Global Sausage Casings Market Size, Share, And Business Benefits By Product Type (Alternative Casings, Natural Casings, Synthetic Casings), By End-Use (Food Manufacturers, Household, Restaurants and Foodservice, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialist Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152005

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

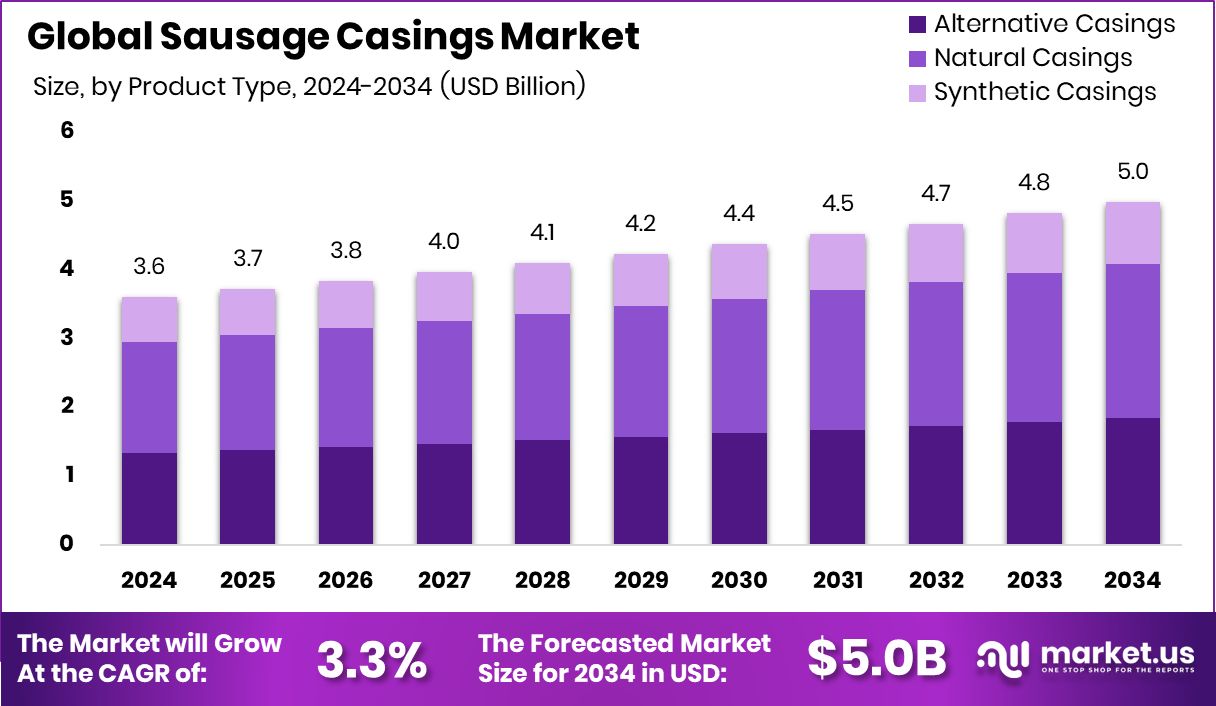

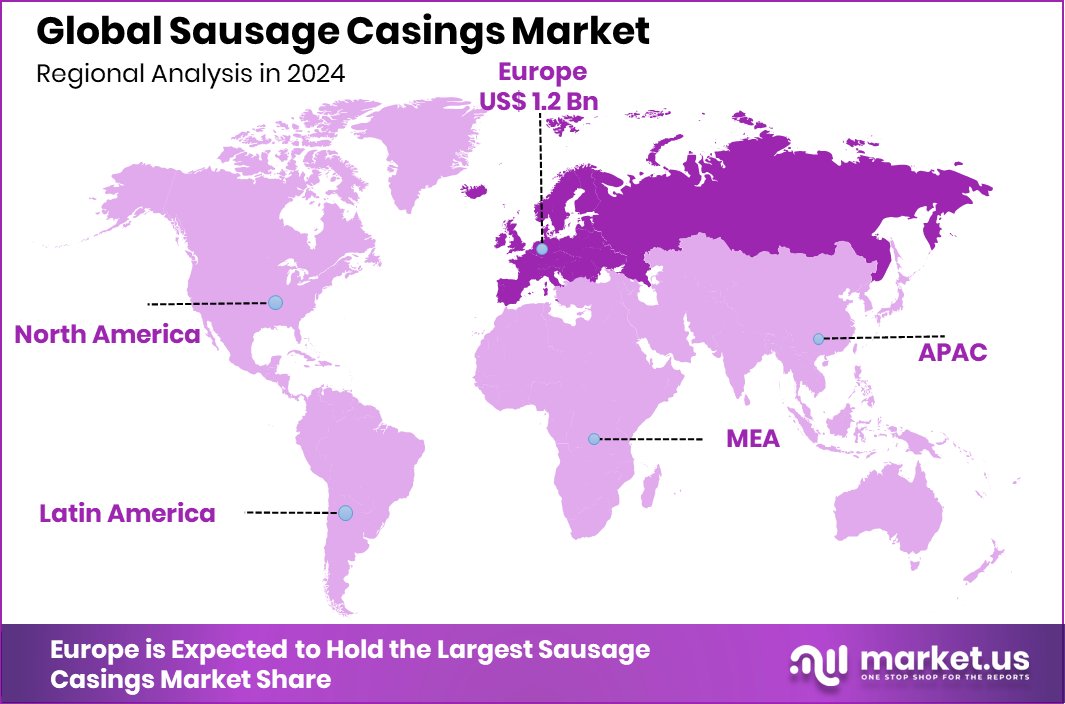

Global Sausage Casings Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.6 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034. With a USD 1.2 billion value, Europe led sausage casings demand at 34.6%.

Sausage casings are the outer coverings that hold and shape ground meat mixtures into sausages. These casings can be made from natural sources such as the intestines of animals (commonly pigs, sheep, or cattle), or they can be manufactured from collagen, cellulose, or plastic. Natural casings are often used in traditional or artisanal sausage-making due to their authentic texture and flavor, while synthetic casings are preferred for industrial use where uniformity and cost-efficiency are critical.

The sausage casings market is witnessing steady growth driven by increased global consumption of processed and ready-to-eat meat products. Urbanization, rising disposable incomes, and busy lifestyles have contributed to the rising demand for convenient protein sources like sausages. In many regions, especially in Asia and Latin America, changing food habits and Western influence have led to increased sausage consumption, further supporting market expansion.

One of the key growth factors is the rising demand for high-protein, meat-based snacks and frozen foods. With more people looking for quick meal options, sausages have become a common choice across households, foodservice outlets, and convenience stores.

The increasing demand for clean-label and organic meat products has opened up opportunities for natural casing producers. Consumers are paying more attention to product ingredients, leading manufacturers to emphasize authenticity, texture, and appearance—qualities that natural casings offer more effectively than synthetic ones.

Key Takeaways

- Global Sausage Casings Market is expected to be worth around USD 5.0 billion by 2034, up from USD 3.6 billion in 2024, and grow at a CAGR of 3.3% from 2025 to 2034.

- In the sausage casings market, natural casings account for 44.9%, reflecting a strong preference for authenticity.

- Food manufacturers lead with a 56.2% share, showing dominant use of sausage casings in commercial production.

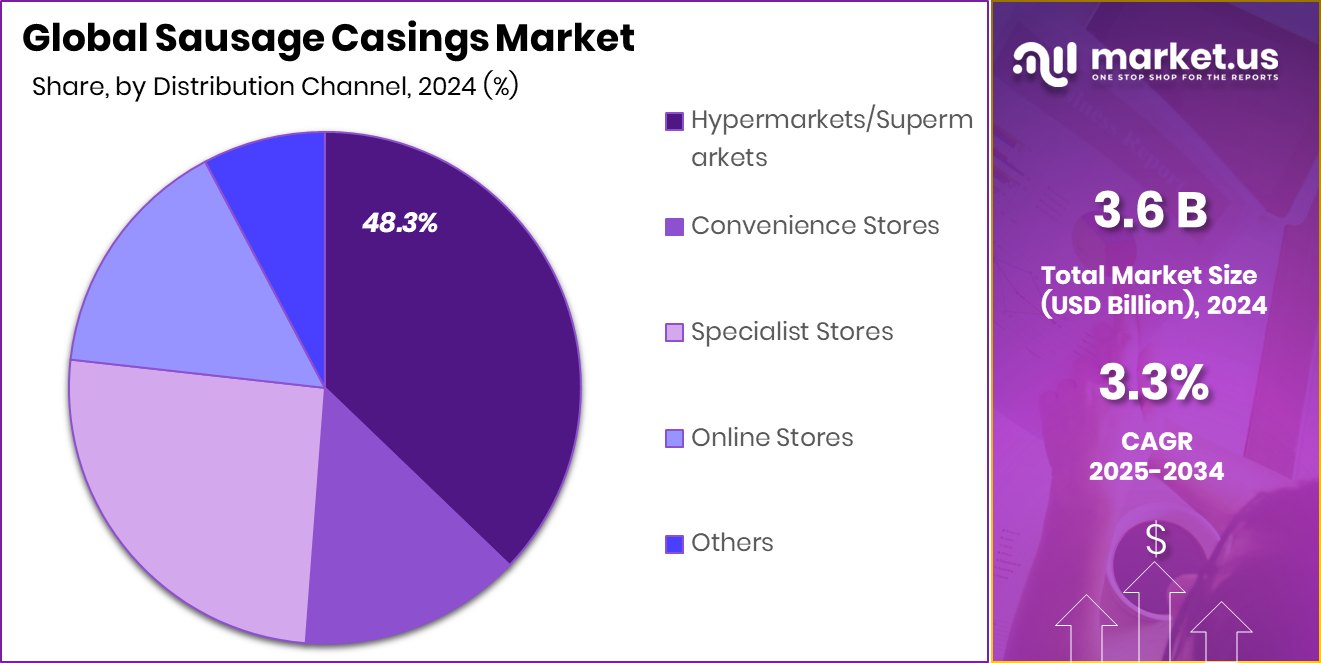

- Hypermarkets and supermarkets hold 48.3% share, making them key distribution channels for sausage casing products.

- Europe held a 34.6% share of the global sausage casings market in 2024.

By Product Type Analysis

Natural casings hold a 44.9% share in the sausage casings market globally.

In 2024, Natural Casings held a dominant market position in the By Product Type segment of the Sausage Casings Market, with a 44.9% share. This significant share highlights the continued preference for natural materials in sausage production, especially among manufacturers targeting traditional, artisanal, and premium segments.

Natural casings, typically derived from animal intestines, are valued for their ability to enhance flavor, offer authentic texture, and deliver an appealing bite—characteristics that are difficult to replicate with synthetic alternatives. Their permeability also allows better smoke absorption, making them suitable for smoked and cured sausage varieties.

The dominance of natural casings can be attributed to growing consumer demand for clean-label and traditionally prepared meat products. In both retail and foodservice settings, products featuring natural casings are often perceived as higher quality or more authentic, which resonates with health-conscious and label-aware consumers.

Furthermore, the increasing consumption of gourmet and region-specific sausages in various markets supports the strong position of natural casings. While these casings may involve higher handling costs and more complex storage requirements, their advantages in flavor, appearance, and consumer preference continue to drive their adoption.

By End-Use Analysis

Food manufacturers dominate the sausage casings market with a 56.2% usage share.

In 2024, Food Manufacturers held a dominant market position in the end-use segment of the Sausage Casings Market, with a 56.2% share. This leading position reflects the large-scale utilization of sausage casings by industrial food producers, who require consistent quality, efficiency, and volume in their operations. Food manufacturers often rely on sausage casings for the mass production of various sausage types intended for supermarkets, frozen food sections, and foodservice distribution.

The strong presence of food manufacturers is also driven by the rising global demand for processed and ready-to-cook meat products, particularly among urban populations. As consumers increasingly prefer convenient meal options, food producers are scaling operations to meet this growing need, leading to a corresponding rise in demand for casings.

Sausage products produced by manufacturers are also tailored to meet diverse consumer preferences across taste, portion size, and shelf life. With advancements in processing and packaging technologies, manufacturers continue to expand their sausage product lines, reinforcing their reliance on reliable casing solutions.

By Distribution Channel Analysis

Hypermarkets and supermarkets lead sausage casings distribution with 48.3% market share.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel segment of the Sausage Casings Market, with a 48.3% share. This leadership reflects the widespread consumer preference for purchasing meat products, including sausages, from large-format retail outlets that offer variety, visibility, and convenience.

Hypermarkets and supermarkets serve as key points of sale for sausage products, where both processed and freshly packed options are available. Their ability to cater to a broad customer base with a mix of branded and private-label products has significantly contributed to this segment’s strong performance.

The 48.3% share in 2024 also indicates the trust consumers place in organized retail chains for hygiene, product quality, and consistent availability. These outlets often support high product turnover and shelf-space allocation for processed meats, making them an essential distribution channel for sausage manufacturers. Promotional strategies, attractive packaging, and the ease of bulk buying further enhance consumer engagement.

As sausage consumption continues to align with modern dietary habits and time-saving food solutions, hypermarkets and supermarkets remain the primary channel for reaching mass-market consumers. Their extensive reach and supply chain capabilities continue to reinforce their dominant role in the sausage casings market landscape.

Key Market Segments

By Product Type

- Alternative Casings

- Natural Casings

- Synthetic Casings

By End-Use

- Food Manufacturers

- Household

- Restaurants and Foodservice

- Others

By Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialist Stores

- Online Stores

- Others

Driving Factors

Rising Processed Meat Demand Boosts Casing Sales

One of the main driving factors for the sausage casings market is the increasing global demand for processed meat products. With busy lifestyles and limited time for meal preparation, more consumers are turning to ready-to-cook and ready-to-eat foods like sausages. These products offer both convenience and nutrition, making them a preferred choice in households, fast-food chains, and foodservice outlets.

As sausage consumption rises, the demand for casings—both natural and synthetic—continues to grow. This trend is especially strong in urban areas where processed meat is a regular part of the diet. The consistent expansion of the food processing industry and the rising number of meat-based product launches are further strengthening the growth of the sausage casings market.

Restraining Factors

Health Concerns Over Processed Meat Limit Growth

One major restraining factor for the sausage casings market is the growing health concerns linked to processed meat consumption. Increasing awareness about the potential risks associated with high intake of processed meats—such as heart disease, obesity, and certain types of cancer—has led some consumers to reduce or avoid these products altogether. Health-conscious individuals are shifting toward plant-based alternatives, which do not require traditional casings.

In addition, global health organizations and nutrition experts are encouraging moderation in meat consumption, further influencing consumer behavior. As this trend grows, it directly impacts the demand for sausages and, in turn, the casings used to produce them. These changing dietary preferences could slow market growth, particularly in developed regions.

Growth Opportunity

Expansion of Ethnic and Specialty Sausage Demand

A significant growth opportunity for the sausage casings market lies in the rising global interest in ethnic and specialty sausages. Consumers are increasingly seeking unique flavors and traditional recipes from diverse cultures, including chorizo, andouille, merguez, and bratwurst. These varieties often require specific types of casings—such as natural casings—to preserve authenticity and texture.

Additionally, foodservice establishments and artisanal producers are expanding their menus to include such specialty sausages, further driving demand. Investment in meeting these varied casing needs can help manufacturers capture new market segments and drive overall growth in the sausage casings industry.

Latest Trends

Clean-Label and Transparent Ingredient Labels Rising

In recent times, there has been a clear trend in the sausage casings market toward clean-label and transparency in product ingredients. Consumers are becoming more aware of what they eat and prefer meats and casings with simple, recognizable components. Natural casings—derived from animal intestines—are being seen as more authentic and less processed than synthetic ones, which appeals to shoppers looking for honest labeling.

Manufacturers are responding by offering casings with minimal additives and clearer sourcing information. This movement toward openness helps build trust between brands and consumers, as shoppers feel confident about the quality and origin of their food. Producers emphasizing transparent, clean-label casings can align themselves with modern consumer values and build stronger loyalty in a competitive market.

Regional Analysis

In Europe, the sausage casings market reached USD 1.2 billion in 2024.

In 2024, Europe emerged as the dominant region in the global sausage casings market, accounting for a significant 34.6% share, with a market value of USD 1.2 billion. This strong regional presence is attributed to the deep-rooted culture of sausage consumption across countries such as Germany, Spain, and Italy, where both traditional and industrial sausage production remains high. The region’s preference for natural casings in artisanal sausage varieties, along with a well-established meat processing industry, supports continued demand.

North America also represents a mature market, characterized by a high consumption of processed meats and strong demand from food manufacturers for consistent, high-volume sausage casing solutions. The Asia Pacific region is witnessing steady growth, driven by increasing urbanization, changing food habits, and growing demand for convenient protein-rich foods like sausages in countries such as China and India.

Meanwhile, the Middle East & Africa and Latin America are emerging as potential growth markets, with rising meat consumption and expanding food processing sectors supporting demand for sausage casings. Although these regions currently hold smaller shares compared to Europe, their improving cold chain infrastructure and growing middle-class populations position them for gradual market expansion in the coming years. Europe, however, remains the clear leader in 2024.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Almol (Australia) Casing Pty Ltd has consolidated a strong position in the Asia-Pacific region by leveraging local sourcing and production efficiency. Its proximity to major meat-producing centers in Australia enables timely supply and quality control, supporting both domestic and export-oriented food manufacturers. Almol’s ability to deliver tailored casing solutions for diverse regional tastes has reinforced its foothold amid growing demand in markets such as China and Southeast Asia.

DAT‑Schaub Group has maintained its status as an industry innovator, particularly in natural casing processing. The company’s investment in advanced casing preparation and packaging systems has optimized shelf life and hygiene standards—attributes highly valued by large-scale food manufacturers in Europe and North America. Its focus on R&D has enabled rapid adaptation to evolving regulatory and clean-label trends, positioning DAT‑Schaub as a trusted name for quality and compliance.

Devro plc has continued to capitalize on its global presence and diversified portfolio, encompassing collagen and cellulose-based casings. With strong integration across manufacturing facilities in Europe and North America, Devro supports both artisan and industrial sausage segments. Its emphasis on sustainability and waste reduction has attracted environmentally mindful clients across various markets.

Kalle GmbH remains a specialist in natural casings, with deep roots in traditional European meat processing. The company’s longstanding expertise in animal intestine-based casings ensures superior taste and texture, qualities important for premium sausage varieties. Kalle’s excellence in quality consistency continues to reinforce its appeal among artisanal producers and niche foodservice channels.

Top Key Players in the Market

- A & H Meyer GmbH

- AGRIMARES Group

- Almol (Australia) Casing Pty Ltd

- DAT-Schaub Group

- Devro plc

- Kalle GmbH

- Natural Casing Company Inc.

- Nippi Incorporated

- Nitta Casings Inc.

- Oversea Casing Company LLC

- Saria Se

- Selo Group

- Shenguan Holdings (Group) Limited

- Syracuse Casing Company

- Viscofan Group

- Devro plc

- Viskase Companies Inc.

Recent Developments

- In June 2025, Devro partnered with natural casing specialist Van Hessen to launch “VH Devro,” a combined market-facing brand. The new brand integrates Van Hessen’s natural casing legacy with Devro’s collagen casing solutions. This unified offering is intended to provide improved quality, broader product range, and better customer service worldwide.

- In May 2025, Kalle GmbH concluded a major refinancing agreement—raising €165 million and USD 137 million—to strengthen its global expansion strategy in sausage casings, sponge cloths, and vegan food solutions. This financing demonstrates the company’s commitment to scaling operations and investing in innovation across both traditional and plant‑based product lines.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 5.0 Billion CAGR (2025-2034) 3.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alternative Casings, Natural Casings, Synthetic Casings), By End-Use (Food Manufacturers, Household, Restaurants and Foodservice, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Specialist Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape A & H Meyer GmbH, AGRIMARES Group, Almol (Australia) Casing Pty Ltd, DAT-Schaub Group, Devro plc, Kalle GmbH, Natural Casing Company Inc., Nippi Incorporated, Nitta Casings Inc., Oversea Casing Company LLC, Saria Se, Selo Group, Shenguan Holdings (Group) Limited, Syracuse Casing Company, Viscofan Group, Devro plc, Viskase Companies Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- A & H Meyer GmbH

- AGRIMARES Group

- Almol (Australia) Casing Pty Ltd

- DAT-Schaub Group

- Devro plc

- Kalle GmbH

- Natural Casing Company Inc.

- Nippi Incorporated

- Nitta Casings Inc.

- Oversea Casing Company LLC

- Saria Se

- Selo Group

- Shenguan Holdings (Group) Limited

- Syracuse Casing Company

- Viscofan Group

- Devro plc

- Viskase Companies Inc.