Global Mud Chemicals Market By Type (Water-based, Oil-based, Synthetic-based, Others), By Application (Onshore, Offshore) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123444

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

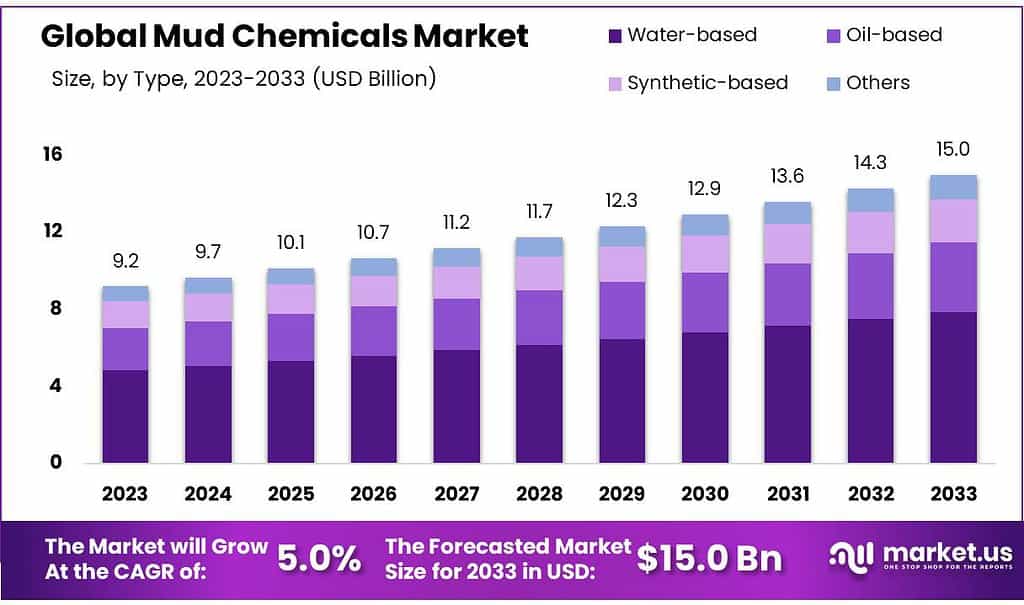

The global Mud Chemicals Market size is expected to be worth around USD 15.0 billion by 2033, from USD 9.2 billion in 2023, growing at a CAGR of 5.0% during the forecast period from 2023 to 2033.

The “Mud Chemicals Market” is a crucial segment within the broader chemical industry, specifically tailored to support drilling operations in the oil and gas sector. These specialized chemicals, commonly known as drilling muds or fluids, are essential in various stages of the drilling process. They perform critical functions such as lubricating the drill bit, stabilizing the wellbore, and controlling downhole pressure.

The efficiency and safety of drilling operations heavily rely on these chemicals. For instance, barite is used to increase the density of the drilling fluid, bentonite provides viscosity and filtration control, and xanthan gum is utilized to improve the carrying capacity of the fluid.

Technological advancements in drilling have had a profound impact on the mud chemicals market. Innovations in drilling technologies require corresponding advancements in mud chemicals to ensure compatibility and efficiency. For example, the development of more sophisticated drilling equipment and techniques necessitates chemicals that can withstand higher pressures and temperatures, as well as those that are more environmentally friendly.

Regulatory standards concerning environmental impact play a significant role in shaping the mud chemicals market. Government regulations aimed at protecting the environment and promoting sustainable practices impose strict guidelines on the composition and disposal of drilling fluids. For instance, regulations may require the use of non-toxic, biodegradable chemicals to minimize environmental pollution. Compliance with such regulations often drives innovation in the development of new, more environmentally friendly mud chemicals.

Government initiatives aimed at reducing pollution and enhancing manufacturing standards can influence the demand and supply dynamics of mud chemicals. For example, stricter waste management and water treatment regulations necessitate the use of effective mud chemicals, thereby boosting market growth. Such regulations not only ensure environmental protection but also drive technological advancements in the industry.

Global trade policies and tariffs are also crucial in the mud chemicals market. Changes in import-export regulations can affect the market prices and availability of these chemicals. Countries with significant chemical production capacities, such as China and India, navigate these regulations to maintain their competitive advantages in the global market. Trade policies that facilitate the export of these chemicals can lead to increased market penetration and growth.

Key Takeaways

- The global Mud Chemicals Market is projected to grow from USD 9.2 billion in 2023 to USD 15.0 billion by 2033. At a (CAGR) of 5.0%

- Water-based mud chemicals held a dominant market position in 2023 with a 52.6% share due to their cost-effectiveness and environmental friendliness.

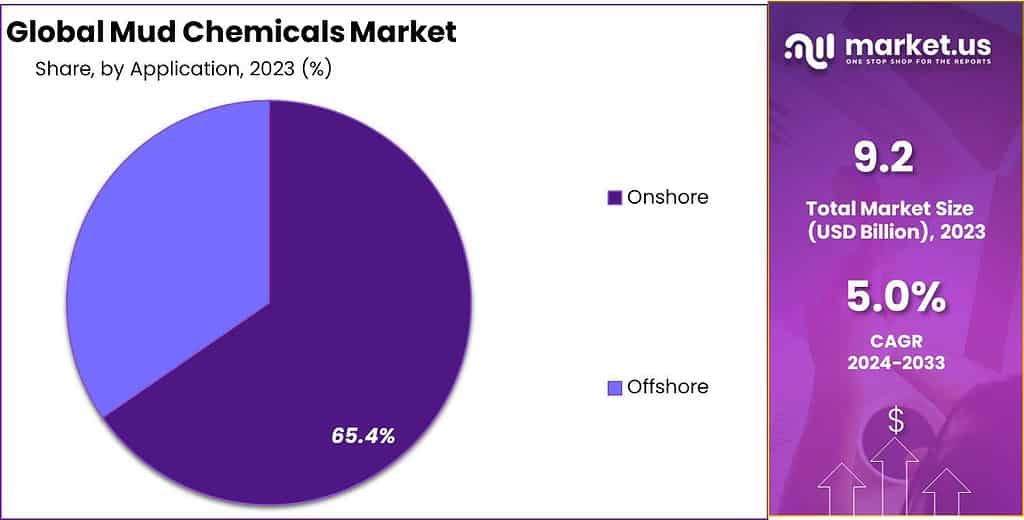

- onshore applications held a dominant market position in the mud chemicals market, capturing more than a 65.4% share.

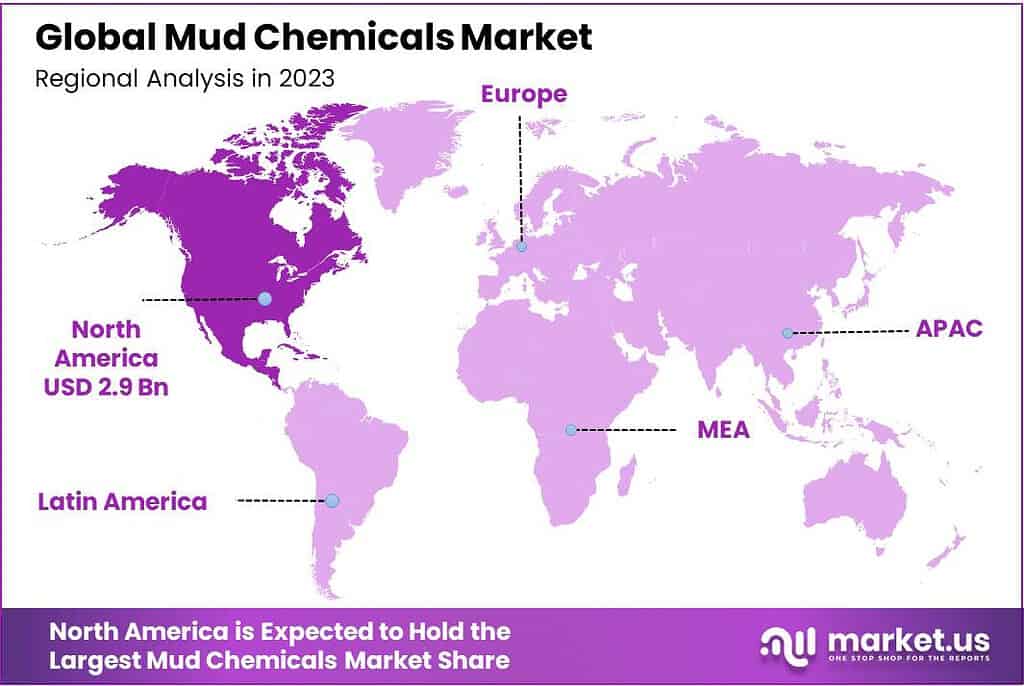

- North America Dominates the market with a 31.2% share valued at USD 2.87 billion, driven by extensive oil and gas exploration activities.

By Type

In 2023, water-based mud chemicals held a dominant market position, capturing more than a 52.6% share. Water-based muds are favored for their cost-effectiveness and environmental friendliness. These muds are primarily used in areas where environmental regulations are strict, as they are less harmful compared to oil-based or synthetic-based muds. They offer good performance in a variety of drilling conditions, making them a versatile choice for many drilling operations.

Oil-based mud chemicals accounted for a significant portion of the market, though their share has declined due to environmental concerns. These muds provide excellent lubrication and stability, especially in challenging drilling conditions such as high-pressure and high-temperature environments. Despite their effectiveness, their use is often restricted by environmental regulations, which promote the use of less toxic alternatives.

Synthetic-based mud chemicals represent a smaller but growing segment of the market. These muds combine the advantages of both water-based and oil-based systems, offering good environmental performance along with high efficiency in complex drilling operations. They are particularly useful in offshore drilling, where environmental impact is a major concern.

By Application

In 2023, onshore applications held a dominant market position in the mud chemicals market, capturing more than a 65.4% share. The demand for mud chemicals in onshore drilling operations is driven by the extensive number of onshore oil and gas rigs compared to offshore rigs. Onshore drilling is often less complex and less expensive, which makes it more prevalent. The need for effective mud chemicals to ensure smooth drilling operations and to meet environmental regulations is crucial in onshore applications.

Offshore applications represent a significant, though smaller, portion of the mud chemicals market. These operations are typically more complex and require specialized mud chemicals that can perform under high-pressure and high-temperature conditions. Offshore drilling often occurs in sensitive ecological areas, making the environmental performance of mud chemicals critical.

Advances in synthetic-based muds and other high-performance formulations are particularly important in this segment to meet stringent environmental standards and ensure the safety and efficiency of offshore drilling operations.

Key Market Segments

By Type

- Water-based

- Oil-based

- Synthetic-based

- Others

By Application

- Onshore

- Offshore

Drivers

Government Initiatives and Policies Boosting the Mud Chemicals Market

Government initiatives aimed at enhancing domestic production capabilities significantly impact the mud chemicals market. In India, the chemical sector is actively promoted through various policies, with the country ranking as the 6th largest producer of chemicals globally. The chemical enterprise in India, valued at approximately USD 232.6 billion in 2021-22, is expected to grow at a CAGR of 9.3% to reach USD 304 billion by 2025.

The Department of Chemicals and Petrochemicals has launched schemes like the establishment of Centers of Excellence and the development of Plastic Parks to support this growth, thereby enhancing the production of mud chemicals to meet the oil and gas sector’s demand.

Governments are also promoting sustainable practices within the chemical industry. The Indian government emphasizes green and circular chemistry to reduce environmental impacts, ensuring the production of environmentally friendly mud chemicals. Regulatory frameworks, such as the introduction of Quality Control Orders (QCOs), enforce stringent quality and environmental guidelines, improving mud chemicals’ quality and sustainability.

Efforts to reduce dependency on imports further drive the market. The Indian government has pushed for increased local production, evidenced by the significant rise in chemical production to 874.30 MMT and petrochemical production to 1,773.74 MMT in February 2023. Competitive advantages like low labor costs and competitive utility costs make it economically viable for companies to set up manufacturing units in India, boosting domestic mud chemicals production.

Government policies and trade agreements also facilitate the growth of the mud chemicals market. India’s strategic trade policies have positioned it as a global hub for chemical exports, with significant exports of organic and inorganic chemicals in 2023. These policies provide access to global markets and create growth opportunities for domestic mud chemical manufacturers.

Restraints

The Role and Impact of Environmental Regulations on the Mud Chemicals Market

Environmental regulations play a crucial role in governing the use of chemicals in drilling operations to ensure that discharged chemicals do not harm aquatic life or contaminate water sources. For instance, countries with strict guidelines on permissible levels of toxic substances in drilling fluids enforce compliance, which increases the cost and complexity of mud chemical production and usage. The European Union’s stringent standards on biodegradability and toxicity require significant investment in R&D to create effective and environmentally friendly formulations.

These stringent regulations lead to increased costs for mud chemical manufacturers, necessitating the development of new compliant products without compromising performance. The approval process for new formulations can be lengthy and expensive, impacting market competitiveness. Additionally, varying regulations across regions complicate operations for international companies, requiring customized products and strategies, which increases operational costs and complexities.

The economic implications are significant, with high compliance costs potentially deterring new entrants and reducing competition. Established players with more resources are better equipped to handle these costs, leading to market consolidation. Resources diverted to environmental compliance can impact long-term sustainability and growth by limiting investment in product innovation and cost reduction.

In response, some governments offer incentives such as tax breaks, grants, or subsidies to companies investing in cleaner technologies or sustainable practices, offsetting compliance costs. Industry associations negotiate with regulatory bodies to ensure regulations balance environmental goals with industry viability, preventing undue stifling of innovation or economic growth.

Opportunity

Market Growth Factors for the Mud Chemicals Market in Asia Pacific

The Asia Pacific region is anticipated to experience significant growth in oil and gas exploration activities, driven by the increasing energy needs of rapidly growing economies such as China and India. These countries are focusing on reducing their reliance on crude oil imports by tapping into untapped oil reserves, necessitating extensive drilling activities where mud chemicals play a crucial role.

Infrastructure development and government initiatives further support this growth, with substantial investments allocated to energy infrastructure projects. For example, the Infrastructure Investment and Jobs Act in the United States has allocated significant funds to the broader chemical industry, including mud chemicals production and innovation.

Technological advancements are also contributing to market growth, with a trend towards developing advanced drilling fluid chemicals that meet stringent environmental standards. Innovations in synthetic-based drilling fluids offer better environmental and operational benefits compared to traditional oil-based fluids, enabling efficient performance under harsh drilling conditions.

Strategic investments and collaborations among major industry players are enhancing product portfolios and expanding global footprints, especially in high-growth regions. These partnerships leverage local expertise and resources to meet regional demand more effectively, driving the growth of the mud chemicals market in the Asia Pacific.

Trends

Sustainability, Technological Advancements, and Regional Dynamics in the Mud Chemicals Market

Sustainability is now a central focus in the production of mud chemicals for drilling operations, driven by stringent Environmental, Social, and Governance (ESG) considerations. Companies are innovating to develop environmentally friendly products, using alternative feedstocks like biogas, hydrogen, and electric heating to replace traditional fossil fuel-based processes. This shift aims to reduce carbon footprints and enhance biodegradability, aligning with global regulatory frameworks aimed at minimizing environmental impact.

Technological advancements, particularly the integration of digital technologies and Artificial Intelligence (AI), are optimizing production and operational efficiencies in the mud chemicals market. AI-driven data analysis enhances product formulations and operational excellence, while real-time insights from digital tools improve decision-making processes. This technological integration is essential for maintaining competitiveness in a rapidly evolving industry.

The market is also influenced by regional dynamics, with significant growth observed in the Asia Pacific region due to its expanding industrial base and increasing energy needs. This growth drives the demand for drilling activities and mud chemicals. While North America continues to dominate the market, emerging markets are experiencing a surge in exploration activities and a focus on domestic resource utilization, contributing to the overall expansion of the mud chemicals market.

Regional Analysis

North America dominates the mud chemicals market with a substantial market share of 31.2%, valued at USD 2.87 billion. This dominance is driven by extensive oil and gas exploration activities, particularly in the United States, which is a leading producer of shale gas and tight oil. Technological advancements in hydraulic fracturing and horizontal drilling have further bolstered the demand for mud chemicals in this region. Canada also contributes significantly, with its vast reserves and ongoing exploration projects.

In Europe, the mud chemicals market is driven by the North Sea’s mature oil fields and new exploration projects in the Arctic region. Countries like Norway and the United Kingdom lead in oil and gas production, necessitating a continuous demand for efficient mud chemicals to optimize drilling operations. Europe’s stringent environmental regulations also push companies to innovate and produce more environmentally friendly chemicals, further driving market growth.

The Asia Pacific region is experiencing rapid growth in the mud chemicals market, supported by increasing oil and gas exploration activities in countries like China, India, and Australia. China’s significant investment in domestic production to reduce reliance on imports and India’s growing energy needs drive the demand for mud chemicals. The region’s market is expected to grow at a compound annual growth rate (CAGR) of 9.3%, reflecting its expanding industrial base and energy sector investments.

The Middle East & Africa region, rich in oil reserves, sees substantial demand for mud chemicals, driven by countries like Saudi Arabia, UAE, and Nigeria. The region’s focus on maintaining its leading position in global oil production fuels ongoing exploration and drilling activities. Investments in advanced drilling technologies and the development of new oil fields in Africa further propel the market.

In Latin America, the mud chemicals market is primarily driven by Brazil and Mexico, where significant offshore oil discoveries have spurred exploration activities. The region’s favorable government policies and investments in energy infrastructure support market growth. Brazil’s pre-salt oil fields and Mexico’s reforms in the oil sector attract considerable interest from international oil companies, boosting the demand for mud chemicals.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Mud Chemicals Market is characterized by the presence of several key players who dominate the industry through their extensive product offerings, technological innovations, and strategic market activities. Leading companies such as Baker Hughes, Halliburton, Schlumberger, and NOV Inc. have established strong market positions by leveraging their comprehensive portfolios of drilling fluids and related services.

These companies invest significantly in research and development to innovate new formulations and enhance the efficiency and environmental sustainability of their products. For instance, Baker Hughes and Schlumberger are known for their cutting-edge technologies and robust global supply chains, which enable them to meet the diverse needs of the oil and gas industry worldwide.

Other notable players include Canadian Energy Services, Flotek Industries, Inc., and TETRA Technologies, Inc., which focus on niche segments and regional markets to carve out their market shares. Companies like Newpark, Secure Energy, and Q’Max Solutions Inc. emphasize tailored solutions and customer-specific services, enhancing their competitive edge in the market.

Additionally, Catalyst Middle East and Global Drilling Fluids and Chemical Limited play significant roles in the regional markets, particularly in the Middle East and Asia-Pacific, where rapid industrialization and increasing oil and gas exploration activities drive demand. Strategic mergers, acquisitions, and partnerships among these key players, such as those involving Weatherford and Scomi Group Bhd, further consolidate their market positions and expand their technological capabilities and geographic reach.

Market Key Players

- Baker Hughes

- Canadian Energy Services

- Catalyst Middle East

- Flotek Industries, Inc.

- Global Drilling Fluids and Chemical Limited

- Halliburton

- Newpark

- NOV Inc

- Q’Max Solutions Inc.

- Sagemines

- Schlumberger

- Secure Energy

- Scomi Group Bhd

- TETRA Technologies, Inc.

- Weatherford

Recent Development

In 2023 Baker Hughes, the company achieved $25.5 billion in revenue, driven by a 16% year-over-year increase, reflecting higher volumes in both their Industrial & Energy Technology (IET) and Oilfield Services & Equipment (OFSE) segments.

In 2023, Canadian Energy Services reported strong quarterly performances, particularly in Q1 where revenue reached $557.7 million, reflecting the company’s robust market presence and operational efficiency.

Report Scope

Report Features Description Market Value (2023) USD 9.2 Bn Forecast Revenue (2033) USD 15.0 Bn CAGR (2024-2033) 5.0% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Water-based, Oil-based, Synthetic-based, Others), By Application (Onshore, Offshore) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Baker Hughes, Canadian Energy Services, Catalyst Middle East, Flotek Industries, Inc., Global Drilling Fluids and Chemical Limited, Halliburton, Newpark, NOV Inc, Q’Max Solutions Inc., Sagemines, Schlumberger, Secure Energy, Scomi Group Bhd, TETRA Technologies, Inc., Weatherford Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Mud Chemicals Market?Mud Chemicals Market size is expected to be worth around USD 15.0 billion by 2033, from USD 9.2 billion in 2023

What is the CAGR for the Mud Chemicals Market?The Mud Chemicals Market is expected to grow at a CAGR of 5.0% during 2023-2032.Who are some key players in the Mud Chemicals Market?Baker Hughes, Canadian Energy Services, Catalyst Middle East, Flotek Industries, Inc., Global Drilling Fluids and Chemical Limited, Halliburton, Newpark, NOV Inc, Q’Max Solutions Inc., Sagemines, Schlumberger, Secure Energy, Scomi Group Bhd, TETRA Technologies, Inc., Weatherford

-

-

- Baker Hughes

- Canadian Energy Services

- Catalyst Middle East

- Flotek Industries, Inc.

- Global Drilling Fluids and Chemical Limited

- Halliburton

- Newpark

- NOV Inc

- Q’Max Solutions Inc.

- Sagemines

- Schlumberger

- Secure Energy

- Scomi Group Bhd

- TETRA Technologies, Inc.

- Weatherford