Global Adventure Tourism Market Size, Share, Growth Analysis By Type (Hard Adventure, Soft Adventure), By Activity (Trekking and Hiking, Mountaineering, Scuba Diving, Paragliding, White-water Rafting, Wildlife Safari, Bungee Jumping, Others), By Age Group (Below 30 Years, 30–50 Years, Above 50 Years), By Booking (Direct, Travel Agent, Marketplace Booking), By Travel Type (Solo, Group, Family, Couples), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142040

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

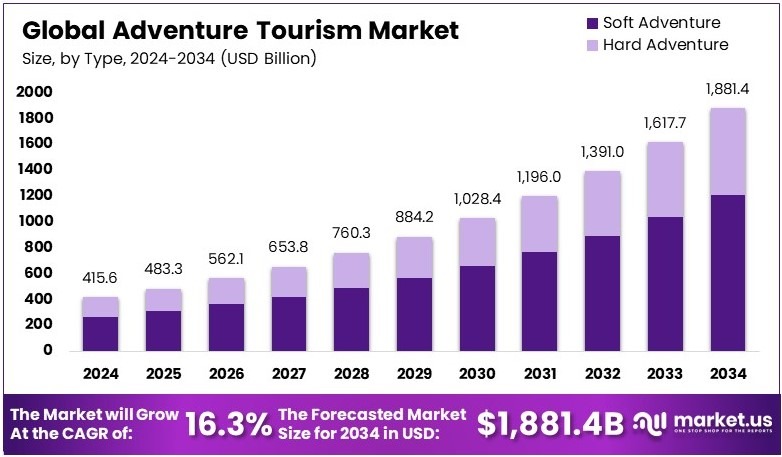

The Global Adventure Tourism Market size is expected to be worth around USD 1,881.4 Billion by 2034, from USD 415.6 Billion in 2024, growing at a CAGR of 16.3% during the forecast period from 2025 to 2034.

Adventure tourism involves travel to exciting and unique destinations. It includes activities like hiking, scuba diving, and wildlife safaris. Travelers seek thrill, nature, and cultural experiences. It can be soft adventure, like trekking, or hard adventure, like rock climbing. Safety, sustainability, and local experiences play a key role.

The adventure tourism market includes businesses offering adventure travel experiences. It covers tour operators, travel agencies, and accommodation providers. Demand is driven by nature lovers, thrill-seekers, and cultural explorers. This market includes domestic and international travel. Digital platforms help travelers book experiences, making adventure tourism more accessible and popular.

Adventure tourism is expanding rapidly as more travelers seek unique and immersive experiences. According to the United Nations World Tourism Organization (UNWTO), 1.1 billion international tourists traveled in the first nine months of 2024, reaching 98% of pre-pandemic levels. Moreover, social media platforms like Instagram have fueled interest in adventure destinations.

For instance, the Faroe Islands welcomed 130,000 visitors in 2023, doubling its tourism income to €125 million. This shift highlights the growing preference for nature-focused and adrenaline-driven trips, benefiting local businesses and conservation efforts.

Furthermore, rising disposable income and better travel infrastructure have contributed to this surge. Governments are investing in roads, airports, and safety measures to make remote areas more accessible. For example, many countries are funding eco-friendly accommodations and sustainable tourism projects.

Consequently, adventure tourism is not just about thrilling activities but also about responsible travel. Companies now focus on minimizing environmental impact while offering authentic experiences. This trend opens opportunities for businesses that promote sustainability and cultural immersion.

However, as demand rises, some destinations face overcrowding and environmental stress. Popular locations struggle with managing large tourist inflows, affecting both local communities and ecosystems. In contrast, emerging markets in Africa and South America present new opportunities for travelers seeking less-explored regions.

Meanwhile, competition among travel companies is increasing. To stay ahead, businesses are offering customized adventure packages, digital booking platforms, and exclusive experiences. This competition benefits travelers, providing them with more diverse and personalized options.

Key Takeaways

- The Adventure Tourism Market was valued at USD 415.6 billion in 2024 and is expected to reach USD 1,881.4 billion by 2034, with a CAGR of 16.3%.

- In 2024, Soft Adventure Tourism dominates the type segment with 64.2% due to its accessibility and lower physical risk.

- In 2024, Couples lead the traveler type segment with 42.1%, reflecting the popularity of adventure trips among partners.

- In 2024, the 30–50 Years age group dominates with 36.1%, driven by higher disposable income and interest in experiential travel.

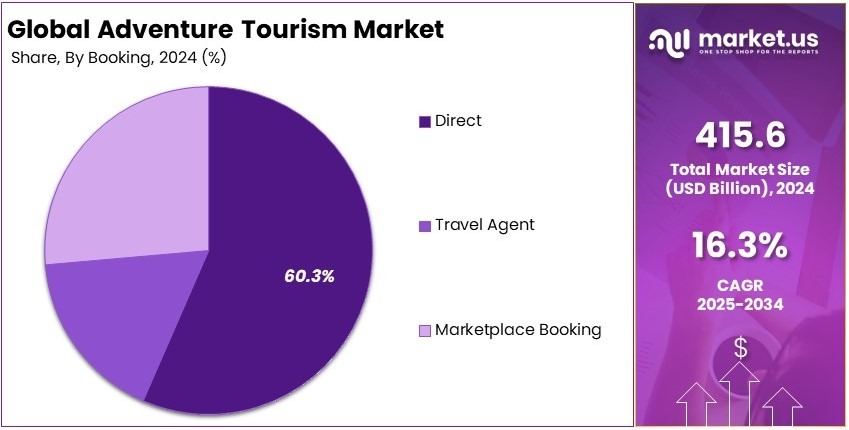

- In 2024, Direct Booking accounts for 60.3%, as travelers prefer direct engagement for customized experiences.

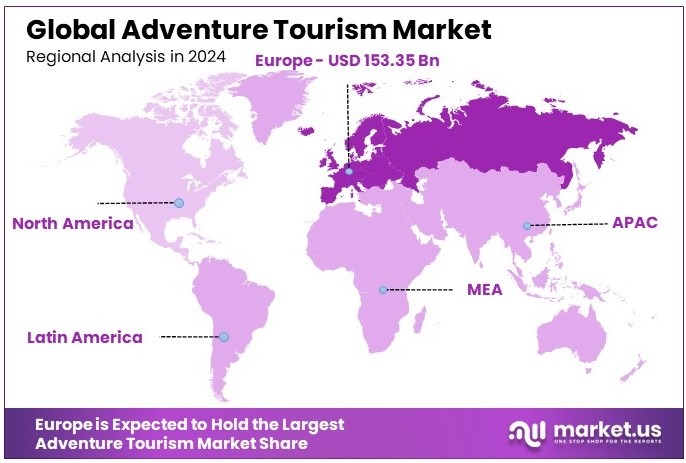

- In 2024, Europe leads with 36.9% and USD 153.35 billion, benefiting from diverse adventure destinations and strong tourism infrastructure.

Type Analysis

Soft Adventure Tourism dominates with 64.2% due to its broader appeal and accessibility.

Soft Adventure Tourism has emerged as the predominant segment within the Adventure Tourism Market, accounting for 64.2% of the market share. This segment includes activities like camping, bird watching, and hiking, which typically require less specialized skills and equipment than hard adventure options, making them accessible to a larger audience.

The appeal of soft adventure lies in its ability to combine the thrill of adventure with the safety and comfort that attract families, novice adventurers, and older tourists. This has contributed significantly to its dominant market position.

Hard Adventure, although less popular, involves more intense activities like rock climbing and paragliding. This sub-segment appeals to a niche market of enthusiasts seeking thrilling experiences, playing a crucial role in attracting high-spending clients who are significant for overall market growth despite its smaller size compared to soft adventures.

Traveler Type Analysis

Couples dominate with 42.1% due to their preference for shared experiences and romantic adventure trips.

The Couples segment within Adventure Tourism has secured a dominant position, holding 42.1% of the market share. This segment’s growth can be attributed to the increasing trend of couples seeking unique and memorable experiences that adventure tourism offers, such as tandem skydiving or couples’ retreats in exotic locations. Such activities provide not only excitement but also an opportunity for bonding, making them highly appealing to romantic partners.

Other traveler types, such as Solo, Group, and Family, contribute to the market by catering to specific needs and preferences. Solo travelers, for example, look for self-discovery and personal challenges, while families seek safe adventure experiences that cater to all ages, enhancing the segment’s diversity and potential for growth.

Age Group Analysis

The 30–50 Years segment leads with 36.1% due to its economic stability and willingness to spend on travel experiences.

Individuals aged 30–50 years dominate the Adventure Tourism Market, representing 36.1% of the market share. This age group typically possesses greater financial stability and a desire for more meaningful, experiential travel compared to younger or older demographics.

The preference for adventure activities among this cohort has been driven by a mix of peak physical conditioning and a willingness to invest in unique travel experiences that combine adventure with comfort, such as luxury hiking or adventure cruises.

The Below 30 Years segment, while less dominant, is characterized by a strong inclination towards budget-friendly and social media-worthy travel options, which include adventure elements. Conversely, the Above 50 Years segment tends to favor less physically demanding activities, focusing on cultural experiences and wildlife viewing, which are significant but smaller contributors to the overall market growth.

Booking Mode Analysis

Direct Booking leads with 60.3% due to its convenience and perceived cost-effectiveness.

Direct Booking has taken the lead in the Adventure Tourism Market with a significant 60.3% market share. This dominance is largely due to the growing consumer preference for making travel arrangements directly with service providers, facilitated by advancements in digital platforms and mobile applications. Travelers perceive direct booking as more straightforward and often cheaper, without the added fees associated with agents or third-party services.

Travel agents and marketplace bookings, while less dominant, still play essential roles. Travel agents offer personalized service and expert advice, valuable to less experienced travelers or those undertaking complex travel plans. Marketplaces, on the other hand, provide a breadth of options and the convenience of comparison, crucial for informed decision-making in a diverse market.

Key Market Segments

By Type

- Hard Adventure

- Soft Adventure

By Activity

- Trekking & Hiking

- Mountaineering

- Scuba Diving

- Paragliding

- White-water Rafting

- Wildlife Safari

- Bungee Jumping

- Others

By Age Group

- Below 30 Years

- 30–50 Years

- Above 50 Years

By Booking

- Direct

- Travel Agent

- Marketplace Booking

By Travel Type

- Solo

- Group

- Family

- Couples

Driving Factors

Economic Empowerment Drives Market Growth

Consumers with rising disposable income increasingly invest in adventure tourism. They now have extra funds to explore unique travel experiences and outdoor activities. Increased personal wealth motivates travelers to seek memorable journeys and diversified adventure packages that boost industry growth.

Multiple sustainable tourism initiatives further elevate market appeal. Eco-friendly practices attract travelers who value nature and conservation. Increased support for green travel enhances local infrastructure and safety. Government investments and policies also encourage the growth of well-organized adventure destinations globally.

Social media plays a vital role by showcasing exciting travel stories. Influencers and bloggers post captivating images that inspire exploration. Their visual content and testimonials create strong demand. Online reviews and recommendations further increase public interest in adventure travel opportunities.

Local communities benefit from increased tourism revenues and job creation. Small businesses, such as local guides and transport services, thrive. The cumulative effect of financial empowerment, environmental care, digital influence, and government support creates a robust adventure tourism market globally.

Restraining Factors

Expense and Compliance Hurdles Restraints Market Growth

High costs restrict consumer access to adventure tourism. Expensive travel packages and specialized equipment discourage many potential travelers. Price sensitivity remains a significant barrier for a large part of the market. This financial limitation reduces overall consumer participation considerably today.

Safety concerns add to consumer hesitation. Many perceive extreme adventure activities as risky and unpredictable. Such worries often deter families and cautious travelers from booking trips. The fear of accidents and inadequate emergency support amplifies these risks considerably every day.

Stringent environmental regulations impose additional costs on operators. Compliance requires significant investment in sustainable practices and eco-friendly equipment. These mandatory measures increase operational expenses. Strict rules slow expansion efforts and limit the number of feasible adventure projects in many regions.

Insufficient availability of certified professionals hampers market progress. The lack of skilled guides undermines consumer trust. Operators struggle to meet safety standards without proper training. This scarcity forces companies to limit service quality and restricts the potential for market expansion.

Growth Opportunities

Virtual Trends and Inclusive Strategies Provide Opportunites

Emerging digital trends offer innovative solutions to enhance adventure tourism. Virtual reality and augmented reality provide immersive previews of travel destinations. These interactive experiences allow consumers to explore locations safely and conveniently before making travel decisions, boosting consumer confidence overall.

Artificial intelligence and big data analytics deliver personalized travel planning. These tools analyze customer preferences and history to suggest tailored adventure packages. Operators can now offer custom itineraries that meet individual needs and improve customer satisfaction significantly across all platforms.

Local communities join forces with tourism operators to create authentic experiences. Collaborations bring cultural exchange and regional development benefits. Such partnerships provide travelers with genuine local insights and support sustainable practices that promote long-term market growth and diverse travel opportunities.

New market segments emerge as adventure tourism expands. Senior citizens and differently-abled travelers now enjoy specially designed tours. Accessible travel packages and customized services increase inclusivity. These innovations broaden the consumer base and open lucrative opportunities for industry stakeholders globally.

Digital tools and strategic partnerships combine to transform adventure tourism. Real-time data enhances service quality and responsiveness. Operators adapt to changing market trends. This integration of technology with local expertise creates robust growth opportunities and an edge for industry players.

Emerging Trends

Solo Ventures and Remote Work Are Latest Trending Factor

Solo travel is emerging as a significant trend in adventure tourism. Independent explorers seek personal journeys and unique challenges. This growing market segment is supported by increased digital connectivity and a desire for self-reliance in planning personalized travel experiences worldwide.

Female-led expeditions are also rising as a powerful trend. More women are venturing into solo and group adventures. Their participation highlights a shift in travel dynamics. Increased female representation encourages broader market acceptance and inspires innovation in adventure tourism offerings.

Off-the-beaten-path destinations gain popularity among adventure seekers. Travelers search for unexplored natural sites and unique cultural experiences. This trend is reinforced by social media, which shares vivid images and travel stories that highlight rare and attractive locales across the globe.

Digital nomadism and workation trends create extra momentum for adventure tourism. Remote workers seek destinations that offer both leisure and work-friendly facilities. This change in work culture boosts travel bookings while enhancing market demand for innovative travel models globally today.

Social media further intensifies trending factors by amplifying travel narratives and images. Online platforms and travel blogs influence consumer behavior. They promote experiences that emphasize uniqueness, freedom, and self-discovery. These digital trends keep the adventure tourism market responsive and evolving.

Regional Analysis

Europe Dominates with 36.9% Market Share in the Adventure Tourism Market

Europe leads the Adventure Tourism Market with a 36.9% share, totaling USD 153.35 billion. This region’s dominance is largely due to its diverse natural landscapes, well-preserved cultural heritage, and robust tourism infrastructure. Europe offers a unique blend of adventure activities, from Alpine skiing to Mediterranean sailing, attracting a wide range of tourists seeking both soft and hard adventure experiences.

The region’s market strength is further supported by a high level of economic stability, which enables significant investments in tourism facilities and safety standards, thereby enhancing the overall tourist experience. Furthermore, Europe’s strategic marketing initiatives aimed at promoting eco-friendly and sustainable tourism practices have positioned it as a top destination for adventure travelers worldwide.

Europe’s influence in the global Adventure Tourism Market is expected to continue growing. The region’s focus on sustainable practices and the integration of digital technologies in tourism management are likely to attract more eco-conscious and tech-savvy travelers, potentially increasing its market share even further.

Regional Mentions:

- North America: North America captures a significant portion of the Adventure Tourism Market with enhanced safety protocols and a wide array of activities from mountain climbing in the Rockies to kayaking in the Great Lakes. This region’s emphasis on customized adventure packages caters to a diverse audience, ensuring steady growth.

- Asia Pacific: Asia Pacific is witnessing rapid growth in Adventure Tourism, driven by its rich natural diversity and cultural heritage. Countries like New Zealand and Australia are popular for their adventure sports, while Southeast Asia attracts with tropical adventures, significantly contributing to the region’s market expansion.

- Middle East & Africa: The Middle East and Africa are steadily gaining traction in the Adventure Tourism Market due to unique landscapes and historical sites. The development of adventure tourism infrastructure, coupled with initiatives to promote local cultures, is drawing more international tourists to the region.

- Latin America: Latin America’s adventure tourism is propelled by its vast rainforests, rugged mountains, and extensive coastlines. The region’s commitment to preserving its natural environments makes it attractive for adventurers seeking authentic experiences, boosting its market presence.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the field of Adventure Tourism, key players such as REI Adventures, G Adventures, Intrepid Travel, and Abercrombie & Kent have carved out leading positions by offering distinct, high-quality experiences tailored to the adventurous traveler. Each of these companies contributes to the market in unique ways that underscore their strengths and appeal.

REI Adventures capitalizes on its established brand reputation in the outdoor gear market to offer adventure travel that emphasizes sustainability and the natural environment. They cater to eco-conscious consumers by providing experiences that support conservation efforts and promote awareness of local wildlife and ecosystems.

G Adventures differentiates itself with a vast array of travel options that are not only budget-friendly but also focus on ethical travel practices. Their itineraries ensure that tourism revenues benefit local communities, and they are particularly noted for their commitment to authentic and responsible travel experiences.

Intrepid Travel is renowned for its small group tours, which enable a more intimate and immersive travel experience. By keeping group sizes small, Intrepid facilitates deeper cultural exchanges and lessens the environmental impact of tours, aligning with the preferences of travelers seeking genuine, unfiltered engagements with their destinations.

Abercrombie & Kent excels in the luxury segment of adventure tourism, offering exclusive, tailor-made travel experiences that combine the thrill of adventure with high comfort levels. They cater to a niche market that desires the excitement of exotic and challenging locales without compromising on the creature comforts of premium travel.

These leading companies not only significantly influence market trends but also push the envelope by continuously innovating and improving their offerings. This dynamic competition propels the growth of the adventure tourism industry, broadening its appeal and accessibility to a global audience.

Major Companies in the Market

- REI Adventures

- G Adventures

- Intrepid Travel

- Abercrombie & Kent

- TUI Group

- Travelopia

- Lindblad Expeditions

- Natural Habitat Adventures

- Austin Adventures

- Mountain Travel Sobek

Recent Developments

- Sikkim Tourism: On March 2025, Sikkim announced its first bungee jumping facility at the Singshore Bridge in the 03-Maneybung-Dentam Constituency. A site inspection, led by Sudesh Kumar Limboo, Hon’ble MLA and Advisor to the Tourism and Civil Aviation Department, along with experts from Nepal, approved the location for the project.

- Jordan Tourism Board (JTB): On November 2024, the Jordan Tourism Board (JTB) promoted its adventure tourism offerings at the World Travel Market (WTM) in London. Led by JTB Director General Abdul Razzaq Arabiyat, the delegation included representatives from the Petra Development and Tourism Region Authority, Royal Jordanian Airlines, and the Jordan Heritage Revival Company.

Report Scope

Report Features Description Market Value (2024) USD 415.6 Billion Forecast Revenue (2034) USD 1,881.4 Billion CAGR (2025-2034) 16.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hard Adventure, Soft Adventure), By Activity (Trekking and Hiking, Mountaineering, Scuba Diving, Paragliding, White-water Rafting, Wildlife Safari, Bungee Jumping, Others), By Age Group (Below 30 Years, 30–50 Years, Above 50 Years), By Booking (Direct, Travel Agent, Marketplace Booking), By Travel Type (Solo, Group, Family, Couples) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape REI Adventures, G Adventures, Intrepid Travel, Abercrombie & Kent, TUI Group, Travelopia, Lindblad Expeditions, Natural Habitat Adventures, Austin Adventures, Mountain Travel Sobek Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Global Adventure Tourism MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Global Adventure Tourism MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- REI Adventures

- G Adventures

- Intrepid Travel

- Abercrombie & Kent

- TUI Group

- Travelopia

- Lindblad Expeditions

- Natural Habitat Adventures

- Austin Adventures

- Mountain Travel Sobek