Global Refrigerated Snacks Market By Nature (Organic, Conventional), By Type (Savoury Snacks, Fruit Snacks, Confectionery Snacks, Bakery Snacks), By End-use (Residential, Food Services), By Distribution Channel (Supermarket and Hypermarket, Specialty Stores, Online Sales Channel), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132335

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

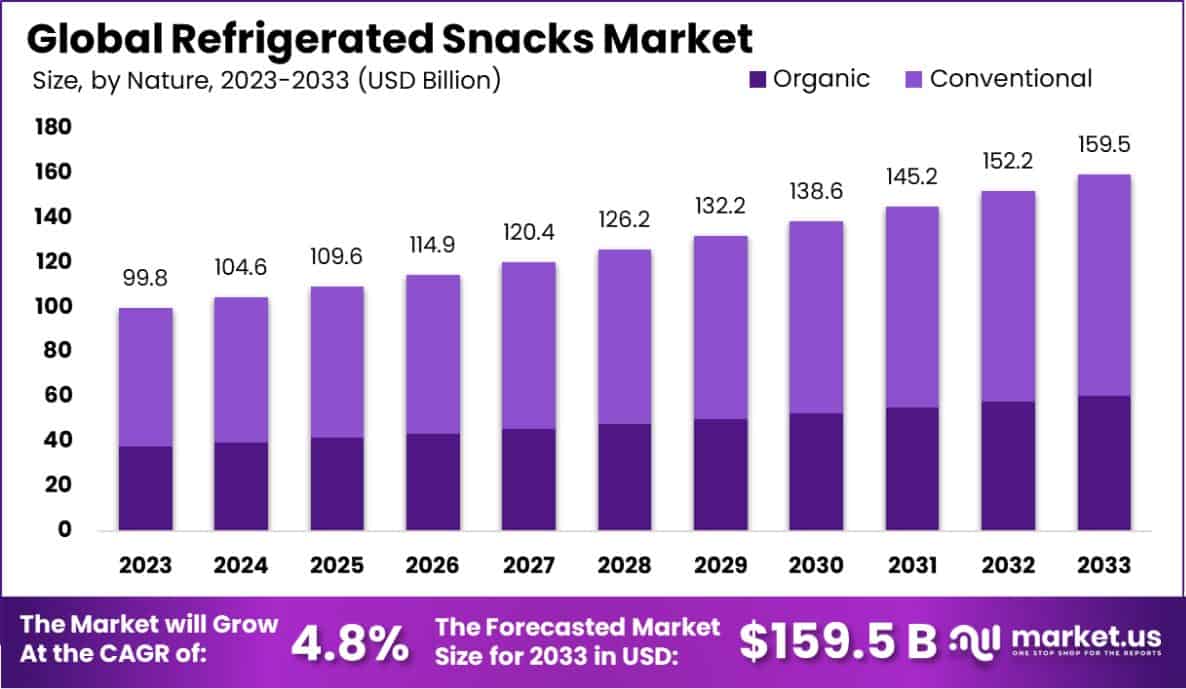

The Global Refrigerated Snacks Market size is expected to be worth around USD 159.5 Bn by 2033, from USD 99.8 Bn in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

Refrigerated snacks are ready-to-eat or easy-to-prepare food products stored under refrigeration to maintain freshness, texture, and taste. These snacks include dairy-based items such as flavoured yogurt, cheese sticks, and dips, as well as plant-based alternatives, refrigerated protein bars, and fresh-cut fruits. They cater to consumers seeking convenient, healthy, and indulgent snack options.

The refrigerated snacks market encompasses the production, distribution, and sale of perishable snack products. This market is driven by changing consumer lifestyles, rising health consciousness, and the increasing demand for fresh, minimally processed snacks. It includes both branded and private-label offerings across various retail channels such as supermarkets, hypermarkets, and convenience stores.

Innovation remains a critical growth driver as companies explore functional ingredients, clean-label formulations, and plant-based alternatives to meet diverse dietary needs. Emerging players attracting substantial investor interest further enrich the competitive landscape, underscoring the market’s growth potential. Startupsavant.com says Skinny Dipped Almonds raised $133.1 million in Series C funding to expand its healthier chocolate-covered almond snacks.

Similarly, Belliwelli secured $16.4 million in Series A funding for its Low FODMAP snack bars, catering to consumers with digestive sensitivities. Convenience-focused ventures like Duffl, which raised $13.3 million in Series A funding, are reshaping distribution models, targeting time-constrained demographics such as college students.

Additionally, Mason Dixie Foods garnered $11.1 million to advance its clean-label frozen breakfast offerings, while Alec’s Ice Cream received $2.1 million in debt financing to scale sustainable, organic ice cream.

The growth of the refrigerated snacks market can be attributed to evolving dietary preferences, emphasizing convenience and health. Increasing urbanization and busier lifestyles have led to higher demand for on-the-go snack solutions. Additionally, innovations in product formulations, such as high-protein, low-fat, and plant-based options, have broadened the consumer base.

The demand for refrigerated snacks is fueled by rising health awareness and a growing preference for fresh, nutrient-dense food products. Consumers are increasingly seeking snacks that provide functional benefits, such as improved digestion or enhanced energy levels, without compromising on taste or convenience.

Significant opportunities exist in the expansion of plant-based refrigerated snacks and the incorporation of functional ingredients like probiotics and omega-3. Emerging markets, with their growing middle-class populations and increased purchasing power, also present untapped potential for market players to establish a foothold.

The refrigerated snacks market is undergoing significant transformation, driven by shifting consumer preferences toward healthier, convenient, and indulgent snack options. Demand for fresh, minimally processed products is escalating, fueled by heightened health consciousness and the need for on-the-go solutions.

Key Takeaways

- Refrigerated Snacks Market size is expected to be worth around USD 152.2 Bn by 2033, from USD 99.8 Bn in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

- Conventional refrigerated snacks dominate the market, holding a substantial 62.4% share by nature.

- Bakery snacks represent 34.5% of the market by type, showcasing diverse consumer preferences.

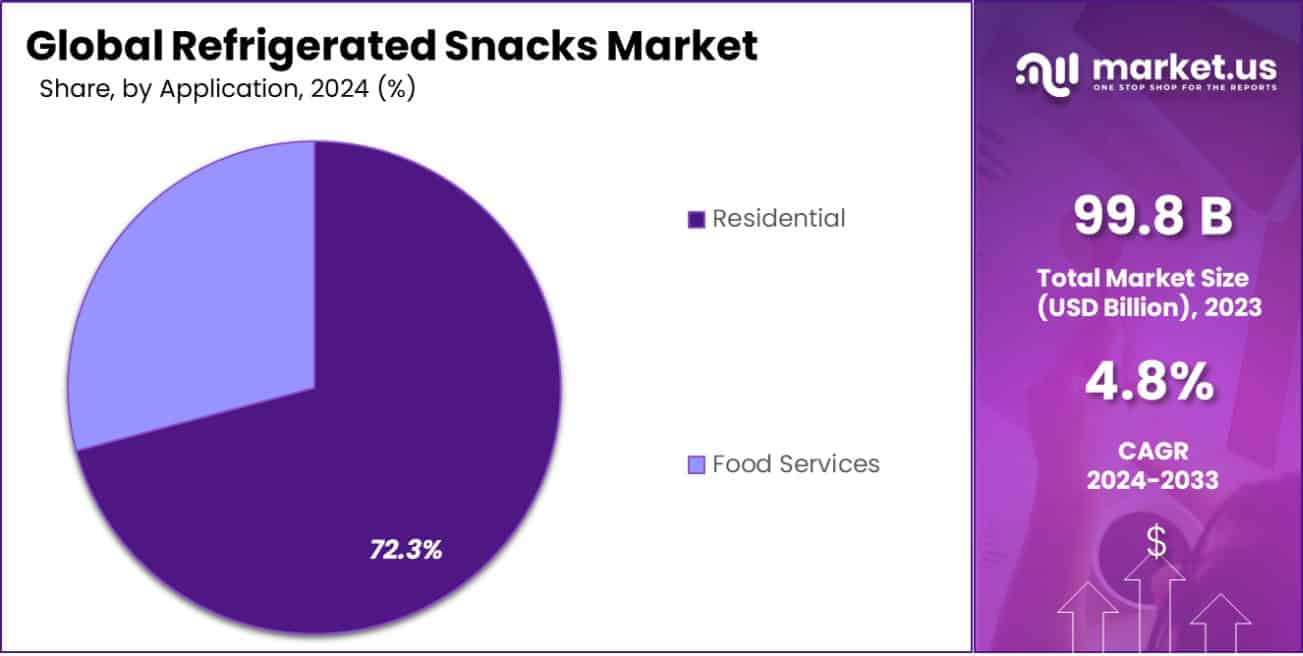

- Residential settings are the leading end-users of refrigerated snacks, making up 72.3% of the market.

- Supermarkets and hypermarkets are the primary distribution channels, accounting for 44.2% of sales.

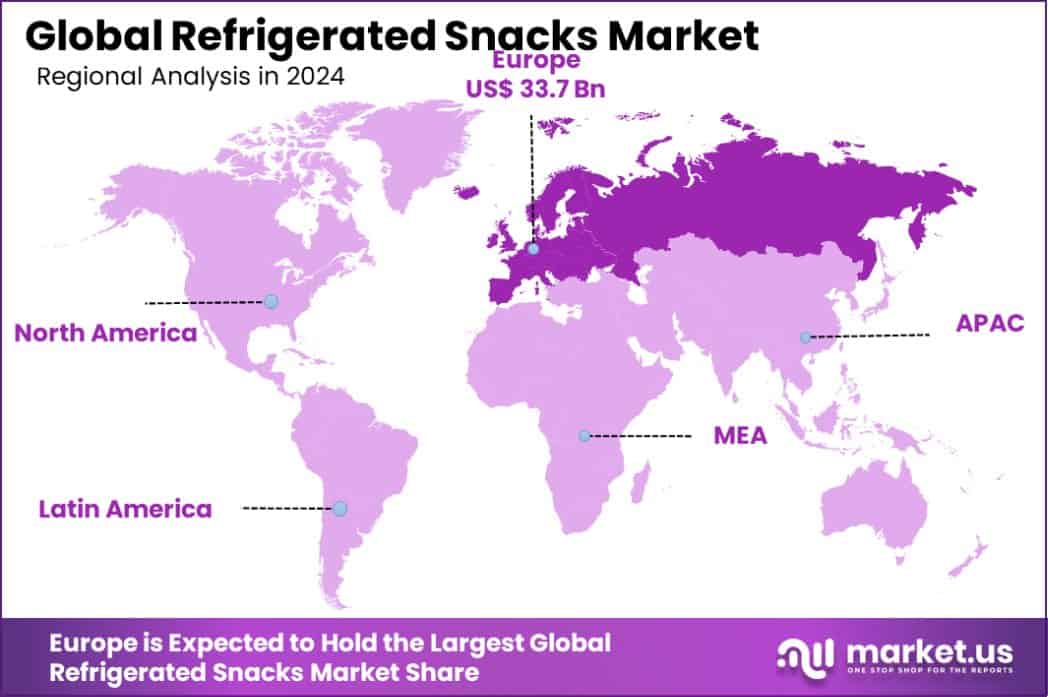

- Europe dominates the Refrigerated Snacks Market with a 33.8% share, valued at USD 33.7 billion.

By Nature Analysis

The refrigerated snacks market shows a significant conventional segment at 62.4%, emphasizing traditional production and consumption methods.

In 2023, Conventional held a dominant market position in the By Nature segment of the Refrigerated Snacks Market, with a 62.4% share. This significant market presence underscores a persistent consumer preference for conventional snacks, likely driven by their widespread availability and often lower price points compared to their organic counterparts.

The market for conventional refrigerated snacks benefits from established supply chains and high-volume production processes, which cater to a broad consumer base seeking convenient, ready-to-eat options.

On the other hand, the organic segment of the refrigerated snacks market, though smaller in comparison, accounted for a market share of 37.6%. This segment continues to grow as consumer awareness of health and wellness increases, driving demand for snacks made from ingredients that are free from synthetic pesticides and fertilizers.

The rising interest in sustainable and ethically produced food products also contributes to the growth of the organic segment. Both segments are positioned to leverage evolving consumer eating habits, with conventional snacks leading in market share while organic options capture interest from health-conscious consumers seeking cleaner labels and transparency in food production.

By Type Analysis

In the type category, bakery snacks hold a substantial share of 34.5%, indicating a strong preference among consumers.

In 2023, Bakery Snacks held a dominant market position in the By Type segment of the Refrigerated Snacks Market, with a 34.5% share. This leading position highlights the robust consumer preference for refrigerated bakery products such as bread, rolls, cakes, and pastries that offer convenience and freshness.

The popularity of bakery snacks can be attributed to their widespread availability, diverse product offerings, and the comfort food status they hold among consumers seeking quick, satisfying options.

The other segments within the market also displayed significant shares, with Savoury Snacks accounting for 26.8%, followed by Fruit Snacks at 21.2%, and Confectionery Snacks holding a 17.5% market share. The savory snacks category benefits from consumer demand for flavorful, protein-rich options that cater to snacking occasions throughout the day.

Meanwhile, fruit snacks continue to gain traction as a healthy alternative, appealing to health-conscious consumers with their natural sugar content and perceived nutritional benefits. Confectionery snacks, though smaller in share, attract a dedicated customer base looking for indulgent, convenient treats.

Each segment responds to distinct consumer preferences and dietary trends, shaping the competitive landscape of the refrigerated snacks market.

By End-Use Analysis

Residential end-use dominates the market with 72.3%, showcasing high demand for refrigerated snacks in household settings.

In 2023, Residential held a dominant market position in the By End-Use segment of the Refrigerated Snacks Market, with a 72.3% share. This overwhelming dominance underscores the significant consumption of refrigerated snacks within household settings, reflecting a growing consumer inclination towards convenience and preference for ready-to-eat food products that fit easily into busy lifestyles.

The residential market benefits from trends such as snacking increased at-home dining, and the rise of families seeking nutritious and quick meal solutions, which have been particularly accentuated by ongoing shifts in work-from-home policies.

Conversely, the Food Services segment accounted for a 27.7% share of the market. This sector includes restaurants, cafes, and other commercial food environments that offer refrigerated snacks as part of their menu to cater to on-the-go consumers and those who dine out.

Despite its smaller share, this segment is poised for growth driven by the recovery of the food service industry post-pandemic and increasing demand for high-quality, innovative snack options that align with consumer interest in unique and diverse culinary experiences.

Both segments are integral to the dynamic landscape of the refrigerated snacks market, each adapting to the evolving dietary habits and preferences of their respective consumer bases.

By Distribution Channel Analysis

Supermarkets and hypermarkets are major distribution channels, accounting for 44.2% of sales, reflecting their critical role in accessibility.

In 2023, Supermarket/Hypermarket held a dominant market position in the By Distribution Channel segment of the Refrigerated Snacks Market, with a 44.2% share. This segment’s prominence is largely attributed to the extensive variety and accessibility of products offered, which cater to a wide consumer base looking for convenience and immediate purchase options.

Supermarkets and hypermarkets are pivotal in driving sales due to their strategic locations, broad product assortment, and the ability to leverage high foot traffic which enhances product visibility and consumer impulse buying.

Specialty Stores captured a 29.5% market share, providing curated selections that appeal to niche market segments interested in gourmet, artisanal, or health-specific refrigerated snack options. This channel benefits from consumer loyalty and a preference for premium products. Meanwhile, Online Sales Channels are rapidly growing and represent 26.3% of the market.

This growth is propelled by the increasing consumer reliance on e-commerce platforms, which offer the convenience of home delivery, easy access to a wide range of products, and the ability to shop anytime. The dynamic nature of distribution channels in the refrigerated snacks market reflects evolving shopping behaviors and the increasing significance of digital platforms in the consumer purchasing journey.

Key Market Segments

By Nature

- Organic

- Conventional

By Type

- Savoury Snacks

- Fruit Snacks

- Confectionery Snacks

- Bakery Snacks

By End-use

- Residential

- Food Services

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Online Sales Channel

Driving Factors

Enhanced Convenience for Busy Lifestyles Boosts Market Growth

The rise of busy lifestyles significantly drives the Refrigerated Snacks Market. Consumers are increasingly seeking quick, hassle-free eating options that align with their fast-paced lives.

Refrigerated snacks offer a convenient solution without compromising on freshness, making them especially appealing to working professionals and active families who prioritize speed and simplicity in meal preparation.

Health Awareness Influences Snack Choices

Heightened health awareness among consumers is reshaping snack choices, propelling the demand for refrigerated snacks. These products often cater to health-conscious individuals by offering organic, low-calorie, and nutritionally enriched options.

This trend is supported by a growing preference for snacks that contribute positively to wellness and diet, influencing product development and consumer buying behavior.

E-commerce Expansion Opens New Market Avenues

The expansion of e-commerce platforms has opened new avenues for the Refrigerated Snacks Market. Online shopping provides easy access to a variety of refrigerated snack options, with the added convenience of home delivery.

This shift is particularly important as consumers increasingly turn to the Internet for grocery shopping, drawn by the promise of both convenience and variety.

Restraining Factors

High Cost of Refrigeration Impacts Consumer and Retailer Choices

The necessity for continuous refrigeration represents a significant restraint in the Refrigerated Snacks Market. The costs associated with refrigeration, including equipment, maintenance, and energy consumption, can deter retailers from stocking these products and lead to higher prices for consumers.

This makes refrigerated snacks less competitive compared to non-perishable alternatives, potentially limiting market penetration and growth.

Limited Shelf Life Reduces Consumer Purchase Frequency

Refrigerated snacks have a shorter shelf life compared to their shelf-stable counterparts, which can restrict purchasing frequencies and volumes. Consumers may hesitate to buy in bulk or choose refrigerated options less frequently due to concerns over spoilage and waste.

This inherent characteristic of refrigerated products can pose challenges to inventory management and sales stability for retailers.

Stringent Food Safety Regulations Constrain Market Expansion

The Refrigerated Snacks Market is subject to stringent food safety regulations, which can act as a barrier to entry and expansion for new and existing players. Compliance with these regulations incurs additional costs and requires rigorous processes, from production to distribution.

These regulatory demands can slow down innovation, increase operational complexities, and impact the overall agility of businesses operating within this market sector.

Growth Opportunity

Rising Demand for Plant-Based Options Opens New Avenues

The increasing consumer shift towards plant-based diets presents a significant growth opportunity for the Refrigerated Snacks Market. As more people seek healthier, sustainable snack options, the demand for refrigerated plant-based snacks such as vegetable dips, meat-free jerky, and dairy-free desserts is expanding.

This trend encourages manufacturers to innovate and expand their product lines to include more plant-based ingredients, catering to the dietary preferences and ethical considerations of a growing consumer segment.

Innovation in Packaging Drives Consumer Interest and Sustainability

Innovative packaging solutions that extend shelf life and enhance convenience can create substantial growth opportunities in the Refrigerated Snacks Market. Smart packaging that includes freshness indicators, improved sealing techniques, and materials that enhance sustainability appeal to environmentally conscious consumers.

Additionally, packaging innovations that improve the portability and ease of consumption of refrigerated snacks can attract consumers looking for on-the-go eating options, driving further market expansion.

Expansion into Emerging Markets with Tailored Offerings

Emerging markets represent a fertile ground for the expansion of the Refrigerated Snacks Market due to rising urbanization and the increasing purchasing power of the middle class. By tailoring products to meet local tastes and dietary preferences, companies can tap into new demographic segments.

Focusing on distribution strategies that align with the retail landscapes and consumer behaviors in these regions can significantly increase market reach and penetration, fueling overall market growth.

Latest Trends

Fusion Flavors Trend Elevates Consumer Interest in Snacks

The trend of fusion flavors is reshaping the Refrigerated Snacks Market as consumers increasingly seek novel and exotic taste experiences. Manufacturers are blending culinary traditions from different cultures to create innovative snack options, such as wasabi-flavored hummus or tandoori chicken wraps.

This trend not only satisfies the adventurous palates of consumers but also differentiates products in a competitive market, driving consumer curiosity and trial of new offerings.

Snackification of Meals Spurs Refrigerated Snack Popularity

The growing consumer preference for snacking over traditional meals, a trend known as “snackification,” is propelling the demand for refrigerated snacks. As busy lifestyles make sit-down meals less feasible, consumers are turning to snacks that offer nutritional value akin to a full meal.

Refrigerated snacks are being developed to be more filling and nutritionally balanced, serving as suitable meal replacements. This shift is leading to an increase in the variety and complexity of snacks available, making them more appealing as meal alternatives.

Health and Wellness Focus Enhances Snack Offerings

Health and wellness trends continue to influence consumer buying behaviors, driving innovation in the Refrigerated Snacks Market. There is a growing demand for snacks that support health goals, such as weight management, digestive health, and increased energy levels.

This trend is leading manufacturers to incorporate functional ingredients like probiotics, protein, and fiber into their products. Snacks with added health benefits are becoming more popular, aligning with the broader consumer trend toward health-conscious eating habits.

Regional Analysis

Europe dominates Refrigerated Snacks Market at 33.8%, valued at USD 33.7 billion.

The Refrigerated Snacks Market is experiencing varied growth across global regions, reflecting differing consumer preferences and market maturities. Europe emerges as the dominating region, accounting for 33.8% of the market with a value of USD 33.7 billion.

This leadership is driven by high consumer demand for healthier snack options and the presence of numerous key players who are innovating in organic and plant-based refrigerated snacks.

North America also holds a significant share, fueled by trends toward convenience eating and a surge in health-conscious consumers looking for nutritious snack alternatives.

The Asia Pacific market is rapidly expanding due to rising urbanization and the increasing availability of refrigeration infrastructure, which is making refrigerated snacks more accessible to the growing middle class.

Meanwhile, Latin America and the Middle East & Africa are emerging as potential growth areas. These regions are experiencing an increase in consumer spending power and a gradual shift towards Western eating habits, which is likely to increase the demand for refrigerated snacks.

Each of these regions presents unique growth opportunities driven by cultural dietary habits, economic growth, and consumer lifestyle changes.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the competitive landscape of the 2023 global Refrigerated Snacks Market, several key players are reshaping industry dynamics. Notably, PepsiCo and Nestle S.A. stand out for their strategic initiatives and robust market presence.

PepsiCo continues to leverage its extensive distribution network and strong brand portfolio to innovate and expand its refrigerated snacks offerings. The company’s focus on health-centric products, such as reduced-calorie snacks and products with added nutritional benefits, aligns with the growing consumer demand for healthier snack options.

Nestle S.A., with its global footprint and diverse product range, remains a formidable player in the refrigerated snacks segment.

The company’s commitment to sustainability and nutrition is evident in its product innovation strategies, which include using responsibly sourced ingredients and improving the nutritional profiles of existing products.

Nestle’s approach to integrating cutting-edge technology in manufacturing and logistics further solidifies its position as a leader in operational efficiency and product freshness.

Both companies are also making significant investments in marketing and consumer engagement strategies to enhance brand loyalty and attract a broader consumer base. Their efforts in digital marketing and direct consumer interaction platforms have been pivotal in maintaining brand visibility and relevance in a rapidly evolving market landscape.

Top Key Players in the Market

- Ajinomoto Co., Inc.

- Cargill Incorporated

- Charoen Pokphand Foods

- Conagra Brands, Inc.

- Danone S.A.

- General Mills Inc.

- Hormel Foods Corporation

- Keventer Agro Limited

- KIND

- Kraft Heinz Company

- Mars Inc.

- Mccain Foods Limited

- Mondelez International, Inc.

- Nestle S.A.

- PepsiCo

- The Kraft Heinz Company

- Sargento Foods Inc.

- Unilever Plc

Recent Developments

- In 2024, Mars Inc. expanded its refrigerated snacks portfolio by acquiring Kellanova for $36 billion, adding brands like Pringles and Cheez-It to its offerings.

- In 2023, Danone S.A. demonstrated strong performance in the refrigerated snacks sector, achieving a 4.2% rise in third-quarter like-for-like sales, primarily driven by increased volumes. This growth reflects a strategic emphasis on volume over price increases amid a challenging market environment.

Report Scope

Report Features Description Market Value (2023) USD 99.8 Billion Forecast Revenue (2033) USD 159.5 Billion CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Type (Savoury Snacks, Fruit Snacks, Confectionery Snacks, Bakery Snacks), By End-use (Residential, Food Services), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Online Sales Channel) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ajinomoto Co., Inc., Cargill Incorporated, Charoen Pokphand Foods, Conagra Brands, Inc., Danone S.A., General Mills Inc., Hormel Foods Corporation, Keventer Agro Limited, KIND, Kraft Heinz Company, Mars Inc., Mccain Foods Limited, Mondelez International, Inc., Nestle S.A., PepsiCo, The Kraft Heinz Company, Sargento Foods Inc., Unilever Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refrigerated Snacks MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Refrigerated Snacks MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Ajinomoto Co., Inc.

- Cargill Incorporated

- Charoen Pokphand Foods

- Conagra Brands, Inc.

- Danone S.A.

- General Mills Inc.

- Hormel Foods Corporation

- Keventer Agro Limited

- KIND

- Kraft Heinz Company

- Mars Inc.

- Mccain Foods Limited

- Mondelez International, Inc.

- Nestle S.A.

- PepsiCo

- The Kraft Heinz Company

- Sargento Foods Inc.

- Unilever Plc