Global Water Taxi Market By Type Outlook (Yachts, Cruise, Ferries, Sail Boats, Others), By Number of Passengers (Upto 12, Above 12), By Length (Upto 10 m, Above 10 m), By Boat Size (50 Feet Boat), By Propulsion Type (Outboard, Inboard, Others), By Propulsion Output ( 600 HP), By Fuel Type (Battery Powered or Electric, Diesel, Hybrid), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 63490

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Outlook Analysis

- By Number of Passengers Analysis

- By Length Analysis

- By Boat Size Analysis

- By Propulsion Type Analysis

- By Propulsion Output Analysis

- By Fuel Type Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

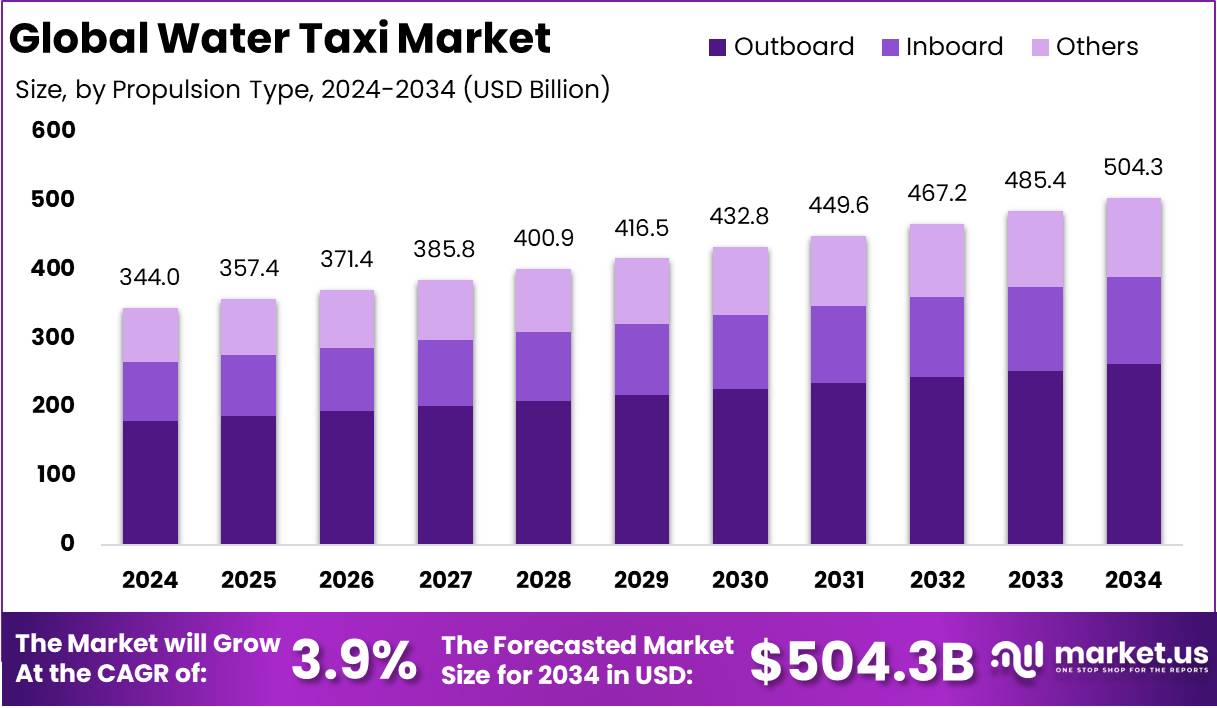

The Global Water Taxi Market size is expected to be worth around USD 504.3 Billion by 2034 from USD 344.0 Billion in 2024, growing at a CAGR of 3.9% during the forecast period from 2025 to 2034.

A water taxi is a specialized waterborne vessel used for public or private transportation along coastal areas, rivers, and urban waterways. These taxis operate much like traditional land taxis, providing on-demand, flexible travel routes for individuals or small groups. They are commonly used in cities with significant water channels, offering an alternative to congested terrestrial traffic and providing a scenic mode of transit.

The water taxi market encompasses all activities related to the operation, manufacturing, and servicing of water taxis, along with the infrastructure supporting their deployment. This market caters to both the tourism sector and daily commuters, positioning itself as a niche yet vital component of urban transportation ecosystems. Key stakeholders include water taxi operators, boat builders, regulatory bodies, and city planners, all of whom play a role in shaping the market dynamics.

The growth of the water taxi market is influenced by several factors, including urbanization and the increasing congestion in city road networks, which compel cities to optimize their waterways for transit. Environmental concerns also play a significant role, as water taxis offer a lower-emission alternative to cars and buses, aligning with global sustainability goals. Additionally, advancements in boat technology, such as electric and solar-powered vessels, are making water taxis more economically viable and environmentally friendly.

Demand for water taxis is driven by the need for efficient and pleasant travel options in water-rich urban environments. Tourists and residents alike are attracted to the convenience and scenic advantages of waterborne travel. Furthermore, the integration of water taxis into broader public transport networks can enhance their appeal, providing seamless intermodal connectivity.

The market presents substantial opportunities for innovation in boat design and service offerings. There is potential for significant investment in sustainable technologies, which could lead to the expansion of the market to new locations previously considered unviable.

Urban development projects along waterfronts often include plans for enhancing water taxi accessibility, which can stimulate local economies and increase the overall attractiveness of water taxi services. Moreover, the increasing focus on smart cities and Internet of Things (IoT) integration offers avenues for improving operational efficiency and customer experience in the water taxi industry.

The European Boating Industry underpins a promising growth outlook for the water taxi market, leveraging an expansive network of over 6 million boats, 36 million avid boaters, and more than 6,000 marinas. This sector, driven by 32,000 businesses primarily consisting of SMEs, employs over 280,000 individuals, significantly enriching local economies, especially in coastal and island areas. The synergy between the robust recreational boating infrastructure and the burgeoning demand for water taxis exemplifies a strategic opportunity to enhance regional transportation and boost tourism.

According to Construction World, the introduction of 10,000 water taxis to connect Mumbai suburbs with the new airport marks a transformative step for the Water Taxi Market. This development will enable passengers from areas like Virar and Kalyan-Dombivli to reach the new airport in just 70 minutes, significantly reducing travel time and contributing to the market’s expansion.

Key Takeaways

- The global water taxi market is projected to grow from USD 344.0 billion in 2024 to USD 504.3 billion by 2034, expanding at a steady CAGR of 3.9% from 2025 to 2034

- The Yachts segment is the dominant sub-segment by type outlook in 2024, capturing over 28.8% of the market share, favored for luxury and private travel experiences.

- The Up to 12 Passengers segment leads in the water taxi market by number of passengers in 2024, holding more than 63.4% of the market share, ideal for short and private trips.

- The Up to 10 m segment is predominant, securing over 58.2% of the market share in 2024, preferred for its agility in crowded urban waterways.

- The <30 Feet Boat segment dominates by boat size in 2024, with a market share of more than 41.2%, valued for its maneuverability in tight waterways.

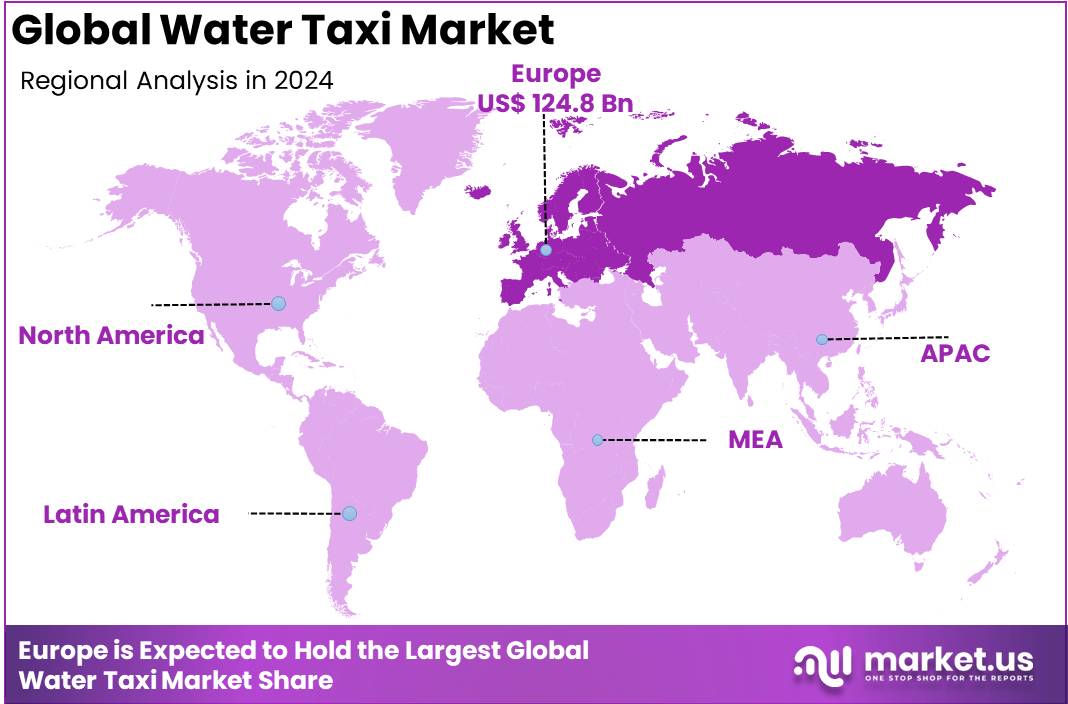

- Europe emerges as the leading region in the global water taxi market, holding a significant 36.3% market share in 2024, driven by its advanced maritime infrastructure and strong tourism sector.

By Type Outlook Analysis

In 2024, the Yachts segment holds a dominant position in the Water Taxi market by type outlook, capturing more than 28.8% of the market share. This segment benefits from the increasing popularity of luxury and leisure travel, especially in coastal and island destinations. Yachts are preferred for their amenities, comfort, and privacy, appealing to tourists and high-net-worth individuals seeking exclusive travel experiences.

The Cruise Ferries segment is a significant player in the water taxi market. These vessels combine the functionality of ferry services with the amenities of a cruise ship, making them attractive for longer journeys and inter-island services. They are particularly popular in regions with large archipelagos, offering both passenger and vehicle transport.

The Sail Boats segment captures a niche in the water taxi market. Sail boats offer an eco-friendly alternative to motorized water taxis, primarily driven by the growing environmental concerns and the push for sustainable tourism practices. They are favored in protected or shallow waters where preservation of the natural acoustic environment is crucial.

The Others segment, which includes various other types of water taxis such as pontoons, pedal boats, and electric boats, caters to a wide range of applications, from urban commuting to scenic city tours. Characterized by their adaptability to different waterway conditions and passenger needs, this segment plays a crucial role in the diversification of the water taxi market.

By Number of Passengers Analysis

In 2024, the Up to 12 Passengers segment holds a dominant position in the Water Taxi market by number of passengers, capturing more than 63.4% of the market share. This segment primarily includes smaller water taxis designed for quick, personal, and private transportation. They are ideal for short distances and are popular in congested urban waterways where speed and frequency of service are prioritized over larger passenger capacity.

The Above 12 Passengers segment addresses the need for larger water taxis that can accommodate more passengers per trip. Although it holds a smaller share of the market, this segment is crucial for group travel, tourist excursions, and regular commuting along popular routes. These larger water taxis are often used in tourist-heavy destinations where larger groups need to be transported efficiently across water bodies.

By Length Analysis

In 2024, the Up to 10 m segment holds a dominant position in the Water Taxi market by length, capturing more than 58.2% of the market share. This segment includes smaller water taxis that are favored for their maneuverability and efficiency in narrower or crowded waterways. Ideal for quick hops and short trips, these compact taxis are extensively used in urban settings where space is at a premium and agility in water traffic is essential.

The Above 10 m segment represents larger water taxis that are designed to accommodate more passengers and provide more comfort during longer journeys. While they hold a smaller portion of the market compared to the “Up to 10 m” segment, they are crucial for servicing longer routes across wider water bodies, offering features that cater to the demands of longer-duration travel and larger group transport.

By Boat Size Analysis

In 2024, the <30 Feet Boat segment holds a dominant position in the Water Taxi market by boat size, capturing more than 41.2% of the market share. This category includes compact water taxis that are highly maneuverable and efficient, ideal for navigating through tight waterways in densely populated urban areas. These boats are preferred for their ability to offer quick and convenient services, especially for short-distance travels.

The 30-50 Feet Boat segment represents a significant portion of the water taxi market, catering to a balance between capacity and maneuverability. These boats are versatile, serving both the demands of commuter traffic and leisure cruises. They are well-suited for medium-length routes that require a larger passenger capacity without compromising the ease of navigation.

The >50 Feet Boat segment includes the largest water taxis in the market, designed for the longest routes and capable of carrying the most passengers. While they command a smaller market share, these boats are essential for high-demand routes, such as tourist excursions and inter-island travel, where comfort, stability, and a higher passenger load are priorities. These vessels are typically equipped with amenities that enhance the passenger experience on longer journeys.

By Propulsion Type Analysis

In 2024, the Outboard segment holds a dominant position in the Water Taxi market by propulsion type, capturing more than 52.2% of the market share. Outboard engines are widely preferred due to their ease of maintenance, cost-effectiveness, and flexibility in operation. These propulsion systems are commonly used in smaller to mid-sized water taxis, providing high maneuverability and efficient fuel consumption, making them ideal for short and medium-range travel.

The Inboard segment represents a significant share of the water taxi market, catering to vessels that require more power and durability. Inboard propulsion systems are commonly used in larger boats designed for longer routes and higher passenger capacities. These engines offer better weight distribution, improved fuel efficiency for extended travel, and reduced noise levels, making them a popular choice for premium and high-performance water taxis.

The Others segment includes alternative propulsion systems such as hybrid, electric, and jet propulsion, which are gaining traction in the market. With increasing environmental concerns and regulatory pushes for sustainable solutions, these propulsion types are witnessing rising adoption, particularly in urban areas and eco-sensitive zones. While this segment currently holds a smaller share, advancements in green technology and government incentives for sustainable transportation are expected to drive future growth.

By Propulsion Output Analysis

In 2024, the <300 HP segment holds a dominant position in the Water Taxi market by propulsion output, capturing more than 45.3% of the market share. Water taxis in this category are primarily used for short-distance travel, urban commuting, and small passenger loads. Their fuel efficiency, lower operational costs, and adaptability to various waterway conditions make them a preferred choice for operators looking for cost-effective and reliable transport solutions.

The 300 HP – 600 HP segment represents a significant portion of the market, catering to mid-sized water taxis that require a balance of power and fuel efficiency. These engines are well-suited for medium-distance routes, handling larger passenger capacities while maintaining operational efficiency. This segment is widely used for inter-city or inter-island services where moderate speed and endurance are necessary.

The >600 HP segment consists of high-powered water taxis designed for long-distance routes, high-speed operations, and heavy passenger loads. These water taxis are commonly used in tourism, luxury transport, and premium services that demand faster travel times and superior performance. While this segment has a smaller market share, it plays a crucial role in regions where rapid water transport is essential for economic activities and tourism growth.

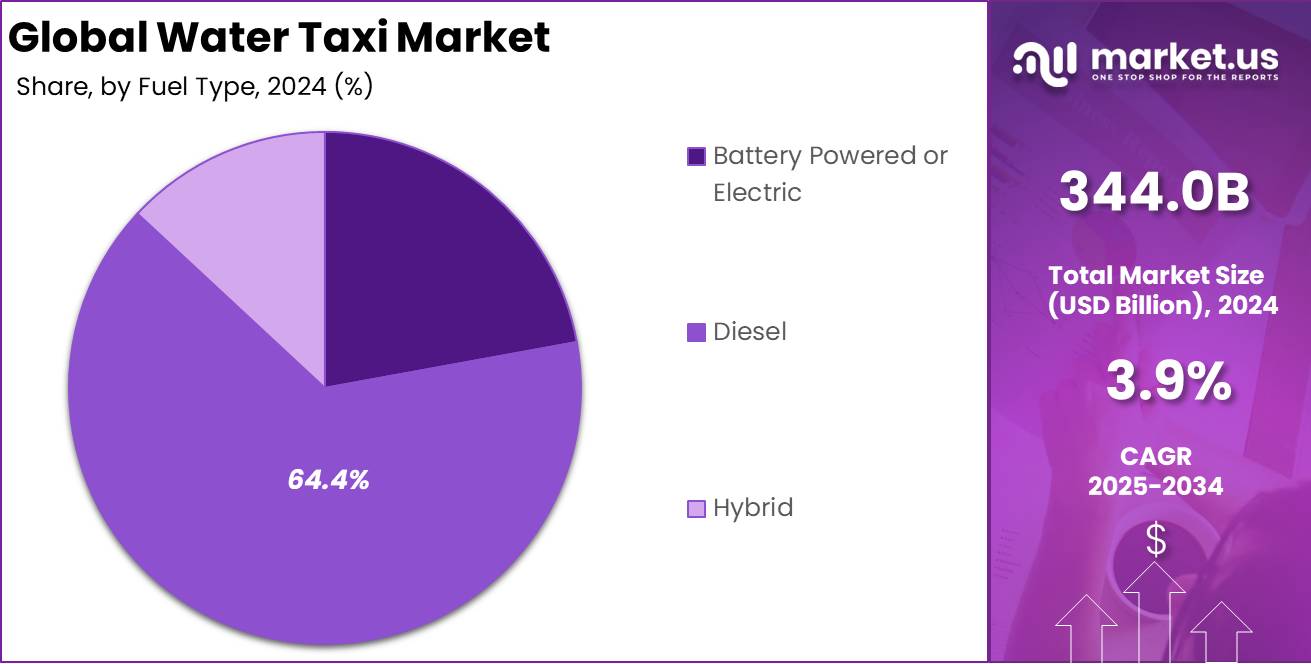

By Fuel Type Analysis

In 2024, the Diesel segment holds a dominant position in the Water Taxi market by fuel type, capturing more than 64.4% of the market share. Diesel-powered water taxis are widely preferred due to their high energy efficiency, durability, and ability to handle long-distance routes with heavy passenger loads. Their reliability and established fueling infrastructure make them the go-to choice for operators requiring cost-effective and powerful propulsion for daily operations.

The Battery Powered or Electric segment is experiencing significant growth, driven by rising environmental concerns and stricter emission regulations. These water taxis are ideal for urban waterways, ecotourism, and regions aiming to reduce their carbon footprint. While their market share remains smaller compared to diesel-powered alternatives, advancements in battery technology, improved charging infrastructure, and government incentives are accelerating their adoption.

The Hybrid segment combines the benefits of conventional fuel with electric propulsion, offering a balance between power efficiency and reduced emissions. Hybrid water taxis are gaining popularity in areas where sustainability initiatives are a priority while maintaining operational flexibility. As technology advances and fuel efficiency regulations tighten, this segment is expected to gain a larger foothold in the market.

Key Market Segments

By Type Outlook

- Yachts

- Cruise

- Ferries

- Sail Boats

- Others

By Number of Passengers

- Upto 12

- Above 12

By Length

- Upto 10 m

- Above 10 m

By Boat Size

- <30 Feet Boat

- 30-50 Feet Boat

- >50 Feet Boat

By Propulsion Type

- Outboard

- Inboard

- Others

By Propulsion Output

- <300 HP

- 300 HP – 600 HP

- > 600 HP

By Fuel Type

- Battery Powered or Electric

- Diesel

- Hybrid

Driver

Increasing Urbanization and Coastal Tourism

The rise of urbanization and the expansion of coastal tourism are significant drivers of the global water taxi market as we move into 2024. Urban centers around the world are experiencing a surge in population density, which in turn increases the demand for alternative modes of transportation.

Water taxis serve as a viable solution, particularly in cities with accessible waterways, by easing traffic congestion on land and reducing commute times. As urban dwellers seek more efficient and pleasant commuting options, water taxis are becoming increasingly popular for their ability to provide scenic and less crowded routes.

Furthermore, the burgeoning coastal tourism industry contributes directly to the growth of water taxi services. Tourists are drawn to the unique experience of exploring destinations via water, which not only enhances their travel experience but also boosts the local economy.

As a result, regions with strong tourism sectors are investing in water taxi services as a key component of their transportation infrastructure to support and capitalize on the increasing influx of visitors. This dual impact of urbanization and tourism not only fuels the demand for water taxis but also encourages continuous improvements and expansions of services, ensuring sustained growth in the market.

Restraint

Environmental Regulations and Operational Costs

Environmental regulations and high operational costs pose significant restraints on the water taxi market. As global awareness and regulatory standards regarding environmental protection increase, water taxi operators face challenges in complying with emissions and noise pollution controls.

These regulations often require investment in newer, eco-friendly technologies, such as electric engines or alternative fuels, which can significantly elevate initial capital expenditures. This shift towards greener operations, while beneficial for the environment, imposes financial and logistical constraints on service providers, potentially stifling market growth.

Moreover, the operational costs associated with running water taxi services such as fuel, maintenance, and labor are inherently high. In areas where economic conditions limit the ability to pass these costs onto consumers through higher fares, operators may struggle to achieve profitability.

This economic dynamic can deter new entrants into the market and limit the expansion of existing services, ultimately restraining the growth potential of the global water taxi industry unless innovative cost management strategies are adopted.

Opportunity

Technological Advancements in Vessel Design

Technological advancements in vessel design present significant opportunities for the water taxi market. As we head into 2024, the integration of advanced materials and propulsion technologies is set to revolutionize water taxi services by making them more efficient, faster, and environmentally friendly.

Innovations such as lightweight composite materials and hydrodynamic hull designs reduce fuel consumption and increase the speed and range of water taxis, enhancing their appeal to commuters and tourists alike.

Additionally, the adoption of electric and hybrid propulsion systems is not only aligning with global environmental goals but also reducing operational costs over time, making water taxi services more sustainable and economically viable.

These technological enhancements facilitate a more attractive and competitive market offering, potentially increasing market penetration in untapped regions and consumer segments. This opportunity for innovation and growth is critical in positioning water taxis as a forward-thinking solution to urban and tourist transportation challenges.

Trends

Shift Toward Integrated Multimodal Transportation Networks

A significant trend in the global water taxi market is the shift toward integrated multimodal transportation networks. Cities around the world are increasingly recognizing the value of comprehensive transportation systems that seamlessly connect water taxis with other forms of public transport, such as buses, trains, and subways.

This integration enhances the overall efficiency and user-friendliness of urban transport systems, making water taxis a more attractive option for daily commuters and tourists.

The development of digital platforms and mobile applications for ticketing and route planning across multiple modes of transport further supports this trend. These technologies ensure a smoother transition between different transport modes, increasing the convenience and appeal of using water taxis as part of a larger travel itinerary.

The move towards interconnected transportation networks not only boosts the usability of water taxis but also promotes sustainable urban mobility, positioning water taxis as a crucial component of future transportation infrastructure. This trend is likely to propel the growth of the water taxi market by broadening its user base and enhancing its integration into the urban lifestyle.

Regional Analysis

Europe Water Taxi Market with the Largest Market Share of 36.3% in 2024

The global water taxi market demonstrates diverse dynamics across various regions, with Europe emerging as the dominant player. As of 2024, Europe holds a commanding 36.3% share of the market, underscored by a valuation of USD 124.8 billion. This prominence is attributed to advanced maritime infrastructure, stringent environmental regulations driving the adoption of cleaner and greener transportation methods, and a robust tourism industry seeking efficient and scenic modes of transport.

In North America, the market is propelled by technological advancements in boat manufacturing and significant investments in waterfront development projects. These initiatives are enhancing the connectivity and appeal of water-based transportation, particularly in urban areas with substantial waterway networks.

The Asia Pacific region shows substantial growth potential due to increasing urbanization and the expansion of the tourism sector. Countries like China and India are investing in maritime infrastructure to boost economic activity and reduce urban congestion, which in turn is facilitating the growth of the water taxi industry.

The Middle East & Africa region is witnessing a gradual adoption of water taxis, driven by the tourism sector in coastal cities and initiatives to diversify transportation options. The region’s focus on luxury and leisure travel also contributes to the demand for water taxis as a preferred mode of transport among tourists seeking unique travel experiences.

Latin America, although smaller in market size compared to other regions, is recognizing the benefits of water taxis in reducing urban congestion and promoting tourism. Countries with significant riverine and coastal landscapes are exploring water taxis as a viable alternative to traditional land-based transportation means.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In the evolving landscape of the Global Water Taxi Market projected for 2024, several key players are poised to influence the industry significantly. Alumax Boats, known for their robust aluminum boats, are expected to leverage their durability and low maintenance features to appeal to commercial operators in urban waterways. American Sail Inc., with their expertise in sailboat manufacturing, might expand their offerings to include sail-powered water taxis, promoting eco-friendly transportation solutions.

ARES SHIPYARD INC. and Artemis Technologies are likely to push the envelope with high-speed and energy-efficient designs, utilizing advanced hydrofoil technologies and electric propulsion systems. This innovation could attract eco-conscious consumers and cities looking to reduce carbon emissions. Azimut Benetti S.p.A and Bavaria Yachtbau, traditionally strong in luxury yacht manufacturing, might develop premium water taxi models to cater to upscale tourism and high-end commuter services.

The Beneteau Group is expected to capitalize on its extensive experience to offer versatile water taxis that blend comfort with performance, suitable for both personal and commercial use. Companies like Brunswick and Catalina Yachts will possibly focus on enhancing onboard technologies and passenger experiences, integrating smart features that improve safety and operational efficiency.

Emerging players like Estaleiros Navais de Peniche and Izmir Shipyard could focus on regional market penetration by offering customized solutions that meet local regulatory and environmental requirements, thereby gaining a competitive edge. Mercan Yachting and Munson Boats are anticipated to emphasize ruggedness and adaptability in their designs to suit various water conditions and service requirements.

Furthermore, luxury brands such as Ferretti and Sunseeker International are likely to introduce high-end, innovative designs that could transform water taxi services into a more glamorous and appealing choice for tourists and high-net-worth individuals. This move could redefine passenger expectations and set new standards in marine transport aesthetics and comfort.

Top Key Players in the Market

- Alumax Boats

- American Sail Inc.

- ARES SHIPYARD INC.

- Artemis Technologies

- Azimut Benetti S.p.A

- Bavaria Yachtbau

- Beneteau Group

- Bord à Bord

- Brunswick

- Catalina Yachts

- Estaleiros Navais de Peniche

- Ferretti

- Izmir Shipyard

- LarsenB

- MacGregor

- Mercan Yachting

- Munson Boats

- Navalt

- Princess Cruise Lines, Ltd.

- Quer Barcelona

- Streamline Marine Composite Developments Ltd

- Sunseeker International

- Uniwork Boats

- WATERBUS SC

Recent Developments

- In January 2023, Brunswick Corporation announced the launch of Veer, a new boat brand at the Consumer Electronics Show in Las Vegas. Aimed at electrification and attracting first-time boaters, Veer introduced its first model, the X13. The brand responds to growing interest from a younger, more diverse group of boating enthusiasts.

- In 2023, AVIKUS, a subsidiary of HD Hyundai focused on autonomous navigation, partnered with Busan City and Korea Marine Consulting and Project Management to initiate an eco-friendly, autonomous water taxi service in South Korea. This development signifies a shift towards sustainable maritime travel, enhancing the tourist experience in Busan.

- In 2024, the State Water Transport Department plans to expand its successful water taxi service to the Ernakulam region in Kerala, India, following strong demand in Alappuzha and Kannur. The introduction of a new speed catamaran is set to enhance the scenic backwater cruises, further boosting local tourism and water transport.

Report Scope

Report Features Description Market Value (2024) USD 344.0 Billion Forecast Revenue (2034) USD 504.3 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type Outlook (Yachts, Cruise, Ferries, Sail Boats, Others), By Number of Passengers (Upto 12, Above 12), By Length (Upto 10 m, Above 10 m), By Boat Size (<30 Feet Boat, 30-50 Feet Boat, >50 Feet Boat), By Propulsion Type (Outboard, Inboard, Others), By Propulsion Output (<300 HP, 300 HP – 600 HP, > 600 HP), By Fuel Type (Battery Powered or Electric, Diesel, Hybrid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alumax Boats, American Sail Inc., ARES SHIPYARD INC., Artemis Technologies, Azimut Benetti S.p.A, Bavaria Yachtbau, Beneteau Group, Bord à Bord, Brunswick, Catalina Yachts, Estaleiros Navais de Peniche, Ferretti, Izmir Shipyard, LarsenB, MacGregor, Mercan Yachting, Munson Boats, Navalt, Princess Cruise Lines, Ltd., Quer Barcelona, Streamline Marine Composite Developments Ltd, Sunseeker International, Uniwork Boats, WATERBUS SC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Beneteau S.A.

- Brunswick Corporation

- Azimut Benetti Group

- Ferretti S.p.A.

- Sunseeker International Ltd.

- Bavaria Yachtbau GmbH

- American Sail Inc.

- Fincantieri S.p.A.

- Princess Yachts Limited

- Greenbay Marine Pte Ltd. and Catalina Yachts