Global Truck Rental Market Size, Share, Growth Analysis By Truck (Light Duty, Medium Duty, Heavy Duty), By Service Provider (Rental and Leasing Companies, OEM Captives, Third Party Service Providers), By Propulsion (ICE, Electric), By Duration (Short Term, Long Term), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151375

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

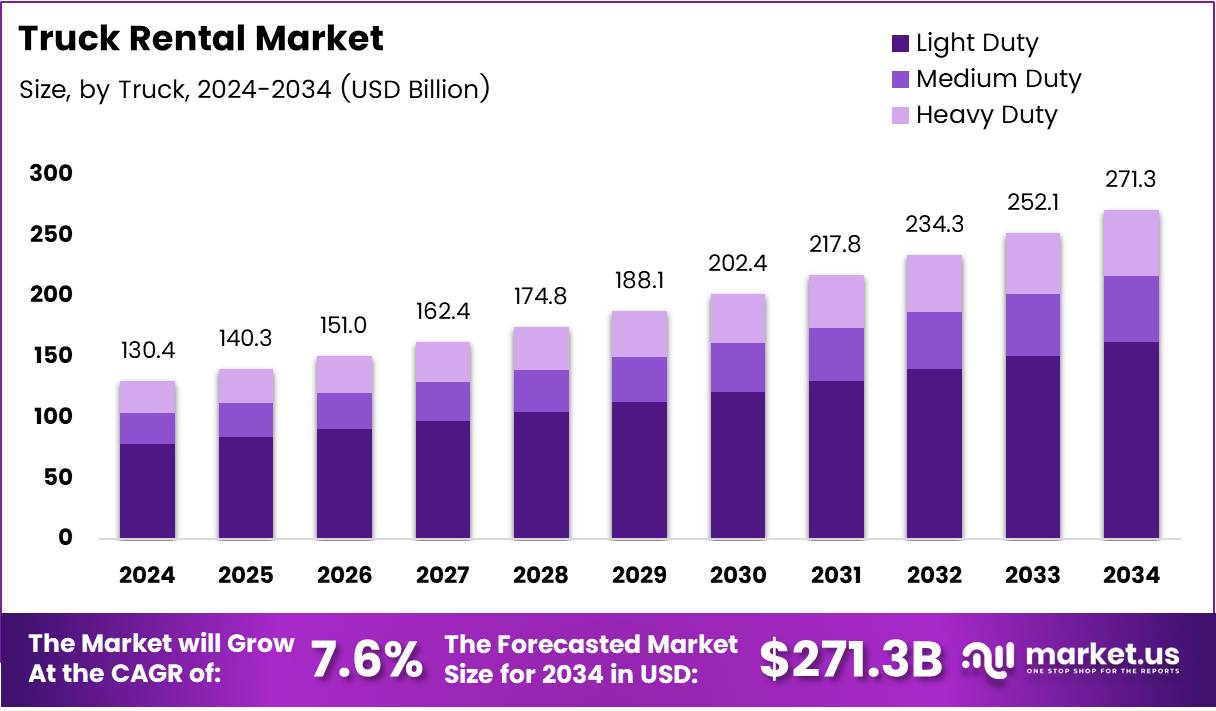

The Global Truck Rental Market size is expected to be worth around USD 271.3 Billion by 2034, from USD 130.4 Billion in 2024, growing at a CAGR of 7.6% during the forecast period from 2025 to 2034.

The truck rental market represents a flexible and cost-effective solution for individuals and businesses needing short-term transportation solutions. Companies, logistics firms, and consumers increasingly rely on truck rental services for local moves, long-distance relocations, and commercial transport needs. Rising demand from e-commerce, construction, and small businesses fuels market growth.

Government investments in infrastructure development further bolster the market. As road networks expand and improve, the need for transportation services grows in parallel. Many small and medium enterprises leverage truck rental services to avoid large capital investments in fleet ownership. This creates steady demand across diverse industries.

According to ThisOldHouse, the average cost to rent a large moving truck ranges from $60–$100 per day, with added mileage fees. This affordability makes rentals attractive for individuals relocating homes and businesses managing variable logistics requirements. Competitive pricing keeps consumer interest strong.

Additionally, major players are rapidly expanding their fleets to meet growing demand. According to U-Haul, customer support has grown their fleet to 192,200 trucks, 138,500 trailers, and 44,500 towing devices. This significant capacity allows companies to serve broader geographic areas and diverse customer needs effectively.

Opportunities continue to emerge from the booming e-commerce sector. As online retail grows, so does the need for last-mile delivery and efficient logistics solutions. Truck rental services offer businesses a scalable option to manage fluctuating delivery volumes without long-term fleet commitments.

Government regulations around emissions and fuel standards are also shaping market dynamics. Many rental companies are upgrading to fuel-efficient and low-emission vehicles to meet stricter environmental policies. This shift not only aligns with regulatory demands but also appeals to eco-conscious customers seeking sustainable transport options.

Investments in technology further enhance the market landscape. Companies are integrating telematics, real-time tracking, and mobile booking platforms to improve customer experience and optimize fleet management. These innovations improve operational efficiency and drive customer loyalty.

Seasonal peaks, such as summer moves and holiday deliveries, create recurring surges in rental demand. Rental firms capitalize on these patterns by offering flexible packages tailored to both short-term personal use and ongoing commercial operations.

In emerging economies, rising urbanization and infrastructure projects amplify the need for transportation solutions. Truck rentals offer an accessible alternative for businesses that cannot afford fleet ownership but require dependable logistics support for growth and expansion.

The competitive landscape remains dynamic, with both global brands and local operators vying for market share. Strategic partnerships, fleet diversification, and customer-centric services play a crucial role in sustaining long-term growth and profitability in the evolving truck rental market.

Key Takeaways

- The Global Truck Rental Market is projected to reach USD 271.3 Billion by 2034, growing from USD 130.4 Billion in 2024 at a CAGR of 7.6%.

- In 2024, Light Duty trucks dominated the “By Truck Analysis” segment with a 70.1% share, driven by last-mile delivery and urban logistics demand.

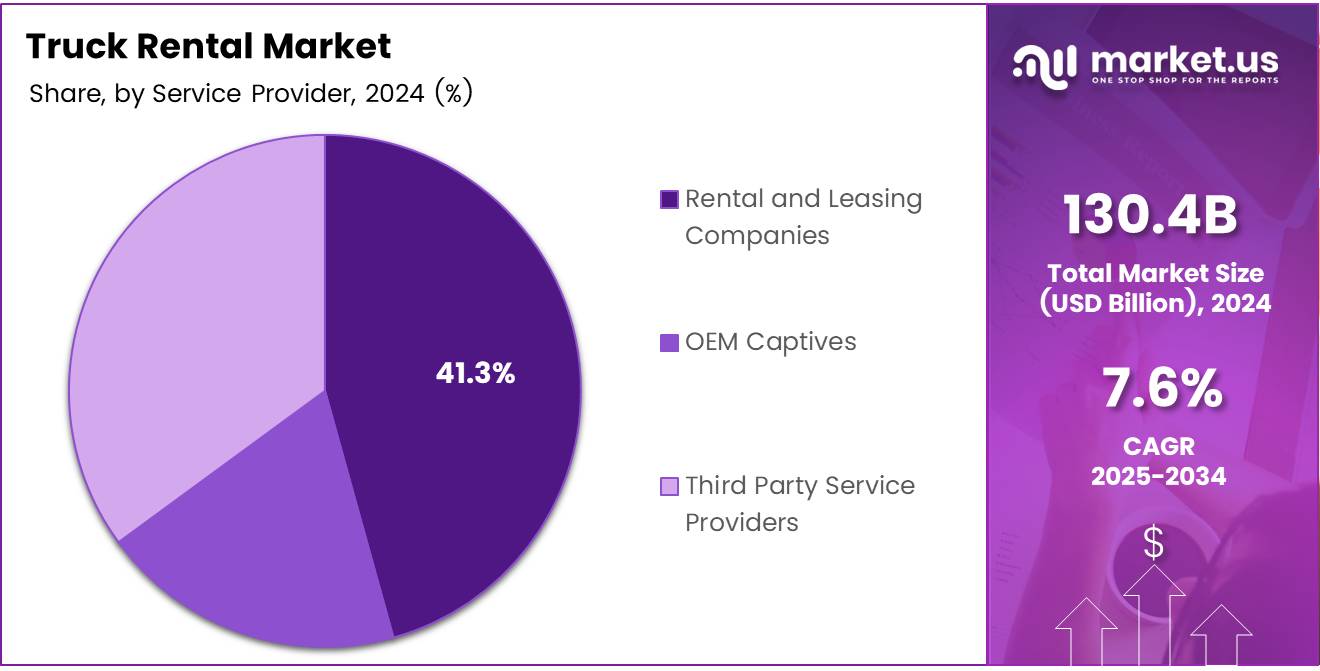

- Rental and Leasing Companies led the “By Service Provider Analysis” segment in 2024 with a 41.3% share due to comprehensive service offerings.

- In 2024, ICE (Internal Combustion Engine) trucks held the dominant position in “By Propulsion Analysis” owing to infrastructure readiness and operational familiarity.

- Short Term rentals led the “By Duration Analysis” segment in 2024, reflecting businesses’ preference for flexible, short-term fleet solutions.

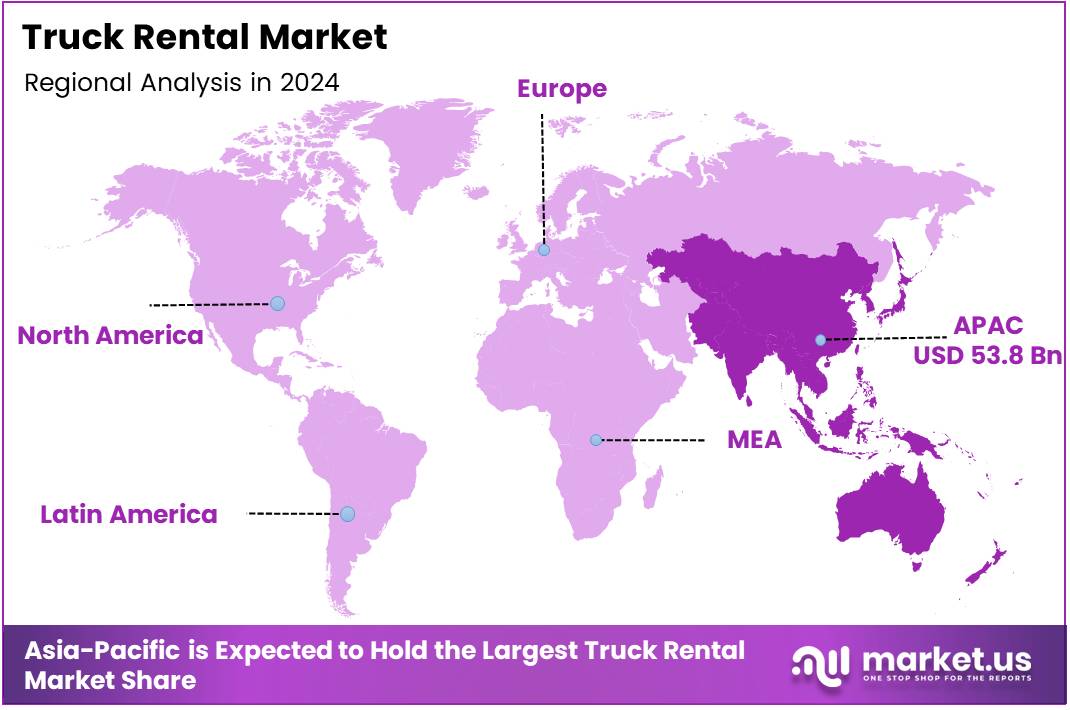

- Asia Pacific accounted for the largest regional share with 41.2%, valued at USD 53.8 Billion, supported by booming e-commerce and infrastructure growth.

Truck Analysis

Light Duty dominates with 70.1% due to its cost-efficiency and operational flexibility.

In 2024, Light Duty held a dominant market position in By Truck Analysis segment of Truck Rental Market, with a 70.1% share. This segment benefits from rising demand for last-mile delivery, urban transportation, and short-haul logistics. Its affordability and ease of maneuverability in congested cities drive its preference among small businesses.

Medium Duty trucks account for a steady share, catering to regional distribution and moderate cargo loads. Businesses involved in construction supplies, furniture delivery, and regional freight increasingly prefer this segment for its balance between capacity and operating costs.

Heavy Duty trucks serve specialized industries that require transportation of large, heavy cargo over long distances. Though they represent a smaller share, sectors like mining, infrastructure development, and large-scale manufacturing contribute consistently to this segment’s demand.

Service Provider Analysis

Rental and Leasing Companies dominate with 41.3% driven by their extensive fleet options and flexible contracts.

In 2024, Rental and Leasing Companies held a dominant market position in By Service Provider Analysis segment of Truck Rental Market, with a 41.3% share. Their broad service offerings, including maintenance, insurance, and roadside assistance, attract both small businesses and large enterprises seeking flexibility without ownership costs.

OEM Captives maintain a strong position by offering integrated solutions directly tied to their vehicle manufacturing capabilities. These providers leverage brand loyalty and tailored leasing programs to capture a dedicated client base across corporate fleets.

Third Party Service Providers contribute by offering niche services and competitive pricing. Their customized solutions for specialized industries, combined with personalized customer service, continue to secure a loyal segment of the rental market.

Propulsion Analysis

ICE dominates due to its widespread infrastructure and established technology.

In 2024, ICE held a dominant market position in By Propulsion Analysis segment of Truck Rental Market. Internal Combustion Engine (ICE) trucks continue to lead due to the established refueling infrastructure, longer range capabilities, and familiarity among fleet operators. Businesses still prefer ICE vehicles for long-haul and heavy-duty transport, where fuel stations are readily accessible.

Electric trucks are gradually emerging, driven by environmental regulations and sustainability goals. Fleets involved in urban delivery and short-haul logistics are adopting electric models for their lower emissions and reduced operating costs. However, infrastructure limitations and higher upfront costs currently restrict their mass adoption.

Duration Analysis

Short Term dominates due to its flexibility for seasonal and project-based demands.

In 2024, Short Term held a dominant market position in By Duration Analysis segment of Truck Rental Market. Companies increasingly rely on short-term rentals to address temporary surges in demand, seasonal peaks, or project-specific needs without long-term financial commitments.

Long Term rentals are favored by businesses requiring consistent fleet availability without the complexities of ownership. This option provides predictable costs and simplifies fleet management, making it attractive for companies with stable, ongoing transportation needs.

Key Market Segments

By Truck

- Light Duty

- Medium Duty

- Heavy Duty

By Service Provider

- Rental and Leasing Companies

- OEM Captives

- Third Party Service Providers

By Propulsion

- ICE

- Electric

By Duration

- Short Term

- Long Term

Drivers

Surge in E-Commerce and Last-Mile Delivery Demand Drives Market Growth

The rise in online shopping has significantly increased the need for quick and efficient delivery services. E-commerce businesses rely heavily on rental trucks for last-mile delivery, especially in urban areas where frequent shipments are required. This trend is pushing rental companies to expand their fleets and services.

Cross-border trade and global logistics are also growing. Many companies prefer renting trucks for international shipments to avoid the high cost of owning vehicles that may not be used regularly. This is especially true for seasonal or occasional shipping needs.

Small and medium-sized enterprises (SMEs) are increasingly turning to truck rental services instead of investing in their own vehicles. On-demand transport helps them manage logistics better without the burden of fleet ownership. It offers them flexibility and reduces upfront capital expenses.

Another key driver is the shift in mindset toward flexible fleet solutions. Companies now prefer renting vehicles to scale operations based on demand. Renting allows businesses to easily adjust the size and type of fleet needed without long-term commitments or maintenance responsibilities.

Restraints

Stringent Government Regulations on Emissions and Safety Impact Market Growth

Government rules on vehicle emissions are becoming more strict. Truck rental companies must upgrade their fleets to meet these standards, which increases costs. Older trucks that don’t comply with regulations may need to be retired early, affecting availability and profitability.

Safety regulations also require constant updates to vehicle features, documentation, and driver training. Meeting these rules can slow down operations and add to the overall cost of running a rental fleet, especially for smaller rental companies.

The ongoing shortage of skilled truck drivers adds another challenge. With fewer qualified drivers available, rental fleets are sometimes underutilized. This issue limits how much rental companies can grow, even if there is strong market demand.

Driver shortages also increase labor costs, as rental companies may have to offer higher wages or better benefits to attract talent. These increased expenses affect pricing and profitability across the industry.

Growth Factors

Integration of Telematics and Real-Time Tracking in Rental Fleets Opens New Opportunities

Telematics technology is helping truck rental companies manage their fleets more efficiently. Real-time tracking of vehicles improves route planning, safety, and fuel use. This not only saves money but also makes the service more attractive to businesses that value control and data insights.

Subscription-based truck rental models are emerging as a flexible solution for companies that want to avoid large upfront costs. These models offer fixed monthly payments and services like maintenance and insurance, making them easier to budget and more scalable.

There’s also a rising interest in electric and alternative fuel trucks. As companies aim to reduce their carbon footprint, they are looking for green transportation options. Truck rental firms that invest in electric vehicles can attract eco-conscious clients and benefit from government incentives.

All these developments are shaping a modern and efficient rental market, offering more choices and better value for customers while creating new revenue streams for providers.

Emerging Trends

Adoption of AI-Powered Fleet Management Solutions Sets New Trends

AI-powered fleet management tools are changing how rental companies operate. These systems use data to predict maintenance needs, optimize routes, and reduce fuel consumption. They help companies save costs and improve service reliability, making AI a key trend in the market.

Another trend gaining traction is contactless rental services. Customers prefer digital processes for booking, pickup, and return of rental trucks. Mobile apps and online platforms make these interactions faster and more convenient, especially in a post-pandemic environment.

Blockchain is also being explored to create transparent and secure rental agreements. It helps track vehicle usage, payments, and contract terms in real time. This builds trust between rental companies and customers and reduces the risk of disputes.

These trends are reshaping the truck rental industry by enhancing user experience, improving security, and driving digital transformation across operations.

Regional Analysis

Asia Pacific Dominates the Truck Rental Market with a Market Share of 41.2%, Valued at USD 53.8 Billion

Asia Pacific holds the largest share in the global truck rental market, driven by the region’s expanding e-commerce sector, rapid urbanization, and infrastructural developments across major economies like China, India, and Southeast Asian countries.

The market in this region is highly dynamic, supported by growing logistics demands and increasing preference for flexible transportation solutions. With a market share of 41.2% and valued at USD 53.8 billion, Asia Pacific leads due to its strong transportation networks and rising commercial vehicle leasing trends.

North America Truck Rental Market Trends

North America continues to demonstrate strong growth in the truck rental industry due to the region’s mature logistics infrastructure and steady demand from the construction and manufacturing sectors. The widespread adoption of rental fleets to minimize operational costs and meet seasonal demands is a key factor driving regional expansion. Technological integration in fleet management is also bolstering market activity.

Europe Truck Rental Market Trends

The European truck rental market benefits from the region’s focus on sustainability, emission regulations, and shifting consumer preferences towards shared mobility. Increasing cross-border transportation and stringent policies regarding vehicle ownership have accelerated demand for short- and long-term truck rentals. Urban freight and last-mile delivery services also contribute significantly to market momentum.

Middle East and Africa Truck Rental Market Trends

The truck rental market in the Middle East and Africa is witnessing gradual growth, primarily fueled by expanding infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. A rising trend toward outsourcing logistics operations and demand from oil and gas, construction, and mining industries supports market development. However, economic diversification and regulatory improvements remain key factors shaping its trajectory.

Latin America Truck Rental Market Trends

In Latin America, the truck rental industry is gaining traction due to the growing need for cost-effective freight solutions across agriculture, retail, and industrial sectors. Challenges such as fluctuating fuel prices and economic instability impact growth, but rising urban delivery services and fleet outsourcing are helping drive the market forward. Improvements in road connectivity and trade logistics are expected to enhance future prospects.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Truck Rental Company Insights

The global truck rental market in 2024 continues to witness steady growth, driven by key players adopting strategic initiatives to strengthen their market presence.

PACCAR Leasing Company remains a significant player, leveraging its strong parent company network and offering comprehensive leasing solutions that integrate maintenance, financing, and fleet management. This approach allows PACCAR Leasing to cater to both large-scale logistics companies and smaller enterprises seeking flexible rental solutions.

IDEALEASE focuses heavily on full-service leasing and rental programs, emphasizing personalized customer support and preventive maintenance. Its widespread dealer network helps IDEALEASE efficiently serve a diverse customer base, particularly in North America, ensuring high fleet availability and minimized downtime for clients.

HERC Rentals Inc. continues to diversify its fleet offerings, targeting various industries beyond traditional freight, such as construction and infrastructure development. By investing in fleet modernization and digital reservation platforms, HERC Rentals enhances customer experience and operational efficiency, capturing a broad market segment.

Driving Force strategically emphasizes specialized rental solutions, particularly for oilfield services, remote worksites, and industries requiring tailored transportation solutions. Its focus on customer-centric customization allows Driving Force to differentiate itself in niche markets where standard rental services may not suffice.

These companies, through their varied approaches—ranging from full-service leasing to niche specialization—illustrate the broad dynamics shaping the global truck rental market in 2024. Their continuous investments in technology, customer service, and fleet diversification are expected to sustain market competitiveness and address evolving transportation demands across industries.

Top Key Players in the Market

- PACCAR Leasing Company

- IDEALEASE

- HERC Rentals Inc.

- Driving Force

- TIP Group

- ORIX Australia Corporation Limited

- Sixt S.E.

- Barco Rent-A-Truck

- Amerco

- Nishio Holdings Co Ltd

- United Rentals, Inc.

- Rush Enterprises

- Premier Truck Rental

- PENSKE Corporation, Inc.

- Enterprise Truck Rental

- Asset Alliance Group

- Avis Budget Group

Recent Developments

- In March 2024, Velocity Truck Rental & Leasing completed the acquisition of AutoW NationaLease Truck Rental, Inc., enhancing its service capabilities and expanding its rental fleet to better serve regional and national logistics clients. This move strengthens its footprint in the full-service truck leasing segment.

- In February 2024, Jim Pattison Lease announced the acquisition of Jamieson Car and Truck Rental, enabling the company to broaden its rental offerings and enter new geographical markets while diversifying its customer portfolio across Canada.

- In September 2024, Penske Truck Leasing agreed to acquire Old Dominion Truck Leasing, significantly increasing its fleet size and service reach, while reinforcing its position as a key player in the North American truck leasing and rental industry.

Report Scope

Report Features Description Market Value (2024) USD 130.4 Billion Forecast Revenue (2034) USD 271.3 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Truck (Light Duty, Medium Duty, Heavy Duty), By Service Provider (Rental and Leasing Companies, OEM Captives, Third Party Service Providers), By Propulsion (ICE, Electric), By Duration (Short Term, Long Term) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape PACCAR Leasing Company, IDEALEASE, HERC Rentals Inc., Driving Force, TIP Group, ORIX Australia Corporation Limited, Sixt S.E., Barco Rent-A-Truck, Amerco, Nishio Holdings Co Ltd, United Rentals, Inc., Rush Enterprises, Premier Truck Rental, PENSKE Corporation, Inc., Enterprise Truck Rental, Asset Alliance Group, Avis Budget Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PACCAR Leasing Company

- IDEALEASE

- HERC Rentals Inc.

- Driving Force

- TIP Group

- ORIX Australia Corporation Limited

- Sixt S.E.

- Barco Rent-A-Truck

- Amerco

- Nishio Holdings Co Ltd

- United Rentals, Inc.

- Rush Enterprises

- Premier Truck Rental

- PENSKE Corporation, Inc.

- Enterprise Truck Rental

- Asset Alliance Group

- Avis Budget Group