Global Small Wind Turbine Market Size, Share, And Growth Analysis Report By Axis (Horizontal Axis, Vertical Axis), By Capacity (Up to 2kW, 2kW to 5kW, 5kW to 10kW), By Installation (Rooftop, Standalone), By Application (Residential, Commercial, Utility), By Grid Connectivity (On-Grid, Off-Grid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145135

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

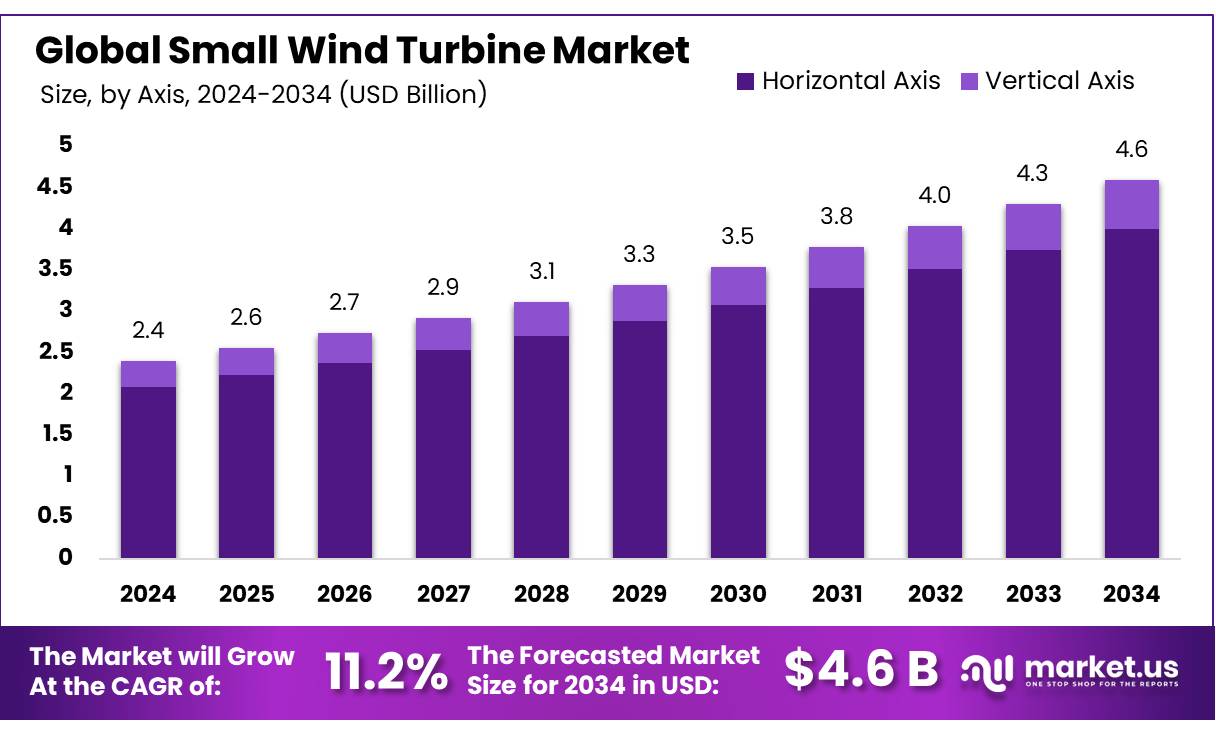

The Global Small Wind Turbine Market size is expected to be worth around USD 4.6 billion by 2034, from USD 2.4 billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

The Small Wind Turbine Market is experiencing a significant upswing, driven by a growing recognition of sustainable energy sources across the world. Small wind turbines, typically defined by capacities under 100 kW, are increasingly favored for their cost-effectiveness and smaller environmental footprint compared to traditional energy sources. These systems are particularly beneficial for remote and rural areas where grid connectivity is either unreliable or nonexistent.

Growth opportunities in the small wind turbine sector are robust, particularly in developing regions such as Asia-Pacific and Africa. These regions are experiencing rapid rural electrification and industrialization, where small wind turbines can play a pivotal role. The trend towards decentralized energy systems and the global push for clean energy are likely to spur further innovations in this sector.

The installed capacity of small wind turbines reached approximately 1,200 MW, with an annual addition of 150 MW, highlighting steady growth. The market is supported by a mix of established manufacturers and emerging players producing turbines with enhanced efficiency and durability.

Production is concentrated in the Asia-Pacific, North America, and Europe, with the Asia-Pacific accounting for 42% of global installations, driven by China’s rural electrification initiatives and India’s renewable energy targets. The industrial landscape also benefits from advancements in materials, such as lightweight composites, reducing costs and improving turbine lifespan.

Renewable energy policies have spurred a 14% annual increase in small wind turbine adoption since 2020. The demand for off-grid solutions in remote areas, coupled with a 20% reduction in installation costs over the past five years, further accelerates market expansion. Emerging markets in Africa and Latin America, with untapped wind potential, offer additional prospects.

Key Takeaways

- The Global Small Wind Turbine Market is projected to grow from USD 2.4 billion in 2024 to USD 4.6 billion by 2034, with a CAGR of 11.2% from 2025 to 2034.

- Horizontal Axis small wind turbines dominate with an 87.2% market share, favored for their efficiency in variable wind conditions.

- The 5kW to 10kW capacity range leads with a 45.3% share, balancing affordability and power output for residential and small business use.

- Rooftop installations hold a 67.5% share, thriving in urban and suburban settings with limited ground space.

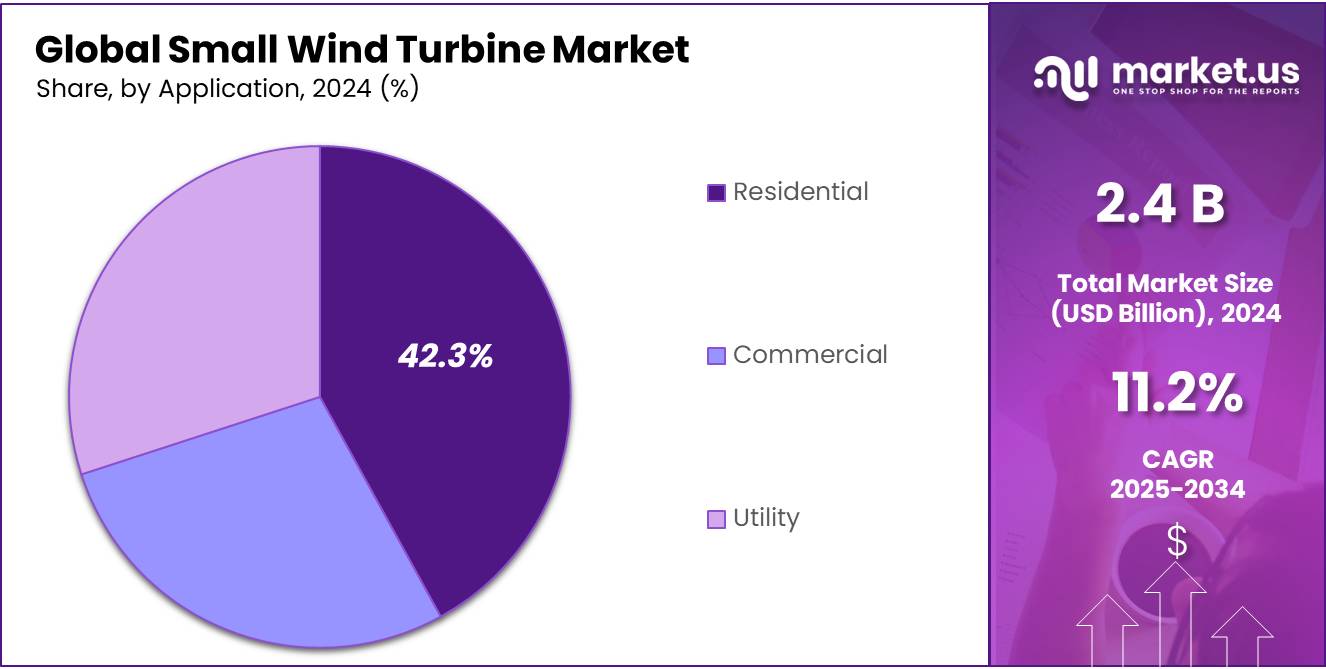

- Residential applications capture a 42.3% share, driven by homeowners’ focus on energy independence and cost savings.

- On-grid small wind turbines lead with a 67.3% share, enabling seamless integration with utility grids for flexible power management.

By Axis

In 2024, Horizontal Axis small wind turbines significantly led the market, accounting for over 87.2% of the total market share. This type of turbine is favored largely due to its efficiency in capturing wind from various directions, making it highly suitable for areas with inconsistent wind patterns.

The design allows for greater energy production as the blades align optimally with the wind direction, enhancing the turbine’s ability to generate power even at lower wind speeds. This adaptability and efficiency are key factors driving its dominant position in the market. As renewable energy solutions continue to gain traction globally, the demand for horizontal-axis turbines is expected to remain strong, underpinning their leading status in the sector.

By Capacity

In 2024, the 5kW to 10kW capacity range of small wind turbines held a dominant market position, capturing more than a 45.3% share. This segment benefits significantly from the balance it offers between affordability and power output, making it an ideal choice for residential properties and small businesses aiming to reduce their energy costs and carbon footprint.

The capacity range is sufficiently robust to handle the energy needs of a typical household or small enterprise without the extensive installation space and capital investment required for larger turbines. As the trend towards sustainable living continues to grow, the demand for turbines in this capacity range is likely to remain strong, reflecting their appeal to a broad segment of environmentally conscious consumers.

By Installation

In 2024, Rooftop Installations of small wind turbines held a dominant market position, capturing more than a 67.5% share. This installation type is particularly popular in urban and suburban areas where ground space is limited but the need for sustainable energy solutions is high.

Rooftop turbines offer a practical solution by utilizing existing building structures to harness wind energy, thus minimizing the land use impact and installation costs associated with alternative energy sources.

Their ability to integrate seamlessly with the electrical systems of residential or commercial buildings further enhances their appeal. As cities continue to expand and the push towards renewable energy sources intensifies, rooftop small wind turbines are likely to maintain their lead in the market.

By Application

In 2024, the Residential Application of small wind turbines held a dominant market position, capturing more than a 42.3% share. This strong preference is driven by the growing desire among homeowners to achieve energy independence and reduce utility bills. Small wind turbines for residential use typically range in size and are adaptable to various property sizes, making them a versatile solution for individual homes.

Their ability to provide a reliable source of renewable energy complements other home-based sustainable practices, such as solar panels and rainwater harvesting. As awareness and support for sustainable living continue to rise, the adoption of small wind turbines in residential settings is expected to maintain a strong market presence.

By Grid Connectivity

In 2024, on-grid small wind turbines held a dominant market position, capturing more than a 67.3% share. These systems are connected directly to the local utility grid, allowing users to draw power when wind generation is low and feed excess power back during high wind periods. This setup offers both reliability and financial benefits, especially in regions with favorable net metering policies.

Homeowners and small businesses prefer on-grid models because they reduce dependence on battery storage and help lower electricity bills. Looking into 2025, the on-grid segment is expected to grow further as more countries upgrade their grid infrastructure and promote clean energy connections.

Key Market Segments

By Axis

- Horizontal Axis

- Vertical Axis

By Capacity

- Up to 2kW

- 2kW to 5kW

- 5kW to 10kW

By Installation

- Rooftop

- Standalone

By Application

- Residential

- Commercial

- Utility

By Grid Connectivity

- On-Grid

- Off-Grid

Drivers

Government Push for Decentralized Renewable Energy Solutions

One of the major driving forces behind the growth of the small wind turbine market is strong government support for decentralized energy generation. Many national and local governments are introducing policies and financial support schemes that directly encourage the installation of small wind turbines, especially in rural, off-grid, or semi-urban areas.

According to the International Renewable Energy Agency (IRENA), decentralized renewable energy solutions like small wind turbines are playing a key role in expanding energy access in remote and underserved regions. IRENA noted that small-scale wind systems, when combined with solar, are becoming increasingly vital to achieving universal electrification goals.

The U.S. Department of Energy (DOE) continues to support small wind projects through grants, tax credits, and the Rural Energy for America Program (REAP). The DOE reports that small wind systems (under 100 kW) have been installed in all 50 U.S. states, and incentives have helped reduce upfront costs by 30% to 50% in many cases

Restraints

High Initial Cost and Long Payback Period

One of the major restraints slowing down the adoption of small wind turbines is the high upfront installation cost combined with a relatively long payback period. For many households and small businesses, the initial investment required can be a significant barrier even if long-term savings on electricity are possible.

According to the U.S. Department of Energy (DOE), the cost of installing a small wind electric system ranges between USD 3,000 to USD 8,000 per kilowatt (kW) of capacity. This means that a typical 5kW residential system could cost anywhere from USD 15,000 to USD 40,000, depending on the site, permitting fees, and installation complexities.

Opportunity

Rising Demand for Clean Energy in Rural and Remote Areas

A major growth factor driving the small wind turbine market is the increasing demand for clean, off-grid power in rural and remote areas. Across many parts of the world, extending centralized power grids is either too costly or technically difficult. In these regions, small wind turbines offer a reliable and eco-friendly alternative to diesel generators and other fossil-fuel-based sources.

The International Renewable Energy Agency (IRENA), about 60% of the global population is without electricity, and over 440 million people live in rural areas. IRENA emphasizes that decentralized renewable solutions, including small wind turbines, will play a key role in reaching these communities. IRENA estimated that decentralized renewables could meet 65% of the new electricity access needed by 2030.

Trends

Integration of Small Wind with Smart Grids and IoT

An emerging factor shaping the future of the small wind turbine market is the growing integration of smart grid technology and Internet of Things (IoT) systems. These innovations are making small wind turbines more intelligent, efficient, and user-friendly, especially in hybrid renewable setups.

Smart grids allow energy systems to become more flexible, responsive, and efficient by using real-time data and automated controls. Small wind turbines connected to such grids can now adjust power output, storage use, or grid feeding based on real-time electricity demand or wind speed. This reduces energy wastage and improves overall grid stability.

The International Energy Agency (IEA), global investment in smart grid infrastructure reached USD 52 billion and is expected to grow further as countries modernize their power networks. The integration of IoT sensors is another breakthrough. These sensors help turbine owners monitor wind speed, blade rotation, power output, and even equipment health through mobile apps or cloud-based dashboards.

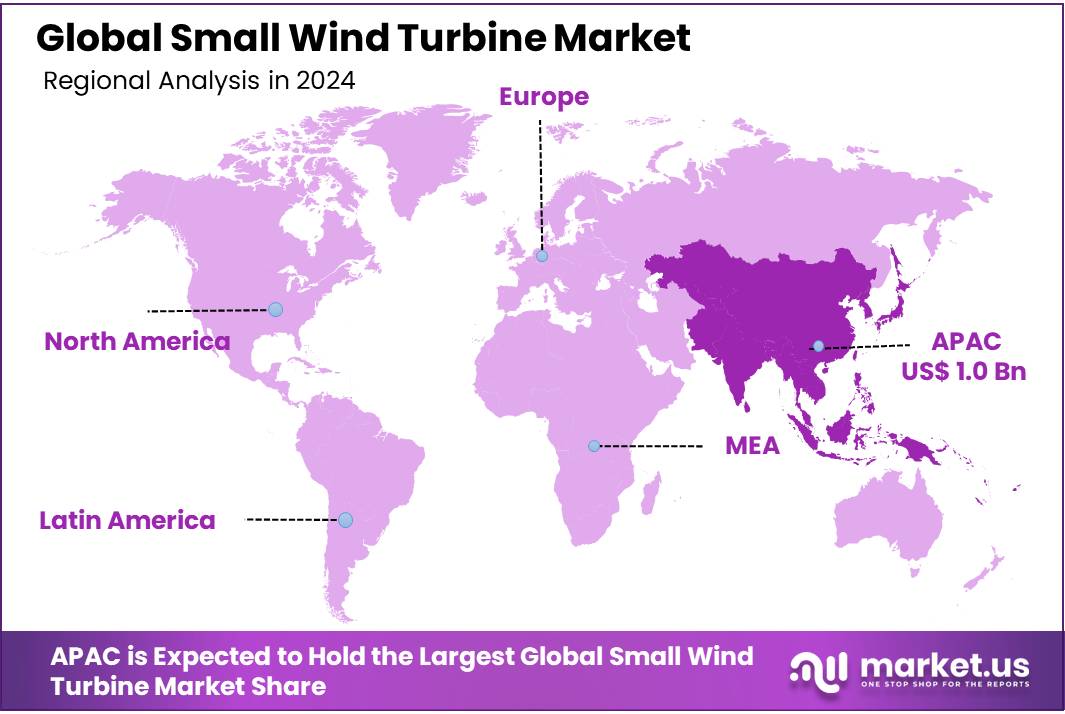

Regional Analysis

The Asia-Pacific (APAC) region stands as a pivotal segment in the global small wind turbine market, driven by rapid urbanization, economic growth, and a strong push toward renewable energy adoption. In 2024, APAC dominated the market with a commanding 42.4% share, translating to a market value of approximately USD 1.0 billion within the global small wind turbine landscape.

This dominance is largely fueled by China and India, where energy demand is surging due to industrial expansion and population growth. China, a leader in the region, installed 60 MW of small wind turbine capacity, contributing to a cumulative total of 704.32 MW, with applications shifting from rural electrification to urban uses like street lighting and telecom power systems.

India followed suit, adding 2.8 GW of new wind capacity in 2023, with small wind turbines playing a key role in rural and off-grid areas, boosting its cumulative capacity to 44.7 GW by year-end. The region’s growth is further supported by government initiatives, such as subsidies in China, India, Thailand, and Malaysia.

APAC’s urbanization rate, at 3% annually, and a projected urban population increase of 1.2 billion by 2050, amplify the demand for decentralized energy solutions like small wind turbines. With a robust policy framework and abundant wind resources, APAC remains the dominating region, setting the pace for global market expansion through 2030 and beyond.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Aeolos Wind Energy Ltd specializes in small wind turbines (300W–50kW) for residential, agricultural, and commercial use. Known for robust, low-maintenance designs, their turbines suit off-grid and hybrid systems. The company focuses on global markets, offering vertical and horizontal axis models.

- Bergey Windpower Co. A pioneer in small wind turbines, Bergey offers 1–10kW systems, primarily for off-grid homes. Their Excel series is renowned for durability and high efficiency. With over 40 years in the industry, Bergey dominates the U.S. market, backed by MCS certification.

- City Windmills Holdings PLC focuses on urban small wind solutions (0.5–20kW), integrating turbines into buildings and streetlights. Their sleek, low-noise designs cater to cities with strict zoning laws. Strong in Europe, they partner with municipalities for sustainable projects. However, high upfront costs and variable wind speeds in urban settings pose challenges.

- Envergate Energy AG specializes in innovative vertical-axis turbines (1–30kW) for commercial and industrial use. Their patented designs excel in turbulent and low-wind areas, differentiating them from competitors. Based in Switzerland, they target European and Asian markets with modular, scalable systems.

- EOCYCLE focuses on ultra-small turbines (100W–3kW) for portable and off-grid applications, including disaster relief and telecom. Their lightweight, low-cost designs target emerging markets in Africa and Latin America. Unlike competitors, EOCYCLE prioritizes affordability and ease of installation.

Top Key Players

- Bergey Windpower Co.

- Aeolos Wind Energy Ltd

- City Windmills Holdings PLC

- Envergate Energy AG

- EOCYCLE

- Inox Wind Ltd.

- Kingspan Group

- Kliux Energies

- Northern Power Systems

- Ryse Energy

- SD Wind Energy Limited

- Shanghai Ghrepower Green Energy Co. Ltd

- Sinovel Wind Group Co., Ltd

- Superwind GmbH

- TUGE Energia OU

- UNITRON Energy Systems Pvt. Ltd

- Wind Energy Solutions

- Windar Renovables

- XZERES Corp.

Recent Developments

- In 2024, Aeolos Wind Energy Ltd, a Denmark-based manufacturer, has been active in expanding its small wind turbine offerings. The company introduced an upgraded Aeolos-H 5kW turbine model, featuring enhanced blade aerodynamics for improved efficiency in low-wind conditions.

- In 2024, Bergey Windpower Co., a U.S.-based pioneer, showcased its latest advancements at the 2024 Wind Energy Conference hosted by the American Wind Energy Association (AWEA). The company presented an updated version of its Excel 15 turbine, launched in mid-2024, with a focus on grid-tied applications.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 4.6 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Axis (Horizontal Axis, Vertical Axis), By Capacity (Up to 2kW, 2kW to 5kW, 5kW to 10kW), By Installation (Rooftop, Standalone), By Application (Residential, Commercial, Utility), By Grid Connectivity (On-Grid, Off-Grid) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aeolos Wind Energy Ltd, Bergey Windpower Co., City Windmills Holdings PLC, Envergate Energy AG, EOCYCLE, Inox Wind Ltd., Kingspan Group, Kliux Energies, Northern Power Systems, Ryse Energy, SD Wind Energy Limited, Shanghai Ghrepower Green Energy Co. Ltd, Sinovel Wind Group Co., Ltd, Superwind GmbH, TUGE Energia OU, UNITRON Energy Systems Pvt. Ltd, Wind Energy Solutions, Windar Renovables, XZERES Corp. Customization Scope Customization for segments, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Small Wind Turbine MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Small Wind Turbine MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bergey Windpower Co.

- Aeolos Wind Energy Ltd

- City Windmills Holdings PLC

- Envergate Energy AG

- EOCYCLE

- Inox Wind Ltd.

- Kingspan Group

- Kliux Energies

- Northern Power Systems

- Ryse Energy

- SD Wind Energy Limited

- Shanghai Ghrepower Green Energy Co. Ltd

- Sinovel Wind Group Co., Ltd

- Superwind GmbH

- TUGE Energia OU

- UNITRON Energy Systems Pvt. Ltd

- Wind Energy Solutions

- Windar Renovables

- XZERES Corp.