Global Shunt Reactor Market Size, Share, And Business Benefits By Phase (Single Phase, Three Phase), By Type (Oil Immersed, Air Core), By Voltage (Upto 400 kV, 400-700 kV, Above 700 kV), By Product (Fixed, Variable), By End-user (Generation (Hydroelectric, Solar, Wind, Geothermal), Transmission and Distribution (FACTS, HVDC LCC, VSC, Others), Power Consumer (Buildings and Cities, Oil and gas, Infrastructure, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142581

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

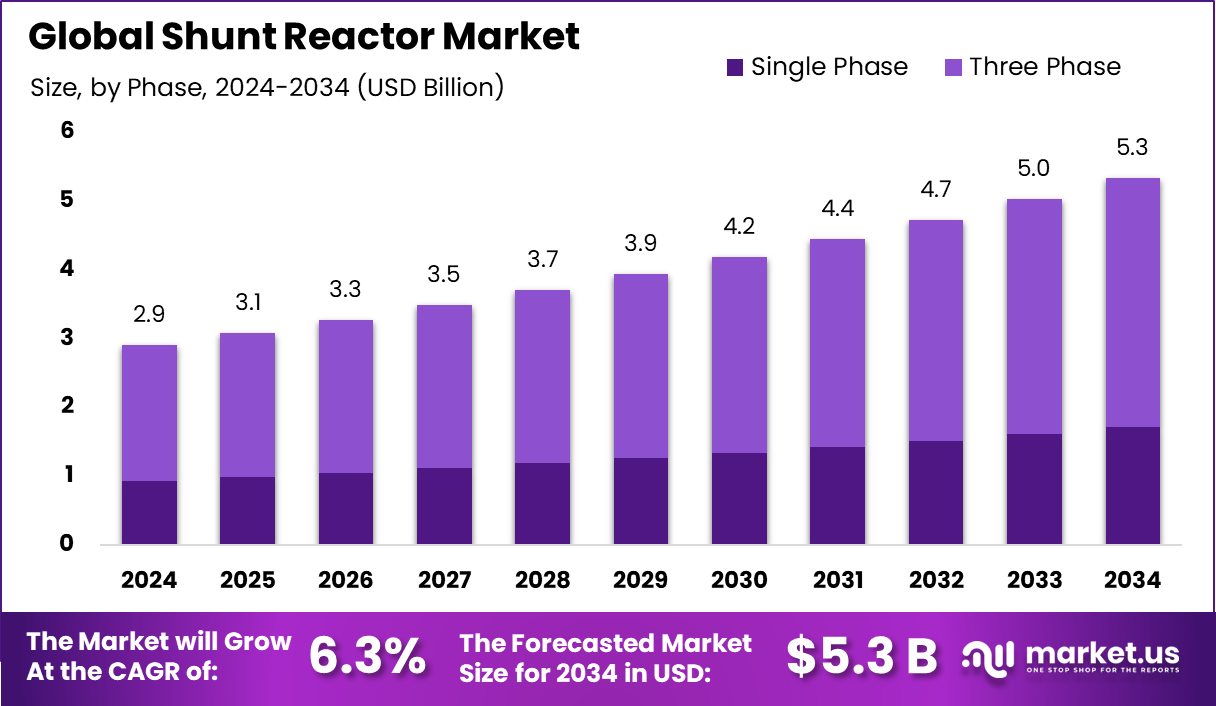

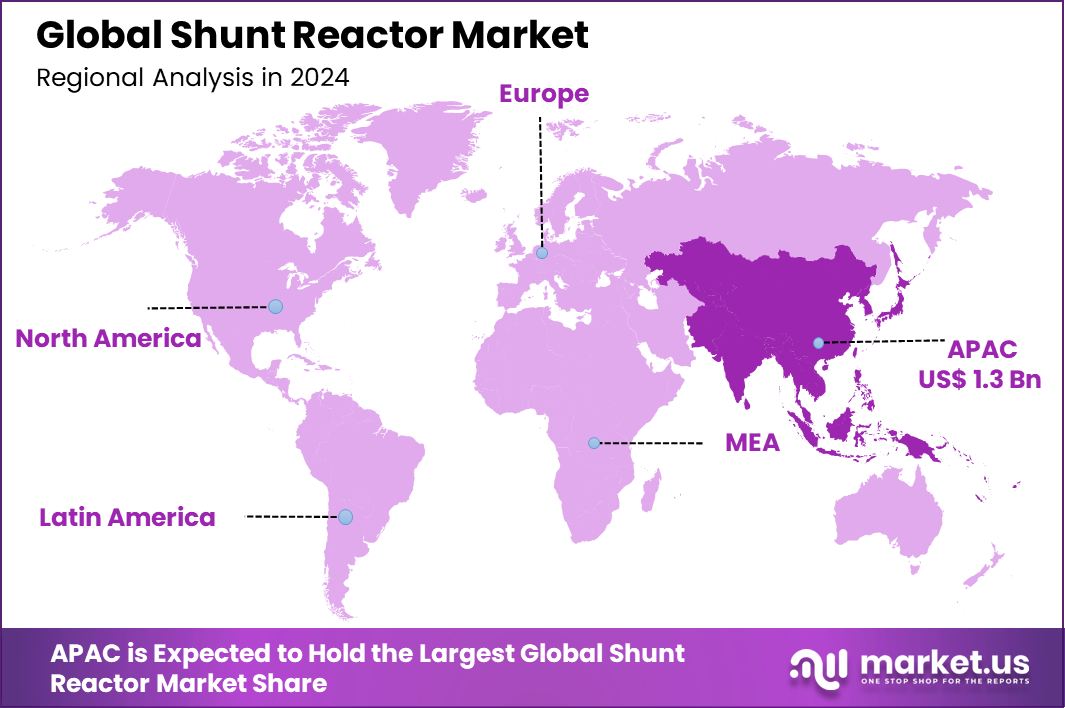

Global Shunt Reactor Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.9 billion in 2024, and grow at a CAGR of 6.3% from 2025 to 2034. Asia-Pacific commands the Shunt Reactor Market, boasting a substantial 46.20% share, equivalent to USD 1.3 billion.

A shunt reactor is an electrical device used primarily in power transmission systems to control voltage during off-peak times by absorbing excess reactive power generated in the network. It helps maintain stability and efficiency in the power system by managing the voltage levels, thus preventing the over-voltage conditions due to the low load conditions in high-voltage transmission lines.

The shunt reactor market involves the production, distribution, and innovation of these devices to meet the demands of the power transmission industry. The market growth is driven by the expansion of power grids, the increasing need for efficient energy management in utilities, and the integration of renewable energy sources, which require effective voltage regulation solutions.

One of the growth factors for the shunt reactor market is the rising investment in renewable energy. As more solar and wind power projects come online, there’s a greater need for voltage control solutions to integrate these intermittent power sources smoothly into the grid, fostering demand for shunt reactors.

The demand for shunt reactors is also bolstered by the global expansion of high-voltage transmission networks. To reduce power loss over long distances and increase the reliability of electrical supply, utilities are expanding their transmission capacities, where shunt reactors play a crucial role.

Opportunities in the shunt reactor market are emerging from advancements in smart grid technology. Smart grids use automated control systems for energy management, and shunt reactors can be crucial for managing the dynamic load and supply variations, offering substantial growth opportunities for manufacturers specializing in adaptable and technologically advanced reactor designs.

Key Takeaways

- Global Shunt Reactor Market is expected to be worth around USD 5.3 billion by 2034, up from USD 2.9 billion in 2024, and grow at a CAGR of 6.3% from 2025 to 2034.

- The Shunt Reactor Market for three-phase reactors holds a significant share at 68.30%.

- Oil-immersed shunt reactors lead the market type segment with 72.30%.

- In the voltage category, 400-700 kV reactors represent 39.20% of the market.

- Fixed shunt reactors dominate the product segment, capturing 62.40% of the market.

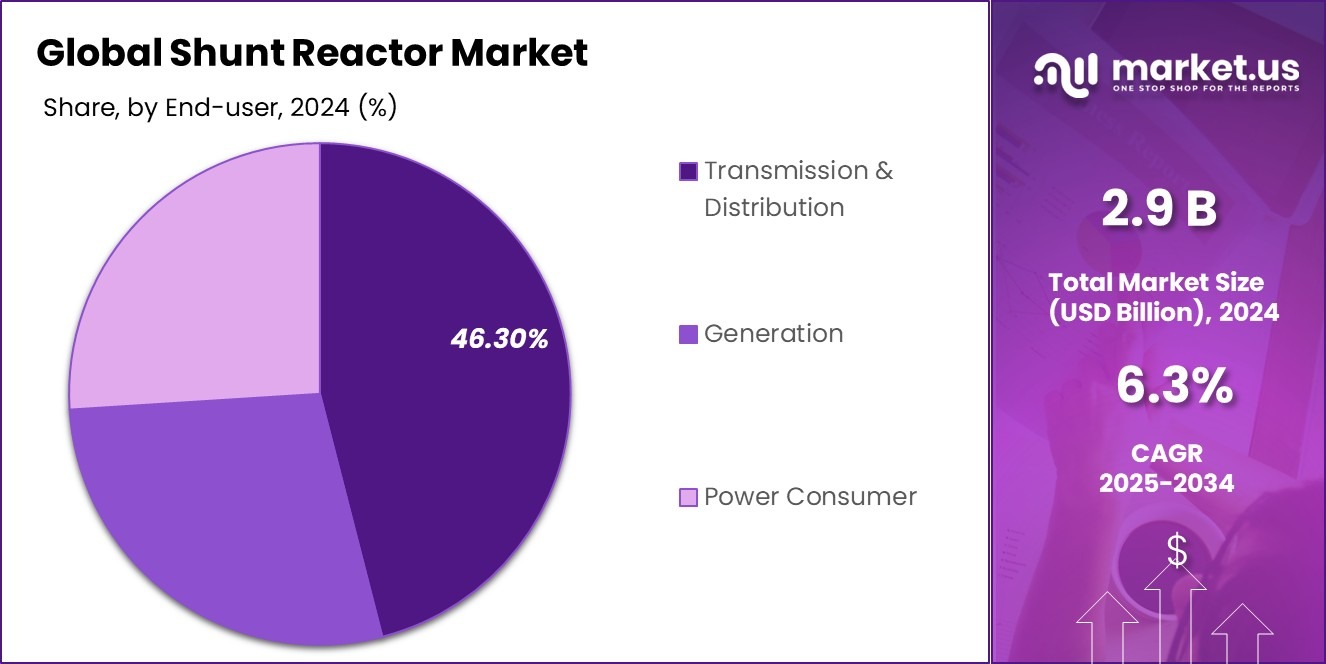

- Transmission and distribution end-users account for 46.30% of the shunt reactor market demand.

- Holding a dominant 46.20% market share, Asia-Pacific’s Shunt Reactor sector is currently valued at USD 1.3 billion.

By Phase Analysis

Three-phase shunt reactors hold a significant 68.30% share of the market.

In 2024, the Three Phase segment held a dominant market position in the Shunt Reactor Market, capturing a substantial 68.30% share. This segment’s prominence is attributed to the widespread adoption of three-phase power systems in industrial and commercial settings, where large amounts of electrical energy are distributed across vast networks.

Three-phase shunt reactors are crucial in these setups, as they enhance the power quality and efficiency by balancing the voltage across the network, particularly in long transmission lines prone to significant power fluctuations.

The robust market share of the three-phase segment is also supported by the ongoing expansion of electrical grids and the integration of renewable energy sources, which often require sophisticated voltage regulation solutions to maintain system stability.

The demand for three-phase shunt reactors is expected to continue its growth trajectory, driven by the need for improved electrical infrastructure and the push toward more renewable installations. This segment’s dominance highlights its critical role in modern power management and its integral contribution to ensuring a reliable power supply in multiphase environments.

By Type Analysis

Oil-immersed types dominate the market with a 72.30% share.

In 2024, the Oil Immersed segment held a dominant market position in the By Type segment of the Shunt Reactor Market, with a substantial 72.30% share. This predominance is primarily due to the reliability and efficiency of oil-immersed shunt reactors in managing high-capacity loads and ensuring operational stability across extensive power networks.

Oil as a cooling medium in these reactors enhances their longevity and allows for more efficient heat dissipation compared to air-cooled models, making them particularly suitable for high voltage applications.

The significant market share of the oil-immersed segment reflects its pivotal role in heavy-duty applications where robust performance is critical, such as in large-scale industrial settings and utility-grade power systems. The continued preference for oil-immersed reactors can be attributed to their proven track record in reducing electrical disturbances and providing superior voltage regulation.

This segment’s dominance is expected to persist as infrastructure developments and upgrades to existing power networks drive further investments in this reliable reactor type. Their critical role in maintaining grid stability and supporting the seamless integration of renewable energy sources further solidifies their position in the market.

By Voltage Analysis

In the 400-700 kV range, shunt reactors have a 39.20% market share.

In 2024, the 400-700 kV segment held a dominant market position in the By Voltage segment of the Shunt Reactor Market, with a significant 39.20% share. This dominance is largely due to the increasing demand for high-voltage transmission networks designed to carry large volumes of electricity over long distances with minimal losses. The 400-700 kV range is particularly crucial in connecting power generation sites, including renewable energy sources, to national grids efficiently and effectively.

The strong market share of this segment underscores its essential role in enhancing grid stability and capacity, especially in regions experiencing rapid industrial growth and urbanization. As utilities continue to upgrade and expand their infrastructure to meet growing energy demands and integrate diverse energy sources, the demand for 400-700 kV shunt reactors is expected to remain robust.

These reactors are instrumental in managing voltage fluctuations and improving the overall efficiency of the power transmission system, making them a key component in future-proofing electrical grids against the challenges of scalability and sustainability.

By Product Analysis

Fixed shunt reactors represent a substantial 62.40% of the product market.

In 2024, the Fixed segment held a dominant market position in the by-product segment of the Shunt Reactor Market, with a commanding 62.40% share. This leadership is primarily attributed to the widespread application and reliability of fixed shunt reactors in stable grid environments where constant reactive power compensation is required.

Fixed shunt reactors are favored for their simplicity, cost-effectiveness, and durability, making them a preferred choice for many utilities aiming to enhance voltage stability across conventional power transmission systems.

The significant market share of the fixed segment reflects its critical role in maintaining power quality in systems with predictable and consistent load patterns. These reactors are integral to preventing over-voltages during light load conditions, thereby safeguarding the grid infrastructure and extending the lifespan of other electrical components within the network.

The continued reliance on fixed shunt reactors is driven by their proven performance in grid stabilization tasks, especially in regions with established power transmission frameworks. As the global demand for reliable and efficient power distribution continues, the fixed shunt reactor segment is expected to maintain its market prominence, offering essential solutions to emerging and mature power markets alike.

By End-user Analysis

For transmission and distribution, end-users comprise 46.30% of the market.

In 2024, the Transmission and Distribution segment held a dominant market position in the By End-user segment of the Shunt Reactor Market, with a significant 46.30% share. This dominance is largely driven by the essential role that shunt reactors play in managing power flow and stabilizing voltage levels across extensive transmission and distribution networks. As the backbone of electrical grids, these networks require efficient and reliable voltage control solutions to minimize energy loss and enhance the quality of power delivered to end users.

The substantial market share of the Transmission and Distribution segment reflects the ongoing investments in infrastructure development and grid modernization efforts globally. These initiatives frequently involve upgrading existing lines and expanding grid capacity to accommodate growing renewable energy integrations and increased electricity demand, particularly in rapidly developing regions.

Shunt reactors, particularly those used in transmission and distribution, are critical in these scenarios for their ability to absorb excess reactive power, thereby preventing potential over-voltage that could lead to system failures and power outages. As more countries and regions invest in improving their electrical infrastructure, the demand within this segment is expected to continue its growth trajectory, further cementing its leading position in the market.

Key Market Segments

By Phase

- Single Phase

- Three Phase

By Type

- Oil Immersed

- Air Core

By Voltage

- Upto 400 kV

- 400-700 kV

- Above 700 kV

By Product

- Fixed

- Variable

By End-user

- Generation

- Hydroelectric

- Solar

- Wind

- Geothermal

- Transmission and Distribution

- FACTS

- HVDC LCC

- VSC

- Others

- Power Consumer

- Buildings and Cities

- Oil and gas

- Infrastructure

- Others

Driving Factors

Growing Demand for Renewable Energy Integration

The global push towards renewable energy sources like wind and solar is significantly driving the demand for shunt reactors. As these renewable sources are inherently intermittent, they require robust grid management tools to handle the variable power supply. Shunt reactors are critical in this regard, helping to stabilize voltage levels that fluctuate due to the sporadic nature of renewable generation.

By absorbing excess reactive power, they ensure a smooth and stable electricity flow across power grids, which is essential for maintaining grid reliability and efficiency. This factor is crucial as countries worldwide strive to increase their renewable energy capacity, making shunt reactors indispensable in modern energy infrastructures tailored to support sustainable power sources.

Restraining Factors

High Installation and Maintenance Costs Limit Adoption

One significant restraining factor in the shunt reactor market is the high cost associated with their installation and maintenance. Shunt reactors are complex devices that require skilled personnel for installation and ongoing maintenance to ensure optimal performance and safety. This complexity leads to higher upfront costs, which can be a barrier for utilities and power companies, especially in developing regions where budget constraints are more pronounced.

Additionally, the maintenance involves regular inspections and potential component replacements, adding to the total cost of ownership. These financial requirements can deter investment in shunt reactors, impacting their market growth despite the technology’s critical benefits in managing power grid stability and efficiency.

Growth Opportunity

Expansion of High-Voltage Networks in Asia

A major growth opportunity for the shunt reactor market lies in the expansion of high-voltage networks across Asia. This region is experiencing rapid industrial growth and urbanization, driving the need for robust power infrastructure to support increasing electricity demand.

High-voltage networks are crucial for efficiently transmitting electricity over long distances with minimal losses, making shunt reactors indispensable for managing power quality and voltage stability.

As countries like China and India continue to invest heavily in upgrading and expanding their grid infrastructure to meet energy needs and integrate renewable energy sources, the demand for shunt reactors is expected to surge. This presents a significant opportunity for market players to expand their presence and capitalize on the burgeoning energy sector in Asia.

Latest Trends

Smart Grid Technology Adoption Boosts Market Growth

A significant trend in the shunt reactor market is the adoption of smart grid technology. Smart grids use digital communication technology to monitor and manage the transport of electricity from all generation sources to meet the varying electricity demands of end users. Shunt reactors play a crucial role in these advanced grids, helping to maintain power quality and system reliability by controlling voltage levels automatically.

As more utilities move toward smart infrastructure to enhance operational efficiency and integrate renewable energy sources seamlessly, the demand for shunt reactors is expected to grow. This trend not only supports grid stability but also enables more dynamic responses to changes in power demand and supply, marking a key development in the evolution of global energy networks.

Regional Analysis

In the Shunt Reactor Market, Asia-Pacific leads with a 46.20% share, valued impressively at USD 1.3 billion.

The Shunt Reactor Market is segmented into several key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each displaying unique growth dynamics. Dominating the global market, Asia-Pacific holds a significant 46.20% share, valued at USD 1.3 billion.

This region’s market leadership is driven by extensive investments in grid infrastructure and an increasing shift toward renewable energy sources, particularly in countries like China and India, which are rapidly enhancing their electrical networks to support urbanization and industrial growth.

In contrast, Europe and North America are focusing on upgrading existing grid infrastructures to integrate more renewable sources and improve energy efficiency. These regions are also adopting advanced technologies such as smart grids that incorporate shunt reactors for better voltage control and grid stability.

Meanwhile, the Middle East & Africa, and Latin America are gradually catching up, with investments slowly increasing in grid modernization and renewable energy projects. These regions represent emerging markets where future growth is anticipated as they begin to overhaul their power systems to meet increasing energy demands and reduce dependency on traditional power sources, paving the way for a broader adoption of shunt reactors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Shunt Reactor Market sees significant contributions from key players like ABB, CG Power and Industrial Solutions Limited, Fuji Electric Co., Ltd., GBE SpA, and General Electric, each playing a pivotal role in shaping industry dynamics.

ABB stands out with its innovative technologies and extensive portfolio of shunt reactors that cater to a wide range of industrial applications, ensuring efficient voltage control and stability across various electrical networks. Their commitment to R&D has positioned them as a leader not only in product development but also in integrating renewable energy sources into the grid, supporting the transition towards more sustainable energy solutions.

CG Power and Industrial Solutions Limited also plays a crucial role, especially in emerging markets. Their products are well-regarded for durability and performance, making them a preferred choice for utilities looking to enhance grid reliability and manage the challenges posed by rapidly changing energy demands.

Fuji Electric Co., Ltd. offers specialized shunt reactors that are designed to withstand the rigorous demands of both industrial and commercial environments. Their focus on energy efficiency and reduced environmental impact aligns with global trends toward sustainability and carbon footprint reduction.

GBE SpA, though smaller in scale compared to its competitors, excels in customized solutions that meet specific customer needs. Their ability to adapt quickly to market requirements and provide tailor-made products sets them apart in niche markets.

General Electric, with its longstanding reputation and technological expertise, continues to influence the shunt reactor market profoundly. GE’s shunt reactors are integral to large-scale and critical infrastructure projects thanks to their reliability and advanced technology.

Top Key Players in the Market

- ABB

- CG Power and Industrial Solutions Limited

- Fuji Electric Co., Ltd.

- GBE SpA

- General Electric

- Hd Hyundai Heavy Industries Co., Ltd.

- Hilkar

- Hitachi Energy

- Hyosung Corporation

- Mitsubishi Electric

- Nissin Electric Co Ltd

- Siemens Ag

- TBEA

- Toshiba Corporation

- Trench Group

Recent Developments

- In October 2024, Hitachi Energy scaled up variable shunt reactors to 500 kV for wind power applications in Uzbekistan, improving grid stability and reliability.

- In February 2024, we entered into agreements with the Power Grid Corporation of India to supply 765 kV shunt reactors, improving grid stability and facilitating the integration of renewable energy.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Phase (Single Phase, Three Phase), By Type (Oil Immersed, Air Core), By Voltage (Upto 400 kV, 400-700 kV, Above 700 kV), By Product (Fixed, Variable), By End-user (Generation (Hydroelectric, Solar, Wind, Geothermal), Transmission and Distribution (FACTS, HVDC LCC, VSC, Others), Power Consumer (Buildings and Cities, Oil and gas, Infrastructure, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, CG Power and Industrial Solutions Limited, Fuji Electric Co., Ltd., GBE SpA, General Electric, Hd Hyundai Heavy Industries Co., Ltd., Hilkar, Hitachi Energy, Hyosung Corporation, Mitsubishi Electric, Nissin Electric Co Ltd, Siemens Ag, TBEA, Toshiba Corporation, Trench Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- CG Power and Industrial Solutions Limited

- Fuji Electric Co., Ltd.

- GBE SpA

- General Electric

- Hd Hyundai Heavy Industries Co., Ltd.

- Hilkar

- Hitachi Energy

- Hyosung Corporation

- Mitsubishi Electric

- Nissin Electric Co Ltd

- Siemens Ag

- TBEA

- Toshiba Corporation

- Trench Group