Global Soluble Fiber Market By Product (Inulin, Oligosaccharides, Resistant Starch, Resistant Maltodextrin, Polydextrose, Beta-Glucan, Others), By Source (Fruits and Vegetables, Cereals and Grains, Others), By Application (Animal Nutrition, Food and Beverages, Nutraceuticals and Pharmaceuticals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139899

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

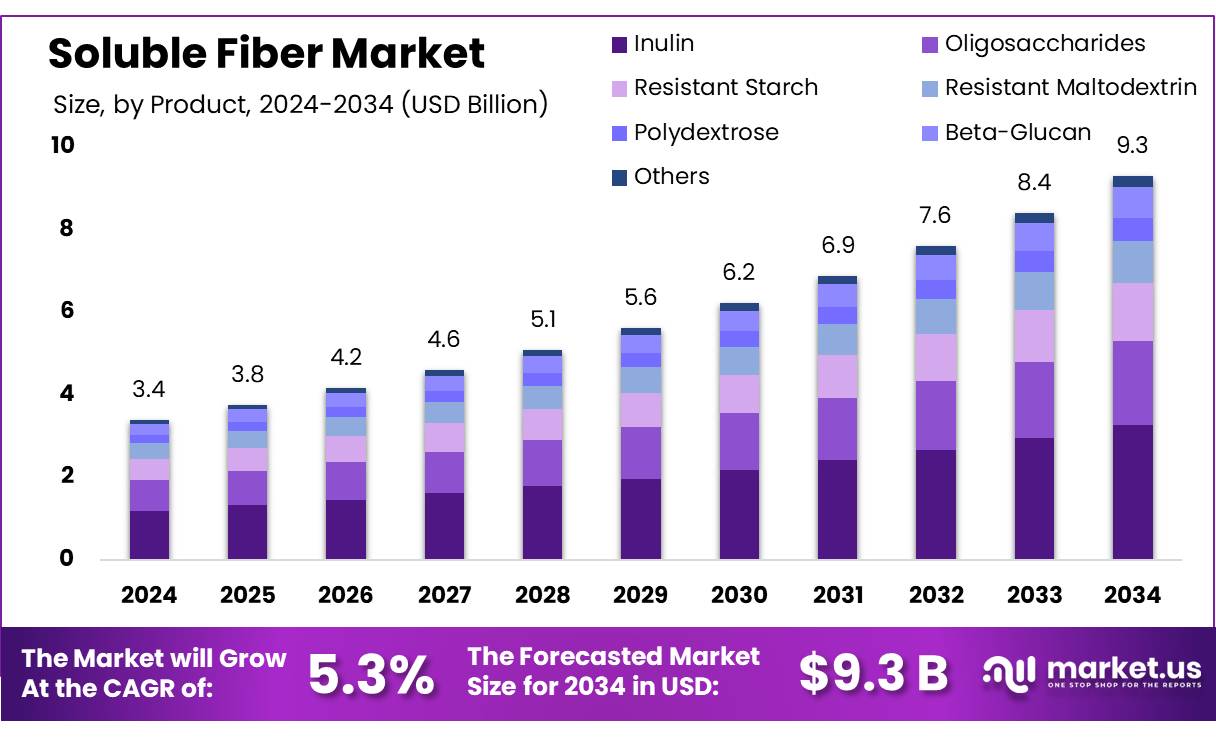

The Global Soluble Fiber Market size is expected to be worth around USD 9.3 Bn by 2034, from USD 3.4 Bn in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034.

Soluble fiber, a pivotal component in dietary nutrition, plays a significant role in improving health outcomes such as lowering blood cholesterol and glucose levels. Derived from oats, peas, beans, apples, citrus fruits, carrots, barley, and psyllium, soluble fiber dissolves in water to form a gel-like material, which can significantly benefit digestive health and reduce the risk of heart disease.Several Driving factors are propelling the growth of the soluble fiber industry. The rising prevalence of chronic diseases such as diabetes, obesity, and cardiovascular conditions has led to increased consumer focus on preventive healthcare and nutritionally enriched diets. Furthermore, government initiatives promoting healthy eating habits and the inclusion of dietary fibers in daily consumption are also significant drivers. The plant-based diets and vegan lifestyles has increased the intake of fruits, vegetables, and grains, which are rich in soluble fiber. This dietary shift is particularly pronounced among millennials and Gen Z consumers, who are more health-conscious and well-informed about the nutritional benefits of dietary fibers.The ongoing research and development aimed at discovering novel sources of soluble fiber and potential health benefits associated with fiber consumption are likely to offer new market opportunities. Additionally, the surge in demand for weight management products and functional foods that offer health benefits beyond basic nutrition is expected to drive the market further.

The plant-based diets and vegan lifestyles has increased the intake of fruits, vegetables, and grains, which are rich in soluble fiber. This dietary shift is particularly pronounced among millennials and Gen Z consumers, who are more health-conscious and well-informed about the nutritional benefits of dietary fibers.The ongoing research and development aimed at discovering novel sources of soluble fiber and potential health benefits associated with fiber consumption are likely to offer new market opportunities. Additionally, the surge in demand for weight management products and functional foods that offer health benefits beyond basic nutrition is expected to drive the market further.Key Takeaways

- Soluble Fiber Market size is expected to be worth around USD 9.3 Bn by 2034, from USD 3.4 Bn in 2024, growing at a CAGR of 10.6%.

- Inulin held a dominant market position, capturing more than a 35.3% share of the soluble fiber market.

- Fruits & Vegetables held a dominant market position, capturing more than a 48.1% share of the soluble fiber market.

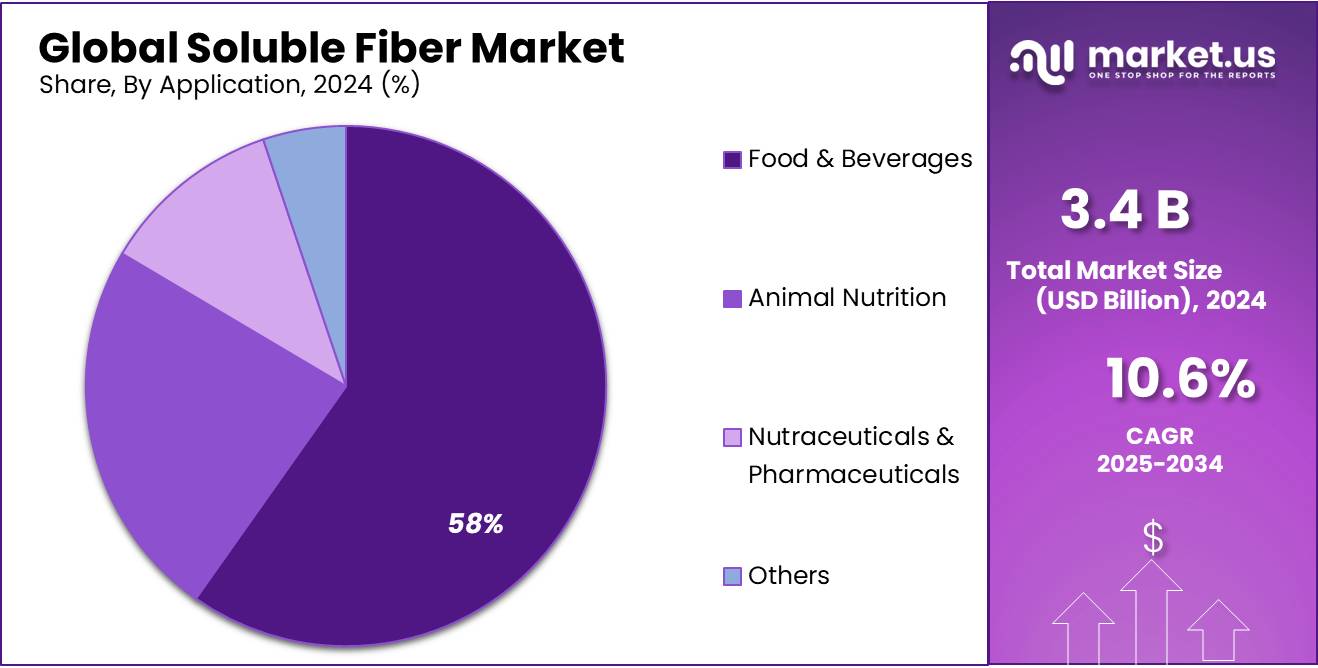

- Food & Beverages held a dominant market position, capturing more than a 58.5% share of the soluble fiber market.

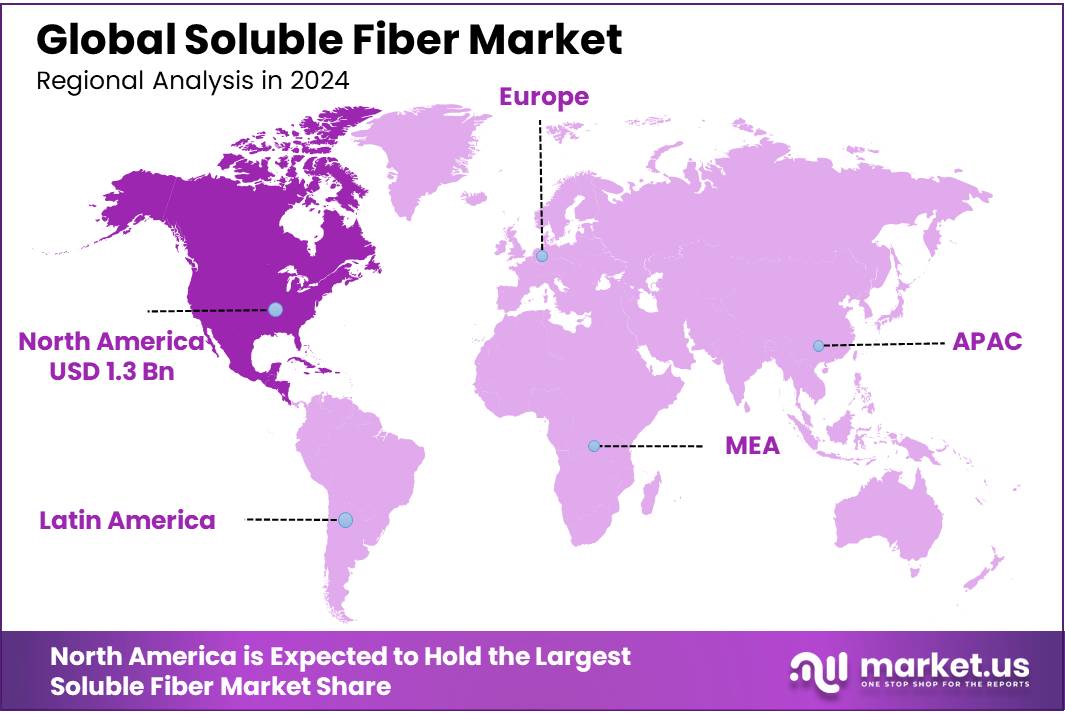

- North America dominated the soluble fiber market, accounting for 39.1% of the global share, valued at approximately USD 1.3 billion.

By Product

In 2024, Inulin held a dominant market position, capturing more than a 35.3% share of the soluble fiber market. This widespread adoption is largely attributed to its versatility and use in various food and beverage applications, including dietary supplements, bakery items, and dairy products. Inulin’s ability to support digestive health and its role as a prebiotic make it a preferred ingredient, especially among health-conscious consumers. Over the years, demand for inulin has been steadily increasing, driven by a growing awareness of the importance of gut health and fiber intake.

Oligosaccharides followed closely in terms of market share, with steady growth anticipated through 2025. Their ability to enhance digestive health and act as a sugar substitute in low-calorie products makes them a key player in the market.

Resistant starch, which accounted for a significant portion of the market in 2024, is anticipated to see increasing demand in the coming years, particularly as consumers seek out high-fiber, low-carb alternatives. Resistant starch helps improve blood sugar regulation and is widely used in processed foods, including snacks and ready-to-eat meals.

Resistant maltodextrin and polydextrose are also gaining traction, driven by their ability to enhance texture and offer low-calorie benefits without compromising on taste. These fibers are commonly used in beverages, dairy products, and snack foods. Beta-glucan, known for its heart health benefits, continues to carve a niche for itself in the market.

By Source

In 2024, Fruits & Vegetables held a dominant market position, capturing more than a 48.1% share of the soluble fiber market. This dominance is primarily driven by the high natural fiber content in fruits and vegetables, which are widely recognized for their digestive health benefits.

The increasing popularity of plant-based diets and the growing focus on the consumption of whole foods have significantly boosted the demand for soluble fibers derived from fruits and vegetables. As consumers continue to prioritize natural sources of nutrition, this segment is expected to maintain a strong market presence through 2025, with continued growth anticipated in both fresh and processed food products.

Cereals & Grains followed as a key source of soluble fiber, accounting for a significant portion of the market in 2024. The demand for fiber-rich cereals and grains, such as oats, barley, and wheat, has been steadily rising, driven by their well-established benefits for heart health, weight management, and digestive function. In 2025, this segment is expected to grow further as consumer awareness of the health benefits of whole grains increases. The rise of gluten-free and high-fiber products within the cereal and grain segment is expected to drive further market expansion.

By Application

In 2024, Food & Beverages held a dominant market position, capturing more than a 58.5% share of the soluble fiber market. The strong demand for functional foods and beverages, particularly those focused on digestive health and weight management, is driving this growth. Soluble fibers are being increasingly used in a wide range of products, including dietary supplements, dairy items, baked goods, and beverages, as consumers continue to prioritize health-conscious options.

Animal Nutrition followed as another key application for soluble fibers in 2024. Although it held a smaller share compared to the food and beverages segment, the animal nutrition market is seeing steady growth, especially in the pet food industry. Soluble fibers are increasingly being added to animal diets to improve digestive health, regulate blood sugar, and promote overall well-being. As pet owners become more concerned about their pets’ health and nutrition, the demand for functional ingredients like soluble fiber is expected to rise in the coming years, particularly in premium and specialized pet foods.

The Nutraceuticals & Pharmaceuticals segment also saw strong performance in 2024, benefiting from a growing interest in fiber-based supplements for digestive health and overall wellness. With consumers seeking out natural alternatives to address a range of health concerns, from gut health to cholesterol management, soluble fibers are becoming an important ingredient in nutraceuticals.

Key Market Segments

By Product

- Inulin

- Oligosaccharides

- Resistant Starch

- Resistant Maltodextrin

- Polydextrose

- Beta-Glucan

- Others

By Source

- Fruits & Vegetables

- Cereals & Grains

- Others

By Application

- Animal Nutrition

- Food & Beverages

- Nutraceuticals & Pharmaceuticals

- Others

Drivers

Rising Demand for Digestive Health and Wellness

One of the major driving factors for the growth of the soluble fiber market is the increasing consumer demand for products that promote digestive health and overall wellness. As consumers become more health-conscious, they are seeking out ingredients that support their gut health, and soluble fibers play a vital role in this. Soluble fiber helps regulate digestion, maintain healthy cholesterol levels, and support a healthy weight, making it a key ingredient in a wide variety of functional foods, supplements, and beverages.

In recent years, health organizations have recognized the importance of fiber in the diet. For example, the World Health Organization (WHO) recommends that adults consume at least 25-30 grams of dietary fiber per day, with a significant portion coming from soluble fibers. Studies have shown that adequate fiber intake can help prevent a range of digestive issues, such as constipation, and improve overall gut health. The increasing recognition of these benefits is prompting more consumers to turn to fiber-rich foods. In fact, according to the U.S. National Institutes of Health (NIH), nearly 95% of the U.S. population does not meet the daily recommended intake of fiber, which has led to a rise in demand for fiber-enriched products.

In response to this growing awareness, many food manufacturers are incorporating soluble fibers into their products to meet consumer demands. Major food organizations, such as the Food and Agriculture Organization (FAO) and the American Heart Association (AHA), have been working on public health campaigns that emphasize the role of fiber in managing health conditions like heart disease, obesity, and diabetes. The focus on preventive health and the growing number of people adopting plant-based diets are expected to continue driving the demand for soluble fibers.

As governments and health organizations continue to advocate for healthier eating habits, the role of soluble fiber in supporting digestive health is likely to remain a significant factor in its market growth.

Restraints

High Cost of Soluble Fiber Ingredients

One of the major restraining factors for the growth of the soluble fiber market is the high cost of sourcing and producing soluble fiber ingredients. While soluble fibers offer significant health benefits, they can be expensive to produce, particularly for specialized types such as inulin, oligosaccharides, and beta-glucan. These higher production costs can make it challenging for manufacturers to offer products at competitive prices, especially in price-sensitive markets.

Inulin, for instance, is commonly derived from chicory root, a process that requires specialized cultivation and harvesting techniques. According to the Food and Agriculture Organization (FAO), chicory root cultivation is labor-intensive and geographically limited, leading to higher costs for the raw material. Similarly, beta-glucan, which is primarily sourced from oats and barley, also requires significant processing to extract the fiber, further driving up costs. These factors contribute to the overall expense of soluble fiber ingredients, which can be a barrier for smaller food manufacturers and companies operating in emerging markets.

A report from the U.S. Department of Agriculture (USDA) highlights that the cost of fiber ingredients can increase by up to 25-30% when derived from specialty sources like oats or chicory. This price premium can ultimately be passed on to consumers, which may limit the widespread adoption of fiber-enriched products, particularly in low-income regions. The price sensitivity of consumers in developing countries makes it even more challenging to promote fiber-rich products as a regular part of their diet.

Furthermore, the high cost of production for soluble fiber ingredients can hinder innovation in the development of new fiber-enriched products. Despite the increasing demand for digestive health solutions, the financial constraints of sourcing high-quality fibers may limit the ability of manufacturers to explore new formulations or introduce affordable options into the market.

Opportunity

Growing Popularity of Plant-Based and Functional Foods

A major growth opportunity for the soluble fiber market lies in the increasing popularity of plant-based diets and functional foods. As more consumers adopt plant-based and health-conscious lifestyles, the demand for fiber-rich ingredients like soluble fiber is expected to rise. The growing awareness of the health benefits associated with fiber, such as improved digestive health, lower cholesterol, and better weight management, is driving this shift.

The rise of plant-based diets, in particular, is creating a significant opportunity for soluble fibers. According to the Plant Based Foods Association, the U.S. plant-based food market grew by 27% between 2020 and 2022, making it a $7 billion industry. As plant-based diets tend to be higher in fiber, manufacturers are increasingly turning to soluble fibers to enhance the nutritional profiles of plant-based products, such as meat alternatives, dairy substitutes, and plant-based snacks. Soluble fiber is especially attractive in this context because it is a natural, plant-derived ingredient, aligning well with consumer preferences for whole, minimally processed foods.

Governments and health organizations are also playing a role in encouraging the consumption of fiber. The World Health Organization (WHO) recommends increasing dietary fiber intake as part of a healthy diet, which has led to more initiatives focusing on fiber enrichment in food products. In countries like the U.S. and Canada, initiatives such as the “Dietary Guidelines for Americans” emphasize the need for increased fiber intake, further boosting demand for fiber-enriched functional foods.

As a result, there is a growing opportunity for soluble fiber to be incorporated into a wide range of new products. From plant-based protein bars to fiber-enriched dairy alternatives, these innovative products offer consumers easy ways to boost their fiber intake without compromising on taste or convenience. This growing trend towards functional foods, driven by both consumer demand and government health initiatives, is expected to continue fueling the growth of the soluble fiber market in the coming years.

Trends

Increasing Demand for Fiber-Enriched Functional Snacks

One of the latest trends in the soluble fiber market is the growing demand for fiber-enriched functional snacks. As consumers become more focused on health and wellness, they are seeking out convenient, on-the-go snacks that offer additional nutritional benefits, with fiber being one of the most sought-after ingredients. These functional snacks, which include bars, chips, and granola, are now being fortified with soluble fibers to meet the rising consumer demand for digestive health support and weight management solutions.

According to the International Food Information Council (IFIC), nearly 58% of consumers in the U.S. reported that they actively seek out foods that offer functional benefits, such as digestive health support, and fiber is one of the key nutrients they are looking for. This trend is particularly evident among younger consumers, with millennials and Gen Z showing a strong preference for functional snacks that align with their health-conscious lifestyle. As a result, snack manufacturers are increasingly turning to soluble fibers like inulin, polydextrose, and oligosaccharides to enhance the nutritional profiles of their products.

The demand for fiber-enriched snacks is also being driven by growing awareness of the importance of gut health. The U.S. Food and Drug Administration (FDA) has recognized the connection between fiber intake and digestive health, further encouraging consumers to seek out products that provide more fiber. With digestive health being a key focus of many health campaigns, the incorporation of soluble fibers into snacks offers an easy and convenient way for consumers to boost their fiber intake, especially as busy lifestyles often leave little time for consuming whole foods.

Regional Analysis

In 2024, North America dominated the soluble fiber market, accounting for 39.1% of the global share, valued at approximately USD 1.3 billion. This strong market presence can be attributed to the high consumer demand for health-focused products, driven by the growing awareness of the importance of dietary fiber for digestive health and overall well-being. The U.S., in particular, is a key market, with increasing consumption of fiber-enriched functional foods and dietary supplements. Additionally, government initiatives, such as the Dietary Guidelines for Americans, encourage higher fiber intake, further boosting market growth in the region.

Europe is the second-largest market for soluble fiber, driven by a rising preference for functional foods, particularly in countries like Germany, the UK, and France. The region is also seeing increased adoption of plant-based diets, which has led to higher demand for fiber-rich products. The European market is projected to grow steadily, supported by health-conscious consumers and ongoing public health campaigns focused on dietary fiber.

The Asia Pacific region is experiencing rapid growth in the soluble fiber market, especially in countries like China and India, where there is a growing awareness of health benefits and increased demand for dietary supplements. However, the region currently holds a smaller share compared to North America and Europe but is expected to witness significant growth in the coming years due to rising disposable incomes and changing dietary patterns.

The Middle East & Africa and Latin America regions represent emerging markets, with steady growth expected as awareness of fiber benefits increases. These regions are likely to see moderate growth, with key factors including improving consumer access to health information and growing demand for functional foods.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The soluble fiber market is highly competitive, with key players such as ADM, Cargill Inc., and Danisco A/S leading the charge in innovation and market expansion. ADM, with its strong global presence, offers a range of soluble fiber ingredients derived from corn and other plant sources, catering to the growing demand for health-conscious products.

Similarly, Cargill Inc. provides a diverse portfolio of soluble fiber solutions, focusing on applications in food, beverages, and dietary supplements. Both companies benefit from their well-established supply chains and extensive distribution networks, allowing them to maintain a strong foothold in North America and other key markets. Danisco A/S, a part of DuPont, is another significant player, providing a broad range of fiber ingredients used in functional foods, including inulin, which has seen increasing popularity for digestive health.

Other notable players in the market include Ingredion Incorporated, Kerry Group, and Tate & Lyle plc. Ingredion offers soluble fiber solutions like resistant dextrin and other fiber ingredients used across various food and beverage applications. Kerry Group focuses on providing innovative fiber ingredients with a focus on clean-label solutions, catering to the rising demand for natural and minimally processed ingredients. Tate & Lyle’s expertise in developing soluble fibers for both the food and nutraceutical sectors has helped it maintain a strong market presence, especially in Europe.

Companies such as NEXIRA and Roquette Frères also play a crucial role, providing plant-based soluble fibers for diverse applications, particularly in the health and wellness industry. Shandong Guangming Super Refractory Fiber Co., Ltd and Huachang Pharmaceuticals focus on offering competitive fiber products, especially in Asia-Pacific markets, contributing to the region’s growing demand for soluble fiber.

Top Key Players

- ADM

- Cargill Inc.

- Danisco A/S

- DuPont

- Europastry

- Huachang Pharmaceuticals

- Incorporated

- INGREDION

- Ingredion Incorporated

- Kerry Group

- NEXIRA

- Roquette Frères

- Shandong Guangming Super Refractory Fiber Co., Ltd

- Sunopta Inc.

- Tate & Lyle plc

Recent Developments

In 2024 ADM reported revenues of approximately $101 billion in 2023, with a growing share of this coming from its nutrition and health division, including soluble fiber products.

In 2023, Cargill reported annual revenues of approximately $165 billion, with a substantial portion of this coming from its nutrition and health division, which includes soluble fibers.

Report Scope

Report Features Description Market Value (2024) USD 3.4 Bn Forecast Revenue (2034) USD 9.3 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Inulin, Oligosaccharides, Resistant Starch, Resistant Maltodextrin, Polydextrose, Beta-Glucan, Others), By Source (Fruits and Vegetables, Cereals and Grains, Others), By Application (Animal Nutrition, Food and Beverages, Nutraceuticals and Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Cargill Inc., Danisco A/S, DuPont, Europastry, Huachang Pharmaceuticals, Incorporated, INGREDION, Ingredion Incorporated, Kerry Group, NEXIRA, Roquette Frères, Shandong Guangming Super Refractory Fiber Co., Ltd, Sunopta Inc., Tate & Lyle plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADM

- Cargill Inc.

- Danisco A/S

- DuPont

- Europastry

- Huachang Pharmaceuticals

- Incorporated

- INGREDION

- Ingredion Incorporated

- Kerry Group

- NEXIRA

- Roquette Frères

- Shandong Guangming Super Refractory Fiber Co., Ltd

- Sunopta Inc.

- Tate & Lyle plc