Global Soy Beverage Market Size, Share, And Business Benefits By Product Type (Soy Milk, Soy Drinkable Yogurt), By Form (Liquid, Powder, Concentrate), By Flavor (Flavored, Unflavored), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Stores, Convenience Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155291

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

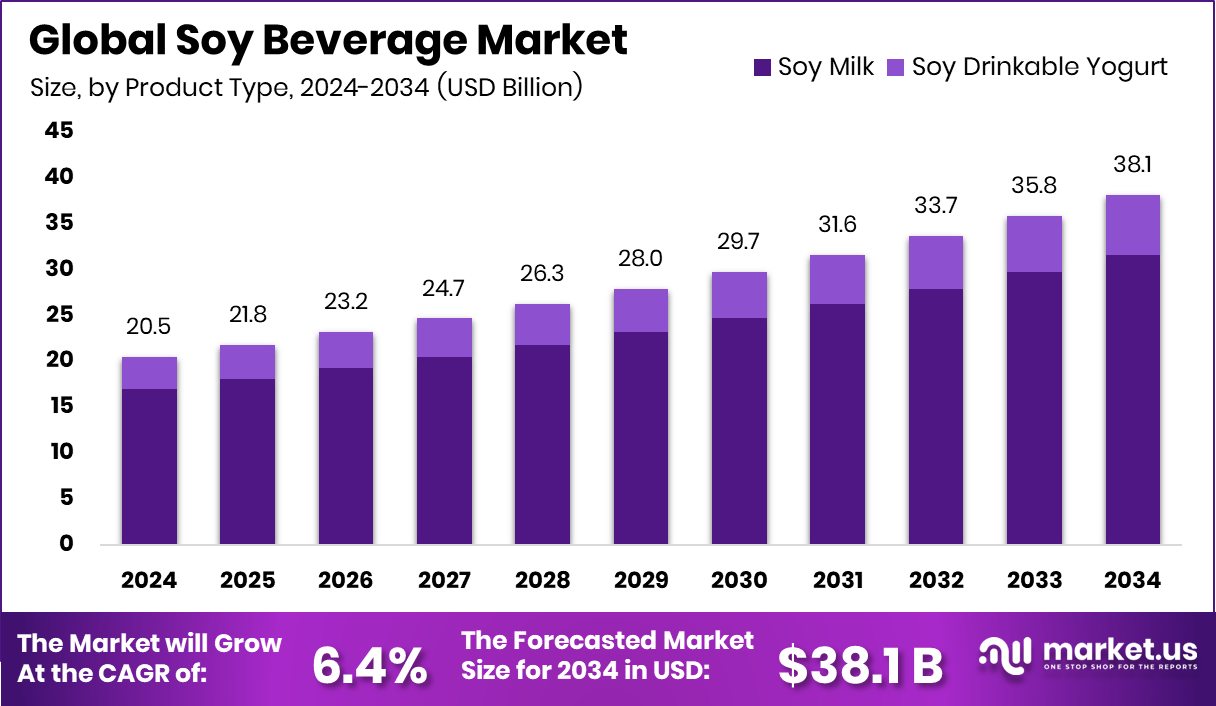

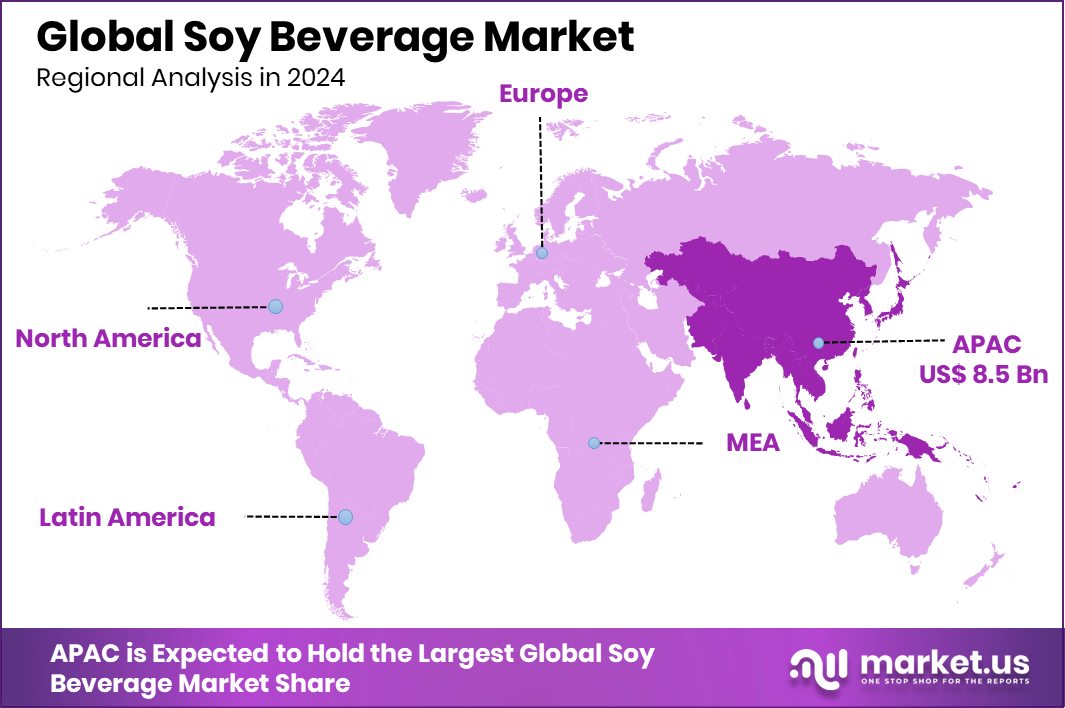

The Global Soy Beverage Market is expected to be worth around USD 38.1 billion by 2034, up from USD 20.5 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Growing lactose intolerance boosts Asia-Pacific’s 41.90%, USD 8.5 Bn market.

A soy beverage, often called soy milk, is a plant-based drink made by soaking, grinding, and boiling soybeans, then filtering the mixture to create a smooth liquid. It is naturally lactose-free, making it suitable for people with dairy intolerance, and is commonly fortified with vitamins and minerals to match or exceed the nutritional profile of cow’s milk. Known for its creamy texture and subtle bean-like flavor, it is consumed as a dairy alternative in drinks, cooking, and baking.

Recent industry activity also supports soy innovation—Sironix, a company transforming soybeans into cleaning ingredients, has secured $3.5 million to boost manufacturing capabilities, while Prefer has raised $2 million in seed funding to create beanless coffee from surplus bread, soy pulp, and spent grain.

The soy beverage market refers to the global trade and consumption of soy-based drinks, driven by the rising preference for plant-based nutrition. This market includes plain, flavored, and fortified varieties, catering to health-conscious consumers, vegans, and those with dietary restrictions. Its growth is fueled by expanding retail availability, innovation in flavors, and increasing awareness of sustainable food choices. The rail board has allocated $12.6 million to the Mitchell area to aid a $500 million soy processing plant project, further strengthening the supply chain for soy-based beverages.

Growth factors include a global shift toward plant-based diets, supported by concerns over animal welfare, lactose intolerance, and the environmental impact of dairy farming. Rising health awareness and the protein-rich nature of soy further boost its appeal. Demand is expanding due to urbanization, busy lifestyles, and growing interest in functional beverages that offer health benefits beyond basic nutrition. Supporting this trend, Purdue Food Science has been awarded a $1.1 million grant to advance commercial soy-based products across the United States, fostering innovation and market expansion.

Key Takeaways

- The Global Soy Beverage Market is expected to be worth around USD 38.1 billion by 2034, up from USD 20.5 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- In the soy beverage market, soy milk dominates product type sales, accounting for a strong 82.3% share.

- Liquid form leads the soy beverage market, capturing 71.4% share due to convenience and wide consumer preference.

- Flavored variants hold 68.9% of the soy beverage market, driven by taste innovation and growing flavor diversity.

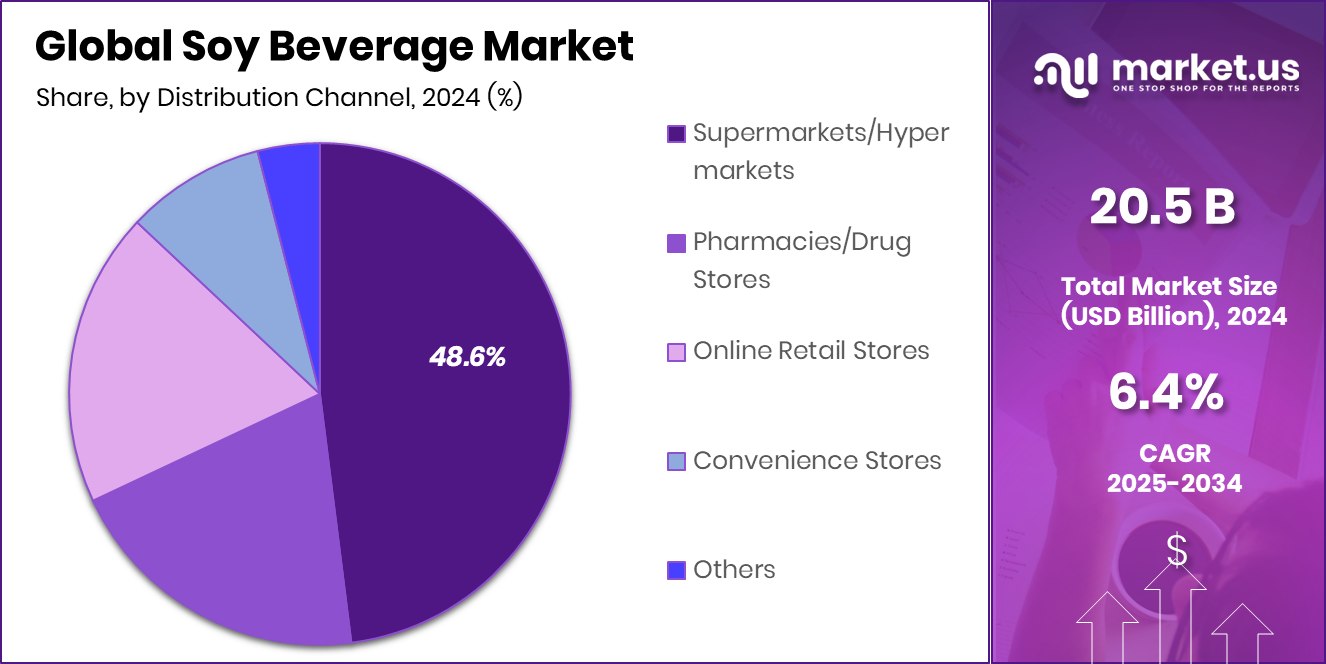

- Supermarkets and hypermarkets command 48.6% of the soy beverage market sales, benefiting from broad availability and consumer accessibility.

- Asia-Pacific’s 41.90% dominance stems from high plant-based beverage consumption rates.

By Product Type Analysis

Soy Beverage Market sees soy milk dominating with an 82.3% share.

In 2024, Soy Milk held a dominant market position in the By Product Type segment of the Soy Beverage Market, with an impressive 82.3% share. This leadership is attributed to its widespread consumer acceptance as a primary dairy alternative, backed by its high protein content, lactose-free nature, and versatility in both direct consumption and culinary applications.

Fortification with vitamins such as B12, D, and calcium has further strengthened its positioning as a nutritionally competitive substitute for cow’s milk. The rising prevalence of lactose intolerance, coupled with the growing adoption of plant-based diets, has played a significant role in sustaining its high market share. Additionally, consumer preference for clean-label, non-GMO, and organic soy milk options has spurred product innovation, appealing to health-conscious buyers.

Flavored and sweetened variants have also broadened their appeal, especially among younger demographics and urban consumers seeking variety. The segment benefits from strong distribution through supermarkets, specialty health stores, and e-commerce platforms, ensuring accessibility across diverse regions.

Sustainability concerns and the lower carbon footprint of soy-based products compared to dairy continue to reinforce demand. With these factors combined, soy milk’s dominance in 2024 highlights its established role as the cornerstone of the soy beverage category, driving consistent market growth.

By Form Analysis

Liquid form leads the Soy Beverage Market with 71.4% preference.

In 2024, Liquid held a dominant market position in the By Form segment of the Soy Beverage Market, with a commanding 71.4% share. This dominance is driven by the product’s convenience, ready-to-drink format, and wide availability across retail channels, including supermarkets, hypermarkets, convenience stores, and online platforms. Liquid soy beverages are favored for their immediate consumption appeal, requiring no preparation, which aligns well with fast-paced urban lifestyles.

The format caters to a broad consumer base, from health-conscious individuals seeking dairy alternatives to those with lactose intolerance or specific dietary preferences. Product innovation, such as the introduction of flavored, fortified, and organic variants, has further expanded consumer reach, enhancing market penetration. Additionally, the liquid form’s suitability for various uses—ranging from direct drinking to incorporation in smoothies, coffee, and cooking—boosts its demand versatility.

Advancements in packaging, particularly shelf-stable cartons and eco-friendly solutions, have improved storage life and sustainability appeal, aligning with environmentally aware consumer choices. Strong marketing around plant-based nutrition, coupled with growing awareness of soy’s protein-rich and low-cholesterol benefits, continues to support liquid soy beverage consumption.

By Flavor Analysis

Flavored varieties capture a 68.9% share in Soy Beverage Market sales.

In 2024, Flavored held a dominant market position in the By Flavor segment of the Soy Beverage Market, with a substantial 68.9% share. This leadership is largely attributed to the segment’s ability to cater to diverse taste preferences, making soy beverages more appealing to a wider audience beyond traditional health-focused consumers. Flavored variants, such as vanilla, chocolate, strawberry, and region-specific options, have successfully attracted younger demographics, families, and first-time buyers transitioning from dairy products.

These options mask the naturally beany taste of soy, thereby enhancing consumer acceptance and repeat purchases. The growth of this segment is further supported by innovations in natural sweeteners, low-sugar formulations, and the use of clean-label flavoring agents, aligning with rising health-consciousness trends. Seasonal and limited-edition flavors have also proven effective in generating excitement and boosting short-term sales.

Moreover, flavored soy beverages benefit from strong marketing, positioning them as both a nutritious and indulgent choice, often fortified with vitamins, minerals, and plant-based proteins. Retail visibility in ready-to-drink formats, along with attractive packaging, has strengthened impulse purchases.

By Distribution Channel Analysis

Supermarkets drive 48.6% of the Soy Beverage Market distribution globally.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the By Distribution Channel segment of the Soy Beverage Market, with a 48.6% share. This dominance is primarily driven by their ability to offer a wide range of soy beverage brands, flavors, and packaging options under one roof, providing consumers with both variety and convenience. These retail formats benefit from high foot traffic, enabling customers to easily compare products and take advantage of in-store promotions, discounts, and sampling campaigns that boost trial and repeat purchases.

The organized shelf placement and clear labeling in supermarkets and hypermarkets also help in educating consumers about the nutritional benefits of soy beverages, enhancing purchase confidence. The segment’s strength is further supported by the expansion of large retail chains into suburban and rural areas, increasing product accessibility across diverse demographics.

Additionally, the integration of modern retail strategies such as loyalty programs, health-focused sections, and eco-friendly product displays has enhanced customer engagement. Seasonal campaigns and festival promotions often see a surge in sales, further solidifying this channel’s lead. With the continued growth of health-conscious shopping trends and the consistent preference for one-stop purchasing, supermarkets and hypermarkets remain the backbone of soy beverage distribution in 2024.

Key Market Segments

By Product Type

- Soy Milk

- Soy Drinkable Yogurt

By Form

- Liquid

- Powder

- Concentrate

By Flavor

- Flavored

- Unflavored

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Online Retail Stores

- Convenience Stores

- Others

Driving Factors

Rising Shift Toward Plant-Based and Dairy-Free Diets

One of the biggest driving forces for the soy beverage market is the growing shift toward plant-based and dairy-free diets. More people are choosing soy milk and other soy drinks as they look for healthier, lactose-free options that are also environmentally friendly. Concerns about dairy allergies, lactose intolerance, and cholesterol have pushed many consumers to explore alternatives like soy beverages, which are naturally cholesterol-free and rich in plant protein.

This trend is especially strong among health-conscious individuals, vegans, and flexitarians. Additionally, younger generations are adopting sustainable food habits, and soy beverages fit perfectly with this lifestyle. The increasing awareness of the environmental benefits of plant-based choices is helping soy beverages become a preferred daily drink worldwide.

Restraining Factors

Allergy Concerns and Negative Perception of Soy

A major restraining factor for the soy beverage market is the concern over soy allergies and the negative perception surrounding soy consumption. Some people are allergic to soy proteins, which can cause reactions ranging from mild discomfort to severe health issues, limiting its adoption among sensitive consumers. Additionally, misinformation about soy’s effects on hormones and long-term health has created hesitation among certain groups, even though many scientific studies have shown its safety when consumed in moderation.

These concerns can lead consumers to choose other plant-based alternatives, reducing soy beverages sales potential. Addressing these issues through clear labeling, public awareness campaigns, and transparent communication about soy’s nutritional benefits is essential for maintaining consumer trust and expanding market acceptance.

Growth Opportunity

Expansion in Emerging Markets with Rising Health Awareness

A key growth opportunity for the soy beverage market lies in expanding into emerging markets where health awareness and disposable incomes are increasing. Countries in Asia, Africa, and Latin America are seeing a growing middle class that is becoming more conscious of nutrition, wellness, and sustainable food choices. As urbanization rises, so does the demand for convenient, healthy beverages, making soy milk an attractive option.

Additionally, many of these regions have high lactose intolerance rates, creating a natural demand for dairy-free alternatives. By introducing affordable, locally adapted flavors and leveraging strong distribution networks, brands can capture new consumer segments. Educational campaigns about soy’s benefits can further boost adoption, driving strong market growth in these high-potential regions.

Latest Trends

Innovative Flavors and Fortified Functional Soy Beverages

A leading trend in the soy beverage market is the rise of innovative flavors and fortified functional drinks. Consumers are looking for more than just plain soy milk — they want exciting taste options like vanilla, chocolate, matcha, coffee blends, and even region-specific flavors. At the same time, there’s a growing demand for soy beverages enriched with extra nutrients such as calcium, vitamin D, B12, omega-3, and probiotics.

These added benefits make soy drinks appealing not only as a dairy alternative but also as a functional health beverage. Brands are focusing on clean-label ingredients, low sugar, and organic options to match consumer preferences. This blend of taste innovation and nutritional enhancement is shaping the future of soy beverages globally.

Regional Analysis

In 2024, Asia-Pacific held 41.90%, worth USD 8.5 Bn.

In 2024, Asia-Pacific emerged as the dominant region in the global Soy Beverage Market, capturing a significant 41.90% share, valued at USD 8.5 billion. This leadership is driven by the region’s high prevalence of lactose intolerance, rising adoption of plant-based diets, and strong cultural acceptance of soy-based products, particularly in countries like China, Japan, and South Korea.

The growing middle-class population, coupled with increasing health awareness, has fueled demand for nutritious dairy alternatives, with soy beverages positioned as an affordable and accessible option. Expanding retail infrastructure, including supermarkets, hypermarkets, and online channels, has further improved product availability. Government-led nutrition campaigns promoting plant-based proteins and sustainable diets are also encouraging higher consumption rates.

Product innovation, such as flavored, fortified, and organic soy beverages, resonates well with younger consumers seeking variety and functional benefits. Additionally, urbanization and busy lifestyles have strengthened the preference for ready-to-drink formats, boosting market penetration.

The rising influence of fitness and wellness trends, combined with an expanding e-commerce presence, is expected to further solidify Asia-Pacific’s dominance. With its strong consumer base, favorable economic conditions, and cultural alignment with soy consumption, the region remains the primary growth driver for the global soy beverage industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Vitasoy International Holdings Ltd. maintained its strong global presence in the soy beverage market by leveraging its deep roots in Asia-Pacific, where soy-based drinks are culturally ingrained. The company focused on expanding its product range with fortified and flavored variants, aligning with growing health-conscious consumer preferences and sustainability trends.

Earth’s Own Food Company Inc. strengthened its position through innovation in plant-based nutrition, introducing clean-label and allergen-friendly soy beverages. The brand’s focus on eco-conscious production and recyclable packaging has enhanced its appeal among environmentally aware consumers in North America.

Alpro (Danone S.A.) capitalized on its extensive distribution network across Europe and beyond, promoting fortified soy milk options enriched with calcium, vitamins, and plant protein. The company’s consistent investment in flavor diversification and organic variants has broadened its customer base, particularly among flexitarians and younger demographics seeking both nutrition and taste.

Eden Foods Inc. maintained its niche positioning by offering organic, non-GMO soy beverages with minimal processing, catering to a loyal segment of health-focused and ingredient-conscious consumers. Its emphasis on traditional soy preparation methods supports a strong brand identity in the natural and specialty food sector.

Top Key Players in the Market

- Vitasoy International Holdings Ltd.

- Earth’s Own Food Company Inc.

- Alpro (Danone S.A.)

- Eden Foods Inc.

- Pacific Foods of Oregon, LLC

- Kikkoman Corporation

- SunOpta Inc.

- The Hain Celestial Group, Inc.

- Morinaga Milk Industry Co., Ltd.

- Pulmuone Co., Ltd.

- Maeil Dairies Co., Ltd.

Recent Developments

- In July 2025, Alpro launched a fortified, low-sugar “Alpro Kids” range, which includes a strawberry soya drink and yoghurts in vanilla and strawberry flavors. These are designed especially for children, contain 30% less sugar, and are packed with nutrients like calcium, vitamin D₂, iodine, B₂, and B₁₂.

- In November 2024, Earth’s Own joined a new initiative in Canada to build a pilot-scale soy powder processing facility in Ontario. This project, backed by Protein Industries Canada and supported by partners like Marusan Ai Co., aims to boost domestic value-add for soybeans, benefiting the plant-based foods sector, including soy beverages.

Report Scope

Report Features Description Market Value (2024) USD 20.5 Billion Forecast Revenue (2034) USD 38.1 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Soy Milk, Soy Drinkable Yogurt), By Form (Liquid, Powder, Concentrate), By Flavor (Flavored, Unflavored), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Stores, Convenience Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Vitasoy International Holdings Ltd., Earth’s Own Food Company Inc., Alpro (Danone S.A.), Eden Foods Inc., Pacific Foods of Oregon, LLC, Kikkoman Corporation, SunOpta Inc., The Hain Celestial Group, Inc., Morinaga Milk Industry Co., Ltd., Pulmuone Co., Ltd., Maeil Dairies Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Vitasoy International Holdings Ltd.

- Earth's Own Food Company Inc.

- Alpro (Danone S.A.)

- Eden Foods Inc.

- Pacific Foods of Oregon, LLC

- Kikkoman Corporation

- SunOpta Inc.

- The Hain Celestial Group, Inc.

- Morinaga Milk Industry Co., Ltd.

- Pulmuone Co., Ltd.

- Maeil Dairies Co., Ltd.