US Hydro Excavation Truck Market Size, Share, Growth Analysis By Product Type (Single Engine, Dual Engine), By Application (Utility Installation, Potholing, Slot Trenching, Debris Removal, Others), By End-User (Construction, Oil & Gas, Municipal, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 73863

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

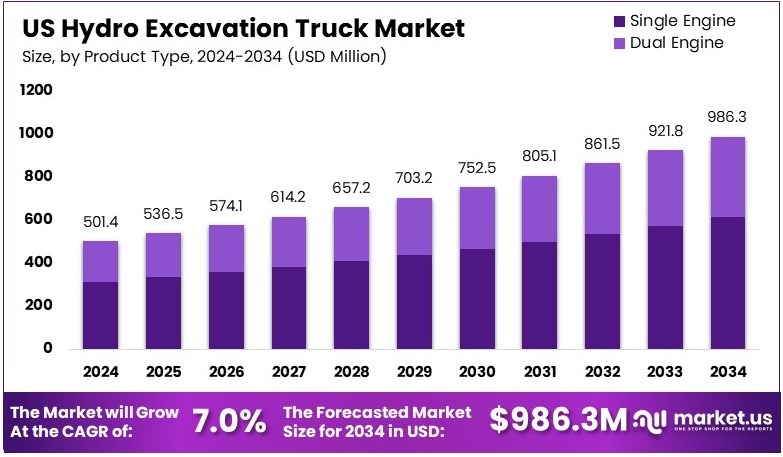

The US Hydro Excavation Truck Market size is expected to be worth around USD 986.3 Million by 2034, from USD 501.4 Million in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034.

US Hydro Excavation Trucks are specialized vehicles equipped with high-pressure water jets and vacuum systems. They are used for digging and excavating soil with precision, minimizing the risk of damaging underground utilities.

The US Hydro Excavation Truck Market is the sector that deals with the production, sale, and operation of hydro excavation trucks. It serves various industries, including construction and utility maintenance, providing efficient and safe excavation solutions across the United States.

The U.S. hydro excavation truck market is experiencing substantial growth, largely fueled by the country’s ongoing and extensive infrastructure enhancement efforts. In fiscal year 2023, a significant investment of $44.8 billion was allocated to various infrastructure projects by the federal government, with an impressive $81.5 billion transferred to state governments.

This financial backing is crucial as it directly increases the demand for specialized excavation equipment, including hydro excavation trucks, which are essential for non-destructive digging methods that protect underground utilities during major construction and maintenance projects.

Furthermore, the competitive landscape of this market is intensifying as manufacturers push to innovate and deliver more efficient, powerful, and environmentally friendly machines. Companies are focusing on technological advancements to gain a competitive edge, including improved suction capabilities and enhanced safety features that meet the rigorous demands of large-scale infrastructure projects.

Additionally, the implementation of the Infrastructure Investment and Jobs Act (IIJA) of 2021 plays a pivotal role in shaping the market. This landmark legislation authorizes over $1.2 trillion in infrastructure spending over the next decade, targeting a broad spectrum of sectors including transportation, water systems, and energy.

The government’s proactive approach, through both direct investment and regulatory support, underscores the importance of modernizing the nation’s infrastructure while promoting the use of technologies that minimize environmental impact and enhance safety. This strategic focus not only supports immediate market growth for hydro excavation trucks but also sets a foundation for long-term demand as the country continues to prioritize infrastructure improvements and innovations.

Key Takeaways

- The US Hydro Excavation Truck Market was valued at USD 501.4 million in 2024 and is expected to reach USD 986.3 million by 2034, with a CAGR of 7.0%.

- In 2024, Single Engine dominated the Product Type segment with 62.1%, attributed to its cost-effectiveness and efficiency.

- In 2024, Utility Installation led the Application segment with 36.3%, driven by increased infrastructure development projects.

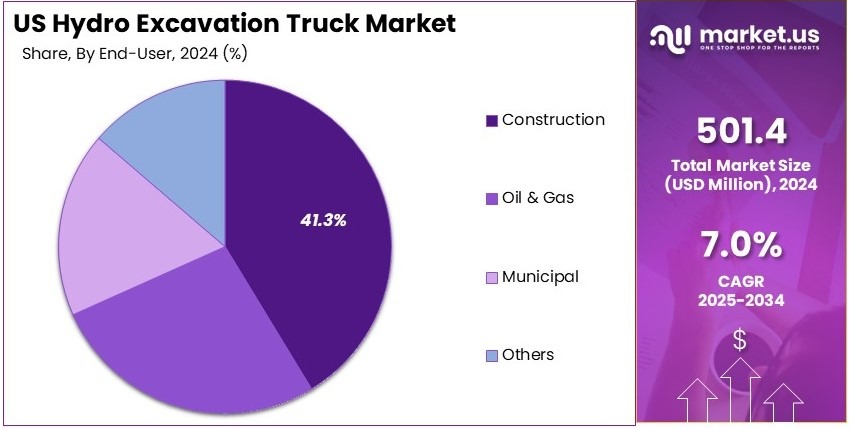

- In 2024, Construction was the largest End-User segment with 41.3%, supported by rising excavation activities in urban areas.

Product Type Analysis

Single Engine dominates with 62.1% due to cost efficiency and wide usage across various applications.

Single-engine hydro excavation trucks dominate the U.S. hydro excavation truck market, accounting for 62.1% of the total market share. This dominance is attributed to the fact that single-engine trucks are more cost-effective and require lower maintenance compared to dual-engine models. The design of single-engine trucks offers simplicity, efficiency, and ease of operation, making them a preferred choice for many industries, especially for smaller-scale excavation tasks.

The lower operating costs and versatility of single-engine trucks contribute significantly to their widespread use. They are ideal for various applications such as potholing, utility installation, and debris removal, where the demand for large-scale excavation is less critical. Furthermore, single-engine trucks are generally more fuel-efficient, providing companies with long-term savings in operational costs.

Dual-engine trucks, though representing a smaller portion of the market, are typically favored for larger, more complex projects. These trucks are designed to handle heavier workloads and more demanding tasks, such as large-scale potholing or deep excavation.

The dual-engine system allows for higher performance, which makes these trucks a preferred choice in the oil & gas industry, where high power and capacity are essential. The “others” category includes trucks with specialized configurations for specific tasks, but they still hold a minor market share.

Application Analysis

Utility Installation dominates with 36.3% due to the growing need for infrastructure development.

Utility installation is the leading application segment in the U.S. hydro excavation truck market, holding a 36.3% share. This segment benefits from the increasing demand for utility infrastructure, including the installation of water, electricity, and gas lines in both urban and rural areas.

Hydro excavation provides an efficient, non-destructive method for excavating around existing underground utilities, making it safer and less disruptive compared to traditional mechanical methods. The growing trend of urbanization and the need for updated infrastructure are key drivers behind this growth.

Other applications, such as potholing, slot trenching, and debris removal, contribute to the overall market but with a smaller share. Potholing, used for locating existing utilities, is another important segment, but it typically makes up a smaller proportion of the market.

Similarly, slot trenching is commonly used for digging narrow trenches with minimal disruption, while debris removal focuses on cleaning up construction sites and excavation areas. These applications benefit from the precision and safety offered by hydro excavation, but they represent a smaller market compared to utility installation.

End-User Analysis

Construction dominates with 41.3% due to the continuous need for excavation services in building projects.

The construction industry leads the U.S. hydro excavation truck market with a 41.3% share. This is because hydro excavation is widely used in construction for tasks such as trenching, foundation work, and site preparation. Construction projects, particularly in urban environments, require methods that are both effective and minimize disruption to surrounding infrastructure.

Hydro excavation trucks are ideal for digging in congested areas, where traditional excavation methods may risk damaging utilities or the environment. The precision of hydro excavation allows for more accurate and less invasive digging, making it an essential tool for modern construction.

The oil & gas sector also plays an important role in the hydro excavation truck market but holds a smaller market share. Oil & gas companies rely on hydro excavation for site preparation and pipeline installation in remote or environmentally sensitive areas.

Municipalities are another key end-user of hydro excavation trucks, particularly for maintaining public utilities and infrastructure. Although the municipal sector uses hydro excavation for a variety of applications, its share is generally lower compared to the construction industry.

Key Market Segments

By Product Type

- Single Engine

- Dual Engine

By Application

- Utility Installation

- Potholing

- Slot Trenching

- Debris Removal

- Others

By End-User

- Construction

- Oil & Gas

- Municipal

- Others

Driving Factors

Rising Demand for Non-Destructive Excavation Drives Market Growth

The rising demand for non-destructive excavation in utility and construction projects is a key factor driving the US hydro excavation truck market. Hydro excavation offers a safer, more precise alternative to traditional digging methods, allowing for the excavation of soil without damaging underground utilities. This makes it increasingly popular in projects where minimizing disruption to existing infrastructure is crucial.

Increased awareness of safety standards and the reduced risk of damage further contribute to the market’s growth. Hydro excavation helps reduce the risk of striking critical utilities like gas, water, or power lines, making it a preferred method in areas with dense utility networks. As safety becomes a top priority in construction and utility maintenance, hydro excavation’s benefits are becoming more recognized.

The growth in infrastructure development and maintenance activities has also played a significant role. As cities expand and aging infrastructure requires updating, the demand for non-invasive excavation methods like hydro excavation has surged. This method is not only more efficient but also reduces the environmental impact, contributing to its growing adoption.

Lastly, advancements in hydro excavation technology for efficiency, including improved vacuum systems and water pressure capabilities, have made the process faster and more cost-effective, further driving the market’s expansion.

Restraining Factors

High Costs and Skill Shortages Restrain Market Growth

The US hydro excavation truck market faces challenges due to high initial investment and operating costs. Hydro excavation trucks are expensive to purchase and maintain, which limits their widespread adoption, particularly among smaller companies or those with tight budgets. The upfront costs, along with the expenses associated with running and maintaining the equipment, can deter businesses from investing in this technology.

Additionally, there is a limited availability of skilled operators for hydro excavation equipment. Operating hydro excavation trucks requires specialized training, and the shortage of qualified personnel can lead to delays and operational inefficiencies. This skill gap hampers market growth, as companies struggle to find experienced workers who can handle the sophisticated equipment.

Environmental regulations concerning water usage and disposal also pose a challenge. Hydro excavation relies heavily on water, and some regions have strict regulations on water usage, especially in areas prone to droughts. Disposal of the used water and debris can also be a complex issue, requiring compliance with local environmental standards.

Finally, the slow adoption of hydro excavation by smaller and medium-sized enterprises (SMEs) further restrains market growth. Many SMEs find it difficult to invest in the necessary technology and training, which slows down the broader adoption of hydro excavation methods across the industry.

Growth Opportunities

Growth in Environmental and Agricultural Sectors Provides Opportunities

The US hydro excavation truck market presents several growth opportunities. One significant opportunity is the growing application of hydro excavation in the environmental and agricultural industries. As concerns about soil preservation and non-invasive methods of land excavation increase, hydro excavation is becoming an attractive option for these sectors. It is particularly useful for projects such as environmental cleanups, tree root management, and land reclamation.

The expansion of services in urban and rural infrastructure projects also offers growth potential. With continued urbanization and the need for rural infrastructure development, hydro excavation is increasingly being used in projects like road construction, utility installation, and sewer repairs. The ability to excavate with minimal disruption to surrounding environments makes it an ideal solution for both urban and rural projects.

Technological advancements in hydro excavation, leading to cost reductions, also create new opportunities. As technology improves, the cost of hydro excavation equipment and its operational efficiency continue to improve, making it more accessible for a broader range of businesses. This is expected to increase market penetration, particularly in smaller enterprises.

Increased demand from the oil and gas sector for non-invasive excavation methods is another opportunity. As the industry focuses on minimizing the environmental impact of its operations, hydro excavation offers a solution for safely digging around underground pipes and cables without causing damage.

Emerging Trends

Eco-Friendly Methods and Telemetry Integration Is Latest Trending Factor

Several trends are shaping the US hydro excavation truck market, with the surge in adoption of eco-friendly hydro excavation methods being a prominent factor. As environmental concerns grow, there is a push towards reducing the environmental impact of excavation projects. Eco-friendly hydro excavation methods, which minimize soil disturbance and reduce water usage, are becoming increasingly popular as they align with sustainability goals.

Growing integration of telemetry and data analytics in excavation trucks is another key trend. Telemetry systems allow for real-time monitoring of equipment performance, water usage, and jobsite conditions, providing valuable data that can improve efficiency and reduce costs. This integration is transforming hydro excavation into a more data-driven and optimized process.

The increased usage of hydro excavation for leak detection in utilities is also a growing trend. This non-destructive method is highly effective in pinpointing leaks in underground utility systems, such as gas or water lines, without the need for large-scale digging. As utilities seek more efficient ways to detect and repair leaks, hydro excavation is becoming a preferred method.

There is a shift towards on-demand and rental hydro excavation services. As businesses and municipalities seek to reduce capital expenditures, they are increasingly turning to rental models for hydro excavation trucks. This trend allows them to access high-quality equipment for specific projects without the long-term commitment, further driving market growth.

Competitive Landscape

The US Hydro Excavation Truck Market is a highly specialized industry with a few key players offering advanced equipment for efficient excavation. Among these, Vac-Con, Inc., Vactor Manufacturing, Inc., GapVax, Inc., and Super Products LLC lead the market with their innovative technologies and comprehensive service offerings.

Vac-Con, Inc. is a leading manufacturer of hydro excavation trucks in the United States. The company’s trucks are known for their reliability and efficiency in handling various excavation tasks. Vac-Con provides a wide range of products that cater to the needs of contractors, municipalities, and utility companies, offering powerful trucks that combine high suction power with precision. Its focus on innovation and customer support has helped Vac-Con maintain a strong market position.

Vactor Manufacturing, Inc. is another key player, known for its high-performance hydro excavation equipment. Vactor’s hydro excavation trucks are designed to perform tasks in a variety of conditions, offering high vacuum power and precision. The company’s emphasis on quality and customer satisfaction has made it a trusted name in the industry. Vactor’s trucks are widely used in applications such as utility work, road repairs, and infrastructure maintenance.

GapVax, Inc. specializes in producing hydro excavation trucks with advanced safety features and high-efficiency capabilities. The company’s trucks are designed to handle difficult excavation projects while minimizing environmental impact. GapVax is recognized for its commitment to innovation, offering customers a range of custom solutions for different types of excavation needs.

Super Products LLC is a well-known manufacturer of hydro excavation trucks, providing durable, high-performance equipment for contractors and service providers. The company’s trucks are designed to meet the needs of both small-scale and large-scale excavation projects. Super Products focuses on providing reliable solutions that enhance productivity while ensuring safety and compliance with industry regulations.

These companies continue to dominate the US hydro excavation truck market through their technological expertise and commitment to providing high-quality, efficient excavation solutions. Their strong presence and continued innovation in the sector position them as the leaders in this specialized industry.

Major Companies in the Market

- Vac-Con, Inc.

- Vactor Manufacturing, Inc.

- GapVax, Inc.

- Super Products LLC

- Federal Signal Corporation

- Hi-Vac Corporation

- Ditch Witch

- Sewer Equipment Co. of America

- Vacall Industries

- Ox Equipment

- Rival Hydrovac Inc.

- HydroVac Industrial Services

Recent Developments

- Herc Holdings Inc.: On February 2025, Herc Holdings Inc. announced a definitive merger agreement to acquire H&E Equipment Services, Inc. for approximately $5.3 billion, including debt. Under the terms, H&E shareholders will receive $78.75 in cash and 0.1287 shares of Herc common stock per share, valuing H&E at $104.89 per share.

- Tornado Global Hydrovacs Ltd.: On December 2024, Tornado Global Hydrovacs Ltd. announced a corporate rebranding to Tornado Infrastructure Equipment Ltd., effective December 18, 2024. This name change reflects the company’s commitment to diversifying its product lines to meet the increasing needs of the infrastructure market and better communicate its capacity to provide comprehensive, turn-key solutions.

Report Scope

Report Features Description Market Value (2024) USD 501.4 Million Forecast Revenue (2034) USD 986.3 Million CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Engine, Dual Engine), By Application (Utility Installation, Potholing, Slot Trenching, Debris Removal, Others), By End-User (Construction, Oil & Gas, Municipal, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vac-Con, Inc., Vactor Manufacturing, Inc., GapVax, Inc., Super Products LLC, Federal Signal Corporation, Hi-Vac Corporation, Ditch Witch, Sewer Equipment Co. of America, Vacall Industries, Ox Equipment, Rival Hydrovac Inc., HydroVac Industrial Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Hydro Excavation Truck MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

US Hydro Excavation Truck MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vac-Con, Inc.

- Vactor Manufacturing, Inc.

- GapVax, Inc.

- Super Products LLC

- Federal Signal Corporation

- Hi-Vac Corporation

- Ditch Witch

- Sewer Equipment Co. of America

- Vacall Industries

- Ox Equipment

- Rival Hydrovac Inc.

- HydroVac Industrial Services