Global Seafood Processing Equipment Market Size, Share, And Business Benefits By Equipment Type (Filleting, Slaughtering, Gutting, Scaling, Others), By Automation Level (Manual, Fully Automatic), By Application (Frozen Seafood, Smoked Seafood, Canned Seafood, Dried Seafood, Surimi Seafood, Others), By End Use (Seafood Processing Plants, Restaurants and Foodservice, Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155465

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

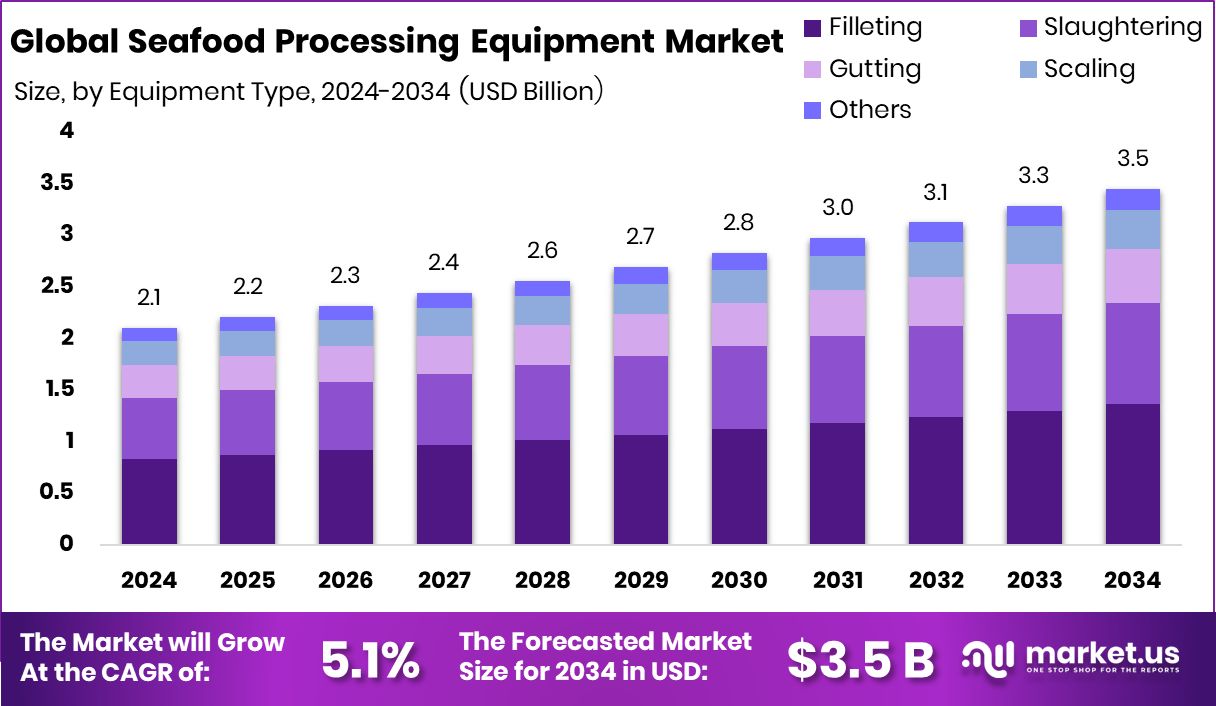

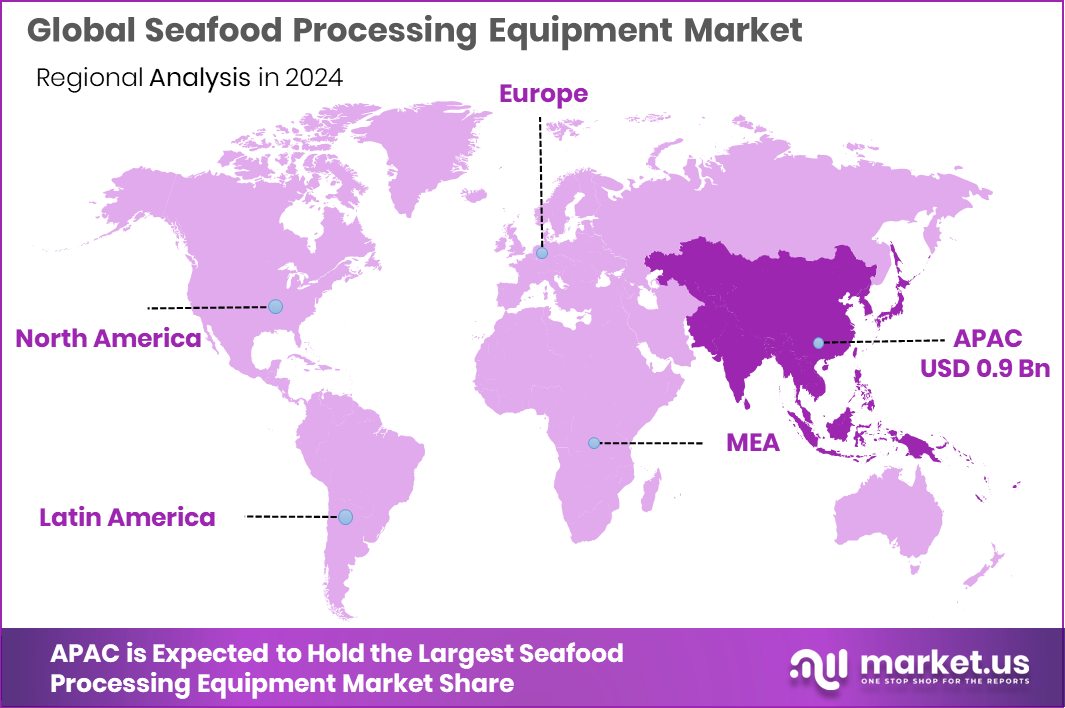

The Global Seafood Processing Equipment Market is expected to be worth around USD 3.5 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034. Technological adoption in processing plants drove Asia Pacific’s 44.7% market share, valued at USD 0.9 Bn.

Seafood processing equipment refers to specialized machinery used to clean, cut, sort, preserve, and package various seafood products, including fish, crustaceans, and mollusks. This equipment can include filleting machines, deboning units, graders, shell removal systems, freezing units, and packaging lines, all designed to maintain freshness, improve hygiene, and increase processing efficiency.

These systems help seafood producers meet strict food safety regulations while reducing manual labor and ensuring consistent product quality. In related industry news, a canned seafood startup recently secured $4M in seed funding, highlighting investor interest in value-added seafood ventures.

The seafood processing equipment market covers the global trade, production, and usage of these machines across industrial seafood processing plants, medium-scale facilities, and specialized operations. It is driven by rising seafood consumption, stricter quality standards, and growing demand for value-added seafood products.

The market also benefits from technological advancements like automation, precision cutting, and energy-efficient freezing systems, enabling higher throughput and reduced operational costs. Programs such as initiatives offering $50,000 funding and expert support to seafood entrepreneurs further encourage innovation in the sector.

Growth factors include the increasing global appetite for seafood due to its health benefits, such as high protein and omega-3 content, which is pushing processors to expand capacity. Additionally, stricter international food safety laws are compelling manufacturers to adopt advanced equipment for hygiene and traceability. Companies like Scout Canning, which raised $4M to grow its tinned seafood platform, reflect how funding supports expansion in premium product categories.

Demand is rising as urban consumers shift toward packaged and ready-to-eat seafood, creating the need for efficient filleting, freezing, and packaging lines. Expanding cold chain infrastructure in emerging economies is further enabling wider seafood distribution, supporting sustained equipment demand. Broader food industry funding, such as Gathered Foods’ $26.35 million, also signals growth potential for seafood-related processing capabilities.

Key Takeaways

- The Global Seafood Processing Equipment Market is expected to be worth around USD 3.5 billion by 2034, up from USD 2.1 billion in 2024, and is projected to grow at a CAGR of 5.1% from 2025 to 2034.

- In 2024, filleting held 39.6% of the Seafood Processing Equipment Market.

- Fully Automatic systems captured a 67.9% share in the Seafood Processing Equipment Market.

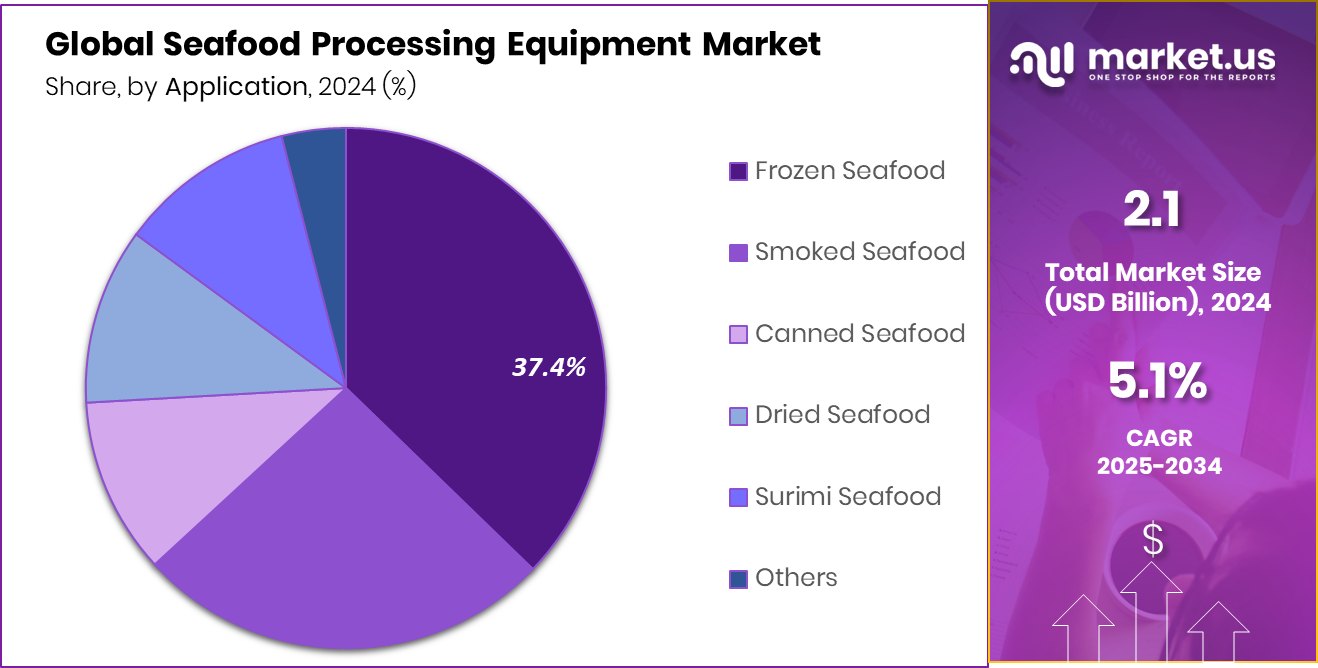

- The Frozen Seafood segment accounted for 37.4% in the Seafood Processing Equipment Market.

- Seafood Processing Plants contributed 58.1% to the Seafood Processing Equipment Market share.

- Strong seafood consumption and aquaculture growth supported the Asia Pacific’s 44.7% share, reaching USD 0.9 Bn.

By Equipment Type Analysis

In the Seafood Processing Equipment Market, Filleting led by Equipment Type with a 39.6% share in 2024.

In 2024, Filleting held a dominant market position in the By Equipment Type segment of the Seafood Processing Equipment Market, with a 39.6% share. This leadership reflects the critical role of filleting machines in delivering high precision, reducing waste, and ensuring consistent quality in processed seafood products.

Filleting is one of the most labor-intensive steps in seafood processing, and automation in this stage has significantly improved production efficiency while maintaining product integrity. The rising global demand for boneless, ready-to-cook, and value-added seafood products has accelerated the adoption of advanced filleting systems, especially in large-scale processing facilities.

Modern filleting equipment integrates sensors, vision systems, and programmable settings to handle different fish species and sizes with minimal human intervention, enhancing hygiene and safety compliance. Additionally, the growing emphasis on maximizing yield from each catch has made efficient filleting technology a key profitability driver for processors.

With expanding aquaculture output and steady consumer preference for uniform, high-quality fillets, this segment is expected to retain its strong position. Energy-efficient models and compact designs are also gaining traction, particularly in regions with rising seafood exports, where processing speed and precision are vital to meeting international market standards.

By Automation Level Analysis

Fully Automatic systems dominated the Seafood Processing Equipment Market by Automation Level, securing a 67.9% market share.

In 2024, Fully Automatic held a dominant market position in the By Automation Level segment of the Seafood Processing Equipment Market, with a 67.9% share. This dominance is driven by the seafood industry’s strong push toward automation to meet growing production demands while ensuring consistent quality and compliance with stringent food safety regulations.

Fully automatic systems streamline multiple stages of seafood processing, from cleaning and filleting to grading, freezing, and packaging, with minimal human intervention. This not only reduces labor costs but also enhances hygiene by limiting direct handling of products. The segment’s growth is further supported by technological advancements, such as AI-enabled sorting systems, precision cutting tools, and integrated monitoring software, which improve yield optimization and reduce wastage.

The adoption of fully automatic equipment is particularly high among large-scale seafood exporters, where rapid throughput and product uniformity are critical to meeting international market requirements. Additionally, the rising demand for ready-to-cook and packaged seafood in urban markets has encouraged processors to invest in high-capacity, automated solutions.

With ongoing developments in energy-efficient machinery and smart process controls, the fully automatic segment is expected to maintain its strong lead, reinforcing its position as the preferred choice for modern seafood processing facilities.

By Application Analysis

Frozen Seafood accounted for a 37.4% share in the Seafood Processing Equipment Market by Application segment during 2024.

In 2024, Frozen Seafood held a dominant market position in the By Application segment of the Seafood Processing Equipment Market, with a 37.4% share. This strong position is driven by the growing global demand for long shelf-life seafood products that retain freshness, taste, and nutritional value. Freezing is a crucial preservation method that allows seafood to be stored and transported over long distances without compromising quality, making it essential for both domestic and export markets.

Modern freezing equipment, such as tunnel freezers and plate freezers, enables rapid temperature reduction, minimizing ice crystal formation and preserving the texture of fish and shellfish. The segment benefits from rising seafood consumption in regions where fresh supply is limited, as frozen products offer year-round availability regardless of seasonal catch variations.

Moreover, the expansion of cold chain infrastructure in emerging markets has further boosted the production and distribution of frozen seafood, increasing the need for high-capacity, energy-efficient freezing systems.

With consumer preferences shifting toward convenience foods and ready-to-cook frozen meals, processors are investing in advanced freezing solutions that integrate with other processing stages to optimize efficiency. This focus on quality, consistency, and scalability ensures the frozen seafood segment continues to hold its leading market position.

By End Use Analysis

Seafood Processing Plants held a 58.1% share of the Seafood Processing Equipment Market in the end-use segment.

In 2024, Seafood Processing Plants held a dominant market position in the By End Use segment of the Seafood Processing Equipment Market, with a 58.1% share. This dominance reflects the high concentration of industrial-scale seafood processing operations that require advanced, high-capacity equipment to meet both domestic and international demand. Seafood processing plants handle large volumes of raw seafood daily, making efficiency, consistency, and compliance with stringent food safety standards essential.

These facilities rely on integrated equipment lines that include cleaning, filleting, deboning, freezing, and packaging systems, enabling seamless production with minimal downtime. The segment’s growth is supported by the expansion of aquaculture production, increased seafood exports, and the rising global appetite for processed seafood products.

Automation adoption is particularly strong in these plants, reducing labor dependency while improving yield and quality control. Additionally, investments in energy-efficient and water-saving technologies are helping processing plants align with sustainability goals and regulatory requirements.

The ability of seafood processing plants to deliver large-scale, uniform, and high-quality products makes them a critical driver of equipment demand. With ongoing upgrades in technology and growing export-focused production, this segment is expected to maintain its lead in the coming years, reinforcing its pivotal role in the seafood value chain.

Key Market Segments

By Equipment Type

- Filleting

- Slaughtering

- Gutting

- Scaling

- Others

By Automation Level

- Manual

- Fully Automatic

By Application

- Frozen Seafood

- Smoked Seafood

- Canned Seafood

- Dried Seafood

- Surimi Seafood

- Others

By End Use

- Seafood Processing Plants

- Restaurants and Foodservice

- Retail

Driving Factors

Rising Seafood Consumption Boosts Equipment Demand Worldwide

The increasing global consumption of seafood is one of the strongest driving forces for the seafood processing equipment market. People are eating more fish, shrimp, crabs, and other seafood because of their health benefits, such as being rich in protein, vitamins, and omega-3 fatty acids. This rising demand is pushing seafood producers to process larger quantities while keeping quality and freshness intact.

As a result, they are investing in modern equipment that can clean, cut, freeze, and package seafood faster and more hygienically. The growing seafood trade between countries, along with the expansion of aquaculture, is also adding pressure on processors to upgrade their technology. This trend ensures steady growth for advanced seafood processing machinery globally.

Restraining Factors

High Equipment Costs Limit Adoption for Processors

One major factor holding back the growth of the seafood processing equipment market is the high cost of modern machinery. Advanced systems, especially those with automation and precision features, require a large upfront investment, which can be difficult for small and medium-sized seafood processors to afford. In addition to purchase costs, there are expenses for installation, maintenance, and operator training, further increasing the financial burden.

Many smaller processors, particularly in developing regions, continue to rely on manual labor or older equipment to reduce expenses, even though it may affect efficiency and quality. This cost barrier slows down the adoption of new technology, creating a gap between large-scale producers and smaller industry players.

Growth Opportunity

Automation and Smart Technology Create New Opportunities

A major growth opportunity in the seafood processing equipment market lies in the adoption of automation and smart technology. Advanced machines equipped with sensors, artificial intelligence, and real-time monitoring can greatly improve processing speed, accuracy, and product quality. These systems can adjust automatically to different seafood types and sizes, helping reduce waste and increase yield.

Automation also lowers dependency on manual labor, which is important in regions facing labor shortages or rising wage costs. Smart technology allows processors to track production data, ensure consistent hygiene standards, and meet strict food safety regulations. As demand for high-quality, ready-to-eat seafood grows, investing in automated, intelligent equipment offers processors a competitive edge and long-term operational efficiency.

Latest Trends

Energy-Efficient Equipment Gains Strong Market Attention

A key trend in the seafood processing equipment market is the shift toward energy-efficient machinery. With rising energy costs and growing pressure to meet environmental standards, processors are looking for equipment that reduces power consumption without affecting performance. New freezing, cutting, and packaging systems are being designed to operate with lower electricity usage, while still maintaining high-speed production and product quality.

Many manufacturers are also focusing on water-saving designs and materials that improve sustainability. This trend is not only helping seafood processors cut operational costs but also supporting their efforts to meet eco-friendly regulations and appeal to environmentally conscious consumers. As sustainability becomes a global priority, energy-efficient equipment is gaining rapid market acceptance.

Regional Analysis

In 2024, the Asia Pacific held a 44.7% share of the Seafood Processing Equipment Market, worth USD 0.9 Bn.

In 2024, the Asia Pacific dominated the Seafood Processing Equipment Market, accounting for 44.7% of the global share, valued at USD 0.9 billion. The region’s leadership is fueled by its position as the world’s largest producer and exporter of seafood, supported by thriving aquaculture industries in countries such as China, India, Vietnam, and Indonesia. High domestic seafood consumption, combined with strong export demand to North America and Europe, has driven significant investments in advanced processing technologies.

Rapid urbanization and changing dietary habits are further boosting the need for packaged and ready-to-cook seafood, prompting processors to adopt modern equipment for filleting, freezing, and packaging. Government initiatives to modernize fisheries infrastructure and improve cold chain logistics are also encouraging equipment upgrades across the region. Additionally, the presence of large-scale seafood processing hubs and free trade agreements with major seafood-importing nations has accelerated the integration of automation and energy-efficient systems.

Asia Pacific’s competitive edge lies in its ability to process high volumes while maintaining the quality standards required for international markets. With ongoing technological advancements and rising focus on sustainability in seafood production, the region is expected to maintain its dominant position, setting the pace for growth in the global seafood processing equipment industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arenco AB maintained its reputation for delivering robust and reliable processing machinery, with a focus on efficiency improvements for high-volume seafood operations. The company’s engineering expertise and emphasis on long-term durability have helped it secure a steady presence in both mature and emerging markets.

Baader Group leveraged its strong global footprint and advanced automation technologies to address the industry’s demand for precision, yield optimization, and minimal product waste. Its equipment’s adaptability to different seafood species remains a key competitive advantage.

Cabinplant A/S stood out for its custom-designed processing solutions, integrating automation with hygienic designs to meet stringent food safety standards. The company’s innovations in weighing, portioning, and packaging systems have been widely adopted by processors aiming to boost productivity.

Cretel NV maintained its niche strength in skinning, scaling, and cleaning machines, focusing on equipment that enhances product presentation and reduces manual labor. Collectively, these companies are shaping the market by responding to industry needs for automation, energy efficiency, and sustainability, while adapting to regional processing requirements. Their combined efforts continue to drive operational efficiency and maintain competitiveness in an evolving global seafood sector.

Top Key Players in the Market

- Arenco AB

- Baader Group

- Cabinplant A/S

- Cretel NV

- GEA Group AG

- JBT Corporation

- John Bean Technologies (JBT)

- Marel

- Optimar AS

- Raytec Vision S.p.A.

Recent Developments

- In November 2024, Baader signed a key contract with Laxey, a land‑based salmon farming company in Iceland, to supply processing equipment for Laxey’s new slaughterhouse project. This deal supports Baader’s expansion in high‑volume aquaculture markets.

- In April 2024, Cabinplant A/S introduced two standout solutions: a camera-operated vision system that enhances fish sorting when paired with existing filleting machines (like Baader or VMK), and a brown crab processing line that’s flexible in speed and belt configuration. Both innovations drew strong interest from visitors.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Billion Forecast Revenue (2034) USD 3.5 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Equipment Type (Filleting, Slaughtering, Gutting, Scaling, Others), By Automation Level (Manual, Fully Automatic), By Application (Frozen Seafood, Smoked Seafood, Canned Seafood, Dried Seafood, Surimi Seafood, Others), By End Use (Seafood Processing Plants, Restaurants and Foodservice, Retail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Arenco AB, Baader Group, Cabinplant A/S, Cretel NV, GEA Group AG, JBT Corporation, John Bean Technologies (JBT), Marel, Optimar AS, Raytec Vision S.p.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Seafood Processing Equipment MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Seafood Processing Equipment MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Arenco AB

- Baader Group

- Cabinplant A/S

- Cretel NV

- GEA Group AG

- JBT Corporation

- John Bean Technologies (JBT)

- Marel

- Optimar AS

- Raytec Vision S.p.A.