Global Pastry Mixes Market Size, Share, And Industry Analysis Report By Product Type (Puff Pastry Mixes, Shortcrust Pastry Mixes, Danish and Croissant Mixes, Choux Pastry Mixes), By Nature (Organic, Conventional), By Sales Channel (Bakery and Patisserie, Foodservice and HoReCa, Industrial and In-store Baking, Home Baking), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176215

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

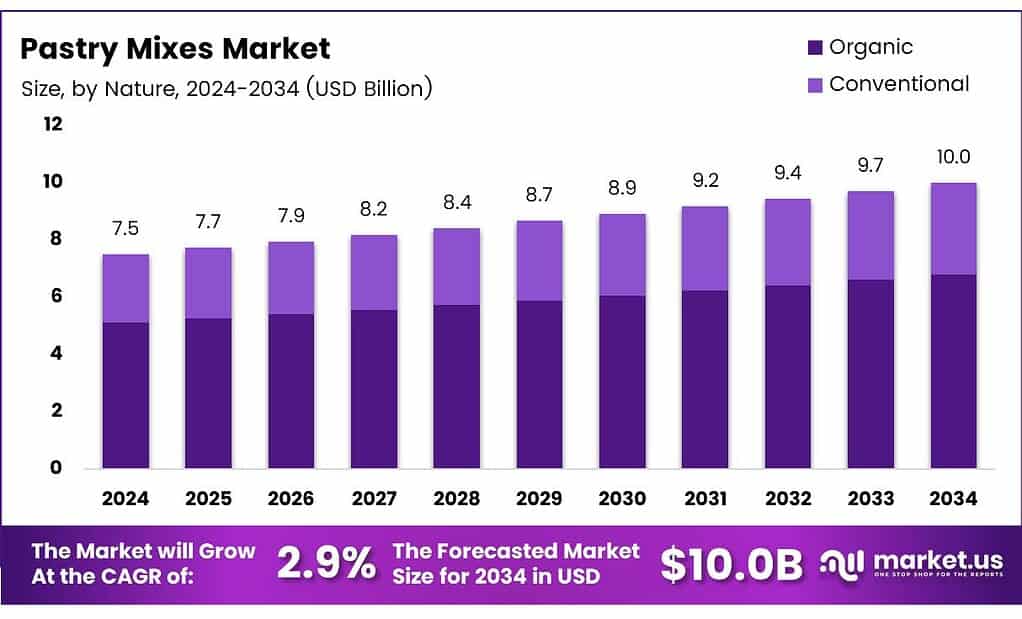

The Global Pastry Mixes Market size is expected to be worth around USD 10.0 billion by 2034, from USD 7.5 billion in 2024, growing at a CAGR of 2.9% during the forecast period from 2025 to 2034.

The Pastry Mixes Market refers to ready-to-use dry blends formulated for preparing pastries, brioche, tarts, and laminated bakery products. These mixes simplify bakery operations by reducing preparation time, improving consistency, and supporting large-scale commercial baking. The market grows steadily as foodservice chains adopt standardized mixes for efficient production.

Moving forward, rising consumer demand for convenient baking solutions boosts market attractiveness. Home bakers and cafés prefer pastry mixes because they ensure texture stability, reduce batch failures, and enhance flavor uniformity. Growing interest in premium bakery categories—such as artisanal brioche, puff pastries, and filled pastries—also supports expansion, particularly in urban and semi-urban regions.

- Replacing wheat flour with whole-grain barley flour alters pastry quality, with 40% causing darker color, reduced flakiness, and lower acceptability, while 20–30% shows only slight flakiness loss, supporting fiber-rich mix innovation. Likewise, brioche’s shaping, proofing, egg-washing, and 230°C baking standards help manufacturers create mixes that meet required texture and thermal performance for diverse bakery applications.

Global bakery manufacturers increasingly invest in clean-label formulations, enabling healthier pastry mix portfolios using natural flavors, specialty grains, and low-sugar bases. Governments in several regions support bakery modernization through food-processing grants, packaging upgrades, and small-enterprise financing, indirectly strengthening demand for pastry ingredients and standardized mixes.

The market benefits from a steady rise in café culture and quick-service restaurants adopting ready-baking solutions to streamline labor. Opportunities emerge in fortified pastry mixes, gluten-reduced variants, and regional flavor blends. These innovations help brands tap into evolving consumer preferences for indulgence combined with better nutritional value.

Key Takeaways

- The Global Pastry Mixes Market is expected to reach USD 10.0 billion by 2034, growing from USD 7.5 billion in 2024 at a 2.9% CAGR.

- Puff Pastry Mixes dominate the product type segment with a 37.1% market share in 2025.

- Conventional pastry mixes lead the nature segment with a strong 79.4% share.

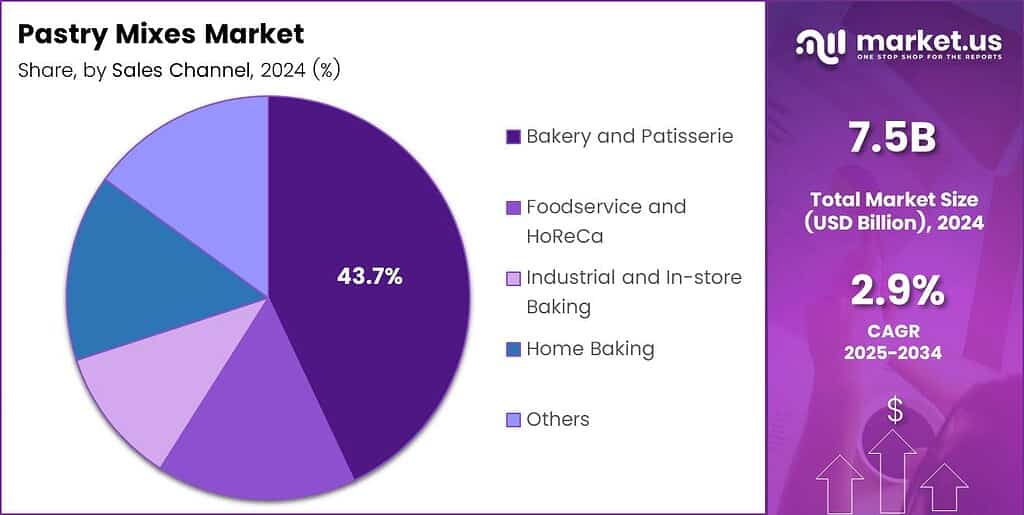

- Bakery & Patisserie outlets account for the largest share in sales channels at 43.7%.

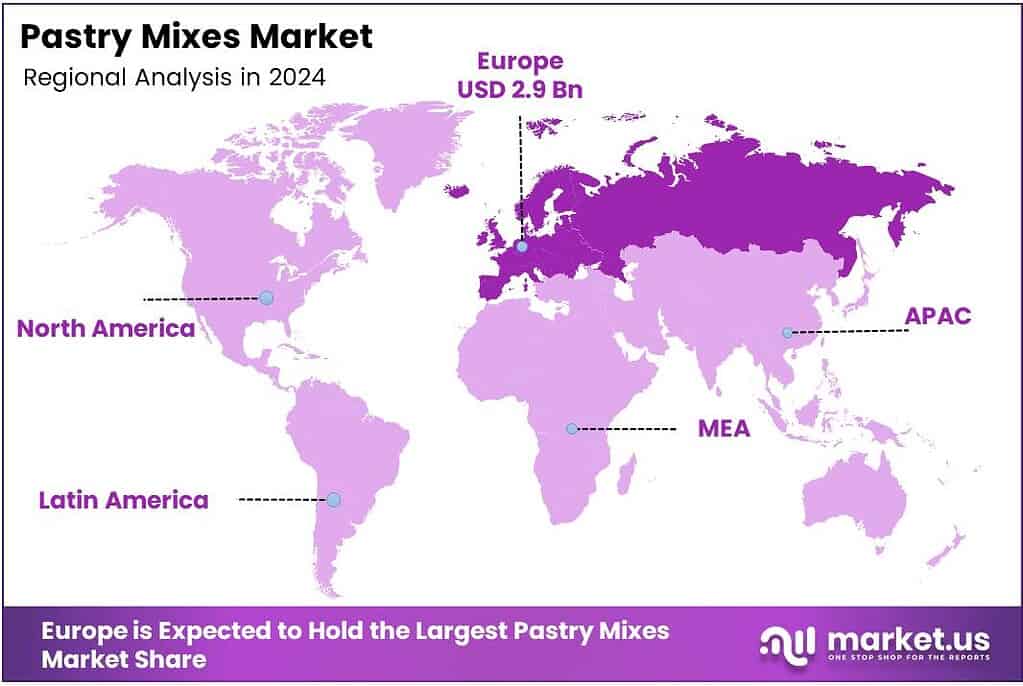

- Europe remains the leading region with a 39.6% market share valued at USD 2.9 billion.

By Product Type Analysis

Puff Pastry Mixes dominate with 37.1% due to their wider use in commercial and retail baking applications.

In 2025, Puff Pastry Mixes held a dominant market position in the By Product Type segment of the Pastry Mixes Market, with a 37.1% share. This segment benefits from strong usage in both industrial and artisanal bakeries. Additionally, rising demand for ready-to-bake laminated dough supports consistent adoption across global markets.

Shortcrust Pastry Mixes continue expanding as consumers seek convenient solutions for pies, tarts, and bakery staples. This sub-segment grows steadily as food retailers and home bakers use versatile mixes for sweet and savory preparations. Increased usage in frozen and chilled bakery categories also enhances its long-term market relevance.

Danish and Croissant Mixes gain momentum as foodservice chains scale breakfast-focused offerings. Rising café culture accelerates the adoption of laminated pastry formats. Their higher butter content and premium sensory appeal attract professional bakers looking for consistency and speed. Growing demand for European-style pastries further strengthens segment performance across urban markets.

Choux Pastry Mixes register stable growth as bakeries expand portfolios of éclairs, profiteroles, and specialty desserts. Their precision-based formulation helps achieve consistent aeration and texture. Meanwhile, the Others category includes niche pastry bases used in regional desserts, contributing incremental revenue as consumers explore diversified bakery experiences worldwide.

By Nature Analysis

Conventional products dominate with 79.4% because of affordability and broad commercial demand.

In 2025, Conventional Pastry Mixes held a dominant market position in the By Nature segment of the Pastry Mixes Market, with a significant 79.4% share. Widespread adoption across industrial bakeries, foodservice suppliers, and retail brands strengthens this segment. Cost-effectiveness and bulk availability continue driving large-scale commercial usage globally.

Organic Pastry Mixes experience steady expansion as consumers shift toward clean-label formulations. Growth is supported by rising interest in healthier bakery alternatives, free-from additives, and synthetic enhancers. Although the segment remains smaller than conventional offerings, continuous improvements in organic ingredient sourcing help sustain increasing adoption among premium bakery consumers.

By Sales Channel Analysis

The bakery and pâtisserie sector dominates at 43.7%, driven by consistent professional demand for high-performance mixes.

In 2025, Bakery and Patisserie outlets held a dominant market position in the By Sales Channel analysis segment of the Pastry Mixes Market, with a strong 43.7% share. Professional bakers rely on standardized mixes to reduce preparation time while maintaining quality. Urban expansion of specialty pastry shops further accelerates segment growth.

Foodservice and HoReCa channels show sustained demand as restaurants, cafés, and hotels expand dessert menus. Ready-to-use pastry mixes help streamline operations and reduce labor costs. Growing breakfast and café culture supports adoption, especially for croissants, Danish pastries, and puff-based bakery items offered across dine-in and takeaway formats.

Industrial and In-store Baking remains essential for the mass production of packaged pastries. Automated systems require a consistent mix of quality to promote steady usage. Supermarkets and hypermarkets leverage in-store baking to increase fresh bakery sales. This segment continues benefiting from large-scale procurement and standardized pastry formats catering to high-volume distribution needs.

Home Baking grows gradually as consumers experiment with convenient pastry solutions. Increased interest in cooking at home, especially during festive seasons, supports mixed purchases. Additionally, the Others category contributes niche revenues through specialty stores and local suppliers that offer tailored pastry bases for regional or artisanal applications.

Key Market Segments

By Product Type

- Puff Pastry Mixes

- Shortcrust Pastry Mixes

- Danish and Croissant Mixes

- Choux Pastry Mixes

- Others

By Nature

- Organic

- Conventional

By Sales Channel

- Bakery and Patisserie

- Foodservice and HoReCa

- Industrial and In-store Baking

- Home Baking

- Others

Emerging Trends

Increasing Shift Toward Premium and Artisan-Style Pastry Mixes Shapes Market Trends

A major trend in the pastry mixes market is the rising demand for premium, artisanal-style mixes. Consumers want mixes that replicate the taste and texture of bakery-quality pastries at home, driving innovation in formulations. Clean-label and natural ingredient trends also influence product development.

- More brands are removing artificial additives and highlighting transparency in ingredients, meeting evolving consumer expectations. The National Restaurant Association forecast that the overall foodservice industry would reach USD 1.5 trillion in sales in 2025, indicating a very large demand pool for back-of-house inputs, including dessert bases and bakery-ready mixes.

Digital marketing trends, including recipe videos, influencer collaborations, and home-baking content, play a key role in shaping purchasing behavior. These social trends inspire consumers to experiment with baking at home using easy-to-prepare mixes.

Drivers

Rising Preference for Convenient Baking Solutions Drives Market Growth

The pastry mixes market is growing steadily as consumers increasingly choose convenient baking options that save time and effort. Busy lifestyles, especially in urban regions, encourage households to replace traditional baking with ready-to-use pastry mixes. This shift improves market demand as consumers look for simple yet high-quality baking products.

- Per-capita wheat flour use was 128.9 pounds in 2024. Even though this number is notlimited to pastry mixes only, it shows how large and enduring flour-based eating occasions remain, giving baking mixes a stable base to compete for share by saving time and improving repeatability.

Moreover, restaurants, cafés, and small bakeries use pastry mixes to ensure consistency and reduce labor costs. Foodservice outlets prefer these products because they speed up production and help manage ingredient inventory more effectively. As a result, commercial usage boosts overall market growth.

Restraints

High Dependence on Raw Material Prices Restrains Market Expansion

One key restraint for the pastry mixes market is the fluctuation in raw material prices. Ingredients like wheat flour, sugar, dairy powders, and flavorings are sensitive to global supply chain disruptions. When production costs rise, manufacturers face challenges in maintaining affordable pricing for consumers.

- Additionally, increasing health consciousness may limit demand for traditional pastry mixes. Many consumers worry about preservatives, high sugar content, and artificial additives. In Europe, in 2024, sales revenues of EUR 4.3 billion, underlining how large mainstream baking and dessert businesses continue to be outside the U.S.

Supermarkets and local bakeries often offer fresh pastries at attractive prices, reducing reliance on ready-mix products. This affects market growth in regions where fresh bakery culture is strong. Limited consumer awareness in rural and developing regions also slows market expansion. Many households still prefer traditional baking methods and do not consider pastry mixes a necessary purchase.

Growth Factors

Growing Demand for Specialty and Health-Focused Mixes Creates Market Opportunities

The pastry mixes market has significant growth opportunities as consumers show interest in specialty bakery products. Gluten-free, keto-friendly, vegan, and organic pastry mixes are becoming more popular, encouraging manufacturers to expand premium product lines.

The rapid rise of e-commerce creates new sales avenues. Online platforms allow brands to reach consumers directly, offer customization, and promote niche baking products. Subscription-based baking kits also present a growing opportunity for recurring revenue.

Emerging markets such as Asia-Pacific, Latin America, and the Middle East offer strong expansion potential. Rising disposable incomes, exposure to Western bakery culture, and urbanization contribute to higher demand for ready-to-use pastry solutions.

Regional Analysis

Europe Dominates the Pastry Mixes Market with a Market Share of 39.6%, Valued at USD 2.9 Billion

Europe holds the leading position in the global pastry mixes market, driven by strong bakery culture, rising convenience food adoption, and high household usage of ready-to-bake mixes. The region’s substantial 39.6% market share and valuation of USD 2.9 billion reflect consistent demand for premium and specialty pastry mixes. Growth is further supported by expanding retail bakeries and an increasing shift toward home baking across countries such as Germany, France, and the U.K.

North America remains a significant market owing to its well-established packaged food sector and widespread acceptance of ready-made baking products. Rising consumer interest in fast-preparation bakery items and increasing experimentation with artisanal and flavored pastry mixes support steady market expansion. Strong retail penetration across the U.S. and Canada keeps demand stable, especially among busy working households.

Asia Pacific is witnessing the fastest growth due to rapid urbanization, evolving dietary habits, and increasing exposure to Western-style baked goods. Countries such as China, India, Japan, and South Korea are driving demand as young consumers adopt convenient baking solutions. Expanding modern retail and rising disposable incomes further propel market potential in this region.

Latin America experiences moderate growth, fueled by increasing household consumption of ready-to-use bakery mixes and the rising popularity of Western dessert formats. Markets such as Brazil, Mexico, and Argentina are contributing to the region’s expansion through higher retail accessibility and growing interest in home baking. Economic improvements and broader supermarket penetration continue to support long-term demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Pastry Mixes Market in 2025 reflects steady expansion as consumers increasingly prefer convenient, ready-to-bake solutions that ensure consistency and quality. Among the leading companies shaping this landscape,

Associated British Foods plc continues to strengthen its position through its diversified bakery ingredients portfolio. The company benefits from strong retail penetration and rising demand for premium pastry mixes aligned with evolving home-baking trends.

Bakels Group maintains notable momentum in 2025, driven by its focus on innovation and clean-label formulations. Its specialty pastry mixes have gained traction, particularly in commercial and artisanal bakery channels, supported by strong distributor networks across mature and emerging markets. The company’s emphasis on technical support also enhances customer loyalty.

Puratos Group remains a critical market influencer with its deep expertise in bakery technologies and growing presence in value-added pastry solutions. Its investments in fermentation, plant-based ingredient systems, and sensory-driven R&D help the company address global shifts toward healthier indulgence while supporting industrial bakeries with reliable, scalable mix formulations.

Dawn Foods continues to leverage its strong footprint in North America and Europe, offering versatile pastry mixes that cater to both retail and foodservice demands. Its strategic focus on customization, flavor diversity, and sustainability aligns well with the needs of commercial bakeries looking for high-performance mixes that reduce preparation time and ensure product uniformity.

Top Key Players in the Market

- Associated British Foods plc

- Bakels Group

- Puratos Group

- Dawn Foods

- ADM

- Mavee Foods

- Rich Products Corporation

- King Arthur Baking Company

- General Mills, Inc

- Tropolite Foods Marketing LLC

- AB Mauri

Recent Developments

- In 2025, Associated British Foods plc (ABF) has been focusing on growth in its ingredients division, expecting sales increases in yeast, bakery ingredients, and specialty ingredients for the year. The company’s product portfolio continues to emphasize bakery mixes and concentrates for products like bread, cake, and dough, alongside animal feed mixes.

- In 2025, Bakels Group has been actively publishing insights on bakery trends, highlighting health-conscious indulgence for 2026, such as combining premium ingredients with protein and weight management claims, with a rise in related food launches noted.

Report Scope

Report Features Description Market Value (2024) USD 7.5 Billion Forecast Revenue (2034) USD 10.0 Billion CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Puff Pastry Mixes, Shortcrust Pastry Mixes, Danish and Croissant Mixes, Choux Pastry Mixes, Others), By Nature (Organic, Conventional), By Sales Channel (Bakery and Patisserie, Foodservice and HoReCa, Industrial and In-store Baking, Home Baking, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Associated British Foods plc, Bakels Group, Puratos Group, Dawn Foods, ADM, Mavee Foods, Rich Products Corporation, King Arthur Baking Company, General Mills, Inc, Tropolite Foods Marketing LLC, AB Mauri Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Associated British Foods plc

- Bakels Group

- Puratos Group

- Dawn Foods

- ADM

- Mavee Foods

- Rich Products Corporation

- King Arthur Baking Company

- General Mills, Inc

- Tropolite Foods Marketing LLC

- AB Mauri