Global Tetramethyl Bisphenol F Market Size, Share, Upcoming Investments Report By Purity (98% Purity, 99% Purity), By Application(Coating, Polymer Additives, Others), By End-use(Electronics, Chemical, Plastics and Polymers, Coatings and Adhesives, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 123562

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

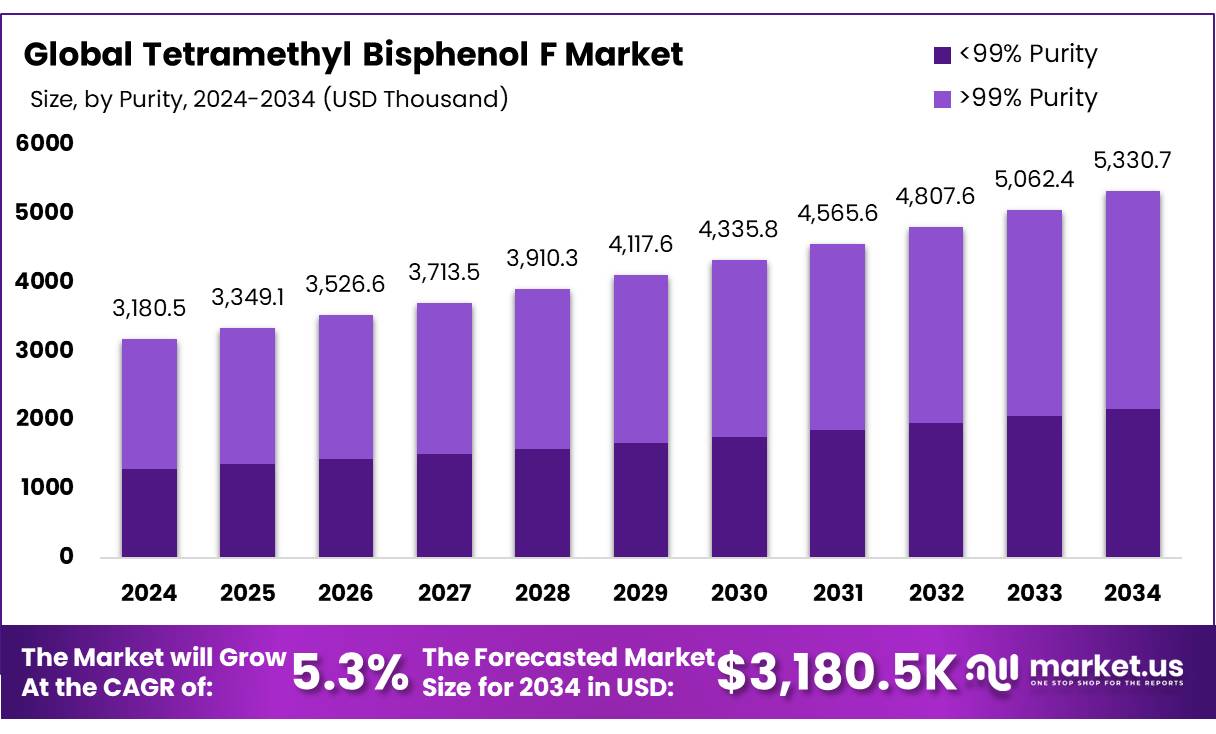

The Global Tetramethyl Bisphenol F Market size is expected to be worth around USD 5330.7 Thousand by 2034, from USD 3,180.5 Thousand in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

Bisphenol A (BPA) Market is a widely recognized member of the bisphenol family, primarily used as a monomer in the production of polymeric epoxy resins. These resins are commonly employed for coating the interior of metal food and beverage cans due to their excellent barrier properties. BPA, a white crystalline solid, dissolves easily in organic solvents and features a 4,4′-methylenediphenol polymer chain functionality. This structure provides durability and high integrity, ensuring long-lasting performance in food-contact applications across various industries.

However, concerns about the endocrine activity of certain bisphenols have led to growing demand for alternatives that show no endocrine activity in testing. Despite these challenges, BPA remains compatible with advanced technologies and green chemistry innovations, cementing its importance in modern industrial applications. Its versatility continues to make it a key material in the development of durable and sustainable polymeric coatings.

Key Takeaways

- The global tetramethyl bisphenol F market was valued at US$ 3,180.5 Thousand in 2024.

- The global tetramethyl bisphenol F market is projected to reach US$ 5330.7 Thousand by 2034.

- Among purity, >99% purity accounted for the largest market share of 59.4%.

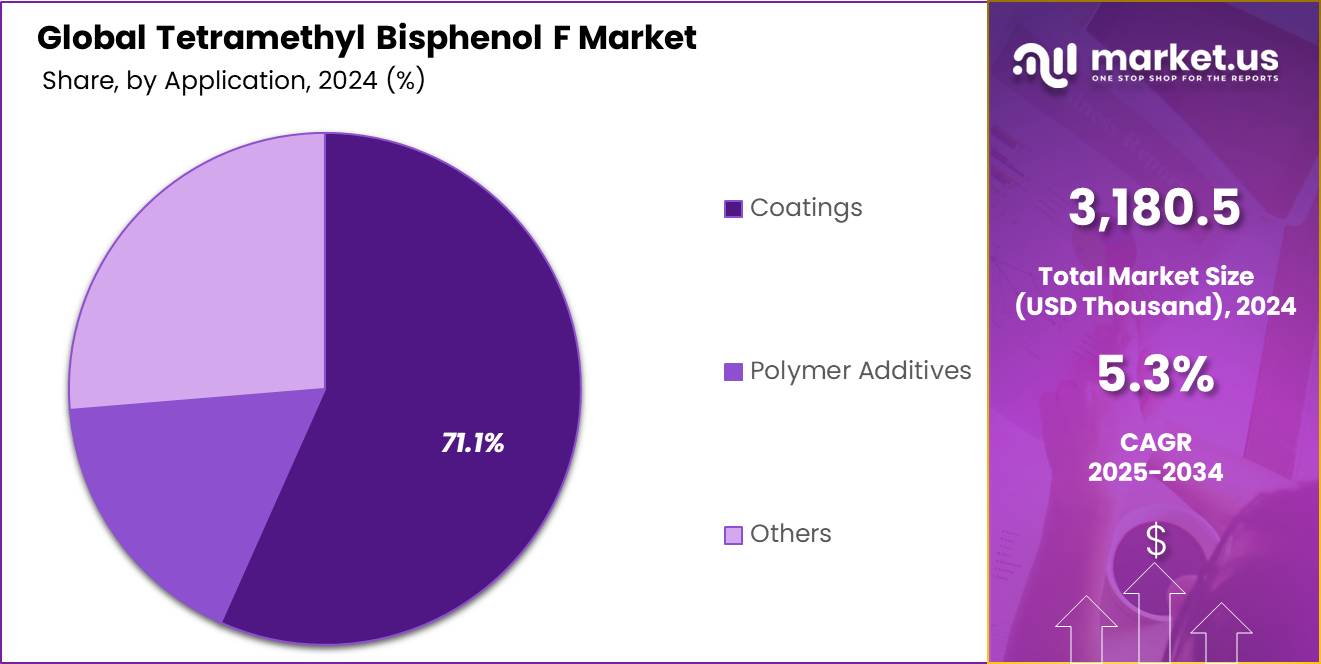

- Among applications, the coatings accounted for the majority of the market share with 71.1%.

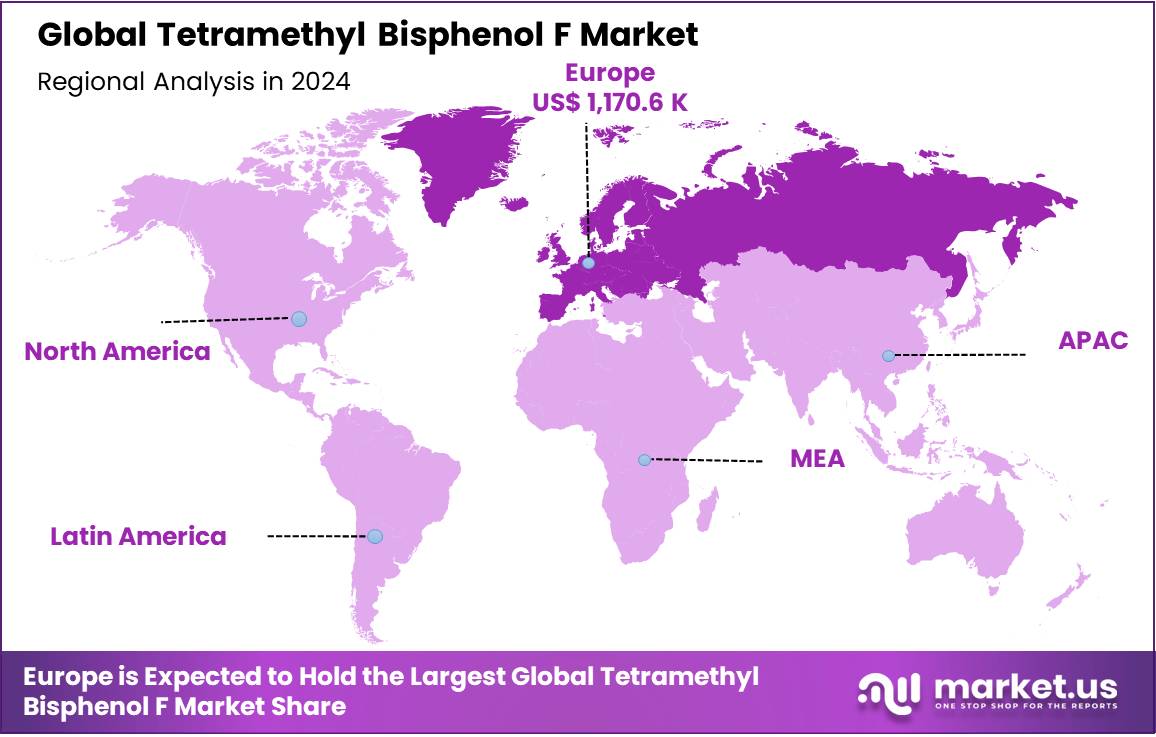

- Europe is expected to hold the largest global tetramethyl bisphenol F market share with 36.8% of the market share with a CAGR of 6.1%.

Purity Analysis

Tetramethyl Bisphenol F with a Purity >99% Purities Dominated the Market Owing to Wide Range Of Applications

The Tetramethyl Bisphenol F market is segmented based on purity into up to <99% purity and >99% purity. Among these, >99% purities held the majority of revenue share of 59.4% in 2024. This dominance can be attributed to the extensive demand for high-purity TMBPF in applications that require exceptional chemical stability, performance, and compliance with stringent regulatory standards. Industries such as food and beverage packaging, electronics, automotive, and medical devices rely heavily on >99% purity TMBPF due to its superior quality and reliability.

One of the primary drivers for the higher adoption of >99% purity TMBPF is the growing regulatory focus on ensuring safety and minimizing health risks, particularly in the food and beverage sector. TMBPF is widely used as a BPA-free alternative in epoxy resin coatings for food cans, beverage containers, and packaging materials. The >99% purity ensures minimal impurities, reducing the risk of harmful substances migrating into consumables. This compliance with food safety standards set by regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA) makes high-purity TMBPF the preferred choice for manufacturers.

Global Tetramethyl Bisphenol F Market, By Purity, 2020-2024 (USD Thousands)

Purity 2020 2021 2022 2023 2024 > 98% Purity 1,150.6 1,177.6 1,209.1 1,249.0 1,292.0 < 99% Purity 1,647.8 1,692.3 1,742.3 1,811.3 1,888.5 Application Analysis

Tetramethyl Bisphenol F is Crucial Intermediate in Coatings Applications

Based on applications, the market is further divided into coatings, polymer additives, and others. Among these applications, coatings accounted for the largest market share in 2024 with 71.1%. This remarkable dominance is driven by the critical role of TMBPF-based epoxy resins in providing high-performance coatings for various industries such as packaging, automotive, construction, and electronics. The superior chemical and thermal properties of TMBPF make it an essential ingredient for durable and efficient coatings, ensuring its extensive adoption across diverse applications.

One of the primary drivers of TMBPF’s prominence in coatings is its widespread use in the food and beverage packaging industry. TMBPF-based coatings serve as BPA-free alternatives for lining aluminum and steel cans, ensuring safety and compliance with stringent food safety regulations. With growing consumer awareness of the potential health risks associated with Bisphenol A (BPA), manufacturers are increasingly adopting TMBPF to create non-toxic coatings that prevent contamination while maintaining the integrity and shelf life of food and beverages. This trend has significantly boosted the demand for TMBPF in the coatings segment.

Global Tetramethyl Bisphenol F Market, By Application, 2020-2024 (USD Thousands)

Application 2020 2021 2022 2023 2024 Coatings 1,977.3 2,029.8 2,089.9 2,171.2 2,261.1 Polymer Additives 606.3 620.4 636.2 656.7 679.1 Others 214.8 219.8 225.2 232.4 240.4 Key Market Segments

By Purity

- >98% Purity

- <99% Purity

By Application

- Coating

- Polymer Additives

- Others

Drivers

Regulatory Scrutiny on Bisphenol A (BPA) Boosting Alternatives such as Tetramethyl Bisphenol F (TMBPF)

The global Tetramethyl Bisphenol F (TMBPF) market is experiencing substantial growth, driven by increasing concerns and regulatory actions against Bisphenol A (BPA). BPA, widely used in polycarbonate plastics and epoxy resins, has come under scrutiny for its potential endocrine-disrupting effects. Studies have linked BPA exposure to hormonal imbalances, reproductive disorders, and an elevated risk of cancers, prompting regulatory bodies worldwide to impose stringent restrictions or bans on its use in consumer products, particularly in food and beverage packaging. This regulatory shift has created a demand for safer alternatives, positioning TMBPF as a promising substitute.

TMBPF offers chemical properties similar to BPA, making it ideal for use in epoxy resins and coatings, especially for aluminum and steel can linings. Its structural stability and resistance to thermal degradation enhance the durability and safety of the products it is used in. Moreover, TMBPF exhibits significantly lower estrogenic activity compared to BPA, addressing the health concerns that have driven BPA’s regulatory challenges. This combination of safety and performance makes TMBPF a preferred choice in applications requiring robust, non-toxic alternatives to BPA.

Restraints

Volatility in Raw Material Prices Impacting Production Costs

The TMBPF market, despite its promising growth, encounters significant challenges, particularly due to the volatility of raw material prices. The production of TMBPF depends on specific chemical precursors, which are highly susceptible to fluctuations influenced by supply chain disruptions, geopolitical tensions, and changes in crude oil prices. Since many of these raw materials are derived from petroleum, variations in crude oil prices have a direct impact on input costs, making production expenses unpredictable. Such volatility complicates the ability of manufacturers to maintain stable pricing strategies and profit margins.

Supply chain disruptions, such as those experienced during the pandemic, have further intensified these challenges. Shortages of critical raw materials and increased procurement costs have made it difficult for manufacturers to ensure consistent production schedules. These issues not only strain operational efficiency but also pose barriers to market expansion. The combined effects of rising costs and supply uncertainties could hinder the growth potential of the TMBPF market, particularly in highly competitive industries where pricing plays a crucial role.

To mitigate these challenges, companies are exploring strategies such as diversifying their supplier base, investing in alternative raw materials, and adopting more efficient production technologies. However, these measures require substantial investment and time to implement effectively. Therefore, raw material price volatility remains a significant restraint in the TMBPF market, necessitating proactive risk management and strategic planning by industry stakeholders.

Opportunity

Emerging Application Areas Are Anticipated To Create Lucrative Opportunities

The global Tetramethyl Bisphenol F (TMBPF) market is poised for growth, driven by its emerging applications across diverse industries. TMBPF is gaining recognition as a safer and more effective alternative to traditional bisphenols, particularly Bisphenol A (BPA). Its unique properties, including high thermal stability, excellent chemical resistance, and lower estrogenic activity, make it a versatile compound with expanding utility in various high-performance applications. These emerging areas are creating lucrative opportunities for manufacturers and suppliers of TMBPF, enabling them to cater to the growing demand for advanced materials across industries.

The medical and healthcare sectors are emerging as potential application areas for TMBPF, driven by the increasing need for safe and durable materials in medical devices and equipment. The compound’s chemical resistance and biocompatibility make it suitable for use in applications such as surgical instruments, diagnostic devices, and laboratory equipment. The ongoing advancements in medical technology and the rising adoption of single-use medical devices are likely to boost the demand for TMBPF in this sector. Additionally, the focus on reducing healthcare-associated infections (HAIs) has led to the development of antimicrobial coatings for medical surfaces, where TMBPF-based materials are being explored for their effectiveness and reliability.

Trends

Expanding Applications in Advanced Materials

The growing demand for advanced materials across various industries is a key driver for the Tetramethyl Bisphenol F (TMBPF) market. TMBPF’s exceptional properties, such as high thermal stability, excellent chemical resistance, and superior mechanical strength, make it a preferred ingredient in producing high-performance polymers and specialty coatings. In the electronics sector, TMBPF is increasingly used for manufacturing heat-resistant insulating materials and circuit boards, ensuring reliability in high-temperature environments. Similarly, the automotive and aerospace industries are leveraging TMBPF-based polymers to create lightweight yet durable components, which enhance fuel efficiency and reduce emissions.

TMBPF’s role extends to flame-retardant materials, which are essential in the construction industry to meet stringent safety regulations for fire-resistant building materials. Additionally, its ability to enhance the performance of epoxy resins and adhesives broadens its application in industries requiring robust and durable materials. With industries increasingly focusing on innovation, sustainability, and performance, the demand for advanced materials incorporating TMBPF is expected to grow steadily. This positions TMBPF as a vital component in the development of high-performance solutions across a wide range of applications.

Increasing Demand for BPA-Free Alternatives

TMBPF’s structural similarity to BPA allows it to deliver comparable performance, particularly in epoxy resins and coatings. However, its lower estrogenic activity and reduced health risks make it a preferred choice for applications requiring BPA-free solutions. The food and beverage packaging industry is at the forefront of this shift. Manufacturers are increasingly adopting TMBPF for producing non-toxic linings for cans, bottles, and other containers. These linings not only ensure product safety but also comply with stringent regulatory standards, such as those set by the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA).

Tetramethyl Bisphenol F (TMBPF) is gaining traction beyond food packaging, finding applications in industries like electronics, construction, and automotive, where high-performance materials are indispensable. The demand for BPA-free alternatives in these sectors is influenced by regulatory mandates and growing consumer preferences for safer, sustainable products. In electronics, TMBPF-based epoxy resins are increasingly used in circuit boards and components requiring high thermal stability and chemical resistance. Similarly, in construction, TMBPF is being incorporated into durable coatings and adhesives, providing a BPA-free solution for infrastructure projects that demand long-lasting and safe materials.

The rise of clean-label and eco-conscious consumer trends has further fueled the demand for BPA-free options like TMBPF. Modern consumers are more aware of the chemicals in the products they use and are willing to pay a premium for safer, environmentally friendly alternatives. This shift is driving manufacturers to reformulate their products with materials that align with sustainability goals. TMBPF’s reduced environmental impact during production and its role in enhancing the recyclability of end products make it an attractive choice for companies aiming to meet regulatory and consumer expectations. Its versatility and alignment with these evolving trends position TMBPF as a key material in the development of sustainable, high-performance solutions across diverse industries.

Geopolitical Impact Analysis

Geopolitical Tensions Have Affected The Growth Of The Tetramethyl Bisphenol F Market Due To Trade Policies And Tariffs.

The global Tetramethyl Bisphenol F (TMBPF) market is notably impacted by the current geopolitical scenario, particularly due to the limited number of manufacturers. With majorly manufacturers based in India, the market faces significant supply chain vulnerabilities, particularly in times of geopolitical tensions or disruptions in international trade. The concentration of production in a few countries increases the risk of market instability if there are political or economic changes within India, such as regulatory shifts, changes in trade agreements, or diplomatic issues with major importing countries.

Geopolitical uncertainties, including trade wars, sanctions, and fluctuating tariff policies, present significant challenges to the Tetramethyl Bisphenol F (TMBPF) market. Trade policies involving key raw material suppliers or target markets for TMBPF can directly influence its availability and pricing. For example, India’s foreign relations with major economies play a crucial role in maintaining stable exports of TMBPF to industries reliant on it for applications in coatings, flame retardants, and polymers. Political instability or conflicts could disrupt supply chains, leading to production delays and forcing industries to seek alternative materials. Such dependency on a limited manufacturing base underscores the importance of diversifying the production landscape to minimize risks associated with geopolitical conditions.

As companies expand into new markets, varying regulatory frameworks and tariffs can further impact the availability and cost of TMBPF, particularly for applications like beverage can linings. Stricter BPA regulations in some regions drive demand for safer alternatives like TMBPF, but this can create uneven growth depending on local policies and political decisions. Moreover, global beverage companies may face pressure to localize production or reconfigure supply chains to mitigate geopolitical risks, potentially increasing operational costs. This dynamic highlights the need for a balanced approach to ensure TMBPF’s global supply remains stable and accessible, even in the face of political and economic uncertainties.

Regional Analysis

Europe is Projected to be the Most Productive Market in the Global Tetramethyl Bisphenol F Market

Europe emerged as the largest market for Tetramethyl Bisphenol F (TMBPF) in 2024, accounting for 36.8% of the global market share, driven by a combination of regulatory advancements, industrial innovation, and growing demand for sustainable materials. The region’s focus on stringent regulations and environmental sustainability has positioned it as a leader in the adoption of safer chemical alternatives such as TMBPF. With increasing restrictions on Bisphenol A (BPA) due to its potential health risks, European industries are rapidly transitioning to BPA-free solutions, and TMBPF has become a preferred substitute across various applications. The European Union’s regulatory framework, particularly the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) policy, plays a significant role in shaping the TMBPF market.

The REACH regulation has been instrumental in promoting the use of safer chemicals by enforcing strict guidelines on hazardous substances such as Bisphenol A (BPA). This regulatory push has encouraged industries like packaging, automotive, and electronics to adopt Tetramethyl Bisphenol F (TMBPF) as a safer alternative to ensure compliance with stringent environmental and health standards. The European Union’s emphasis on circular economy principles and eco-friendly production processes has further accelerated the adoption of TMBPF, as it aligns with sustainable practices. TMBPF’s compatibility with these principles makes it an ideal choice for various industrial applications requiring safety, durability, and reduced environmental impact.

In Europe, the food and beverage packaging industry is one of the largest consumers of TMBPF, driven by concerns over BPA leaching into food and beverages. Manufacturers are increasingly using TMBPF-based epoxy resins for applications like can linings, food containers, and beverage bottles to meet regulatory requirements and ensure consumer safety. This transition reflects the region’s focus on high-quality standards and clean-label products that appeal to environmentally conscious consumers. The growing demand for BPA-free packaging solutions is further supported by European customers’ strong preference for transparency and sustainability, cementing TMBPF’s role in the region’s eco-conscious market landscape.

Global Tetramethyl Bisphenol F Market, By Region, 2020-2024 (USD Thousands)

Region 2020 2021 2022 2023 2024 North America 931.8 957.0 985.8 1,023.9 1,065.8 Europe 1,009.6 1,039.8 1,074.3 1,120.1 1,170.6 APAC 605.4 617.7 631.6 650.7 672.0 Latin America 141.7 144.1 146.7 150.3 154.3 MEA 109.9 111.3 113.0 115.3 117.8 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Strong Focus On Product Portfolio Expansion Through Various Strategies Maintain the Dominance of Industry Leaders

Industry leaders in the Tetramethyl Bisphenol F (TMBPF) market maintain their dominance through strategic initiatives that enhance innovation, optimize operations, and address evolving consumer and regulatory demands. A key focus is on investing in research and development (R&D) to create advanced TMBPF formulations tailored to meet the specific needs of industries such as packaging, automotive, and construction. These innovations not only improve product performance but also ensure compliance with stringent global environmental and health regulations. Strategic partnerships with manufacturers and distributors further enable companies to strengthen their supply chains and market presence, ensuring seamless product delivery and customer satisfaction.

Market expansion into rapidly industrializing regions such as Asia-Pacific, Latin America, and the Middle East is another critical strategy employed by leading companies. These regions present immense opportunities due to the rising demand for high-performance materials in industries driven by urbanization and economic growth. By focusing on local production and distribution, companies can better meet region-specific requirements, reduce logistics costs, and align with local regulatory frameworks. Combined with a strong emphasis on sustainability and innovation, these efforts position industry leaders to maintain their competitive edge in a dynamic and evolving TMBPF market.

Major Key Players

- Deepak Novochem Technologies LTD

- Jeevan Chemicals Private Limited

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$ 3,180.5 Thousand Forecast Revenue (2034) US$ 5,461.5 Thousand CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to <99% Purity and >99% Purity), By Application (Coatings, Polymer Additives, And Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Deepak Novochem Technologies LTD, Jeevan Chemicals Private Limited and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tetramethyl Bisphenol F MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Tetramethyl Bisphenol F MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Deepak Novochem Technologies LTD

- Jeevan Chemicals Private Limited

- Other Key Players