Pico Projector Market By Product (USB, Embedded, Media Player, Stand-alone), By Technology (Digital Light Processing, Liquid Crystal on Silicon, Laser Beam Steering, Holographic Laser Projection), By Compatibility (Laptop/Desktop, Smartphones, Digital Cameras, Portable Media Players, Others), Application (Consumer Electronics, Business and Education, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 26427

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

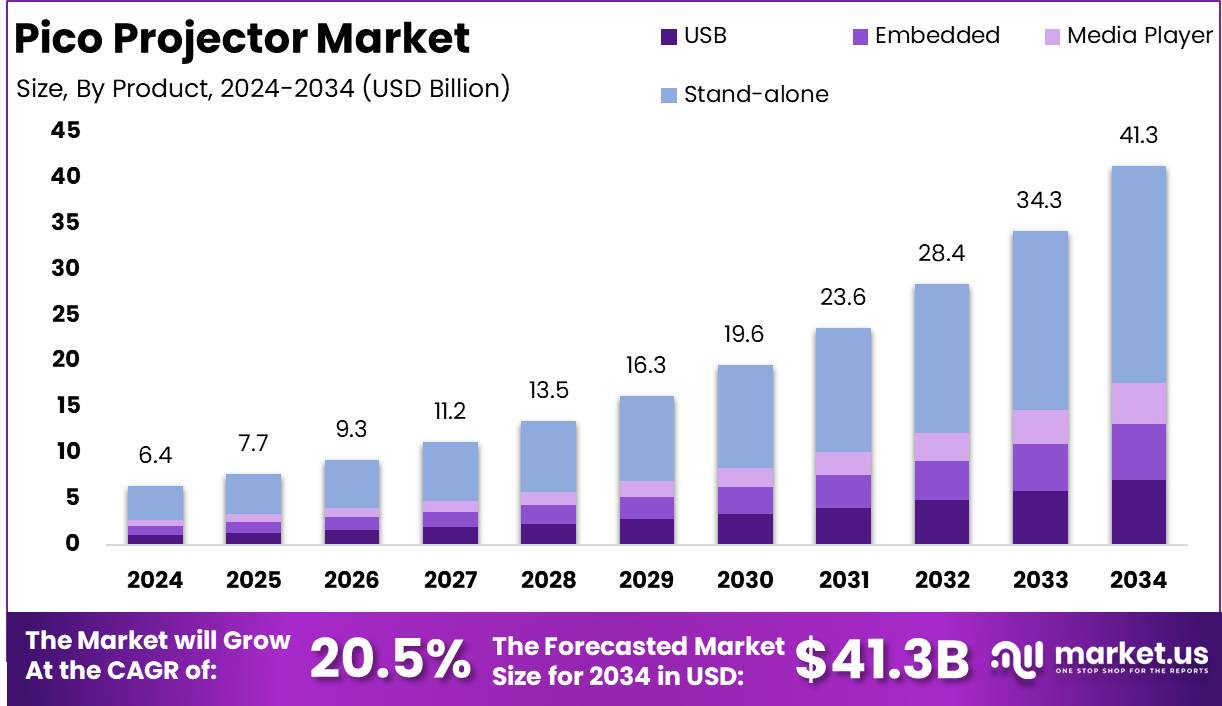

The Global Pico Projector Market size is expected to be worth around USD 41.3 Billion by 2034 from USD 6.4 Billion in 2024, growing at a CAGR of 20.5% during the forecast period from 2025 to 2034.

A Pico projector is a compact, lightweight projection device that utilizes advanced display technologies such as Digital Light Processing (DLP), Liquid Crystal on Silicon (LCoS), or laser-based projection to deliver high-quality images on various surfaces.

These portable projectors are designed for on-the-go applications, offering versatility across personal entertainment, business presentations, and educational purposes. Due to their small form factor, they can be easily integrated into smartphones, tablets, cameras, and even wearable devices, making them a preferred choice for users seeking mobility and convenience.

The Pico projector market encompasses the production, distribution, and adoption of portable projection devices across various industries. This market is characterized by the integration of Pico projectors into consumer electronics, automotive heads-up displays (HUDs), medical imaging devices, and business communication tools.

The market landscape is influenced by technological advancements in miniaturization, wireless connectivity, and improvements in projection resolution and brightness. As industries increasingly embrace mobility-driven solutions, the demand for compact and high-performance projection technologies continues to grow.

Several key factors contribute to the expansion of the Pico projector market. Advancements in laser and LED-based projection technologies have enhanced brightness, resolution, and energy efficiency, driving adoption across multiple applications. The growing prevalence of BYOD (Bring Your Own Device) culture in corporate environments has increased demand for wireless and portable display solutions.

The demand for Pico projectors is witnessing a steady rise due to the increasing need for portable, high-resolution display solutions across both consumer and professional domains. The shift towards remote work, virtual collaboration, and hybrid workplaces has propelled the adoption of wireless projectors that seamlessly connect with multiple devices.

The Pico projector market presents significant growth opportunities through technological advancements, expanding application areas, and strategic collaborations. The increasing adoption of AI-powered and IoT-enabled projection systems is expected to redefine the market landscape.

According to Gizmochina, the launch of Xiaomi’s Xming Q5 projector marks a notable development in the Pico Projector market. This device offers 1080P resolution and 280 lumens brightness, coupled with a unique 360-degree rotation capability, enhancing its appeal. Available for purchase at 999 Yuan ($140) on JD.com, this model exemplifies the innovation and affordability driving market growth.

Key Takeaways

- The Global Pico Projector market is forecasted to expand significantly, from USD 6.4 billion in 2024 to approximately USD 41.3 billion by 2034. This represents a robust compound annual growth rate (CAGR) of 20.5% from 2025 to 2034.

- In 2024, stand-alone Pico Projectors dominated the market, securing over 57.2% of the total market share. Their appeal lies in their self-sufficiency, as they do not require any external devices to function.

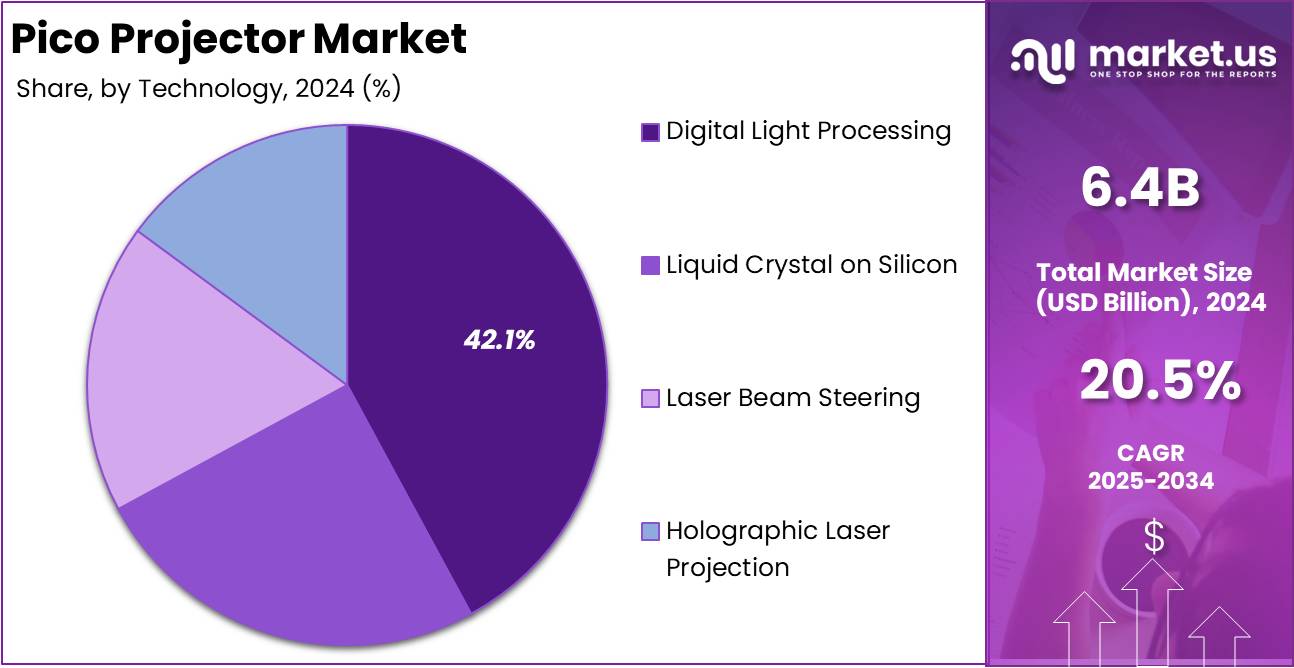

- Digital Light Processing (DLP) technology led the market in 2024, accounting for more than 42.1% of the overall market share, underscoring its widespread adoption.

- Smartphones were the leading segment in terms of compatibility with Pico Projectors in 2024, holding more than 35.9% of the market share, highlighting the trend towards mobile integration.

- Consumer electronics were the primary application for Pico Projectors in 2024, capturing more than 46.8% of the market share, indicating strong demand within this sector.

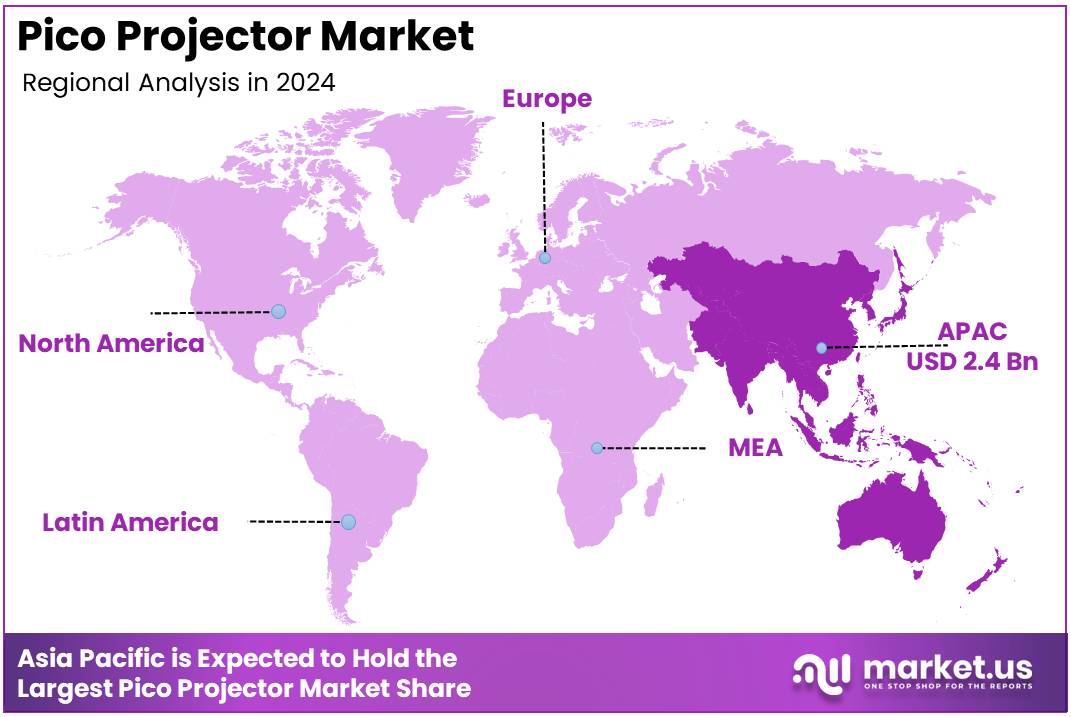

- The Asia Pacific region was particularly prominent in the Pico Projector market in 2024, holding a 38% share, valued at USD 2.4 billion. This region’s significant market share emphasizes its role as a key player in the global market.

By Product Analysis

Stand-alone Segment Dominates Pico Projector Market with 57.2% Share

In 2024, the stand-alone segment secured a dominant position in the Pico Projector market, capturing more than 57.2% of the total market share. These projectors are highly valued for their self-sufficiency, eliminating the need for additional devices to display content.

The popularity of stand-alone pico projectors is driven by their enhanced battery life, superior storage capacity, and the ability to project images and videos directly from internal memory. They are particularly favored in business settings for quick presentations and in personal settings for easy entertainment.

USB pico projectors have carved out their niche by offering extreme portability and ease of use. They draw power directly from the USB connection to laptops or other host devices, which eliminates the need for a separate power source, making them ideal for on-the-go presentations and impromptu gatherings. The simplicity of plug-and-play functionality means they are readily usable with minimal setup, appealing to professionals and casual users alike.

Embedded pico projectors are integrated into other electronic devices, such as smartphones, cameras, and laptops, offering an added utility to the primary device. This integration allows for spontaneous sharing of multimedia content without the need for external projection equipment. As consumer electronics continue to evolve, the embedded projector segment is expected to expand, particularly with the increasing consumer interest in multifunctional devices.

Media player projectors represent a hybrid of traditional media players and projectors, equipped with capabilities to play media files directly from internal storage or via external connections like USBs and SD cards.

These devices are particularly attractive in educational and leisure settings where there is a need to project content without the hassle of additional devices. Their built-in speakers and decent storage capacity allow for a standalone operation, making them a versatile choice for users looking for an all-in-one solution.

By Technology Analysis

Digital Light Processing Dominates Pico Projector Market with 42.1% Share

In 2024, the Pico Projector Market is predominantly led by Digital Light Processing (DLP) technology, capturing more than 42.1% of the market share. This technology is favored for its ability to deliver sharp images and reliable performance, which are crucial in portable projection solutions.

The compact nature of DLP technology aligns perfectly with the minimalistic design requirements of pico projectors, making it a preferred choice among consumers seeking lightweight and efficient projection options.

Following DLP, Liquid Crystal on Silicon (LCoS) holds a significant position in the pico projector market. LCoS technology offers enhanced color accuracy and image resolution, which are pivotal for high-quality projections in compact devices.

This technology combines the benefits of liquid crystals and silicon backplanes, effectively creating high-resolution displays in a small form factor, thereby appealing to a segment of users focused on superior visual performance.

Laser Beam Steering (LBS) technology is gaining traction in the pico projector market due to its ability to provide precise image control and scalability in projection size. This innovative approach utilizes moving laser beams to create images, eliminating the need for traditional optical components. The result is a highly portable and versatile projector, ideal for dynamic environments and mobile applications.

Holographic Laser Projection (HLP) is emerging as a cutting-edge technology in the pico projector market. Although still in the nascent stages, HLP offers the potential for creating high-resolution, three-dimensional images without the need for glasses.

This technology could revolutionize the way visual content is displayed in portable devices, offering a new dimension of interactivity and engagement in personal and professional settings.

By Compatibility Analysis

Smartphones Dominate Pico Projector Market with 35.9% Share

In 2024, smartphones are the dominant segment by compatibility in the Pico Projector Market, capturing more than 35.9% of the market share. This prevalence is driven by the increasing integration of pico projector technology into smartphones, enhancing their utility as multifunctional devices. Users favor the added capability of projecting videos and images directly from their mobile devices, making smartphones a central platform for personal and professional projection needs.

Laptops and desktops also form a vital segment in the Pico Projector Market. These devices often require external projection solutions for presentations and personal entertainment, supporting the demand for compatible pico projectors. The need for larger displays during presentations and meetings drives the adoption of pico projectors among laptop and desktop users, who appreciate the portability and ease of setup offered by these devices.

Digital cameras with pico projector capabilities represent a niche but growing segment of the market. These devices appeal to professional and amateur photographers alike, who benefit from the ability to instantly project captured images for review, editing, or display. This integration caters to the trend of sharing visual content dynamically and enhances the functionality of traditional digital cameras.

Portable media players are increasingly incorporating pico projectors to offer an all-in-one media experience. This allows users to enjoy videos and other media content on a larger screen, anywhere and anytime. The convergence of media playback and projection capabilities in portable devices underscores the evolving consumer demand for versatility and mobility in media consumption.

The Others category includes various emerging and specialized devices that are compatible with pico projectors, such as gaming consoles, wearable devices, and more. This segment captures a smaller portion of the market but is significant for its potential to expand as new technologies develop. The diversity in applications showcases the adaptability of pico projector technology across different consumer electronics, highlighting its broad market appeal.

By Application Analysis

Consumer Electronics Leads Pico Projector Market with 46.8% Share

In 2024, consumer electronics emerge as the dominant market by application in the Pico Projector Market, capturing more than 46.8% of the market share. This dominance is attributed to the widespread use of pico projectors in various consumer devices like smartphones, tablets, and digital cameras.

The increasing consumer demand for portable and convenient projection solutions drives this segment, enhancing the user experience in personal entertainment and multimedia applications.

The business and education sectors also represent a significant application area for pico projectors. These sectors utilize pico projectors for training, presentations, and educational purposes, benefiting from their portability and ease of use. In classrooms and meeting rooms, pico projectors facilitate interactive learning and collaborative projects, making them invaluable tools in professional and academic settings.

The Others category encompasses a variety of niche applications for pico projectors, including automotive, healthcare, and advertising industries. Although this segment holds a smaller portion of the market, its importance is growing as innovative uses for pico projection technology are developed. These applications highlight the versatility of pico projectors, extending beyond traditional settings into areas where compact and mobile projection capabilities are increasingly valued.

Key Market Segments

By Product

- USB

- Embedded

- Media Player

- Stand-alone

By Technology

- Digital Light Processing

- Liquid Crystal on Silicon

- Laser Beam Steering

- Holographic Laser Projection

By Compatibility

- Laptop/Desktop

- Smartphones

- Digital Cameras

- Portable Media Players

- Others

By Application

- Consumer Electronics

- Business and Education

- Others

Driver

Integration with Portable Devices

The integration of pico projectors with portable consumer electronics like smartphones, tablets, and laptops is a significant driver for the growth of the global pico projector market in 2024. This integration is propelled by the increasing demand for convenient and compact multimedia technology, which allows users to project videos, presentations, and images on-the-go.

As mobile devices continue to serve as central hubs for media consumption, the inclusion of pico projectors enhances their functionality, making them more appealing to tech-savvy consumers and professionals alike.

Moreover, advancements in connectivity technologies such as USB-C, Bluetooth, and Wi-Fi have simplified the process of connecting pico projectors with other devices, thereby enhancing user experience. This ease of connectivity, coupled with the development of miniaturized optical components that do not compromise on image quality, has made these devices increasingly popular.

The result is a market trend where consumers prioritize mobility without sacrificing the quality of their viewing experience, driving further adoption of integrated pico projectors in the portable electronics market.

Restraint

High Cost of Advanced Technology

The high cost associated with advanced pico projector technologies acts as a major restraint in the global market. These projectors often incorporate sophisticated features such as high-resolution output, durable battery life, and wireless connectivity, which elevate production costs.

Consequently, the retail price for end-users increases, making these devices less accessible to a broader audience. This price barrier is particularly significant in developing regions where consumer spending power is limited.

In 2024, as manufacturers strive to introduce innovations like laser projection technology and higher lumens output, the cost implications could potentially slow down market penetration rates.

While technological enhancements aim to offer superior image quality and functionality, they must also be balanced with cost-effective manufacturing techniques to prevent pricing out potential customers. Thus, managing the equilibrium between technological advancement and affordability remains a critical challenge for the growth of the pico projector market.

Opportunity

Expanding Applications in Commercial Sectors

In 2024, the expansion of pico projector applications across various commercial sectors presents a substantial opportunity for market growth. Originally confined to personal entertainment and small-scale presentations, pico projectors are increasingly being adopted for use in sectors such as education, marketing, and healthcare.

In educational settings, they are used to facilitate interactive learning and mobile presentations. Marketers utilize them to create dynamic and engaging advertisements in unconventional spaces.

This versatility is significantly enhanced by improvements in brightness and battery life, allowing for longer use in diverse settings without the need for constant recharging or additional lighting sources.

As industries continue to recognize the benefits of portable and efficient projection technology, the demand for pico projectors is expected to rise, providing ample growth opportunities for manufacturers focused on expanding their applications in the commercial sphere.

Trends

Enhancement in Image Quality and Compactness

The trend towards enhancing image quality while maintaining device compactness is shaping the pico projector market in 2024. Consumers and professionals alike are increasingly demanding higher resolution and better color accuracy from their portable projectors, which has driven manufacturers to invest in optical and electronic technologies that improve these aspects without increasing the size of the projectors.

Technologies such as DLP (Digital Light Processing) and LCoS (Liquid Crystal on Silicon) are being refined to deliver sharper images and more vibrant colors. Additionally, the push for compactness is not just about reducing size but also about integrating pico projectors into wearable technologies, such as glasses and head-mounted displays.

This convergence of high-quality projection technology and wearable computing devices opens new avenues for on-the-move data and media consumption, significantly impacting consumer preferences and behaviors. The combination of enhanced visual performance and ultra-portability is likely to continue as a leading trend, driving innovation and consumer interest in the pico projector market well beyond 2024.

Regional Analysis

APAC in the Pico Projector Market with the Largest Market Share of 38% in 2024

The Pico Projector market exhibits significant regional segmentation with variances in market growth dynamics and technological adoption across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific (APAC) stands out prominently, holding a 38% market share in 2024, valued at USD 2.4 billion. Each region contributes distinctly to the global market landscape, influenced by local consumer behavior, regulatory policies, and technological advancements.

North America In this region, the market for Pico Projectors is driven by a high adoption rate of portable electronics and a robust presence of high-tech companies, which encourages rapid technological advancements. The demand is further supported by the consumer preference for compact and efficient devices.

Europe shows a steady growth in the Pico Projector market. The growth can be attributed to increasing investments in smart devices and IoT integration across various industries. European consumers’ preference for high-quality, durable products also supports the adoption of advanced Pico Projectors.

Middle East & Africa The market in this region is emerging, with growth driven by increasing technological adoption and digital transformation initiatives in various sectors such as education and business. The economic diversification strategies away from oil dependence are also creating opportunities for new technologies, including Pico Projectors.

In Latin America, the market is developing with a focus on consumer electronics. The increasing penetration of internet services and mobile devices acts as a catalyst for the growth of Pico Projectors, with Brazil and Mexico leading the regional market due to their large population and increasing tech-savviness.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global Pico projector market is poised for significant expansion in 2024, driven by technological advancements and increasing demand for portable projection solutions. A thorough examination of market key players reveals a diverse ecosystem of innovation and strategic positioning.

AAXA Technologies Inc. continues to be a frontrunner, specializing in compact projectors. Their focus on enhancing image quality and battery life is likely to attract consumers seeking mobility and convenience. Acer Inc. leverages its robust manufacturing capabilities and global distribution network to deliver cost-effective and versatile Pico projectors, which may increase its market share in various regions.

Coretronic Corp., with its strong emphasis on R&D, is advancing the technology behind LED and laser illumination sources, which are crucial for improving the performance of Pico projectors. This focus is essential as customers increasingly demand higher brightness and clarity from miniaturized devices.

Koninklijke Philips N.V. capitalizes on its brand reputation and innovative prowess to expand its footprint in the lifestyle and personal electronics sector. The integration of smart features, such as Wi-Fi connectivity and inbuilt media players, could enhance the appeal of their Pico projectors.

Lenovo and Miroir USA are expected to intensify their market presence by integrating Pico projectors into other consumer electronics, offering a bundled value proposition that could appeal to tech-savvy consumers. Meanwhile, Samsung’s entry into the Pico projector market underscores its strategy to diversify its electronics portfolio, likely focusing on synergy with its mobile devices.

Syndiant and Texas Instruments Incorporated are key players in the component space, providing vital DLP and LCoS technology that enables manufacturers to keep their devices compact yet powerful. Texas Instruments, in particular, is instrumental in driving the adoption of Pico projectors through continuous advancements in DLP technology, which may lead to enhanced market growth.

Top Key Players in the Market

- AAXA TECHNOLOGIES INC.

- Acer Inc.

- Coretronic Corp.

- Koninklijke Philips N.V.

- Lenovo

- Miroir USA

- Samsung

- SYNDIANT

- Texas Instruments Incorporated

Recent Developments

- In June 2023, Zebronics introduced its latest innovation, the ZEB-PixaPlay 22 Smart-LED Projector. Designed to enhance home entertainment, this projector features a sleek, modern vertical design and is equipped with powerful built-in speakers, delivering an impressive cinematic experience right in your living room. The ZEB-PixaPlay 22 merges advanced smart technology with user-friendly features, including electronic focus, a quad-core processor, dual band connectivity, and mirroring support.

- In 2025, JMGO has revolutionized projector setup with the N3 Ultra Max, featuring a motorized gimbal controlled by a motion-sensing wireless remote. This all-in-one projector automates alignment and adjusts focus, optical zoom, and keystone to project a perfectly aligned image.

- In 2023, AAXA Technologies unveiled the AAXA P7+ 1080P Mini Projector, a small but powerful device that supports true native 1080P resolution and 4K inputs. Despite its size, roughly larger than a 3-inch cube, the P7+ is powered by premium Luminus LEDs, offering bright visuals and a potential 120-inch display.

- In 2023, Portronics released the Beem 410 Smart Portable Android Projector, a compact device capable of turning any flat surface into a vibrant display for entertainment or business needs. Following closely, Portronics also launched the PICO 12 Smart Portable Projector, providing 4K support in a device as small as a soda can, ideal for enhancing indoor and outdoor entertainment.

- In 2024, Xiaomi’s sub-brand Xming introduced the Q5 projector in China, a device boasting 1080P resolution, 280 lumens, and 360-degree rotation, available on JD.com for an accessible price.

- In May 12, 2023, VANKYO announced a collaboration with Roku to launch the VANKYO Leisure 470 Roku, combining VANKYO’s premium projection technology with Roku’s extensive streaming library, offering an enhanced viewing experience for diverse entertainment options.

Report Scope

Report Features Description Market Value (2024) USD 12.2 Billion Forecast Revenue (2034) USD 21.8 Billion CAGR (2025-2034) 20.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (USB, Embedded, Media Player, Stand-alone), By Technology (Digital Light Processing, Liquid Crystal on Silicon, Laser Beam Steering, Holographic Laser Projection), By Compatibility (Laptop/Desktop, Smartphones, Digital Cameras, Portable Media Players, Others), Application (Consumer Electronics, Business and Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AAXA TECHNOLOGIES INC., Acer Inc., Coretronic Corp., Koninklijke Philips N.V., Lenovo, Miroir USA, Samsung, SYNDIANT, Texas Instruments Incorporated Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AAXA TECHNOLOGIES INC.

- Acer Inc.

- Coretronic Corp.

- Koninklijke Philips N.V.

- Lenovo

- Miroir USA

- Samsung

- SYNDIANT

- Texas Instruments Incorporated