Global Taxi App Market Size, Share, Statistics Analysis Report By Type (Ride-Hailing, Ride-Sharing, Car Rentals), By Platform (Android, iOS), By End-User (Individuals, Corporate), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134908

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

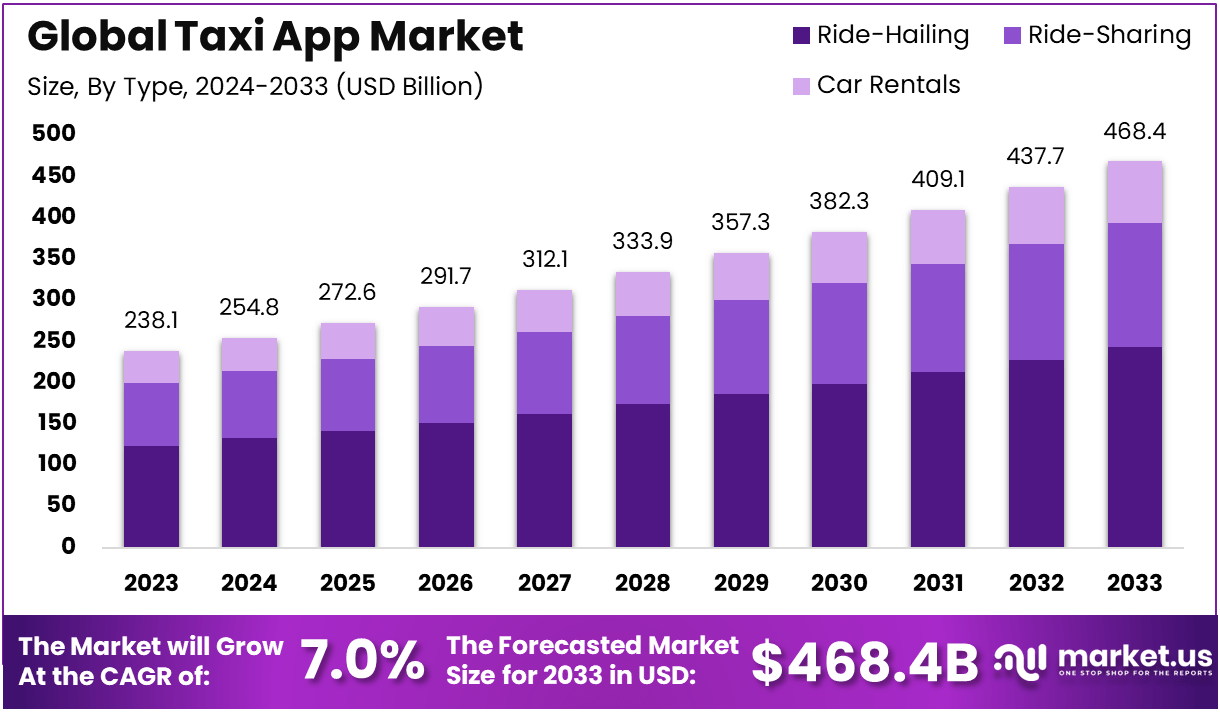

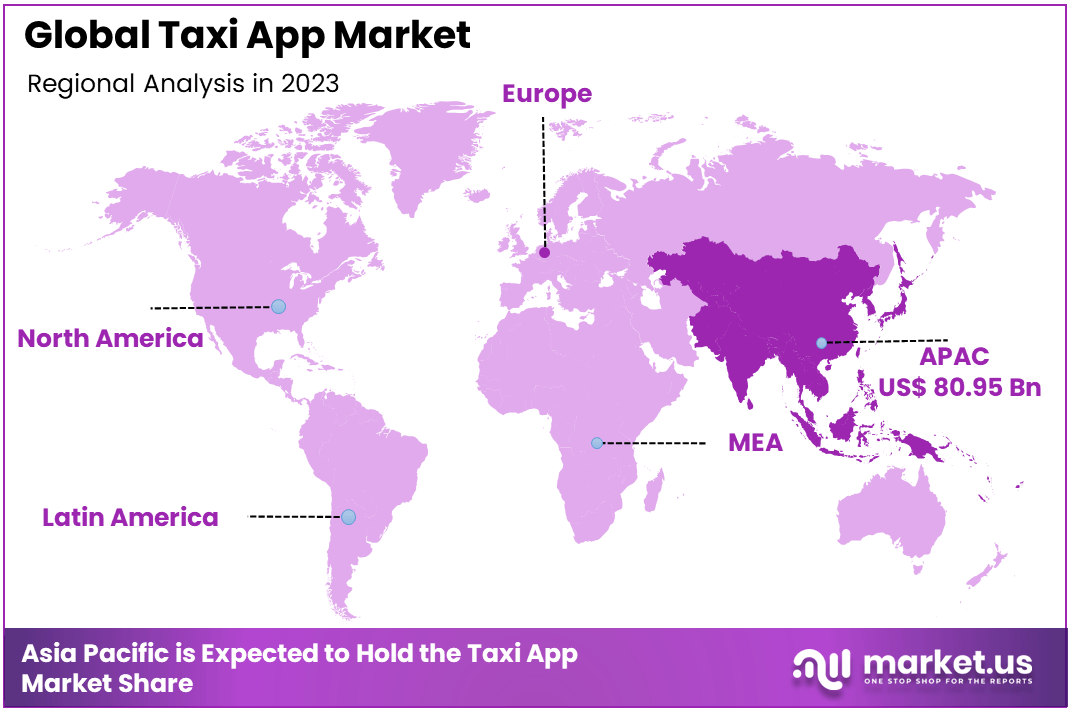

The Global Taxi App Market is expected to be worth around USD 468.4 Billion By 2033, up from USD 238.1 billion in 2023, growing at a CAGR of 7% during the forecast period from 2024 to 2033. Asia Pacific held a dominant market position, capturing over 34% share, holding USD 80.95 Billion in revenue.

A taxi app is a mobile application that allows users to book a ride from a nearby taxi or private vehicle. These apps connect passengers with drivers using GPS technology, allowing seamless communication and ride management. Unlike traditional taxi services, which often require hailing a cab from the street or calling a dispatcher, taxi apps provide a more efficient and user-friendly experience.

Passengers can request rides, track the location of their assigned driver, view fare estimates, and make payments—all through their smartphones. Popular taxi apps such as Uber, Lyft, and Ola have transformed the transportation industry by making on-demand ride services more accessible, transparent, and convenient for consumers.

The taxi app market refers to the global market for mobile applications that facilitate ride-hailing services. This market has seen rapid growth in recent years, driven by the increasing demand for convenient and efficient transportation solutions. The market includes both well-established players like Uber and Lyft, as well as emerging competitors in various regions.

These apps have revolutionized the way people think about urban transportation, offering flexibility, ease of use, and affordability. The market is expected to continue expanding due to growing urbanization, technological advancements, and increasing smartphone penetration. The market also benefits from rising disposable incomes and a growing preference for ride-hailing over traditional forms of transportation.

Urbanization is a key driver of growth in the taxi app market, as more people continue to move into cities, creating a higher demand for convenient and flexible transportation options. Taxi apps cater to this demand by offering affordable, on-demand rides that make it easier for individuals to get around without the hassle of owning a car.

Along with urbanization, the increasing penetration of smartphones, particularly in emerging markets, has significantly expanded the reach of taxi apps. As smartphones become more widespread, they provide users with easy access to ride-hailing services, enabling a larger and more diverse customer base to benefit from these platforms.

The convenience of using taxi apps is another major factor contributing to their popularity. Users can book a ride instantly through the app, track the driver’s location in real-time, and make cashless payments—all from their mobile device. This level of convenience is highly valued by consumers, especially those who prioritize time-saving and seamless experiences.

Moreover, the rise of ride-hailing preferences reflects a shift in consumer behavior. People no longer feel the need to own a car when they can choose from a variety of ride types—such as economy, luxury, or shared rides—that suit their needs, whether for personal use or business travel. This shift in preferences is driving the continued expansion of taxi apps, making them a preferred mode of transportation in cities around the world.

The demand for taxi apps has been consistently rising due to the growing preference for on-demand mobility services. In major cities worldwide, there is a strong desire for alternatives to traditional taxi services that can be easily accessed via smartphones.

The demand is also fueled by the increasing reliance on apps for everyday services such as food delivery, healthcare, and, of course, transportation. Additionally, the COVID-19 pandemic has contributed to increased interest in contactless, private transportation options, which has further driven the adoption of taxi apps.

The leading revenue generators in the taxi app sector include DiDi, which generated about $19.7 billion in 2022, followed by Uber with $14 billion. Other notable players include Lyft at $4.09 billion, Bolt at $1.08 billion, and Cabify at $0.68 billion. The app-based taxi industry holds a market share of between 72% and 75%, indicating a strong consumer preference for mobile applications over traditional taxi services.

The U.S. ride-hailing industry alone was valued at about $5.1 billion in 2020, with estimates suggesting that around 100 billion people prefer booking taxis via online platforms. Overall, the taxi app industry has witnessed significant growth, with over 300 million users worldwide, where major players like DiDi and Uber account for approximately 150 million users combined.

Key Takeaways

- Market Growth: The global taxi app market is projected to grow from USD 238.1 billion in 2023 to USD 468.4 billion by 2033, reflecting a significant CAGR of 7% over the forecast period.

- Dominant Segment by Type: The ride-hailing segment leads the market, accounting for 52% of the total share in 2023, driven by the rising demand for convenient, on-demand transportation solutions.

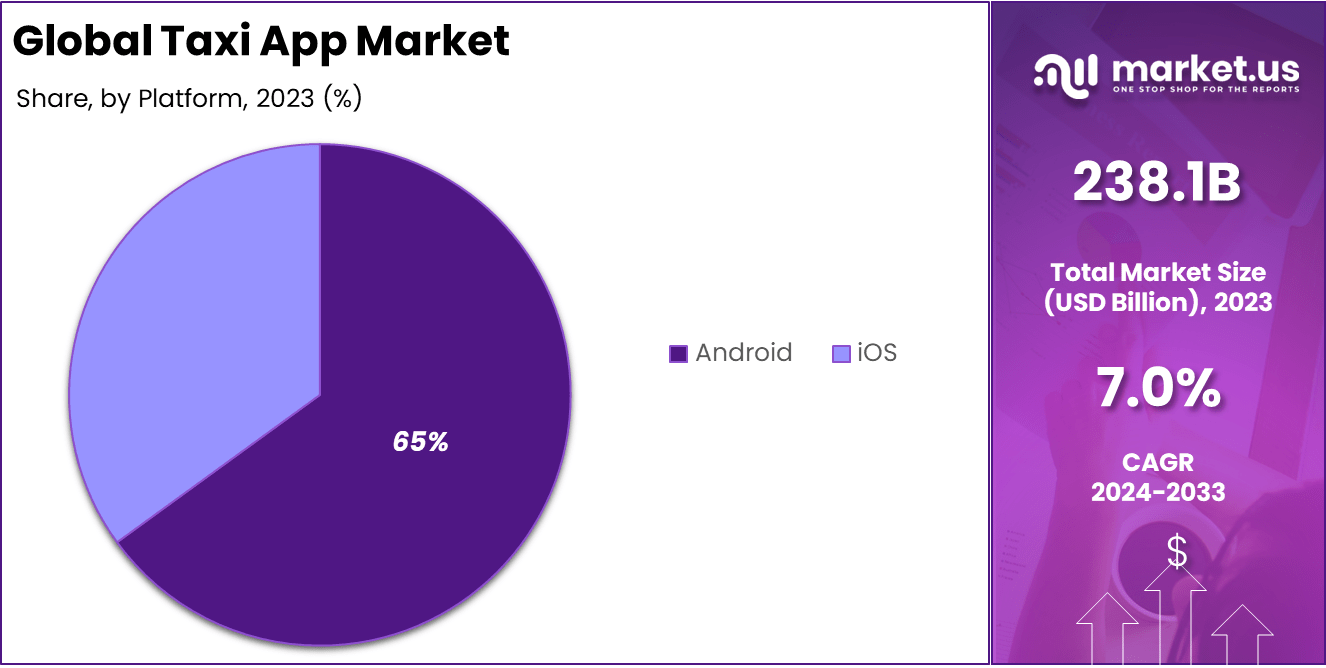

- Leading Platform: Android platforms dominate the taxi app market with a 65% share in 2023, supported by the widespread adoption of Android smartphones in emerging markets, making taxi services more accessible.

- Key End-User Segment: Individuals constitute the largest consumer group, representing 78% of the total market, highlighting the strong demand for personal, on-demand taxi services through mobile apps.

- Regional Leadership: The Asia Pacific region holds a dominant 34% market share in 2023, fueled by rapid urbanization, high smartphone penetration, and growing adoption of ride-hailing services in countries like China and India.

By Type

In 2023, the Ride-Hailing segment held a dominant market position, capturing more than 52% of the total market share. This growth is primarily driven by the increasing demand for convenient, on-demand transportation options.

Ride-hailing apps, such as Uber, Lyft, and others, have significantly reshaped the global transportation landscape, offering users the ability to book a ride with just a few taps on their smartphones. This convenience, coupled with the ability to track drivers in real-time and make cashless payments, has made ride-hailing a preferred mode of transportation, especially in urban areas.

The segment’s dominance can also be attributed to the flexibility it offers. Unlike traditional taxis, ride-hailing services provide customers with the option to choose between various ride types, including economy, luxury, and shared rides. This variety of options allows ride-hailing platforms to cater to a broad consumer base, from individuals seeking affordable transport to those looking for premium services. Additionally, the on-demand nature of ride-hailing services means users don’t have to wait long for a vehicle, further enhancing its appeal.

Moreover, the growing trend of urbanization has contributed to the rise of ride-hailing services. As more people move into cities, the demand for quick and accessible transportation increases. Ride-hailing apps address this demand by providing an efficient alternative to owning a car. This has been particularly beneficial in densely populated cities where parking and traffic congestion are significant concerns.

Lastly, the continued advancements in technology, such as AI-driven algorithms and real-time route optimization, have made ride-hailing services more efficient and reliable. These innovations allow platforms to better match supply with demand, reduce waiting times, and improve the overall user experience. This combination of convenience, flexibility, and technological innovation positions the ride-hailing segment as the leader in the global taxi app market.

By Platform

In 2023, the Android segment held a dominant market position, capturing more than 65% of the total share in the Taxi App Market. This strong market presence is largely due to the widespread adoption of Android smartphones globally, particularly in emerging markets.

With Android being the most widely used mobile operating system in the world, taxi app developers have focused heavily on optimizing their platforms for Android devices. The accessibility and affordability of Android smartphones have made them the go-to choice for consumers in both developed and developing regions, further driving the demand for taxi apps.

Android’s dominance in the taxi app market is also fueled by the diverse range of devices it powers. Unlike iOS, which is limited to Apple’s premium devices, Android operates on a wide variety of smartphones across different price ranges.

This has allowed taxi apps to reach a larger, more diverse user base, including budget-conscious consumers who may not opt for high-end devices. Consequently, taxi app developers target Android first, knowing that it offers a greater potential for mass adoption.

Furthermore, the integration of Android with Google services has proven beneficial for taxi app companies. Features like Google Maps, Google Pay, and integration with other Android services make the user experience more seamless, thus enhancing customer satisfaction. The robust support for third-party apps and services has made Android the preferred platform for both users and developers.

The affordability and flexibility of Android also help taxi apps cater to various consumer needs, from basic ride-hailing to more advanced services, such as car rentals or luxury ride options. As Android continues to be the leading operating system in many regions, particularly in Asia-Pacific, the segment’s market dominance is expected to remain strong for the foreseeable future.

By End-User

In 2023, the Individuals segment held a dominant market position, capturing more than 78% of the total share in the Taxi App Market. This large market share can be attributed to the growing demand for convenient, on-demand transportation services among individual users.

With the increasing adoption of smartphones and the rise of ride-hailing services, individuals are increasingly turning to taxi apps as a primary means of transportation for daily commuting, leisure activities, and other personal travel needs. The convenience of booking a ride instantly and the ability to track drivers in real-time have made these apps particularly appealing to consumers seeking efficiency and reliability in their transportation options.

The dominance of the Individual segment is also driven by changing urban lifestyles. As more people migrate to cities and rely on public transportation or shared mobility solutions, taxi apps provide an easy and cost-effective alternative to car ownership.

The flexibility to choose between different ride options (economy, premium, shared rides) also adds to the appeal for individual users who prioritize affordability and choice in their transportation decisions. Moreover, cashless payments and seamless integration with other apps and services have enhanced the overall user experience, contributing to the growth of this segment.

Additionally, the growing trend of individuals opting for environmentally friendly transportation choices has fueled demand for electric vehicle (EV) ride-hailing services offered by various taxi app platforms. With eco-conscious consumers increasingly preferring green travel options.

Taxi apps that integrate EVs into their fleets are gaining traction, which further strengthens the Individual segment’s market leadership. The ongoing improvement in-app features, such as ride-sharing and location-based services, continues to enhance user satisfaction and further drive the growth of individual consumers in the taxi app market.

Key Market Segments

By Type

- Ride-Hailing

- Ride-Sharing

- Car Rentals

By Platform

- Android

- iOS

By End-User

- Individuals

- Corporate

Driving Factors

Growing Smartphone Penetration

The increasing penetration of smartphones, especially in emerging markets, has significantly driven the growth of the taxi app market. As more people gain access to affordable smartphones, particularly in regions like Asia Pacific, the adoption of mobile ride-hailing apps has surged.

In 2023, smartphone penetration was a key factor that helped accelerate app usage, making it easier for users to access ride-hailing services at their fingertips. The rise in internet accessibility has further boosted this trend, especially in rural areas where traditional transportation options might be limited.

Smartphones provide an easy interface for both riders and drivers, facilitating seamless booking and payment systems, which is a huge benefit for users. The integration of features such as real-time tracking, ratings, and cashless payments has also made the experience more attractive to individuals. The convenience of not having to wait for a taxi on the street or deal with cash transactions has led to a growing preference for these services.

Moreover, smartphone-based taxi apps can offer personalized services through machine learning and AI. This allows for customized recommendations, efficient route management, and improved customer service, which collectively enhance the user experience. Additionally, smartphones serve as a powerful tool for drivers, offering navigational assistance, payment options, and communication with riders, all within one device.

Restraining Factors

Regulatory Challenges

One of the major restraints for the global taxi app market is the increasing regulatory pressure on ride-hailing companies. In several countries, local governments have imposed strict regulations that limit the operations of taxi apps.

For instance, cities in Europe and North America have established rules around the licensing of ride-hailing services, mandatory insurance coverage, and driver background checks. In some cases, there are even regulations requiring drivers to have specific permits or to undergo certain training programs to operate legally.

The regulatory landscape is particularly complex, as it differs significantly from region to region. This can create uncertainty for taxi app companies looking to expand their services globally. For example, while some countries have embraced ride-hailing services, others have imposed restrictions or outright bans. In India, regulatory frameworks are still evolving, and companies like Uber and Ola face challenges with government authorities, which has slowed the pace of growth in the region.

Furthermore, the issue of tax compliance and the treatment of gig workers also poses challenges. Many taxi app companies face scrutiny over whether their drivers should be considered employees or independent contractors.

This has legal implications, including the need for benefits, insurance, and tax contributions, which could impact the operational model of these platforms. These regulatory hurdles add complexity to the market and make it harder for companies to scale and operate efficiently in some regions.

Growth Opportunities

Integration of Electric Vehicles (EVs)

An exciting opportunity in the taxi app market is the integration of electric vehicles (EVs) into ride-hailing fleets. With growing concerns about climate change and the global push towards sustainability, there is a significant opportunity for ride-hailing services to adopt EVs and offer eco-friendly transportation options.

Many cities around the world are now focusing on reducing their carbon footprints and improving air quality by incentivizing the use of electric vehicles, creating a ripe opportunity for taxi apps to align with these trends.

The transition to EVs can help taxi app companies lower operating costs in the long run, as EVs generally have lower fuel and maintenance costs compared to traditional gasoline or diesel-powered vehicles. Additionally, with the rise of government incentives for electric vehicles, companies can benefit from tax breaks, subsidies, and other financial perks, making the transition even more appealing.

Moreover, the integration of electric vehicles can cater to the growing consumer demand for environmentally-friendly transportation options. A significant portion of ride-hailing customers are becoming more eco-conscious and prefer services that prioritize sustainability. By providing EVs as an option, taxi apps can attract a new segment of eco-conscious customers, further expanding their user base.

Challenging Factors

Intense Competition

One of the biggest challenges facing the taxi app market today is the intense competition among ride-hailing platforms. With several global and local players such as Uber, Lyft, Ola, and Didi, competition in the taxi app market is fierce. These companies not only compete for market share in terms of riders but also face challenges in attracting and retaining drivers, who are crucial to their operations.

The competitive pressure is heightened by the fact that most ride-hailing services offer similar pricing structures, service offerings, and app features. This makes it difficult for companies to differentiate themselves, leading to price wars and promotional offers that often affect profit margins. Additionally, with numerous players entering the market, saturation is a concern in certain regions, as it becomes harder to attract users and drivers when the market becomes overcrowded.

Moreover, new competitors in the form of local ride-hailing companies are emerging in various regions, challenging established players. These smaller companies often have a better understanding of the local market dynamics and consumer behavior, which can help them tailor their services more effectively. As a result, established companies must constantly innovate and invest in technology to maintain their market leadership.

Growth Factors

One of the key growth factors propelling the taxi app market is the rapid adoption of smartphones and the internet globally. As smartphone penetration continues to increase, particularly in emerging markets, more consumers are accessing ride-hailing services with ease.

This has led to a significant rise in demand for on-demand transportation services, which are now more accessible and convenient than ever. With apps offering real-time tracking, cashless payments, and ride-sharing options, users have embraced these services due to their enhanced convenience and flexibility.

Emerging Trends

A significant emerging trend in the taxi app market is the increasing adoption of electric vehicles (EVs) and sustainable transportation solutions. Many taxi app companies are transitioning to EVs as part of their commitment to reducing carbon emissions and improving sustainability.

Additionally, the integration of artificial intelligence (AI) and machine learning is transforming the way apps optimize routes, manage traffic patterns, and enhance customer service. The trend towards autonomous vehicles is also gaining traction, promising to further revolutionize the ride-hailing experience.

Business Benefits

For businesses, taxi apps offer numerous benefits. They can tap into a large customer base, enhance operational efficiency, and improve driver productivity. By leveraging real-time data, businesses can optimize routes and reduce fuel consumption, contributing to cost savings.

The ability to collect user data also helps businesses personalize services, enhance customer loyalty, and drive repeat business. Furthermore, with the increase in demand for shared and affordable transportation options, businesses can expand their reach and improve profitability.

Regional Analysis

In 2023, Asia Pacific (APAC) held a dominant market position in the global taxi app market, capturing more than 34% of the market share, with a revenue of USD 80.95 billion. The region’s leadership can be attributed to several key factors.

Including a large and growing population, increasing urbanization, and a significant rise in smartphone penetration. The rapid adoption of mobile technology and the internet, particularly in countries like India, China, and Southeast Asia, has created a favorable environment for taxi app services to thrive.

The demand for ride-hailing services in APAC is further bolstered by the need for convenient, affordable, and accessible transportation solutions in crowded urban centers. Many countries in the region face transportation challenges such as traffic congestion and limited public transportation options, making taxi apps an attractive alternative.

Furthermore, the rise of the middle class, combined with increasing disposable income, has driven consumer spending on such services. In 2023, cities like Shanghai, Delhi, and Jakarta witnessed exponential growth in the use of ride-hailing apps.

Technologically, APAC is also a hotspot for innovation in the taxi app sector. Local companies like Didi Chuxing, Ola, and Grab have pioneered advanced features like ride-sharing, electric vehicle integration, and AI-based route optimization.

These innovations have not only enhanced the user experience but also attracted significant investment in the region. As electric vehicles and green transportation solutions gain traction, APAC is expected to continue to lead in terms of the adoption of eco-friendly ride-hailing options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Uber Technologies, one of the most recognized players in the global taxi app market, has consistently maintained its position as a leader through strategic acquisitions and product expansions. In recent years, Uber has significantly diversified its portfolio, not only focusing on ride-hailing but also expanding into food delivery services (Uber Eats) and freight logistics (Uber Freight).

Uber’s acquisitions, such as the purchase of Postmates in 2020, have helped broaden its customer base and service offerings, particularly in the food delivery space. Furthermore, Uber has invested heavily in technology, including artificial intelligence and autonomous vehicle research, to future-proof its business.

Lyft, Uber’s primary competitor in North America, has been focusing on growing its market share and expanding its reach through strategic partnerships and product launches. In 2023, Lyft unveiled its new electric vehicle (EV) initiative to promote sustainable urban mobility.

This move aims to align with global environmental trends while catering to the growing demand for eco-friendly transportation options. Additionally, Lyft has formed partnerships with major automotive companies like General Motors to expand its fleet of electric vehicles, contributing to its goal of achieving carbon neutrality by 2030.

DiDi Global, the leading ride-hailing company in China, has been aggressively expanding both domestically and internationally, making it a formidable competitor in the global taxi app market. In 2023, DiDi continued to dominate the Chinese market with over 80% of the share, and it has been working to capture new users in Southeast Asia, Latin America, and Australia.

The company made significant strides in improving its platform’s user experience by introducing features such as real-time ride tracking and enhanced safety measures for passengers and drivers. DiDi also launched its electric ride-hailing service to tap into the growing demand for sustainable transportation solutions.

Top Key Players in the Market

- Uber Technologies

- Lyft

- DiDi Global

- Grab Holdings

- Ola Cabs

- Bolt (Taxify)

- Gett

- Free Now

- Gojek

- Curb Mobility

- Cabify

- Other Key Players

Recent Developments

- In 2024: Uber introduced several new features to improve the safety and convenience of both drivers and passengers. One of the most notable updates includes the implementation of real-time safety alerts, which notify passengers and drivers of potential risks or hazards during their rides.

- In 2024: Lyft has partnered with an autonomous vehicle technology company to expand its offerings into self-driving ride-hailing services. The partnership, announced in early 2024, aims to accelerate the development and deployment of autonomous vehicles within Lyft’s fleet.

Report Scope

Report Features Description Market Value (2023) USD 238.1 Bn Forecast Revenue (2033) USD 468.4 Bn CAGR (2024-2033) 7% Largest Market Asia Pacific Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ride-Hailing, Ride-Sharing, Car Rentals), By Platform (Android, iOS), By End-User (Individuals, Corporate) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Uber Technologies, Lyft, DiDi Global, Grab Holdings, Ola Cabs, Bolt (Taxify), Gett, Free Now, Gojek, Curb Mobility, Cabify, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Uber Technologies

- Lyft

- DiDi Global

- Grab Holdings

- Ola Cabs

- Bolt (Taxify)

- Gett

- Free Now

- Gojek

- Curb Mobility

- Cabify

- Other Key Players