Global Solo Travel Market Size, Share, Growth Analysis By Traveler Type (Female Solo Travelers, Male Solo Travelers, Senior Solo Travelers, Millennials or Gen Z Solo Travelers), By Purpose of Travel (Leisure or Vacation, Adventure Travel, Business Travel, Wellness Travel, Volunteer or Charity Travel), By Age Group (18–30 Years, 31–45 Years, 46–60 Years, Above 60 Years), By Booking Channel (Online Travel Agencies (OTAs), Direct Booking (Airlines or Hotels), Travel Agents, Mobile Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144502

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

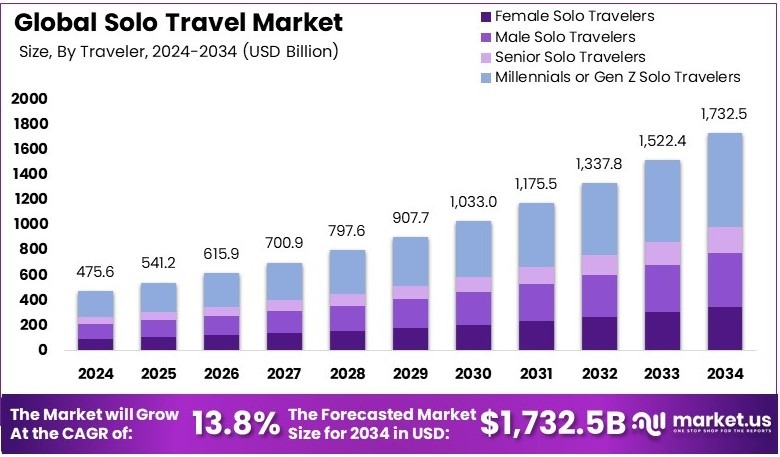

The Global Solo Travel Market size is expected to be worth around USD 1,732.5 Billion by 2034, from USD 475.6 Billion in 2024, growing at a CAGR of 13.8% during the forecast period from 2025 to 2034.

Solo travel means traveling alone without companions. People choose it for freedom, self-discovery, or flexible planning. It allows travelers to explore destinations at their own pace. Popular among young adults and retirees, solo travel is often linked to cultural trips, wellness retreats, or backpacking journeys.

The solo travel market includes services and products made for individual travelers. It covers flights, hotels, tours, and digital platforms. Growth is driven by changing lifestyles and rising demand for personalized experiences. Companies focus on safety, flexible booking, and solo-friendly activities to attract this growing segment.

Solo travel is gaining popularity fast. According to Condor Ferries, 25% of Americans traveled solo in 2023, up from 16% in 2022. That’s about 83 million people. This sharp rise shows how independent travel is no longer niche—it’s becoming a regular choice for many, especially younger generations.

In fact, a 2024 global study shows 76% of Millennials and Gen Z plan to take a solo trip within the year. Similarly, online searches for “solo travel” have grown by 223% over the last decade. This highlights strong curiosity and shifting preferences toward flexible, personal travel experiences.

As a result, the solo travel market is expanding fast. Travel agencies, hotels, and apps are tailoring services for solo adventurers. From single-room packages to social tours, companies are building value around independence and self-exploration. This opens up new revenue streams, especially in wellness, local culture, and adventure travel.

In contrast, market saturation remains low. There are still gaps in solo-friendly services, especially outside major tourist zones. This leaves room for small businesses and niche travel platforms to innovate. Meanwhile, competition is growing, particularly among digital platforms offering personalized travel planning and safety-focused features.

On a broader scale, solo travelers contribute to tourism growth in remote or less-visited places. This supports local economies and helps spread travel spending more evenly. In places like Bali or Lisbon, solo visitors boost local shops, hostels, and guides. Locally, this creates jobs and supports small business owners directly.

Key Takeaways

- The Solo Travel Market was valued at USD 475.6 billion in 2024 and is expected to reach USD 1,732.5 billion by 2034, with a CAGR of 13.8%.

- In 2024, Millennials/Gen Z Solo Travelers led with 43.2%, fueled by a growing preference for independent exploration.

- In 2024, Leisure/Vacation Travel dominated with 57.1%, as solo travelers seek relaxation and adventure.

- In 2024, 18–30 Years was the dominant age group, holding 50.6%, due to high enthusiasm for travel among younger individuals.

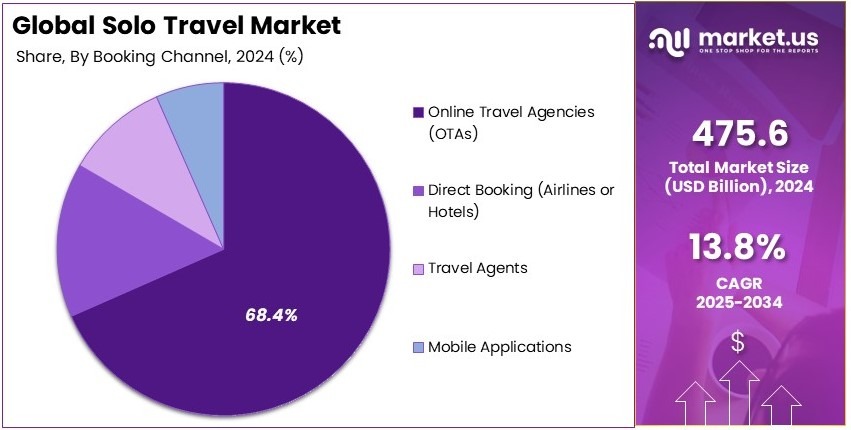

- In 2024, Online Travel Agencies (OTAs) accounted for 68.4%, driven by convenience and extensive travel options.

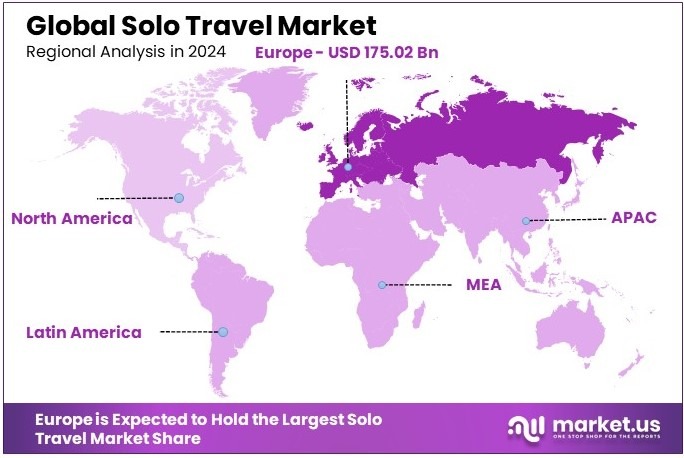

- In 2024, Europe led with 36.8%, valued at USD 175.02 billion, due to strong tourism infrastructure and cultural appeal.

Traveler Type Analysis

Millennials/Gen Z Solo Travelers dominate with 43.2% due to their preference for experiential travel and digital connectivity.

Millennials and Generation Z solo travelers represent the largest sub-segment within the solo travel market, holding a 43.2% share. This dominance is primarily attributed to their strong inclination towards exploring new cultures, seeking unique experiences, and their proficiency with digital tools for travel planning and social sharing. This group’s travel behavior significantly influences market trends, particularly in the integration of technology and personalization of travel experiences.

Female solo travelers are increasingly significant, driven by rising empowerment movements and safety-enhanced travel planning resources. Their travels are often motivated by self-discovery and social media influence, which contribute to the market’s growth.

Male solo travelers maintain a steady market presence, with many seeking adventure and leisure travel. Their consistent demand helps stabilize the market and encourages diverse offerings from travel providers.

Senior solo travelers are a growing niche, motivated by leisure and the desire to experience travel later in life. While smaller in market share, their higher disposable income influences premium travel services and customized travel packages.

Purpose of Travel Analysis

Leisure/Vacation travel dominates with 57.1% due to the universal desire for relaxation and escape from daily routines.

Leisure and vacation travel is the most prominent reason for solo trips, holding a market share of 57.1%. The pursuit of relaxation, pleasure, and new experiences drives this segment, making it a fundamental part of the solo travel industry. This category’s strength lies in its broad appeal across all demographics, from young adults to retirees, emphasizing its universal relevance.

Adventure travel is highly attractive among younger solo travelers who seek physical activities and adrenaline-fueled experiences. This segment is essential for driving innovation in travel offerings, such as eco-friendly tours and extreme sports options.

Business travel or MICE, although a smaller portion of solo travel, remains vital. It often blends with leisure travel, leading to the trend of “bleisure” travel where business trips are extended for personal enjoyment.

Wellness travel focuses on health and rejuvenation, attracting individuals looking to improve their mental and physical well-being. This niche is expanding as more travelers prioritize health and wellness during their journeys.

Volunteer/Charity travel appeals to those looking to make a positive impact while exploring new places. Although it commands a smaller share, it is significant for fostering cultural exchange and sustainable travel practices.

Age Group Analysis

18–30 Years dominate with 50.6% due to their adventurous nature and increasing financial independence.

The 18–30 age group holds the majority in the solo travel market with a 50.6% share. This segment’s dominance is fueled by young adults’ desire for adventure, personal growth, and social interactions while traveling alone. They are more likely to embrace backpacking, hostel stays, and budget travel, which are popular among this demographic.

The 31–45 years segment focuses on quality and meaningful experiences, often seeking solo travel as a break from family or career pressures. Their travel decisions are more about depth than breadth, favoring immersive experiences.

Individuals aged 46–60 are increasingly active travelers, often seeking comfort and luxury in their solo journeys. This group’s financial stability allows them to spend more on travel, influencing the market towards high-quality, tailored experiences.

Those above 60 years are a rapidly growing demographic in solo travel, driven by a desire for new experiences after retirement. They tend to prefer organized tours and cultural trips, which offer safety and social interaction.

Booking Channel Analysis

Online Travel Agencies (OTAs) dominate with 68.4% due to their convenience and comprehensive offerings.

Online Travel Agencies are the preferred booking channel for solo travelers, accounting for 68.4% of the market. Their dominance is based on the convenience they offer, including one-stop-shop capabilities for comparing prices, reading reviews, and booking multiple aspects of travel from accommodations to activities. This segment’s robust growth is supported by the increasing comfort with digital platforms among consumers.

Direct bookings with airlines and hotels are also prevalent, favored for their potential cost savings and loyalty benefits. Travelers who book directly often seek deeper control over their travel experiences.

Traditional travel agents provide personalized service and expert advice, particularly valued by less experienced travelers or those visiting complex destinations. Despite the rise of digital options, this channel retains a significant market segment due to its personalized touch.

Mobile applications are increasingly important, especially for younger travelers who prefer managing travel arrangements through their smartphones. Apps offer unparalleled convenience for on-the-go booking and itinerary adjustments, which is critical for solo travelers seeking flexibility.

Key Market Segments

By Traveler Type

- Female Solo Travelers

- Male Solo Travelers

- Senior Solo Travelers

- Millennials/Gen Z Solo Travelers

By Purpose of Travel

- Leisure/Vacation

- Adventure Travel

- Business Travel

- Wellness Travel

- Volunteer/Charity Travel

By Age Group

- 18–30 Years

- 31–45 Years

- 46–60 Years

- Above 60 Years

By Booking Channel

- Online Travel Agencies (OTAs)

- Direct Booking (Airlines/Hotels)

- Travel Agents

- Mobile Applications

Driving Factors

Remote Work and Personalized Planning Drive Market Growth

The solo travel market is experiencing steady growth, driven by shifts in work culture and consumer preferences. The rise of digital nomadism and remote work has made it easier for individuals to travel while maintaining their professional responsibilities. Travelers can now work from beaches, mountain cabins, or cultural hubs around the world, fueling the demand for long-term solo stays.

In addition, the availability of budget-friendly accommodations such as hostels, co-living spaces, and short-term rentals makes solo travel more affordable. These options are particularly popular among younger travelers and freelancers looking for cost-effective solutions.

Women-only travel packages are also gaining traction. These services are designed with safety and comfort in mind, offering curated experiences in secure environments. This has opened up the market for a growing segment of female solo travelers.

Furthermore, the rise of AI-driven travel planning tools is simplifying the process of building personalized itineraries. From suggesting places to visit to offering real-time safety alerts, these digital tools give travelers more control and confidence. As such, a mix of work flexibility, accessible lodging, safety-conscious travel options, and smart planning technology is encouraging more individuals to explore the world on their own.

Restraining Factors

Cost, Safety, and Isolation Limit Market Expansion

Several obstacles are slowing the solo travel market’s broader expansion. One of the major concerns is safety. Solo travelers, particularly in unfamiliar regions, are more vulnerable to scams, theft, or harassment. This makes safety a top priority, especially for first-time or female travelers.

Another issue is the cost of single-occupancy travel. Many travel packages and hotel rooms are priced for double occupancy, making solo travel more expensive than group travel. This pricing gap can discourage budget-conscious individuals from traveling alone.

Additionally, solo travelers often face limited opportunities for social interaction. This can lead to feelings of loneliness or isolation during longer trips, especially in less populated or remote areas.

Visa rules and travel restrictions also add complexity. Spontaneous or last-minute solo travel plans can be hindered by changing entry requirements, especially in politically sensitive or post-pandemic regions. Taken together, these factors challenge the accessibility and affordability of solo travel. To grow the market further, service providers must address safety, pricing, and community-building efforts for solo tourists.

Growth Opportunities

Wellness, Flexibility, and Connection Provide Opportunities

The solo travel market is unlocking new opportunities through innovation and changing traveler expectations. Peer-to-peer networking platforms are gaining momentum. These platforms help solo travelers connect with others in real time, share local tips, or even meet up, creating a sense of community on the go.

Eco-tourism and sustainable travel are also rising trends. Many solo travelers now prefer low-impact experiences such as hiking, wildlife volunteering, or cultural immersion. This type of travel aligns with a growing desire to be environmentally responsible while exploring the world.

Subscription-based travel services are offering flexible and affordable options, especially for frequent solo travelers. With monthly or annual plans, users can access discounted flights, stays, or curated experiences without the pressure of long-term commitments.

Another major area of growth is in wellness and adventure tourism. Solo retreats focused on mental health, yoga, or fitness are in demand. Adventure packages like solo hiking tours or guided safaris offer thrill and self-discovery. These shifts show that flexibility, meaningful experiences, and supportive tools are providing solo travelers with more confidence and choice than ever before.

Emerging Trends

Experiential and Tech-Based Solutions Are Latest Trending Factor

Several trends are shaping the solo travel market, with a growing focus on unique, tech-enabled, and personalized experiences. Digital detox and off-the-grid travel are becoming more popular. Many solo travelers are choosing to disconnect from devices and social media, seeking peace in nature or rural areas like Iceland’s highlands or Japan’s countryside.

Artificial intelligence is also playing a role. AI-powered travel assistants are helping solo travelers plan smartly, adjust itineraries on the go, and stay updated with safety alerts. These tools enhance convenience and reduce risks for individuals traveling alone.

Compact and multi-functional travel gear is now in demand. From convertible backpacks to portable cooking kits, solo travelers prefer lightweight yet practical products that support long journeys or unexpected detours.

Themed solo tours are another rising trend. Culinary trips in Italy, photography journeys in Morocco, or heritage tours in Greece allow travelers to explore a passion while discovering new places. These personalized experiences cater to niche interests, making solo trips more fulfilling. In summary, the solo travel market is increasingly shaped by innovation, practicality, and self-expression—creating more meaningful and trend-driven journeys for individuals around the world.

Regional Analysis

Europe Dominates with 36.8% Market Share

Europe leads the Solo Travel Market with a 36.8% share, valued at USD 175.02 billion. This significant market presence is driven by a strong tradition of solo travel, supported by safe and well-connected transport networks, and a variety of destinations catering to diverse interests.

The region’s rich cultural heritage, combined with its safe and tourist-friendly cities, makes it an ideal destination for solo travelers. Additionally, the ease of movement facilitated by the Schengen Area enhances travel convenience, further boosting the attractiveness of Europe for independent travelers.

The influence of Europe in the global Solo Travel Market is expected to remain strong. With increasing trends towards experiential travel and the rise of digital nomadism, Europe’s comprehensive travel infrastructure and diverse cultural offerings will likely continue to attract solo travelers, maintaining its dominance in the market.

Regional Mentions:

- North America: North America maintains a robust share in the Solo Travel Market, driven by a wide array of destinations and well-established travel infrastructure. The region’s focus on safety and convenience makes it a preferred choice for solo travelers.

- Asia Pacific: Asia Pacific is rapidly growing in the Solo Travel Market, thanks to booming tourism sectors in countries like Thailand and Japan. The region’s rich cultural diversity and affordable travel options attract a large number of solo travelers.

- Middle East & Africa: The Middle East and Africa are witnessing growth in solo travel, fueled by the development of tourism infrastructure and increasing global exposure. The regions offer unique historical and cultural experiences attracting adventurous solo travelers.

- Latin America: Latin America is seeing a rise in solo travel, driven by its vibrant cultures, scenic landscapes, and the growing safety measures in tourist spots. This trend is enhancing the region’s appeal to independent travelers seeking unique and immersive experiences.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the solo travel space, Intrepid Travel, G Adventures, Trafalgar, and Exodus Travels are the top players. They offer organized tours tailored to solo adventurers seeking experience, safety, and connection.

Intrepid Travel focuses on small group tours with local impact. It promotes sustainable travel and cultural immersion. Its tours are affordable, well-planned, and friendly for solo travelers of all ages.

G Adventures also champions community-based tourism. It offers adventure-filled itineraries to global destinations. Solo travelers enjoy flexibility, support, and ethical travel experiences. Their “no single supplement” policy is a major draw.

Trafalgar provides premium travel with guided group tours. It appeals to solo travelers looking for comfort, history, and cultural depth. Trafalgar’s strong reputation, expert guides, and well-organized itineraries build loyalty among travelers.

Exodus Travels focuses on activity-based solo tours. Popular themes include hiking, cycling, and wildlife adventures. Its safety standards and expert planning make it ideal for solo explorers.

These four companies succeed by offering safety, social experiences, and global reach. They cater to modern travelers who want freedom without isolation. Their strong online presence and customer service also help them maintain leadership in the fast-growing solo travel market.

Major Companies in the Market

- Intrepid Travel

- G Adventures

- Trafalgar

- Exodus Travels

- Contiki Tours

- Abercrombie & Kent

- EF Go Ahead Tours

- Road Scholar

- REI Adventures

- Flash Pack

- TourRadar

- Insight Vacations

- Backroads

Recent Developments

- Intrepid Travel: On February 2025, Intrepid Travel, an Australian-based global tour operator, acquired Dutch tour operator Sawadee Reizen, significantly expanding its presence in the European travel market. This acquisition is expected to boost Intrepid’s annual turnover by $100 million, adding approximately 20,000 customers annually. The move aligns with Intrepid’s goal to reach a $1 billion valuation within five years.

- TravelPerk: On January 2025, TravelPerk, a business travel platform, announced a $200 million Series E funding round led by Atomico and EQT Growth, nearly doubling its valuation to $2.7 billion. Concurrently, TravelPerk acquired Yokoy, a German expense software company, enhancing its expense management capabilities and reinforcing its position in the corporate travel sector.

Report Scope

Report Features Description Market Value (2024) USD 475.6 Billion Forecast Revenue (2034) USD 1,732.5 Billion CAGR (2025-2034) 13.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Traveler Type (Female Solo Travelers, Male Solo Travelers, Senior Solo Travelers, Millennials or Gen Z Solo Travelers), By Purpose of Travel (Leisure or Vacation, Adventure Travel, Business Travel, Wellness Travel, Volunteer or Charity Travel), By Age Group (18–30 Years, 31–45 Years, 46–60 Years, Above 60 Years), By Booking Channel (Online Travel Agencies (OTAs), Direct Booking (Airlines or Hotels), Travel Agents, Mobile Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Intrepid Travel, G Adventures, Trafalgar, Exodus Travels, Contiki Tours, Abercrombie & Kent, EF Go Ahead Tours, Road Scholar, REI Adventures, Flash Pack, TourRadar, Insight Vacations, Backroads Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intrepid Travel

- G Adventures

- Trafalgar

- Exodus Travels

- Contiki Tours

- Abercrombie & Kent

- EF Go Ahead Tours

- Road Scholar

- REI Adventures

- Flash Pack

- TourRadar

- Insight Vacations

- Backroads