Global Tablets Market By Type (Slate Tablet, Detachable Tablet, Others), By Operating System (Android, Ios, Windows, Others), By Screen Size (8 to 10 inches, 10 to 12 inches, 12 inches and above, Less than 8 inches), By End User (Consumer, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 134006

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

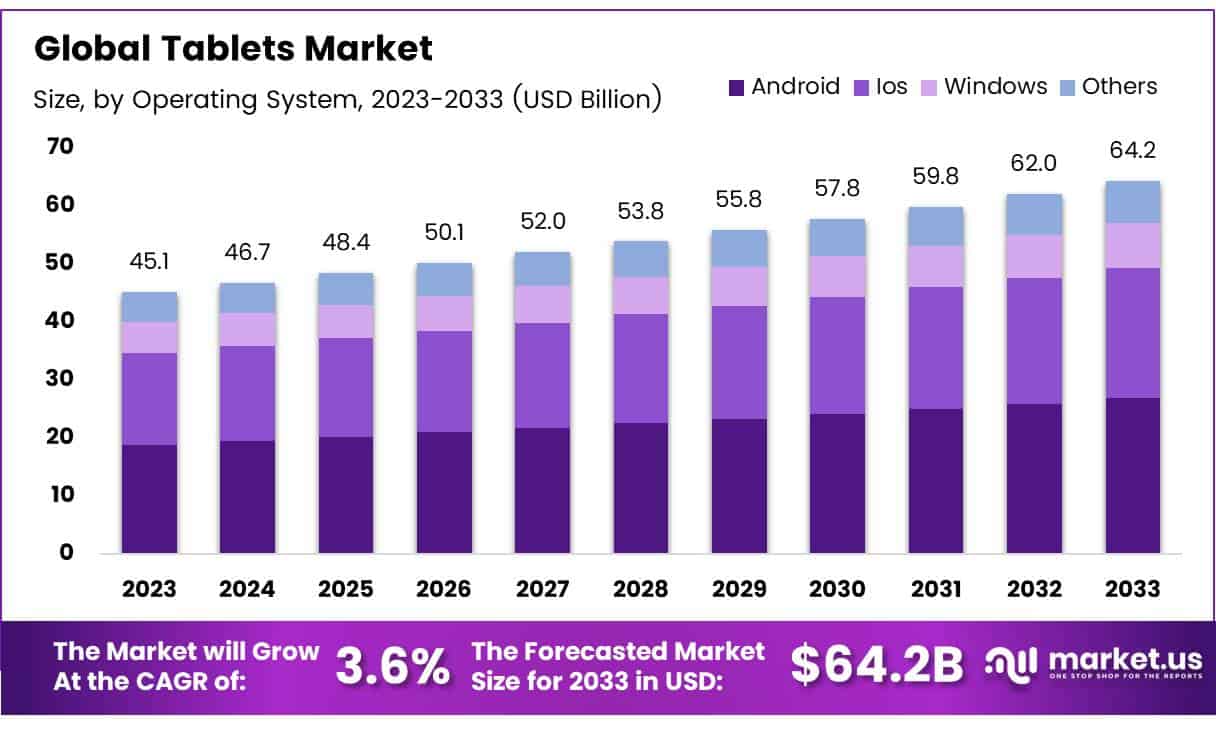

The Global Tablets Market size is expected to be worth around USD 64.2 Billion by 2033, from USD 45.1 Billion in 2023, growing at a CAGR of 3.6% during the forecast period from 2024 to 2033.

Tablets are portable devices featuring a touchscreen interface, used for a variety of tasks from entertainment to productivity. Tablets run on different operating systems, including iOS, Android, and Windows, and are available in various sizes, processing power, and price points to suit different user needs.

The tablet market consists of manufacturers, consumers, distributors, and service providers involved in the development, sale, and use of these devices.

The global tablet market has seen significant growth recently and is expected to continue expanding. According to IDC, tablet shipments grew by 20.4% in Q3 2024, reaching 39.6 million units, showing a recovery after the pandemic.

This growth is driven by the increasing demand for portable devices in both professional and personal use, alongside improvements in tablet technology, such as better processing power, battery life, and a wider range of applications. The rise of remote work, e-learning, movies and entertainment content consumption has further boosted tablet demand, reinforcing the device’s versatility for both work and leisure.

Emerging markets in Asia-Pacific, Latin America, and Africa offer significant growth opportunities for tablets, driven by rising digital adoption, increasing disposable incomes, and improved internet infrastructure. Tablets are gaining traction in education, healthcare, and business sectors.

Additionally, the integration of technologies like AR, AI, and IoT is creating new use cases in industries such as education, retail, and healthcare, further boosting demand.

Government initiatives are also playing a key role in expanding tablet adoption, particularly in education. For example, in Jamaica, the NCB Foundation is distributing tablets to 35 primary schools as part of a $50 million program.

Similarly, in the U.S., the federal government has allocated $122 billion through the ARP ESSER funds, some of which is being used to purchase tablets for schools across the country. These efforts help bridge the digital divide and promote digital literacy, driving demand for tablets.

Regulations surrounding data privacy, security, and environmental sustainability are also shaping the tablet market. Governments are increasingly mandating that tablets meet energy efficiency standards and comply with data protection laws, particularly as tablets are used more in education and healthcare.

At the same time, tablet manufacturers must contend with changing trade policies and tariffs, which can affect manufacturing costs and global distribution. Ongoing trade tensions between major economic regions can influence supply chains and pricing strategies.

However, the market’s resilience, fueled by continuous technological advancements and strong demand across various sectors, is expected to help mitigate these risks and continue driving growth in the tablet

Key Takeaways

- The global tablets market is projected to reach USD 64.2 billion by 2033, growing at a CAGR of 3.6% from 2024 to 2033.

- Slate tablets held the largest share in the market in 2023 due to their widespread adoption across various user demographics.

- Android dominated the operating system segment in 2023 with a 51.3% share, driven by its wide range of devices and flexibility.

- Tablets with 8 to 10-inch screens led the market in 2023, capturing 43.8% of the market share due to their balance of portability and functionality.

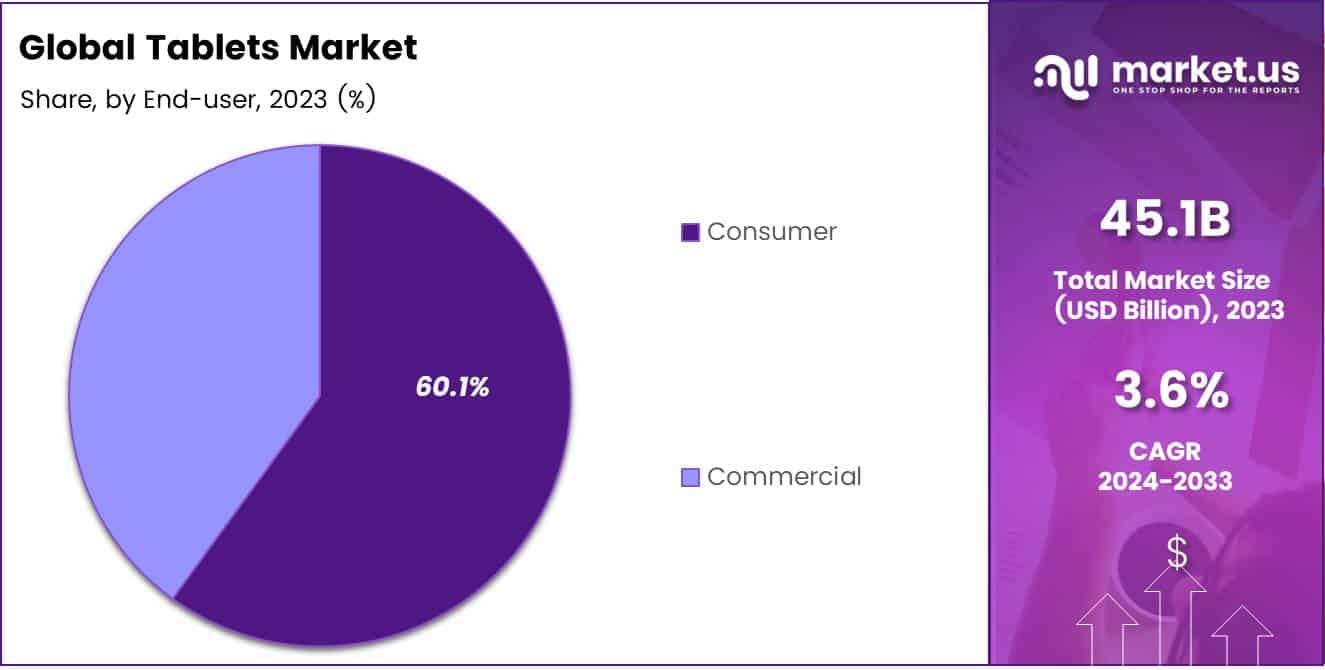

- The consumer segment dominated the tablets market in 2023, with a 60.1% share, driven by demand for entertainment, remote work, and online education.

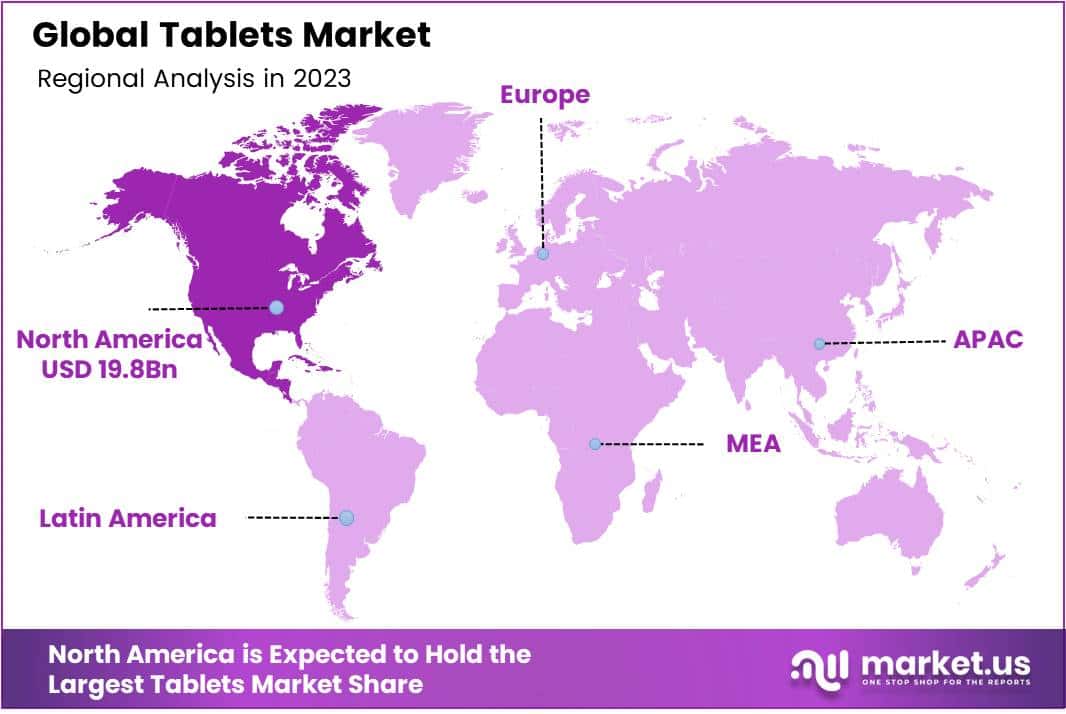

- North America led the global tablets market in 2023, holding a 44.6% share, valued at USD 19.8 billion.

Type Analysis

Slate Tablets Lead the Market in 2023, Dominating the By Type Analysis Segment of the Tablets Market

In 2023, Slate Tablets held a dominant market position in the By Type Analysis segment of the global Tablets Market, capturing the largest share due to their widespread adoption across various user demographics.

Slate Tablets, characterized by their single-piece design and typically larger screens, are favored by consumers for their versatility, ease of use, and value for general computing tasks, entertainment, and productivity. Their popularity can be attributed to the growing demand for cost-effective alternatives to laptops and the preference for larger screen sizes in media consumption and work-related tasks.

Following Slate Tablets, Detachable Tablets represent a significant portion of the market. These devices, which combine the features of both tablets and laptops with a detachable keyboard, are gaining traction among business users, professionals, and students for their portability and functionality. The ability to switch seamlessly between tablet and laptop modes makes them highly appealing to users seeking flexibility.

Meanwhile, the Others category, which includes hybrid devices and niche products, accounts for a smaller market share but continues to see growth driven by specialized use cases and innovations in design and functionality. Despite this, Slate Tablets remain the preferred choice for the majority of consumers, maintaining a dominant position in 2023.

Operating System Analysis

In 2023, Android Led the Tablets Market with a 51.3% Share by Operating System

In 2023, Android held a dominant market position in the By Operating System segment of the Tablets Market, with a 51.3% share. This strong performance can be attributed to Android’s wide range of device options, including budget-friendly models and premium tablets, making it highly accessible to a diverse consumer base.

iOS secured the second position in the market, accounting for a significant share. iOS tablets, particularly the iPad series, continue to be favored in education, professional, and creative industries, contributing to the operating system’s stable market presence.

Windows OS, primarily represented by tablets used in professional and enterprise environments, captured a smaller portion of the market. Windows tablets are typically preferred for their compatibility with desktop applications and multitasking capabilities, making them an ideal choice for business and productivity use cases.

Other operating systems, including Linux and custom-built platforms, made up the remaining share, reflecting their niche presence in the market. Despite their limited share, these systems cater to specialized use cases, such as in gaming or development environments.

Screen Size Analysis

In 2023, 8 to 10 Inches Held the Largest Share in the Tablets Market by Screen Size

In 2023, the 8 to 10 inches screen size segment dominated the tablets market, with a 43.8% market share. This segment’s appeal stems from its ideal balance between portability and screen size, offering an optimal user experience for both casual and professional tasks.

Tablets within this size range are commonly used for media consumption, productivity tasks, and light design work, positioning them as versatile devices in the consumer market.

The 10 to 12 inches category follows closely, catering to users who require larger screens for more detailed tasks such as document editing, content creation, and enhanced multimedia experiences. These tablets are often favored by business professionals and creative individuals who seek both mobility and functionality.

The 12 inches & above segment is smaller in comparison but is still significant, with these devices preferred by users in specialized industries such as graphic design and architecture, where larger screens and advanced performance are essential for precise work.

Conversely, the Less than 8 inches category appeals to those looking for highly portable, compact tablets. These devices are often chosen for basic tasks such as reading, casual browsing, and light gaming, though they represent a smaller portion of the market due to their limited functionality compared to larger tablets.

End User Analysis

In 2023, Consumer Segment Dominated the Tablets Market with a 60.1% Share in the By End User Analysis Segment

In 2023, the Consumer segment held a dominant market position in the By End User Analysis segment of the Tablets Market, with a 60.1% share. This strong performance reflects the growing consumer preference for tablets, driven by factors such as increased demand for portable entertainment, remote work solutions, and online education.

Tablets have become an essential device for personal use, offering flexibility and performance that cater to a wide range of applications, from media consumption to productivity tasks. As consumer behavior continues to evolve, with a preference for multi-functional devices, the market share for the consumer segment is expected to maintain its lead.

The Commercial segment, while smaller in comparison, is also gaining traction. Tablets are being increasingly adopted by businesses across various industries, including retail, healthcare, and education, for their efficiency and ease of integration into business operations.

Despite its smaller share, the commercial segment plays a crucial role in driving technological innovation within enterprises, facilitating streamlined workflows, and improving customer engagement.

Key Market Segments

By Type

- Slate Tablet

- Detachable Tablet

- Others

By Operating System

- Android

- Ios

- Windows

- Others

By Screen Size

- 8 to 10 inches

- 10 to 12 inches

- 12 inches & above

- Less than 8 inches

By End User

- Consumer

- Commercial

Drivers

Increased Demand for Mobile Computing Drives Tablet Market Growth

The tablet market has experienced significant growth, driven largely by the rising demand for mobile computing solutions. Consumers and businesses alike are seeking devices that offer the portability of smartphones combined with the processing power and functionality of laptops.

Tablets provide an ideal balance, offering ease of use, versatility, and enhanced productivity in various environments, including work, education, and entertainment. This is particularly evident in professional and educational settings where tablets are increasingly used for tasks such as note-taking, presentations, and collaboration.

Advancements in display technology have further bolstered the tablet’s appeal. Improvements in screen resolution, color accuracy, and refresh rates have provided users with a more immersive and responsive experience, making tablets an attractive option for both work and leisure. Additionally, the growing popularity of e-reading has contributed to the market’s expansion.

Tablets, with their larger screens compared to smartphones, are becoming preferred devices for reading digital content like e-books, magazines, and newspapers. The combination of portability, functionality, and an enhanced reading experience positions tablets as an essential tool for consumers looking to stay connected, productive, and entertained while on the go. Together, these drivers are shaping the continued growth and adoption of tablets across multiple industries and consumer segments.

Restraints

High Competition from Smartphones and Laptops

The tablets market faces significant challenges due to intense competition from both smartphones and laptops. Smartphones, with their portability and increasing capabilities, serve as a key alternative to tablets, as they offer many of the same functions, such as internet browsing, media consumption, and communication, in a more compact form. On the other hand, laptops provide superior processing power, larger storage, and multitasking capabilities, which make them the preferred choice for professional and high-performance tasks such as gaming, content creation, and complex business applications.

As a result, tablets often find themselves positioned as a middle-ground device, offering some benefits of both categories but failing to outperform either smartphones or laptops in their respective strengths. This limitation in functionality, combined with the saturation of smartphones and laptops in the market, has led to slower growth in tablet demand, especially in regions where consumers prioritize devices with higher computing capabilities or greater portability.

Additionally, the pricing of tablets can sometimes make them less attractive when consumers can opt for a smartphone with similar features or a laptop for a slightly higher investment, further challenging the tablet market’s growth. Consequently, while tablets still hold appeal in specific niches, such as for media consumption and light productivity, they are under continuous pressure from these competing devices.

Growth Factors

Growth Opportunities in the Tablets Market

The tablets market is poised for significant growth, driven by several key opportunities. One of the most promising is the increasing adoption of tablets in education. As educational institutions embrace digital learning tools, tablets are becoming essential for interactive teaching, content delivery, and online courses, particularly in K-12 schools and higher education. This trend is further accelerated by the need for flexible, on-the-go learning solutions.

In the healthcare sector, tablets are also playing a critical role in digital health and telemedicine. With the growing demand for remote diagnostics, patient management, and telehealth services, tablets offer a practical and cost-effective solution. This shift towards digital health provides an attractive growth opportunity for the tablet market as healthcare providers continue to invest in technology. Moreover, the rise of mobile gaming has also opened new avenues for tablet manufacturers.

As more consumers turn to gaming on mobile devices, tablets are emerging as a strong alternative to smartphones, offering a larger screen and a more immersive experience. With advancements in graphics and processing power, tablets are well-positioned to cater to the growing demand for portable gaming devices. Collectively, these factors suggest that the tablets market is on a path to steady growth, driven by innovations in education, healthcare, and entertainment.

Emerging Trends

Key Trends Shaping the Tablets Market

The tablets market is experiencing significant innovation, driven by several emerging factors. One notable trend is the rise of hybrid devices, which combine the functionality of tablets and laptops. These devices, often featuring detachable keyboards, are appealing particularly to business and professional users who require the flexibility of a portable tablet with the productivity of a laptop. This trend is gaining traction as users seek all-in-one solutions that can meet both work and entertainment needs.

Another key development is the integration of 5G technology in tablets, enhancing connectivity and improving the overall user experience. With faster download speeds, lower latency, and greater network reliability, 5G-enabled tablets are becoming increasingly popular among mobile workers, providing seamless access to data and applications while on the move.

Additionally, the incorporation of artificial intelligence (AI) features, such as voice assistants (e.g., Siri, Google Assistant) and predictive capabilities, is elevating tablet functionality. These AI-powered features help improve efficiency and usability for both personal and business applications, enabling users to perform tasks more intuitively. As these factors continue to evolve, the tablets market is expected to grow, driven by the demand for more versatile, connected, and intelligent devices that cater to diverse consumer and professional needs.

Regional Analysis

North America Dominates the Tablets Market with a Share of 44.6% (USD 19.8 Billion)

The global tablets market is experiencing significant growth, with key regions driving its expansion. North America remains the dominant region, accounting for 44.6% of the total market share, valued at USD 19.8 billion.

The region’s market leadership is driven by the high penetration of tablets in various sectors, including education, healthcare, and business, where they are widely adopted for productivity, communication, and entertainment. The strong technological infrastructure and consumer preference for advanced digital devices further support this growth trajectory.

Regional Mentions:

Europe holds a significant share of the global market, driven by strong demand in both developed and emerging economies. Key countries such as Germany, the UK, and France contribute to Europe’s high tablet adoption rates, supported by increasing reliance on mobile technology for personal and professional purposes. The rise in e-learning initiatives and the growing trend of hybrid working also play a role in boosting the market in this region.

The Asia Pacific region is experiencing the fastest growth, spurred by rapid technological adoption, growing disposable incomes, and a large population base. Countries like China, India, and Japan are seeing increased demand for tablets, particularly in educational institutions and businesses. This region’s market is expected to continue expanding rapidly as digital transformation initiatives and mobile internet penetration increase.

Meanwhile, Middle East & Africa (MEA) and Latin America represent smaller shares of the market, though both regions are seeing gradual growth. Rising internet access and the increasing use of tablets for e-commerce, digital learning, and entertainment are driving demand in these regions.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global tablets market continues to be dominated by key players that exhibit strong brand recognition, innovative product offerings, and robust distribution networks.

Apple Inc., with its iPad series, remains the market leader, benefiting from an established ecosystem that integrates seamlessly with other Apple devices. The iPad’s strong presence in both consumer and enterprise segments, combined with consistent product innovation, positions Apple for continued dominance in the premium tablet market.

Samsung Electronics Co., Ltd. follows closely, leveraging its Galaxy Tab series to appeal to a diverse customer base, particularly in the Android segment. Samsung’s integration of advanced display technologies, such as AMOLED screens, and its focus on productivity features (e.g., the S Pen) contribute to its competitive edge.

Other notable players such as Microsoft Corporation and Lenovo Group Limited focus on hybrid tablets, offering versatility for both personal and professional use. Microsoft’s Surface Pro line, with its detachable keyboard and Windows OS, caters to the growing demand for tablets that double as laptops. Lenovo’s Yoga tablets, with high-end performance and flexible designs, provide value in the mid-range segment.

The rise of e-commerce and content consumption has propelled Amazon.com, Inc. to the forefront with its Fire tablets, which cater primarily to budget-conscious consumers. In the budget tablet market, companies like Xiaomi Corporation and TCL Communication Technology Holdings Limited also maintain a competitive presence, offering affordable yet feature-rich tablets in emerging markets.

Overall, the global tablets market is characterized by intense competition, with each player carving out distinct segments based on price, functionality, and regional focus. As technological advancements continue, such as 5G and AI integration, these companies are expected to enhance their product portfolios to meet evolving consumer demands.

Top Key Players in the Market

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Google LLC

- Toshiba Corporation

- Huawei Technologies Co., Ltd.

- Amazon.com, Inc.

- Lenovo Group Limited

- Microsoft Corporation

- Xiaomi Corporation

- TCL Communication Technology Holdings Limited

- Sony Corporation

- LG Electronics Inc.

- Barnes & Noble, Inc.

- Fujitsu Limited

- ASUS Computer International

- Acer Inc.

- Dell Technologies Inc.

- HP Inc.

- Alcatel-Lucent S.A.

Recent Developments

- In August 2023, Samsung released new iterations of its Galaxy Tab series, including the Galaxy Tab S9 series, continuing its innovation in the tablet market.

- In February 2024, ControlZ secured funding to enhance the quality of its offerings in the smartphone segment.

- In November 2024, ForeFront RF secured £16 million in funding to make smartphones, tablets, and IoT devices more accessible to a broader audience.

Report Scope

Report Features Description Market Value (2023) USD 45.1 Billion Forecast Revenue (2033) USD 64.2 Billion CAGR (2024-2033) 3.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Slate Tablet, Detachable Tablet, Others), By Operating System (Android, Ios, Windows, Others), By Screen Size (8 to 10 inches, 10 to 12 inches, 12 inches and above, Less than 8 inches), By End User (Consumer, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Apple Inc., Samsung Electronics Co., Ltd., Panasonic Corporation, Google LLC, Toshiba Corporation, Huawei Technologies Co., Ltd., Amazon.com, Inc., Lenovo Group Limited, Microsoft Corporation, Xiaomi Corporation, TCL Communication Technology Holdings Limited, Sony Corporation, LG Electronics Inc., Barnes & Noble, Inc., Fujitsu Limited, ASUS Computer International, Acer Inc., Dell Technologies Inc., HP Inc., Alcatel-Lucent S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Google LLC

- Toshiba Corporation

- Huawei Technologies Co., Ltd.

- Amazon.com, Inc.

- Lenovo Group Limited

- Microsoft Corporation

- Xiaomi Corporation

- TCL Communication Technology Holdings Limited

- Sony Corporation

- LG Electronics Inc.

- Barnes & Noble, Inc.

- Fujitsu Limited

- ASUS Computer International

- Acer Inc.

- Dell Technologies Inc.

- HP Inc.

- Alcatel-Lucent S.A.