Global Solar Ingot Wafer Market Size, Share Analysis Report By Type (Monocrystalline, Polycrystalline), By Wafer Size (125mm, 156mm, 210mm, Others), By Application (Mono Solar Cells, Multi Solar Cells) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146185

- Number of Pages: 335

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

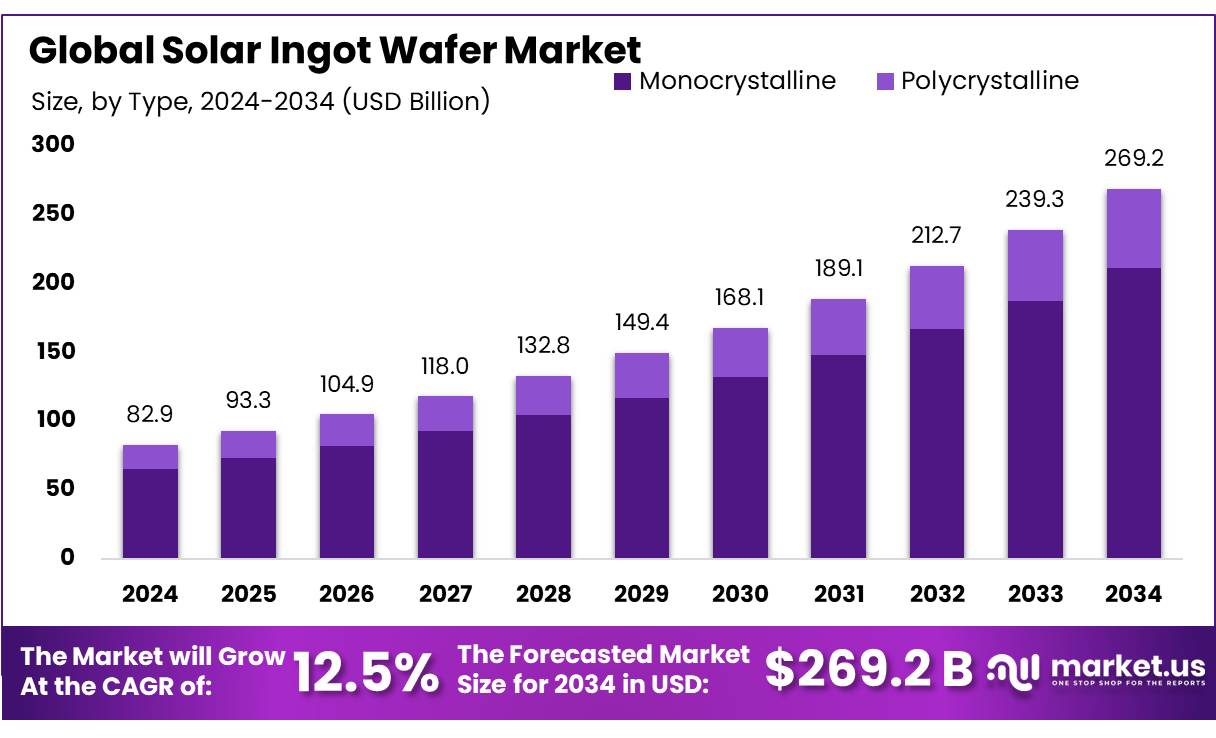

The Global Solar Ingot Wafer Market size is expected to be worth around USD 269.2 Bn by 2034, from USD 82.9 Bn in 2024, growing at a CAGR of 12.5% during the forecast period from 2025 to 2034.

The solar ingot wafer market is a pivotal component of the photovoltaic (PV) industry, serving as the foundational material for the production of solar cells. These wafers, primarily made from crystalline silicon, are the building blocks for solar panels, which convert sunlight into electricity. The market has witnessed significant growth due to the global push towards renewable energy sources aimed at reducing carbon footprints and mitigating climate change impacts.

As of 2025, the solar ingot wafer industry is characterized by rapid technological advancements and scaling production capacities to meet the burgeoning demand for solar energy. Leading manufacturers are concentrated in Asia-Pacific, particularly in China, which dominates the market by supplying over 70% of the global demand. This region benefits from the availability of raw materials, advanced manufacturing technologies, and supportive government policies promoting solar energy.

Several factors are driving the growth of the solar ingot wafer market. Government incentives and policies play a pivotal role. In the U.S., the Inflation Reduction Act (IRA) of 2022 introduced tax credits for solar manufacturing, leading to significant investments in domestic production facilities. Similarly, India has implemented policies to boost its solar manufacturing sector, aiming to achieve 25 GW of solar cell and 60 GW of solar module production capacity by the end of 2025 . Technological advancements, such as the development of larger format wafers, have also contributed to increased efficiency and reduced production costs, further stimulating market growth .

Governments Initiatives are supporting solar energy through incentives such as feed-in tariffs and tax rebates. For instance, the Indian government’s National Solar Mission aims to establish India as a global leader in solar energy by deploying 100 GW of solar power by 2022.

The future of the solar ingot wafer market appears promising, with emerging markets presenting significant opportunities. Countries in Africa, Southeast Asia, and Latin America are increasingly investing in solar energy to meet their growing energy needs sustainably.

Key Takeaways

- Solar Ingot Wafer Market size is expected to be worth around USD 269.2 Bn by 2034, from USD 82.9 Bn in 2024, growing at a CAGR of 12.5%.

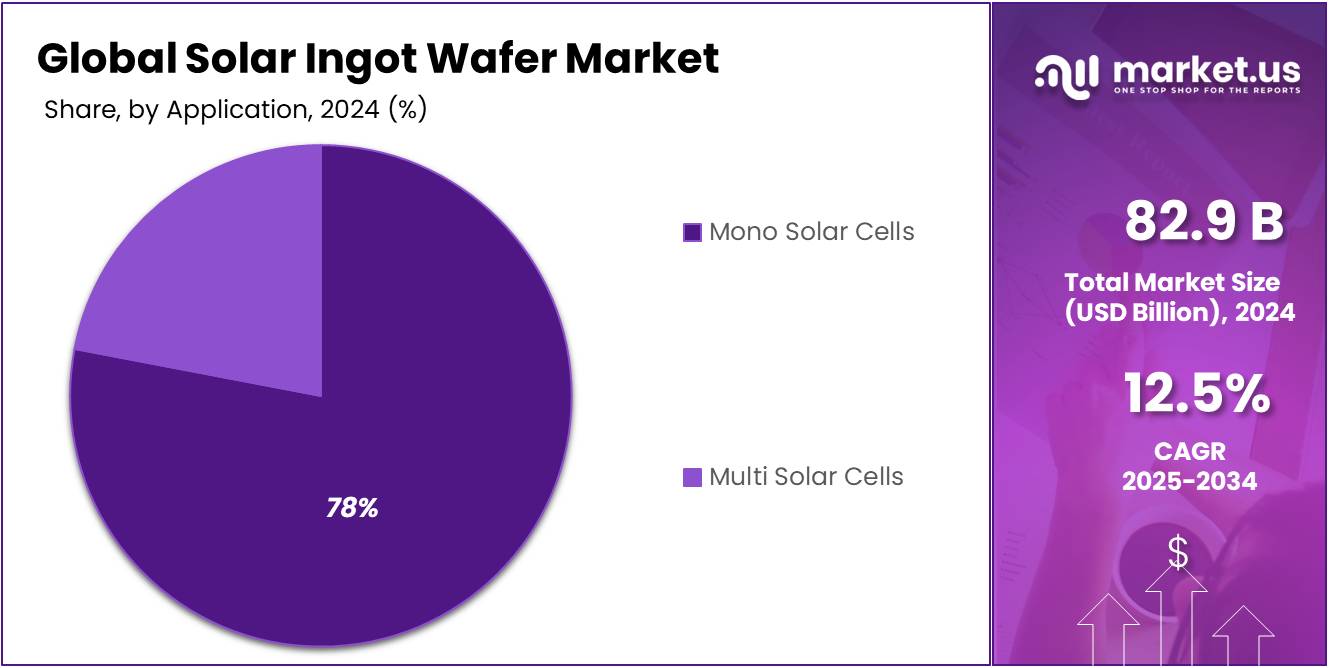

- Monocrystalline solar ingots secured a commanding market position, holding more than a 78.5% share.

- 210mm solar wafers solidified their leadership in the market by capturing more than a 57.6% share.

- Mono solar cells established a commanding presence in the solar ingot wafer market, securing more than a 78.3% share.

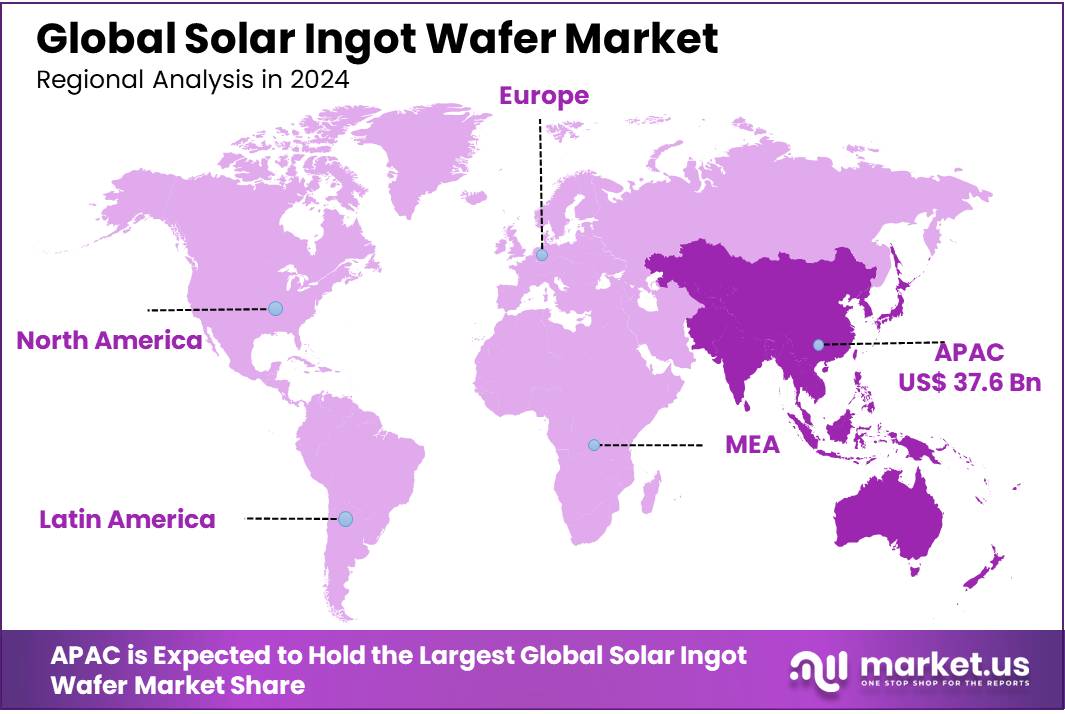

- Asia-Pacific (APAC) region held a dominant position in the solar ingot wafer market, capturing a substantial 45.40% share, which translates to approximately USD 37.6 billion.

Analysts’ Viewpoint

From an investment perspective, the market presents both opportunities and risks. The demand for high-efficiency monocrystalline wafers is on the rise, offering potential for higher returns. However, the market is also facing challenges such as overcapacity and intense price competition, which could impact profitability. Technological advancements, including kerfless wafer production, are expected to improve efficiency and reduce costs, further influencing market dynamics . Investors should consider these factors when evaluating opportunities in the solar ingot wafer market.

Technological advancements are also shaping the market. Innovations in wafer production, such as kerfless wafer technology, are improving efficiency and reducing costs. Additionally, the development of high-efficiency solar cells is driving demand for quality ingot wafers. On the regulatory front, policies promoting renewable energy adoption are creating a favorable environment for market growth. However, trade policies and tariffs can impact the global supply chain, influencing investment decisions.

By Type

Monocrystalline Solar Ingots Lead with 78.5% Share for Enhanced Efficiency

In 2024, Monocrystalline solar ingots secured a commanding market position, holding more than a 78.5% share. This significant market dominance can be attributed to their high efficiency and longevity, qualities that are highly valued in solar installations. Monocrystalline ingots, known for their pure silicon content, offer superior performance in converting sunlight to electricity, making them a preferred choice for both residential and commercial solar systems.

Their ability to perform better in low-light conditions also bolsters their widespread adoption, ensuring robust growth in the solar energy sector. As the industry leans towards more sustainable and effective energy solutions, monocrystalline solar ingots continue to be at the forefront, driving innovations and setting benchmarks in solar technology.

By Wafer Size

210mm Wafers Command 57.6% Market Share for Their High Efficiency

In 2024, 210mm solar wafers solidified their leadership in the market by capturing more than a 57.6% share. This dominance is largely due to their optimal size, which balances efficiency and cost-effectiveness, making them highly sought after in the solar panel manufacturing industry. The 210mm wafer size allows for higher power output while maintaining manageable weight and handling characteristics, which are critical factors for large-scale solar installations. As the solar industry continues to evolve towards more powerful and efficient solutions, the 210mm wafers are expected to remain a pivotal component in the manufacturing of next-generation solar panels. Their significant market share underscores their crucial role in driving forward the adoption of solar energy globally.

By Application

Mono Solar Cells Dominate with 78.3% Share for Superior Performance

In 2024, Mono solar cells established a commanding presence in the solar ingot wafer market, securing more than a 78.3% share. Their dominance is attributed to their high efficiency and superior performance characteristics, which are essential for maximizing solar energy conversion. Mono solar cells are preferred for their ability to produce more power per square meter than other types of solar cells, making them particularly valuable in both residential and commercial solar projects where space and efficiency are at a premium. This market segment is bolstered by ongoing advancements in photovoltaic technology, ensuring that mono solar cells continue to be a top choice for those seeking to leverage renewable energy solutions efficiently.

Key Market Segments

By Type

- Monocrystalline

- Polycrystalline

By Wafer Size

- 125mm

- 156mm

- 210mm

- Others

By Application

- Mono Solar Cells

- Multi Solar Cells

Drivers

Government Support Bolsters Solar Ingot Wafer Market Growth

One of the primary driving factors for the growth of the solar ingot wafer market is the substantial support from government initiatives around the world. Governments are increasingly recognizing the importance of renewable energy sources in achieving energy independence and reducing carbon emissions. For instance, the U.S. Department of Energy (DOE) has consistently funded programs aimed at advancing solar technology and reducing the cost of solar energy. Such initiatives have significantly boosted the confidence of investors and manufacturers in the solar market.

In Europe, the European Commission has set ambitious renewable energy targets under the European Green Deal, aiming for a 55% reduction in greenhouse gas emissions by 2030. These targets are backed by funding mechanisms and policies that encourage the adoption of solar technology among EU member states. For example, the EU’s Horizon 2020 program has allocated substantial funds to research and innovation in solar technologies, fostering developments that directly benefit the solar ingot and wafer sector.

Asia is not left behind, with countries like China and India leading the charge. China’s latest Five-Year Plan emphasizes the development of renewable energy sectors, including solar. The plan includes financial incentives for solar farms and subsidies for manufacturers of solar technology components like ingots and wafers. India, under its National Solar Mission, has also set forth policies and financial incentives to support solar energy production, significantly impacting the demand for solar ingots and wafers.

Restraints

Supply Chain Disruptions Challenge Solar Ingot Wafer Market Growth

A significant restraining factor affecting the solar ingot wafer market is the disruption in the global supply chain. These disruptions can have a profound impact on the production and distribution of solar ingots and wafers, which are crucial components of solar panels. The volatility in the supply of raw materials, such as high-purity silicon, which is essential for producing monocrystalline and polycrystalline solar cells, directly affects the market.

During recent years, events such as the COVID-19 pandemic have exemplified how quickly and severely supply chain issues can impact the solar industry. For instance, lockdowns and restrictions in key manufacturing hubs like China, which is a leading producer and supplier of photovoltaic (PV) silicon, caused significant delays and increased costs for solar panel manufacturers worldwide. These challenges are not only limited to pandemics but also include geopolitical tensions and trade disputes that can lead to tariffs and other trade barriers.

For example, ongoing trade disputes between major global economies can lead to tariffs on imported solar components, which raises production costs and slows down the adoption of solar energy systems. Such economic barriers discourage investment in solar technologies and can significantly slow down market growth. The U.S. imposition of tariffs on solar panels from certain countries is a case in point, demonstrating how political decisions can have extensive economic effects on the global solar market.

Opportunity

Emerging Markets Present Expansive Growth Opportunities for Solar Ingot Wafer Industry

A significant growth opportunity for the solar ingot wafer market lies in the expanding renewable energy markets in developing countries. As nations around the world intensify their efforts to combat climate change and reduce carbon emissions, solar energy is increasingly becoming a cornerstone of renewable energy policies, especially in regions with high solar irradiance.

Countries in Africa, Southeast Asia, and Latin America are experiencing rapid economic growth and are looking to address their increasing energy needs through sustainable sources. For example, India has committed to achieving 50% energy capacity from renewable resources by 2030 under its National Solar Mission. This ambitious goal is supported by various government incentives, such as subsidies and tax benefits, which directly benefit the solar sector.

Moreover, as the cost of solar technology continues to decrease due to technological advancements and economies of scale, solar energy becomes more accessible. This affordability enhances the market for solar ingot wafers, as more developers can invest in solar projects. The decreasing cost of photovoltaic technology is a key driver in making solar installations competitive with traditional fossil fuel energy sources, even in less developed markets.

Trends

Technological Innovations Propel Efficiency Gains in Solar Ingot Wafer Market

One of the most significant latest trends in the solar ingot wafer market is the rapid advancement in photovoltaic (PV) technology, specifically in the development of thinner and more efficient wafers. These innovations are crucial as they directly influence the efficiency and cost-effectiveness of solar panels, making solar energy more competitive with traditional energy sources.

Recent years have seen a notable shift towards producing thinner solar wafers without compromising the durability and efficiency of solar cells. This trend is driven by the ongoing research and development efforts aimed at reducing material costs and improving the light absorption capabilities of solar cells. For instance, the introduction of diamond wire saws in the manufacturing process has allowed producers to cut wafers more thinly and uniformly, which significantly reduces silicon waste and lowers production costs.

Governments are also playing a crucial role by funding solar energy projects and R&D initiatives. For example, the U.S. Department of Energy’s Solar Energy Technologies Office (SETO) supports projects aimed at reducing the cost of solar energy and enhancing the efficiency of solar technologies, which includes innovations in solar ingot wafer production.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a dominant position in the solar ingot wafer market, capturing a substantial 45.40% share, which translates to approximately USD 37.6 billion in market value. This impressive market share underscores APAC’s pivotal role in the global solar industry, driven largely by the extensive manufacturing capacities and robust government support found in countries such as China, India, and South Korea.

China, in particular, stands as a global leader in the production of solar ingot wafers, housing some of the world’s largest manufacturers that benefit from government subsidies and a favorable industrial policy landscape. These manufacturers are crucial to the supply chain of the global solar market, providing critical components that feed into the worldwide demand for renewable energy installations.

India, another key player in the region, has been rapidly expanding its solar energy capacity through ambitious government initiatives aimed at promoting renewable energy sources. The Indian government’s target to achieve 175 GW of renewable energy capacity by 2022, with a significant focus on solar, has spurred growth in domestic manufacturing of solar wafers and related components. These initiatives are part of a broader strategy to decrease dependency on imported oil and make solar energy a cornerstone of the national energy grid.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

CETC Solar Energy Holdings Co., Ltd., a leader in the solar energy sector, specializes in the production of high-quality solar ingot wafers essential for photovoltaic solutions. Known for their innovation and efficiency, CETC’s products serve both domestic and international markets, bolstering the global transition towards renewable energy.

DCH Group International stands out in the solar ingot wafer market for its comprehensive approach to solar solutions. The company manufactures high-grade wafers that are crucial for the efficiency of solar panels. With a focus on sustainability and cutting-edge technology, DCH Group is dedicated to enhancing solar energy adoption worldwide, providing robust and reliable components that meet the growing demand for renewable energy.

EPC Group is a renowned player in the solar industry, known for its engineering excellence and integration of solar technology into various industrial applications. The company produces solar ingot wafers that are key to high-performance solar panels. EPC Group’s commitment to quality and innovation ensures their products are at the forefront of the solar market, driving forward the efficiency and accessibility of solar energy solutions.

Top Key Players in the Market

- CETC Solar Energy Holdings Co., Ltd.

- DCH Group international

- EPC Group

- GCL-Poly Energy Holdings

- GlobalWafers

- JA SOLAR Technology Co., Ltd.

- Kalyon Solar Technologies Factory

- Konca Solar Cell Co., Ltd.

- LDK Solar Technology Co., Ltd.

- LONGI Solar Technology Co., Ltd.

- NorSun AS

- Okmetic

- Shin-Etsu Chemical Co., Ltd

- Siltronic AG

- SK Siltron

- SN Materials

- Sumco Corporation

Recent Developments

In 2024, CETC Solar Energy reported significant production outputs, aligning with the industry’s growing demand for renewable energy solutions. Their strategic focus on research and development has allowed them to enhance the efficiency and reduce the costs of solar panels, catering to both commercial and residential markets globally.

In 2024, EPC Group’s commitment to sustainability and innovation not only fortifies its position in the market but also aligns with global efforts to transition towards renewable energy sources, making them a critical player in the solar energy landscape.

Report Scope

Report Features Description Market Value (2024) USD 82.9 Bn Forecast Revenue (2034) USD 269.2 Bn CAGR (2025-2034) 12.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Monocrystalline, Polycrystalline), By Wafer Size (125mm, 156mm, 210mm, Others), By Application (Mono Solar Cells, Multi Solar Cells) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape CETC Solar Energy Holdings Co., Ltd., DCH Group international, EPC Group, GCL-Poly Energy Holdings, GlobalWafers, JA SOLAR Technology Co., Ltd., Kalyon Solar Technologies Factory, Konca Solar Cell Co., Ltd., LDK Solar Technology Co., Ltd., LONGI Solar Technology Co., Ltd., NorSun AS, Okmetic, Shin-Etsu Chemical Co., Ltd, Siltronic AG, SK Siltron, SN Materials, Sumco Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CETC Solar Energy Holdings Co., Ltd.

- DCH Group international

- EPC Group

- GCL-Poly Energy Holdings

- GlobalWafers

- JA SOLAR Technology Co., Ltd.

- Kalyon Solar Technologies Factory

- Konca Solar Cell Co., Ltd.

- LDK Solar Technology Co., Ltd.

- LONGI Solar Technology Co., Ltd.

- NorSun AS

- Okmetic

- Shin-Etsu Chemical Co., Ltd

- Siltronic AG

- SK Siltron

- SN Materials

- Sumco Corporation