Global Synchrophasor Market Size, Share Analysis Report By Component (Hardware, Software), By Application (Fault Analysis, State Estimation, Stability Monitoring, Power System Control, Operational Monitoring, Improve Grid Visualization, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146140

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

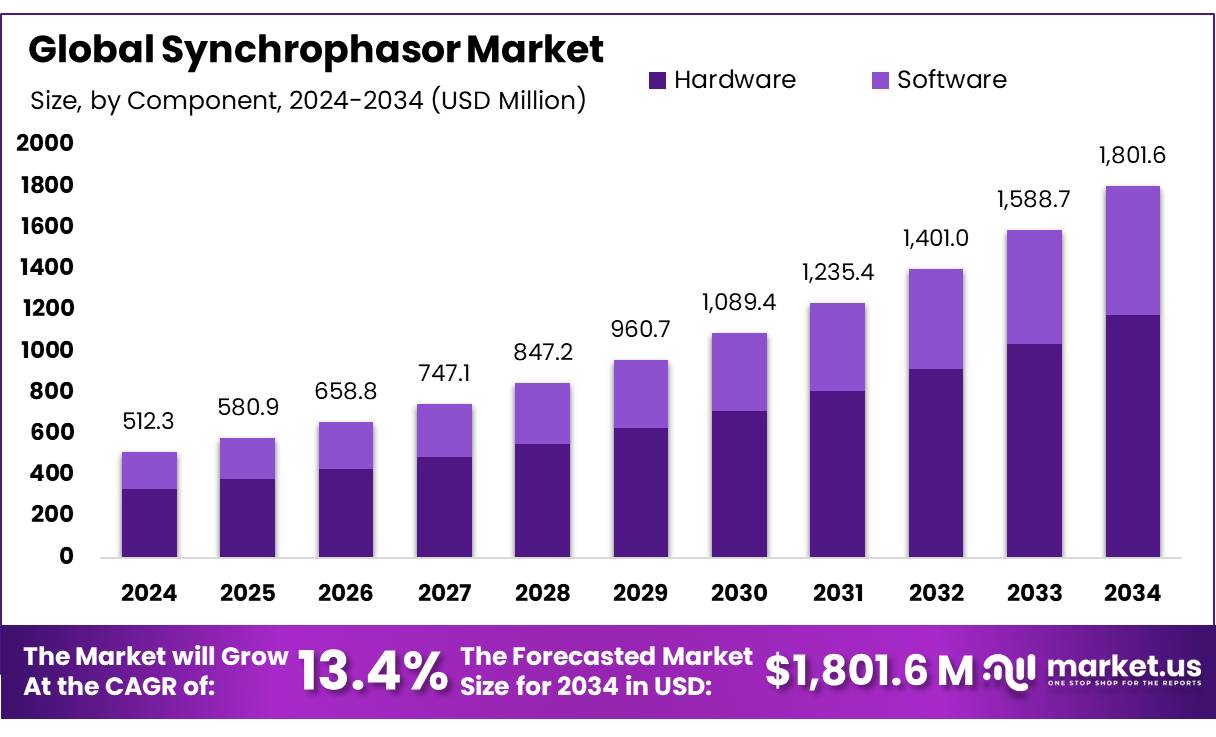

The Global Synchrophasor Market size is expected to be worth around USD 1801.6 Mn by 2034, from USD 512.3 Mn in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034.

Synchrophasors, or Phasor Measurement Units (PMUs), are advanced devices that provide real-time, time-synchronized measurements of electrical waves on power grids. These measurements are crucial for monitoring grid stability, detecting faults, and enhancing the overall reliability of power systems. Unlike traditional SCADA systems that report data every few seconds, synchrophasors can provide data 30 to 60 times per second, offering a more granular view of grid dynamics.

For instance, the U.S. Department of Energy (DOE) has been instrumental in promoting synchrophasor technology through initiatives like the Smart Grid Investment Grant (SGIG) program, which allocated USD 4.5 billion to modernize the nation’s electric grid. This funding facilitated the deployment of PMUs across various utilities, enhancing real-time monitoring capabilities.

In India, the adoption of synchrophasor technology is being propelled by government initiatives aimed at enhancing grid reliability and integrating renewable energy. The Unified Real Time Dynamic State Measurement (URTDSM) project, under the Ministry of Power’s Smart Grid initiatives, involves the installation of approximately 1,400 PMUs across the country, with 34 control centers to facilitate wide-area monitoring . This large-scale deployment underscores India’s commitment to leveraging advanced technologies for grid modernization.

Several factors are driving the growth of the synchrophasor market. The increasing complexity of power grids, due to the integration of variable renewable energy sources like wind and solar, necessitates advanced monitoring tools. Synchrophasors enable operators to detect and respond to grid disturbances promptly, ensuring stability and preventing outages. Additionally, the rising demand for electricity, coupled with the need for efficient transmission and distribution, underscores the importance of real-time grid monitoring solutions.

Future growth opportunities in the synchrophasor market are abundant. The integration of synchrophasor data with big data analytics, artificial intelligence (AI), and machine learning (ML) can provide deeper insights into grid operations, enabling predictive maintenance and optimized performance.

Key Takeaways

- Synchrophasor Market size is expected to be worth around USD 1801.6 Mn by 2034, from USD 512.3 Mn in 2024, growing at a CAGR of 13.4%.

- Hardware segment solidified its lead in the synchrophasor market, capturing an impressive 65.3% share.

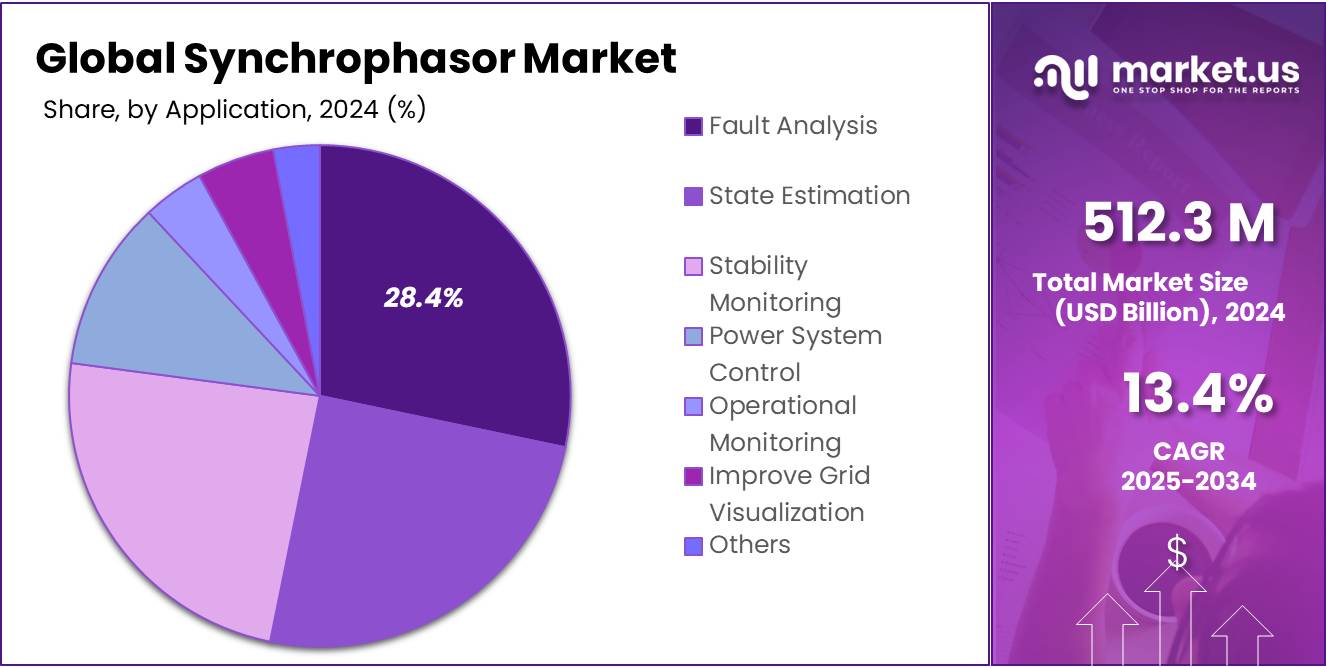

- Fault analysis emerged as a leading application in the synchrophasor market, securing a 28.4% share.

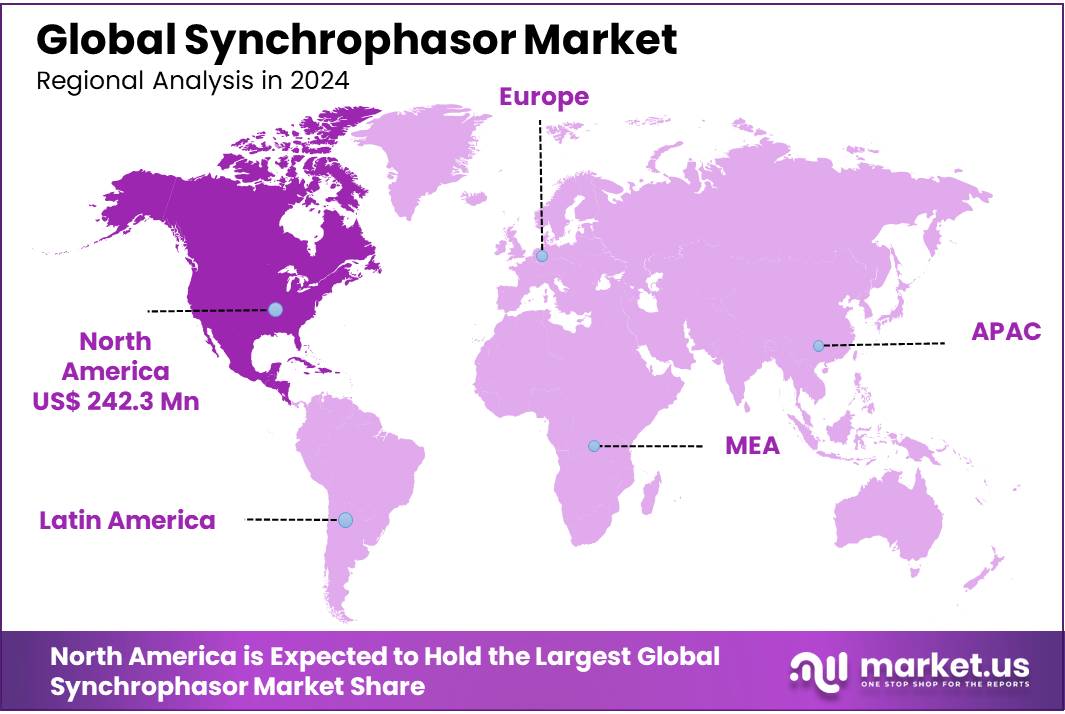

- North America emerged as the dominant region in the global synchrophasor market, capturing a substantial 47.7% share, equivalent to USD 242.3 million.

Analysts’ Viewpoint

Investment Landscape in the Synchrophasor Market

From an investment perspective, the synchrophasor market presents substantial growth opportunities, driven by the global push towards grid modernization and the integration of renewable energy sources. This growth is underpinned by increasing investments in smart grid infrastructure and the need for real-time monitoring to enhance grid reliability and efficiency. However, investors should be cognizant of potential risks, including high initial deployment costs, interoperability challenges, and cybersecurity concerns associated with the integration of advanced monitoring systems.

Consumer insights indicate a growing demand for reliable and efficient power transmission, particularly in regions experiencing rapid urbanization and industrialization. Utilities and grid operators are increasingly adopting synchrophasor technology to manage the complexities introduced by distributed energy resources and to mitigate the risks of power outages. Technological advancements, such as the integration of artificial intelligence and machine learning with synchrophasor data, are enhancing predictive maintenance capabilities and operational decision-making.

Regulatory support, exemplified by initiatives like the U.S. Department of Energy’s Smart Grid Investment Grant program, which allocated USD 4.5 billion for grid modernization efforts , further bolsters the market’s growth prospects. As the energy sector continues to evolve, investments in synchrophasor technology are poised to yield significant returns, provided that stakeholders effectively navigate the associated challenges.

By Component

Hardware Dominates Synchrophasor Market with 65.3% Share in 2024

In 2024, the hardware segment solidified its lead in the synchrophasor market, capturing an impressive 65.3% share. This significant market dominance can be attributed to the essential role hardware components play in the precise measurement and real-time monitoring of electrical systems. Synchrophasors, primarily consisting of Phasor Measurement Units (PMUs), are crucial for enhancing the reliability and efficiency of the power grid.

Their ability to provide detailed insights into grid conditions and support quicker decision-making processes has made them indispensable in modern energy management practices. As the demand for improved grid stability and efficient energy distribution continues to rise, the hardware segment’s pivotal role ensures its substantial impact on the market’s dynamics.

By Application

Fault Analysis Leads Synchrophasor Applications with 28.4% Market Share in 2024

In 2024, fault analysis emerged as a leading application in the synchrophasor market, securing a 28.4% share. This segment’s prominence is primarily driven by the critical need for precise and swift fault detection in power grids to prevent outages and ensure operational continuity. Synchrophasors provide high-fidelity data that helps in pinpointing the location and nature of faults within the grid, thus facilitating faster restoration and minimizing downtime.

The integration of synchrophasor technology in fault analysis not only enhances the reliability of electrical networks but also supports the maintenance strategies that are vital for modern energy systems. As grids become more complex and laden with renewable energy sources, the role of fault analysis using synchrophasors becomes increasingly crucial, reinforcing its substantial share in the market.

Key Market Segments

By Component

- Hardware

- Software

By Application

- Fault Analysis

- State Estimation

- Stability Monitoring

- Power System Control

- Operational Monitoring

- Improve Grid Visualization

- Others

Drivers

Government Initiatives Fuel Synchrophasor Market Growth

One of the primary drivers of the synchrophasor market is the increasing support from governments worldwide for modernizing electrical grids. These initiatives aim to enhance grid reliability, integrate renewable energy sources, and improve overall energy efficiency.

In the United States, the Department of Energy (DOE) has been at the forefront of promoting synchrophasor technology. Through programs like the Smart Grid Investment Grant (SGIG), the DOE has provided substantial funding to utilities for the deployment of Phasor Measurement Units (PMUs) and related infrastructure. These efforts have significantly improved the real-time monitoring capabilities of the U.S. power grid, allowing for better management of grid stability and quicker response to disturbances.

Similarly, in Europe, the European Union’s Clean Energy Package has set ambitious targets for renewable energy integration and grid modernization. Member states are investing in advanced grid technologies, including synchrophasors, to meet these goals. For instance, Germany and France have initiated projects to deploy PMUs across their transmission networks, enhancing their ability to monitor and control grid operations in real time.

In Asia, countries like India and China are also making significant strides. India’s Unified Real Time Dynamic State Measurement (URTDSM) project has led to the installation of nearly 2,000 PMUs across the country, making it one of the largest synchrophasor deployments globally. This initiative aims to provide comprehensive visibility into the grid’s dynamic behavior, facilitating better decision-making and improved grid reliability.

These government-led initiatives not only provide financial support but also establish regulatory frameworks that encourage the adoption of synchrophasor technology. By prioritizing grid modernization and reliability, governments are creating a conducive environment for the growth of the synchrophasor market.

Restraints

High Implementation Costs Hinder Synchrophasor Adoption

A significant challenge facing the synchrophasor market is the substantial initial investment required for deployment. Phasor Measurement Units (PMUs), essential components of synchrophasor systems, involve considerable costs for procurement, installation, and commissioning. According to the U.S. Department of Energy, the average overall cost per PMU ranges from $40,000 to $180,000, depending on system complexity and infrastructure requirements .

These high costs encompass not only the hardware but also the necessary upgrades to communication networks, data management systems, and cybersecurity measures. For utilities operating with limited budgets, especially in developing regions, these expenses can be prohibitive, delaying or even preventing the adoption of synchrophasor technology.

Furthermore, integrating synchrophasor systems into existing grid infrastructures presents technical challenges. Many utilities operate legacy systems that may not be compatible with the advanced functionalities offered by synchrophasors, necessitating further investments in system upgrades and staff training.

Despite these challenges, the long-term benefits of synchrophasor technology—such as improved grid reliability, enhanced efficiency, and better integration of renewable energy sources—are driving continued interest and investment. However, addressing the high initial costs remains crucial for broader adoption and realization of these benefits.

Opportunity

Integration of Renewable Energy Sources Presents Significant Growth Opportunity for Synchrophasor Market

The increasing integration of renewable energy sources into power grids worldwide presents a substantial growth opportunity for the synchrophasor market. As countries strive to reduce carbon emissions and transition to sustainable energy, the variability and unpredictability of renewable sources like solar and wind pose challenges to grid stability. Synchrophasors, or Phasor Measurement Units (PMUs), provide real-time monitoring and precise measurements of electrical waves, enabling grid operators to manage these fluctuations effectively.

In the United States, the Federal Energy Regulatory Commission (FERC) supports the integration of PMUs for real-time grid monitoring and fault detection, enhancing the reliability of power systems as renewable energy adoption increases. Similarly, the European Union’s Clean Energy for All Europeans Package encourages investments in smart grid technologies, including synchrophasors, to facilitate the integration of renewable energy sources and improve grid resilience.

In Asia, China’s State Grid Corporation is deploying PMUs to improve transmission stability and reduce energy losses, aligning with the country’s goal to increase renewable energy capacity. India’s National Smart Grid Mission also emphasizes the deployment of synchrophasor technology to enhance grid reliability amid growing renewable energy integration.

Trends

AI and Machine Learning Integration: A Transformative Trend in Synchrophasor Technology

In recent years, the integration of artificial intelligence (AI) and machine learning (ML) into synchrophasor technology has emerged as a significant trend, revolutionizing the way power grids are monitored and managed. Synchrophasors, or Phasor Measurement Units (PMUs), provide real-time data on electrical waves, enabling precise monitoring of the power grid. The incorporation of AI and ML enhances the capabilities of these devices, allowing for predictive analytics, automated fault detection, and improved decision-making processes.

For instance, AI algorithms can analyze vast amounts of data generated by PMUs to predict potential system failures before they occur, facilitating proactive maintenance and reducing downtime. Machine learning models can identify patterns and anomalies in the grid’s performance, enabling quicker responses to disturbances and enhancing overall grid stability. This technological advancement is particularly crucial as the energy sector increasingly relies on renewable sources, which can introduce variability and complexity into the grid.

Government initiatives have also recognized the importance of this trend. The U.S. Department of Energy’s Grid Modernization Strategy emphasizes the need for advanced data analytics, including AI and ML, to support robust operational planning and ensure resource adequacy . Such support underscores the critical role that intelligent data analysis plays in modern energy systems.

Regional Analysis

North America Leads Synchrophasor Market with 47.7% Share, Valued at USD 242.3 Million in 2024

In 2024, North America emerged as the dominant region in the global synchrophasor market, capturing a substantial 47.7% share, equivalent to USD 242.3 million. This leadership is primarily attributed to significant investments in grid modernization and the widespread adoption of advanced monitoring technologies. The United States, in particular, has been at the forefront, with initiatives like the U.S. Department of Energy’s Grid Modernization Strategy emphasizing the deployment of Phasor Measurement Units (PMUs) to enhance grid reliability and resilience .

The region’s focus on integrating renewable energy sources has further propelled the demand for synchrophasor technology. As utilities strive to manage the variability of renewables like wind and solar, real-time data provided by synchrophasors becomes essential for maintaining grid stability. Additionally, regulatory bodies such as the Federal Energy Regulatory Commission (FERC) support the integration of PMUs for real-time grid monitoring and fault detection, reinforcing the technology’s adoption.

Canada also contributes significantly to the region’s market share, with utilities investing in synchrophasor deployments to enhance grid performance and reliability. The country’s commitment to clean energy and grid modernization aligns with the broader North American trend of embracing advanced grid technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Ltd. is a major force in the synchrophasor market, offering advanced Phasor Measurement Units (PMUs) and integrated grid solutions. The company focuses on enhancing real-time monitoring and fault detection in electrical systems. With global operations and strong R&D, ABB supports smart grid upgrades and renewable integration. Its synchrophasor technologies are widely adopted across North America and Europe, making it a key enabler of grid modernization and energy efficiency in utility infrastructures.

Arbiter Systems Inc. specializes in high-precision time and frequency standards, critical for synchrophasor performance. The company’s PMU-compatible products are known for their accuracy, helping utilities achieve precise grid monitoring. Arbiter supports real-time analysis and compliance with IEEE standards. Its focus on measurement precision and affordable hardware has earned it recognition, especially in academic, utility, and R&D sectors. The company serves a global client base and continues to expand its footprint in smart grid solutions.

Electric Power Group LLC is widely recognized for its software-based synchrophasor solutions, particularly for grid analytics and visualization. The company develops real-time monitoring systems that help utilities identify and mitigate grid instabilities. Its flagship product, the Grid Real-Time Performance Monitoring (RTPM), is used across U.S. utilities. EPG’s tools enhance grid situational awareness, improve operational reliability, and support wide-area measurement systems (WAMS), making it a key player in digital grid management.

Top Key Players in the Market

- ABB Ltd.

- Alstom Grid

- Arbiter Systems Inc.

- Electric Power Group LLC

- Electro Industries

- FUJI ELECTRIC FRANCE S.A.S.

- General Electric company

- Hitachi Energy

- Macrodyne

- NR Electric Co. Ltd.

- Qualitrol Company LLC (Fortive Corporation)

- Schneider Electric

- Schweitzer Engineering Laboratories

- Siemens Energy

- Toshiba Corporation

- Vizimax Inc.

- Wasion Group Holdings Ltd.

- XJ Electric Co. Ltd

Recent Developments

In 2024, ABB Ltd. solidified its position as a leading player in the synchrophasor market, contributing significantly to the global market’s valuation of approximately USD 380.88 million. ABB’s advanced Phasor Measurement Units (PMUs) and integrated grid solutions have been pivotal in enhancing real-time monitoring and fault detection across electrical systems.

In 2024, Alstom Grid continued to strengthen its presence in the synchrophasor market by delivering advanced grid stability solutions that integrate Phasor Measurement Units (PMUs) with Energy Management Systems (EMS). Notably, Alstom secured a €15 million contract with Terna SpA to modernize Italy’s high-voltage power lines, supplying components essential for grid reliability over a 24-month period.

Report Scope

Report Features Description Market Value (2024) USD 512.3 Mn Forecast Revenue (2034) USD 1801.6 Mn CAGR (2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software), By Application (Fault Analysis, State Estimation, Stability Monitoring, Power System Control, Operational Monitoring, Improve Grid Visualization, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., Alstom Grid, Arbiter Systems Inc., Electric Power Group LLC, Electro Industries, FUJI ELECTRIC FRANCE S.A.S., General Electric company, Hitachi Energy, Macrodyne, NR Electric Co. Ltd., Qualitrol Company LLC (Fortive Corporation), Schneider Electric, Schweitzer Engineering Laboratories, Siemens Energy, Toshiba Corporation, Vizimax Inc., Wasion Group Holdings Ltd., XJ Electric Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- Alstom Grid

- Arbiter Systems Inc.

- Electric Power Group LLC

- Electro Industries

- FUJI ELECTRIC FRANCE S.A.S.

- General Electric company

- Hitachi Energy

- Macrodyne

- NR Electric Co. Ltd.

- Qualitrol Company LLC (Fortive Corporation)

- Schneider Electric

- Schweitzer Engineering Laboratories

- Siemens Energy

- Toshiba Corporation

- Vizimax Inc.

- Wasion Group Holdings Ltd.

- XJ Electric Co. Ltd