Global Frozen Bakery Additives Market Size, Share, Statistics Analysis Report By Product (Port Wine, Vermouth, Sherry, Marsala, Madeira, Others), By Alcohol Content (Below 15%, 15% to 20%, Above 20%), By Distribution Channel (Pub, Bars and Restaurants, Internet Retailing, Liquor Stores, Supermarkets, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: April 2025

- Report ID: 146936

- Number of Pages: 254

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

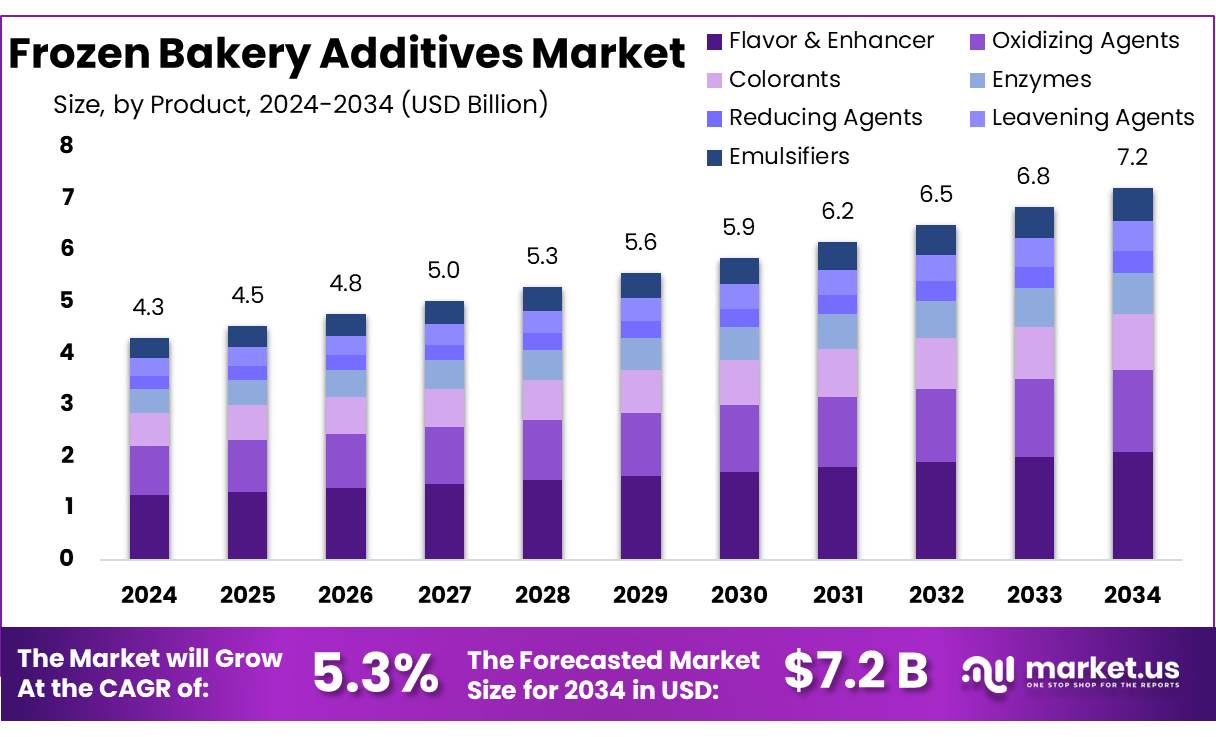

The Global Frozen Bakery Additives Market size is expected to be worth around USD 7.2 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The frozen bakery additives market has become a pivotal segment within the broader bakery industry, providing essential ingredients that enhance the quality, shelf life, and sensory attributes of frozen bakery products. Frozen bakery additives include emulsifiers, preservatives, stabilizers, enzymes, and oxidizing agents used across breads, pastries, cakes, and other baked goods to maintain freshness during storage and distribution.

According to the Food and Agriculture Organization (FAO) of the United Nations, the global bakery product consumption reached more than 115 million metric tons in 2023, underlining the rising dependence on additives to support mass production and long shelf life. The growing urbanization and demand for convenient ready-to-bake products are accelerating the adoption of high-performance additives in frozen bakery goods.

Government Initiatives and Trusted Sources Various government initiatives aimed at food safety and export quality standards also support the market growth. For example, the European Commission’s regulations on food additives, including those used in frozen bakery products, aim to enhance transparency and ensure that foods are safe for consumption across Europe. Moreover, data from the U.S. Department of Agriculture (USDA) indicates that the export of bakery products has grown by 3% annually, influenced partly by the improved quality and extended shelf life made possible by additives.

The future growth opportunities lie in the development of enzyme-based and plant-derived additives that meet clean label demands while optimizing production efficiency. The frozen bakery additives market is poised to benefit from sustainable innovation, with the European Commission allocating €10 billion under Horizon Europe (2021–2027) for research projects, including sustainable food systems. As food regulations tighten and consumers become more health-conscious, manufacturers offering natural, multifunctional additives will likely command premium positioning in the frozen bakery segment over the next decade.

Key Takeaways

- Frozen Bakery Additives Market size is expected to be worth around USD 7.2 Billion by 2034, from USD 4.3 Billion in 2024, growing at a CAGR of 5.3%.

- Flavor enhancers in the frozen bakery additives market held a dominant position, capturing more than a 29.1% share.

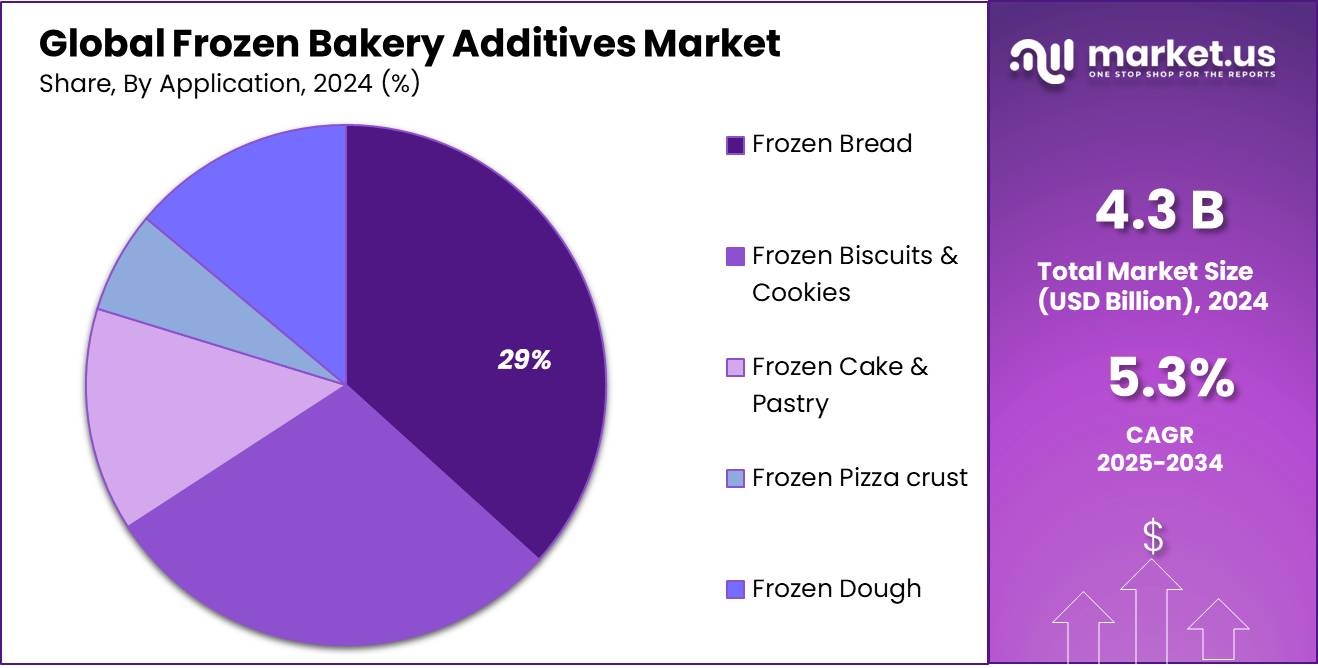

- Frozen bread maintained a dominant market position in the frozen bakery additives sector, capturing more than a 29.4% share.

- Industrial distribution channel held a dominant market position in the frozen bakery additives market, capturing more than a 47.9% share.

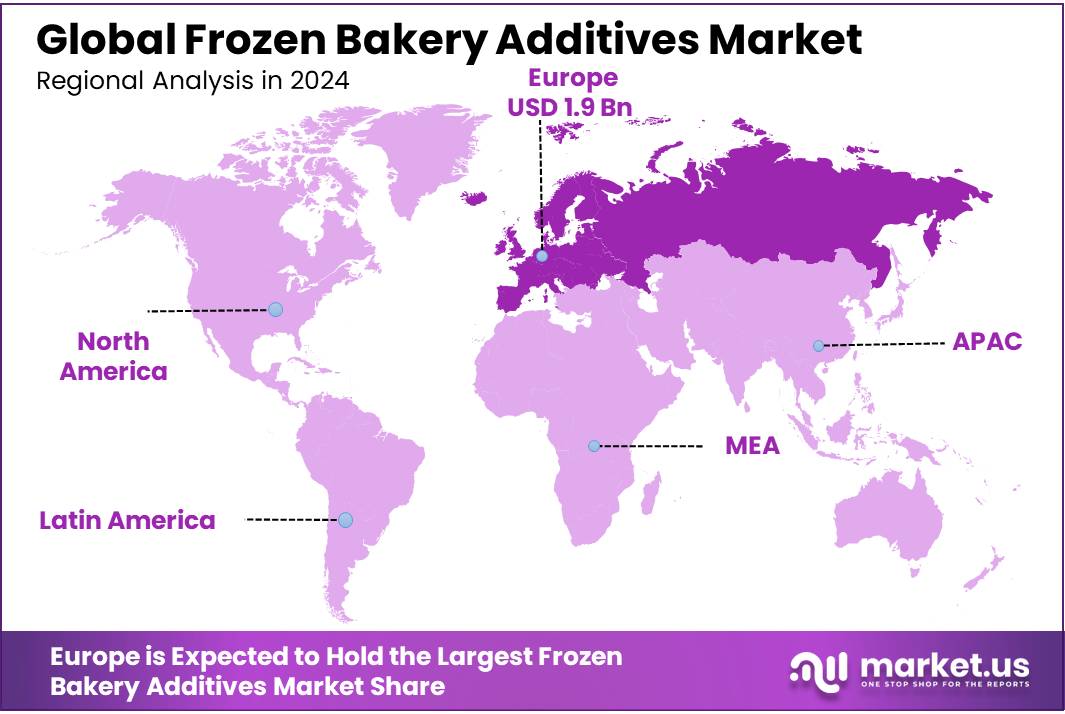

- Europe dominated the frozen bakery additives market, capturing more than 46.2% of the global share, valued at approximately USD 1.9 billion.

Analyst Viewpoint

From an investment standpoint, the frozen bakery additives market in 2024 presents both promising opportunities and notable risks. This growth is fueled by increasing consumer demand for convenient and ready-to-eat food products, particularly in urban areas where busy lifestyles drive the need for quick meal solutions . Investors may find opportunities in companies that focus on clean-label and natural additives, as there’s a significant shift towards health-conscious eating habits. However, the market also faces challenges, including stringent regulatory requirements and the high cost of natural additive alternatives, which can impact profit margins.

Consumer insights reveal a growing preference for frozen bakery products that not only offer convenience but also align with health and wellness trends. There’s an increasing demand for products with natural ingredients, minimal processing, and added nutritional benefits. Technological advancements play a crucial role in meeting these consumer expectations. Innovations in enzyme-based solutions and natural emulsifiers have improved the texture and shelf-life of frozen bakery items, making them more appealing to health-conscious consumers .

Regulatory environments are also evolving, with stricter guidelines on food additives pushing manufacturers to invest in research and development for compliant and consumer-friendly solutions. Overall, while the frozen bakery additives market offers substantial growth potential, success will depend on navigating regulatory landscapes and aligning product offerings with emerging consumer preferences.

By Product

Flavor & Enhancers Lead with a 29.1% Market Share Owing to Rising Consumer Demand for Tastier Options

In 2024, the segment of flavor enhancers in the frozen bakery additives market held a dominant position, capturing more than a 29.1% share. This significant market share is largely attributed to the growing consumer preference for enhanced taste profiles in frozen bakery products. As consumers increasingly seek convenience without compromising on taste, manufacturers have been keen to innovate and expand their offerings of flavor enhancers. These additives not only improve the taste but also the overall appeal of products such as frozen pastries, breads, and pizzas, meeting consumer expectations for high-quality, ready-to-eat options. The emphasis on flavor enhancement reflects a broader trend in the food industry, where taste continues to be a paramount consideration in purchase decisions.

By Application

Frozen Bread Maintains a Stronghold with a 29.4% Market Share, Reflecting Robust Demand

In 2024, frozen bread maintained a dominant market position in the frozen bakery additives sector, capturing more than a 29.4% share. This leading share underscores the enduring popularity of frozen bread among consumers, who value both its convenience and consistency. Frozen bread’s appeal lies in its ability to deliver a near-fresh experience to consumers who may not have the time to bake at home or purchase fresh bread daily. The segment benefits significantly from advancements in freezing technology and the development of additives that help retain the bread’s texture, flavor, and nutritional value post-thawing. As a staple in many households, frozen bread continues to be a key driver in the frozen bakery market, supported by its widespread acceptance across various consumer segments.

By Distribution Channel

Industrial Distribution Channels Command a 47.9% Market Share, Highlighting Efficiency and Scale

In 2024, the industrial distribution channel held a dominant market position in the frozen bakery additives market, capturing more than a 47.9% share. This substantial market share is indicative of the critical role that industrial buyers play in the supply chain for frozen bakery products. Industrial channels, which include large-scale manufacturers and processors, leverage these additives to ensure product quality and consistency, which are essential in meeting consumer expectations at a mass scale. The dominance of this segment is also reflective of the efficient logistics and large volume capacities that industrial channels offer, facilitating the widespread availability of enhanced frozen bakery goods across various markets. As these channels continue to optimize for efficiency and cost-effectiveness, their role in the distribution of frozen bakery additives remains pivotal.

Key Market Segments

By Product

- Flavor & Enhancer

- Oxidizing Agents

- Colorants

- Enzymes

- Reducing Agents

- Leavening Agents

- Emulsifiers

By Application

- Frozen Bread

- Frozen Biscuits & Cookies

- Frozen Cake & Pastry

- Frozen Pizza crust

- Frozen Dough

By Distribution Channel

- Industrial

- Retail

- Foodservice

Drivers

Increasing Demand for Convenience Foods Drives Growth in the Frozen Bakery Additives Market

One major driving factor for the growth of the frozen bakery additives market is the rising demand for convenience foods. As consumer lifestyles become busier and more fast-paced, the demand for ready-to-eat and easy-to-prepare food products continues to rise. According to the Food and Agriculture Organization (FAO), global food consumption is expected to grow by approximately 3.2% annually over the next few years, with convenience foods, including frozen bakery products, playing a significant role in this trend.

The increase in consumer preference for convenience foods directly boosts the demand for frozen bakery additives, which are essential in maintaining product quality, texture, and shelf life. Additives such as preservatives, emulsifiers, and flavor enhancers ensure that frozen bakery products, like bread, pastries, and pizzas, maintain their freshness and appeal even after long storage periods. This is particularly important in the context of frozen foods, where maintaining the quality of the product during freezing and thawing is critical.

Furthermore, government initiatives aimed at improving food safety standards and promoting the preservation of food products also contribute to this market’s growth. For instance, the U.S. Food and Drug Administration (FDA) and European Food Safety Authority (EFSA) regulate and oversee the use of additives in food products, ensuring their safety for consumption while also encouraging innovation in the food processing industry. These regulations create a stable and trustworthy market environment, further stimulating demand for frozen bakery additives.

Restraints

Health and Safety Concerns Over Additives Limit Frozen Bakery Additives Market Growth

A significant challenge facing the frozen bakery additives market is the growing consumer concern over the health implications of certain additives used in these products. As consumers become more health-conscious, there is an increasing demand for clean-label products that are free from artificial additives and preservatives. This shift in consumer preferences is influencing manufacturers to reconsider the types of additives they use in their products.

Studies have raised alarms about the potential health risks associated with some food additives. For instance, research published in The Lancet found that the consumption of certain emulsifiers, such as xanthan gum, is linked to an increased risk of developing type 2 diabetes. The study followed over 100,000 adults and observed that each additional daily serving of foods containing xanthan gum was associated with an 8% higher risk of developing the disease .

Latest news & breaking headlinesIn response to these concerns, regulatory bodies in various regions are tightening regulations on food additives. For example, the European Union has banned the use of titanium dioxide (E171) as a food additive, citing safety concerns. The European Food Safety Authority concluded that titanium dioxide can no longer be considered safe when used as a food additive, leading to its removal from the market . While the U.S. Food and Drug Administration (FDA) continues to evaluate the safety of titanium dioxide, the differing regulatory approaches between regions can create challenges for global manufacturers.

Opportunity

Rising Demand for Gluten-Free Products Presents Growth Opportunities

A significant growth opportunity in the frozen bakery additives market lies in the increasing demand for gluten-free products. This trend is driven by a combination of health considerations, dietary preferences, and lifestyle choices. According to the U.S. Food and Drug Administration (FDA), the prevalence of celiac disease, an autoimmune disorder triggered by gluten, is estimated to affect approximately 1 in 133 individuals in the United States. This statistic underscores the importance of gluten-free options for a substantial portion of the population.

Beyond medical necessity, there is a growing consumer inclination towards gluten-free diets as a preventive measure against various health issues, including obesity, diabetes, and cardiovascular diseases.

Government initiatives also play a pivotal role in promoting gluten-free products. For instance, the FDA’s regulation requires that foods labeled as “gluten-free” contain less than 20 parts per million of gluten, ensuring safety for individuals with celiac disease. Such regulations not only protect consumers but also encourage manufacturers to innovate and expand their gluten-free product offerings.

In response to this demand, companies are investing in research and development to create high-quality gluten-free bakery additives. These innovations aim to improve the texture, taste, and nutritional profile of gluten-free baked goods, making them more appealing to a broader consumer base. As the market for gluten-free products continues to grow, there is a significant opportunity for businesses to capitalize on this trend by developing and offering gluten-free bakery additives that meet consumer expectations and regulatory standards.

Trends

Clean Label Movement Shapes the Future of Frozen Bakery Additives

A significant trend influencing the frozen bakery additives market is the growing demand for clean label ingredients. Consumers are increasingly seeking products with transparent, natural, and recognizable ingredients, leading manufacturers to reformulate their products accordingly.

This shift is prompting a move away from synthetic additives towards natural alternatives such as plant-based emulsifiers, natural colorants, and preservatives derived from herbs and spices. For instance, the U.S. Food and Drug Administration (FDA) has announced plans to phase out petroleum-based artificial food dyes by the end of 2026, encouraging the use of natural colorants in food products .

In response to these consumer preferences and regulatory changes, companies are investing in research and development to create clean-label additives that do not compromise the quality, taste, or shelf life of frozen bakery products. This trend not only aligns with consumer demand for healthier options but also supports manufacturers in meeting evolving regulatory standards.

As the clean label movement continues to gain momentum, the frozen bakery additives market is expected to see sustained growth, driven by innovation in natural ingredients and a commitment to transparency and consumer health.

Regional Analysis

Europe Leads Frozen Bakery Additives Market with 46.2% Share, Valued at USD 1.9 Billion

In 2024, Europe dominated the frozen bakery additives market, capturing more than 46.2% of the global share, valued at approximately USD 1.9 billion. This leadership is attributed to the region’s strong tradition in bakery products, high consumer demand for convenience foods, and advanced food processing technologies.

This growth is driven by factors such as increasing disposable income, urbanization, and a shift towards processed and ready-to-eat foods. Countries like Germany, France, and the United Kingdom are leading the demand, with a preference for high-quality, long-shelf-life frozen bakery products.

The European Union’s stringent food safety regulations and support for food innovation further bolster market expansion. For instance, the EU’s emphasis on clean-label products and natural ingredients aligns with consumer preferences, encouraging manufacturers to adopt additives that enhance product quality without compromising health standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ashland specializes in innovative chemical solutions, including a variety of food additives that are integral to the frozen bakery sector. Their offerings include thickeners, stabilizers, and functional ingredients that improve the texture and stability of frozen baked goods. Ashland’s commitment to sustainable manufacturing practices and high-quality standards makes it a trusted supplier in the food additives market.

Associated British Foods Plc is a diversified international food, ingredients, and retail group with significant influence in the frozen bakery additives market. Their ingredients division produces a wide array of additives such as enzymes and emulsifiers that are essential for the frozen bakery industry. The company focuses on innovation and efficiency to meet the evolving needs of the global food market.

Cargill is a global leader in the food industry, providing food, agriculture, financial, and industrial products and services. In the frozen bakery additives market, Cargill offers a comprehensive range of products that include sweeteners, hydrocolloids, and emulsifiers. Their commitment to food safety and supply chain sustainability has made them a preferred choice for bakery additive solutions worldwide.

Top Key Players in the Market

- Archer Daniels Midland Company

- Ashland

- Associated British Foods Plc.

- Avebe

- Cargill

- Corbion

- DowDuPont

- DSM

- Kerry Group

- Lesaffre

- Novozymes A/S

- Palsgaard

- Puratos

- Tate Lyle PLC

Recent Developments

In 2024, Cargill reported revenues of $160 billion, marking a nearly 10% decline from the previous year due to global economic challenges . While specific revenue figures for its bakery additives segment are not publicly disclosed, Cargill’s comprehensive portfolio includes emulsifiers, stabilizers, and enzymes tailored for frozen bakery applications.

In 2024, ADM reported adjusted earnings per share in the range of $4.00 to $4.75 for the year, indicating weaker market fundamentals and ongoing biofuel and trade policy uncertainties. Despite these challenges, ADM’s commitment to innovation and sustainability positions it to capitalize on the growing demand for high-quality frozen bakery additives in the coming years.

Report Scope

Report Features Description Market Value (2024) USD 4.3 Bn Forecast Revenue (2034) USD 7.2 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Port Wine, Vermouth, Sherry, Marsala, Madeira, Others), By Alcohol Content (Below 15%, 15% to 20%, Above 20%), By Distribution Channel (Pub, Bars and Restaurants, Internet Retailing, Liquor Stores, Supermarkets, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, Ashland, Associated British Foods Plc., Avebe, Cargill, Corbion, DowDuPont, DSM, Kerry Group, Lesaffre, Novozymes A/S, Palsgaard, Puratos, Tate Lyle PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Frozen Bakery Additives MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Frozen Bakery Additives MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Archer Daniels Midland Company

- Ashland

- Associated British Foods Plc.

- Avebe

- Cargill

- Corbion

- DowDuPont

- DSM

- Kerry Group

- Lesaffre

- Novozymes A/S

- Palsgaard

- Puratos

- Tate Lyle PLC