for vehicle intrusion detection systems, several challenges slow market expansion. One major barrier is the high cost of implementing advanced security solutions. Many automakers hesitate to invest in expensive security technology, especially for budget-friendly car models. The high costs make these solutions less accessible to a broader market, limiting widespread adoption.

Additionally, integrating multiple security layers into modern vehicles can be highly complex. Cars now feature a mix of sensors, cameras, and software-based detection tools, making seamless integration difficult. Ensuring that all components work together without causing system malfunctions or delays requires significant investment in research and development.

Another challenge is the limited consumer awareness of vehicle intrusion detection systems. Many vehicle owners remain unaware of potential cyber risks or the benefits of security solutions, reducing adoption rates. Without proper education and marketing efforts, customers may not see the need for these protective measures.

Furthermore, false alarms in intrusion detection systems can cause inconvenience. These alerts, triggered by minor disturbances or system errors, may lead to unnecessary concerns for vehicle owners, discouraging them from relying on these systems. As a result, manufacturers need to refine their technology to reduce false positives while keeping costs manageable.

Growth Opportunities

5G and Cloud-Based Security Provide Opportunities

The expansion of 5G technology is opening new opportunities for real-time vehicle security monitoring. Faster and more reliable internet connections allow intrusion detection systems to operate with minimal delay, improving response times in case of security threats. With 5G, vehicles can instantly communicate with security networks, making real-time monitoring more effective.

Additionally, cloud-based security monitoring systems are gaining popularity. These solutions enable remote tracking and monitoring of vehicle security, allowing automakers and fleet operators to detect suspicious activity instantly. Through cloud-based platforms, companies can store, analyze, and act on security data without relying solely on in-vehicle computing power.

Another promising development is the adoption of blockchain technology for secure data transmission. With blockchain, vehicle data can be stored and shared securely, reducing the risk of hacking and data manipulation. This technology ensures that data exchanges remain transparent and tamper-proof, enhancing overall vehicle security.

Furthermore, edge computing is being integrated into vehicle security systems to enhance localized intrusion detection. This approach ensures that threat detection and response happen within the vehicle itself, without relying on external servers. These advancements present major growth opportunities for companies in the vehicle intrusion detection market.

Emerging Trends

Remote Immobilization and V2X Integration Are Latest Trending Factors

Remote vehicle immobilization is emerging as a key trend in the vehicle intrusion detection market. This feature allows owners or law enforcement to disable a stolen vehicle remotely, preventing theft and improving recovery rates. Automakers are increasingly integrating this functionality into their security systems, making it a sought-after feature for modern vehicles.

Another significant trend is the integration of intrusion detection systems with vehicle-to-everything (V2X) communication. V2X technology enables cars to interact with other vehicles, traffic signals, and infrastructure, improving security through real-time threat detection. This connectivity enhances overall vehicle awareness and helps prevent potential cyber threats before they become serious issues.

Additionally, biometric authentication methods such as facial recognition and voice authentication are becoming more common in modern vehicles. These features offer a secure, convenient way to verify the driver’s identity, reducing the risk of unauthorized access. As more automakers incorporate biometrics, vehicle security will become more personalized and harder to breach.

The rise of electric and autonomous vehicles is also influencing the adoption of advanced intrusion detection solutions. Since these vehicles rely heavily on software and connectivity, they require strong cybersecurity measures to prevent hacking attempts. As technology advances, these trends will continue shaping the vehicle intrusion detection market, making security a key focus for automakers and technology providers.

Regional Analysis

North America Dominates with 38.8% Market Share in the Vehicle Intrusion Detection Market

North America leads the Vehicle Intrusion Detection Market with a substantial 38.8% share, valued at USD 1.18 billion. This commanding presence is fueled by the region’s advanced automotive sector, comprehensive adoption of cutting-edge security technologies, and significant consumer awareness about vehicle safety.

The region’s strong automotive industry, coupled with a high demand for advanced safety features in vehicles, drives the adoption of intrusion detection systems. Furthermore, collaborations between automotive manufacturers and tech companies enhance product offerings, boosting the market’s growth.

Looking forward, North America is expected to maintain its lead in the market due to ongoing innovations in vehicle technology and growing investments in automotive security. The increasing prevalence of connected cars and the expansion of electric vehicle production are likely to further enhance the demand for sophisticated intrusion detection systems.

Regional Mentions:

- Europe: Europe remains a strong player in the Vehicle Intrusion Detection Market, driven by stringent safety regulations and the high adoption rate of new technologies. The region’s focus on automotive safety and security standards supports steady growth.

- Asia Pacific: Asia Pacific is rapidly advancing in the Vehicle Intrusion Detection Market, spurred by the expanding automotive industry in countries like China and India. Increasing vehicle production and rising security concerns are key growth drivers.

- Middle East & Africa: The Middle East and Africa are gradually catching up in the market, with improvements in vehicle safety standards and the slow but steady adoption of modern automotive technologies.

- Latin America: Latin America shows potential growth in the Vehicle Intrusion Detection Market, though it is currently small. The region is beginning to embrace more advanced automotive technologies, driven by increasing vehicle sales and security concerns.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the Vehicle Intrusion Detection Market, the top contenders include Bosch Group, Continental AG, Denso Corporation, and Valeo SA. These companies are instrumental in advancing intrusion detection technologies and have a significant impact on market trends.

Bosch Group is a leader in automotive technologies, providing sophisticated intrusion detection systems that enhance vehicle security. Their products are renowned for reliability and integration with other vehicle safety features. Continental AG complements this with a range of security solutions that include advanced sensor technologies and system solutions that improve the overall safety and security of vehicles.

Denso Corporation, known for its innovation in automotive electronics, offers cutting-edge intrusion detection systems that are integral to modern vehicle safety architectures. Lastly, Valeo SA specializes in providing automotive suppliers with robust detection systems that incorporate ultrasonic sensors and cameras to detect potential breaches effectively.

These companies are pivotal in pushing the boundaries of what’s possible in vehicle security, continuously innovating to address emerging threats and enhance user safety. Their collective efforts are shaping a more secure future in automotive technology, making vehicles safer and more resistant to unauthorized access.

Major Companies in the Market

- Bosch Group

- Continental AG

- Denso Corporation

- Valeo SA

- Hella GmbH & Co. KGaA

- Delphi Technologies (BorgWarner)

- Autoliv Inc.

- Aptiv PLC

- Magna International Inc.

- ZF Friedrichshafen AG

- Tass International (Siemens)

- Panasonic Corporation

Recent Developments

- Triton and Bosch: On December 2024, private equity firm Triton acquired Bosch’s security and communications technology business, which includes Video, Access and Intrusion, and Communication units. This division, generating over €1 billion in sales and employing 4,300 individuals, represents Triton’s strategic expansion into security technologies. The deal is expected to close by mid-2025, subject to regulatory approvals.

- Eagle Eye Networks: In 2023, cloud-based video surveillance leader Eagle Eye Networks secured a $100 million investment from SECOM. The investment is intended to enhance Eagle Eye’s artificial intelligence capabilities in physical security. Since its founding in 2012, the company has been recognized for its rapid growth, featuring consistently on the Deloitte Technology Fast 500 list.

Report Scope

Report Features Description Market Value (2024) USD 3.0 Billion Forecast Revenue (2034) USD 5.1 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Technology (Radar-Based Intrusion Detection, Ultrasonic-Based Intrusion Detection, Infrared-Based Intrusion Detection, LIDAR-Based Intrusion Detection, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Application (Active Vehicle Protection Systems, Remote Vehicle Monitoring, Emergency Vehicle Systems, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bosch Group, Continental AG, Denso Corporation, Valeo SA, Hella GmbH & Co. KGaA, Delphi Technologies (BorgWarner), Autoliv Inc., Aptiv PLC, Magna International Inc., ZF Friedrichshafen AG, Tass International (Siemens), Panasonic Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vehicle Intrusion Detection MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Vehicle Intrusion Detection MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bosch Group

- Continental AG

- Denso Corporation

- Valeo SA

- Hella GmbH & Co. KGaA

- Delphi Technologies (BorgWarner)

- Autoliv Inc.

- Aptiv PLC

- Magna International Inc.

- ZF Friedrichshafen AG

- Tass International (Siemens)

- Panasonic Corporation