Global Stolen Vehicle Tracking Software Market Based on Technology (Ultrasonic, RFID, Other Technologies), Based on Component (UIP, BBS, Central Locking Systems, ACDS, ADRS, Remote Keyless Entry System), Based on Vehicle (Passenger Car, LCV, HCV, Electric Vehicle), Based on the Sales Channel (OEM, Aftermarket), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 99533

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

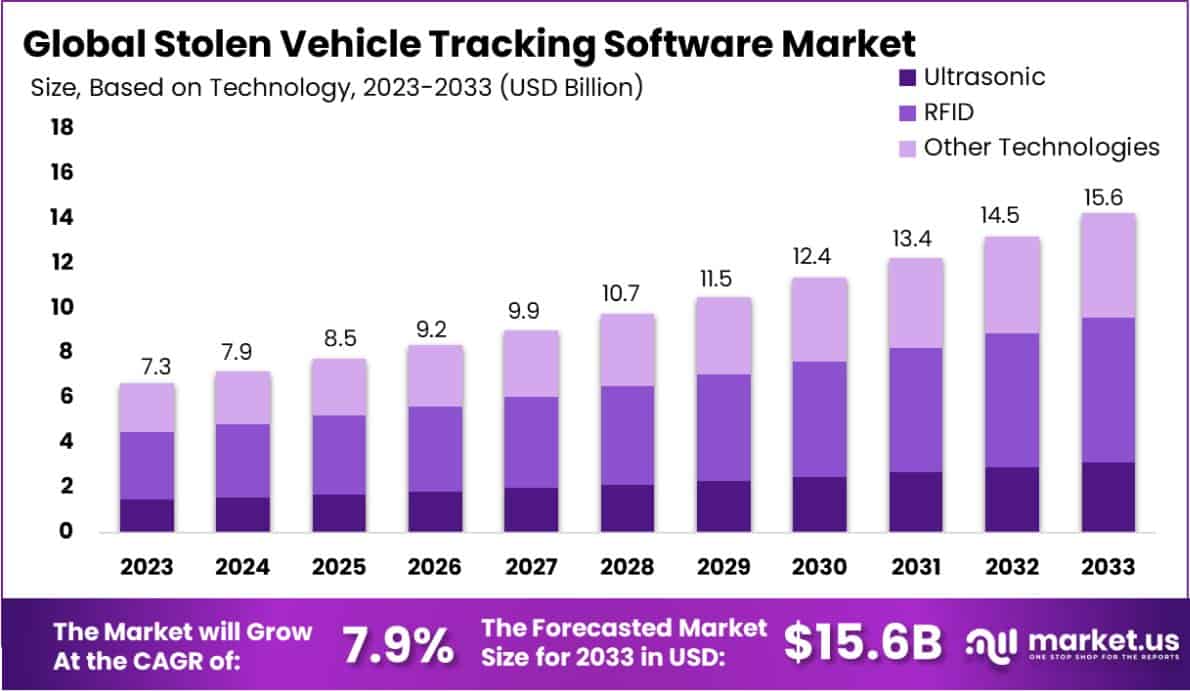

The Global Stolen Vehicle Tracking Software Market is expected to be worth around USD 15.6 billion by 2033, up from USD 7.3 billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

Stolen Vehicle Tracking Software is a specialized solution designed to locate and recover stolen vehicles using GPS technology and wireless communication systems. The software enables real-time tracking, sends alerts to vehicle owners and law enforcement, and provides detailed reports on vehicle movements, enhancing recovery efforts.

The Stolen Vehicle Tracking Software Market comprises enterprises that develop and distribute software solutions for tracking stolen vehicles. Growth in this market is propelled by increasing vehicle theft rates globally, rising consumer awareness about vehicle security, and the adoption of advanced technology in the automotive industry.

The market’s growth is primarily driven by the escalating number of vehicle thefts worldwide, compelling vehicle owners and insurance companies to invest in advanced tracking technologies. Enhanced GPS accuracy and the integration of IoT devices further bolster the market expansion.

Demand for stolen vehicle tracking software is surging due to heightened vehicle security concerns among owners and the integration of these systems with smartphone applications. Insurance companies also promote the adoption of tracking solutions by offering premium discounts, thus fueling market demand.

Opportunities in the Stolen Vehicle Tracking Software Market are expanding with advancements in telematics and machine learning, allowing for more precise vehicle monitoring and predictive analytics. Expansion into emerging markets, where vehicle security is becoming a growing concern, also presents significant potential for market growth.

Key Takeaways

- The Global Stolen Vehicle Tracking Software Market is expected to be worth around USD 15.6 billion by 2033, up from USD 7.3 billion in 2023, growing at a CAGR of 7.9% during the forecast period from 2024 to 2033.

- In 2023, RFID held a dominant market position in the Based on Technology segment of the Stolen Vehicle Tracking Software Market.

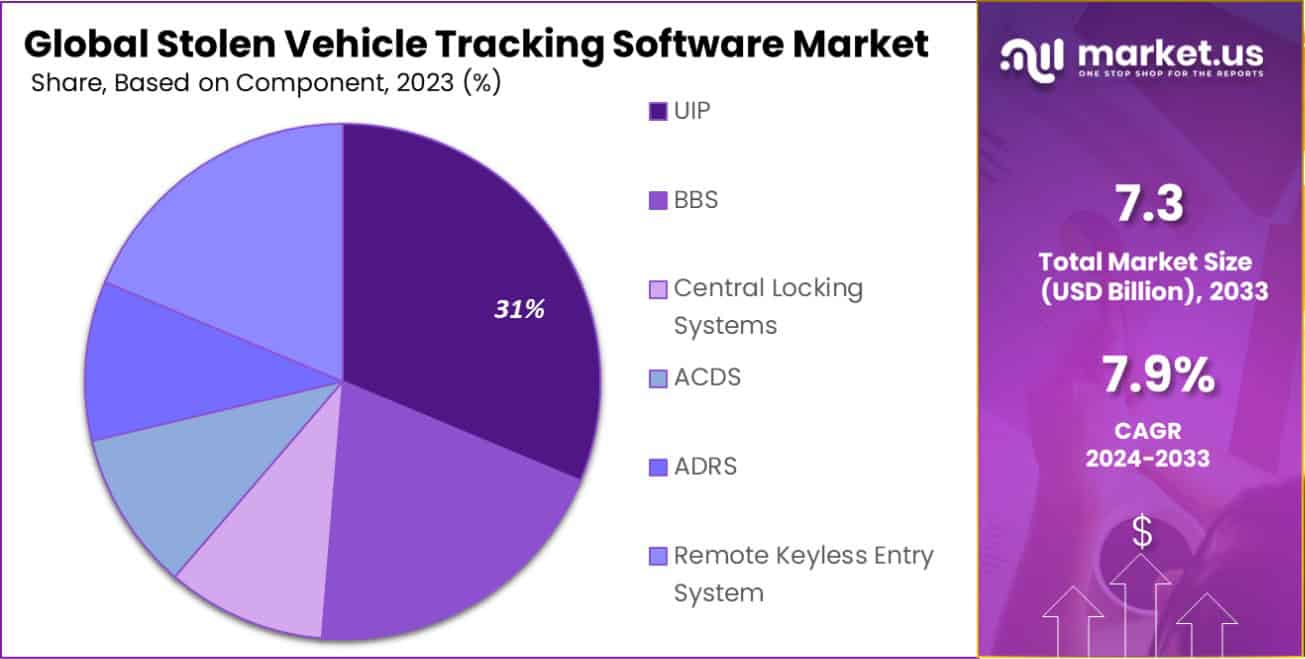

- In 2023, UIP held a dominant market position in the Based on Component segment of the Stolen Vehicle Tracking Software Market with a 31.3% share.

- In 2023, Passenger Cars held a dominant market position in the Based on Vehicle segment of the Stolen Vehicle Tracking Software Market.

- In 2023, OEM held a dominant market position Based on the Sales Channel segment of the Stolen Vehicle Tracking Software Market.

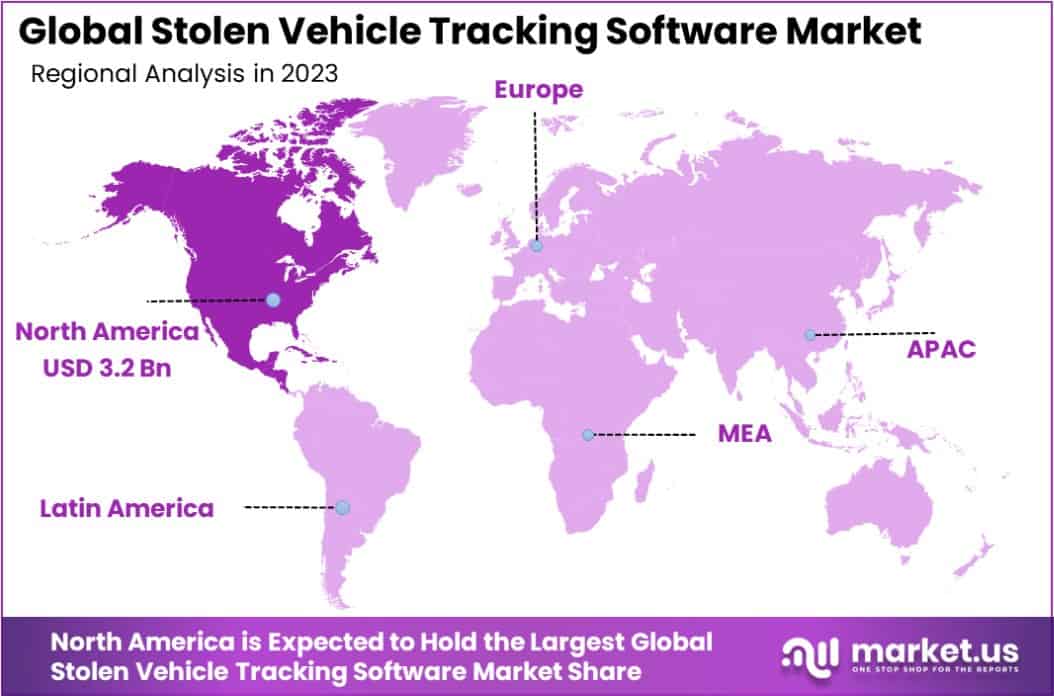

- North America dominated a 44.2% market share in 2023 and held USD 3.2 Billion in revenue from the Stolen Vehicle Tracking Software Market.

Based on Technology Analysis

In 2023, RFID held a dominant market position in the “Based on Technology” segment of the Stolen Vehicle Tracking Software Market. RFID technology has proven critical in enhancing vehicle security systems through its ability to offer real-time location tracking and easy integration with existing automotive frameworks.

This technology’s adaptability has fostered its application across various vehicle segments, from personal cars to commercial fleets, substantially contributing to its market dominance.

RFID systems in stolen vehicle tracking leverage long-range communication capabilities to maintain constant vehicle monitoring without significant power consumption, which is pivotal for effective theft prevention and recovery.

These systems are particularly valued for their reliability and the robustness of the data security measures they can support, which is essential in preventing hacking or tampering attempts.

The growth of RFID technology in this market is also propelled by its cost-effectiveness and ease of installation, which have encouraged broader adoption among vehicle manufacturers and owners seeking affordable yet efficient vehicle security solutions.

As technological advancements continue to enhance RFID capabilities, its market share is expected to see further expansion, driven by increasing demand for high-security vehicle tracking systems. This trend is complemented by the integration of advanced analytics, offering insights into vehicle usage patterns and potential security breaches.

Based on Component Analysis

In 2023, the User Interface Platform (UIP) held a dominant market position in the “Based on Component” segment of the Stolen Vehicle Tracking Software Market, commanding a 31.3% share. This substantial market share reflects the critical role that UIPs play in the user experience of vehicle tracking systems.

UIPs serve as the primary interface for users to interact with the tracking software, offering real-time data visualization, customizable alerts, and access to historical tracking data, which are pivotal for the efficient management of vehicle security.

The prominence of UIPs in the market is further underscored by their integration capabilities with mobile and web applications, enhancing accessibility for users and facilitating immediate responses to theft alerts.

This adaptability has made UIPs essential for both individual vehicle owners and commercial fleet managers who require robust, user-friendly systems to monitor and manage multiple vehicles effectively.

The continued innovation in UIP technology, focusing on improving user engagement and ease of use, has driven its adoption. Features like geofencing, route history, and predictive analytics are increasingly standard, offering users enhanced security measures and insightful data to prevent theft and unauthorized use.

As the market evolves, the UIP segment is expected to grow further, driven by technological advancements and increasing consumer demand for sophisticated vehicle security solutions.

Based on Vehicle Analysis

In 2023, the Passenger Car segment held a dominant market position in the “Based on Vehicle” segment of the Stolen Vehicle Tracking Software Market. This segment’s leadership is largely attributed to the increasing penetration of vehicle tracking systems in personal vehicles, driven by heightened consumer awareness and growing concerns about automobile theft.

Passenger cars, as a principal mode of personal transportation globally, represent a substantial market for stolen vehicle tracking solutions, reflecting the segment’s broad consumer base and the essential need for enhanced vehicle security.

The rise in passenger car sales, coupled with the integration of advanced telematics and connectivity solutions in modern vehicles, has further fueled the adoption of tracking software. Consumers are increasingly favoring cars equipped with sophisticated security features, including GPS tracking and real-time monitoring, to safeguard against theft.

This trend is supported by insurance companies offering reduced premiums for vehicles fitted with anti-theft systems, thus promoting higher uptake in the passenger car segment.

Looking forward, the demand in this segment is expected to continue growing as innovations in mobile technology and software integration offer even more robust and user-friendly tracking solutions.

This will likely enhance consumer trust and dependency on digital security measures, thereby expanding the market footprint of the Passenger Car segment in the stolen vehicle tracking software industry.

Based on the Sales Channel Analysis

In 2023, the Original Equipment Manufacturer (OEM) channel held a dominant market position in the “Based on the Sales Channel” segment of the Stolen Vehicle Tracking Software Market.

This leadership is primarily due to the increasing incorporation of vehicle tracking systems directly at the point of manufacture, which ensures seamless integration and higher reliability of the tracking solutions offered.

The growing partnerships between vehicle manufacturers and tracking software providers have bolstered this trend, as OEMs aim to enhance the value proposition of their vehicles by including advanced security features as standard.

OEMs benefit from the ability to offer warranty-backed vehicle tracking solutions, which significantly attract buyers by offering peace of mind about both vehicle security and product quality. Additionally, regulatory mandates in various countries that require the installation of vehicle security systems in new cars have further driven the dominance of the OEM segment.

Looking forward, the OEM sales channel is expected to maintain its market superiority, supported by continuous innovations in vehicle technology and consumer preferences shifting towards more secure and technology-equipped new vehicles.

This trend underscores the strategic importance of OEMs in the deployment of advanced vehicle tracking and security solutions within the automotive industry.

Key Market Segments

Based on Technology

- Ultrasonic

- RFID

- Other Technologies

Based on Component

- UIP

- BBS

- Central Locking Systems

- ACDS

- ADRS

- Remote Keyless Entry System

Based on Vehicle

- Passenger Car

- LCV

- HCV

- Electric Vehicle

Based on the Sales Channel

- OEM

- Aftermarket

Drivers

Key Drivers of the Vehicle Tracking Market

The Stolen Vehicle Tracking Software Market is expanding primarily due to the increasing incidences of vehicle theft globally, which necessitates effective recovery solutions. This market growth is further propelled by advancements in GPS and mobile technology, making tracking systems more accessible and user-friendly.

Insurance companies also play a crucial role by often requiring such systems for coverage approval, thereby boosting market demand. Additionally, the integration of real-time tracking features in modern vehicles as a standard safety measure by manufacturers supports market expansion.

Moreover, government initiatives aimed at enhancing vehicle security standards are encouraging the adoption of these systems, contributing significantly to the market’s growth.

Restraint

Challenges Facing Vehicle Tracking Market

The growth of the Stolen Vehicle Tracking Software Market is hindered by several factors, with privacy concerns being the most significant. Many consumers are wary of installing tracking software due to fears about their personal information being accessed or misused.

Additionally, the high cost of advanced tracking systems can also be a barrier for individual car owners and small businesses. Another restraint is the availability of cheaper, less reliable tracking solutions that can discourage users from investing in higher-quality, more secure systems.

Furthermore, the rapid pace of technological change can lead to compatibility issues, as newer vehicle models may not support older tracking systems. This could limit the market’s expansion as potential customers might hesitate to adopt technologies that could quickly become outdated.

Opportunities

Growth Opportunities in Tracking Market

The Stolen Vehicle Tracking Software Market holds significant opportunities for growth through technological advancements. Innovations such as integration with smartphones and cloud-based services enhance the functionality and accessibility of tracking systems, attracting more users.

The rise in vehicle sales globally, coupled with increasing consumer awareness about vehicle security, also presents a substantial market opportunity. Additionally, collaborations between tracking software companies and automotive manufacturers can lead to built-in tracking features in new vehicles, expanding the customer base.

Emerging markets with increasing rates of vehicle ownership and theft are particularly promising regions for expansion. Furthermore, the potential for incorporating artificial intelligence to predict theft patterns and offer proactive protection could revolutionize the market, providing a competitive edge to those who embrace these innovations.

Challenges

Barriers in Vehicle Tracking Adoption

The Stolen Vehicle Tracking Software Market faces notable challenges that could impede its growth. A primary issue is the resistance from individuals concerned about privacy, fearing constant surveillance and data breaches.

Additionally, the legal restrictions in various countries regarding tracking devices complicate market entry and expansion, requiring companies to navigate a complex web of regulations. Technological disparities between regions also limit market penetration, as not all areas have the necessary infrastructure to support advanced tracking systems.

The presence of low-cost, low-quality competitors can further dilute market standards and consumer trust. Moreover, the rapid evolution of technology in this sector means that companies must continually invest in research and development to stay relevant, which can strain resources and focus.

Growth Factors

Drivers Boosting Tracking Software Market

The Stolen Vehicle Tracking Software Market is experiencing robust growth driven by the rising vehicle theft rates globally, compelling both individual and commercial vehicle owners to adopt advanced tracking solutions. Enhanced connectivity and technological improvements in GPS tracking devices and mobile technology significantly boost the efficiency and user-friendliness of these systems.

Additionally, insurance companies increasingly mandate the installation of such systems, serving as a critical market driver by linking insurance premiums and policies to the presence of tracking technology. The ongoing integration of smart technologies into vehicles by manufacturers also promotes market growth by making these systems standard features in new models.

Furthermore, government regulations aimed at enhancing vehicle security are pushing consumers towards these technologies, thereby expanding the market’s reach and depth.

Emerging Trends

Emerging Trends in Tracking Market

Emerging trends in the Stolen Vehicle Tracking Software Market reflect significant technological integration and market expansion. Key developments include the adoption of Artificial Intelligence (AI) and Machine Learning (ML) to enhance predictive capabilities, allowing for more proactive theft prevention and quicker recovery actions.

The integration of IoT (Internet of Things) technology is also pivotal, enabling more sophisticated and connected tracking ecosystems that communicate seamlessly with other smart devices. Additionally, there’s a growing trend towards the use of cloud-based platforms, which improve data management and accessibility, facilitating better user interaction and service customization.

The market is also seeing a shift towards subscription-based models, offering customers flexible and scalable services. These innovations not only enhance product offerings but also open new avenues for growth by attracting tech-savvy consumers and expanding into untapped regional markets.

Regional Analysis

The Stolen Vehicle Tracking Software Market exhibits varying degrees of growth and market penetration across regions, underpinned by regional economic conditions, technological advancement, and regulatory landscapes. North America leads the market, holding a commanding 44.2% share, with a market value of USD 3.2 billion.

This dominance is primarily due to the high vehicle ownership rates, well-established automotive industry, and stringent regulatory standards that mandate the incorporation of vehicle tracking systems in new automobiles.

In Europe, privacy concerns and stringent data protection laws contrast with strong market demand driven by high vehicle theft rates, particularly in urban areas. The market is supported by advanced infrastructure capable of integrating and supporting sophisticated tracking technologies.

Asia Pacific is experiencing rapid growth due to increasing vehicle sales and improving technological infrastructure. The region’s large population and rising income levels contribute to a growing consumer base seeking security solutions.

The Middle East & Africa, and Latin America markets are gradually expanding, driven by increasing awareness of vehicle security, though growth is tempered by economic variability and technological disparities. Each region’s market growth is propelled by unique factors tailored to their specific socioeconomic and technological contexts.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the global Stolen Vehicle Tracking Software Market for 2023, key players Robert Bosch GmbH, Lear Corporation, and Valeo stand out for their innovative contributions and strategic market positioning.

Robert Bosch GmbH continues to lead with its technologically advanced solutions that integrate seamlessly with global automotive standards. Bosch’s strength lies in its R&D capabilities and extensive industry experience, which allow it to offer robust vehicle tracking systems that are both reliable and efficient.

The company’s commitment to innovation is evident in its latest developments that incorporate AI and IoT, enhancing the predictive capabilities and connectivity of its systems. Bosch’s global footprint and strong brand reputation provide a competitive edge, enabling it to maintain a significant share of the market.

Lear Corporation focuses on the expansion of its telematics and connected vehicle solutions, which include stolen vehicle tracking systems. Lear’s strategic approach involves partnerships with automotive manufacturers to embed its tracking technology directly into vehicles during the manufacturing process.

This integration ensures high adoption rates and opens new avenues for growth. Lear’s systems are renowned for their precision and the ability to provide real-time tracking data, which is critical for the recovery of stolen vehicles.

Valeo is making impressive strides with its focus on affordability and accessibility, making vehicle tracking solutions more available to a broader market segment. Valeo’s innovations are particularly noticeable in developing markets, where cost concerns are predominant.

The company has successfully managed to offer cost-effective solutions without compromising on the quality or effectiveness of its tracking technology.

Each of these companies contributes uniquely to the dynamics of the market, with Bosch leading in innovation, Lear in automotive integration, and Valeo in market penetration, particularly in cost-sensitive regions. Their combined efforts are shaping a more secure and technologically advanced vehicle tracking environment globally.

Top Key Players in the Market

- Robert Bosch GmbH

- Lear Corporation

- Valeo

- Continental AG

- DENSO Corporation

- TOKAI RIKA, CO, LTD.

- OMRON Corporation

- Mitsubishi Electric Corporation

- HELLA GmbH & Co. KGaA

- ALPS ALPINE CO., LTD.

- Other Key Players

Recent Developments

- In May 2024, Lear Corporation acquired WIP Industrial Automation, enhancing its manufacturing efficiency with advanced robotics and AI, aligning with its strategy to mitigate labor costs and innovate in automotive technology.

- In May 2023, Renault Group and Valeo partnered to develop a Software Vehicle architecture for next-gen vehicles, enabling updates and new functionalities without hardware changes.

Report Scope

Report Features Description Market Value (2023) USD 7.3 Billion Forecast Revenue (2033) USD 15.6 Billion CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Technology (Ultrasonic, RFID, Other Technologies), Based on Components (UIP, BBS, Central Locking Systems, ACDS, ADRS, Remote Keyless Entry System), Based on Vehicle (Passenger Car, LCV, HCV, Electric Vehicle), Based on the Sales Channel (OEM, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Lear Corporation, Valeo, Continental AG, DENSO Corporation, TOKAI RIKA, CO, LTD., OMRON Corporation, Mitsubishi Electric Corporation, HELLA GmbH & Co. KGaA, ALPS ALPINE CO., LTD., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stolen Vehicle Tracking Software MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Stolen Vehicle Tracking Software MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Lear Corporation

- Valeo

- Continental AG

- DENSO Corporation

- TOKAI RIKA, CO, LTD.

- OMRON Corporation

- Mitsubishi Electric Corporation

- HELLA GmbH & Co. KGaA

- ALPS ALPINE CO., LTD.

- Other Key Players