Global Synthetic Ropes Market Size, Share Analysis Report By Type (Polypropylene, Polyester, Nylon, Polyethylene, Specialty Fibers, Others), By End Use (Marine and Fishing, Mining, Oil and Gas, Sports, Building and Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153267

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

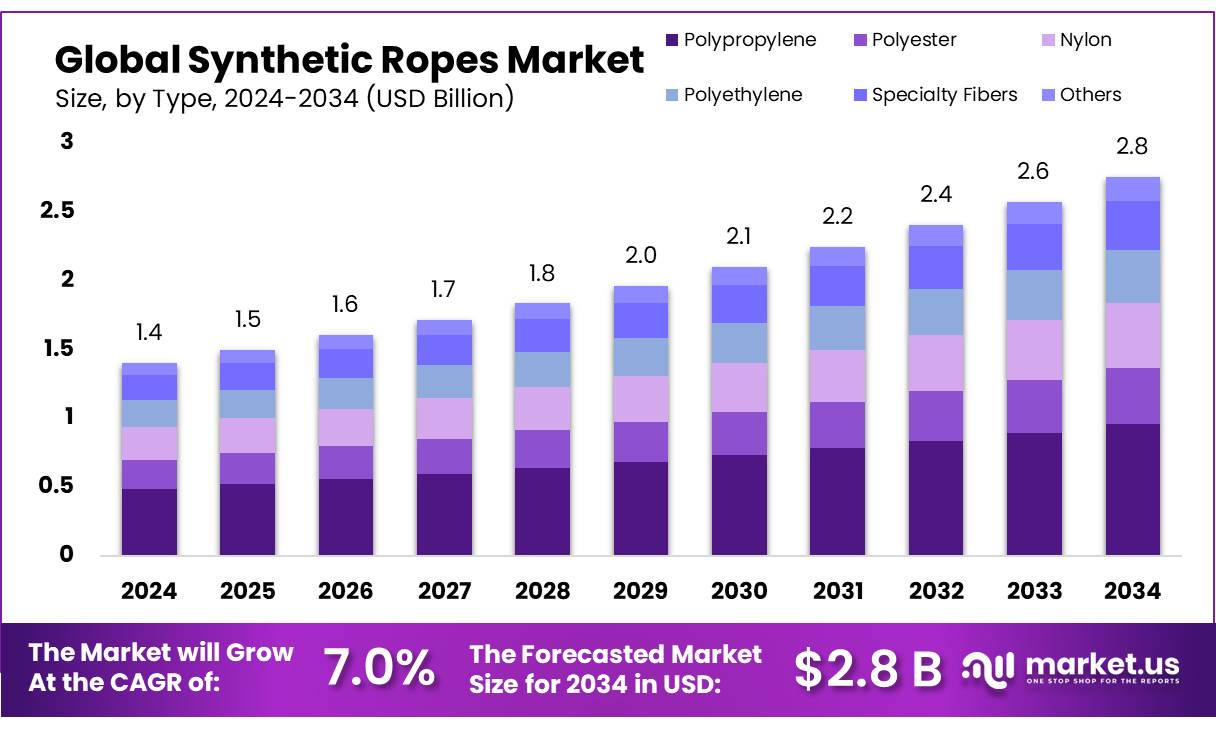

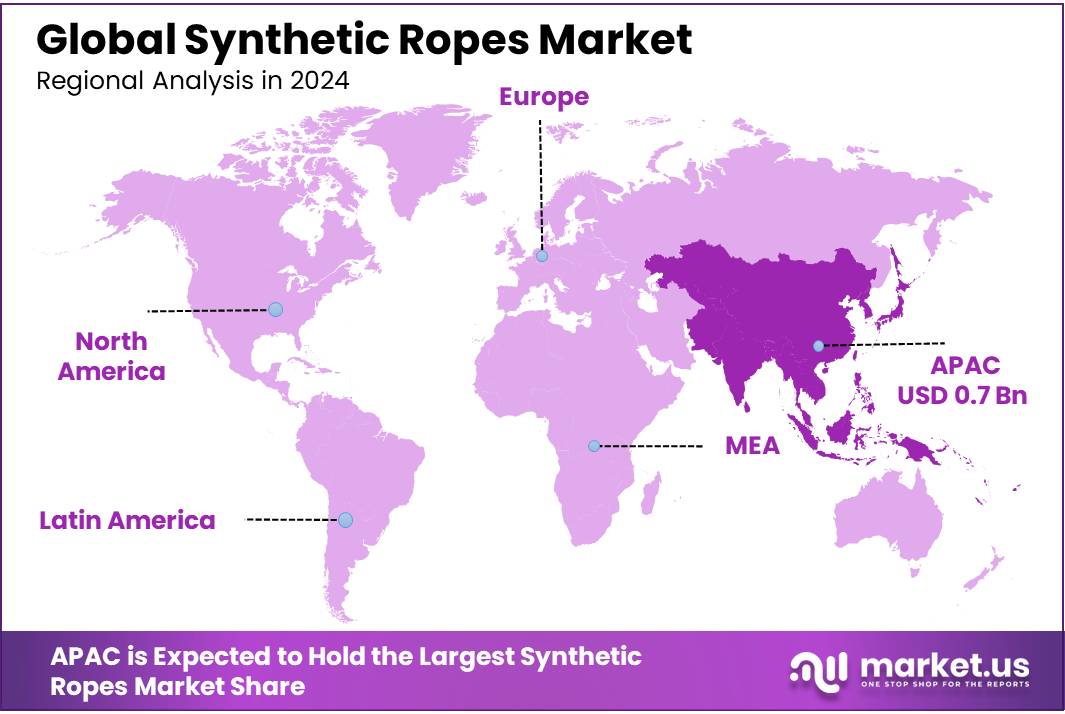

The Global Synthetic Ropes Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 52.7% share, holding USD 0.7 Billion revenue.

The synthetic rope concentrate industry involves the production and processing of high-performance polymer-based fibers—such as polypropylene, polyester, nylon, polyethylene, and specialty fibers—for use in rope manufacturing. These concentrates serve as essential feedstocks that provide critical performance attributes like superior tensile strength, UV resistance, chemical durability, and abrasion resistance, making them integral to the quality and reliability of synthetic ropes.

Synthetic ropes, made using these advanced concentrates, are rapidly replacing traditional natural fiber and steel ropes across multiple sectors. Their lightweight nature, combined with enhanced flexibility and strength, makes them particularly suitable for demanding applications in marine operations, construction, oil and gas, and industrial lifting. As industries increasingly prioritize safety, efficiency, and durability, the demand for synthetic ropes—and consequently synthetic rope concentrates—is witnessing consistent growth.

The Indian government has introduced several initiatives to bolster the growth of the synthetic rope industry. One such effort is the Mega Integrated Textile Region and Apparel (PM MITRA) scheme, launched in 2021, which aims to establish seven integrated textile parks across the country. With a total investment of ₹4,445 crore, this scheme is intended to promote sustainable development and enhance the global competitiveness of India’s textile sector, including the production of synthetic ropes.

In addition to infrastructure development, support is also extended through export facilitation. The Synthetic and Rayon Textile Export Promotion Council (SRTEPC) plays a vital role by offering financial assistance under the Market Development Assistance (MDA) scheme. This support helps exporters of synthetic textiles, including synthetic ropes, access international markets, thereby contributing to the sector’s overall growth and global outreach.

The surge in demand for synthetic ropes is attributed to their superior strength-to-weight ratio, durability, and resistance to environmental factors such as UV radiation and chemicals. These properties make them ideal for applications in marine and fishing, oil and gas, construction, and sports and leisure industries. Notably, India’s inland waterway and smart port projects contributed to an 18% year-over-year increase in synthetic rope demand in 2023.

Technological advancements have also played a crucial role in the industry’s expansion. The development of high-performance fibers such as Dyneema and Kevlar has enhanced the strength and durability of synthetic ropes, making them suitable for demanding applications in offshore oil and gas operations, heavy lifting, and rescue missions. These innovations have contributed to the growing preference for synthetic ropes over traditional materials.

Key Takeaways

- The global Synthetic Ropes Market is projected to reach USD 2.8 billion by 2034, rising from USD 1.4 billion in 2024, with a compound annual growth rate (CAGR) of 7.0% during the forecast period.

- Polypropylene emerged as the leading material type, accounting for over 34.7% of the total synthetic ropes market share globally.

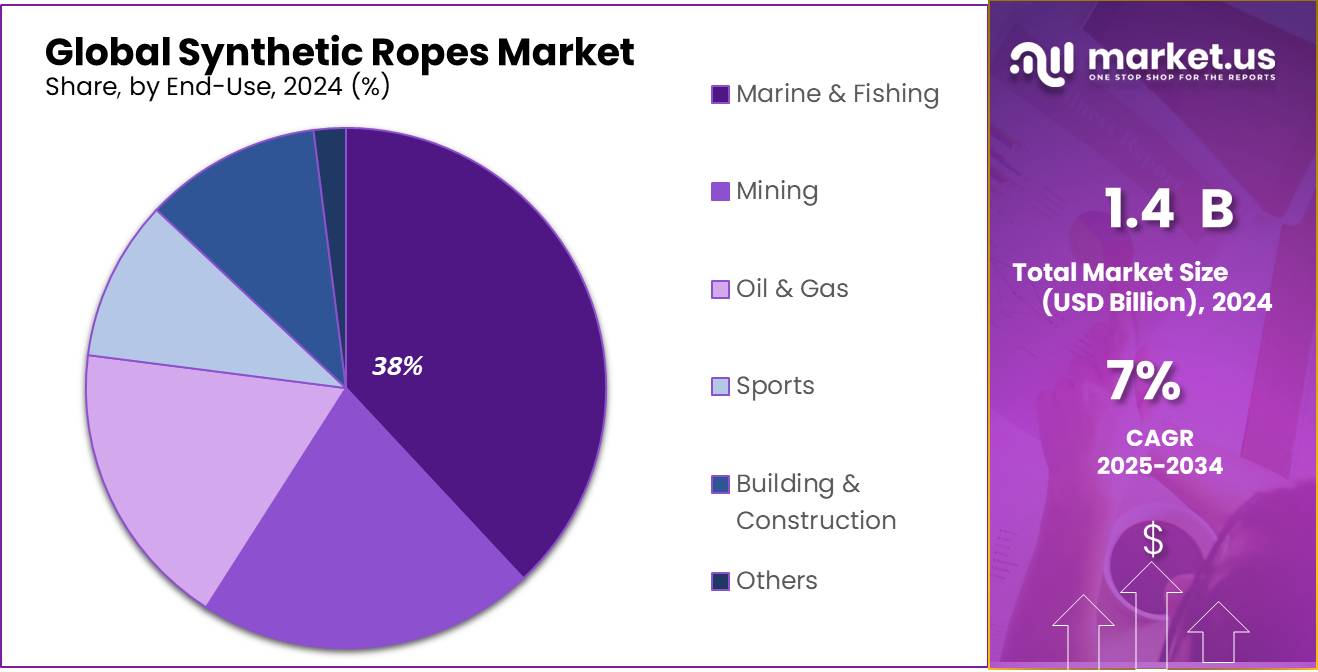

- The Marine & Fishing sector dominated the application segment, representing more than 38.1% of the global market demand for synthetic ropes.

- The Asia-Pacific (APAC) region led the global market with a 52.7% share, amounting to approximately USD 0.7 billion in market value in 2024.

By Type Analysis

Polypropylene dominates with 34.7% share in 2024 due to its lightweight, strength, and affordability.

In 2024, Polypropylene held a dominant market position, capturing more than a 34.7% share of the global synthetic ropes market. This leading share was primarily driven by the material’s excellent balance of strength, low weight, and cost-effectiveness, making it highly suitable for marine, fishing, and industrial applications. Polypropylene ropes are known for their resistance to water, mildew, and most chemicals, which adds to their popularity in outdoor and harsh environments. Their floating property makes them especially preferred in aquaculture and boating sectors. Additionally, in regions with rising coastal economies, such as Southeast Asia and parts of South America, the demand for affordable and durable synthetic ropes like polypropylene has been rising steadily.

By End Use Analysis

Marine & Fishing leads with 38.1% share in 2024 driven by strong coastal activities and global seafood demand.

In 2024, Marine & Fishing held a dominant market position, capturing more than a 38.1% share in the global synthetic ropes market. This leading role was mainly due to the continuous expansion of the global fishing industry, particularly in countries with long coastlines and strong maritime economies. Synthetic ropes such as polypropylene and polyester are widely used in fishing nets, mooring lines, and towing operations because they are lightweight, resist saltwater corrosion, and last longer than traditional materials.

Additionally, commercial fishing fleets and marine transport operations have increasingly adopted synthetic ropes to reduce downtime and maintenance costs. In 2025, the segment is expected to maintain its growth momentum as sustainable fishing practices and international seafood trade continue to expand.

Key Market Segments

By Type

- Polypropylene

- Polyester

- Nylon

- Polyethylene

- Specialty Fibers

- Others

By End Use

- Marine & Fishing

- Mining

- Oil & Gas

- Sports

- Building & Construction

- Others

Emerging Trends

Integration of Synthetic Ropes in Offshore Wind Energy Projects

A significant trend in the synthetic ropes industry is their increasing integration into offshore wind energy projects. These projects require durable, lightweight materials capable of withstanding harsh marine environments, making synthetic ropes an ideal choice for applications such as mooring, towing, and securing equipment. Their superior strength-to-weight ratio and resistance to corrosion and UV degradation make them more suitable than traditional steel ropes in offshore wind installations.

For instance, the UK government has reformed its Contracts for Difference (CfD) scheme to accelerate the deployment of clean energy projects, particularly offshore wind. The revised scheme aims to increase offshore wind capacity from around 15 GW to 43-50 GW by 2030, extending contract lengths for offshore wind projects from 15 to 20 years to provide greater financial certainty for investors . This expansion is expected to drive demand for materials like synthetic ropes, which are essential for the construction and maintenance of offshore wind farms.

Similarly, in the United States, the Department of Energy has funded projects to support the development of offshore renewable energy, including research to improve the reliability and environmental compatibility of mooring systems used in offshore wind installations . These initiatives highlight the growing recognition of the importance of high-performance materials, such as synthetic ropes, in the advancement of offshore wind energy infrastructure.

The adoption of synthetic ropes in offshore wind energy projects not only enhances the efficiency and safety of installations but also aligns with global efforts to transition to renewable energy sources. As governments continue to invest in offshore wind energy, the demand for synthetic ropes is expected to rise, presenting significant growth opportunities for the industry.

Drivers

Growing Demand in Maritime and Offshore Industries

The global demand for synthetic ropes is driven by the increasing need for lightweight, durable, and high-strength materials, particularly in industries like maritime, offshore oil, and gas. Synthetic ropes are often preferred over traditional materials due to their superior properties, including resistance to abrasion, UV radiation, and moisture. This makes them ideal for use in harsh environments such as those found in marine applications.

According to the International Maritime Organization (IMO), the number of vessels in the global fleet has grown by approximately 2.5% annually, fueling the need for high-quality ropes that can withstand demanding conditions. In the offshore sector, synthetic ropes are essential for deep-sea oil and gas exploration, where they are used in applications such as mooring systems, lifting, and towing operations. The offshore oil and gas industry, which is valued at US$ 40 billion globally, continues to expand, and synthetic ropes are becoming the go-to solution due to their strength and ability to function in extreme conditions.

Governments have also played a role in fostering the use of synthetic ropes. For example, in 2022, the European Union introduced several maritime safety regulations that call for the use of more reliable and environmentally friendly materials in shipping and offshore projects. These initiatives are likely to contribute to the growing adoption of synthetic ropes, as industries seek to meet stricter environmental standards while improving safety.

The versatility of synthetic ropes in multiple industries, including construction, fishing, and rescue operations, further strengthens their market position. As global industries continue to expand and embrace sustainable solutions, synthetic ropes are expected to see a rise in demand, helping companies improve safety and performance in their operations.

Restraints

High Initial Cost of Synthetic Ropes

One of the major challenges facing the synthetic ropes market is the high initial cost of these materials compared to traditional alternatives, such as steel ropes or natural fiber ropes. While synthetic ropes offer several advantages, including better durability and performance in harsh environments, their higher manufacturing cost can limit adoption, particularly among small and medium-sized enterprises (SMEs) that operate under tight budget constraints.

According to data from the International Labour Organization (ILO), the cost of synthetic ropes can be up to 30% higher than steel or natural fiber ropes, depending on the material used. This price discrepancy often deters companies, especially in emerging markets, from transitioning to synthetic alternatives despite their long-term benefits. In industries like agriculture, construction, and fishing, where ropes are used extensively, the upfront cost remains a significant barrier.

Additionally, the production of synthetic ropes relies on advanced materials like high-density polyethylene (HDPE) and polyamide, which require specialized manufacturing processes. These processes are more expensive than those used for steel or natural fiber ropes, contributing to the overall higher cost. Government initiatives aimed at promoting the use of synthetic materials in key industries have been somewhat limited, and financial incentives to offset the high costs remain scarce.

The higher cost factor can also be seen in the food industry, where the use of synthetic ropes for packaging or lifting has not yet gained widespread adoption due to financial concerns. According to the Food and Agriculture Organization (FAO), industries in the food sector often prioritize cost-effective solutions, leading them to favor traditional ropes that are less expensive despite their shorter lifespan.

Opportunity

Expansion of Synthetic Ropes in Renewable Energy Sector

One of the most promising growth opportunities for synthetic ropes lies in the expanding renewable energy sector, particularly in offshore wind farms. As the world shifts toward sustainable energy, the need for durable and reliable materials for offshore installations has surged. Synthetic ropes, due to their lightweight, high-strength properties, are gaining popularity for use in the construction and maintenance of offshore wind turbines.

According to the International Renewable Energy Agency (IRENA), the global offshore wind capacity is projected to grow from 35 GW in 2020 to 234 GW by 2030, representing a significant increase in demand for materials like synthetic ropes. These ropes are used for various applications, including mooring systems, lifting, and securing equipment during installation. Their resistance to corrosion, abrasion, and UV damage makes them ideal for the harsh marine environment, where traditional steel cables are prone to degradation.

Government initiatives have been a key driver in this market. The European Union, for example, has committed to investing over €26 billion in offshore wind energy projects by 2026, as part of its Green Deal to achieve net-zero emissions by 2050. This push for renewable energy has led to a growing need for high-performance materials, with synthetic ropes being a crucial component in these large-scale projects. In the United States, the Biden administration has set ambitious targets to develop 30 GW of offshore wind capacity by 2030, further fueling demand for synthetic ropes in the renewable energy industry.

Regional Insights

Asia-Pacific dominates the synthetic ropes market with 52.7% share, reaching USD 0.7 billion in 2024, led by strong marine, construction, and industrial demand.

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global synthetic ropes market, accounting for over 52.7% of total market share and reaching a value of approximately USD 0.7 billion. This leadership is largely attributed to the region’s well-established maritime economy, rapid industrialization, and robust growth in construction, shipping, and aquaculture sectors. Countries such as China, India, Japan, South Korea, and Indonesia are major contributors, collectively driving demand for synthetic ropes due to their expanding port activities, fisheries, and infrastructure development.

China, being the world’s largest fishing nation and a leading shipbuilding hub, significantly fuels polypropylene and polyester rope consumption. In India, growing investments in coastal shipping and inland waterways under initiatives like Sagarmala have amplified the use of durable synthetic ropes for mooring and towing operations.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Atlantic Braids is a leading manufacturer of synthetic ropes, known for producing high-quality products for various industries, including marine, fishing, and industrial applications. The company specializes in custom ropes, offering solutions tailored to client needs. Its advanced manufacturing techniques and focus on durability and strength make it a preferred supplier for heavy-duty applications. Atlantic Braids also emphasizes sustainability, using eco-friendly materials and processes in its production.

Axiom Cordages Limited is a well-established company offering a wide range of synthetic ropes for marine, offshore, and industrial sectors. Known for its innovation, the company specializes in manufacturing ropes that are lightweight, strong, and resistant to harsh environmental conditions. Axiom Cordages is recognized for its commitment to quality, providing customized rope solutions to meet specific project needs. Its products are trusted in high-performance applications across global industries, enhancing safety and operational efficiency.

Cancord Ropes Inc. is a prominent manufacturer of synthetic ropes, specializing in high-performance solutions for marine, oil & gas, and industrial applications. With a focus on delivering high-quality, reliable products, Cancord Ropes serves clients globally, offering a wide range of rope sizes, materials, and designs. The company is committed to meeting industry standards, ensuring the safety and efficiency of its ropes for critical applications in challenging environments, such as offshore drilling and commercial fishing.

Top Key Players Outlook

- Atlantic Braids

- Axiom Cordages Limited

- Bridon-Bekaert

- Cancord Ropes Inc.

- Cortland International

- DSR Corp.

- English Braids Ltd.

- Katradis Marine Ropes Ind. S.A.

- Kennedy Wire Rope & Sling

- Koronakis SA

- LANEX a.s.

- MAGENTO, INC.

- Marlow Ropes

- Novatec Braids, Ltd.

- Parker Hannifin Corporation

Recent Industry Developments

In 2024, Bridon-Bekaert Ropes Group reported €552 million in sales, down slightly from €589 million in 2023, but synthetic rope specifically showed strong organic gains within a challenging market.

In 2024, Atlantic-Braids reported serving over 40 years of rope expertise, manufacturing high-performance braided synthetic ropes used by industries such as marine, rescue, military, and even aerospace. The Canada-based firm employs approximately nine staff at its ISO 9001:2015-certified facility in Ontario.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 2.8 Bn CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polypropylene, Polyester, Nylon, Polyethylene, Specialty Fibers, Others), By End Use (Marine and Fishing, Mining, Oil and Gas, Sports, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlantic Braids, Axiom Cordages Limited, Bridon-Bekaert, Cancord Ropes Inc., Cortland International, DSR Corp., English Braids Ltd., Katradis Marine Ropes Ind. S.A., Kennedy Wire Rope & Sling, Koronakis SA, LANEX a.s., MAGENTO, INC., Marlow Ropes, Novatec Braids, Ltd., Parker Hannifin Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Atlantic Braids

- Axiom Cordages Limited

- Bridon-Bekaert

- Cancord Ropes Inc.

- Cortland International

- DSR Corp.

- English Braids Ltd.

- Katradis Marine Ropes Ind. S.A.

- Kennedy Wire Rope & Sling

- Koronakis SA

- LANEX a.s.

- MAGENTO, INC.

- Marlow Ropes

- Novatec Braids, Ltd.

- Parker Hannifin Corporation