Global Northern Lights Tourism Market By Traveler Type (Couple, Friends, Family, Solo), By Age Group (18-34 Years, 35-49 Years, 50-64 Years, 65+ Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136166

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

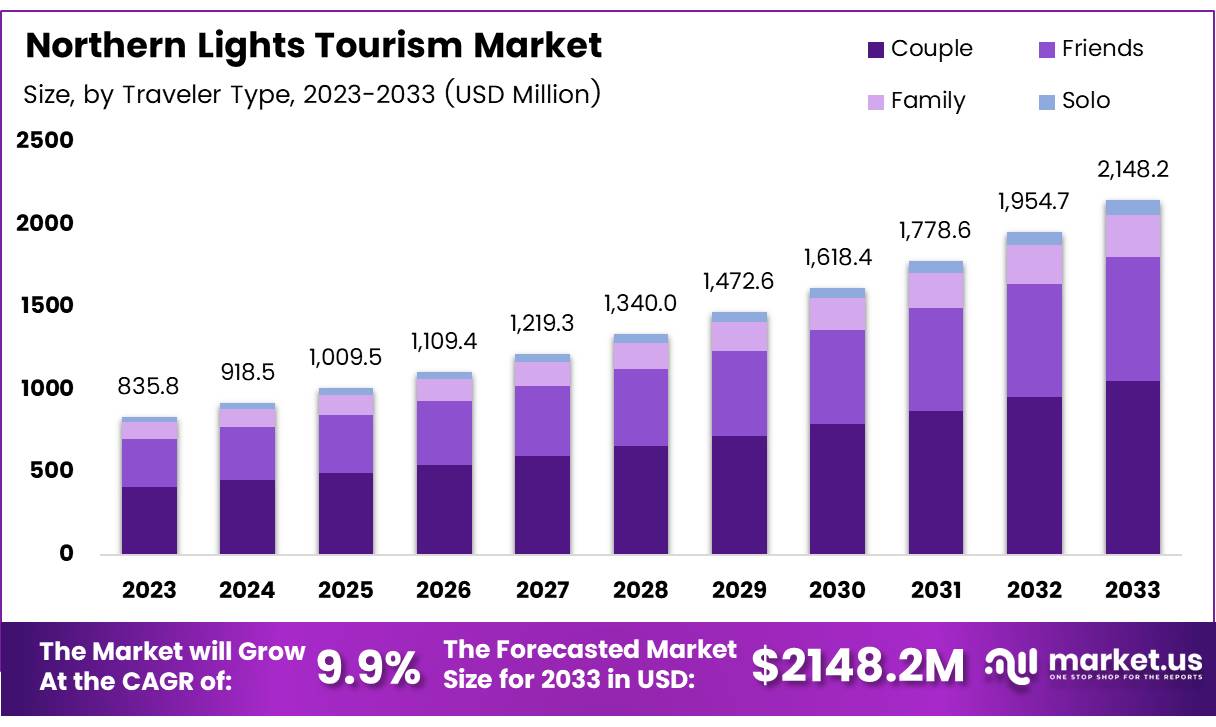

The Global Northern Lights Tourism Market size is expected to be worth around USD 2148.2 Million by 2033, from USD 835.8 Million in 2023, growing at a CAGR of 9.9% during the forecast period from 2024 to 2033.

Northern Lights tourism, also known as aurora tourism, focuses on travel experiences centered around viewing the Northern Lights, or aurora borealis. This natural phenomenon, known for its beauty and rarity, primarily occurs in high-latitude regions like Northern Norway, Finland, Sweden, Iceland, and Canada.

Tourists engage in activities such as aurora-viewing tours, glass igloo stays, guided photography expeditions, and Arctic adventures like dog sledding and snowmobiling. The combination of adventure, nature, and cultural experiences makes this market unique and increasingly popular.

The Northern Lights tourism market encompasses travel services, accommodations, and experiences tailored for aurora enthusiasts. It includes tour operators, airlines, hospitality providers, and local businesses offering packages such as luxury hotel, guided tours, and eco-friendly travel options.

Growth in this market is fueled by a rising global interest in unique, nature-focused travel. For example, Finland experienced a 197% surge in hotel searches for Northern Lights trips in 2023 compared to 2022, highlighting the increasing demand.

Destinations like Finnish Lapland and Northern Norway are leveraging the aurora borealis to attract tourists. Northern Norway welcomed 320,000 international winter visitors during the 2022–2023 season, while Finnish Lapland saw a 328% increase in interest in 2023.

Key opportunities include investments in infrastructure, such as glass igloos and remote lodges, and the integration of technology to enhance visitor experiences. Virtual and augmented reality tools are being used to offer digital previews of destinations, further driving interest.

However, challenges exist. Increased tourism in fragile Arctic ecosystems raises environmental concerns. Stakeholders are addressing these through eco-friendly accommodations and carbon-offset programs. For instance, the Finnish government is offering grants for sustainable tourism initiatives, ensuring long-term environmental preservation.

Northern Lights tourism is poised for strong growth due to consumer demand for experiential and sustainable travel. The appeal is particularly high among Canadian tourists, with 71% expressing a desire to see the aurora borealis. Governments and private entities are prioritizing sustainable models and infrastructure development to meet this demand.

The market’s expansion, driven by accessibility, innovative technologies, and eco-conscious initiatives, underscores its potential for long-term success. Finland’s 197% growth in hotel searches and Northern Norway’s increased visitor numbers demonstrate a thriving industry that continues to evolve, offering exciting opportunities for both businesses and travelers.

Key Takeaways

- The Northern Lights Tourism Market is projected to grow from USD 835.8 million in 2023 to USD 2148.2 million by 2033, at a CAGR of 9.9%.

- Couples are the leading demographic in the Northern Lights Tourism Market, holding 48.6% of the market share in 2023.

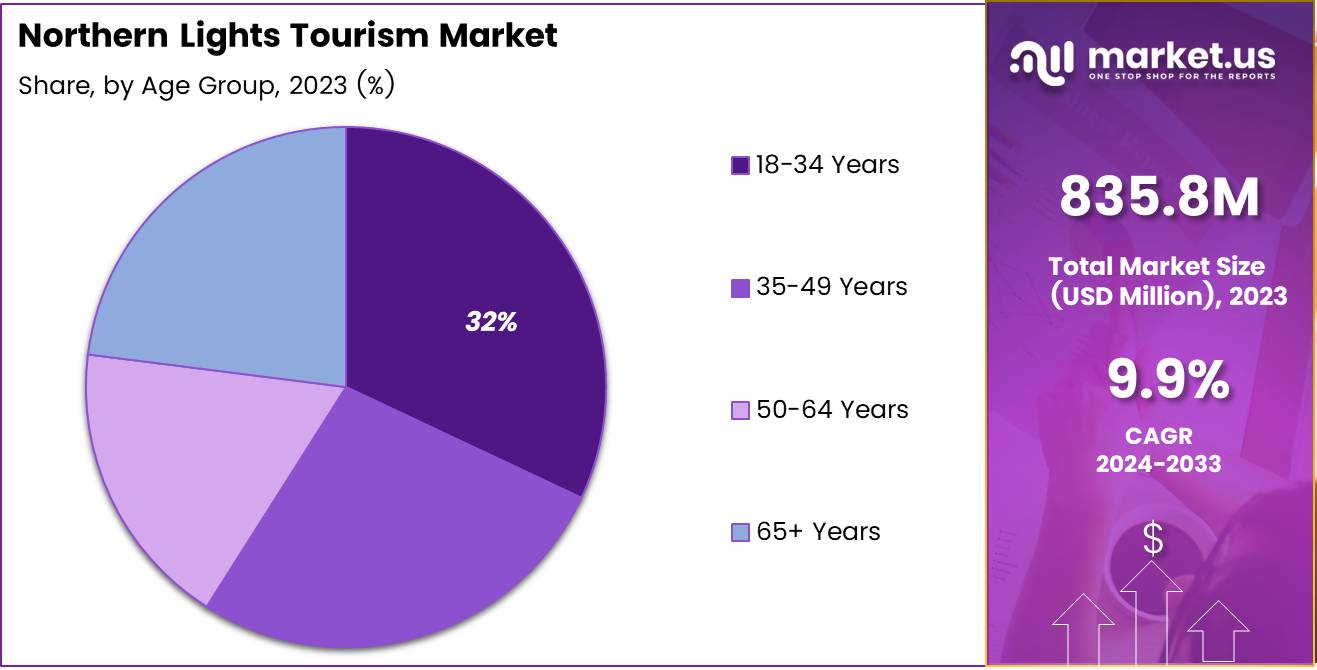

- The 18-34 age group is the dominant age demographic, representing 32% of the market in 2023.

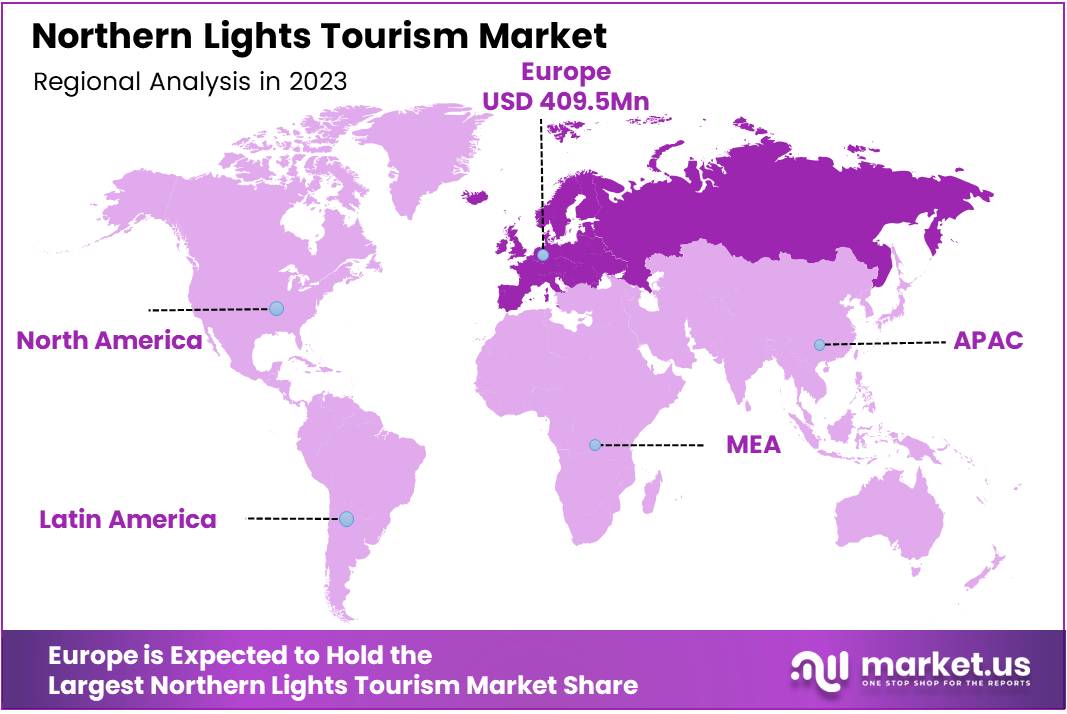

- Europe is the leading region in the Northern Lights tourism market with a 45.9% share, generating about USD 409.5 million in revenue.

Traveler Type Analysis

Couples Lead Northern Lights Tourism with 48.6% Share, Preferring Romantic and Unique Experiences

In 2023, Couple held a dominant market position in the By Traveler Type Analysis segment of the Northern Lights Tourism Market, with a 48.6% share. This substantial market share underscores the strong preference among couples for romantic and unique travel experiences offered by Northern Lights viewing.

Friends as a traveler type followed, capturing a significant share, highlighting the appeal of shared adventures in attracting groups of peers. Family travelers also showed significant engagement, accounting for a notable portion of the market. This indicates a growing trend towards educational and experiential travel that appeals to all ages.

Meanwhile, solo travelers held the smallest share, reflecting a more niche market of individuals seeking solitude and personal enrichment through travel. Collectively, these dynamics suggest that while couples continue to drive demand in this sector, other groups also present viable opportunities for market expansion and targeted marketing strategies.

Age Group Analysis

18-34 years Lead the Way in Northern Lights Tourism with a 32% Market Share, Driven by a Quest for Unique Experiences

In 2023, the 18-34 years age group held a dominant position in the By Age Group Analysis segment of the Northern Lights Tourism Market, boasting a 32% share. This demographic showcased a strong interest in adventure tourism, driven by a desire for unique and Instagram-worthy travel experiences.

Their engagement is crucial, as it not only reflects current trends but also sets the stage for future marketing strategies aimed at younger travelers.

The 35-49 years segment followed, representing a significant portion of the market with interests that often included educational components of the trips, indicating a preference for a blend of leisure and learning. Those aged 50-64 years also maintained a steady interest in Northern Lights tours, likely appreciating the natural phenomenon from a more contemplative and leisure-focused standpoint.

The 65+ years age group, while smaller in market share, displayed a keen interest, underscoring the universal appeal of the Northern Lights across different age groups. This age segment tends to favor comfort and accessibility in their travel choices, suggesting that tailored trips that offer convenience and ease of travel could increase their market share in the future.

Each age group’s preferences highlight diverse motivations and expectations, which are essential for segmenting marketing efforts and developing targeted tourism products.

Key Market Segments

By Traveler Type

- Couple

- Friends

- Family

- Solo

By Age Group

- 18-34 Years

- 35-49 Years

- 50-64 Years

- 65+ Years

Drivers

Interest in Adventure Tourism Boosts Northern Lights Market

The Northern Lights tourism market has experienced significant growth, primarily fueled by the increased interest in adventure tourism. Globally, travelers are seeking unique and adventure-based experiences, which positions Northern Lights viewing as a highly desirable activity.

The allure of witnessing this natural phenomenon is amplified by the pervasive influence of social media, where stunning images of the auroras are shared widely, inspiring more people to add this experience to their travel bucket lists.

Additionally, improvements in transportation and infrastructure in regions known for Northern Lights, such as Norway, Sweden, and Iceland, have made these previously remote destinations more accessible. Enhanced accessibility has allowed a broader spectrum of tourists to embark on this once-in-a-lifetime journey.

Furthermore, a rise in disposable income across various global demographics has enabled more individuals to indulge in luxury and luxury travel experiences, further bolstering the market for Northern Lights tourism. These factors combined have contributed to the robust growth of this niche tourism sector, attracting adventure seekers and nature enthusiasts from around the world.

Restraints

Seasonal Limitations Impact Northern Lights Tourism

The growth of the Northern Lights tourism market is significantly restrained by its limited seasonal window and unpredictable weather conditions.

The Northern Lights are visible only during specific times of the year, primarily from late autumn to early spring. This narrow viewing period restricts the market’s ability to operate year-round, thereby limiting revenue generation opportunities to a few months annually.

Furthermore, the visibility of the Northern Lights is highly susceptible to weather conditions. Cloud cover and adverse weather conditions can severely impact visibility, resulting in frequent occurrences of customer dissatisfaction.

These unpredictable elements not only pose challenges for tourists hoping to witness this natural phenomenon but also create operational and planning difficulties for service providers within the market. This leads to increased marketing and operational costs as businesses strive to manage customer expectations and enhance the overall experience despite these inherent limitations.

Growth Factors

Growth Potential in Northern Lights Tourism with Luxury Aurora Lodges

The Northern Lights tourism market presents a significant opportunity for growth, particularly through the development of luxury Aurora lodges. These high-end accommodations are tailored specifically for optimal viewing of the auroras, offering a unique blend of comfort and spectacle. This strategy not only enhances the visitor experience but also attracts a wealthier demographic willing to pay a premium for exclusivity and convenience.

Additionally, the integration of Augmented Reality (AR) technology can transform the viewing experience, enabling tourists to enjoy the lights even during suboptimal conditions, thereby extending the tourist season and increasing revenue potential. Furthermore, tapping into emerging markets like Russia and Alaska, with their pristine viewing conditions, could diversify tourist streams and bolster market resilience.

Collaborative efforts with airlines to introduce Northern Lights-themed flights and packages could further stimulate interest and accessibility, creating a comprehensive travel experience that appeals to global adventurers. Together, these strategies harness technology, luxury, and untapped markets to expand the Northern Lights tourism sector, presenting a promising horizon for industry stakeholders.

Emerging Trends

Focus on Off-Season Activities Bolsters Northern Lights Tourism

The Northern Lights tourism market is experiencing significant growth, driven by several trending factors that enhance visitor experiences beyond the traditional winter viewing season. Firstly, the expansion of off-season activities, such as dog sledding, ice fishing, and snowmobiling, has broadened the appeal of Aurora-viewing destinations, attracting tourists throughout the year and not just during peak Aurora seasons.

Additionally, technological advancements play a pivotal role; mobile applications and various gadgets are now widely used to predict and track Aurora activity, considerably improving the chances of witnessing this natural phenomenon. This technological aid not only enhances visitor satisfaction but also helps manage expectations and improve trip planning.

Furthermore, the adoption of drone technology for photography has revolutionized how tourists capture and share their experiences. Drones offer unique aerial perspectives of the Northern Lights, creating compelling content that boosts digital engagement and promotes further interest in Aurora tourism. These factors collectively contribute to the robust growth of the Northern Lights tourism market, ensuring a dynamic blend of adventure, technology, and nature.

Regional Analysis

Europe Leads Northern Lights Tourism with 45.9% Market Share, Generating USD 409.5 Million Due to Prime Viewing Locations and Strong Infrastructure

The global market for Northern Lights tourism exhibits significant regional segmentation, with Europe, North America, Asia Pacific, the Middle East & Africa, and Latin America each offering unique contributions and opportunities in this niche tourism sector.

Europe stands as the dominant region in the Northern Lights tourism market, commanding a substantial 45.9% share, which equated to a revenue generation of approximately USD 409.5 million in the last recorded year.

This dominance is primarily due to the geographical advantage of countries like Norway, Sweden, Finland, and Iceland, where the aurora borealis is most visible. The region benefits from well-established tourism infrastructure tailored to aurora viewing, complemented by robust marketing strategies that attract a high volume of international tourists seeking this natural spectacle.

Regional Mentions:

In North America, particularly in Canada and Alaska, the market is also robust, driven by optimal viewing conditions and the development of tailored travel packages that include aurora viewing as a key attraction. The growth in this region is supported by increasing investments in tourism facilities and promotional activities by governmental bodies aimed at boosting winter tourism.

The Asia Pacific region is witnessing gradual growth in this market segment. Countries such as Japan have started capitalizing on their northern regions like Hokkaido, which offers a favorable view of the Northern Lights during peak seasons. Tourism boards in these areas are increasingly promoting winter tourism that includes Northern Lights viewing as a potential activity.

The Middle East & Africa and Latin America currently represent smaller segments of the Northern Lights tourism market. These regions are primarily potential markets with growth driven by increasing outbound tourism. Tour operators in these regions are beginning to include Northern Lights viewing packages in their European travel itineraries to attract tourists seeking unique and experiential travel.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Northern Lights Tourism Market has witnessed a dynamic interplay of competitive efforts, spearheaded by notable entities such as Abercrombie & Kent, Quark Expeditions, and Hurtigruten Expeditions. These companies have consistently enhanced their market presence through innovative offerings and strategic marketing, aimed at captivating the growing interest in aurora borealis tourism.

Abercrombie & Kent, known for its luxury travel experiences, has effectively capitalized on its reputation by offering exclusive Northern Lights viewing packages. These packages are tailored to affluent travelers seeking personalized and intimate encounters with the phenomenon, thereby reinforcing their position in the high-end segment of the market.

Quark Expeditions, on the other hand, has emphasized its specialized polar expeditions to attract adventure-seeking tourists. Their expertise in navigating polar regions positions them uniquely within the market, providing them an edge in attracting a niche client base interested in combining aurora viewing with polar exploration.

Hurtigruten Expeditions continues to leverage its longstanding maritime heritage to offer a distinctive blend of cruise-based Northern Lights tourism. Their approach not only highlights the natural spectacle of the auroras but also integrates educational components about marine and polar environments, appealing broadly to eco-conscious travelers.

Together, these key players demonstrate a robust grasp of market dynamics, each carving out distinct niches within the broader Northern Lights tourism spectrum. Their strategies underscore a deep understanding of consumer preferences and the evolving landscape of experiential travel, setting a competitive benchmark in this specialized tourism sector.

Top Key Players in the Market

- Abercrombie & Kent

- Quark Expeditions

- Lindblad Expeditions

- Hurtigruten Expeditions

- Butterfield & Robinson Inc.

- Travel Edge

- Scott Dunn

- Exodus Travels

- Intrepid Travels

- The Aurora Zone

Recent Developments

- In November 2024, the Tourism Fund allocated over $1 million to support local initiatives, enhancing community-based projects and cultural events to boost local economies.

- In January 2024, Arctic Kingdom successfully acquired Blachford Lake Lodge, positioning itself prominently within the luxury tourism market by owning one of the premier destinations for viewing the northern lights.

- In June 2024, Singapore introduced its own version of the northern lights at Gardens by the Bay, creating a spectacular light installation that replicates the awe-inspiring natural phenomenon, attracting both locals and tourists alike.

- In November 2024, Pandox AB announced the acquisition of the Radisson Blu Hotel Tromsø, a strategic move aimed at consolidating its presence within the Scandinavian hospitality market, enhancing its portfolio of high-quality accommodations.

Report Scope

Report Features Description Market Value (2023) USD 835.8 Million Forecast Revenue (2033) USD 2148.2 Million CAGR (2024-2033) 9.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Traveler Type (Couple, Friends, Family, Solo), By Age Group (18-34 Years, 35-49 Years, 50-64 Years, 65+ Years) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abercrombie & Kent, Quark Expeditions, Lindblad Expeditions, Hurtigruten Expeditions, Butterfield & Robinson Inc., Travel Edge, Scott Dunn, Exodus Travels, Intrepid Travels, The Aurora Zone Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Northern Lights Tourism MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Northern Lights Tourism MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Abercrombie & Kent

- Quark Expeditions

- Lindblad Expeditions

- Hurtigruten Expeditions

- Butterfield & Robinson Inc.

- Travel Edge

- Scott Dunn

- Exodus Travels

- Intrepid Travels

- The Aurora Zone