Global Purple Foods Market By Source (Fruits, Vegetables, Grain, Legumes, Others), By Product Type (Organic, Conventional), By Form (Fresh, Dried, Powder), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, E-Commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132685

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

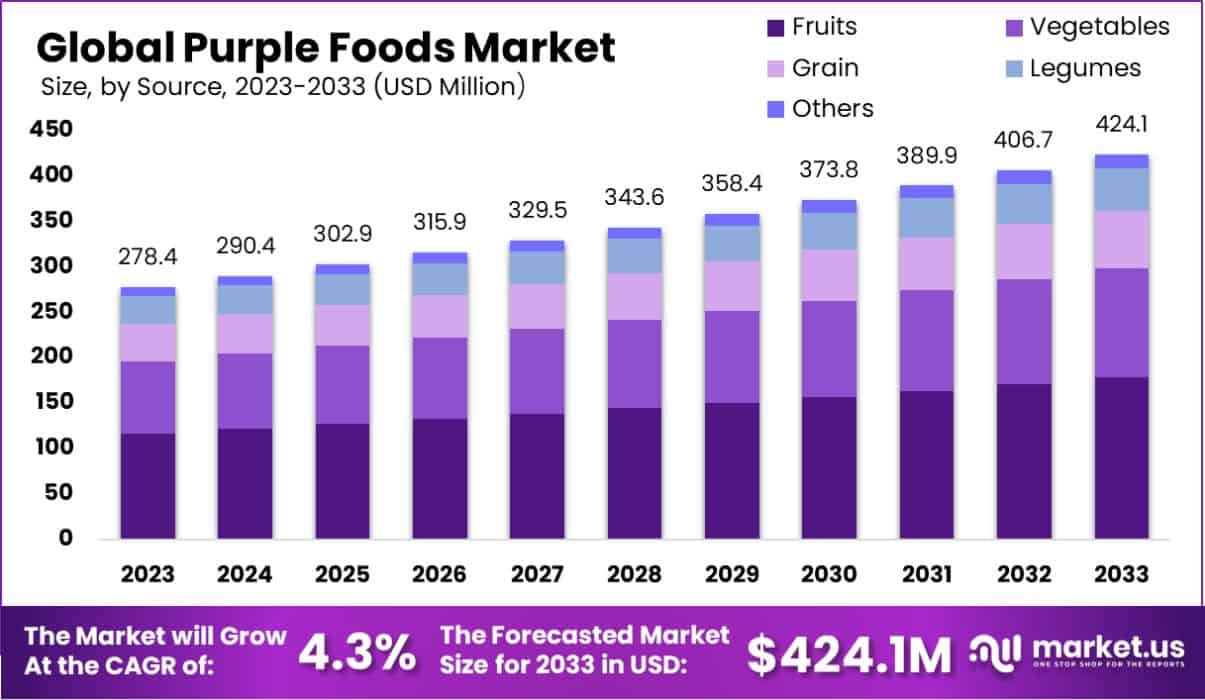

The Global Purple Foods Market is expected to be worth around USD 424.1 Million by 2033, up from USD 278.4 Million in 2023, and grow at a CAGR of 4.3% from 2024 to 2033.

Purple foods refer to fruits, vegetables, and grains that are naturally purple, deriving their hues from anthocyanins, a type of powerful antioxidant. These include items like purple cabbage, eggplants, beets, blueberries, and black rice. Purple foods are celebrated for their health benefits, particularly for their potential to reduce the risk of heart disease and neurological disorders.

The purple foods market is an emerging segment within the health food industry, driven by increasing consumer awareness of the health benefits associated with anthocyanin-rich foods. This market encompasses the production, distribution, and sale of purple-colored natural foods, catering to health-conscious consumers and those following specialty diets.

The Purple Foods market, characterized by its offerings rich in health benefits, has increasingly caught the attention of investors, notably with Purplle—a company indirectly involved through its beauty and personal care sector—securing substantial financial backing.

Recently, Purplle successfully raised INR 1,000 crore (approximately $120 million) in a funding initiative led by a subsidiary of the Abu Dhabi Investment Authority (ADIA). This pivotal round included both primary and secondary share sales, highlighting a robust market confidence in the sector’s growth potential.

Complementing this financial boost, Purplle has further reinforced its corporate structure by introducing an Employee Stock Ownership Plan (ESOP) liquidity program valued at INR 50 crore, aimed at fostering employee commitment and aligning interests with the company’s long-term goals.

Additional insights from economictimes.indiatimes.com reveal that the funding round saw contributions ranging from $40 million to $50 million, earmarked specifically for supporting expansions within the beauty and personal care niche that Purple Foods influences through its innovative product integrations.

This strategic infusion is part of a broader agenda to leverage Purple Foods’ unique properties, enhancing product appeal and tapping into the growing consumer demand for health-oriented beauty solutions.

This alignment of investment and strategic product development underscores the sector’s potential for continued growth and innovation, setting a strong foundation for future market expansion and product diversification in the burgeoning wellness space

The growth of the purple foods market can be attributed to the rising consumer preference for natural and nutrient-dense foods. As awareness of the specific health benefits of anthocyanins becomes more widespread—such as inflammation reduction and improved heart health—demand for purple foods is expected to surge, particularly among populations with increasing health consciousness.

Demand in the purple foods market is bolstered by the growing trends in healthy eating and wellness lifestyles. Consumers seeking dietary choices that offer both nutritional value and disease prevention are increasingly turning to purple foods.

The visually appealing color and the perceived health benefits drive consumer interest, integrating these foods into various diets, including vegan and gluten-free options. Opportunities within the purple foods market include expansion into new geographical regions and innovation in product offerings.

With the global rise in health and wellness trends, companies have the potential to innovate by incorporating purple foods into a variety of products such as snacks, juices, and nutritional supplements. This diversification can meet the increasing demand for health-centric food options and attract a broader consumer base.

Key Takeaways

- The Global Purple Foods Market is expected to be worth around USD 424.1 Million by 2033, up from USD 278.4 Million in 2023, and grow at a CAGR of 4.3% from 2024 to 2033.

- Fruits dominate the Purple Foods Market, accounting for 42.2% of the product sources.

- Conventional products lead the market, comprising 58.2% of Purple Foods by product type.

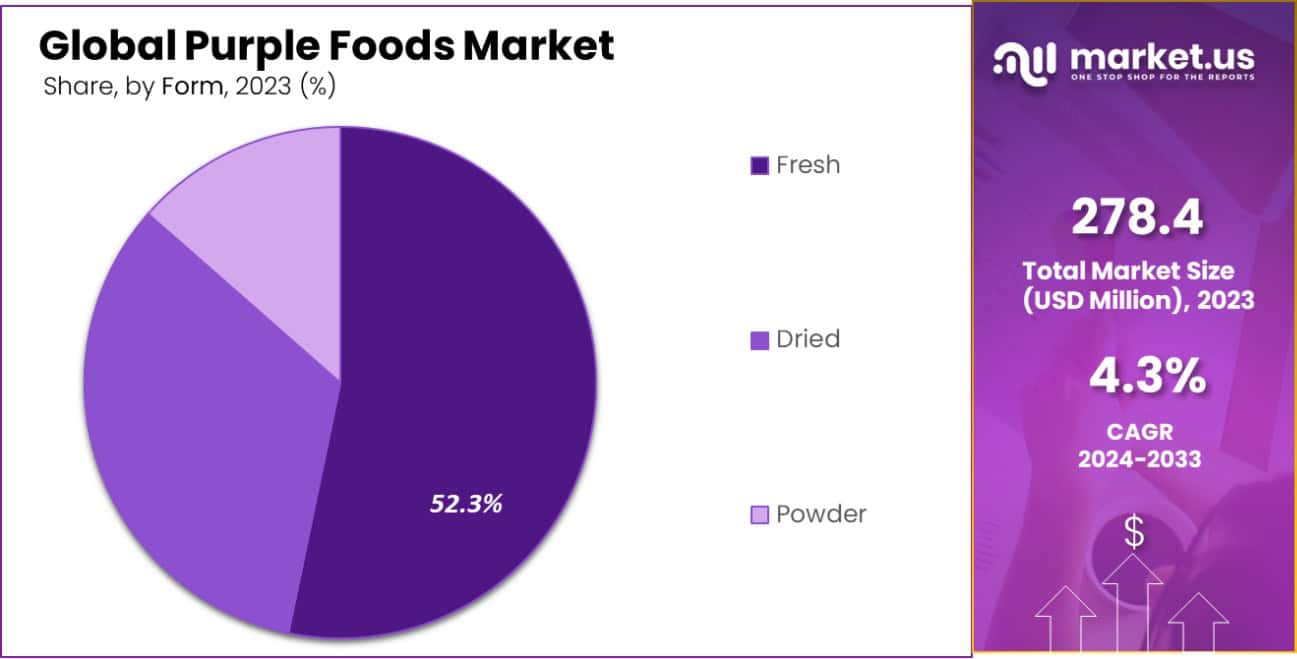

- Fresh forms are preferred, representing 52.3% of the Purple Foods available in the market.

- Hypermarkets and supermarkets are the main distribution channels, holding a 43.3% market share.

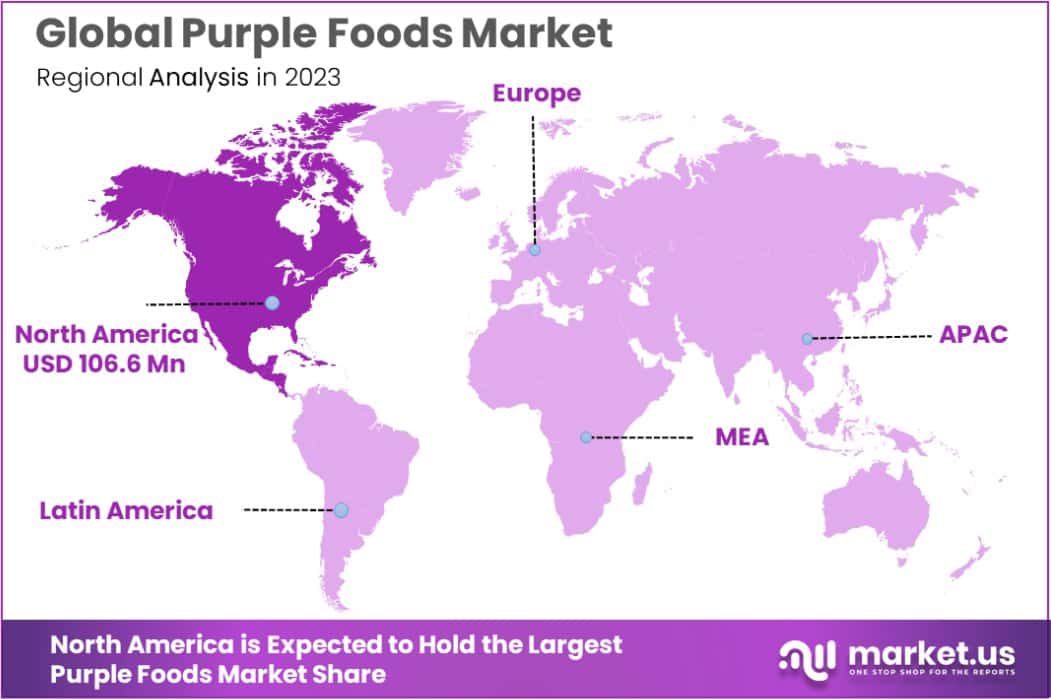

- North America’s Purple Foods Market holds 36%, valued at USD 106.6 million.

By Source Analysis

Fruits dominate the Purple Foods Market with a 42.2% share.

In 2023, Fruits held a dominant market position in the “By Source” segment of the Purple Foods Market, with a 42.2% share, illustrating consumer preferences for naturally-derived antioxidants. Vegetables, grains, and legumes also contributed significantly to the market, reflecting a diverse sourcing base catering to varying consumer dietary needs.

Specifically, vegetables followed closely, appealing to those seeking varied nutrient profiles from their diet. Grains and legumes, though smaller in percentage, are gaining traction due to increasing awareness of their health benefits, including fiber and protein content.

The segment’s dynamics are influenced by growing health consciousness among consumers, who are increasingly drawn to the health benefits offered by purple foods. These benefits include improved cardiovascular health and enhanced neurological functions attributed to the high anthocyanin content.

The market is also seeing a shift towards more organic and natural products, with conventional purple foods comprising 58.2% of the market. This is predominantly due to their availability and often lower price points compared to their organic counterparts.

Furthermore, the preference for fresh over processed options is evident, with fresh purple foods constituting 52.3% of the market. This preference underscores the consumer desire for nutrient retention and flavor that fresh produce offers.

Distribution through hypermarkets and supermarkets remains prevalent, capturing 43.3% of the market, which underscores the accessibility and consumer reliance on large retail chains for their grocery needs. This distribution strategy benefits from wide consumer reach and convenience, driving the segment’s growth.

By Product Type Analysis

Conventional products hold a 58.2% share in the Purple Foods Market.

In 2023, Conventional held a dominant market position in the “By Product Type” segment of the Purple Foods Market, with a 58.2% share, reflecting widespread consumer access and affordability.

Organic products, while growing in popularity, command a smaller market share but are steadily gaining ground due to rising consumer awareness of health benefits and environmental impacts associated with organic farming.

The conventional segment’s prominence is bolstered by established supply chains and the extensive availability of conventional purple foods in mainstream retail outlets. These products often come at a lower price point compared to organic options, making them more accessible to a broader demographic.

However, the growing consumer interest in health and sustainability is driving notable growth in the organic segment. This shift is fueled by the increasing scrutiny of food origins and production practices, with many consumers willing to pay a premium for products perceived as healthier and more environmentally friendly.

Distribution channels like hypermarkets and supermarkets play a critical role, accounting for 43.3% of the market’s distribution. These venues are pivotal in making conventional purple foods readily available to the mass market.

Moreover, with fresh purple foods comprising 52.3% of the market, the demand for high-quality, minimally processed options is evident, reflecting a consumer preference that spans both conventional and organic products.

This dynamic suggests a significant opportunity for organic products to increase their market share as consumer preferences continue to evolve towards health-centric and eco-conscious food choices.

By Form Analysis

Fresh forms represent 52.3% of products in the Purple Foods Market.

In 2023, Fresh held a dominant market position in the “By Form” segment of the Purple Foods Market, with a 52.3% share, highlighting consumer preference for fresh, nutrient-rich products. Dried and powdered forms also make significant contributions to the market, catering to different consumer needs such as convenience and long shelf life.

The preference for fresh purple foods underscores the growing consumer demand for products that maintain their nutritional integrity and flavor. This form is particularly popular among health-conscious consumers who value the antioxidant benefits of fresh produce like purple fruits and vegetables.

Meanwhile, dried purple foods offer an alternative for consumers seeking longer-lasting options without sacrificing the health benefits, making them ideal for snacks and culinary uses.

Powdered forms of purple foods are increasingly favored for their versatility and ease of incorporation into diverse dietary habits, from smoothies to baking, offering concentrated nutrients in a convenient format. This segment is poised for growth, driven by the functional food market’s expansion and the rising popularity of health supplements.

Distribution through hypermarkets and supermarkets, which account for 43.3% of the market’s distribution channels, supports the availability of these forms, ensuring they are accessible to a broad consumer base.

As the market continues to evolve, each form—fresh, dried, and powdered—plays a vital role in meeting the dynamic preferences and lifestyles of today’s consumers.

By Distribution Channel Analysis

Hypermarkets and supermarkets are key, holding a 43.3% distribution channel share.

In 2023, Hypermarkets and Supermarkets held a dominant market position in the “By Distribution Channel” segment of the Purple Foods Market, with a 43.3% share, underlining their pivotal role in consumer access to food products.

Convenience stores and e-commerce platforms also contributed to the market’s distribution dynamics, each adapting to unique consumer buying behaviors and preferences.

The significant share held by hypermarkets and supermarkets can be attributed to their ability to offer a wide variety of purple foods under one roof, coupled with the advantage of physical inspection and immediate purchase.

These outlets are typically preferred by consumers seeking both convenience and variety in their shopping experience. Meanwhile, convenience stores cater to impulse buys and immediate needs, serving customers who require quick access to purple foods without the intention of bulk purchases.

E-commerce is rapidly growing as a distribution channel for purple foods, driven by the shift towards online shopping, which offers consumers the convenience of home delivery and often competitive pricing. The digital platform’s growth is accelerated by enhancements in logistic services and the increasing trust and reliability of online payment systems.

This channel is particularly appealing to tech-savvy consumers and those with limited access to physical retail outlets, indicating a potential area for significant growth and market penetration in the coming years.

Key Market Segments

By Source

- Fruits

- Vegetables

- Grain

- Legumes

- Others

By Product Type

- Organic

- Conventional

By Form

- Fresh

- Dried

- Powder

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- E-Commerce

- Others

Driving Factors

Rising Health Awareness Fuels Demand for Nutrient-Rich Foods

The increasing consumer awareness regarding health and wellness is a primary driver for the Purple Foods Market. As more individuals seek diets rich in antioxidants and nutrients, the demand for purple foods, known for their health benefits like improving heart health and reducing inflammation, has surged.

This trend is supported by a broader shift towards natural and organic dietary choices, positioning purple foods as a preferred option for health-conscious consumers.

The appeal of Natural and Organic Products Boosts Market Growth

The growing preference for natural and organic products is significantly impacting the Purple Foods Market. Consumers are increasingly opting for foods perceived as pure and free from artificial additives, which has led to higher consumption of purple foods, considered natural sources of vital nutrients.

This shift is not just a trend but a lasting movement towards healthier lifestyles, supporting sustained growth in the market.

Expansion of Retail Distribution Enhances Market Accessibility

The expansion of retail distribution channels, especially hypermarkets, supermarkets, and e-commerce platforms, has made purple foods more accessible to a wider audience. This ease of access is crucial in driving the market as it allows consumers from various regions and demographics to purchase purple foods conveniently.

Improved distribution networks also help in maintaining the freshness and nutritional quality of these foods, further enhancing their appeal among consumers.

Restraining Factors

High Cost of Production Limits Market Expansion

The production and sourcing of purple foods often incur higher costs due to the specialized nature of their cultivation and harvesting. These elevated costs can make purple foods more expensive for consumers, potentially limiting their widespread adoption, especially in cost-sensitive markets.

The premium pricing of purple foods can restrict their appeal primarily to higher-income demographics, which might hinder market growth in broader consumer segments.

Limited Consumer Awareness Outside Health Circles

While health enthusiasts widely recognize the benefits of purple foods, general consumer awareness remains relatively limited. This lack of broader recognition can act as a barrier to market penetration, particularly in regions where dietary habits are deeply entrenched and less influenced by global health trends.

Increasing consumer education and targeted marketing are essential to overcome this challenge and expand the market base.

Supply Chain Volatility Affects Availability

Supply chain issues, such as logistical disruptions, climate impacts on agriculture, or political instability in key growing regions, can significantly affect the availability and price stability of purple foods.

These factors can lead to fluctuating supply levels, which may deter retailers and consumers from consistently choosing purple foods over more readily available alternatives. Managing these supply chain vulnerabilities is crucial for maintaining market stability and consumer trust.

Growth Opportunity

Innovation in Product Offerings Expands the Consumer Base

The Purple Foods Market has significant room for growth through product innovation. By developing new and varied forms of purple food products, such as snacks, juices, or supplements, companies can appeal to a broader consumer base. I

innovations that cater to conveniences, such as ready-to-eat snacks or easy-to-prepare options, can attract busy consumers looking for healthful solutions that fit their lifestyles. Expanding the range of purple food products can address different consumer needs and preferences, enhancing market reach and consumer engagement.

Strategic Marketing Campaigns Increase Market

Visibility Leveraging targeted marketing campaigns to educate consumers about the unique benefits of purple foods can significantly enhance market growth. Effective marketing strategies that highlight the antioxidant properties and health benefits of purple foods can raise awareness and curiosity among a wider audience.

By focusing on digital platforms and influencer partnerships, brands can reach younger demographics and health-conscious consumers more effectively, driving demand and increasing market visibility.

Expansion into Emerging Markets Offers New Revenue Streams

Emerging markets represent untapped potential for the Purple Foods Market. As global health awareness increases, expanding into new geographic areas where consumers are becoming more health-conscious offers a substantial growth opportunity.

Tailoring products and marketing strategies to fit local tastes and dietary preferences in these markets can help companies gain a foothold and establish strong consumer relationships. This strategic expansion can diversify revenue streams and reduce dependency on established markets.

Latest Trends

Integration of Purple Foods in Functional Beverages

The trend of incorporating purple foods into functional beverages is gaining momentum. These beverages, which include smoothies and health energy drinks, are enriched with purple fruits and vegetables like blueberries and beets, offering enhanced nutritional benefits such as high antioxidant content.

This trend is driven by consumers seeking convenient, health-boosting options that fit easily into their daily routines. As functional beverages continue to rise in popularity, the presence of purple foods in this segment is expected to grow, meeting the demand for both health and convenience.

Rise of Plant-Based Diets Amplifies Purple Food Popularity

The shift towards plant-based diets has spotlighted purple foods, known for their deep colors and nutritional benefits. As more consumers adopt vegetarian and vegan lifestyles, the demand for nutrient-dense, plant-based foods increases.

Purple foods, rich in vitamins, minerals, and antioxidants, are becoming staples in these diets for their health advantages and ability to add variety in color and flavor. This trend is fostering new product development across various food categories, promoting the growth of the purple foods market.

Adoption of Organic and Non-GMO Purple Foods

Consumers are increasingly seeking organic and non-GMO food options, influencing the purple foods market significantly. This trend reflects a growing concern about the environmental and health impacts of genetically modified organisms and pesticides in agriculture.

Purple foods marketed as organic and non-GMO are perceived as safer and of higher quality, appealing to health-conscious consumers who prioritize purity in their food choices. This demand is encouraging producers to focus on organic farming practices and non-GMO cultivars, potentially expanding the market’s reach and consumer trust.

Regional Analysis

In North America, the Purple Foods Market commands 36% with a value of USD 106.6 million.

In the global Purple Foods Market, regional dynamics vary significantly, reflecting diverse consumer preferences and market maturity. North America dominates the market with a 36% share, translating to a market value of USD 106.6 million.

This substantial market presence is driven by high consumer awareness about health and wellness, coupled with a robust distribution network spanning hypermarkets, supermarkets, and increasingly, e-commerce platforms.

Europe follows closely, leveraging its strong focus on health-centric diets and organic food products. The market in Europe benefits from stringent food safety regulations that promote the consumption of natural and minimally processed foods, including purple foods known for their antioxidant properties.

Asia Pacific presents rapid growth opportunities, fueled by expanding middle-class populations and rising health consciousness. This region is seeing increased integration of purple foods into traditional diets, which is bolstered by local availability and the intrinsic appeal of naturally colorful foods.

Meanwhile, the Middle East & Africa, and Latin America are emerging as potential growth areas. These regions are gradually embracing health and wellness trends, which are penetrating urban centers and influencing dietary patterns.

Efforts to educate consumers and enhance distribution capabilities are key to expanding the market in these regions, where there is a growing appreciation for the nutritional benefits of purple foods.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic global Purple Foods market, key players such as Archer Daniels Midland Company and Conagra Foods play pivotal roles, leveraging extensive portfolios and robust distribution networks to meet growing consumer demand for health-centric products.

Archer Daniels Midland Company, renowned for its agricultural processing prowess, strategically positions itself by offering a range of purple food ingredients that cater to both the food and beverage sectors. Similarly, Conagra Foods capitalizes on consumer preferences for convenient and healthy food options, integrating purple foods into its array of ready-to-eat products.

Companies like Exberry and Hollyberry BV specialize in natural food coloring, with Exberry being a notable player providing vibrant, purple hues derived from fruits and vegetables, enhancing the visual appeal and nutritional profile of food products. Meanwhile, Hollyberry BV focuses on innovative berry-based products, aligning with consumer trends toward superfoods.

Emerging players such as Jiangxi Cereal Food Co., Ltd, and Nutraonly are making significant inroads in the Asian markets, offering purple rice and other nutrient-rich purple grains that cater to local tastes and nutritional expectations. These companies are pivotal in expanding the reach of purple foods, driving awareness and accessibility in regions with rising health consciousness.

In Europe, Kent Frozen Foods Ltd and Lemon Concentrate address the demand for frozen and concentrated purple food products, which are favored for their convenience and extended shelf life. These offerings are particularly appealing in markets where consumers are increasingly seeking out easy-to-prepare yet healthy food options.

Overall, the diverse strategies and product offerings of these key companies underline the vibrancy and competitive nature of the Purple Foods market, highlighting a strong trajectory for growth influenced by health trends and global consumer preferences.

Top Key Players in the Market

- Archer Daniels Midland Company.

- Conagra Foods

- Exberry

- Hollyberry BV

- Jiangxi Cereal Food Co., Ltd

- Kanegrade

- Kent Frozen Foods Ltd

- Lemon Concentrate

- Merry Berry

- Nutraonly

- T. Hasegawa

- Vinyak Ingredients India Pvt.Ltd

Recent Developments

- In 2024, Kanegrade has focused on enhancing its flavor and color offerings, tailoring them to customer-specific needs which is a significant step for its innovation in the natural colors sector

- In 2024, T. Hasegawa has positioned ube, a vivid purple yam, as the “Flavor of the Year” in its Food and Beverage Flavor Trends Report. This selection highlights Ube’s rising popularity and its versatile applications ranging from desserts to savory dishes, driven by its natural color and distinctive taste.

Report Scope

Report Features Description Market Value (2023) USD 278.4 Million Forecast Revenue (2033) USD 424.1 Million CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Fruits, Vegetables, Grain, Legumes, Others), By Product Type (Organic, Conventional), By Form (Fresh, Dried, Powder), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, E-Commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Archer Daniels Midland Company., Conagra Foods, Exberry, Hollyberry BV, Jiangxi Cereal Food Co., Ltd, Kanegrade, Kent Frozen Foods Ltd, Lemon Concentrate, Merry Berry, Nutraonly, T. Hasegawa, Vinyak Ingredients India Pvt.Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Company.

- Conagra Foods

- Exberry

- Hollyberry BV

- Jiangxi Cereal Food Co., Ltd

- Kanegrade

- Kent Frozen Foods Ltd

- Lemon Concentrate

- Merry Berry

- Nutraonly

- T. Hasegawa

- Vinyak Ingredients India Pvt.Ltd