Global Toxicology Drug Screening Market By Product Type (Reagents & Consumables, Software, Instruments, Animal Models, and Others), By Application (Immunotoxicity, Systemic Toxicity, Developmental & Reproductive Toxicity, Endocrine Disruption, and Others), By Testing Type (In Vitro, In Vivo, and In Silico), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168505

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

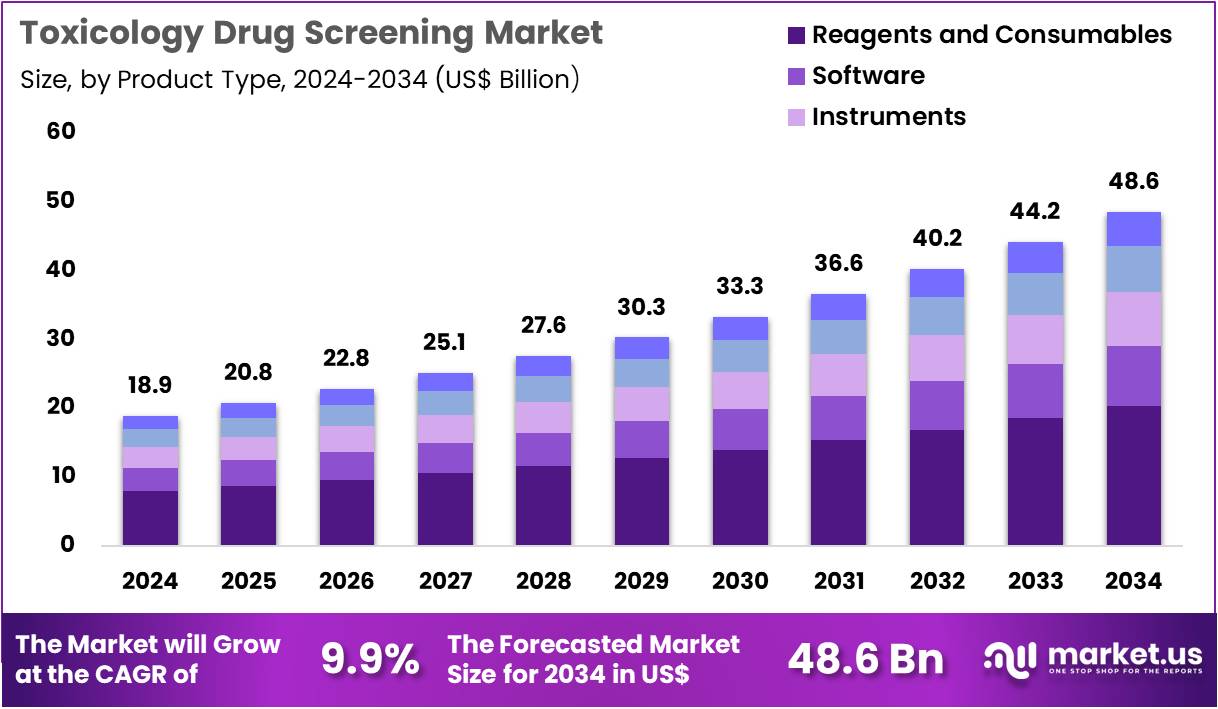

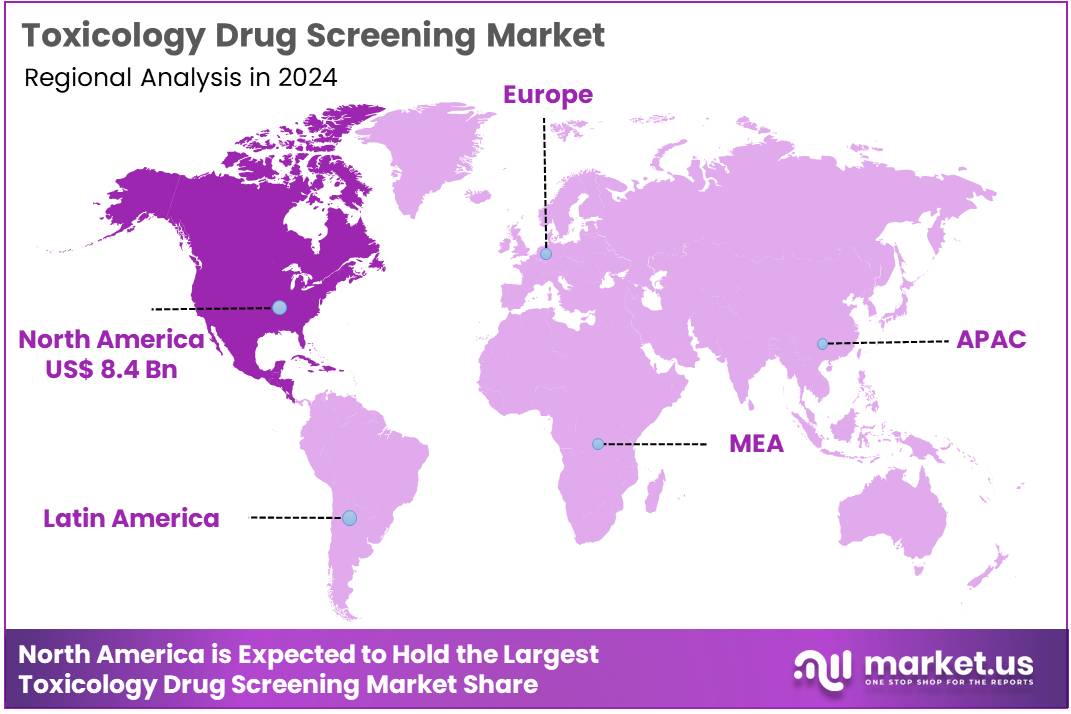

The Global Toxicology Drug Screening Market size is expected to be worth around US$ 48.6 Billion by 2034 from US$ 18.9 Billion in 2024, growing at a CAGR of 9.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 44.3% share with a revenue of US$ 8.4 Billion.

Increasing regulatory mandates for workplace and safety compliance propels the Toxicology Drug Screening market, as employers and agencies enforce routine testing to mitigate risks associated with substance use. Diagnostic firms develop immunoassays and chromatography panels that detect opioids, amphetamines, cannabinoids, and synthetic cathinones with minimal false positives.

These tools enable pre-employment verification to ensure candidate suitability, random post-incident analysis for accident investigations, probationary monitoring for rehabilitation compliance, and athletic integrity checks under anti-doping protocols. High-sensitivity instrumentation creates opportunities for multiplexed screening that covers emerging designer drugs alongside traditional substances.

Thermo Fisher launched an advanced LC-MS system in June 2022 tailored for forensic toxicology, expanding detection capabilities for novel illicit compounds and modernizing laboratory processes to handle escalating test volumes. This innovation significantly boosts adoption of precise, scalable screening solutions.

Growing integration of point-of-care testing accelerates the Toxicology Drug Screening market, as healthcare providers seek immediate results to inform urgent clinical interventions and reduce turnaround delays. Developers engineer lateral flow devices and handheld analyzers that deliver qualitative and semi-quantitative data from saliva, urine, or breath samples in minutes.

Applications encompass emergency room triage for overdose reversal using naloxone, pain management oversight in chronic opioid therapy, substance abuse evaluation during psychiatric admissions, and roadside enforcement for impaired driving detection. Portable formats open avenues for field-based deployments in occupational health and public safety operations. Biotechnology companies increasingly prioritize user-friendly kits that comply with regulatory cutoffs while minimizing sample preparation.

Rising adoption of artificial intelligence in predictive toxicology invigorates the Toxicology Drug Screening market, as laboratories leverage machine learning to forecast toxicity profiles from molecular structures and historical data. Technology providers incorporate AI-driven algorithms into high-throughput platforms for quantitative structure-activity relationship modeling and adverse outcome pathway analysis.

These advancements support pharmaceutical safety assessments during early drug development, environmental hazard evaluations for chemical exposures, veterinary screening for animal poisoning incidents, and epidemiological surveillance of community drug trends. Computational tools create opportunities for personalized risk stratification and reduced animal testing reliance. Exscientia extended its collaboration with Amazon Web Services in July 2024 to enhance AI applications in drug discovery, streamlining toxicity predictions and elevating efficiency across screening pipelines.

Key Takeaways

- In 2024, the market generated a revenue of US$ 18.9 Billion, with a CAGR of 9.9%, and is expected to reach US$ 48.6 Billion by the year 2034.

- The product type segment is divided into reagents & consumables, software, instruments, animal models, and others, with reagents & consumables taking the lead in 2024 with a market share of 41.9%.

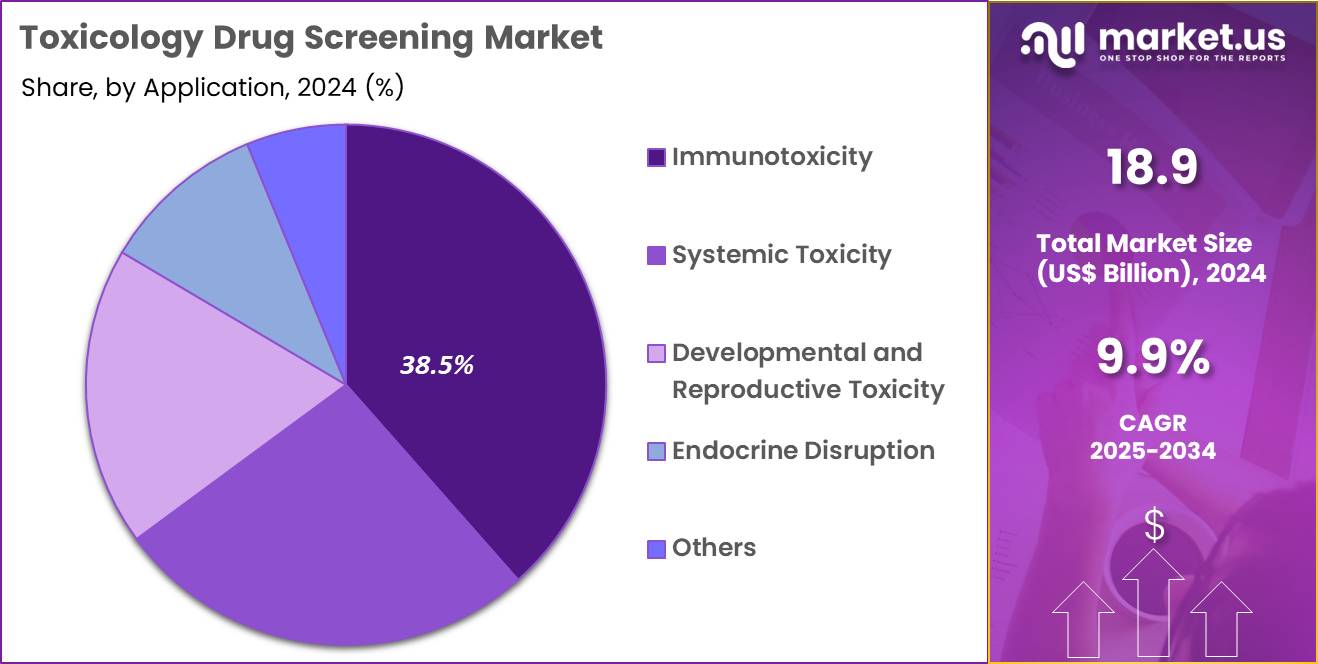

- Considering application, the market is divided into immunotoxicity, systemic toxicity, developmental & reproductive toxicity, endocrine disruption, and others. Among these, immunotoxicity held a significant share of 38.5%.

- Furthermore, concerning the testing type segment, the market is segregated into in vitro, in vivo, and in silico. The in vitro sector stands out as the dominant player, holding the largest revenue share of 52.7% in the market.

- North America led the market by securing a market share of 44.3% in 2024.

Product Type Analysis

Reagents and consumables, holding 41.9%, are expected to dominate due to continuous, high-frequency usage across toxicology workflows. Laboratories depend on assay kits, buffers, antibodies, cell-culture reagents, and detection chemicals for repeated experimentation in drug safety evaluation. Pharmaceutical companies increase screening volumes as their pipelines expand across biologics, cell therapies, small molecules, and novel compounds.

High-throughput platforms generate constant demand for compatible consumables optimized for automation. CROs use large batches of reagents to meet tightening project timelines from global sponsors. Academic laboratories rely on specialized consumables to study toxicity pathways at molecular and cellular levels. Manufacturers introduce improved reagent chemistries that enhance assay sensitivity and reproducibility, attracting more users.

Toxicology programs in emerging markets expand laboratory capacities, increasing procurement volumes. Growth in regulatory-required safety assessments strengthens recurring demand. These dynamics keep reagents and consumables anticipated to remain the dominant product type.

Application Analysis

Immunotoxicity, holding 38.5%, is anticipated to dominate due to rising global focus on immune-system safety during drug development. Biopharmaceutical companies evaluate immune activation, suppression, hypersensitivity, and cytokine modulation using validated toxicology assays. Growth of immunotherapies, mRNA platforms, biologics, and gene-modifying treatments increases the need for specialized immune-safety testing. Regulatory agencies emphasize immune-system evaluation before clinical advancement, strengthening assay adoption.

Academic researchers expand studies on immune-response mechanisms associated with drug exposure. CROs run large immunotoxicity panels for global sponsors, boosting testing volumes. Advancements in flow cytometry, cytokine profiling, high-content imaging, and in vitro immune models improve detection accuracy.

Increased understanding of immune-related adverse events in oncology and autoimmune diseases accelerates testing expansion. Integration of multiplex immune assays enables faster and deeper analysis. These factors keep immunotoxicity projected to remain the leading application segment.

Testing Type Analysis

In vitro testing, holding 52.7%, is expected to remain dominant as the industry shifts toward ethical, rapid, and highly scalable toxicity-screening alternatives. Laboratories adopt in vitro assays to reduce reliance on animal models and increase mechanistic understanding of drug-induced toxicity. High-throughput screening systems, microfluidic organ-on-chip models, and human-cell–based assays support faster safety evaluation.

Regulatory bodies encourage in vitro approaches for early-stage toxicology to minimize late-stage failures. Pharmaceutical companies integrate in vitro models into screening pipelines to study cytotoxicity, genotoxicity, immunotoxicity, and metabolic effects with higher precision. Advanced imaging and real-time cell-analysis tools enhance assay accuracy.

CROs expand in vitro service portfolios to match demand for rapid, cost-efficient safety assessment. Academic researchers use in vitro models to dissect toxicity pathways at molecular and cellular levels. The global push toward animal-reduction policies strengthens in vitro adoption. These drivers keep in vitro testing anticipated to remain the most influential testing type in the toxicology drug screening market.

Key Market Segments

By Product Type

- Reagents & Consumables

- Software

- Instruments

- Animal Models

- Others

By Application

- Immunotoxicity

- Systemic Toxicity

- Developmental & Reproductive Toxicity

- Endocrine Disruption

- Others

By Testing Type

- In Vitro

- In Vivo

- In Silico

Drivers

Escalating Drug Overdose Deaths is Driving the Market

The sharp rise in drug overdose fatalities has positioned it as a critical driver for the toxicology drug screening market, compelling expanded implementation of screening protocols in healthcare and public safety settings. This surge underscores the need for rapid, sensitive assays to detect synthetic opioids and polydrug combinations in urgent care environments.

Emergency departments and first responders are prioritizing point-of-care toxicology panels to inform immediate interventions and reduce mortality risks. Manufacturers are innovating with multiplex kits capable of identifying emerging substances, aligning with evolving threat profiles. Regulatory agencies advocate for mandatory screening in high-risk populations, integrating toxicology into overdose prevention strategies.

Collaborative surveillance networks between health departments and labs facilitate real-time data sharing, enhancing kit demand for confirmatory testing. The economic toll of overdoses justifies increased funding for screening infrastructure, supporting scalable deployment in community clinics. Professional guidelines from medical associations emphasize routine toxicology in suspected cases, embedding products in standard workflows. This driver accelerates research into biomarker stability for field use, broadening applicability beyond hospitals.

Educational campaigns target law enforcement on kit utilization, fostering interdisciplinary adoption. The Centers for Disease Control and Prevention reported approximately 105,000 drug overdose deaths in the United States in 2023, with nearly 80,000 involving opioids. Such alarming figures propel the market toward comprehensive, accessible screening solutions.

Restraints

Complex Regulatory Compliance Requirements is Restraining the Market

Stringent and evolving regulatory frameworks for toxicology drug screening continue to impose significant restraints, complicating product development and market entry for new assays. Compliance with standards from agencies like the Substance Abuse and Mental Health Services Administration demands extensive validation studies, prolonging timelines and escalating certification costs. This barrier disproportionately affects smaller innovators, who lack resources for multi-phase regulatory submissions across jurisdictions.

Laboratories must navigate varying state-level mandates, leading to fragmented adoption and operational inefficiencies. The restraint fosters hesitancy in investing in novel screening technologies, as uncertainty over approvals delays commercialization. Policy harmonization efforts, while promising, progress slowly amid competing priorities in public health agendas. Manufacturers face recurring audits and labeling revisions, diverting focus from innovation to documentation.

These requirements amplify liability risks, with non-compliance potentially resulting in product recalls or fines. International variations further challenge global suppliers, restricting export potentials in harmonized markets. Addressing this necessitates streamlined guidelines tailored to rapid-response needs.

A congressional testimony on Regulatory Toxicology 2.0 highlighted that modern data needs far outstrip current production capabilities, straining regulatory processes as of 2024. This disparity underscores the administrative burdens curbing market fluidity.

Opportunities

Rising Workplace Drug Testing Mandates is Creating Growth Opportunities

The intensification of mandatory workplace drug screening programs is unveiling substantial growth opportunities for the toxicology drug screening market, driven by employer efforts to ensure safety and productivity. These policies target high-risk industries like transportation and construction, necessitating reliable, non-invasive testing solutions for pre-employment and random checks. Opportunities emerge in developing tamper-evident kits that detect adulteration attempts, addressing vulnerabilities in standard urine screens.

Regulatory expansions under occupational health standards facilitate bulk procurement contracts with corporate clients. Partnerships between screening providers and human resources platforms enable integrated reporting, streamlining compliance tracking. This landscape supports innovation in oral fluid-based assays, offering alternatives to invasive methods for on-site implementation.

Economic incentives from reduced absenteeism and insurance premiums encourage adoption among small businesses. Global labor market trends amplify demand, with multinational firms standardizing protocols across regions. The resultant ecosystem diversifies revenue through subscription-based testing services.

Long-term, these mandates position the market for expansions into remote worker monitoring technologies. Quest Diagnostics’ 2024 Drug Testing Index analyzed nearly 10 million tests, revealing a more than six-fold increase in tampering attempts in the general U.S. workforce in 2023 compared to 2022. This escalation highlights untapped potential for advanced, secure screening modalities.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic drivers accelerate the Toxicology Drug Screening market as global healthcare systems allocate more funds to combat rising substance abuse and enforce stricter compliance standards. Companies harness this growth by deploying innovative, user-friendly kits that deliver faster results and bolster forensic and workplace testing protocols.

Economic volatility and inflation, however, erode lab budgets and compel organizations to scale back investments in high-throughput screening technologies across underfunded regions. Geopolitical frictions, especially US-China trade standoffs, fracture supply chains for essential reagents and calibration standards, obliging manufacturers to confront export controls and erratic freight disruptions. These challenges intensify cross-border regulatory complexities and curtail collaborative efforts to refine detection sensitivities.

Current US tariffs on imported branded diagnostic components and assay materials aggravate these issues by surging procurement expenses, which end-users offset through price hikes and restrained purchasing in clinical environments. Firms, in response, aggressively pursue reshoring strategies to US-based operations, secure incentives for local production, and diversify sourcing to low-tariff allies like the EU.

In the final analysis, this market thrives on such adaptive measures, cementing toxicology drug screening as an indispensable asset for safeguarding communities and driving operational excellence.

Latest Trends

FDA Launch of SafetAI Initiative is a Recent Trend

The U.S. Food and Drug Administration’s initiation of the SafetAI program has marked a transformative trend in the toxicology drug screening market in 2025, leveraging artificial intelligence for predictive toxicity assessments. This development focuses on AI models to forecast adverse effects, reducing reliance on traditional animal testing in drug screening pipelines. The trend promotes integration of machine learning algorithms into assay interpretation, enhancing accuracy for novel compounds.

Regulatory endorsements validate AI-driven tools for early hazard identification, accelerating development cycles. Manufacturers are adapting screening platforms to incorporate AI analytics, enabling real-time risk profiling. This shift intersects with high-throughput screening, where AI optimizes hit prioritization in compound libraries. Collaborative pilots between FDA and industry refine model transparency, addressing black-box concerns in toxicological predictions.

The approach extends to environmental toxicology, adapting AI for mixture effect evaluations. Broader implications include cost reductions in preclinical phases, appealing to biotech startups. Ethical frameworks emphasize bias mitigation in training datasets for equitable outcomes. The SafetAI Initiative was established by the FDA in 2025 to develop AI models for toxicological endpoints informing drug safety reviews. This endeavor exemplifies the trend’s paradigm-shifting potential in regulatory science.

Regional Analysis

North America is leading the Toxicology Drug Screening Market

North America accounted for 44.3% of the overall market in 2024, and the region recorded strong growth as healthcare systems increased workplace, clinical, and forensic drug monitoring across high-risk populations. Laboratories expanded chromatographic and immunoassay capabilities to address rising polysubstance misuse, and employers strengthened compliance programs across transportation and logistics.

Hospital emergency departments increased toxicology panels as fentanyl-related cases surged across multiple states. The Centers for Disease Control and Prevention reported 107,941 drug-overdose deaths in 2022 (CDC, National Center for Health Statistics), and this escalation directly encouraged broader adoption of rapid and confirmatory drug testing systems.

Pharmaceutical companies advanced therapeutic drug monitoring workflows, and academic centers upgraded mass spectrometry platforms to support translational toxicology research. Government funding for substance-use surveillance enhanced laboratory capacity. These combined shifts reinforced the region’s substantial market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong forward momentum during the forecast period as healthcare institutions increase routine drug-misuse detection and clinical monitoring across urban and semi-urban centers. Governments intensify efforts to improve public-health surveillance, which stimulates higher demand for advanced analytical testing workflows.

Diagnostic laboratories upgrade LC-MS/MS throughput to support expanding toxicology menus, while hospitals enhance emergency screening to manage rising synthetic-drug exposure. The Australian Criminal Intelligence Commission reported that national methamphetamine consumption increased by 10% in 2023 (ACIC, National Wastewater Drug Monitoring Program Report 16), and this trend illustrates why testing requirements continue rising across the region.

Research institutes broaden toxicology capabilities to support pharmacokinetic and drug-interaction studies. Manufacturers increase regional distribution strength, ensuring faster availability of assay kits and reagents. These developments collectively position Asia Pacific for sustained growth over the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Market leaders adopt multiple growth strategies in the toxicology screening arena by forging alliances with contract research organisations and academic labs to broaden service reach and enhance assay portfolios. They roll out advanced instrumentation and high-throughput consumables that streamline workflows and reduce per-test cost, responding to regulatory tightening and increasing demand for workplace and clinical monitoring.

They push geographic expansion into Asia Pacific and Latin America to capture emerging markets, while offering training and support programs that build customer loyalty and embed their platforms in client labs. They leverage digital and informatics capabilities to enable remote monitoring of toxicology outcomes and integrate data analytics into screening programmes to drive value.

They pursue strategic acquisitions of niche technology providers to accelerate time-to-market for novel biomarkers and specialty testing panels. Abbott Laboratories serves as a core example: the company operates across diagnostics, devices and nutrition, deploys global manufacturing and R&D infrastructure, and channels its diagnostic arm to support expanded toxicology and drug-screening services globally.

Top Key Players

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- F. Hoffmann‑La Roche Ltd

- Siemens Healthineers AG

- OraSure Technologies, Inc.

- Alfa Scientific Designs, Inc.

- Drägerwerk AG & Co. KGaA

- Bio‑Rad Laboratories, Inc.

Recent Developments

- In April 2023, the Japan Metropolitan Police Department introduced its first on-site test kit for identifying the presence of date-rape drugs. By giving investigators a fast and reliable way to screen suspects and victims, this development increases demand for rapid, field-deployable toxicology tools. Such adoption by law-enforcement agencies strengthens the market for portable drug screening technologies and pushes manufacturers to expand point-of-care toxicology platforms.

- In November 2022, Instem upgraded its computational toxicology software, expanding access to over 600,000 toxicology studies. This enhancement accelerates chemical hazard prediction and improves data confidence for regulatory submissions. As toxicology screening increasingly integrates digital analytics to evaluate complex compound libraries, the update fuels market growth by improving the speed and accuracy of early-stage toxicology assessments used by pharmaceutical, chemical, and consumer-product developers.

Report Scope

Report Features Description Market Value (2024) US$ 18.9 Billion Forecast Revenue (2034) US$ 48.6 Billion CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Reagents & Consumables, Software, Instruments, Animal Models, and Others), By Application (Immunotoxicity, Systemic Toxicity, Developmental & Reproductive Toxicity, Endocrine Disruption, and Others), By Testing Type (In Vitro, In Vivo, and In Silico) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Laboratory Corporation of America Holdings (LabCorp), F. Hoffmann‑La Roche Ltd, Siemens Healthineers AG, OraSure Technologies, Inc., Alfa Scientific Designs, Inc., Drägerwerk AG & Co. KGaA, Bio‑Rad Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Toxicology Drug Screening MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Toxicology Drug Screening MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (LabCorp)

- F. Hoffmann‑La Roche Ltd

- Siemens Healthineers AG

- OraSure Technologies, Inc.

- Alfa Scientific Designs, Inc.

- Drägerwerk AG & Co. KGaA

- Bio‑Rad Laboratories, Inc.