Global Vegetable Seed Market Size, Share, And Business Benefits By Type (Open Pollinated Varieties, Traditional Open-Pollinated Varieties, Hybrid), By Traits (Genetically Modified, Conventional), By Form (Organic, Inorganic), By Crop Type (Solanaceae, Root and Bulb, Cucurbit, Brassica, Leafy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153674

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

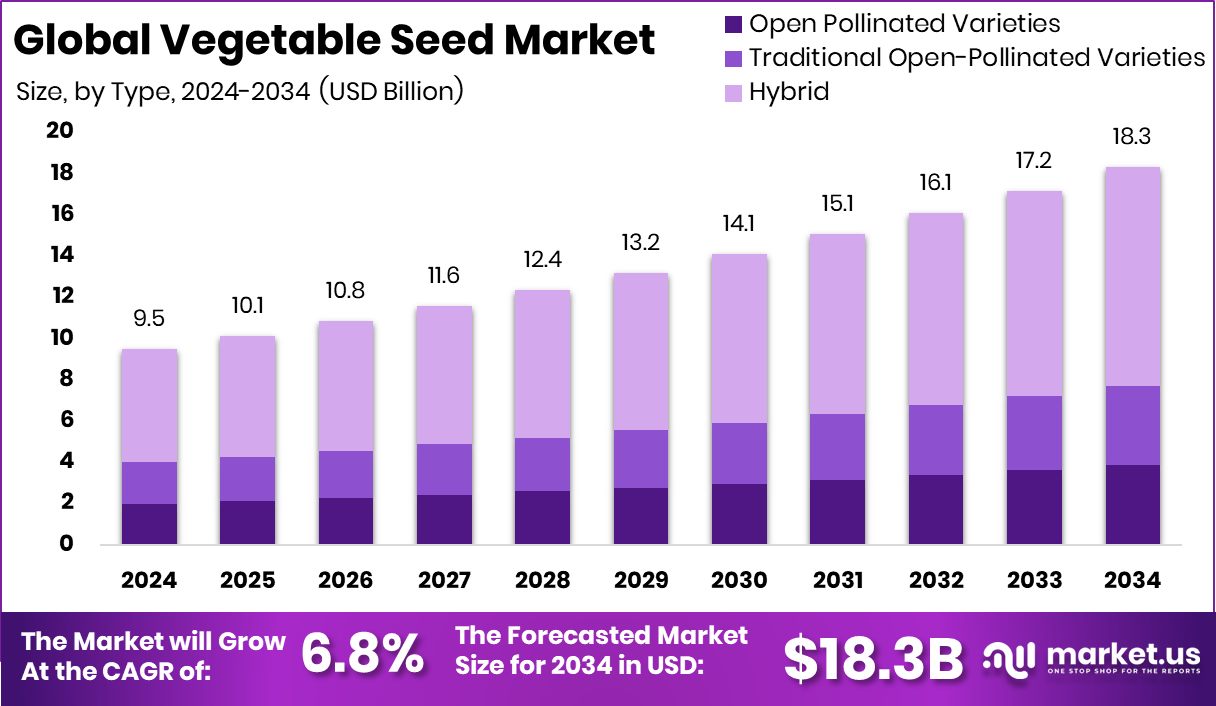

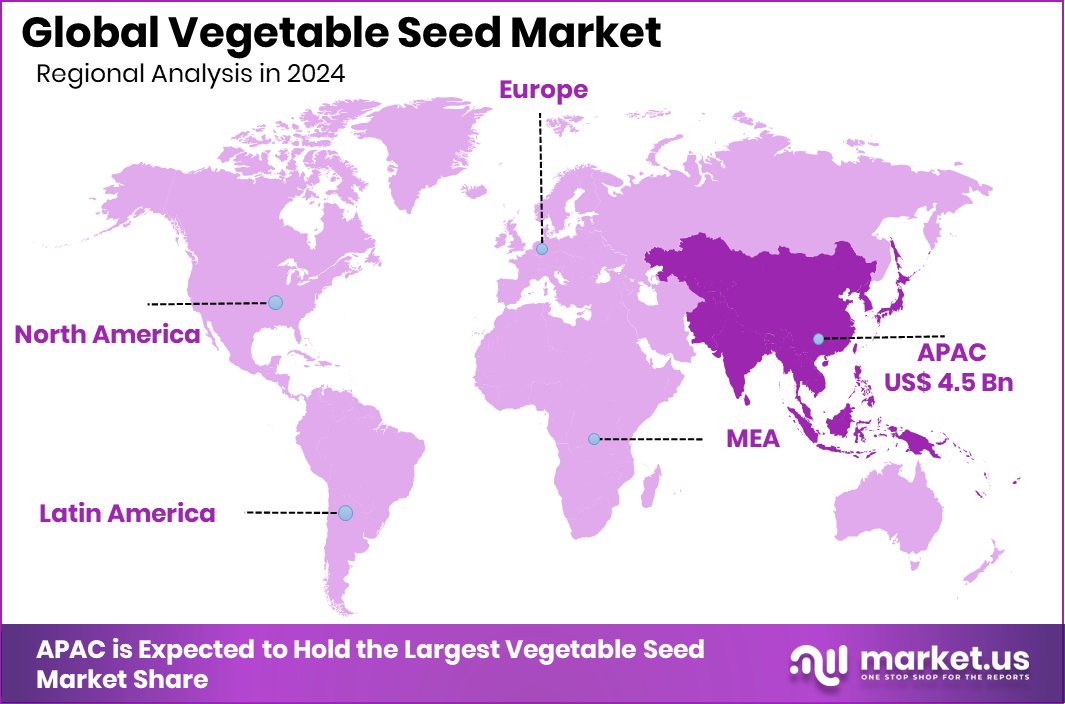

The Global Vegetable Seed Market is expected to be worth around USD 18.3 billion by 2034, up from USD 9.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034. Strong agricultural activity and rising vegetable demand supported the Asia-Pacific’s USD 4.5 billion market.

Vegetable seed refers to the reproductive material used for growing various types of vegetables. These seeds are carefully selected, processed, and stored to ensure high germination rates and desirable plant traits, including disease resistance, yield performance, and uniformity. Vegetable seeds come in different forms, including open-pollinated, hybrid, and genetically developed varieties. They are used by farmers, greenhouse growers, and home gardeners to produce crops like tomatoes, carrots, lettuce, cucumbers, and more.

The vegetable seed market comprises the global trade and sale of seeds used to grow vegetable crops. This market supports both small-scale subsistence farming and large-scale commercial agriculture. It includes the development, production, distribution, and retail of vegetable seeds, catering to a wide range of climatic and soil conditions. With increasing demand for fresh produce and advancements in seed technology, the vegetable seed market has evolved into a significant sector within the agricultural industry.

The rising population and the need to produce more food on limited arable land are key growth drivers. Advanced farming techniques and the availability of high-yielding seed varieties are also contributing to better productivity, which supports market expansion.

Urbanization and changing dietary habits are increasing the demand for fresh and organic vegetables. Consumers are more health-conscious, leading to higher consumption of vegetables, thereby increasing the need for quality seeds.

There is a growing opportunity in the development of climate-resilient and pest-resistant seed varieties. Additionally, the shift toward protected farming and precision agriculture is creating space for innovation in seed genetics and tailored seed solutions.

Key Takeaways

- The Global Vegetable Seed Market is expected to be worth around USD 18.3 billion by 2034, up from USD 9.5 billion in 2024, and is projected to grow at a CAGR of 6.8% from 2025 to 2034.

- In 2024, Hybrid seeds led with a 58.4% share, favored for their high productivity and consistency.

- Conventional traits dominated the market, capturing 71.3% share due to reliability and widespread farmer preference.

- Inorganic seed form held a strong 78.4% share, driven by affordability and broad-scale cultivation practices.

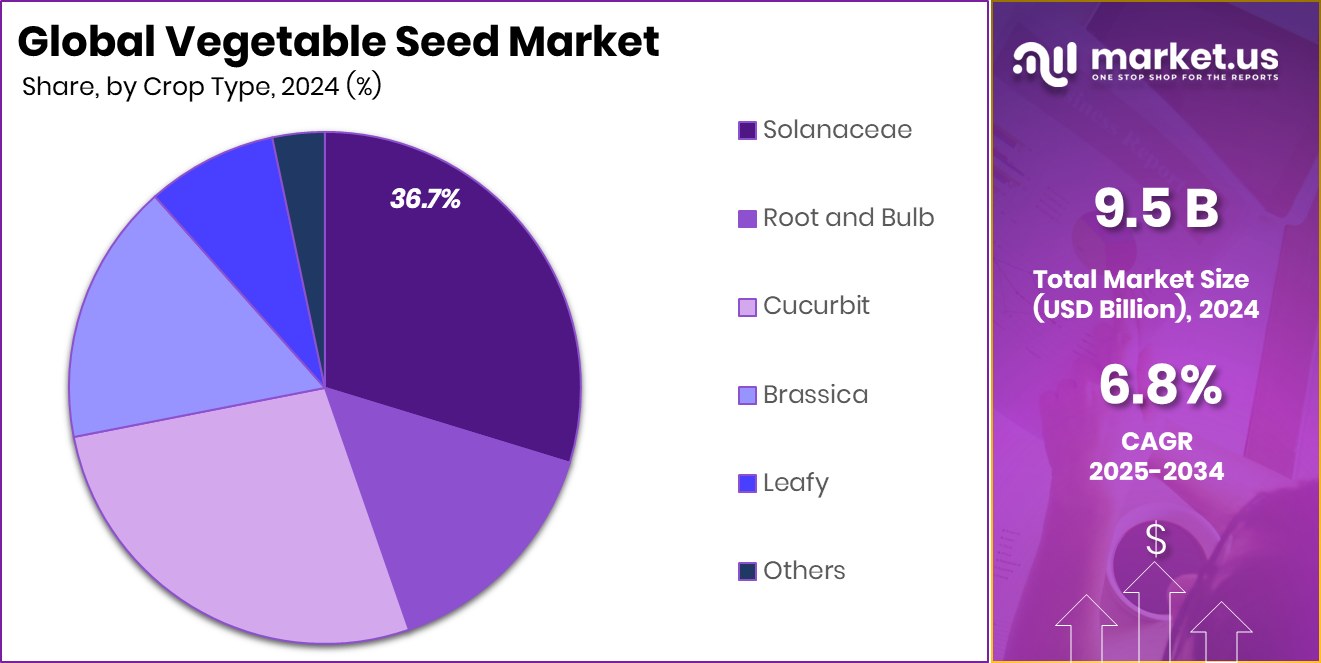

- Solanaceae crops, including tomatoes and peppers, led with a 36.7% share due to global dietary demand.

- The Asia-Pacific market reached a total value of USD 4.5 billion in 2024.

By Type Analysis

Hybrid seeds dominate the market, holding a 58.4% share.

In 2024, Hybrid held a dominant market position in the By Type segment of the Vegetable Seed Market, with a 58.4% share. This leading position can be attributed to the superior traits offered by hybrid seeds, including higher yield potential, better disease resistance, and improved adaptability to diverse climatic conditions.

Hybrid seeds are widely adopted by commercial growers aiming to maximize productivity and ensure consistent crop performance. Their ability to deliver uniformity in size, color, and maturity stage of vegetables makes them highly suitable for large-scale farming and organized retail supply chains.

Moreover, the rising focus on sustainable agriculture and efficient land use has further strengthened the preference for hybrids. Farmers are increasingly seeking solutions that minimize input costs while optimizing returns, and hybrid seeds offer a reliable pathway to achieving that balance.

The increasing awareness of hybrid seed benefits among farmers, supported by training programs and demonstration plots in many regions, has also encouraged their wider adoption. As vegetable demand continues to rise due to population growth and dietary shifts toward plant-based foods, the hybrid seed segment is expected to maintain its strong market presence, driven by its performance advantages and compatibility with modern farming practices.

By Traits Analysis

Conventional traits are preferred, capturing 71.3% of total demand.

In 2024, Conventional held a dominant market position in the By Traits segment of the Vegetable Seed Market, with a 71.3% share. This dominance reflects the continued reliance on traditional breeding methods and open-pollinated seed varieties that have been tested over time for their adaptability and reliability in varying farming conditions. Conventional seeds are widely preferred in regions where farming practices are less mechanized and where growers prioritize seed saving for future planting seasons.

The strong market presence of conventional seeds is also supported by their lower cost compared to technologically enhanced alternatives, making them accessible to small and medium-scale farmers. These seeds are known for their stable performance, especially in local environmental conditions, and are often chosen for crops where natural resilience and historical growing patterns are valued.

Moreover, the demand for chemical-free and non-GMO produce among consumers is indirectly supporting the use of conventionally bred seeds. As awareness grows around sustainable and organic farming practices, conventional vegetable seeds are increasingly viewed as a compatible input, helping maintain ecological balance and reduce dependency on synthetic inputs, thereby reinforcing their position in the market.

By Form Analysis

Inorganic seed forms lead the market with a 78.4% share.

In 2024, Inorganic held a dominant market position in the By Form segment of the Vegetable Seed Market, with a 78.4% share. This significant share highlights the widespread adoption of conventionally treated and chemically coated seeds across commercial farming operations. Inorganic seeds are commonly preferred for their enhanced shelf life, faster germination rates, and resistance to pests and diseases during the early growth stages.

The use of inorganic forms is particularly favored in intensive agricultural settings, where inputs are closely managed to ensure predictable results. These seeds are often treated with fungicides, insecticides, or micronutrients to improve their performance, especially in challenging environments. Their availability, cost-effectiveness, and compatibility with mechanized sowing techniques have made them a staple in mainstream vegetable production systems.

In addition, the established supply chains and regulatory acceptance of inorganic seeds in many regions have further supported their widespread distribution and use. With vegetable consumption rising globally and producers focused on minimizing risks and losses, the demand for inorganic seeds remains high. This has reinforced their dominant position in the market, reflecting current agricultural practices and productivity-driven approaches.

By Crop Type Analysis

Solanaceae crops account for 36.7% of vegetable seed sales.

In 2024, Solanaceae held a dominant market position in the By Crop Type segment of the Vegetable Seed Market, with a 36.7% share. This dominance reflects the high global demand for Solanaceae crops such as tomatoes, peppers, and eggplants, which are widely consumed both fresh and in processed forms. These crops are staple ingredients in numerous cuisines and play a significant role in household diets and commercial food services.

The strong performance of the Solanaceae segment is supported by its adaptability to various climatic conditions and its economic importance to growers. These crops offer relatively high returns per hectare, encouraging farmers to prioritize their cultivation. In addition, Solanaceae crops are widely cultivated in both open fields and protected environments, such as greenhouses and net houses, allowing year-round production in many regions.

Seed demand within this segment is further strengthened by ongoing improvements in yield, disease resistance, and shelf life through selective breeding. As consumer preference for fresh produce continues to rise, and with growing urban consumption of vegetables, the demand for Solanaceae seeds has remained robust. The segment’s consistent output, market value, and suitability for modern agricultural practices have collectively contributed to its leading share in the vegetable seed market.

Key Market Segments

By Type

- Open Pollinated Varieties

- Traditional Open-Pollinated Varieties

- Hybrid

By Traits

- Genetically Modified

- Conventional

By Form

- Organic

- Inorganic

By Crop Type

- Solanaceae

- Root and Bulb

- Cucurbit

- Brassica

- Leafy

- Others

Driving Factors

Rising Demand for Healthy and Fresh Vegetables

One of the key driving factors for the vegetable seed market is the increasing demand for healthy and fresh vegetables across the world. People are becoming more health-conscious and prefer adding more vegetables to their daily meals for better nutrition. This change in food habits is pushing farmers to grow more vegetables, which increases the need for quality seeds.

Urban populations are also choosing fresh, organic, and locally grown produce, adding to this trend. As a result, there is a steady rise in vegetable farming activities, especially in peri-urban and rural areas. To meet this growing demand, farmers are looking for seeds that give higher yields and better resistance to pests and weather conditions, driving the market forward.

Restraining Factors

High Cost of Quality Seeds Limits Adoption

A major restraining factor in the vegetable seed market is the high cost of quality seeds, especially hybrid and improved varieties. Many small and medium-scale farmers find it difficult to afford these expensive seeds, even though they offer better yields and disease resistance. In regions with limited financial support or subsidies, this becomes a serious challenge.

As a result, many growers continue using low-cost traditional seeds, which do not perform as well. This limits the overall productivity and slows down the adoption of modern seed technologies. Without access to affordable and high-quality seeds, the benefits of advanced agricultural practices cannot be fully realized, thereby affecting the market’s growth potential in several developing regions.

Growth Opportunity

Expansion of Protected Farming Boosts Seed Demand

A major growth opportunity in the vegetable seed market lies in the expansion of protected farming methods such as greenhouse cultivation, polyhouses, and net houses. These farming systems provide better control over environmental conditions, allowing year-round vegetable production and reducing crop losses from pests and weather changes. As more farmers adopt protected farming to increase productivity and income, the demand for high-performing vegetable seeds will also grow.

These methods often require seeds with specific traits like fast germination, disease resistance, and adaptability to controlled environments. This shift creates new opportunities for seed producers to develop and supply specialized seeds tailored for protected farming, helping expand the vegetable seed market in both developed and developing regions.

Latest Trends

Rise of Climate‑Smart Seeds for Changing Conditions

A key latest trend in the vegetable seed market is the growing focus on climate-smart seed varieties. These seeds are developed to handle changing weather patterns, such as drought, heat waves, or heavy rain. Farmers are looking for seed types that can survive and still produce good yields even under unpredictable conditions. Such seeds may have traits like tolerance to temperature stress, better water efficiency, or resistance to new pests.

As farmers face more challenges from shifting climates, they are increasingly choosing seeds that can cope with these stresses. This trend is helping the seed market by encouraging breeding efforts focused on resilience, ensuring vegetable production remains steady despite climate uncertainties.

Regional Analysis

In 2024, the Asia-Pacific dominated the vegetable seed market with a 47.9% share.

In 2024, Asia-Pacific held a dominant position in the global vegetable seed market, accounting for 47.9% of the total share and reaching a market value of USD 4.5 billion. This leadership is supported by the region’s large agricultural base, favorable climatic conditions, and high consumption of vegetables in countries such as China, India, and Southeast Asian nations. The demand for high-yielding and disease-resistant seed varieties continues to grow in this region due to increasing population and rising awareness about improved farming techniques.

North America and Europe represent mature markets where commercial farming practices and the use of hybrid seeds are well-established. These regions maintain stable demand, supported by technological advancements in seed development and strong infrastructure in the agricultural sector. Latin America is experiencing gradual growth in vegetable seed adoption due to expanding cultivation areas and the promotion of export-oriented farming.

The Middle East & Africa, though currently holding a smaller share, shows potential for future growth as governments emphasize food security and sustainable farming. However, Asia-Pacific remains the leading contributor by a significant margin, driven by large-scale vegetable production and a strong shift toward modern agricultural practices, reinforcing its role as the most influential region in the global vegetable seed market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

American Takii Inc. remains recognized for its strong focus on open‑pollinated and specialty vegetable seeds, often chosen by growers seeking reliable heirloom and regional varieties. Its enduring emphasis on seed purity and culinary quality positions it favorably within niche customer segments.

BASF SE continues to leverage its large R&D infrastructure, with a strong orientation toward innovation in traits such as disease resistance and seed treatment technologies. Its integrated approach combining chemistry and seed biology is likely to support steady growth and broad adoption in commercial-scale farming.

Bayer AG maintains its presence as a major diversified agricultural science provider, focusing on hybrid and trait‑enhanced vegetable seeds. Its ability to combine crop protection with seed technology ensures that growers have access to bundled solutions, aligning with modern precision agriculture practices.

Bejo Zaden B.V. is known for its Dutch and European focus on high‑performance varieties, particularly in cucurbits, leafy vegetables, and other segments. Its breeding expertise and supply to greenhouse and open‑field growers contribute to its reputation for consistent quality and yield performance under varied conditions.

Finally, East‑West Seed Group continues to play an influential role by focusing on tropical and subtropical vegetable varieties tailored to smallholder and emerging‑market growers. Its breeding programmes address regional climate challenges and affordability, helping expand adoption in high‑growth developing regions.

Top Key Players in the Market

- American Takii Inc.

- BASF SE

- Bayer AG

- Bejo Zaden B.V.

- East-West Seed Group

- Enza Zaden BV

- Groupe Limagrain Holding

- Namdhari Seeds Pvt Ltd.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed Corporation

- Syngenta Crop Protection AG

- Takii & Co., Ltd.

- UPL Limited

Recent Developments

- In August 2024, BASF announced the upcoming launch of two new high‑performance InVigor® hybrid canola varieties for the 2025 growing season in Australia. These varieties combine PodGuard®, LibertyLink®, and TruFlex traits, offering improved yield potential, shatter tolerance, and flexible weed control options for growers.

- In July 2024, Takii introduced a refreshed brand identity for its Sahin portfolio, which includes vegetable seed varieties aimed at home gardeners and specialty growers. The new branding emphasises quality, reliability, and innovation while preserving Sahin’s legacy in non‑GMO, open‑pollinated seeds. This move positions the portfolio for future market adaptability and growth.

Report Scope

Report Features Description Market Value (2024) USD 9.5 Billion Forecast Revenue (2034) USD 18.3 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Open Pollinated Varieties, Traditional Open-Pollinated Varieties, Hybrid), By Traits (Genetically Modified, Conventional), By Form (Organic, Inorganic), By Crop Type (Solanaceae, Root and Bulb, Cucurbit, Brassica, Leafy, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape American Takii Inc., BASF SE, Bayer AG, Bejo Zaden B.V., East-West Seed Group, Enza Zaden BV, Groupe Limagrain Holding, Namdhari Seeds Pvt Ltd., Rijk Zwaan Zaadteelt en Zaadhandel B.V., Sakata Seed Corporation, Syngenta Crop Protection AG, Takii & Co., Ltd., UPL Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Takii Inc.

- BASF SE

- Bayer AG

- Bejo Zaden B.V.

- East-West Seed Group

- Enza Zaden BV

- Groupe Limagrain Holding

- Namdhari Seeds Pvt Ltd.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- Sakata Seed Corporation

- Syngenta Crop Protection AG

- Takii & Co., Ltd.

- UPL Limited