Global Therapeutic Drug Monitoring Market By Product Type (Consumables and Equipment), By Technology (Immunoassays and Chromatography-Spectrometry), By Drug Class (Antiepileptic Drugs, Antiarrhythmic Drugs, Immunosuppressant Drugs, Antibiotic Drugs, and Others), By End-user (Hospitals, Diagnostic Labs, and Research and Academic Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150833

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

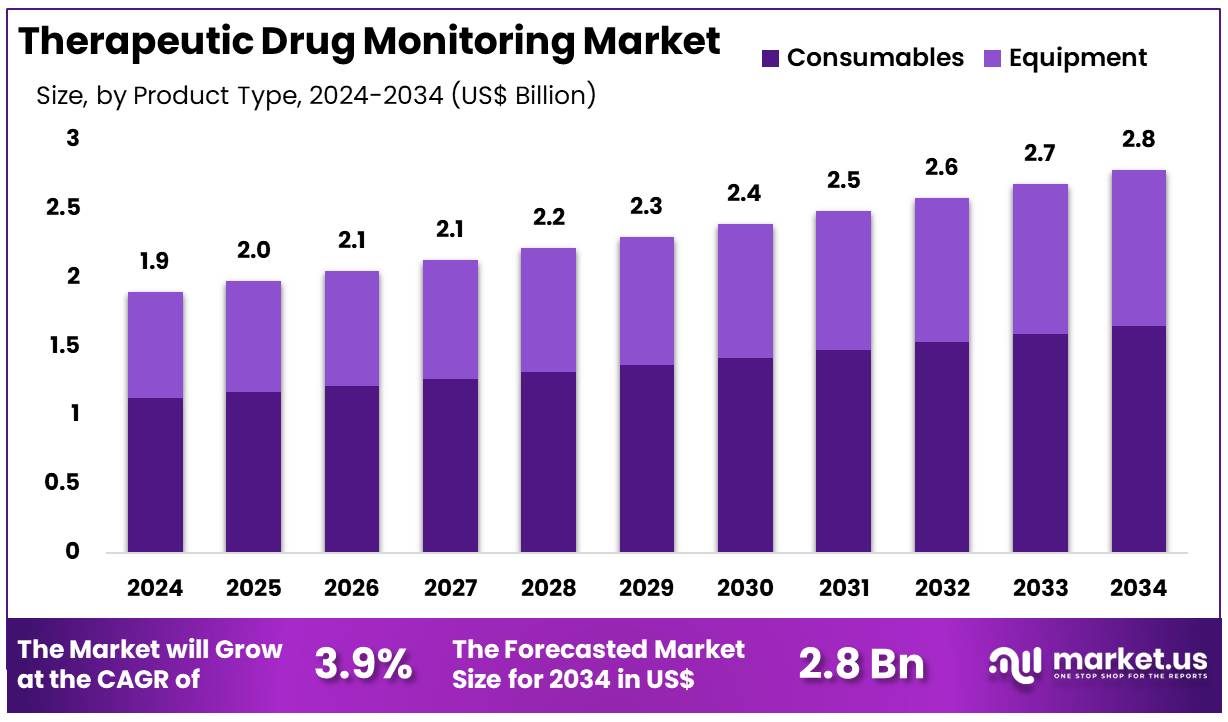

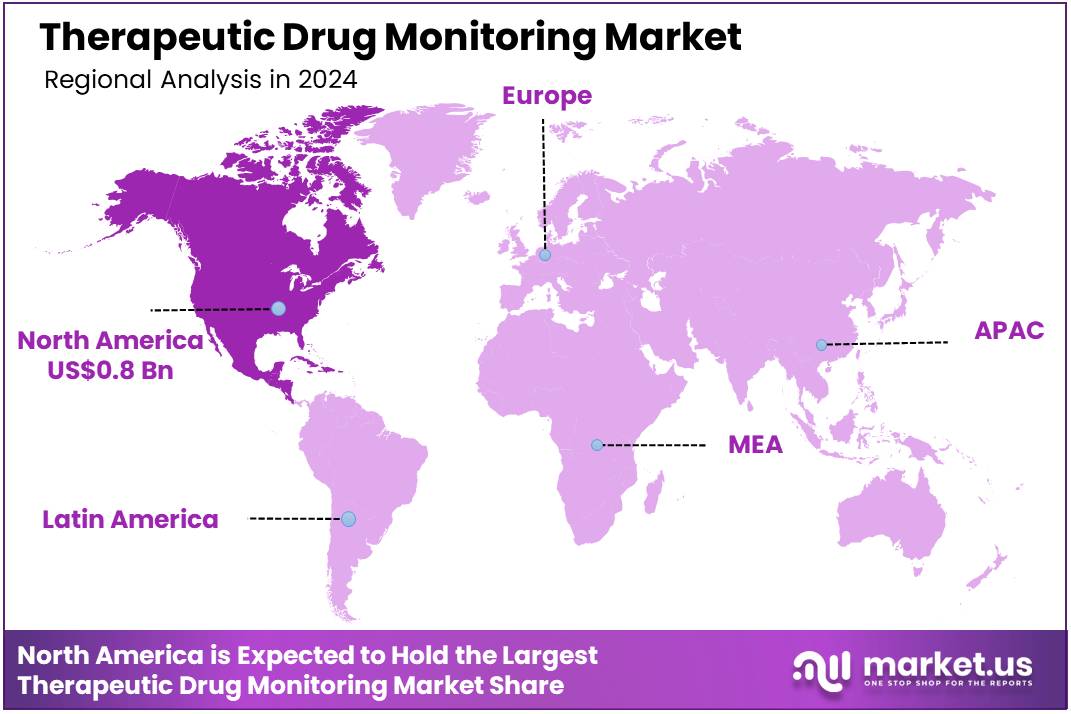

Global Therapeutic Drug Monitoring Market size is expected to be worth around US$ 2.8 Billion by 2034 from US$ 1.9 Billion in 2024, growing at a CAGR of 3.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 0.8 Billion.

Rising prevalence of chronic diseases, including cardiovascular conditions, cancer, and diabetes, drives the growth of the therapeutic drug monitoring (TDM) market. TDM plays a crucial role in optimizing drug therapies, ensuring that drug concentrations remain within the therapeutic range to maximize efficacy while minimizing toxicity. The increasing use of complex biologics, immunosuppressants, and chemotherapy agents has highlighted the need for precise drug monitoring, further propelling market demand.

As personalized medicine continues to gain traction, TDM enables healthcare providers to tailor treatments to individual patient profiles, enhancing treatment outcomes. Additionally, the growing focus on patient safety, adherence to prescribed regimens, and minimizing adverse drug reactions contributes to the market’s expansion. In recent years, advancements in technologies such as point-of-care testing, wearable devices, and digital health tools have made TDM more accessible, efficient, and cost-effective.

Moreover, increasing regulatory support for the use of TDM in clinical settings, especially in managing high-risk therapies, opens up new opportunities for growth. The shift towards home-based healthcare and remote patient monitoring also presents significant opportunities for TDM solutions, as patients seek convenient and accurate ways to monitor their drug levels. As healthcare providers prioritize the optimization of treatment regimens, TDM will continue to play an essential role in improving patient care and outcomes.

Key Takeaways

- In 2024, the market for therapeutic drug monitoring generated a revenue of US$ 3.9 billion, with a CAGR of 3.9%, and is expected to reach US$ 2.8 billion by the year 2034.

- The product type segment is divided into consumables and equipment, with consumables taking the lead in 2024 with a market share of 59.3%.

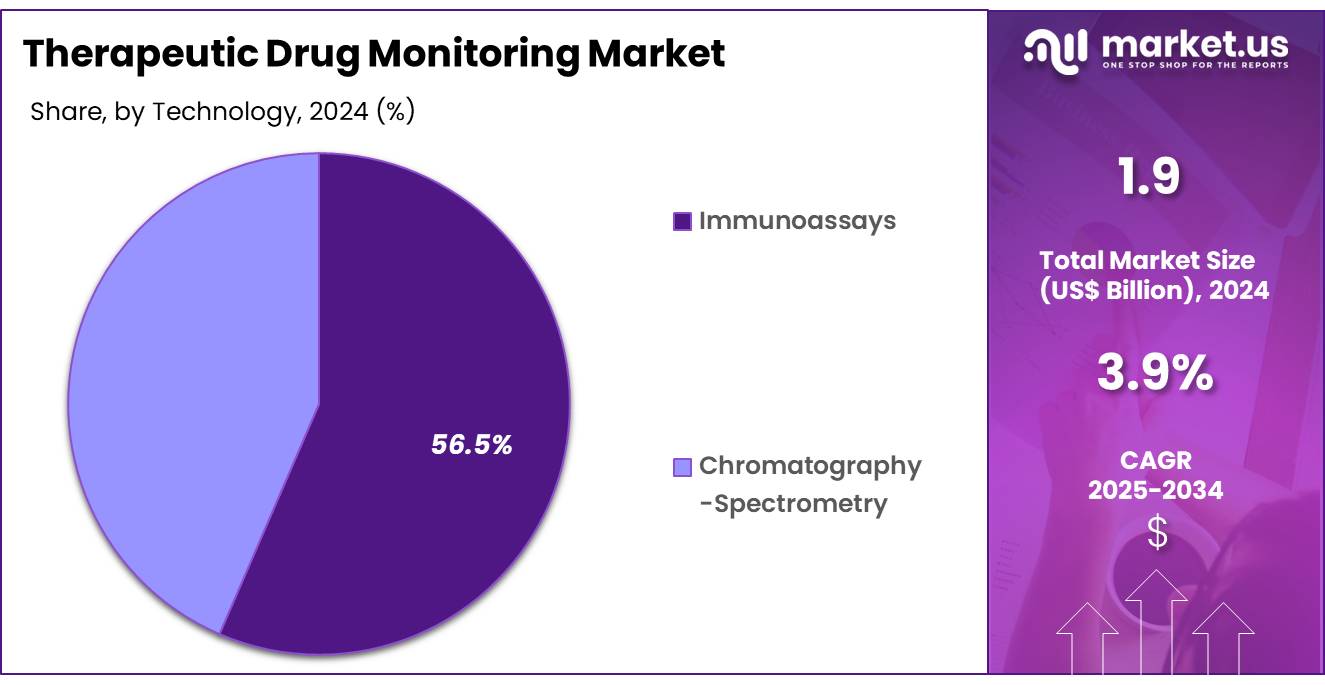

- Considering technology, the market is divided into immunoassays and chromatography-spectrometry. Among these, Immunoassays held a significant share of 56.5%.

- Furthermore, concerning the drug class segment, the market is segregated into antiepileptic drugs, antiarrhythmic drugs, immunosuppressant drugs, antibiotic drugs, and others. The antiepileptic drugs sector stands out as the dominant player, holding the largest revenue share of 45.7% in the therapeutic drug monitoring market.

- The end-user segment is segregated into hospitals, diagnostic labs, and research and academic institutes, with the hospitals segment leading the market, holding a revenue share of 53.9%.

- North America led the market by securing a market share of 41.4% in 2024.

Product Type Analysis

The consumables segment claimed a market share of 59.3% owing to their essential role in the ongoing monitoring and management of patient drug levels. The market for consumables is projected to grow as healthcare providers increasingly prioritize effective therapeutic monitoring to ensure the safety and efficacy of drug therapies.

The demand for consumables, such as reagents, test kits, and sampling devices, is anticipated to rise in line with the growing number of patients requiring long-term drug monitoring. As the focus on precision medicine increases, the need for regular monitoring of drug concentrations in patients undergoing treatment for chronic conditions will drive the consumables segment’s expansion. Additionally, the development of more efficient and cost-effective consumables is expected to contribute to the continued growth of this segment in the market.

Technology Analysis

The Immunoassays held a significant share of 56.5% due to their high sensitivity and specificity in detecting and quantifying drug concentrations. The increasing use of immunoassay-based technologies in hospitals and diagnostic laboratories is expected to drive market growth, particularly in drug monitoring applications where precise measurement is crucial.

Immunoassays are anticipated to remain popular for monitoring a wide range of drugs, especially for antiepileptic, antiarrhythmic, and immunosuppressant drugs. The growing adoption of immunoassay techniques is likely to be fueled by their ability to provide rapid, accurate results, making them highly suitable for routine clinical use.

Additionally, innovations in immunoassay technology, such as more automated systems, are expected to enhance the efficiency and cost-effectiveness of therapeutic drug monitoring, further expanding their use in healthcare settings.

Drug Class Analysis

The antiepileptic drugs segment had a tremendous growth rate, with a revenue share of 45.7% owing to the increasing prevalence of epilepsy and other seizure disorders. The demand for AED monitoring is projected to rise as healthcare providers strive to achieve optimal therapeutic levels for patients, minimizing both therapeutic failure and drug toxicity.

The segment is anticipated to benefit from the growing use of AEDs for managing chronic epilepsy and seizure disorders, particularly in pediatric and elderly populations. Ongoing advancements in AED formulations and the development of more effective drug therapies will likely contribute to the growth of this segment.

Furthermore, as epilepsy management becomes more personalized, the need for precise and consistent therapeutic drug monitoring will continue to drive demand for AED testing in clinical settings, ensuring that this segment remains a dominant force in the market.

End-User Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 53.9% due to their central role in managing complex drug regimens for critically ill patients. Hospitals are projected to see significant growth in the use of therapeutic drug monitoring to ensure the safety and efficacy of treatments, particularly in high-risk patient populations, such as those receiving immunosuppressant drugs, antiarrhythmic drugs, or antiepileptic drugs.

The need for regular monitoring of drug levels to avoid adverse reactions and improve patient outcomes is anticipated to drive hospitals’ increased adoption of monitoring technologies. Additionally, hospitals’ focus on improving patient care through precision medicine and personalized treatment plans will continue to foster growth in the demand for therapeutic drug monitoring solutions. As healthcare infrastructure expands and the demand for specialized treatments rises, hospitals will maintain their dominant position in the market, driving continued growth in this segment.

Key Market Segments

By Product Type

- Consumables

- Equipment

By Technology

- Immunoassays

- Chromatography-Spectrometry

By Drug Class

- Antiepileptic Drugs

- Antiarrhythmic Drugs

- Immunosuppressant Drugs

- Antibiotic Drugs

- Others

By End-user

- Hospitals

- Diagnostic Labs

- Research and Academic Institutes

Drivers

Increasing Prevalence of Chronic Diseases and Complex Therapies is Driving the Market

The rising global incidence of chronic diseases, such as autoimmune disorders, cancers, and infectious diseases, coupled with the increasing use of complex biological and narrow therapeutic index drugs, is a primary driver for the therapeutic drug monitoring (TDM) market. For many of these conditions, maintaining optimal drug concentrations in the bloodstream is crucial to maximize efficacy and minimize adverse effects, making TDM an indispensable tool for personalized medicine.

The Centers for Disease Control and Prevention (CDC) continuously updates its Chronic Disease Indicators web tool, and its 2022-2024 refresh includes 113 measures across 21 topic areas, highlighting the widespread and growing burden of chronic illnesses. These diseases often require long-term, individualized drug regimens where TDM can significantly improve patient outcomes by guiding dosage adjustments.

Restraints

Lack of Standardization and Infrastructure in Clinical Practice is Restraining the Market

The therapeutic drug monitoring market faces significant restraint due to the lack of standardization in TDM protocols and the insufficient infrastructure for widespread implementation in routine clinical practice. Variations in sample collection, handling, assay methods, and interpretation of results can lead to inconsistencies and limit the reliability of TDM data across different healthcare settings. Furthermore, many smaller healthcare facilities lack the specialized laboratory equipment, trained personnel, and integrated electronic health record systems necessary to efficiently conduct and utilize TDM.

A 2024 publication in MDPI on the implementation of modern TDM approaches in clinical practice noted that limitations exist, including a lack of standardization of work procedures and high costs for certain analytical methods. These challenges hinder the broader adoption and full integration of TDM into everyday patient care.

Opportunities

Advancements in Analytical Technologies and Point-of-Care Testing Create Growth Opportunities

Ongoing advancements in analytical technologies, particularly in mass spectrometry, immunoassay platforms, and the development of point-of-care (PoC) testing, present significant growth opportunities in the therapeutic drug monitoring market. These technological innovations enable more rapid, accurate, and cost-effective measurement of drug concentrations, expanding the accessibility and applicability of TDM.

The miniaturization of devices and integration with digital health platforms are making TDM more convenient for both clinicians and patients. For example, recent developments highlighted by the US Food and Drug Administration (FDA) in 2023 include advancements in in vitro diagnostics, with a notable increase in the approval of novel diagnostic tests designed for rapid and precise measurement, many of which can be adapted for drug concentration analysis. These innovations are poised to enhance the utility and reach of TDM, particularly in decentralized healthcare settings.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the therapeutic drug monitoring market, primarily through their impact on healthcare expenditure, pharmaceutical research and development (R&D) funding, and the prioritization of diagnostic technologies. A robust global economy generally leads to increased investment in healthcare infrastructure and innovative medical technologies, allowing for the procurement of advanced TDM equipment and expanded laboratory capabilities.

The Organization for Economic Co-operation and Development (OECD) reported in March 2025 that R&D expenditure in the OECD area grew by 2.4% in inflation-adjusted terms in 2023, following a 3.6% rise in 2022, indicating a general increase in scientific investment. Conversely, economic downturns or periods of high inflation can lead to tighter budgets for public and private healthcare payers, potentially slowing the adoption of new TDM technologies or limiting reimbursement for TDM tests.

Geopolitical stability also plays a crucial role by ensuring the smooth flow of highly specialized reagents, calibrators, and analytical equipment across international borders. Disruptions in global supply chains, such as those caused by geopolitical tensions in 2024, can lead to increased costs and delays in obtaining essential materials, impacting the efficiency and cost-effectiveness of TDM services. Despite these external pressures, the increasing emphasis on personalized medicine and optimizing drug therapy often provides a strong impetus for continued investment and growth in the TDM market, ensuring its resilience.

Current US tariff policies can directly impact the therapeutic drug monitoring market by altering the cost of imported diagnostic reagents, laboratory equipment, and specialized components. While many medical products have specific tariff classifications, targeted tariffs on certain chemicals or electronic components crucial for TDM analytical platforms could raise manufacturing costs for diagnostic companies.

For instance, the US Department of Commerce’s Bureau of Economic Analysis reported that US imports of medical equipment, which include diagnostic instruments, reached US$54.6 billion in the fourth quarter of 2023. Any new tariffs on these imports would directly increase the expenses for diagnostic companies operating within the US.

The American Hospital Association (AHA) stated in May 2025 that new tariffs could have “significant implications for healthcare,” noting that the US imported over US$75 billion in medical devices and supplies in 2024. This could translate to higher prices for TDM tests, potentially impacting patient access or increasing the financial burden on healthcare providers.

However, these tariff policies can also incentivize domestic manufacturing and sourcing of TDM components and instruments within the US. This strategic shift could lead to a more secure and localized supply chain for diagnostic tools in the long term, potentially reducing vulnerability to international disruptions and enhancing national self-sufficiency in critical healthcare technologies, despite initial challenges.

Latest Trends

Integration of Artificial Intelligence and Machine Learning in Data Interpretation is a Recent Trend

A prominent recent trend in the therapeutic drug monitoring market is the increasing integration of artificial intelligence (AI) and machine learning (ML) for data analysis and interpretation. AI algorithms can process vast amounts of patient data, including demographics, genetic information, co-medications, and TDM results, to predict individual drug pharmacokinetics and optimize dosing regimens with greater precision. This shift moves TDM beyond simple concentration measurements to a more predictive and personalized approach.

A May 2025 analysis of the precision medicine market noted that the integration of artificial intelligence and big data analytics is transforming the precision medicine landscape by enabling real-time monitoring and analysis of patient data, directly impacting areas like TDM. This trend promises to enhance the efficiency and effectiveness of TDM, allowing clinicians to make more informed and timely therapeutic decisions.

Regional Analysis

North America is leading the Therapeutic Drug Monitoring Market

North America dominated the market with the highest revenue share of 41.4% owing to the increasing prevalence of chronic diseases requiring precise medication management and a rising number of organ transplant procedures. Autoimmune diseases, for instance, affect a substantial portion of the US population; according to a study using electronic health record data up to June 2022, over 15 million people, or 4.6% of the US population, had been diagnosed with at least one autoimmune disease. This widespread prevalence of chronic conditions often necessitates individualized drug dosing, a key application for TDM.

Furthermore, the Canadian Institute for Health Information (CIHI) reported a total of 3,369 solid organ transplants in Canada in 2023, an increase from 2,886 in 2022. Post-transplant care heavily relies on TDM to optimize immunosuppressant levels and prevent organ rejection. Major diagnostics companies like Abbott Laboratories, a key player in this space, reported total revenues of US$41.95 billion in 2024, up from US$40.109 billion in 2023, indicating a broad increase in diagnostic testing, which includes TDM solutions. This growth reflects the ongoing need for personalized medicine and improved patient outcomes across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to its expanding aging population and increasing healthcare investments. The United Nations’ “Asia-Pacific Population and Development Report 2023” emphasizes the region’s significant demographic shift towards an older populace, which inherently leads to a higher burden of chronic diseases requiring regular drug level monitoring.

For instance, in China, the total number of diabetes patients reached 233.03 million in 2023, indicating a vast and growing patient pool that will require precise therapeutic management. Concurrently, rising healthcare expenditure across major economies supports greater access to advanced diagnostic services; India’s total health expenditure was estimated at US$904,461 crore in fiscal year 2022, demonstrating a substantial commitment to healthcare infrastructure and services.

Japan, with an estimated 893,673 diagnosed prevalent cases of epilepsy in 2022, highlights another therapeutic area where careful drug level monitoring is crucial for effective treatment. These factors collectively indicate that the Asia Pacific region will present significant opportunities for expansion in the therapeutic drug monitoring sector.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the therapeutic drug monitoring (TDM) market employ strategies such as expanding their product portfolios, enhancing formulation technologies, and pursuing strategic partnerships to drive growth. Companies focus on developing long-acting injectable formulations to improve patient compliance and reduce treatment frequency.

They also invest in research and development to explore new therapeutic applications and improve existing formulations. Collaborations with healthcare providers and other pharmaceutical companies help in expanding market reach and improving patient access to treatments. Additionally, key players are increasing their presence in emerging markets to capitalize on the growing demand for these treatments.

Abbott Laboratories is a global healthcare company headquartered in Abbott Park, Illinois. The company develops and manufactures a wide range of medical devices, diagnostics, branded generic medicines, and nutritional products. Abbott’s diagnostic division offers a variety of assays and instruments tailored to monitor drug levels in patients effectively.

These products aid healthcare providers in optimizing medication dosages, ensuring efficacy, and enhancing patient safety across various therapeutic areas. Abbott’s strong distribution network and commitment to innovation position it as a significant player in the TDM market.

Top Key Players

- Thermo Fisher Scientific Inc

- Hoffmann-La Roche Ltd

- Chromsystems Instruments & Chemicals GmbH

- Bio-Rad Laboratories, Inc

- Beckman Coulter, Inc

- ALPCO

- Abbott

- Ferring B.V.

Recent Developments

- In April 2024, Ferring B.V. launched its products, Rebyota and Adstiladrin, in the US These launches are expected to provide significant long-term growth prospects for the company, expanding its footprint in the therapeutics drug market and addressing unmet medical needs with innovative treatments.

- In July 2023, Beckman Coulter introduced the Dxl 9000 Access Immunoassay Analyzer, designed to meet the increasing demands of clinical laboratories for rapid, reliable, and high-quality diagnostic solutions. This new analyzer will support laboratories in expanding their testing capabilities, thereby improving operational efficiency and diagnostic accuracy.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 Billion Forecast Revenue (2034) US$ 2.8 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Consumables and Equipment), By Technology (Immunoassays and Chromatography-Spectrometry), By Drug Class (Antiepileptic Drugs, Antiarrhythmic Drugs, Immunosuppressant Drugs, Antibiotic Drugs, and Others), By End-user (Hospitals, Diagnostic Labs, and Research and Academic Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc, F.Hoffmann-La Roche Ltd, Chromsystems Instruments & Chemicals GmbH, Bio-Rad Laboratories, Inc, Beckman Coulter, Inc, ALPCO, Abbott, Ferring B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Therapeutic Drug Monitoring MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Therapeutic Drug Monitoring MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc

- Hoffmann-La Roche Ltd

- Chromsystems Instruments & Chemicals GmbH

- Bio-Rad Laboratories, Inc

- Beckman Coulter, Inc

- ALPCO

- Abbott

- Ferring B.V.