Global Sustainable Athleisure Market Size, Share, Growth Analysis By Type (Mass, Premium), By Product (Shirt, Yoga Pant, Leggings, Shorts, Others), By Gender (Men, Women), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146046

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

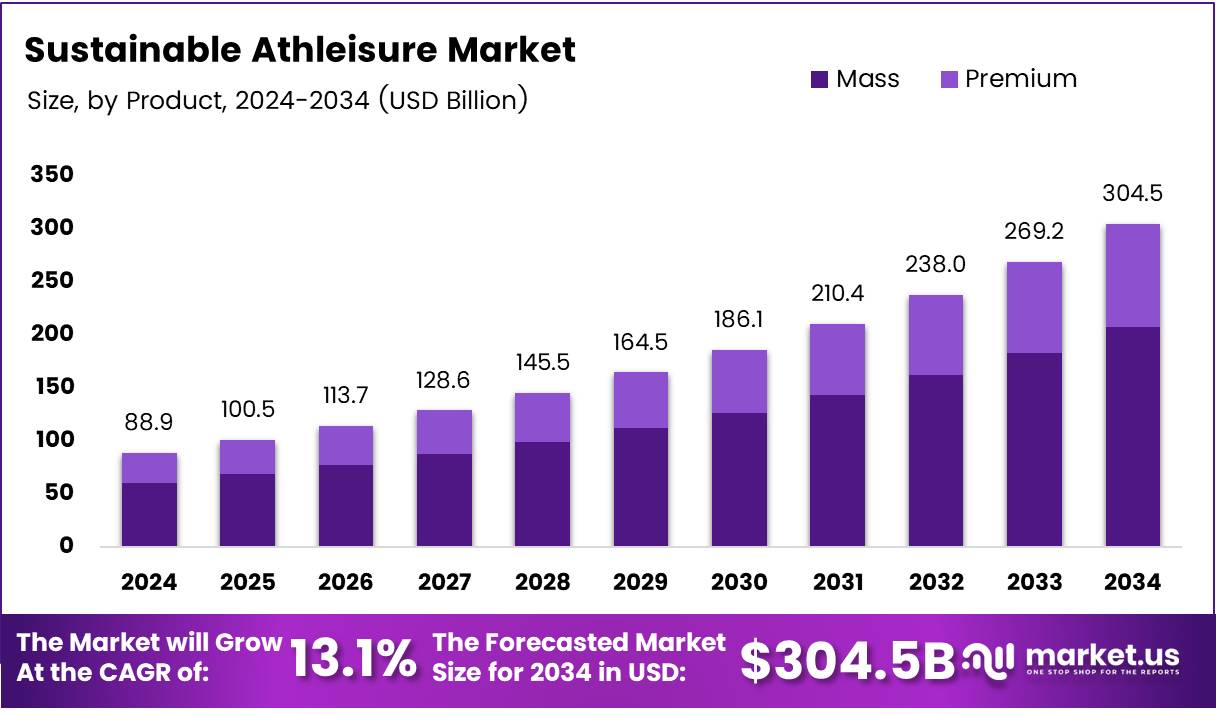

The Global Sustainable Athleisure Market size is expected to be worth around USD 304.5 Billion by 2034, from USD 88.9 Billion in 2024, growing at a CAGR of 13.1% during the forecast period from 2025 to 2034.

The sustainable athleisure market refers to the segment of the apparel industry that blends athletic and casual wear while incorporating environmentally friendly and ethical manufacturing practices. This includes the use of sustainable materials such as organic cotton, recycled polyester, and bamboo fibers, as well as eco-conscious supply chain practices.

The market caters to the growing consumer demand for fashion that aligns with personal health, fitness, and environmental values. As sustainability becomes a key purchasing criterion, this niche has evolved into a dynamic and competitive space, drawing attention from both established apparel brands and emerging eco-conscious startups.

The rise of sustainable athleisure reflects a broader lifestyle shift where consumers prioritize health, convenience, and responsibility. With a strong emphasis on comfort and functionality, sustainable athleisure products have emerged as a symbol of conscious consumption. As per Bamboogetup, 85% of brands are advancing towards the use of more sustainable activewear materials, signaling a significant market pivot.

The trend is no longer niche—it’s mainstream, driven by Gen Z and millennial consumers who actively seek purpose-driven brands. Brands that fail to integrate sustainability into their core offering risk obsolescence as consumer loyalty increasingly hinges on environmental values.

The sustainable athleisure market is experiencing strong momentum, driven by shifting consumer behavior, digital retail evolution, and innovation in sustainable textiles. According to Venuz, athleisure saw an 84% increase in orders since the pandemic began, highlighting a lasting change in wardrobe preferences.

In a competitive landscape, staying fashion-forward is vital—YourView poll reports that 24.4% of consumers prioritize trendy and stylish designs. Simultaneously, functionality remains a key differentiator. According to Lifestylemonitor, 74% of male consumers and 63% of female consumers look for performance features in activewear, pointing to the importance of balancing design and utility.

The sustainable athleisure market is projected to expand rapidly, supported by innovations in bio-based fabrics, circular fashion models, and sustainable supply chain practices. Growth opportunities lie in premium eco-performance wear, personalized digital retail experiences, and localized production models. Governments are increasingly supportive, with investment in green textile technologies and incentives for sustainable manufacturing.

Regulatory frameworks across North America and Europe are tightening, mandating transparency in sourcing and carbon emissions. As sustainability reporting becomes mandatory for fashion brands, early adopters will gain a competitive edge. The market is poised for transformation—one where profitability and planet-positive practices go hand in hand.

Key Takeaways

- Global Sustainable Athleisure Market projected to reach USD 304.5 Billion by 2034, up from USD 88.9 Billion in 2024, growing at a CAGR of 13.1%.

- Mass segment dominated the By Type analysis in 2024 with a 63.4% market share, driven by cost-effectiveness and accessibility.

- Shirts led the By Product segment in 2024, due to their versatile use in workout and casual settings.

- Men held the dominant position in the By Gender analysis in 2024, influenced by rising gym memberships and fitness awareness.

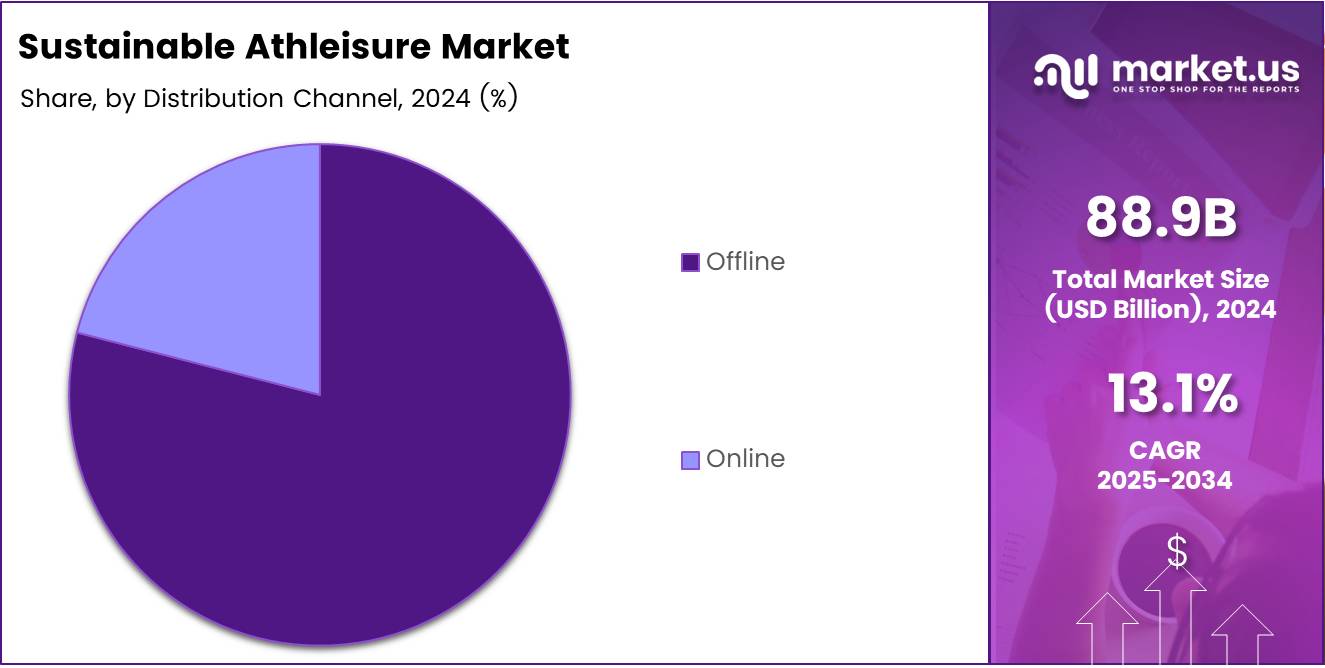

- Offline distribution channels were dominant in 2024, favored for the in-store experience and product trials.

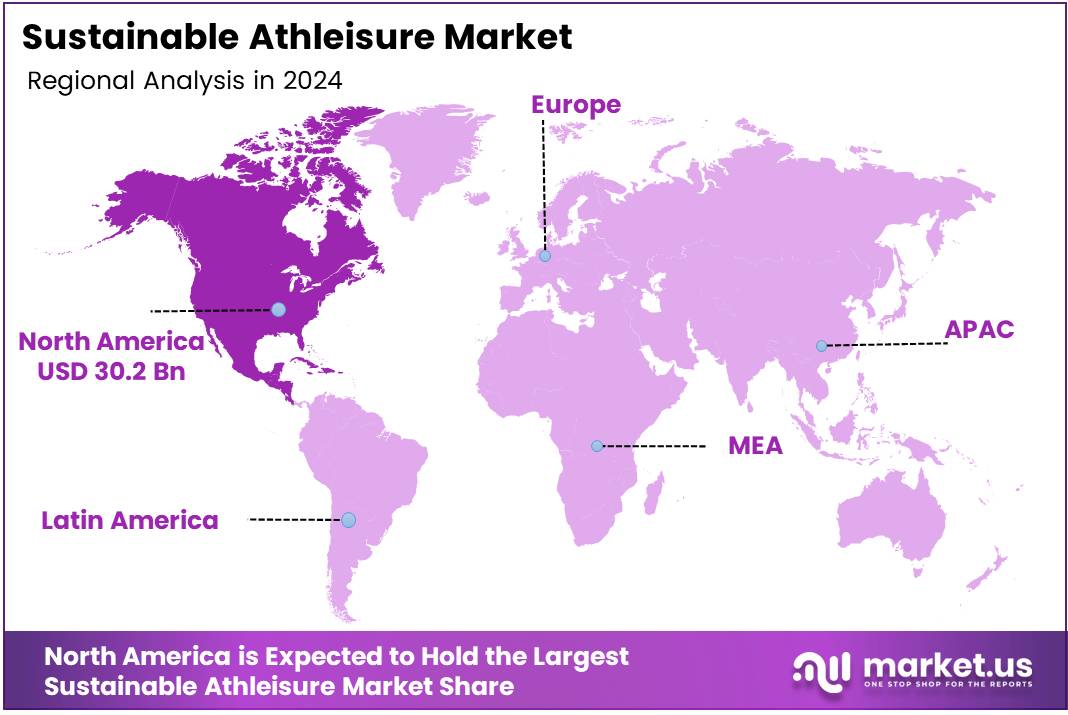

- North America led the global market in 2023 with a 34.1% share, valued at USD 30.2 Billion.

Type Analysis

Mass dominates with 63.4% due to its affordability and broader consumer appeal

In 2024, Mass held a dominant market position in the By Type Analysis segment of the Sustainable Athleisure Market, with a 63.4% share. The high share can be attributed to the cost-effective nature of mass-produced athleisure products, making them more accessible to a larger consumer base. The rising demand for affordable yet sustainable options among middle-income consumers significantly contributed to this segment’s growth.

Premium athleisure, while gaining attention for its quality and brand appeal, has a relatively niche consumer base. It targets health-conscious, fashion-forward consumers willing to invest in durable and ethically-produced activewear. However, due to its higher price points, its adoption remains limited in price-sensitive markets.

Product Analysis

Shirt leads the pack due to its versatility across activities and styles

In 2024, Shirt held a dominant market position in the By Product Analysis segment of the Sustainable Athleisure Market. Shirts have become a staple in both workout and casual settings, driving their popularity. Their universal design, comfort, and adaptability to a wide range of physical and lifestyle activities make them a preferred choice among consumers seeking multifunctional clothing.

Yoga Pants continue to gain traction, particularly among female consumers, driven by the growing culture of yoga and wellness. Their comfort, stretchability, and body-conforming fit enhance their relevance in this space.

Leggings maintain strong demand, especially in cooler climates and for users who prioritize support and coverage. Meanwhile, Shorts appeal to warmer markets and consumers engaging in high-intensity workouts, while the Others category—comprising sports bras, tanks, and hybrid wear—is slowly expanding with the rise of innovative designs.

Gender Analysis

Men remain the leading consumers due to increasing fitness participation

In 2024, Men held a dominant market position in the By Gender Analysis segment of the Sustainable Athleisure Market. A significant surge in gym enrollments, sports participation, and awareness around personal fitness among men contributed to this trend. The demand for performance-oriented, sustainable activewear is particularly strong in urban regions, where male consumers are more brand- and quality-conscious.

Women’s segment, although slightly trailing, is growing rapidly owing to increasing focus on health, body positivity, and the influence of social media. Female consumers are also driving demand for aesthetic yet functional athleisure wear, with brands offering tailored fits and style options to tap into this audience.

Distribution Channel Analysis

Offline channels dominate due to strong consumer preference for trial and feel

In 2024, Offline held a dominant market position in the By Distribution Channel Analysis segment of the Sustainable Athleisure Market. Physical retail stores continue to attract consumers who prefer to touch, try, and experience products before purchase. This trend is particularly relevant in athleisure, where comfort, fit, and material quality are key decision factors.

Moreover, brand-owned outlets and sporting goods chains offer exclusive collections and immersive brand experiences that enhance customer engagement. On the other hand, Online channels are rapidly gaining share, especially among tech-savvy and younger demographics. The convenience, wider selection, and frequent promotional offers make e-commerce a promising channel, particularly in metropolitan regions.

Key Market Segments

By Type

- Mass

- Premium

By Product

- Shirt

- Yoga Pant

- Leggings

- Shorts

- Others

By Gender

- Men

- Women

By Distribution Channel

- Offline

- Online

Drivers

Growing Eco-conscious Mindsets are Reshaping Consumer Choices

The shift towards sustainable living is having a powerful impact on the athleisure market. Today’s consumers are more environmentally aware and are actively looking for products that align with their values. This includes a strong preference for ethically produced clothing made from eco-friendly materials like organic cotton, bamboo, or recycled polyester.

As this awareness spreads, consumers are increasingly willing to pay a premium for products that have a lower environmental impact. Alongside this, the global rise in health, fitness, and wellness trends has created consistent demand for activewear. Activities like yoga, home workouts, and outdoor training require comfortable, durable clothing—making sustainable athleisure a perfect fit.

On the industry side, major sportswear brands are committing to sustainability by investing in green technologies, reducing carbon footprints, and promoting circular fashion practices. Their efforts are setting a precedent and encouraging innovation across the entire market. The combination of consumer behavior shifts and corporate responsibility is creating a solid growth path for the sustainable athleisure industry.

Restraints

High Production Costs Make Eco-friendly Athleisure Less Affordable

While demand is growing, there are still several restraints holding back the sustainable athleisure market. A major hurdle is the high cost of production. Using sustainable materials and ensuring ethical manufacturing often requires more resources, labor, and time, which drives up product prices. As a result, sustainable athleisure products are typically more expensive than conventional activewear, which may discourage price-sensitive consumers. Another limiting factor is the scarcity of sustainably sourced materials in bulk quantities.

Fabrics like recycled polyester, hemp, and organic cotton are not yet available at the scale needed to meet global demand efficiently. This makes it harder for manufacturers to produce sustainable clothing at scale and affects supply chain consistency. Additionally, this limited availability leads to longer production cycles and reduced flexibility for retailers.

These factors combined make it difficult for the sustainable athleisure segment to compete on price and availability with traditional fast fashion or mainstream sportswear brands. Until costs come down and materials become more accessible, these challenges will likely continue to impact market expansion.

Growth Factors

Expanding in Emerging Economies Opens New Doors for Growth

The sustainable athleisure market has promising opportunities for growth, especially in emerging economies. Regions like Asia-Pacific, Latin America, and Africa are witnessing a rapid rise in middle-class populations, urbanization, and disposable income. At the same time, there is a growing cultural interest in fitness and wellness, creating a perfect environment for the expansion of sustainable activewear.

These markets remain relatively untapped and represent an excellent chance for brands to reach new consumers who are increasingly looking for stylish, functional, and environmentally conscious options. Moreover, the integration of smart textiles and eco-friendly materials is unlocking a new wave of innovation. Features such as moisture control, odor resistance, and temperature regulation—when paired with sustainability—appeal to a wide audience of tech-conscious buyers.

Additionally, many sustainable athleisure brands are moving toward direct-to-consumer (DTC) business models. By selling online and cutting out middlemen, these brands can offer premium products at more competitive prices while building stronger customer relationships. This approach also allows brands to respond faster to trends and feedback, giving them a competitive edge in a fast-changing market landscape.

Emerging Trends

Biodegradable Fabrics and Tech Transparency are Leading New Trends

Several trending factors are shaping the future of the sustainable athleisure market. One key trend is the growing use of biodegradable and plant-based fabrics such as bamboo, hemp, and Tencel. These materials not only reduce environmental harm but also offer excellent performance for activewear, including breathability and softness. Consumers are increasingly seeking products that are not just sustainable, but also comfortable and functional, and these fabrics fit the bill perfectly.

Another rising trend is the move toward gender-neutral designs and inclusive sizing. Brands are focusing on creating athleisure collections that embrace diversity, catering to a broader range of body types and gender identities. This inclusivity adds both social and commercial value, appealing to a wider customer base.

On the technology front, blockchain is gaining attention for its role in enhancing supply chain transparency. By using blockchain systems, brands can offer proof of sustainable sourcing, ethical labor practices, and environmental impact—building greater trust with their customers. These trends reflect a maturing market that is not only growing but also evolving in alignment with consumer expectations and technological advances.

Regional Analysis

North America Leads the Sustainable Athleisure Market with 34.1% Share, Valued at USD 30.2 Billion

The global sustainable athleisure market exhibits significant regional dynamics, with North America leading the charge. In 2023, North America accounted for 34.1% of the global market, valued at USD 30.2 billion.

The region is projected to maintain its dominance due to high consumer awareness, a strong presence of established athleisure brands, and a well-developed retail infrastructure that supports the availability of eco-conscious products. The increasing demand for performance wear that aligns with sustainability is driving innovation and growth within the U.S. and Canada.

Regional Mentions:

Europe follows closely, representing a mature and highly sustainability-conscious market. The region benefits from stringent environmental regulations and a strong consumer preference for eco-friendly apparel. Western European nations, particularly the United Kingdom, France, and Germany, play a central role in driving demand for sustainable athleisure, supported by a well-established fashion industry and increasing lifestyle-driven fitness adoption.

Asia Pacific stands out as the fastest-growing region in the sustainable athleisure space. The market is projected to reach USD 36.1 billion by 2030, supported by rising disposable incomes, growing urbanization, and heightened awareness of environmental issues. Countries such as China, India, Japan, and South Korea are witnessing increased demand for sustainable fashion alternatives, spurred by expanding middle-class populations and youth-driven trends.

In Middle East & Africa, the market is gradually evolving, backed by a young and increasingly health-conscious demographic. While still a smaller share globally, this region presents strong future potential as fitness culture and awareness of sustainable consumption continue to rise.

Latin America is experiencing steady growth, fueled by rising health consciousness and the influence of global fashion movements. Brazil and Mexico are among the prominent markets in the region, with increasing consumer openness to green and ethical apparel options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2024, the global sustainable athleisure market continues to evolve rapidly, with several key players shaping its trajectory through innovation, ethical sourcing, and consumer-centric strategies.

EILEEN FISHER stands out for its long-standing commitment to circular fashion and sustainable sourcing. The brand leverages minimalist designs with a focus on organic materials and take-back programs, reinforcing its appeal among environmentally conscious consumers. Its consistent emphasis on transparency and responsible production continues to build strong brand equity in the sustainable fashion segment.

HANESBRANDS INC., a more mass-market player, is making notable strides in integrating sustainability across its supply chain. With initiatives targeting reduced carbon emissions and the use of recycled fibers, the company is positioning itself as a volume-driven leader adapting to greener practices. Its ability to balance affordability with sustainability gives it a competitive edge in reaching a broader demographic.

Vuori, a rising force in the premium athleisure category, combines West Coast aesthetics with ethical manufacturing. Its investment in climate-neutral operations and community-focused initiatives has cemented its role as a lifestyle brand that resonates with younger, values-driven consumers. Vuori’s growth trajectory indicates strong market acceptance and brand loyalty.

Patagonia, Inc. remains a benchmark for sustainable business models. The company’s unwavering dedication to environmental activism, durable product design, and regenerative practices sets a high standard within the athleisure segment. Its strong brand advocacy continues to influence both consumer behavior and industry practices.

adidas AG is leveraging its global scale to make sustainability mainstream. Through innovations such as recyclable materials and eco-collaborations, adidas is actively integrating green practices into performance and fashion lines, appealing to both athletes and style-conscious shoppers seeking ethical alternatives.

Top Key Players in the Market

- EILEEN FISHER

- HANESBRANDS INC.

- Vuori

- Patagonia, Inc.

- adidas AG

- ABLE

- Outerknown

- Wear Pact, LLC

- PANGAIA

- Under Armour, Inc.

Recent Developments

- In November 2024, Vuori completed a significant share sale, valuing the athleisure startup at $5.5 billion. This valuation highlights Vuori’s continued growth and strong position in the premium performance wear segment.

- In June 2024, TechnoSport, a performance wear brand, secured $21 million in funding from A91 Partners. The investment will support expansion, product innovation, and strengthening the brand’s market presence.

- In June 2024, The Pant Project raised $4.25 million in a Series A funding round led by Sorin Investments. The funds will be used to scale operations and enhance digital infrastructure for personalized menswear.

- In November 2024, Boldfit raised $13 million in fresh funding from Bessemer Venture Partners, placing the brand at a $74 million valuation. The funding aims to accelerate brand growth and expand wellness product offerings.

- In July 2024, Activewear brand TALA secured £5 million in funding from major investors. This round will help boost global presence and support sustainable fashion initiatives.

Report Scope

Report Features Description Market Value (2024) USD 88.9 Billion Forecast Revenue (2034) USD 304.5 Billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mass, Premium), By Product)Shirt, Yoga Pant, Leggings, Shorts, Others), By Gender (Men, Women), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape EILEEN FISHER, HANESBRANDS INC., Vuori, Patagonia, Inc., adidas AG, ABLE, Outerknown, Wear Pact, LLC, PANGAIA, Under Armour, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sustainable Athleisure MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Sustainable Athleisure MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- EILEEN FISHER

- HANESBRANDS INC.

- Vuori

- Patagonia, Inc.

- adidas AG

- ABLE

- Outerknown

- Wear Pact, LLC

- PANGAIA

- Under Armour, Inc.