Global Digital Photography Market By Type (Photo Processing Equipment, Interchangeable Lenses, Camera Cell Phones), By Application (Photography Software, Photo Looks, Photo Processing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 67487

- Number of Pages: 209

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

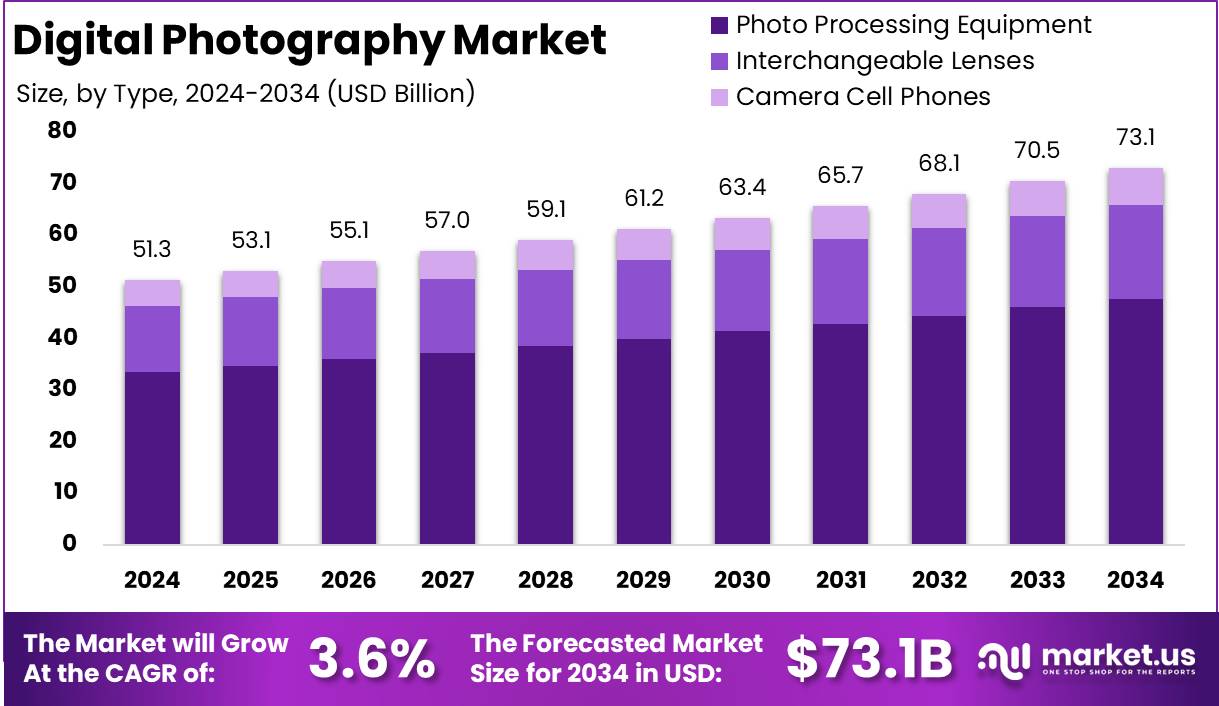

The Global Digital Photography Market size is expected to be worth around USD 73.1 Billion by 2034 from USD 51.3 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

Digital photography refers to the process of capturing and storing images in a digital format, as opposed to traditional film-based methods. This technology uses electronic sensors to convert light into data, which is then processed and saved as digital files.

Digital cameras, smartphones, and other imaging devices are at the core of this innovation, allowing for immediate viewing, editing, and sharing of photographs. Over the years, digital photography has evolved significantly, integrating advanced features such as higher resolution sensors, improved low-light performance, and seamless connectivity to digital platforms.

The digital photography market encompasses the global industry involved in the production, distribution, and consumption of digital imaging devices and services. This includes digital cameras, camcorders, lenses, accessories, and photo editing software, as well as related services such as cloud storage, image sharing platforms, and professional photo services.

The market is driven by both consumer demand for high-quality personal photography experiences and professional applications in sectors such as media, advertising, real estate, and e-commerce.

The digital photography market is experiencing steady growth, supported by several key factors. The increasing adoption of smartphones with advanced camera capabilities is a primary driver, enabling consumers to take high-quality images without the need for dedicated cameras.

The demand for digital photography is being fueled by both the consumer and professional segments. On the consumer side, there is a growing preference for devices that offer convenience, high-quality imaging, and versatility, such as smartphones, action cameras, and mirrorless cameras.

The continuous improvement in camera technologies, such as higher resolution sensors and better image processing algorithms, has led to a more refined user experience. On the professional side, the demand for digital photography is rising in industries such as advertising, media production, tourism, and real estate, where high-quality images are essential for marketing, content creation, and client engagement.

According to Photutorial, the global digital photography market is witnessing significant growth, driven by the increasing volume of photos captured worldwide. With approximately 5.3 billion photos taken daily, or 61,400 photos per second, the demand for digital photography solutions continues to expand.

In the U.S., the average citizen captures 20.2 photos per day, a figure higher than the global average, with regions like Asia-Pacific 15 photos/day and Latin America 11.8 photos/day following closely.

Smartphones, accounting for 94% of all photos taken in 2024, remain the dominant platform. Furthermore, Google Image Search indexes an estimated 136 billion images, underscoring the growing reliance on digital photography across both consumer and commercial sectors. This surge in daily photo creation, combined with the increasing use of mobile devices, points to a rapidly evolving digital photography landscape.

According to Photoaid, the digital photography market has seen a major shift with smartphones capturing 92.5% of all images, leaving conventional cameras with just 7.5%. On average, smartphone users store approximately 2,795 photos in their camera roll, and globally, 92 million selfies are taken daily.

In the U.S., individuals engage with their phones for photography an average of six times per day, with nearly 40% of that time spent capturing photos at events. Post-event, Americans review their photos around 13 times annually, highlighting the ongoing centrality of smartphones in modern digital photography.

Key Takeaways

- The global digital photography market is projected to grow at a CAGR of 3.6%, reaching USD 73.1 billion by 2034 from USD 51.3 billion in 2024.

- Photo Processing Equipment is expected to maintain a dominant position in the market, capturing more than 65.3% of the total market share in 2024.

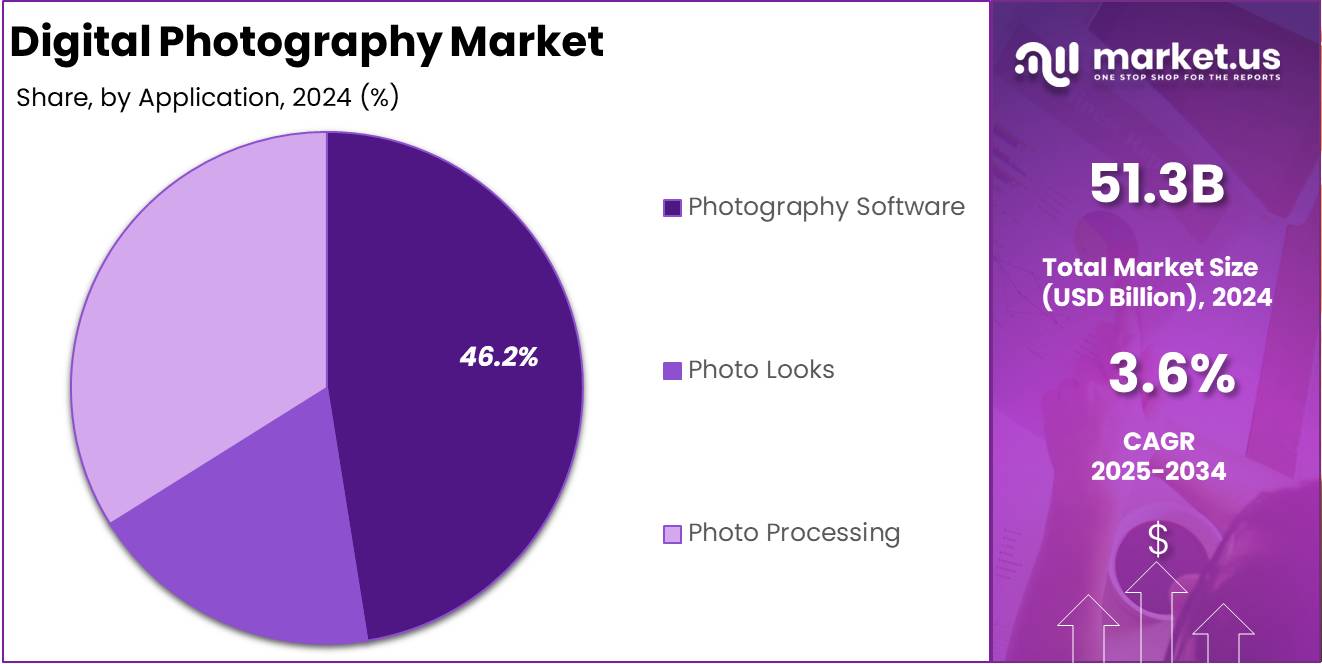

- Photography Software is expected to hold a leading market share of more than 46.2% in 2024 within the digital photography sector.

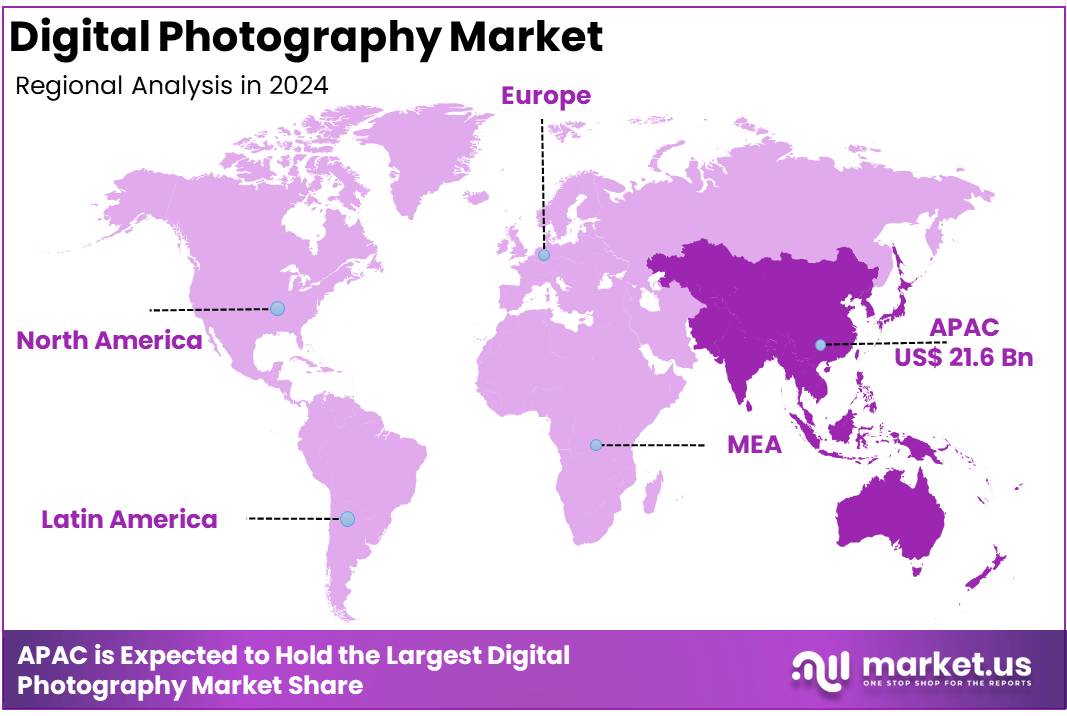

- Asia Pacific is projected to lead the digital photography market, holding a dominant 42.3% market share in 2024, valued at USD 21.6 billion.

By Type Analysis

In 2024, Photo Processing Equipment held a dominant market position in the Digital Photography sector, capturing more than 65.3% of the total market share. This segment has experienced sustained growth due to the increasing demand for high-quality photo printing solutions, advancements in image processing technologies, and the growing popularity of professional photography.

Photo processing equipment plays a crucial role in enhancing photo output, making it indispensable in both consumer and professional photography settings. Interchangeable Lenses have emerged as a critical component in the Digital Photography market, offering photographers the flexibility to capture high-quality images in various settings.

As mirrorless and DSLR cameras remain popular, the market for interchangeable lenses is poised for continued growth, driven by technological improvements and the demand for specialized lenses for different photography styles.

Camera Cell Phones have significantly disrupted the Digital Photography landscape, as smartphones become the go-to tool for everyday photography. With advancements in camera technology, such as multi-lens setups and AI-driven enhancements, camera cell phones are increasingly favored by consumers for their convenience and ability to produce high-quality images on the go.

By Application Analysis

In 2024, Photography Software holds a dominant market position in the Digital Photography market, capturing more than a 46.2% share. This segment’s significant share can be attributed to the increasing demand for advanced software solutions that offer features such as photo editing, retouching, and image enhancement.

As digital photography continues to evolve, both professionals and enthusiasts rely heavily on these software tools to achieve high-quality images, driving the sustained growth of this segment.

The Photo Looks segment is experiencing steady growth, driven by consumer preferences for customizable filters and effects. With the rise of social media and influencer culture, photo styling has become an integral part of digital photography. Users seek applications that can offer unique, visually appealing aesthetics to their photos, which is fueling the demand for photo looks.

Photo Processing continues to be a key segment, supported by the demand for efficient and high-quality image processing tools. This application is particularly vital for professional photographers and businesses that require large-scale photo editing and batch processing capabilities. The continued advancements in cloud computing and AI-driven processing solutions further enhance the segment’s appeal.

Key Market Segments

By Type

- Photo Processing Equipment

- Interchangeable Lenses

- Camera Cell Phones

By Application

- Photography Software

- Photo Looks

- Photo Processing

Digital Photography Market Business Benefits

The digital photography market offers a range of significant business benefits, driven by technological advancements and evolving consumer demand. With the widespread use of smartphones equipped with high-quality cameras, the market has seen a surge in both amateur and professional photography.

Businesses involved in digital cameras, lenses, software, and accessories benefit from this growing consumer base, offering new opportunities for innovation and product differentiation.

Furthermore, the increasing demand for high-quality content in digital marketing, social media, and e-commerce platforms has driven a boom in professional photography services. Businesses can leverage digital photography to enhance their branding, improve product visibility, and engage more effectively with customers.

Additionally, with the rise of e-learning, virtual events, and online content creation, the need for high-quality images and videos continues to grow, creating a profitable avenue for businesses in related sectors, such as stock photography, digital editing software, and cloud storage services.

Understanding the Scale of Global Photo Taking

The number of photos taken globally each year is truly staggering, with humanity collectively capturing nearly 2 trillion images annually, as noted by Photutorial. This translates to approximately:

- 61,400 photos per second

- 3.7 million photos per minute

- 221 million photos per hour

- 5.3 billion photos per day

- 162 billion photos per month

To put this into perspective, if you were to take a photo every second, it would take you almost an entire day to reach the number of photos taken globally in just one second. To match the total number of photos taken worldwide in a single year would require over 61,000 years. This remarkable volume of images highlights the rapid expansion of digital photography and its impact on our daily lives.

Driver

Increasing Consumer Demand for High-Quality Imagery

The global digital photography market is witnessing significant growth due to the increasing consumer demand for high-quality imagery. As digital devices such as smartphones and digital cameras continue to improve in terms of camera technology, more consumers are seeking devices that provide professional-grade images.

The rapid advancement in sensor technology, coupled with features like 4K video capture and improved autofocus systems, has driven the demand for high-resolution and versatile cameras. Furthermore, the growing interest in content creation, such as vlogging, social media influencers, and user-generated content, is a key factor in fueling this demand.

The rise of platforms like Instagram, TikTok, and YouTube has made high-quality, visually appealing content a key element of personal branding and professional influence. Individuals and businesses alike are investing in better photography tools to enhance their content creation capabilities.

The demand for professional-grade cameras is not just limited to enthusiasts and professionals the average consumer is increasingly becoming an active participant in photography. As a result, digital cameras are becoming more accessible, user-friendly, and affordable, further contributing to their widespread adoption. This shift is expected to propel the growth of the global digital photography market in 2024 and beyond.

Restraint

Saturation in the Smartphone Camera Segment

One of the significant restraints to the growth of the digital photography market is the saturation in the smartphone camera segment. With most smartphones now offering high-quality cameras that cater to the everyday consumer, the demand for standalone digital cameras has slowed down.

Smartphone manufacturers have heavily invested in camera technology, incorporating multiple lenses, enhanced image processing capabilities, and AI-powered features that rival dedicated digital cameras. As a result, many consumers no longer see the need for a separate digital camera, leading to market stagnation in certain categories.

The high level of competition in the smartphone industry further exacerbates this issue. Smartphone brands are continually improving their camera technologies, which often include capabilities that were once exclusive to high-end cameras, such as optical zoom, night mode, and 4K video recording.

While this innovation improves the overall consumer experience, it creates a challenge for traditional digital camera manufacturers, who struggle to differentiate their products in a market increasingly dominated by multifunctional smartphones. This saturation has led to declining sales in the standalone camera segment, impacting overall growth in the digital photography market, especially in consumer-facing product categories.

Opportunity

Growth of Artificial Intelligence and Automation in Photography

The integration of artificial intelligence (AI) and automation into photography presents a significant opportunity for the digital photography market in 2024. AI-driven features, such as image recognition, scene optimization, and automatic subject tracking, have already begun to revolutionize the way digital cameras function.

These technologies allow users, both amateur and professional, to achieve better results with minimal effort, making digital photography more accessible and efficient. As AI becomes more advanced, the ability to automatically edit, enhance, and organize photos is expected to further increase the appeal of digital cameras.

The opportunity for growth is also seen in the increasing application of AI in professional photography, where it is used to streamline workflows, improve image quality, and assist in post-production processes. With AI technologies allowing for better image composition, lighting adjustments, and even the removal of background noise, photographers can save time and improve the quality of their work.

Additionally, AI-enhanced cameras are likely to attract a broader audience, including tech enthusiasts, photographers, and content creators, all of whom are seeking tools that can improve their photography experience. As these innovations continue to gain traction, they are expected to significantly contribute to market growth in the coming years.

Trends

Shift Towards Mirrorless Cameras

One of the most prominent trends in the digital photography market in 2024 is the increasing shift towards mirrorless cameras. Traditionally, digital single-lens reflex (DSLR) cameras dominated the professional photography market, offering superior image quality and manual control.

However, mirrorless cameras are becoming more popular due to their compact size, faster autofocus, and comparable image quality to DSLRs. This trend is driven by both consumer and professional demand for lightweight, portable, and feature-rich cameras that can easily capture high-quality images without the bulk of traditional DSLR systems.

The mirrorless segment is experiencing rapid technological advancements, with manufacturers introducing innovative features such as in-body image stabilization, advanced autofocus systems, and faster processing speeds. These enhancements make mirrorless cameras a more attractive option for professionals who need reliability and high performance in a smaller package.

Additionally, the growing demand for video content has further boosted the popularity of mirrorless cameras, as many of these devices offer superior video recording capabilities, including 4K and even 8K video resolution. This trend towards mirrorless technology is expected to continue gaining momentum in 2024, contributing to the ongoing transformation of the digital photography market.

Regional Analysis

Asia Pacific Digital Photography Market with Largest Market Share of 42.3%

The digital photography market is witnessing substantial growth across various global regions, with Asia Pacific emerging as the dominant region. The region is projected to hold a market share of 42.3% in 2024, valued at USD 21.6 billion.

This growth can be attributed to the rising adoption of digital cameras, advancements in mobile photography, and a surge in the number of consumers seeking high-quality photography products. With rapid technological innovations and increasing disposable incomes in key countries, Asia Pacific is expected to continue driving the demand for digital photography solutions.

North America follows closely as a significant market player, holding a notable share in the digital photography sector. The region benefits from a strong presence of established digital camera manufacturers, along with widespread consumer adoption of high-definition photography equipment.

In addition, the increasing use of digital imaging for both personal and professional applications supports growth in the North American market. However, the market growth rate in this region is projected to be slower than in Asia Pacific, with market conditions remaining stable.

Europe presents a diverse digital photography market, characterized by both mature and emerging segments. The region is expected to maintain a steady share in the global market, driven by high demand for professional and advanced photography equipment.

The growing popularity of photography-related applications, such as social media content creation and travel photography, further supports the market’s expansion in Europe. The European market is projected to experience consistent growth, though it is outpaced by the rapid acceleration seen in the Asia Pacific region.

Latin America, while smaller in comparison to other regions, shows a promising increase in the demand for digital photography products, particularly in countries like Brazil and Mexico. The regional market is anticipated to experience steady growth, supported by increased consumer spending and the expanding middle class. However, economic challenges and slower adoption of high-end digital photography products may moderate the market’s overall performance.

The Middle East and Africa (MEA) region, with its diverse consumer base, also contributes to the global market. The growth in this region is driven by rising disposable incomes, increasing interest in social media platforms, and a growing demand for both consumer and professional photography solutions. Despite being a relatively smaller market, MEA’s demand for digital photography is expected to expand gradually, particularly in urban areas.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

In 2024, the global digital photography market remains highly competitive, with several key players shaping the industry’s landscape. Canon Inc. Nikon Corporation, and Sony Corporation continue to dominate the market, leveraging their strong brand presence and technological innovations to maintain a significant share.

Canon’s diverse portfolio, from consumer cameras to professional-grade models, and Nikon’s consistent performance in DSLR and mirrorless cameras ensure their leadership.

Sony, known for its high-performance sensors and mirrorless camera systems, also maintains a competitive edge. Fujifilm Holdings Corporation and Olympus Corporation stand out for their innovation in mirrorless and compact cameras, with Fujifilm’s X-series being a top contender in the enthusiast and professional market.

Samsung Electronics, while focusing on smartphones, still has a notable footprint in the camera segment with high-quality mobile sensors. Meanwhile, Leica Camera AG, Hasselblad, and Phase One A/S target the premium and professional photographer segments, offering high-resolution, medium-format cameras that emphasize superior image quality.

Emerging brands like GoPro Inc., DJI, and Polaroid Corporation focus on specific niches action cameras, drones, and instant photography, respectively allowing them to carve out loyal customer bases.

Meanwhile, Ricoh, Pentax, and Sigma continue to serve the mid-range market, providing quality options for hobbyists and professionals alike. With continued advancements in sensor technology, lens innovation, and mobile integration, these players will drive future growth in an ever-evolving digital photography market.

Top Key Players in the Market

- Canon Inc.

- Nikon Corporation

- Sony Corporation

- Fujifilm Holdings Corporation

- Olympus Corporation

- Samsung Electronics Co. Ltd.

- Leica Camera AG

- GoPro Inc.

- Ricoh Company, Ltd.

- Hasselblad

- Phase One A/S

- Sigma Corporation

- Zeiss

- Casio Computer Co. Ltd.

- Pentax Ricoh Imaging Company, Ltd.

- Seiko Epson Corporation

- Polaroid Corporation

- Lytro, Inc.

- DJI

- Panasonic Corp

Recent Developments

- In July 2024, Canon India, a leader in digital imaging technology, introduced the EOS R1 and EOS R5 Mark II to its EOS R series. These new cameras incorporate advanced features aimed at transforming the photography and videography landscape. With enhanced speed, quality, and intuitive design, Canon continues to set new standards in the imaging industry.

- On February 26, 2024, Sony India launched the Alpha 9 III, featuring the world’s first full-frame global shutter image sensor. This breakthrough innovation allows the camera to capture high-speed bursts at up to 120 fps without distortion or blackout, coupled with an advanced AI autofocus system. With these cutting-edge technologies, the Alpha 9 III provides professionals with unparalleled capabilities for precise, high-speed photography.

- In June 2024, The Home Depot®, the largest home improvement retailer globally, finalized its acquisition of SRS Distribution, Inc. for $18.25 billion. SRS, a leading distributor in the residential specialty trade industry, will strengthen Home Depot’s position in servicing roofing, landscaping, and pool contracting professionals.

- In 2025, Getty Images and Shutterstock, two of the world’s largest stock photo companies, will merge, creating a new entity valued at $3.7 billion. The merger, pending regulatory approval, will result in Getty Images Holdings, with Getty’s shareholders holding a majority share of 54.7%.

- In 2024, Samsung Electronics announced the launch of three new mobile image sensors: the ISOCELL HP9, GNJ, and JN5. These sensors, designed for both primary and secondary smartphone cameras, promise superior image quality and enhanced photography capabilities, continuing Samsung’s leadership in semiconductor and imaging technology.

- In 2023, Apple introduced the iPhone 15 Pro and iPhone 15 Pro Max, featuring a lightweight, yet durable titanium design. These new models offer advanced camera upgrades, including a 48MP main camera and a 5x telephoto lens exclusive to the Pro Max. The A17 Pro chip enhances gaming performance, while the new USB-C connector supports faster data transfer, enabling professional workflows.

Report Scope

Report Features Description Market Value (2024) USD 51.3 Billion Forecast Revenue (2034) USD 73.1 Billion CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Photo Processing Equipment, Interchangeable Lenses, Camera Cell Phones), By Application (Photography Software, Photo Looks, Photo Processing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Canon Inc., Nikon Corporation, Sony Corporation, Fujifilm Holdings Corporation, Olympus Corporation, Samsung Electronics Co. Ltd., Leica Camera AG, GoPro Inc., Ricoh Company, Ltd., Hasselblad, Phase One A/S, Sigma Corporation, Zeiss, Casio Computer Co. Ltd., Pentax Ricoh Imaging Company Ltd., Seiko Epson Corporation, Polaroid Corporation, Lytro Inc., DJI, Panasonic Corp

-

-

- PENTAX

- Panasonic Corp.

- Nikon Corp.

- Sony Corp.

- Canon Inc.

- Samsung Electronics Co. Ltd

- Fujifilm Holdings Corp.

- Olympus

- Kodak Co.

- Other Key Players