Global Cruise Tourism Market Size, Share, Growth Analysis By Cruise Type (Ocean Cruise, River Cruise, Luxury Cruise, Expedition Cruise, Others), By Traveler Type, By Age Group, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136472

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

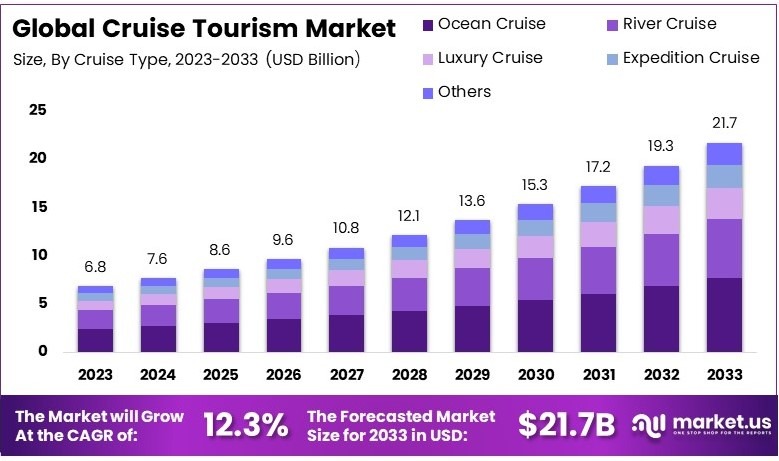

The Global Cruise Tourism Market size is expected to be worth around USD 21.7 Billion by 2033, from USD 6.8 Billion in 2023, growing at a CAGR of 12.3% during the forecast period from 2024 to 2033.

Cruise tourism involves traveling on cruise ships that provide accommodations, entertainment, and various activities. Passengers visit multiple destinations while enjoying onboard amenities. It caters to a wide range of travelers, including families, couples, and solo adventurers seeking both relaxation and exploration.

The cruise tourism market includes companies that operate cruise, offer travel packages, and provide related services. Major cruise lines, travel agencies, and destination ports are part of this market. It focuses on delivering comprehensive travel experiences by combining transportation, lodging, dining, and entertainment for passengers.

Cruise tourism remains a robust sector, attracting diverse travelers worldwide. Luxury travel segments like Regent Seven Seas Cruises and Crystal Cruises offer exclusive experiences. For example, Regent’s Seven Seas Explorer appeals to high-net-worth individuals with personalized services, ensuring sustained interest and growth in this niche market.

The cruise tourism market is expanding steadily, driven by increasing affluent travelers and family-oriented cruises. Brands such as Disney Cruise Line recorded over 4 million passengers in 2022. Additionally, river cruises by AmaWaterways, carrying more than 150,000 passengers annually, highlight the market’s diverse offerings and potential for further expansion.

Growth factors include rising disposable incomes and the allure of unique travel experiences. Technological advancements and eco-friendly designs also play a crucial role. The push for sustainable cruising, influenced by the International Maritime Organization’s CO2 reduction targets, attracts environmentally conscious travelers, fostering market growth.

Demand and opportunities are bolstered by the surge in billionaires globally. According to Forbes, the U.S. hosts 735 billionaires, while China has 495. India saw its billionaire count rise to 166 in 2022. This wealth increase fuels demand for luxury yachts and high-end cruise services, presenting significant opportunities for market players.

While major brands dominate, specialized operators can capture underserved markets. The presence of first-time cruisers, around 30% for river cruises, indicates potential for attracting new customers without excessive competition.

Key Findings

- The Cruise Tourism Market was valued at USD 6.8 Billion in 2023, and is expected to reach USD 21.7 Billion by 2033, with a CAGR of 12.3%.

- In 2023, Ocean Cruise dominates the cruise type segment with 40.5% due to its widespread appeal among various traveler groups.

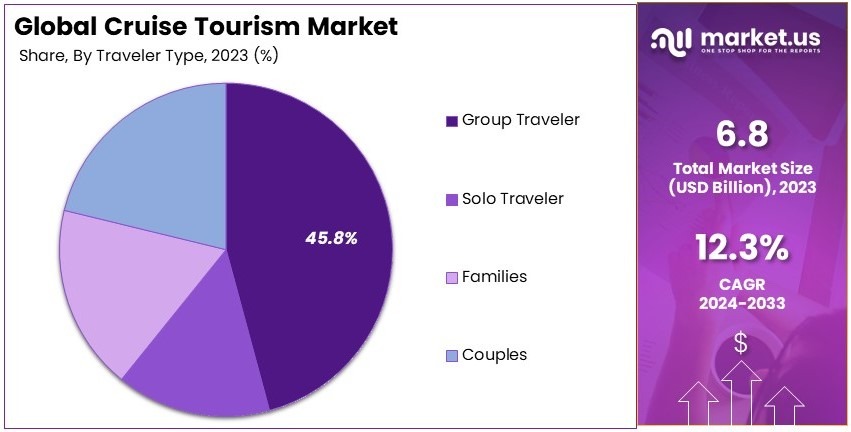

- In 2023, Group Traveler leads the traveler type segment with 45.8%, highlighting the preference for shared travel experiences.

- In 2023, the 41–60 Years age group accounts for 35.2%, indicating a significant portion of mature travelers.

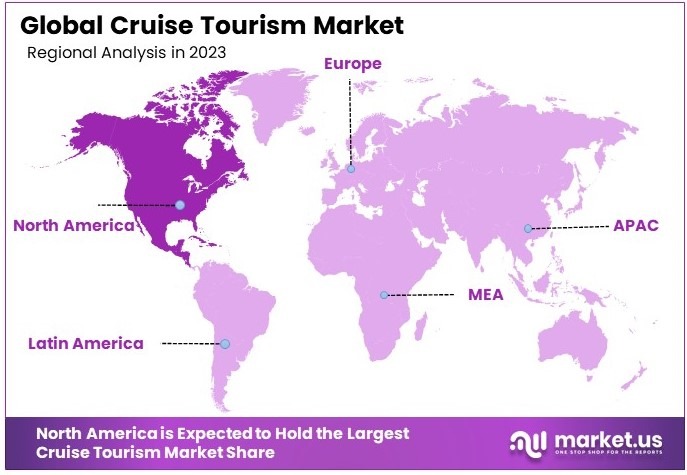

- In 2023, North America dominates the region segment, driven by its established cruise industry and high tourist activity.

Business Environment Analysis

Cruise tourism remains moderately saturated, with Muscat’s Port Sultan Qaboos welcoming over 431,000 tourists and 110 cruise ship calls in 2023. According to Oman’s tourism strategy, enhancements aim to accommodate larger vessels by 2024, ensuring growth without excessive competition.

The target demographic for cruise tourism includes affluent travelers and families. For example, Jamaica attracted 1.26 million cruise passengers in 2023, a 48.3% increase from 2022. Additionally, India’s Cruise Bharat Mission launched in September 2024 aims to reach 1 million passengers by 2029, targeting diverse age groups and income levels.

Product differentiation is evident through unique offerings and exclusive experiences. Muscat’s upgraded port facilities and Jamaica’s varied shore excursions generate distinct attractions. Furthermore, China’s investments in cruise infrastructure during 2023 position it as a premier hub, offering tailored services that set it apart globally.

Value chain analysis highlights the importance of partnerships and infrastructure. Collaborations like the Caribbean Tourism Organization with Royal Caribbean during the 2024 Iconic Summit enhance service quality and sustainability. Additionally, India’s Cruise Bharat Mission provides funds and incentives, supporting the entire cruise ecosystem from shipbuilding to onshore services.

Investment opportunities in cruise tourism are substantial. China’s “Second Golden Age” saw significant infrastructure investments in 2023, while India’s Cruise Bharat Mission in September 2024 allocates funds to develop world-class ports. Moreover, Jamaica’s US$197.8 million revenue in the 2023/2024 season showcases lucrative prospects for investors.

Export-import dynamics in cruise tourism involve the movement of essential goods and services. Ports like Muscat and regions in China facilitate the import of luxury goods and ship supplies, while exporting local products to international visitors. This flow supports global trade and strengthens economic ties, according to industry reports.

Cruise Type Analysis

Ocean Cruise dominates with 40.5% due to extensive routes and comprehensive service offerings.

The cruise tourism market is segmented primarily by the type of cruise, with Ocean Cruises standing out as the dominant sub-segment. Ocean cruises hold a significant market share of 40.5%, attributed to their ability to offer extensive itineraries covering multiple countries and continents. These cruises cater to a diverse demographic by providing a variety of entertainment options, amenities, and excursion possibilities that appeal to both seasoned and first-time travelers.

River Cruises are favored for their intimate settings and closer proximity to inland attractions, offering passengers a detailed exploration of the cultural and historical landscapes along major waterways.

Luxury Cruises are characterized by their premium services, exclusivity, and personalized experiences, targeting affluent travelers seeking comfort and elegance.

Expedition Cruises are tailored for adventure seekers interested in wildlife tourism and untouched natural environments, often accessing remote locations that are typically unreachable by traditional cruise ships.

The ‘Others’ category includes themed cruises and niche market cruises that cater to specific interests such as culinary arts, music tourism, and wellness, offering unique and specialized experiences.

Traveler Type Analysis

Group Traveler dominates with 45.8% due to shared experiences and cost-effective solutions.

In the traveler type segment of the cruise tourism market, Group Travelers lead with a market share of 45.8%. This dominance can be attributed to the social aspect of group travel where people find value in shared experiences, which often include comprehensive tour packages and discounts that make traveling in groups cost-effective.

Solo Travelers are a growing segment as cruises offer a safe and engaging way to meet new people while exploring the world.

Families are drawn to cruises because of the wide range of activities suitable for all ages, making it an ideal option for family vacations.

Couples prefer cruises for romantic getaways, offering luxury and relaxation with opportunities for intimate dinners and private excursions.

Age Group Analysis

41–60 Years dominates with 35.2% due to a mix of disposable income and vacation time.

Age demographics within cruise tourism reveal that the 41–60 Years segment leads with 35.2% of the market share. This age group typically possesses higher disposable income and available vacation time, making them prime candidates for multiple cruise offerings ranging from leisurely ocean cruises to adventurous expedition voyages.

The 20–40 Years group includes young professionals and younger families interested in exploring new destinations in a relatively cost-effective and convenient manner.

Below 20 Years are primarily influenced by family vacations where children travel with parents or as part of large family gatherings.

Above 60 Years are attracted by the relaxed pace and high level of service that cruises offer, catering to retirees who prioritize comfort and convenience during their travels.

Key Market Segments

By Cruise Type

- Ocean Cruise

- River Cruise

- Luxury Cruise

- Expedition Cruise

- Others

By Traveler Type

- Solo Traveler

- Group Traveler

- Families

- Couples

By Age Group

- Below 20 Years

- 20–40 Years

- 41–60 Years

- Above 60 Years

Driving Factors

Economic Growth and Technological Innovation Drive Market Growth

The Cruise Tourism Market is experiencing significant growth propelled by several key factors. Increasing disposable income among middle-class consumers has expanded the potential customer base. More individuals can now afford cruise vacations. Additionally, cruise line networks are expanding to emerging destinations. This opens up new travel opportunities and attracts tourists seeking unique experiences.

Advancements in onboard technology also play a crucial role. Improved entertainment systems, better connectivity, and enhanced comfort elevate passenger experiences. Furthermore, the rising popularity of all-inclusive vacation packages simplifies the booking process. These packages offer greater value, making cruises more appealing to a broader audience.

These driving factors collectively contribute to the market’s expansion. They make cruise vacations more accessible, enjoyable, and varied. As consumers seek both value and unique experiences, cruise lines are well-positioned to capitalize on these trends. This drives sustained growth in the industry.

Restraining Factors

Environmental and Operational Challenges Restrain Market Growth

Despite the positive outlook, the Cruise Tourism Market faces several restraining factors. Environmental concerns and regulatory restrictions are significant obstacles. Increasing scrutiny on emissions and waste management requires cruise lines to invest heavily in sustainable practices.

High operational costs also pose a challenge. Fuel prices and maintenance expenses are rising, coupled with economic fluctuations. These factors can reduce profitability and limit expansion efforts. Health and safety concerns, particularly after global health crises, have led to stricter regulations. This heightens consumer apprehension, impacting booking rates and operational stability.

Additionally, limited accessibility to remote destinations restricts cruise lines’ ability to diversify itineraries. This makes it harder to attract adventurous travelers. These challenges collectively create barriers that can slow down market growth. They increase operational complexities and costs.

Growth Opportunities

Sustainable Practices and Digital Innovation Provide Opportunities

The Cruise Tourism Market is poised for significant opportunities driven by emerging trends and strategic initiatives. Developing eco-friendly and sustainable cruise practices addresses growing environmental concerns. This allows cruise lines to attract environmentally conscious travelers and comply with stricter regulations.

Integration of personalized services through digital innovations enhances the customer experience. Tailored itineraries, customized onboard activities, and seamless booking processes increase customer satisfaction and loyalty. Expansion into untapped regional markets presents lucrative growth avenues. Cruise operators can diversify their offerings and capture new customer segments.

Additionally, collaboration with travel agencies and online platforms for marketing broadens the reach and visibility of cruise offerings. This facilitates increased bookings and market penetration. These opportunities enable cruise lines to differentiate themselves in a competitive market.

Emerging Trends

Specialized Experiences and Technological Trends Are Latest Trending Factors

The Cruise Tourism Market is evolving with several trending factors shaping its current landscape. The growth of thematic and specialized cruises caters to niche interests. Culinary tours, adventure expeditions, and cultural explorations attract specific traveler segments seeking unique experiences.

Increased demand for luxury and boutique cruise experiences offers high-end services and personalized attention. This appeals to affluent travelers who prioritize comfort and exclusivity. Incorporation of wellness and health programs onboard addresses the rising consumer focus on health and well-being. Amenities like spas, fitness centers, and wellness workshops enhance the overall cruise experience.

Additionally, the adoption of virtual and augmented reality technologies for enhanced entertainment creates immersive experiences. These technologies engage passengers in innovative ways and differentiate cruise offerings from competitors. These trending factors collectively drive the market by aligning cruise offerings with current consumer preferences and technological advancements.

Regional Analysis

North America Dominates with Major Market Share

North America leads the Cruise Tourism Market with a significant share. This dominance is bolstered by a mature tourism infrastructure, a large fleet of cruise ships, and high disposable income among travelers. The region is also home to some of the world’s leading cruise lines, which offer a wide range of itineraries appealing to both domestic and international tourists.

The market’s strength in North America is further supported by innovative cruise experiences, such as themed cruises and adventure cruises, along with strong marketing strategies aimed at attracting a diverse audience. Additionally, the presence of numerous tourist attractions along the coasts and good air connectivity enhances the accessibility of cruise ports.

The future of North America’s influence in the cruise tourism market looks promising due to the increasing interest in unique travel experiences, such as eco-tourism and cultural tourism, which can be effectively integrated into cruise itineraries. The ongoing investments in port infrastructure and the rising popularity of river cruises are expected to further drive market growth in the region.

Regional Mentions:

- Europe: Europe is a significant player in the Cruise Tourism Market, known for its rich cultural heritage and scenic cruise routes. The region’s extensive history and numerous coastal cities make it an attractive destination for cruisers looking for a blend of leisure and exploration.

- Asia Pacific: Asia Pacific is experiencing rapid growth in the Cruise Tourism Market, driven by the increasing affluence of consumers and the development of maritime infrastructure. Countries like China and Australia are investing heavily in cruise facilities to attract large vessels and more tourists.

- Middle East & Africa: Middle East & Africa are emerging in the cruise tourism sector with luxury offerings and unique destinations. The development of new ports in the UAE and improved tourism policies are positioning the region as a luxury cruise hub.

- Latin America: Latin America is gradually enhancing its position in the Cruise Tourism Market with its diverse landscapes and cultural richness. Countries like Brazil and Argentina are improving their port facilities to cater to larger ships and more tourists, tapping into the cruise market potential.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The cruise tourism market is driven by a few dominant players that account for a significant share of global operations. The leading companies in the market include Carnival Corporation & plc, Royal Caribbean International, Norwegian Cruise Line, and MSC Cruises. These key players leverage large fleets, strong brand portfolios, and extensive geographic reach to maintain market dominance.

Carnival Corporation & plc leads the market with its diversified portfolio of cruise lines, including Princess Cruises, Holland America Line, and Seabourn. It targets a broad audience, from budget-friendly travelers to luxury-seeking customers. Carnival invests heavily in innovation, sustainability, and new ship launches to attract new travelers.

Royal Caribbean International focuses on unique onboard experiences, including high-tech amenities and adventure-oriented services. Its emphasis on family-friendly and luxury cruising appeals to diverse consumer groups. Strategic partnerships and fleet expansion further support its strong market position.

Norwegian Cruise Line is recognized for its “Freestyle Cruising” model, allowing travelers greater flexibility. The company also emphasizes destination-focused itineraries and premium offerings. Investments in eco-friendly ships and advanced technologies position it as a sustainable choice.

MSC Cruises has rapidly grown with a focus on European markets and emerging regions like Asia. It emphasizes Mediterranean-style luxury and state-of-the-art ships. MSC is expanding its fleet and investing in sustainable practices, such as reducing carbon emissions.

The top four players differentiate themselves through brand recognition, extensive route networks, and innovation. These companies dominate key markets such as North America, Europe, and the Caribbean. Their ability to adapt to customer preferences and trends, including eco-tourism and personalized experiences, ensures sustained market leadership.

Major Companies in the Market

- Carnival Corporation & plc

- Royal Caribbean International

- Norwegian Cruise Line

- MSC Cruises

- Princess Cruises

- Holland America Line

- Celebrity Cruises

- Disney Cruise Line

- Seabourn Cruise Line

- Silversea Cruises

- PONANT

- AmaWaterways

- Ambassador Cruise Holidays Limited

Latest Advancements

- Disney Cruise Line: On December 2024, Disney announced a substantial investment of $12 billion to expand its cruise fleet from six to thirteen ships by 2031. This strategic move aims to tap into the growing demand for immersive cruise experiences, particularly among affluent travelers. The expansion includes ventures into the Asian market, with the “Disney Adventure” ship set to launch in Singapore in 2025, targeting travelers from India, Indonesia, and Malaysia.

- Carnival Corporation: On December 2024, Carnival Corporation reported robust financial results for the fiscal fourth quarter, achieving a net income of $303 million, a significant turnaround from a loss in the previous year. Revenue reached $5.94 billion, with earnings per share (EPS) of $0.14, surpassing analysts’ expectations. The company also noted record levels of bookings and occupancy rates, with strong future booking volumes extending into 2025 and 2026.

- Major Cruise Operators: On October 2024, major cruise operators, including Royal Caribbean, Carnival, and Norwegian, have been investing significantly in developing private islands to enhance guest experiences and boost revenue. These private destinations offer exclusive amenities, allowing cruise lines to retain more revenue by avoiding certain port fees and taxes.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Billion Forecast Revenue (2033) USD 21.7 Billion CAGR (2024-2033) 12.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cruise Type (Ocean Cruise, River Cruise, Luxury Cruise, Expedition Cruise, Others), By Traveler Type (Solo Traveler, Group Traveler, Families, Couples), By Age Group (Below 20 Years, 20–40 Years, 41–60 Years, Above 60 Years) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Carnival Corporation & plc, Royal Caribbean International, Norwegian Cruise Line, MSC Cruises, Princess Cruises, Holland America Line, Celebrity Cruises, Disney Cruise Line, Seabourn Cruise Line, Silversea Cruises, PONANT, AmaWaterways, Ambassador Cruise Holidays Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Carnival Corporation & plc

- Royal Caribbean International

- Norwegian Cruise Line

- MSC Cruises

- Princess Cruises

- Holland America Line

- Celebrity Cruises

- Disney Cruise Line

- Seabourn Cruise Line

- Silversea Cruises

- PONANT

- AmaWaterways

- Ambassador Cruise Holidays Limited