Global Renal Function Test Market By Product Type (Dipsticks, Reagents, and Disposables), By Test Type (Urine Tests (Urine Protein Tests, Creatinine Clearance Tests, and Microalbumin Tests) and Blood Tests (Serum Creatinine Tests, Glomerular Filtration Rate Tests, and Blood Urea Nitrogen Tests)), By End-user (Hospitals, Diagnostic Laboratories, and Research Laboratories & Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165004

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

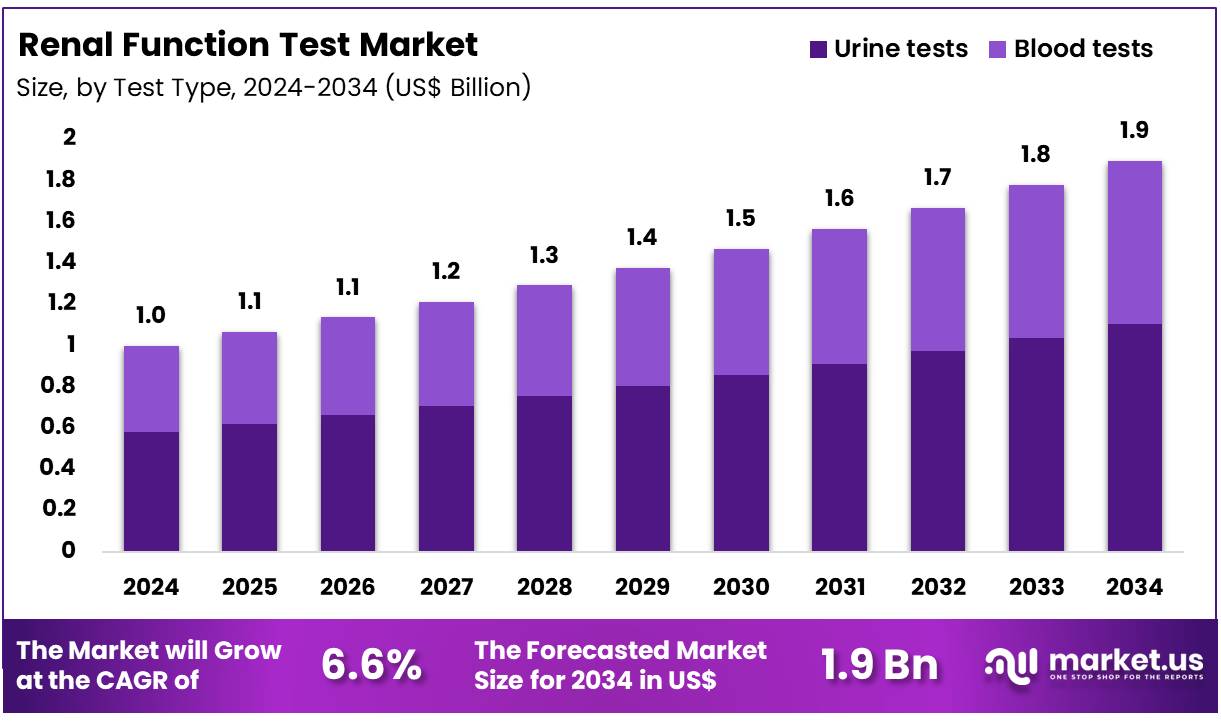

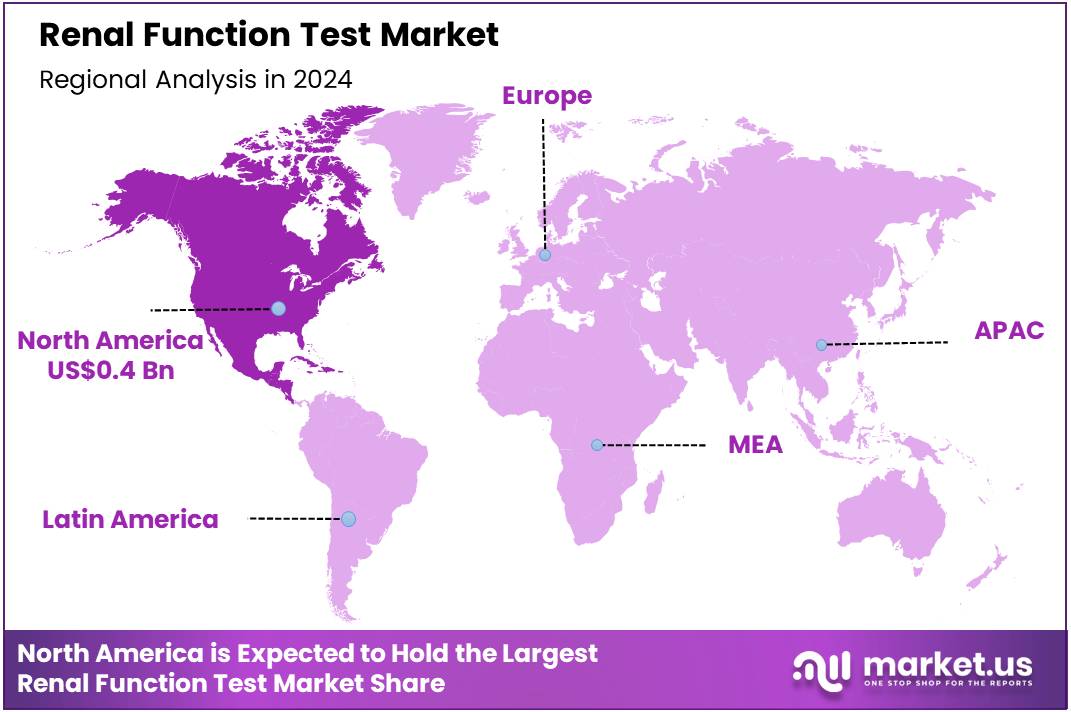

Global Renal Function Test Market size is expected to be worth around US$ 1.9 Billion by 2034 from US$ 1.0 Billion in 2024, growing at a CAGR of 6.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.3% share with a revenue of US$ 0.4 Billion.

Increasing incidence of diabetes-related complications drives the Renal Function Test Market, as nephrologists prioritize early detection of kidney impairment. Clinicians apply serum creatinine and cystatin C measurements to calculate estimated glomerular filtration rate, staging chronic kidney disease progression. These tests support cardiology by monitoring renal function in heart failure patients on diuretics, preventing acute kidney injury.

Pharmaceutical researchers utilize urine albumin-to-creatinine ratios in clinical trials to evaluate nephroprotective drug efficacy. In May 2024, Boditech Med licensed the DNlite-IVD103 biomarker from Bio Preventive Medicine Corp for diabetic kidney disease detection up to five years early. This partnership accelerates market growth by enabling preventive renal diagnostics and global commercialization.

Growing emphasis on point-of-care monitoring creates opportunities in the Renal Function Test Market, as portable devices empower proactive health management. Primary care physicians deploy handheld analyzers to assess electrolyte balance in hypertensive patients, optimizing antihypertensive therapy. These assays aid endocrinology by tracking kidney function in thyroid disorder treatments, adjusting medication dosages accordingly.

Veterinary applications integrate renal panels to manage feline chronic kidney disease, extending companion animal lifespan. In August 2022, Bloom Diagnostics launched the Bloom Kidney Test measuring cystatin C with IoT-enabled GFR estimation and data visualization. This patient-centric platform drives market expansion through accessible, connected renal function testing solutions.

Rising integration of novel biomarkers propels the Renal Function Test Market, as advanced indicators enhance diagnostic accuracy beyond traditional markers. Transplant specialists monitor donor-derived cell-free DNA alongside creatinine to detect allograft rejection early, preserving graft viability.

These tests support oncology by evaluating nephrotoxicity in chemotherapy regimens, guiding dose modifications for cisplatin. Trends toward multiplex urine proteomics identify tubular injury patterns in acute settings. Automated immunoassay platforms streamline high-volume screening in hospital laboratories. These innovations position the market for sustained advancement in comprehensive renal health assessment and intervention.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.0 Billion, with a CAGR of 6.6%, and is expected to reach US$ 1.9 Billion by the year 2034.

- The product type segment is divided into dipsticks, reagents, and disposables, with dipsticks taking the lead in 2023 with a market share of 46.8%.

- Considering test type, the market is divided into urine tests and blood tests. Among these, urine tests held a significant share of 58.3%.

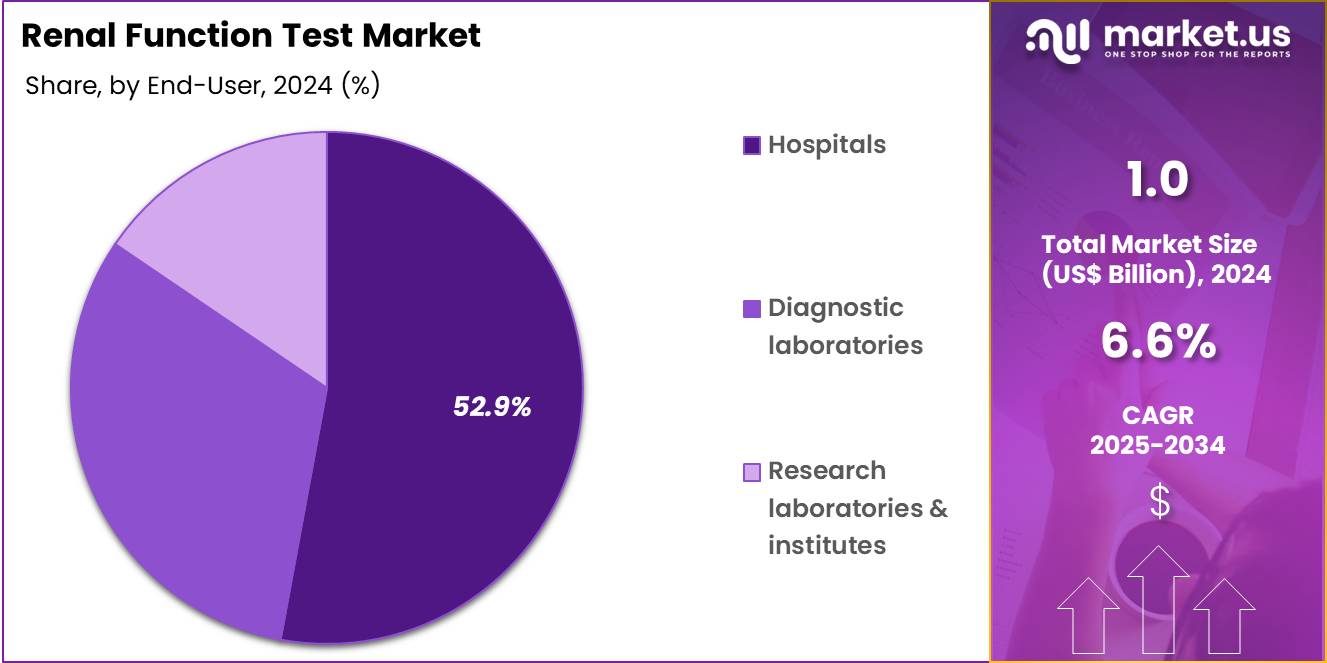

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, diagnostic laboratories, and research laboratories & institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 52.9% in the market.

- North America led the market by securing a market share of 38.3% in 2023.

Product Type Analysis

Dipsticks account for 46.8% of the Renal Function Test market and are anticipated to remain dominant due to their simplicity, affordability, and rapid diagnostic capability. The widespread use of dipsticks in point-of-care testing supports early detection of renal disorders in primary healthcare and home settings. The growing prevalence of chronic kidney disease (CKD) and diabetes worldwide is increasing demand for cost-effective testing methods.

Dipsticks are favored for their ability to detect key urinary parameters such as protein, glucose, blood, and creatinine, offering an initial assessment of renal health. Manufacturers are introducing multi-analyte and digital dipstick systems with smartphone connectivity, enabling instant data sharing with healthcare providers. The expansion of telemedicine and remote patient monitoring further accelerates adoption.

Continuous innovations in reagent chemistry have improved sensitivity and test accuracy. Increased awareness among patients regarding preventive kidney screening strengthens product demand. As healthcare systems emphasize early diagnosis to reduce CKD progression and healthcare burden, dipsticks are projected to maintain their leading position in renal diagnostics globally.

Test Type Analysis

Urine tests hold 58.3% of the Renal Function Test market and are expected to remain the most utilized test type owing to their non-invasive nature and broad diagnostic scope. Urine analysis allows evaluation of essential renal biomarkers including albumin, creatinine, and microalbumin levels, aiding in early-stage kidney dysfunction detection. The global rise in diabetes and hypertension two major causes of CKD is expanding the adoption of urine-based renal assessments.

Automated urine analyzers in hospitals and laboratories enhance diagnostic throughput and accuracy. The growing implementation of microalbuminuria screening in community health programs supports regular kidney health monitoring. Technological advancements have led to improved reagent stability and precision in detecting trace proteins. Portable urine analyzers are gaining popularity for field-based and home diagnostics.

Integration of AI-driven urine analysis tools for pattern recognition enhances early risk prediction. The emphasis on preventive healthcare and government-led CKD screening initiatives is anticipated to further accelerate demand for urine-based renal testing across both developed and emerging economies.

End-User Analysis

Hospitals contribute 52.9% of the Renal Function Test market and are likely to maintain dominance due to their comprehensive diagnostic infrastructure and high patient throughput. Hospitals serve as the primary centers for advanced renal diagnostics, offering both blood and urine testing for inpatients and outpatients. The increasing number of hospital admissions related to diabetes, hypertension, and renal failure is driving continuous testing demand.

Hospital laboratories rely on automated analyzers, dipstick-based screening systems, and immunoassay platforms for efficient and accurate testing. Integration of renal diagnostics with electronic medical records (EMRs) improves real-time monitoring and clinical decision-making. Hospitals also play a critical role in pre-surgical and dialysis-related renal evaluations.

Growing investment in healthcare modernization and government-funded nephrology programs enhances hospital-based diagnostic capacity. Training initiatives for clinical staff ensure improved accuracy in test interpretation and patient management. The rising preference for consolidated testing within hospital networks supports steady segment expansion. As hospitals continue to adopt precision diagnostics and digital workflow integration, they are expected to remain central to the global renal function testing landscape.

Key Market Segments

By Product Type

- Dipsticks

- Reagents

- Disposables

By Test Type

- Urine Tests

- Urine Protein Tests

- Creatinine Clearance Tests

- Microalbumin Tests

- Blood Tests

- Serum Creatinine Tests

- Glomerular Filtration Rate Tests

- Blood Urea Nitrogen Tests

By End-user

- Hospitals

- Diagnostics Laboratories

- Research Laboratories & Institutes

Drivers

Rising Prevalence of Chronic Kidney Disease is Driving the Market

The increasing occurrence of chronic kidney disease has considerably propelled the renal function test market, as these assessments are fundamental for early detection and ongoing management of kidney impairment. Renal function tests, encompassing serum creatinine, blood urea nitrogen, and glomerular filtration rate estimations, provide critical insights into filtration capacity, guiding interventions to slow progression. This driver is especially evident in populations with diabetes and hypertension, where routine monitoring prevents advancement to end-stage disease.

Healthcare systems are embedding these tests into chronic care models, leveraging point-of-care devices for frequent evaluations in primary settings. The condition’s asymptomatic early stages necessitate broad screening, amplifying demand in at-risk demographics. Public health campaigns highlight their prognostic importance, subsidizing lab expansions for population surveillance.

The Centers for Disease Control and Prevention estimates that 14.3% of U.S. adults, or approximately 37 million people, have chronic kidney disease, with 9 in 10 unaware of their condition, based on 2023 data. This figure emphasizes the screening necessity, as tests enable timely lifestyle modifications and pharmacotherapy. Developments in cystatin C assays enhance accuracy, accommodating age-related declines.

Economically, their routine use averts dialysis costs, endorsing infrastructure investments. Global initiatives standardize eGFR calculations, ensuring comparable results internationally. This prevalence escalation not only heightens test frequency but also solidifies renal evaluations’ role in nephrology protocols. Collectively, it stimulates refinements in biomarker panels, coordinating diagnostics with preventive strategies.

Restraints

Medicare Reimbursement Constraints is Restraining the Market

Inconsistent Medicare reimbursement policies for renal function tests persist in limiting market accessibility, as coverage caps and coding complexities discourage expanded utilization in outpatient environments. These tests, vital for monitoring chronic conditions, frequently encounter prior authorization requirements, burdening providers with administrative delays. This impediment particularly challenges community labs, where financial pressures favor basic panels over comprehensive profiles.

Regional variations in fee schedules exacerbate the issue, with local determinations imposing stringent medical necessity proofs. Producers confront validation expenses without proportional returns, curbing investments in novel formats. The outcome sustains under-testing, inflating progression risks and healthcare expenditures.

The Centers for Medicare & Medicaid Services reported that Medicare Part B spending on clinical diagnostic laboratory tests decreased by 10 percent to $8.4 billion in 2022 from $9.3 billion in 2021, reflecting volume-driven constraints amid stable rates. These reductions highlight fiscal pressures, as policy stabilizations hindered broader implementations.

Clinician reliance on covered essentials marginalizes advanced assays. Efforts for equitable coding evolve methodically, impeded by utilization data shortages. These reimbursement barriers not only impede scalability but also perpetuate diagnostic disparities. Thus, they require advocacy to integrate affordability with clinical imperatives.

Opportunities

Advancements in Point-of-Care Renal Testing is Creating Growth Opportunities

The development of portable renal function analyzers has unveiled notable expansion paths for the market, permitting immediate creatinine and eGFR measurements in non-lab settings to accelerate decision-making. These devices, employing dry chemistry strips, yield results in minutes, ideal for emergency triage and home monitoring in chronic patients. Opportunities emerge in telemedicine pairings, where subsidies fund validations for rural deployments amid rising telemedicine adoption.

Enterprise-clinic collaborations underwrite cartridge innovations, resolving delays in traditional venipuncture. This immediacy counters hospitalization escalations, framing point-of-care as facilitators of outpatient oversight. Budgets for decentralized diagnostics hasten procurements, branching into integrated diabetes-kidney panels.

Formulations with ambient-stable reagents bolster field durability, easing logistical strains. As digital interfaces mature, point-of-care data unlock predictive health revenues. These portable advancements not only diversify usage contexts but also interlace the market into ambulatory renal care structures.

Impact of Macroeconomic / Geopolitical Factors

Increasing hypertension cases and strong public health campaigns drive healthcare providers to incorporate renal function tests in standard wellness exams for prompt kidney damage identification, helping specialists recommend dietary adjustments that sustain organ vitality and lower long-term treatment expenses. Steady supply chain pressures from global economic shifts, however, restrict hospital procurements, as institutions hold off on stocking advanced creatinine analyzers and protein panels to navigate fiscal squeezes.

Geopolitical flashpoints, like Panama Canal delays from environmental disputes, extend transit for electrolyte buffers from Latin American processors, requiring vendors to handle markup volatility that disrupts monthly replenishment schedules. Current US tariffs, charging a 10% rate on imported lab consumables and devices from more than 180 trading partners since April 2025, elevate prices for cystatin C strips from European lines, burdening urban clinics with pass-through fees and slowing integration in outpatient services.

That notwithstanding, these duties foster collaborations with regional fabricators, generating user-friendly, app-linked test strips that speed up data sharing and lessen exposure to international delays. Surging corporate fitness initiatives likewise promote routine renal evaluations, buffering against coverage fluctuations and encouraging consistent patient follow-ups.

Latest Trends

FDA Clearance of Siemens Healthineers’ Atellica CH 930 Analyzer is a Recent Trend

The endorsement of automated clinical chemistry systems has signified a pivotal evolution in renal function testing during 2024, prioritizing high-throughput eGFR calculations for efficient chronic disease surveillance. Siemens Healthineers’ Atellica CH 930, integrating creatinine and cystatin C assays, delivers results in under 10 minutes, supporting consolidated workflows in core labs. This clearance embodies a refinement toward modular platforms, accommodating renal panels alongside electrolytes for comprehensive metabolic profiling.

Authority confirmations validate its precision, hastening adoptions in high-volume facilities amid caseload surges. This automation dovetails with lab digitization, associating outputs to middleware for algorithmic alerts. The system confronts throughput bottlenecks, favoring configurations resilient to interferents. The U.S. Food and Drug Administration cleared the Siemens Healthineers Atellica CH 930 chemistry analyzer in 2024, expanding capabilities for renal function parameters in routine diagnostics.

These clearances underscore adaptability, as validations match legacy benchmarks. Forecasters anticipate protocol embeddings, magnifying its eminence in stewardship guidelines. Progressive appraisals demonstrate variance reductions, optimizing operational efficiencies. The prospect envisions AI calibrations, envisioning prognostic integrations. This chemistry-centric progression not only elevates testing reliability but also coordinates with streamlined nephrology imperatives.

Regional Analysis

North America is leading the Renal Function Test Market

The market in North America is anticipated to have held a 38.3% share of the global renal function test landscape in 2024, advanced by CDC’s emphasis on CKD screening for high-risk groups with diabetes and hypertension, which affects 1 in 3 and 1 in 5 such individuals, driving widespread adoption of eGFR and albuminuria assays in primary care to enable early nephroprotective interventions like SGLT2 inhibitors.

Labs ramped up utilization of cystatin C-based tests for more accurate GFR estimation in elderly patients, achieving 20% better precision over creatinine alone in cohorts with reduced muscle mass, correlating with NIH-backed validations that reduced misclassification rates in transplant evaluations.

The National Institute of Diabetes and Digestive and Kidney Diseases’ USRDS 2023 report highlighted CKD’s role in 24.1% of Medicare spending for seniors, prompting federal grants for point-of-care platforms that streamlined urine albumin-to-creatinine ratio testing in community health centers. Regulatory efficiencies under FDA’s CLIA oversight expedited clearances for automated analyzers, aligning with Medicare expansions for annual screenings in prediabetic populations.

Demographic pressures from 35.5 million affected adults amplified demand for comprehensive panels in urban clinics. These elements positioned the region as a leader in proactive nephrology diagnostics. The Centers for Disease Control and Prevention reported CKD affecting more than 1 in 7 U.S. adults estimated at 35.5 million in 2023

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as governmental health drives prioritize eGFR and proteinuria assays to combat CKD burdens in aging societies with high diabetes prevalence. Officials in China and India invest in cystatin C kits, outfitting rural labs to assess filtration rates in hypertensive cohorts from low-income districts. Diagnostic providers collaborate with national institutes to standardize albuminuria tests, anticipating refined staging for diabetic nephropathy in urban migrants.

Regulatory bodies in Japan and South Korea subsidize automated analyzers, enabling community facilities to monitor GFR without central dependencies. Countrywide programs estimate integrating renal panel results into digital registries, expediting SGLT2 referrals for early-stage patients.

Regional nephrologists develop multiplex formats, aligning with WHO networks to profile proteinuria in tropical infection survivors. These strategies yield a versatile framework for kidney health surveillance. The World Health Organization estimated CKD prevalence at 4.7% to 17.4% across Asia-Pacific countries in 2022, with an overall regional figure of 434.3 million cases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading organizations in the kidney performance evaluation sector accelerate progress by unveiling high-throughput analyzers that combine eGFR calculations with novel proteinuria markers, empowering physicians to detect acute injuries in critical care units. They orchestrate targeted buyouts of specialty reagent firms to fortify assay robustness, streamlining validation and boosting reliability for global labs. Enterprises funnel capital into wearable biosensors for continuous monitoring, bridging gaps in home-based dialysis management and tele-nephrology.

Decision-makers build joint ventures with pharmaceutical developers to embed tests in drug-induced nephrotoxicity trials, unlocking companion diagnostic opportunities. They deepen footholds in South Asia and sub-Saharan Africa, adapting devices to regional disease patterns and securing public health tenders. Additionally, they craft flexible leasing programs with embedded AI forecasting, locking in hospital commitments and generating stable cash flows.

Abbott Laboratories, founded in 1888 and headquartered in Chicago, Illinois, crafts cutting-edge diagnostics that encompass renal panels for serum and urine metrics, aiding proactive kidney disease interventions across 160 nations. The firm advances its Alinity ci-series for seamless creatinine and urea testing, integrating cloud analytics for trend predictions in patient care. Abbott commits vigorous R&D to biomarker expansions, prioritizing user-centric designs for varied healthcare infrastructures.

CEO Robert B. Ford helms a vast operation focused on affordability and precision in chronic condition tracking. The company allies with renal societies to shape screening standards, promoting widespread implementation. Abbott entrenches its authority by blending device ingenuity with data ecosystems to redefine nephrology outcomes.

Top Key Players

- Sysmex Corporation

- Siemens Healthineers

- Randox Laboratories Ltd

- Quest Diagnostics

- Nova Biomedical Corporation

- Laboratory Corporation of America Holdings

- Hoffmann-La Roche Ltd.

- Danaher

- ACON Laboratories, Inc.

- Abbott

Recent Developments

- In February 2024, Simple HealthKit launched a kidney testing initiative designed to evaluate kidney function both at home and in clinical settings. This program, aimed at diabetes patients, integrates accessible renal health assessments that help insurers and providers track patient outcomes. By supporting early detection and proactive management, this initiative drives growth in the renal function test market through wider adoption of home-based and digital diagnostic models.

- In December 2023, the U.S. FDA approved the NGAL biomarker developed by Cincinnati Children’s for pediatric use. Known as the ProNephro AKI test, it enables clinicians to identify acute kidney injury risk within 48–72 hours. This approval marks a critical step toward integrating biomarker-driven diagnostics into pediatric care, strengthening demand for advanced renal function testing solutions in critical care settings.

Report Scope

Report Features Description Market Value (2024) US$ 1.0 Billion Forecast Revenue (2034) US$ 1.9 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dipsticks, Reagents, and Disposables), By Test Type (Urine Tests (Urine Protein Tests, Creatinine Clearance Tests, and Microalbumin Tests) and Blood Tests (Serum Creatinine Tests, Glomerular Filtration Rate Tests, and Blood Urea Nitrogen Tests)), By End-user (Hospitals, Diagnostic Laboratories, and Research Laboratories & Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sysmex Corporation, Siemens Healthineers, Randox Laboratories Ltd, Quest Diagnostics, Nova Biomedical Corporation, Laboratory Corporation of America Holdings, F. Hoffmann-La Roche Ltd., Danaher, ACON Laboratories, Inc., Abbott. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Sysmex Corporation

- Siemens Healthineers

- Randox Laboratories Ltd

- Quest Diagnostics

- Nova Biomedical Corporation

- Laboratory Corporation of America Holdings

- Hoffmann-La Roche Ltd.

- Danaher

- ACON Laboratories, Inc.

- Abbott