Global Pharmaceutical Sterility Testing Market By Product Type (Kits & Reagents and Instruments), By Test Type (Bioburden Testing, Sterility Testing, Bacterial Endotoxin Testing, ATP Bioluminescence, Fluorescent Labeling and Others), By Application (Sterile Drugs, Biologics and Therapeutics and Medical Devices), By Services (Outsourced and In-House), By End-User (Medical Devices Companies, Compounding Pharmacies and Pharmaceutical Companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174684

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- By Test Type Analysis

- Application Analysis

- Services Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

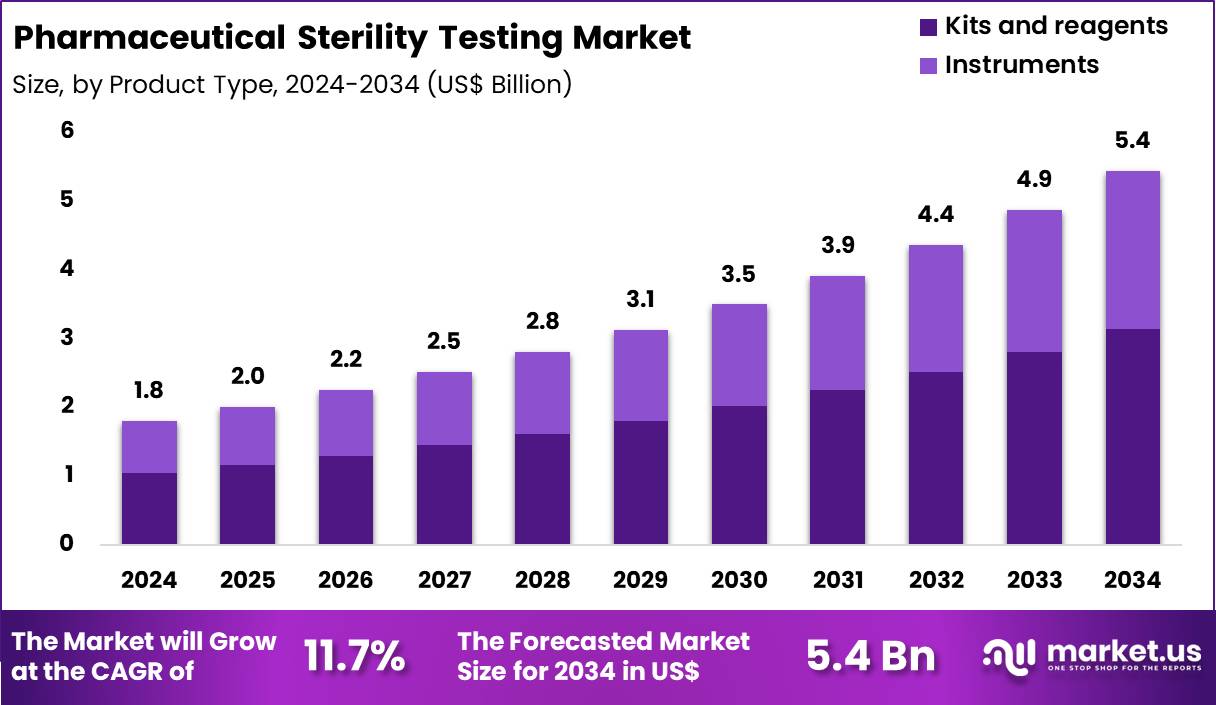

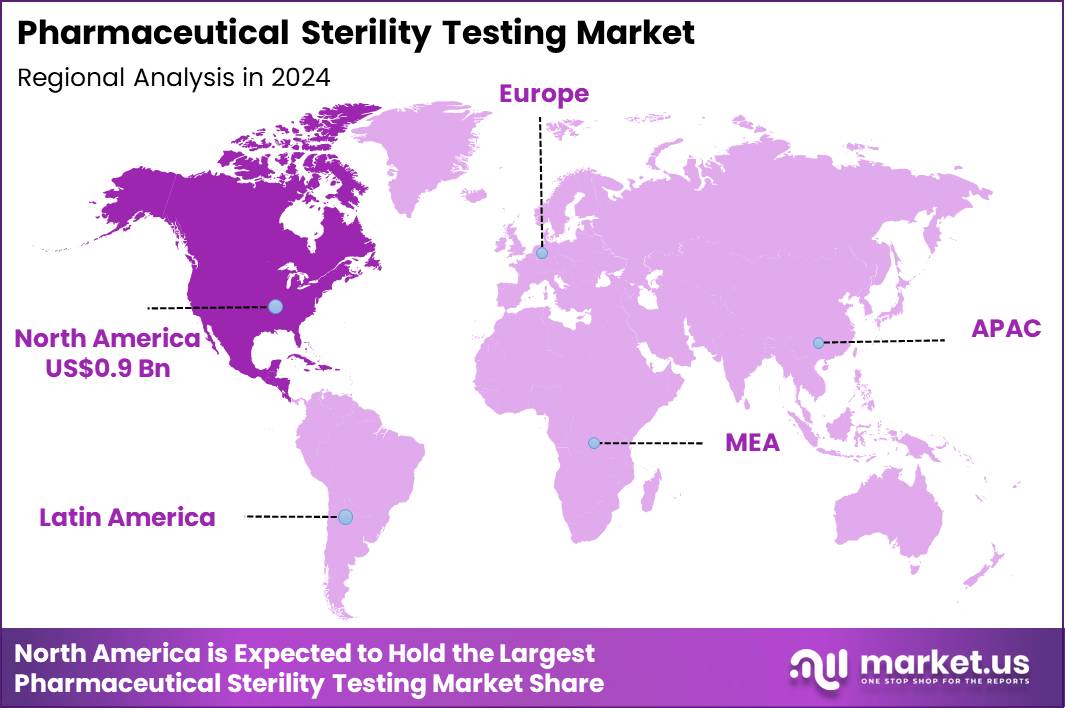

The Global Pharmaceutical Sterility Testing Market size is expected to be worth around US$ 5.4 Billion by 2034 from US$ 1.8 Billion in 2024, growing at a CAGR of 11.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 48.8% share with a revenue of US$ 0.9 Billion.

Rising regulatory scrutiny and stringent quality requirements compel pharmaceutical manufacturers to prioritize sterility testing that ensures the absence of viable microorganisms in injectable, ophthalmic, and parenteral products. Quality control laboratories increasingly perform membrane filtration sterility tests on large-volume parenterals, capturing and incubating any potential contaminants to confirm product safety before batch release.

These methods support rapid microbial detection in biologics manufacturing, where aseptic processing demands rigorous validation of filling lines and lyophilized formulations. Manufacturers apply direct inoculation techniques for small-volume injectables and medical devices, allowing comprehensive assessment of antimicrobial effectiveness in preservative systems.

Sterility testing also verifies the integrity of closed-system transfer devices and prefilled syringes, mitigating contamination risks during compounding and administration. In August 2023, Pace Analytical Services expanded its analytical testing capabilities through the acquisition of Alpha Analytical. This move strengthened Pace’s expertise in hydrocarbon analysis and broadened its sediment and tissue testing services, enhancing support for complex environmental and industrial testing requirements across regulated markets.

Contract testing organizations seize opportunities to integrate automated microbial detection systems that accelerate sterility results, enabling faster release of time-sensitive biologics and vaccines. Providers develop advanced growth media and alternative methods such as ATP bioluminescence and flow cytometry, reducing incubation periods while maintaining regulatory acceptance for compendial compliance.

These innovations facilitate real-time monitoring in continuous manufacturing environments, supporting process analytical technology initiatives for sterile drug products. Opportunities emerge in specialized testing for cell and gene therapies, where low-bioburden requirements demand highly sensitive assays to detect adventitious agents.

Companies advance container-closure integrity testing that complements sterility assessments, ensuring package protection throughout shelf life. Firms invest in validated rapid sterility platforms that align with modern aseptic processing guidelines, streamlining workflows for high-throughput production of injectables and biologics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.8 Billion, with a CAGR of 11.7%, and is expected to reach US$ 5.4 Billion by the year 2034.

- The product type segment is divided into kits & reagents and instruments, with kits & reagents taking the lead with a market share of 57.6%.

- Considering test type, the market is divided into bioburden testing, sterility testing, bacterial endotoxin testing, ATP bioluminescence, fluorescent labeling and others. Among these, bioburden testing held a significant share of 34.8%.

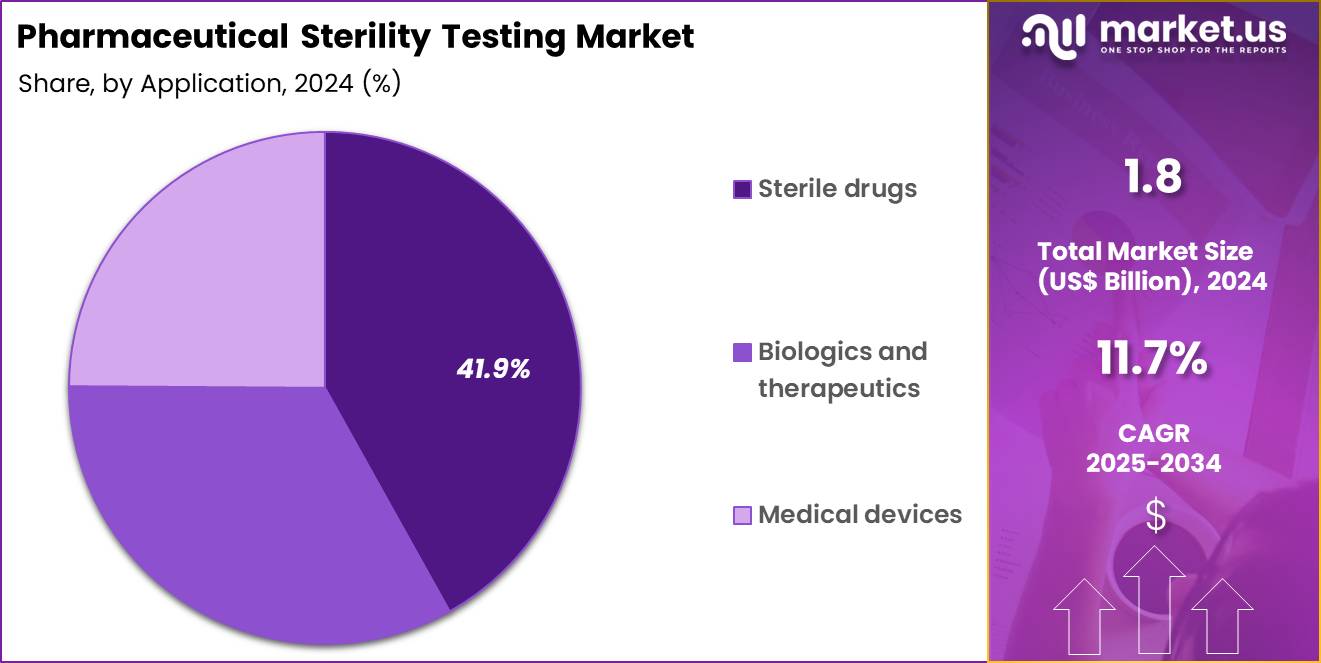

- Furthermore, concerning the application segment, the market is segregated into sterile drugs, biologics and therapeutics and medical devices. The sterile drugs sector stands out as the dominant player, holding the largest revenue share of 41.9% in the market.

- The services segment is segregated into outsourced and in-house, with the outsourced segment leading the market, holding a revenue share of 62.3%.

- Considering end-user, the market is divided into medical devices companies, compounding pharmacies and pharmaceutical companies. Among these, medical devices companies held a significant share of 39.5%.

- North America led the market by securing a market share of 48.8%.

Product Type Analysis

Kits and reagents accounted for 57.6% of growth within the product type category and represent the most frequently consumed components in the Pharmaceutical Sterility Testing market. Routine sterility and contamination assessments require consistent reagent usage across batches. Manufacturers prefer ready-to-use kits to standardize testing outcomes. High testing frequency increases repeat procurement volumes.

Regulatory requirements mandate validated reagents for compliance. Rapid testing workflows rely on reliable reagent performance. Outsourced laboratories prioritize kits that reduce preparation time. Batch-to-batch consistency supports quality assurance objectives. Suppliers expand reagent portfolios to address multiple test types. Shelf-stable formats improve logistics and inventory planning.

Global manufacturing expansion increases testing throughput. Biologic and device complexity raises reagent demand. Automation compatibility strengthens kit adoption. Training simplicity improves laboratory efficiency. Reduced hands-on time lowers operational costs. Quality audits emphasize reagent traceability and documentation.

Continuous production models increase reagent consumption rates. Emerging rapid methods increase specialized reagent use. Procurement favors scalable consumables over capital equipment. The segment is projected to remain dominant due to recurring consumption and regulatory reliance. Overall growth reflects routine use, compliance needs, and workflow efficiency.

By Test Type Analysis

Bioburden testing represented 34.8% of growth within the test type category and stands as the primary screening method in the Pharmaceutical Sterility Testing market. Manufacturers use bioburden testing to assess microbial load before terminal sterilization. Early-stage contamination detection reduces downstream failure risk. Process control strategies prioritize bioburden limits across manufacturing steps. Medical device and sterile drug production rely heavily on this test.

Faster turnaround times support manufacturing schedules. Regulatory guidance emphasizes bioburden monitoring as a preventive control. Outsourced labs offer validated bioburden methods at scale. High sample volumes increase test frequency. Risk-based quality systems integrate bioburden results into release decisions.

Continuous manufacturing increases monitoring intensity. Bioburden data supports sterilization validation activities. Manufacturers seek rapid methods to shorten hold times. Method standardization improves inter-lab comparability. Training requirements remain manageable for routine testing. Global expansion of sterile manufacturing increases testing needs.

Process deviations trigger additional bioburden assessments. Cost efficiency supports broad adoption. Audit readiness strengthens dependence on consistent testing. The segment is anticipated to retain dominance due to preventive value and regulatory emphasis. Growth reflects upstream control and manufacturing scale.

Application Analysis

Sterile drugs accounted for 41.9% of growth within the application category and represent the largest demand base for sterility testing services. Injectable and ophthalmic products require stringent sterility assurance. Regulatory scrutiny remains highest for parenteral formulations. Manufacturing expansion of injectables increases testing volumes. Complex aseptic processes require frequent verification. Batch release depends on compliant sterility outcomes.

Outsourced testing supports capacity during peak production. High-value products justify comprehensive testing programs. Process changes trigger additional sterility assessments. Cold-chain and fill-finish operations raise contamination risk awareness. Biologic injectables increase analytical complexity. Global supply chains require consistent quality validation. Accelerated approvals increase testing intensity during development. Stability programs extend testing across product lifecycle.

Risk management plans emphasize sterile drug safety. Contract manufacturers rely on third-party labs for independence. Audit outcomes reinforce rigorous sterility testing. Training and documentation standards increase testing rigor. The segment is projected to remain dominant due to safety criticality and regulatory demand. Overall growth reflects injectable expansion and compliance intensity.

Services Analysis

Outsourced services represented 62.3% of growth within the services category and dominate the Pharmaceutical Sterility Testing market. Manufacturers outsource to access specialized expertise and validated methods. Capacity constraints drive external testing partnerships. Cost optimization favors variable over fixed laboratory costs. Independent testing supports regulatory confidence and audit outcomes. Outsourcing reduces capital investment in instruments and facilities.

Global CDMOs integrate testing into end-to-end offerings. Rapid turnaround requirements favor experienced service providers. Small and mid-sized firms rely on outsourcing to scale quickly. Geographic expansion increases cross-border testing needs. Method validation burdens shift to specialized labs. Staffing challenges increase reliance on external resources. Surge testing during product launches supports outsourcing growth.

Digital reporting improves data transparency for sponsors. Compliance with multiple regional standards favors expert providers. Business continuity planning includes third-party testing capacity. Specialized rapid methods drive premium outsourcing demand. Long-term contracts stabilize testing pipelines. The segment is expected to retain dominance due to flexibility, expertise access, and cost efficiency. Growth reflects manufacturing scale and regulatory complexity.

End-User Analysis

Medical devices companies accounted for 39.5% of growth within the end-user category and lead demand in the Pharmaceutical Sterility Testing market. Device sterilization validation requires extensive microbial testing. High production volumes increase routine testing needs. Diverse materials and designs raise contamination risk profiles. Regulatory pathways mandate documented sterility assurance.

Contract manufacturing expands testing requirements across product lines. Product lifecycle changes trigger revalidation testing. Global distribution necessitates consistent quality evidence. Outsourced sterilization partners increase independent testing demand. Process innovations require updated bioburden limits. Short product cycles increase testing frequency.

Risk management standards emphasize microbial control. Audit readiness drives comprehensive testing programs. Packaging integrity testing complements sterility assessments. Post-market surveillance increases follow-up testing. Complex assemblies require tailored test methods. Training and documentation expectations increase rigor.

Growth in minimally invasive devices expands sterile portfolios. Emerging markets manufacturing increases local testing demand. The segment is anticipated to remain dominant due to regulatory rigor and production scale. Overall growth reflects device innovation and compliance intensity.

Key Market Segments

By Product Type

- Kits & Reagents

- Instruments

By Test Type

- Bioburden Testing

- Sterility Testing

- Bacterial Endotoxin Testing

- ATP Bioluminescence

- Fluorescent Labeling

- Others

By Application

- Sterile Drugs

- Biologics and Therapeutics

- Medical Devices

By Services

- Outsourced

- In-House

By End-user

- Medical Devices Companies

- Compounding Pharmacies

- Pharmaceutical Companies

Drivers

Increasing number of drug recalls due to contamination is driving the market. The rising incidence of drug recalls linked to contamination has heightened the demand for robust sterility testing in pharmaceutical manufacturing. Regulatory agencies require thorough testing to ensure product safety and prevent public health risks from contaminated medications. Manufacturers are investing in advanced testing protocols to comply with stringent standards and avoid costly recalls.

The focus on quality control has intensified as contamination can lead to severe consequences, including patient harm and financial losses. Pharmaceutical companies are adopting more rigorous sterility measures to maintain market trust and regulatory approval. Enhanced testing helps identify potential issues early in the production process, reducing the likelihood of batch failures.

Government oversight has increased, pushing the industry toward proactive sterility assurance strategies. Improved diagnostic tools are being integrated to detect contaminants more effectively. The economic burden of recalls motivates firms to prioritize comprehensive testing regimes. According to the U.S. Food and Drug Administration’s FY2024 Report on the State of Pharmaceutical Quality, there were 260 drug recall events in FY2024, representing a 15% increase from FY2023.

Restraints

Deficiencies in aseptic processing practices is restraining the market. Inadequate aseptic techniques in pharmaceutical facilities hinder effective sterility testing and overall market progress. Inspections often reveal failures in maintaining sterile environments, leading to production delays and regulatory actions. Companies face challenges in training personnel to adhere to strict aseptic protocols, impacting testing reliability.

Non-compliance with good manufacturing practices results in increased scrutiny and potential facility shutdowns. The complexity of aseptic processes requires significant resources, straining smaller manufacturers. Persistent issues in environmental monitoring contribute to higher rates of false positives in sterility tests.

Regulatory warnings highlight the need for improved validation of aseptic methods, yet implementation lags. Contaminated equipment and improper handling exacerbate testing inaccuracies. Addressing these deficiencies demands substantial investment in infrastructure and expertise. According to the U.S. Food and Drug Administration, in a 2024 warning letter following a 2023 inspection, Central Admixture Pharmacy Services initiated voluntary recalls of sterile drug products due to lack of sterility assurance.

Opportunities

Development of rapid microbiological methods is creating growth opportunities. Rapid microbiological methods offer faster results compared to traditional testing, enabling quicker product release. These innovations reduce testing timelines from weeks to days, enhancing operational efficiency. Pharmaceutical firms can accelerate drug development cycles with reliable rapid detection technologies. Regulatory bodies are supporting the validation of these methods for sterility assurance.

Integration of automation in rapid testing minimizes human error and improves accuracy. The methods are particularly useful for time-sensitive biologics and gene therapies. Collaborative efforts between industry and regulators facilitate broader adoption. Investment in research is yielding more sensitive detection capabilities for low-level contaminants.

Rapid methods align with the need for real-time monitoring in continuous manufacturing. In May 2024, the U.S. Food and Drug Administration’s Center for Biologics Evaluation and Research presented on the evaluation and implementation of rapid microbial methods at the Regulatory Education for Industry annual conference.

Impact of Macroeconomic / Geopolitical Factors

Global economic stability stimulates pharmaceutical production volumes, heightening the need for rigorous sterility testing to comply with expanding regulatory demands worldwide. Executives capitalize on surging healthcare budgets in emerging markets, which bolsters investments in advanced testing kits and services for biologics and generics alike.

Nevertheless, fluctuating inflation rates elevate operational expenditures for testing facilities, compelling providers to optimize resource allocation amid rising energy and labor demands. Geopolitical shifts toward protectionism encourage reshoring of drug manufacturing, which amplifies local testing requirements and creates new opportunities for regional service expansions.

Tensions in global trade routes, however, provoke supply chain interruptions for essential reagents, urging companies to adapt through contingency planning and diversified partnerships. Current US tariffs, including a 100% duty on branded imported pharmaceuticals unless firms commit to domestic plant construction, intensify pricing pressures on foreign-sourced testing materials and indirectly constrain international collaborations.

American enterprises respond by prioritizing U.S.-based innovations in rapid microbiology methods, which enhances competitiveness and aligns with national security priorities. Evolving regulatory harmonization and technological integrations in automated systems ultimately reinforce the market’s resilience, paving the way for accelerated growth and superior quality assurance across the industry.

Latest Trends

Adoption of rapid microbiological methods is a recent trend. The pharmaceutical industry is increasingly incorporating rapid microbiological methods to streamline sterility testing processes. These methods provide expedited detection of microbial contamination, supporting faster decision-making. Advances in technology, such as PCR and bioluminescence, are gaining traction for their precision.

Regulators are updating frameworks to accommodate these innovative approaches in quality control. Manufacturers benefit from reduced inventory holding times due to quicker test outcomes. The trend is driven by the need to handle complex biologics requiring swift sterility verification. Training programs are evolving to equip staff with skills for operating rapid systems.

Environmental sustainability is enhanced through less resource-intensive testing. Global harmonization efforts are promoting standardized use of rapid methods. According to the U.S. Food and Drug Administration’s Bacteriological Analytical Manual update in July 2024, rapid methods for detecting foodborne pathogens are included in Appendix 1, reflecting ongoing refinements for microbiological analyses.

Regional Analysis

North America is leading the Pharmaceutical Sterility Testing Market

North America accounted for 48.8% of the overall market in 2024, and the Pharmaceutical Sterility Testing market expanded as drug manufacturers intensified quality assurance across injectable drugs, biologics, and advanced therapies. Strong production volumes of sterile injectables, vaccines, and cell-based products increased routine sterility verification requirements.

Regulatory scrutiny from health authorities pushed companies to adopt rapid and validated microbial testing methods to minimize contamination risks. Growth in contract manufacturing and outsourcing further supported demand for third-party sterility testing services. Increased focus on patient safety and batch-release accuracy reinforced testing frequency across production cycles.

The U.S. Food and Drug Administration conducted over 3,000 domestic pharmaceutical manufacturing inspections in fiscal year 2023, highlighting strict compliance oversight driving testing adoption. Automation and rapid microbiology technologies improved turnaround times. These factors collectively supported robust market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong growth during the forecast period as the Pharmaceutical Sterility Testing market benefits from rapid expansion of pharmaceutical manufacturing and biologics production. Governments promote domestic drug manufacturing through policy incentives, increasing sterile production capacity.

Rising exports of injectables and biosimilars require strict adherence to international sterility standards. Pharmaceutical companies invest in modern microbiology laboratories to support faster batch release and global compliance. Growth in contract research and manufacturing organizations strengthens regional testing demand.

The World Health Organization reported that Asia Pacific accounted for over 60% of global vaccine manufacturing capacity in 2022, underscoring the need for extensive sterility verification. Workforce training and lab automation further enhance testing capabilities. These developments position the region for sustained and accelerated market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Pharmaceutical Sterility Testing market drive growth by adopting rapid microbiological methods that significantly reduce release timelines for injectables, biologics, and cell-based therapies. Companies expand demand by integrating automation, closed systems, and digital data capture that improve accuracy and compliance with global regulatory expectations.

Commercial strategies emphasize long-term partnerships with drug manufacturers and CDMOs that require reliable, high-throughput sterility assurance across development and commercial stages. Innovation priorities focus on alternative testing technologies, contamination detection speed, and validation support to replace traditional culture-based methods.

Market expansion targets regions scaling sterile drug manufacturing capacity and tightening quality oversight. Charles River Laboratories operates as a leading participant by combining advanced sterility testing platforms, deep regulatory expertise, and global laboratory infrastructure that supports critical quality control for pharmaceutical producers worldwide.

Top Key Players

- SGS SA

- Eurofins Scientific

- Intertek Group plc

- Charles River Laboratories

- SGS Life Sciences

- Toxikon Corporation

- Nelson Laboratories

- Labcorp (Laboratory Corporation of America)

- Bureau Veritas

- QIMA

Recent Developments

- In June 2025, Berkshire Sterile Manufacturing, a fill finish contract manufacturer based in Lee, Massachusetts, announced that it had enabled in house sterility testing through a newly commissioned isolator system. By performing sterility testing on site for GMP manufactured batches, the company expects to shorten product release timelines for its clients, reducing reliance on external laboratories and improving overall manufacturing efficiency.

- In January 2024, Rapid Micro Biosystems revealed plans to introduce its Growth Direct rapid sterility testing application by the middle of the year. The system is designed to accelerate sterility test results compared with traditional methods, supporting faster batch disposition for pharmaceutical and biologics manufacturers while maintaining regulatory compliance.

Report Scope

Report Features Description Market Value (2024) US$ 1.8 Billion Forecast Revenue (2034) US$ 5.4 Billion CAGR (2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits & Reagents and Instruments), By Test Type (Bioburden Testing, Sterility Testing, Bacterial Endotoxin Testing, ATP Bioluminescence, Fluorescent Labeling and Others), By Application (Sterile Drugs, Biologics and Therapeutics and Medical Devices), By Services (Outsourced and In-House), By End-User (Medical Devices Companies, Compounding Pharmacies and Pharmaceutical Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SGS SA, Eurofins Scientific, Intertek Group plc, Charles River Laboratories, SGS Life Sciences, Toxikon Corporation, Nelson Laboratories, Labcorp, Bureau Veritas, QIMA. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmaceutical Sterility Testing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Sterility Testing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- SGS SA

- Eurofins Scientific

- Intertek Group plc

- Charles River Laboratories

- SGS Life Sciences

- Toxikon Corporation

- Nelson Laboratories

- Labcorp (Laboratory Corporation of America)

- Bureau Veritas

- QIMA