Global Chromatography Market By Chromatography Systems (Gas, Liquid, Fluid, and Thin Layer), By Accessories (Columns, Pressure Regulators, Solvents, Detectors, and Others), By End-user (Academic & Research Institutes, Pharmaceutical & Biotechnology Company, Food & Beverage Company, and Life Science Industries, Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2034

- Published date: Feb 2025

- Report ID: 139877

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

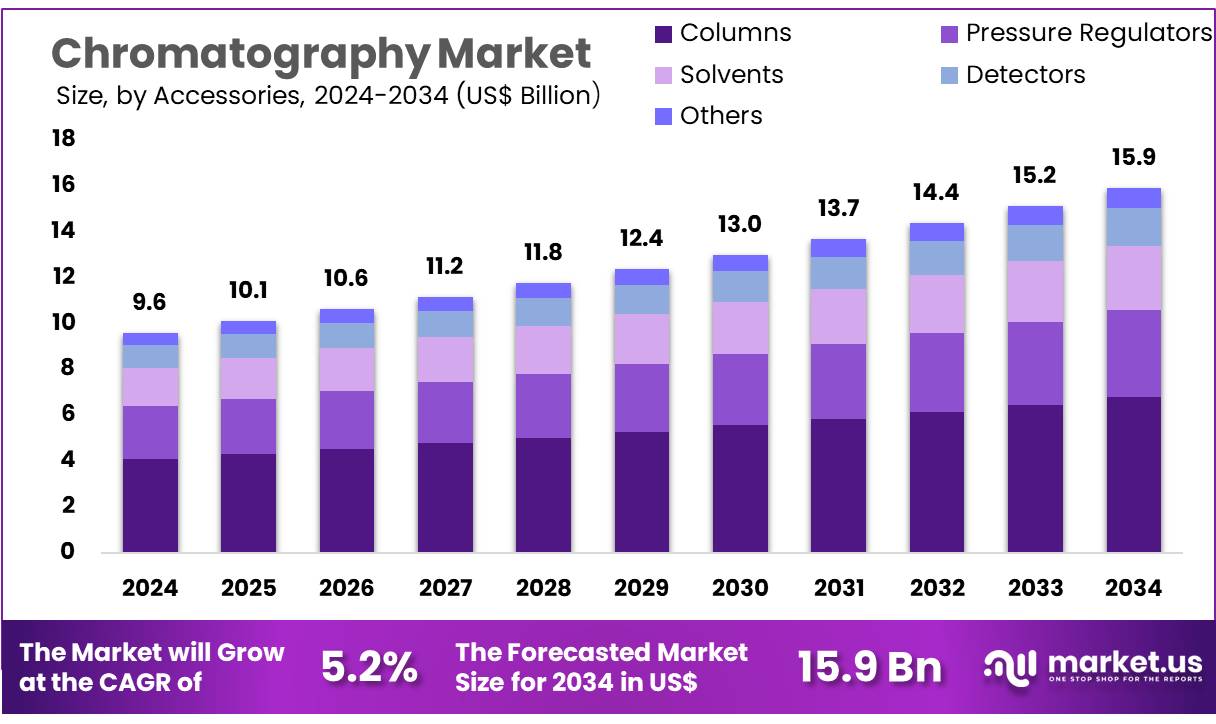

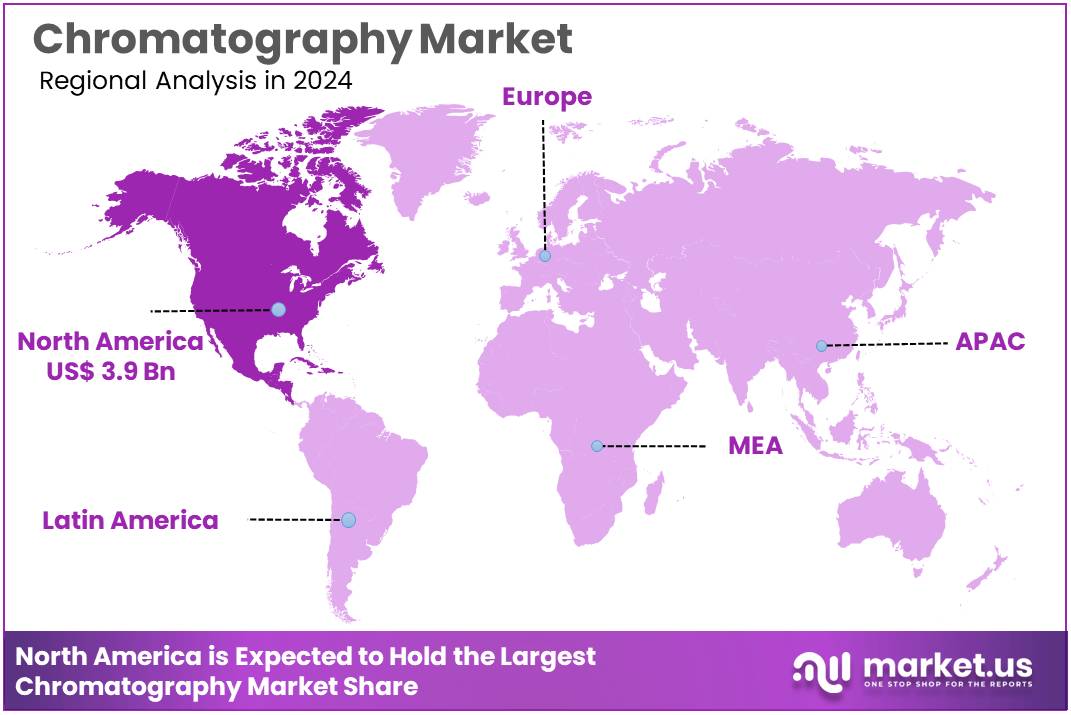

The Global Chromatography Market size is expected to be worth around US$ 15.9 billion by 2034 from US$ 9.6 billion in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 3.9 Billion.

Increasing demand for high-quality separation and analysis of complex mixtures is driving the growth of the chromatography market. Chromatography plays a critical role in various industries, including pharmaceuticals, biotechnology, food and beverage, environmental testing, and clinical diagnostics. The technology is widely used for purifying and analyzing chemical compounds, proteins, and other biomolecules, supporting drug discovery, quality control, and regulatory compliance.

As the global pharmaceutical industry expands, there is a growing need for reliable and efficient analytical techniques, presenting significant opportunities for the chromatography market. In August 2024, Calibre Scientific expanded its portfolio by acquiring Greyhound Chromatography, a UK-based supplier of chromatography consumables and analytical standards, signaling the ongoing consolidation in the market.

Additionally, in June 2024, ePrep signed a partnership with Agilent Technologies to distribute its ePrep ONE workstation, designed for chromatography sample preparation, highlighting the rising trend of automation in chromatography processes to improve efficiency and reduce human error. Another notable development occurred in June 2024 when CatSci acquired Reach Separations, a UK-based company specializing in chromatography services for the analysis and purification of therapeutics.

This acquisition underscores the increasing importance of chromatography in drug development and therapeutic research. Recent trends also show a growing adoption of advanced chromatography techniques, such as high-performance liquid chromatography (HPLC) and gas chromatography (GC), for more precise and faster analysis, which is expected to continue driving market growth.

Key Takeaways

- In 2024, the market for chromatography generated a revenue of US$ 6 billion, with a CAGR of 5.2%, and is expected to reach US$ 15.9 billion by the year 2034.

- The chromatography systems segment is divided into gas, liquid, fluid, and thin layer, with liquid taking the lead in 2024 with a market share of 36.4%.

- Considering accessories, the market is divided into columns, pressure regulators, solvents, detectors, and others. Among these, columns held a significant share of 42.7%.

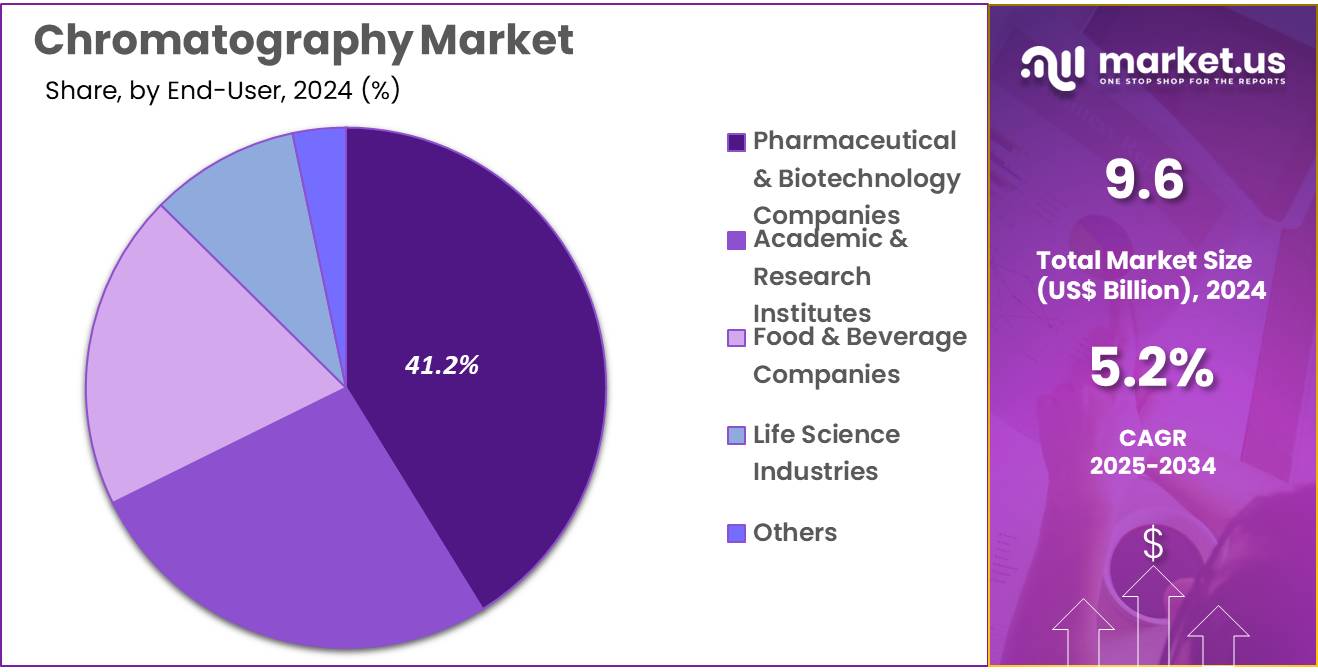

- Furthermore, concerning the end-user segment, the market is segregated into academic & research institutes, pharmaceutical & biotechnology company, food & beverage company, and life science industries, others. The pharmaceutical & biotechnology company sector stands out as the dominant player, holding the largest revenue share of 41.2% in the chromatography market.

- North America led the market by securing a market share of 40.3% in 2024.

Chromatography Systems Analysis

The liquid segment led in 2024, claiming a market share of 36.4% owing to its essential role in various analytical applications, particularly in chemical, pharmaceutical, and environmental testing. Liquid chromatography is anticipated to become increasingly popular because it offers high-resolution separations, which are critical in the analysis of complex mixtures like proteins, peptides, and pharmaceuticals.

The growth of this segment is likely to be driven by advancements in liquid chromatography technology, including improvements in column efficiency and detector sensitivity. As industries continue to demand precise and accurate analytical solutions for quality control and research, the liquid chromatography market is projected to expand. Additionally, the growing use of liquid chromatography in clinical diagnostics, biotechnology, and food safety testing will likely contribute to the continued growth of this segment.

Accessories Analysis

The columns held a significant share of 42.7% due to the increasing demand for high-performance columns used in various chromatographic processes. Columns, as essential components of chromatography systems, are expected to see rising adoption in industries such as pharmaceuticals, biotechnology, and environmental testing. The demand for more specialized columns, including those designed for specific applications like protein separation or environmental contaminants, is anticipated to drive growth.

As chromatography techniques become more refined and industries require more precise separations, the need for high-quality, durable columns will continue to rise. The advancements in column packing materials and designs, aimed at improving efficiency, will likely contribute to the sustained expansion of the columns segment within the market.

End-user Analysis

The pharmaceutical & biotechnology company segment had a tremendous growth rate, with a revenue share of 41.2% as these industries increasingly rely on chromatography for research, drug development, and quality control processes. Pharmaceutical and biotechnology companies are likely to drive the demand for chromatography systems due to their ability to separate complex biomolecules and identify impurities in drug formulations.

The ongoing focus on personalized medicine and the growing emphasis on biologics and biosimilars are projected to further increase the need for chromatography in the pharmaceutical and biotechnology sectors. As regulatory requirements for drug safety and efficacy become stricter, these companies are expected to invest more in chromatography systems for analytical testing, quality assurance, and clinical trials. Furthermore, the expanding applications of chromatography in gene therapy, proteomics, and biomarker discovery will likely contribute to the growth of this segment.

Key Market Segments

Chromatography Systems

- Gas

- Liquid

- Fluid

- Thin Layer

Accessories

- Columns

- Pressure Regulators

- Solvents

- Detectors

- Others

End-user

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Company

- Food & Beverage Company

- Life Science Industries

- Others

Drivers

Launch of Novel Innovative Solutions Driving the Chromatography Market

The launch of novel innovative solutions is anticipated to drive the chromatography market significantly. In June 2024, Sartorius introduced the Arium Mini Extend, an advanced laboratory water purification system designed to enhance flexibility and user convenience. This product caters to laboratories specializing in life science, analytical, and general research applications, addressing the demand for ultrapure water in high-precision workflows.

New product launches like this improve efficiency in sample preparation, a critical step in chromatographic processes. Innovations in instrumentation enhance detection sensitivity and data accuracy, making chromatography indispensable in drug development and environmental testing. Increasing focus on high-throughput systems meets the growing demand for analytical solutions across diverse industries. Companies prioritize advancements in automation and software integration to streamline complex workflows.

Expanding applications in biopharmaceuticals, food safety, and chemical research further bolster market growth. Collaboration between equipment manufacturers and research institutions accelerates the development of tailored solutions. Rising awareness about precision analytical methods drives adoption among academic and industrial users. These trends highlight the transformative impact of innovative solutions on advancing chromatographic technologies.

Restraints

High Costs Are Restraining the Chromatography Market

High costs associated with chromatography systems are restraining the market. Advanced instruments require significant investments, making them unaffordable for smaller research labs and organizations with limited budgets. The expense of consumables, including columns, solvents, and reagents, adds to the operational costs, reducing accessibility. Maintenance and calibration requirements further escalate the overall expense, particularly for high-end systems.

In developing regions, inadequate funding for research infrastructure restricts the adoption of chromatographic technologies. Complex training needs for handling sophisticated equipment increase operational overheads for institutions. Limited reimbursement policies for analytical tests in certain industries further hinder market penetration. Addressing these challenges requires innovations aimed at reducing production costs and supportive government policies to make chromatographic systems more accessible globally.

Opportunities

Growing Investment in R&D Activities as an Opportunity for the Chromatography Market

Growing investment in R&D activities is projected to create significant opportunities for the chromatography market. According to a 2021 OECD report, the top 10 pharmaceutical companies collectively invested over US$ 200 billion in research and development, marking a 15% increase from the previous year. This surge in spending drives the adoption of advanced analytical tools necessary for drug discovery and development.

Chromatographic techniques play a critical role in characterizing complex molecules like monoclonal antibodies and gene therapies. Increasing demand for precision and reproducibility in analytical workflows enhances the adoption of advanced instruments. Collaborations between pharmaceutical companies and chromatography manufacturers foster innovation tailored to evolving industry needs.

Rising focus on addressing chronic and rare diseases accelerates the integration of advanced analytical solutions in R&D pipelines. Expanding research in biopharmaceuticals and personalized medicine further amplifies the demand for chromatographic technologies. These trends position growing R&D investments as a key driver for the global chromatography market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the chromatography market. On the positive side, increasing global healthcare and research investments boost the demand for chromatography technologies in pharmaceutical and biotechnology industries. The growing need for high-quality and accurate analytical techniques for drug development, diagnostics, and environmental analysis further supports market expansion.

However, economic recessions can result in reduced research funding, slowing the adoption of advanced chromatography solutions. Geopolitical tensions and trade restrictions can disrupt the global supply chain for essential chromatography equipment and reagents, raising costs and affecting availability. Regulatory differences between countries can also complicate the market, as standards for analytical methods vary.

Despite these challenges, the continued advancements in chromatography techniques and the growing global focus on quality control and regulatory compliance ensure a strong growth trajectory for the market.

Latest Trends

Increasing Awareness of Food Toxicity Driving the Chromatography Market:

Rising awareness of food toxicity is driving significant growth in the chromatography market. High demand for safer food products and greater scrutiny on food safety standards are expected to increase the adoption of chromatography techniques for food testing and quality control. The growing concern over contaminants, such as pesticides, heavy metals, and foodborne pathogens, has prompted stricter regulations worldwide.

In 2022, the European Commission revised its standards for pesticide residue limits in food, establishing new Maximum Residue Limits (MRLs) for 67 pesticide-commodity combinations based on toxicity risk assessments. These updates are driving food producers and exporters to adopt chromatography techniques to ensure compliance with international food safety regulations. As global food safety awareness continues to grow, the chromatography market is likely to expand, offering more efficient and precise analytical solutions.

Regional Analysis

North America is leading the Chromatography Market

North America dominated the market with the highest revenue share of 40.3% owing to increasing demand from various industries, including pharmaceuticals, biotechnology, environmental testing, and food and beverage quality control. Chromatography plays a crucial role in the analysis and purification of chemical substances, which has led to its widespread adoption across these sectors.

The rising focus on precision medicine, stricter regulations in the pharmaceutical industry, and the growing need for advanced analytical tools have further boosted the demand for chromatography solutions. A key development in this market was the introduction of PerkinElmer, Inc.’s GC 2400 Platform in June 2022, a cutting-edge solution that integrates automated gas chromatography (GC), headspace sampling, and GC/mass spectrometry (GC/MS).

This platform aims to streamline laboratory workflows, deliver highly accurate analytical results, and provide flexible monitoring solutions for various applications, contributing to the market’s growth. Additionally, the increasing need for high-throughput analysis, along with continuous advancements in chromatography technologies, is expected to support the expansion of the chromatography market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising demand for advanced analytical techniques in biotechnology, pharmaceuticals, and environmental sectors. The region’s expanding pharmaceutical industry, along with a growing focus on regulatory compliance and quality assurance, is likely to drive the need for efficient and reliable chromatography systems.

Countries like China, India, and Japan are expected to lead this growth, as their healthcare and biotechnology sectors continue to evolve and modernize. The increasing prevalence of chronic diseases, along with the demand for better diagnostics and personalized treatments, is anticipated to drive the need for high-precision chromatography technologies.

Additionally, growing environmental concerns and the need for environmental monitoring are likely to fuel demand in the region. The increasing investments in research and development, along with the rise of government initiatives aimed at improving healthcare and biotechnology infrastructure, are expected to further boost the chromatography market in Asia Pacific. With these factors in place, the region is projected to become a significant hub for chromatography market growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the chromatography market focus on developing advanced systems and consumables to improve separation efficiency and analysis precision across industries like pharmaceuticals, biotechnology, and food safety. Companies invest in R&D to innovate techniques such as liquid and gas chromatography, addressing complex analytical challenges.

Collaborations with research institutions and end-users drive product customization and application expansion. Geographic expansion into regions with growing industrial and academic research activities supports market growth. Many players also prioritize automation and digital integration to enhance throughput and data management in laboratories.

Agilent Technologies, Inc. is a leading company in this market, offering a comprehensive range of chromatography instruments, columns, and consumables. The company combines cutting-edge technology with customer-centric solutions to deliver high-performance analytical tools. Agilent’s strong global presence and continuous innovation position it as a trusted partner in the analytical science community.

Top Key Players

- Thermo Fisher Scientific Inc

- Shimadzu Corp

- Merck KGaA

- ICON plc

- GE Healthcare

- Danaher Corp

- Bio-Rad Laboratories Inc

- Agilent Technologies

Recent Developments

- In June 2022, Agilent Technologies, a global leader in laboratory instruments, software, services, and consumables, launched new quadrupole mass spectrometers designed for both liquid chromatography-mass spectrometry (LC-MS) and gas chromatography-mass spectrometry (GC-MS). These advanced systems feature enhanced instrument intelligence and diagnostic capabilities, focused on improving system uptime and overall operational efficiency for users.

- In January 2024, ICON plc, a clinical research and healthcare intelligence firm, released a whitepaper discussing strategies to optimize biotech funding. The report revealed that 60% of biotech companies plan to increase their R&D budgets, with clinical trials being identified as a key challenge in the process.

Report Scope

Report Features Description Market Value (2024) US$ 9.6 billion Forecast Revenue (2034) US$ 15.9 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Chromatography Systems (Gas, Liquid, Fluid, and Thin Layer), By Accessories (Columns, Pressure Regulators, Solvents, Detectors, and Others), By End-user (Academic & Research Institutes, Pharmaceutical & Biotechnology Company, Food & Beverage Company, and Life Science Industries, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc, Shimadzu Corp, Merck KGaA, ICON plc, GE Healthcare, Danaher Corp, Bio-Rad Laboratories Inc, and Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific Inc

- Shimadzu Corp

- Merck KGaA

- ICON plc

- GE Healthcare

- Danaher Corp

- Bio-Rad Laboratories Inc

- Agilent Technologies