Global Blind Spot Alert System Market Based On Product Type (Blind spot detection system, Park assist system, Backup camera system, Surround-view system, Other Product Types), Based on Technology (Camera-based system, Radar-based system, Ultrasonic-based system, Other Technologies), Based on Vehicle Type (Passenger vehicle, Light commercial vehicle, Heavy commercial vehicle, Other Vehicles), Based On the Sales Channel (OEM, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 99473

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based On Product Type Analysis

- Based on Technology Analysis

- Based on Vehicle Type Analysis

- Based On the Sales Channel Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

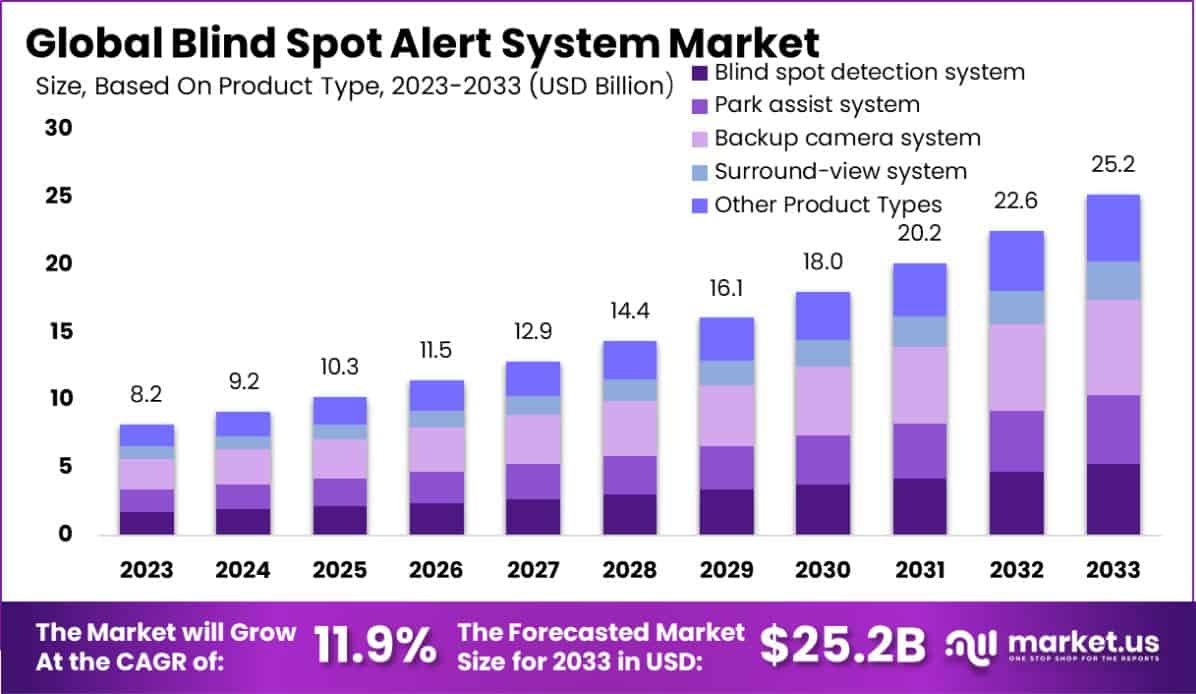

The Global Blind Spot Alert System Market is expected to be worth around USD 25.2 billion by 2033, up from USD 8.2 billion in 2023, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

A Blind Spot Alert System is a vehicle-based sensor device that detects other vehicles located on the driver’s side and rear. Warnings can be visual, audible, vibrating, or tactile. However, they might not detect fast-moving vehicles or pedestrians and cyclists. The system is designed to increase safety by reducing accidents caused by the driver’s failure to see other vehicles in the blind spot during lane changes or other maneuvers.

The Blind Spot Alert System Market involves the sales of sensor-based systems used in automobiles to alert drivers about obstacles in their blind spots. This market has grown with the increase in vehicle automation and safety standards globally. It encompasses various technologies including radar, ultrasonic, and cameras integrated into passenger and commercial vehicles.

The primary growth factor for the Blind Spot Alert System Market is the increasing emphasis on automotive safety standards worldwide. Governments and regulatory bodies are implementing stringent safety norms compelling manufacturers to integrate advanced safety technologies into their vehicles. This regulatory pressure, coupled with consumer demand for safer vehicles, drives the adoption of blind spot alert systems.

Demand in the Blind Spot Alert System Market is driven by consumer awareness of vehicle safety and the rising prevalence of road accidents. As drivers become more safety-conscious, the demand for vehicles equipped with advanced driver-assistance systems (ADAS) like blind spot detection increases. This trend is supported by the overall shift towards more technologically advanced vehicles.

Significant opportunities in the Blind Spot Alert System Market lie in the integration of these systems with broader automotive safety networks. As vehicles become increasingly connected, integrating blind spot detection with other safety features like lane-keeping assists and adaptive cruise control presents a chance for market expansion. Additionally, the push towards autonomous vehicles offers further prospects for advanced, integrated safety technologies.

The Blind Spot Alert System Market is witnessing a significant trajectory, underscored by a blend of regulatory push and technological advancements. A notable incident highlighting the imperative for such systems was reported by Finra, where a firm faced nearly $265,000 in unwarranted charges due to a blind spot in its oversight system, affecting over 1,450 accounts.

This underscores a broader market necessity for precision in monitoring systems that can preemptively identify and mitigate risks.

In the technology sphere, the progression of companies like ADASTECH, also known as Haomibo, further cements the market’s growth vector. ADASTECH’s recent Series A+ funding round, which attracted substantial investments from prominent entities like JAC Motors and Eastern Bell Capital, raised an impressive sum, converting to approximately $15.8 million.

The company specializes in millimeter-wave radar systems integral for blind spot detection, among other automotive applications. Since its inception in 2016 in Suzhou, China, ADASTECH has been at the forefront of innovating radar technologies that enhance vehicular safety and complement the growing demands of the automotive industry.

The convergence of escalating regulatory requirements with cutting-edge technological innovations presents substantial growth opportunities within the Blind Spot Alert System Market.

As vehicular safety becomes non-negotiable, and as automotive manufacturers invest in robust safety features, the market for blind spot alert systems is set to expand, driven by the dual engines of necessity and innovation.

This market dynamic not only enhances safety but also propels a shift towards more sophisticated vehicular communication systems, paving the way for advanced driver-assistance systems (ADAS) and eventually autonomous driving technologies.

Key Takeaways

- The Global Blind Spot Alert System Market is expected to be worth around USD 25.2 billion by 2033, up from USD 8.2 billion in 2023, growing at a CAGR of 11.9% during the forecast period from 2024 to 2033.

- In 2023, Backup camera systems held a dominant market position in the Based On Product Type segment of the Blind Spot Alert System Market, with a 28.2% share.

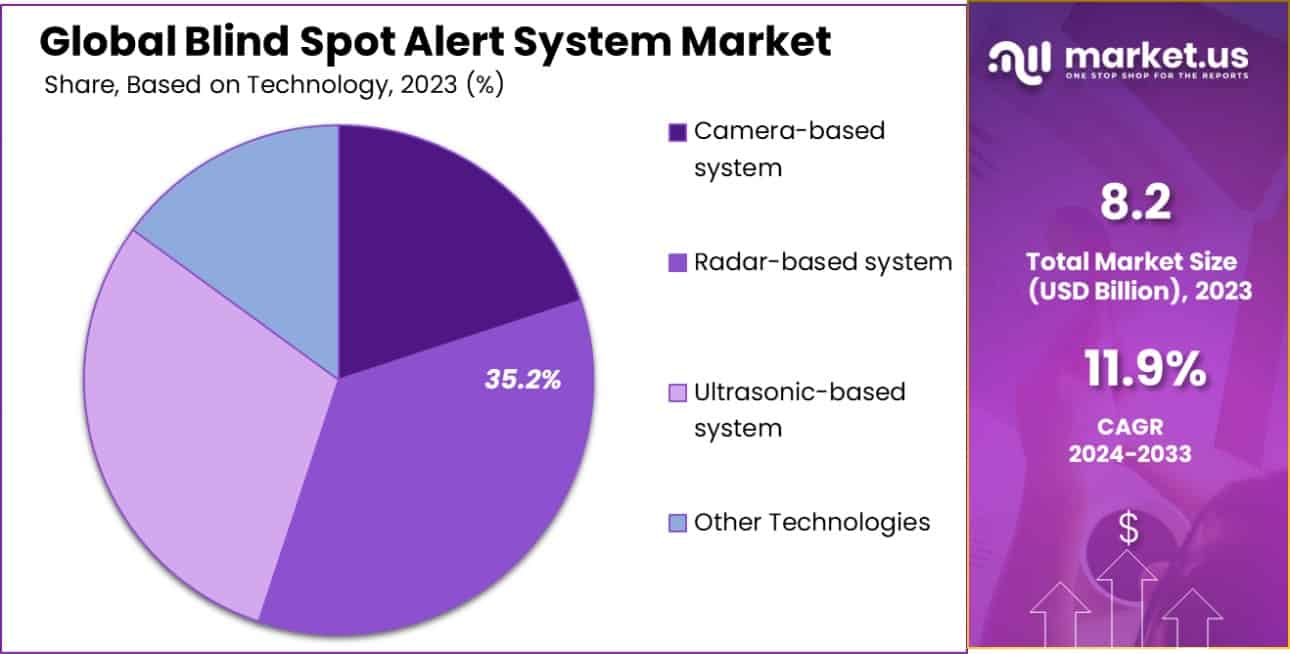

- In 2023, Radar-based systems held a dominant market position in the Based on Technology segment of the Blind Spot Alert System Market, with a 35.2% share.

- In 2023, Passenger vehicles held a dominant market position in the Based on Vehicle Type segment of the Blind Spot Alert System Market.

- In 2023, OEM held a dominant market position in the Based On the Sales Channel segment of the Blind Spot Alert System Market, with a 60.2% share.

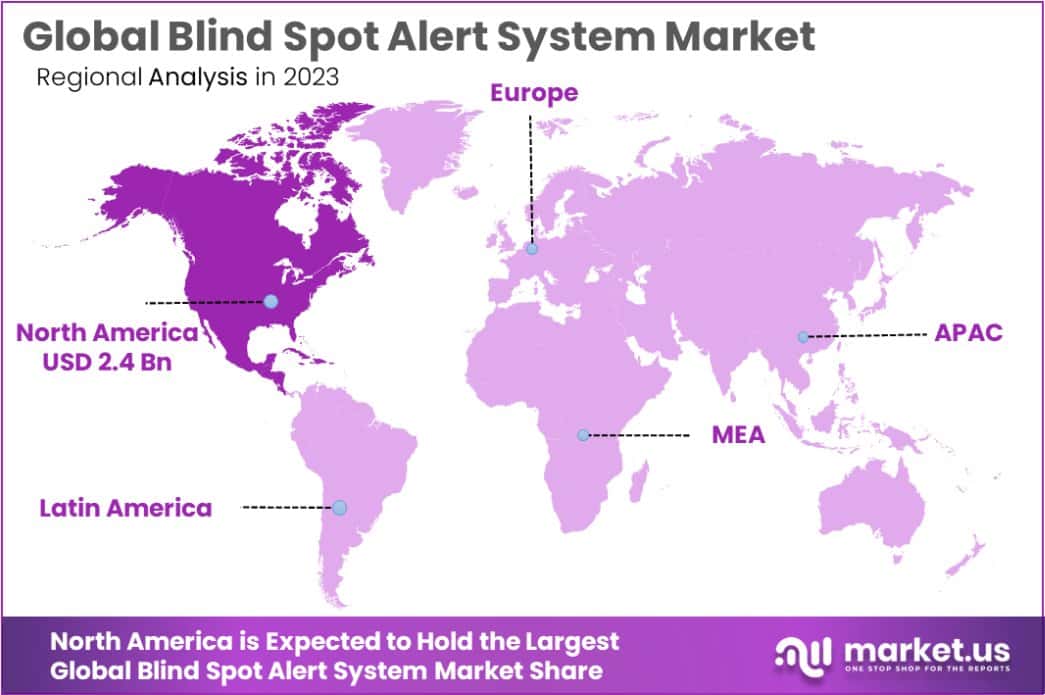

- North America dominated a 29.5% market share in 2023 and held USD 2.4 Billion in revenue from the Blind Spot Alert System Market.

Based On Product Type Analysis

In 2023, the Backup Camera System held a dominant market position in the “Based On Product Type” segment of the Blind Spot Alert System Market, with a 28.2% share. This segment includes other product types such as Blind Spot Detection System, Park Assist System, Surround-View System, and Other Product Types.

The strong performance of the Backup Camera System can be attributed to its critical role in enhancing vehicle safety by providing drivers with a clear rear view, thus reducing the risk of accidents during reversing maneuvers. This demand is driven by increasing consumer awareness regarding vehicle safety features and stringent safety regulations mandating the integration of advanced safety systems in vehicles.

The market also saw significant contributions from other segments. Blind Spot Detection Systems and Park Assist Systems are increasingly being adopted due to their effectiveness in preventing collision and assisting in low-speed maneuvers respectively, further emphasizing the industry’s shift towards automation and safety.

Meanwhile, the adoption of Surround-View Systems is growing, fueled by the luxury segment where consumers demand comprehensive safety and convenience features. The segment labeled “Other Product Types” includes emerging technologies that are gaining traction due to innovation in smart sensor technology and integration capabilities, pointing towards a diversifying market landscape focused on enhancing vehicular safety and driver comfort.

Based on Technology Analysis

In 2023, the Radar-based System held a dominant market position in the “Based on Technology” segment of the Blind Spot Alert System Market, with a 35.2% share. This segment encompasses various technologies including Camera-based Systems, Ultrasonic-based Systems, and Other Technologies.

The predominance of Radar-based Systems can be primarily attributed to their superior ability to detect objects at greater distances and in challenging weather conditions, which significantly enhances vehicle safety and driver awareness.

Camera-based Systems also play a crucial role in the market, offering high-resolution visual feedback that is integral for functions like parking assistance and traffic monitoring. Meanwhile, Ultrasonic-based Systems are favored in lower-speed applications, providing proximity alerts that are essential for parking and navigating tight spaces.

The category labeled “Other Technologies” captures emerging and niche technologies that are beginning to impact the market, potentially offering new functionalities and improving system integration with other vehicle safety features.

The demand for Radar-based Systems is expected to remain robust, driven by advancements in automotive radar technology and a growing emphasis on safety features by both consumers and regulatory bodies, ensuring that vehicles are equipped with the most effective systems to prevent accidents and enhance driver perception.

Based on Vehicle Type Analysis

In 2023, the Passenger Vehicle segment held a dominant market position in the “Based on Vehicle Type” segment of the Blind Spot Alert System Market. This category also includes Light Commercial vehicles, Heavy Commercial Vehicles, and Other Vehicles.

The preeminence of Passenger Vehicles can be largely attributed to the increasing consumer demand for enhanced safety features in personal transportation coupled with the widespread adoption of advanced driver-assistance systems (ADAS) in new vehicle models.

The Light Commercial Vehicle segment is also experiencing growth, driven by the rising need for safety in small businesses and fleet operations, which frequently navigate urban environments prone to blind spot accidents.

Meanwhile, the Heavy Commercial Vehicle sector is incorporating these systems to reduce the high risk of accidents associated with larger vehicle blind spots, which is critical for improving road safety and reducing liability.

The “Other Vehicles” category includes specialized vehicles that are gradually integrating blind spot alert systems to cater to specific safety requirements. As regulatory frameworks continue to evolve and mandate the inclusion of safety technologies, the overall market for Blind Spot Alert Systems across all vehicle types is expected to expand, reflecting a broader industry trend toward maximizing safety through technological advancements.

Based On the Sales Channel Analysis

In 2023, the Original Equipment Manufacturer (OEM) channel held a dominant market position in the “Based On the Sales Channel” segment of the Blind Spot Alert System Market, with a 60.2% share. This segment is bifurcated into OEM and Aftermarket channels.

The substantial share of the OEM segment can be attributed to the integration of blind spot alert systems in new vehicles as standard or optional equipment, driven by increasing consumer demand for advanced safety features and regulatory mandates for vehicle safety.

The strong preference for OEM-installed systems ensures that consumers receive fully integrated and warranty-backed solutions that are specifically designed for their vehicles. This integration not only enhances the overall functionality and reliability of the safety systems but also maintains the aesthetic integrity of the vehicle.

Meanwhile, the Aftermarket segment also plays a significant role, providing retrofit options for vehicles that were not originally equipped with these systems. The aftermarket solutions cater to a broad consumer base, looking to upgrade their existing vehicles with modern safety technologies.

Despite the prominence of the OEM segment, the aftermarket is anticipated to grow, fueled by technological advancements and the increasing affordability of blind spot detection devices, broadening the accessibility of safety features across older vehicle models.

Key Market Segments

Based On Product Type

- Blind spot detection system

- Park assist system

- Backup camera system

- Surround-view system

- Other Product Types

Based on Technology

- Camera-based system

- Radar-based system

- Ultrasonic-based system

- Other Technologies

Based on Vehicle Type

- Passenger vehicle

- Light commercial vehicle

- Heavy commercial vehicle

- Other Vehicles

Based On the Sales Channel

- OEM

- Aftermarket

Drivers

Key Drivers for Blind Spot Alert Systems

The growth of the Blind Spot Alert System market is primarily driven by increasing vehicle safety concerns among consumers and regulatory bodies. As traffic density rises and road safety becomes a critical issue, more vehicle manufacturers are incorporating advanced driver assistance systems (ADAS) like blind spot alerts to enhance safety.

These systems help prevent accidents by alerting drivers to unseen vehicles in adjacent lanes, especially during high-speed maneuvers and lane changes. Additionally, governments are imposing stricter safety regulations to reduce road fatalities, which further encourages automakers to integrate these safety features.

The rising trend of autonomous vehicles also supports the demand for sophisticated technologies, including blind spot alert systems, to ensure safer and more efficient vehicle operation.

Restraint

Challenges Limiting Blind Spot Systems

The expansion of the Blind Spot Alert System market faces significant challenges, primarily due to high system costs and compatibility issues. These advanced systems, which require sophisticated sensors and software, can significantly increase the overall cost of vehicles, making them less affordable for average consumers.

Additionally, integrating these systems into older or lower-end models presents technological challenges, limiting widespread adoption across all vehicle segments. Consumer skepticism about the reliability and necessity of such advanced safety features also poses a restraint.

This hesitation can be attributed to a lack of understanding or distrust in automated systems, potentially delaying broader acceptance and integration of blind spot alert technologies in the automotive industry.

Opportunities

Expanding Opportunities in Safety Tech

The Blind Spot Alert System market is poised for growth, driven by increasing consumer demand for vehicle safety and technological advancements. As consumer awareness of vehicle safety features grows, there is a rising demand for cars equipped with advanced driver assistance systems (ADAS), including blind spot alerts.

This trend is supported by the growing adoption of electric and autonomous vehicles, which are typically outfitted with the latest safety technologies. Furthermore, emerging markets present a significant opportunity for expansion as these regions experience increased vehicle sales and enhanced regulatory standards for vehicle safety.

Technological innovations, such as the integration of AI and machine learning to improve system accuracy and reliability, also open new avenues for development within the blind spot alert systems market, making vehicles safer and more appealing to safety-conscious consumers.

Challenges

Overcoming Blind Spot System Barriers

The Blind Spot Alert System market faces several challenges that could hinder its growth. High installation costs are a major barrier, making these systems less accessible for budget-conscious consumers and less lucrative for manufacturers targeting lower-end vehicle segments.

Additionally, the complexity of integrating these systems with existing vehicle electronics can deter both automakers and consumers from adopting them. There is also the issue of consumer resistance to trusting automated safety technologies, stemming from concerns over reliability and the potential for system failures.

Regulatory variations across different countries regarding the approval and mandatory implementation of such technologies further complicate market expansion. These challenges necessitate continuous innovation and effective marketing strategies to enhance consumer trust and make blind spot alert systems a standard feature across all vehicle types.

Growth Factors

Driving Growth in Safety Features

The Blind Spot Alert System market is experiencing robust growth, driven by several key factors. Enhanced consumer awareness and preference for vehicle safety features are significantly boosting demand. As road traffic increases globally, the need for advanced safety systems that can prevent accidents becomes more critical, encouraging manufacturers to integrate these technologies into new models.

Regulatory mandates across various countries are also pivotal, as governments enforce stricter safety standards to reduce traffic-related injuries and fatalities, pushing automakers to adopt blind spot detection systems. Furthermore, the rise in autonomous and semi-autonomous vehicles, which require extensive sensor-based systems to operate safely, provides a substantial growth avenue for this market.

These factors collectively contribute to the widespread adoption and continuous development of blind spot alert technologies, ensuring safer roads and driving conditions.

Emerging Trends

Trends Shaping Blind Spot Alerts

Emerging trends in the Blind Spot Alert System market are set to transform how these systems are integrated into modern vehicles. One significant trend is the advancement and reduction in costs of sensor technology, making these systems more affordable and accessible to a broader range of vehicles, from luxury to standard models.

Additionally, there is a growing integration of blind spot alerts with other safety features, such as rear cross-traffic alerts and automatic emergency braking, to create comprehensive safety suites. The expansion of connected vehicle technologies also plays a crucial role, enabling vehicles to communicate with each other and with road infrastructure to enhance overall safety dynamically.

Furthermore, the push towards fully autonomous vehicles continues to fuel the demand for highly accurate and reliable blind spot detection systems, critical for safe autonomous navigation. These trends underscore the evolving landscape of vehicle safety technology, promising enhanced protection for all road users.

Regional Analysis

The Blind Spot Alert System market exhibits varied growth dynamics across global regions, reflecting differing consumer preferences, regulatory landscapes, and technological adoption rates.

North America leads the market with a dominant share of 29.5%, valued at USD 2.4 billion, driven by stringent safety regulations and high consumer awareness about vehicle safety technologies.

The adoption in this region is further bolstered by the presence of major automotive manufacturers investing heavily in advanced driver assistance systems (ADAS).

In Europe, the market is propelled by similar safety mandates and a strong automotive industry, with a keen focus on innovation and safety enhancements in vehicles. The market in Asia Pacific is rapidly expanding, thanks to increasing vehicle sales in emerging economies, growing consumer demand for safety features, and improving regulatory standards.

Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth due to rising economic prosperity and the subsequent increase in modern vehicle penetration. These regions are expected to show significant growth potential as awareness and infrastructure for vehicle safety technologies develop further.

Collectively, these regional markets underscore the global push towards enhancing road safety through technological integration in vehicles.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Blind Spot Alert System market continues to be significantly shaped by the contributions and innovations of key players such as Robert Bosch GmbH, Delphi Automotive LLP, and Continental AG. Each company plays a crucial role in advancing the technology and expanding the market’s reach, influenced by its strategic initiatives and product advancements.

Robert Bosch GmbH stands as a leading innovator in automotive safety technologies. The company’s investment in R&D has led to the development of highly sophisticated blind spot detection systems that are integrated with other safety features, offering comprehensive vehicle safety solutions. Bosch’s systems are known for their reliability and precision, making them a preferred choice for premium automotive manufacturers.

Delphi Automotive LLP, now Aptiv PLC, continues to leverage its expertise in automotive parts and electronics to enhance its blind spot alert offerings. The company focuses on creating more affordable solutions that can be adopted in mid-range vehicles, significantly broadening the market base. Delphi’s commitment to innovation is evident in its use of advanced radar and camera technologies to improve the effectiveness of its blind spot detection systems.

Continental AG has made notable strides in integrating blind spot alert systems with other connected car technologies. Their approach to creating interconnected safety systems not only enhances vehicle safety but also aligns with the trends toward autonomous driving. Continental’s systems are designed to seamlessly integrate with the vehicle’s existing safety infrastructure, making them adaptable and forward-compatible.

These companies are pivotal in driving the Blind Spot Alert System market forward through their relentless pursuit of technological advancements, commitment to safety, and strategic market expansions. As they continue to innovate and adapt to new safety standards and consumer expectations, Bosch, Delphi, and Continental are well-positioned to maintain their leadership and influence in the market.

Top Key Players in the Market

- Robert Bosch GmbH

- Delphi Automotive LLP

- Continental AG

- ZF Friedrichshafen AG

- Autoliv Inc.

- Denso Corporation

- Valeo SA

- Magna International

- Ficosa Internacional SA

- Aisin Seiki Co.

- NVIDIA Corporation

- Harman International Inc.

- Hitachi

- NXP Semiconductors N.V.

- Other Companies

Recent Developments

- In May 2024, Valeo inaugurated a new manufacturing facility in Daegu, Korea, for vehicle automation sensors. With a $56 million investment, this plant serves as a vital production hub in Asia, emphasizing ADAS and exporting globally.

- In May 2023, DENSO launched a pilot energy management system at its Nishio Plant in Japan, aiming to eliminate CO2 emissions. The system includes a Solid Oxide Fuel Cell (SOFC), storage battery, Vehicle-to-Grid (V2G) system, and solar panels, focusing on high efficiency and sustainability.

Report Scope

Report Features Description Market Value (2023) USD 8.2 Billion Forecast Revenue (2033) USD 25.2 Billion CAGR (2024-2033) 11.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based On Product Type (Blind spot detection system, Park assist system, Backup camera system, Surround-view system, Other Product Types), Based on Technology (Camera-based system, Radar-based system, Ultrasonic-based system, Other Technologies), Based on Vehicle Type (Passenger vehicle, Light commercial vehicle, Heavy commercial vehicle, Other Vehicles), Based On the Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Delphi Automotive LLP, Continental AG, ZF Friedrichshafen AG, Autoliv Inc., Denso Corporation, Valeo SA, Magna International, Ficosa Internacional SA, Aisin Seiki Co., NVIDIA Corporation, Harman International Inc., Hitachi, NXP Semiconductors N.V., Other Companies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blind Spot Alert System MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Blind Spot Alert System MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Delphi Automotive LLP

- Continental AG

- ZF Friedrichshafen AG

- Autoliv Inc.

- Denso Corporation

- Valeo SA

- Magna International

- Ficosa Internacional SA

- Aisin Seiki Co.

- NVIDIA Corporation

- Harman International Inc.

- Hitachi

- NXP Semiconductors N.V.

- Other Companies