Global Class 2 Trucks Market Size, Share, Growth Analysis By Fuel Type (Gasoline, Diesel, Electric, Hybrid), By Drive Configuration (4x2 Drive, 4x4 Drive, All-Wheel Drive), By Distribution Channel (OEMs and Dealerships, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138090

- Number of Pages: 202

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

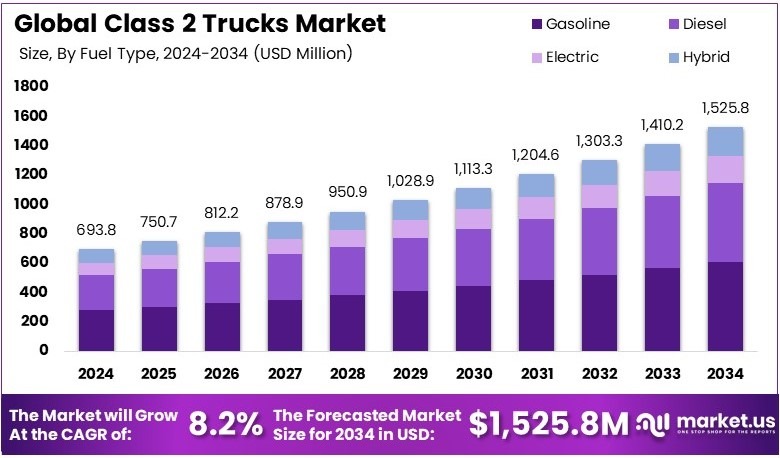

The Global Class 2 Trucks Market size is expected to be worth around USD 1,525.8 Million by 2034, from USD 693.8 Million in 2024, growing at a CAGR of 8.2% during the forecast period from 2025 to 2034.

Class 2 trucks are medium-duty vehicles with a Gross Vehicle Weight Rating between 6,001 and 10,000 pounds. They include pickup trucks and small commercial vehicles. These trucks are used for light delivery, service work, and local hauling. Their design balances power and maneuverability for various tasks.

The Class 2 trucks market involves manufacturing and selling medium-duty vehicles. This market serves industries requiring smaller trucks for urban deliveries, service routes, and light transport. It includes various models designed for efficiency and reliability. The market caters to the needs of businesses needing dependable, versatile transportation.

The versatility of Class 2 trucks ensures steady demand within the market, and their suitability for various industries supports continuous market expansion. Enhanced by global import-export activities and significant technological advancements, this segment is poised for further growth.

Environmental sustainability is becoming increasingly crucial in vehicle regulation. The U.S. Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA) are leading the charge with stringent emissions standards, aiming for a 25% reduction in commercial greenhouse gas emissions from Class 2 trucks by 2027.

Similarly, the European Union’s Euro VI norms impose rigorous emissions controls, necessitating significant technological shifts in truck design and operation. These regulations not only encourage environmental responsibility but also drive innovation within the industry.

In parallel, the U.S. Department of Energy (DOE) has committed $137 million to the development of advanced technologies for medium and heavy-duty vehicles. This investment is focused on improving fuel efficiency and reducing emissions, catalyzing progress and innovation in the Class 2 truck segment.

Key Takeaways

- Class 2 Trucks Market was valued at USD 693.8 Million in 2024, and is expected to reach USD 1,525.8 Million by 2034, with a CAGR of 8.2%.

- In 2024, Gasoline dominates the fuel type segment, preferred for its accessibility and cost-effectiveness in light-duty trucks.

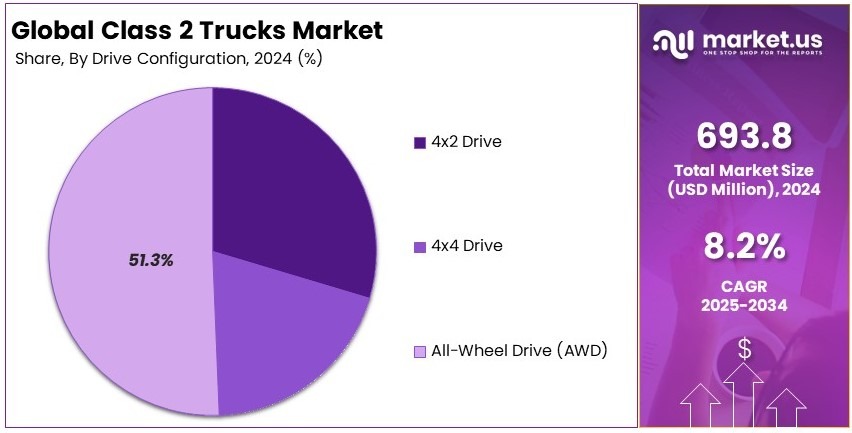

- In 2024, All-Wheel Drive (AWD) dominates the drive configuration segment with 51.3%, offering enhanced stability and traction.

- In 2024, OEMs (Dealerships) lead the distribution channel segment, making up the majority of truck sales and ensuring consistent demand.

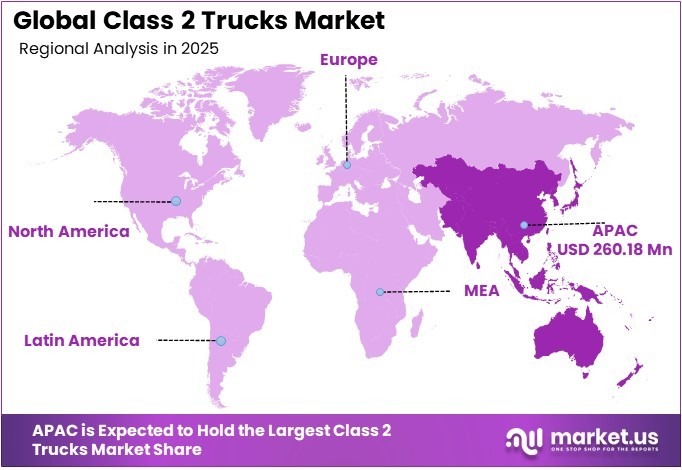

- In 2024, Asia-Pacific dominates the regional market with 37.5%, contributing USD 260.18 Million, driven by robust vehicle demand in emerging economies.

Fuel Type Analysis

Gasoline dominates the market due to its widespread availability and cost-effectiveness.

In the Class 2 Trucks Market, Gasoline emerges as the dominant fuel type. This prevalence can be attributed to gasoline’s widespread availability and generally lower cost compared to other fuel types. Gasoline engines are known for their reliability and lower maintenance costs, making them a preferred choice for many truck users, particularly in sectors where cost efficiency is paramount.

Other fuel types also play important roles in this market. Diesel trucks are appreciated for their better fuel economy and higher torque, making them suitable for heavier loads and longer trips.

Electric trucks are gaining traction due to their lower emissions and reduced operational costs, aligning with increasing environmental concerns and regulations. Hybrid trucks offer a compromise, combining the benefits of internal combustion engines with electric power to improve fuel efficiency and reduce emissions.

Drive Configuration Analysis

All-Wheel Drive (AWD) leads with 51.3% due to its enhanced stability and performance in varied driving conditions.

All-Wheel Drive (AWD) configurations dominate the Class 2 Trucks Market with a significant 51.3% market share. This dominance is primarily because AWD provides enhanced stability and performance, particularly under challenging driving conditions such as wet or uneven roads.

AWD is increasingly preferred for its ability to distribute power to all four wheels, which improves handling and safety, a critical factor for commercial vehicles in diverse geographical and weather conditions.

In contrast, 4×2 Drive trucks are commonly used for lighter duties and are valued for their fuel efficiency and lower cost. 4×4 Drive trucks are suitable for off-road and rugged conditions, where additional traction and power are necessary.

Distribution Channel Analysis

OEMs (Dealerships) dominate due to their direct relationships with manufacturers and comprehensive service offerings.

OEMs, or Original Equipment Manufacturers, through dealerships, are the leading distribution channel in the Class 2 Trucks Market. This dominance is due to the strong relationships dealerships maintain with manufacturers, offering customers trustworthiness and reliability in vehicle purchasing.

Dealerships provide a wide range of services, including customer service, maintenance, and access to genuine parts, which are crucial for buyers seeking full-service solutions.

The Aftermarket segment, although smaller, plays a vital role in providing parts, accessories, and services that are not tied directly to the OEMs. This channel is crucial for customers looking to customize their trucks or require more cost-effective maintenance and repair options.

Key Market Segments

By Fuel Type

- Gasoline

- Diesel

- Electric

- Hybrid

By Drive Configuration

- 4×2 Drive

- 4×4 Drive

- All-Wheel Drive (AWD)

By Distribution Channel

- OEMs (Dealerships)

- Aftermarket

Driving Factors

Growth Through Market Demand and Innovation Drives Market Growth

The Class 2 trucks market sees a rise due to increasing demand for light-duty trucks in cities and suburbs. There is growing interest in pickups for commercial uses and expanding e-commerce delivery services. The need for versatile, fuel-efficient trucks fuels innovation.

This trend is seen in urban logistics where electric and hybrid models are being adopted. For instance, companies use these trucks for last-mile delivery, which cuts down fuel costs. The growth of e-commerce demands reliable transportation, leading to development in driver assistance and safety systems.

New materials help improve fuel efficiency and lower emissions. In addition, vehicles are being customized for specific industries, meeting unique needs. The smart truck market is benefiting from IoT integration, providing real-time data and improving fleet management.

These factors collectively push the market forward. The emphasis on versatile and fuel-efficient trucks, along with technological advancements, creates sustainable growth. As such, market players are incentivized to innovate and adapt.

Restraining Factors

Infrastructure and Regulation Challenges Restraints Market Growth

The market faces challenges due to limited electric truck range and insufficient charging infrastructure. Regulations on emissions and fuel efficiency add pressure. Competition from smaller Class 1 and larger Class 3 trucks limits growth.

Volatile fuel prices increase costs for operators. These factors combined slow market expansion. For example, a fleet manager in a mid-sized city might hesitate to switch to electric trucks due to scarce charging stations. This shortage can dampen enthusiasm for electric transition.

In addition, strict fuel efficiency regulations require expensive updates to vehicles. The rising competition means companies must continually adapt to newer models. High fuel costs also affect logistics budgets. Each issue compounds the overall challenge.

Growth Opportunities

Strategic Shifts and Customization Provides Opportunities

Opportunities in the market arise from strategic shifts, such as adopting electric and hybrid trucks and increasing customization. Companies improve fleets for urban logistics by choosing cleaner vehicles. They also tailor trucks for industry-specific needs.

For instance, a delivery firm may opt for a truck with reinforced cargo space. Manufacturers develop lightweight materials, which boost fuel efficiency and lower costs. They also focus on last-mile delivery services. This opens up new revenue streams.

Customers benefit from more efficient operations and reduced emissions. The growth in IoT integration makes trucks smarter. These trucks provide data on routes, fuel use, and driver behavior. As a result, businesses achieve better fleet management.

The customization trend supports various sectors, from retail to logistics. Additionally, smart trucks with safety systems appeal to companies aiming to reduce accidents. These factors create a wealth of opportunities for players.

Emerging Trends

Technological Integration and Safety Trends Is Latest Trending Factor

The latest trends show a push towards driver assistance, safety systems, and smart IoT integration. New technologies are being introduced in trucks to improve safety and efficiency. The development of lightweight materials is trending, which supports fuel efficiency and environmental goals.

For example, trucks equipped with advanced sensors reduce accidents on busy roads. There is a focus on smart trucks that connect to the internet. This trend provides real-time data on vehicle performance and route optimization.

Ride-sharing and car rental fleets are now using Class 2 trucks more often. This shows a shift in market preferences. Likewise, advancements in driver safety features are becoming common, helping reduce operational risks.

The integration of smart features also attracts younger drivers who prefer modern technology. Such trends drive market growth and innovation. They inspire confidence in potential buyers. The emphasis on safety and efficiency points to a future of smarter and more reliable trucks.

Regional Analysis

Asia Pacific Dominates with 37.5% Market Share

Asia Pacific leads the Class 2 Trucks Market with a 37.5% share, amounting to USD 260.18 million. This prominent market presence is driven by robust economic growth, rapid urbanization, and extensive industrial activities in the region.Key factors contributing to this dominance include the expanding logistics and e-commerce sectors, which necessitate efficient transportation solutions like Class 2 trucks.

Additionally, favorable government policies supporting automotive manufacturing and infrastructure development enhance market growth.Looking ahead, Asia Pacific’s influence in the Class 2 Trucks Market is expected to grow.

Increasing investments in transportation infrastructure and the rising demand for commercial vehicles due to urban and industrial expansion are likely to propel further growth, solidifying the region’s leading position.

Regional Mentions:

- North America: North America holds a significant share in the Class 2 Trucks Market, supported by advanced manufacturing technologies and high consumer spending on transportation. The region’s emphasis on emission reduction and vehicle efficiency continues to influence market dynamics.

- Europe: Europe maintains a strong position in the Class 2 Trucks Market, driven by stringent environmental regulations and high demand for fuel-efficient vehicles. The integration of advanced safety and connectivity features is a key trend enhancing vehicle appeal.

- Middle East & Africa: The Middle East and Africa are experiencing moderate growth in the Class 2 Trucks Market, supported by increasing construction and infrastructural projects. The region’s focus on diversifying economies from oil dependency to broader industrial activities boosts the truck market.

- Latin America: Latin America’s Class 2 Trucks Market is growing due to the expanding retail and construction sectors. Improvements in road infrastructure and urban development are key factors driving the demand for commercial vehicles in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Class 2 Trucks Market is characterized by strong competition among key players such as Ford Motor Company, General Motors (Chevrolet and GMC), Stellantis N.V. (RAM Trucks), and Toyota Motor Corporation (Toyota Tundra). These companies are leaders due to their strong brand recognition, extensive dealer networks, and commitment to technological innovation.

Ford Motor Company leads with its popular F-Series trucks, renowned for their durability and performance. Ford’s continuous innovation in fuel efficiency and engine performance keeps it at the forefront of the market.

General Motors, with its Chevrolet Silverado and GMC Sierra models, competes closely by offering trucks known for their reliability and versatility, combined with cutting-edge technology features that appeal to a broad consumer base.

Stellantis N.V., through its RAM Trucks, offers vehicles that are highly regarded for their towing capacity, luxurious interiors, and robust build, making them favorites in both commercial and personal use sectors.

Toyota Motor Corporation provides the Tundra, which stands out for its build quality and reliability, attributes that are synonymous with Toyota’s brand reputation. The Tundra’s strong performance in safety and customer satisfaction helps maintain its competitive position.

These manufacturers dominate the Class 2 Trucks Market by leveraging their strengths in innovation, customer loyalty, and comprehensive vehicle offerings that meet diverse consumer and commercial needs, driving their continued dominance and growth in the market.

Major Companies in the Market

- Ford Motor Company

- General Motors (Chevrolet and GMC)

- Stellantis N.V. (RAM Trucks)

- Toyota Motor Corporation (Toyota Tundra)

- Nissan Motor Corporation (Nissan Titan)

- Honda Motor Co., Ltd. (Honda Ridgeline)

- Isuzu Motors Limited

- Volkswagen Group (Amarok)

- Mahindra & Mahindra Limited

- Tata Motors Limited

Recent Developments

- Daimler India Commercial Vehicles (DICV): On August 2024, Daimler India Commercial Vehicles (DICV) launched a new series of BharatBenz Rigid heavy-duty trucks. These trucks are designed for improved fuel efficiency and payload applications, and they feature the BSVI-Stage 2 6.7-litre diesel engine.

- SpaceX: On August 2024, SpaceX’s Starship program successfully completed a Stage 2 test fire of its private space launch vehicle, marking an important milestone for the company’s goal of commercial spaceflight.

Report Scope

Report Features Description Market Value (2024) USD 693.8 Million Forecast Revenue (2034) USD 1,525.8 Million CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fuel Type (Gasoline, Diesel, Electric, Hybrid), By Drive Configuration (4×2 Drive, 4×4 Drive, All-Wheel Drive), By Distribution Channel (OEMs/Dealerships, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ford Motor Company, General Motors (Chevrolet and GMC), Stellantis N.V. (RAM Trucks), Toyota Motor Corporation (Toyota Tundra), Nissan Motor Corporation (Nissan Titan), Honda Motor Co., Ltd. (Honda Ridgeline), Isuzu Motors Limited, Volkswagen Group (Amarok), Mahindra & Mahindra Limited, Tata Motors Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ford Motor Company

- General Motors (Chevrolet and GMC)

- Stellantis N.V. (RAM Trucks)

- Toyota Motor Corporation (Toyota Tundra)

- Nissan Motor Corporation (Nissan Titan)

- Honda Motor Co., Ltd. (Honda Ridgeline)

- Isuzu Motors Limited

- Volkswagen Group (Amarok)

- Mahindra & Mahindra Limited

- Tata Motors Limited