Global Para Dichloro Benzene Market Size, Share Analysis Report By Form (Solid, Liquid, Gas), By Purity (High Purity, Low Purity), By Application (Pesticides, Fungicides, Herbicidal, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155244

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

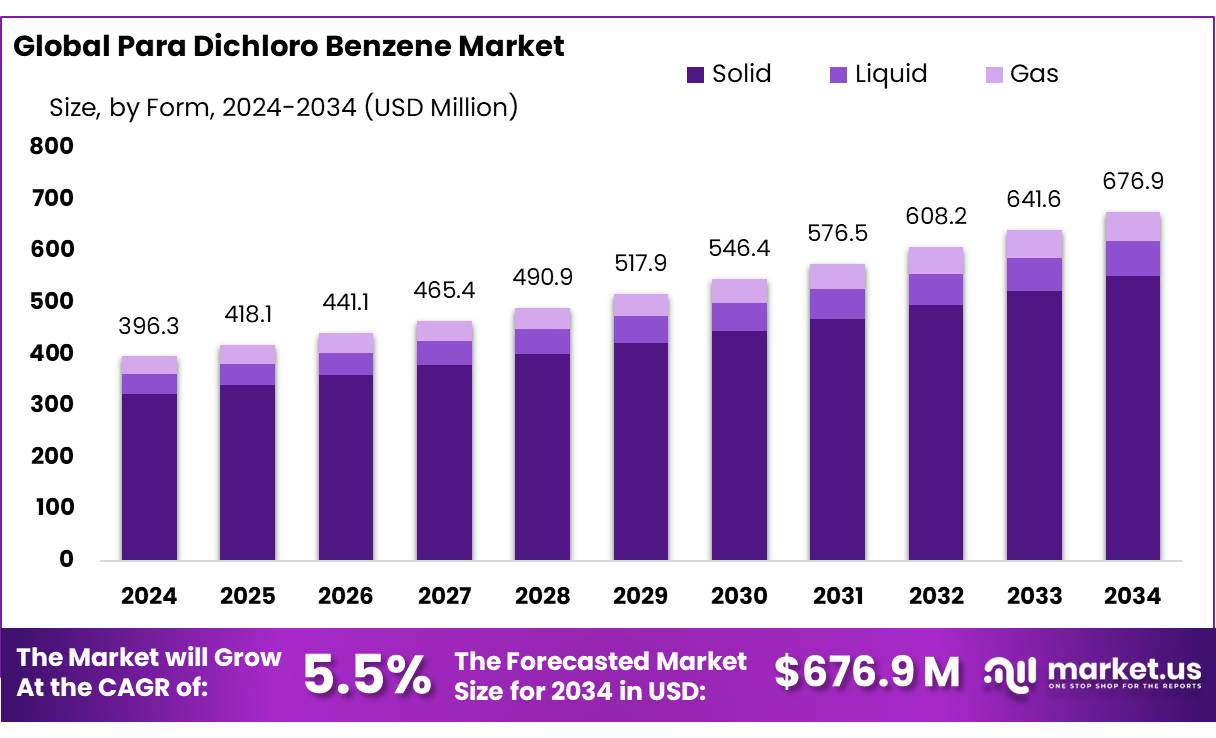

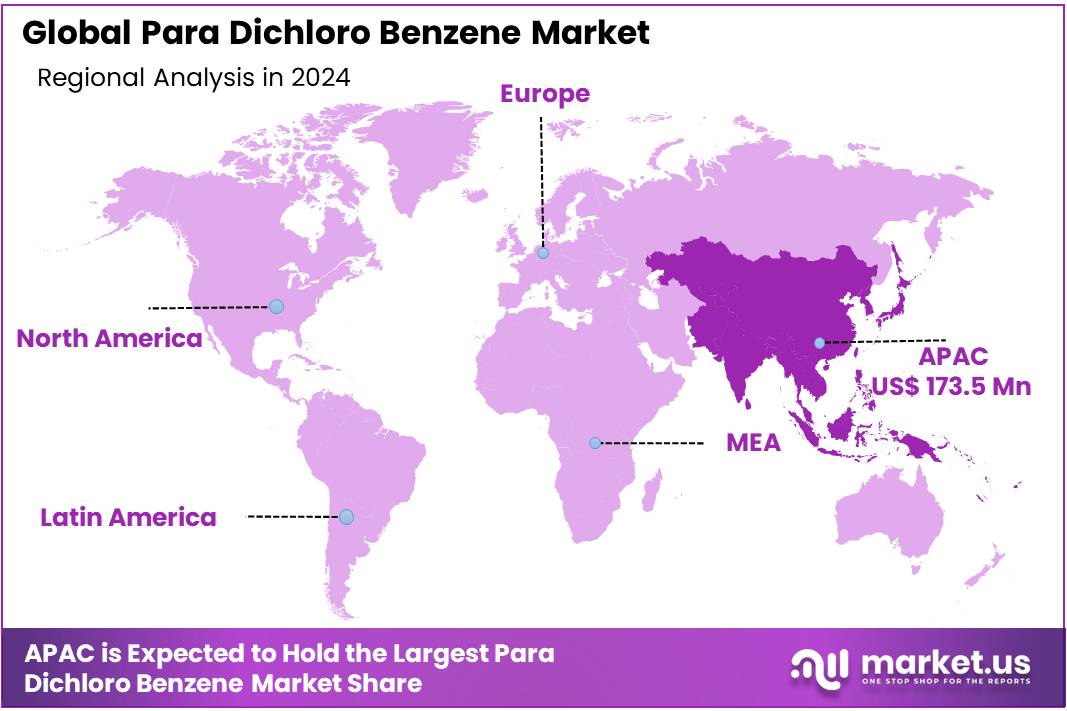

The Global Para Dichloro Benzene Market size is expected to be worth around USD 676.9 Million by 2034, from USD 396.3 Million in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 43.80% share, holding USD 173.5 Million revenue.

Para-dichlorobenzene (p-DCB; CAS 106-46-7) is a chlorinated aromatic produced by benzene chlorination and isomer separation. It’s a white, mothball-like solid used as an intermediate (notably for polyphenylene sulfide, PPS) and as an odor agent in certain deodorant blocks. In the U.S., EPA’s Chemical Data Reporting shows national manufacture+import in the range of 50–100 million lbs in 2015/2016, underscoring continued industrial relevance even as some legacy consumer uses decline.

Para-dichlorobenzene (PDCB) is a chlorinated aromatic compound extensively utilized across various industrial applications, including as a chemical intermediate, industrial solvent, and in the manufacture of moth repellents and air fresheners. In India, PDCB production is integral to the chemical sector, which contributes approximately 7% to the country’s GDP and is the sixth-largest chemicals producer globally. India ranks as the sixth-largest producer of chemicals globally and the third-largest in Asia, producing over 80,000 different chemical products.

In terms of international trade, India has demonstrated a consistent export performance for PDCB. According to data from the Ministry of Commerce and Industry, India’s exports of PDCB were valued at approximately USD 40.05 million in 2018, with a volume of around 41,665 metric tonnes. These figures indicate a stable demand for PDCB in global markets, reflecting its importance in various applications.

The demand for PDCB is driven by its widespread use in pest control products, particularly mothballs, and as a deodorizing agent in air fresheners. Additionally, PDCB serves as a crucial intermediate in the production of other chemicals, thereby supporting its continued relevance in the chemical manufacturing sector.

Key Takeaways

- Para Dichloro Benzene Market size is expected to be worth around USD 676.9 Million by 2034, from USD 396.3 Million in 2024, growing at a CAGR of 5.5%.

- Solid held a dominant market position, capturing more than an 81.5% share in the para-dichloro benzene market.

- High Purity held a dominant market position, capturing more than a 62.9% share in the para-dichloro benzene market.

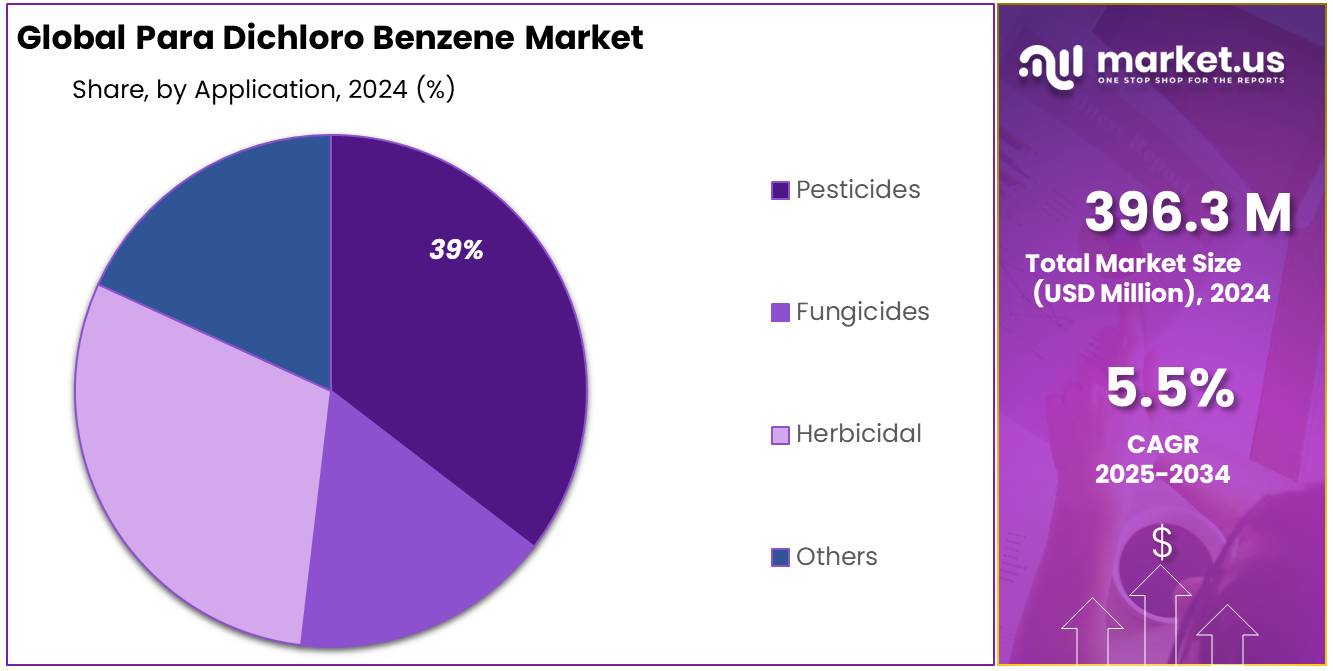

- Pesticides held a dominant market position, capturing more than a 39.8% share in the para-dichloro benzene market.

- In 2024, Asia-Pacific held a dominant market position, capturing more than a 43.80% share valued at USD 173.5 Mn.

By Form Analysis

Solid form dominates with 81.5% share driven by wide industrial use.

In 2024, Solid held a dominant market position, capturing more than an 81.5% share in the para-dichloro benzene market. This form remains the preferred choice due to its stability, ease of storage, and suitability for large-scale industrial applications such as moth repellents, deodorant blocks, and intermediate production for polyphenylene sulfide (PPS). Its solid crystalline structure ensures longer shelf life and reduced handling risks compared to liquid alternatives. Industrial buyers in 2024 favored solid p-DCB for consistent quality and cost efficiency, especially in bulk chemical manufacturing.

Moving into 2025, demand for the solid form is expected to remain strong, supported by its adaptability in closed-loop industrial processes and compliance with strict transportation and storage regulations. The consistent physical properties of solid p-DCB also make it ideal for controlled dosing in manufacturing setups, ensuring process reliability and quality control. This dominance is further reinforced by its lower volatility, which aligns well with environmental safety measures and occupational health standards.

By Purity Analysis

High Purity dominates with 62.9% share backed by premium industrial demand.

In 2024, High Purity held a dominant market position, capturing more than a 62.9% share in the para-dichloro benzene market. This grade is highly sought after in specialty chemical manufacturing, particularly for producing high-performance polymers like polyphenylene sulfide (PPS) and for use in precision applications requiring consistent chemical composition. Industries in 2024 preferred high purity p-DCB due to its superior performance, reduced impurities, and ability to meet stringent regulatory and quality standards.

Moving into 2025, the trend is expected to continue as electronics, automotive, and advanced material sectors expand, driving higher consumption of high purity grades. Its stable composition ensures better product yields and process efficiency, making it a cost-effective choice despite its premium pricing. Additionally, environmental and safety regulations are pushing manufacturers toward cleaner, high-purity inputs to reduce byproducts and emissions, further strengthening its market hold.

By Application Analysis

Pesticides dominate with 39.8% share driven by strong agricultural usage.

In 2024, Pesticides held a dominant market position, capturing more than a 39.8% share in the para-dichloro benzene market. This application benefits from p-DCB’s strong insecticidal and fumigant properties, making it effective for controlling moths, beetles, and other pests in stored grains and agricultural environments. Farmers and storage facility operators in 2024 continued to rely on p-DCB-based pesticide formulations for their long-lasting protection and cost efficiency.

The product’s stability and low volatility in solid form also make it easier to apply and store, particularly in rural supply chains. Moving into 2025, demand is expected to remain stable, supported by the need to protect crops and food stocks from post-harvest losses. Additionally, its role in integrated pest management strategies—especially in regions with high grain production—is likely to keep this application segment strong despite increasing regulatory oversight.

Key Market Segments

By Form

- Solid

- Liquid

- Gas

By Purity

- High Purity

- Low Purity

By Application

- Pesticides

- Fungicides

- Herbicidal

- Others

Emerging Trends

Emphasis on Sustainable Production and Regulatory Compliance

A notable trend in the para-dichlorobenzene (PDCB) industry is the increasing focus on sustainable production practices and adherence to stringent regulatory standards. This shift is driven by growing environmental concerns, consumer demand for safer products, and evolving government regulations aimed at reducing the ecological footprint of chemical manufacturing.

In the United States, the Environmental Protection Agency (EPA) has designated PDCB as a high-priority chemical for risk evaluation under the Toxic Substances Control Act (TSCA). This evaluation considers various factors, including potential human health risks and environmental impacts associated with PDCB exposure. The EPA’s assessment process underscores the importance of ensuring that chemicals used in consumer products do not pose unreasonable risks to public health or the environment.

Internationally, regulatory bodies have implemented measures to control the use of PDCB due to its potential health hazards. For example, the European Union has restricted the sale of PDCB as a substance or as a constituent of mixtures in concentrations equal to or greater than 1% by weight when used as an air freshener or deodorizer in indoor public areas. Such regulations reflect a global trend towards limiting exposure to chemicals that may pose health risks.

In response to these regulatory pressures, manufacturers are investing in research and development to create safer and more environmentally friendly alternatives to traditional PDCB products. This includes developing formulations with reduced toxicity and exploring biodegradable options that minimize environmental impact. These innovations not only help companies comply with regulations but also align with the growing consumer preference for sustainable and health-conscious products.

Furthermore, governments are providing incentives to encourage the adoption of green technologies in chemical manufacturing. For instance, in India, the government offers subsidies for the development of eco-friendly infrastructure under the National Livestock Mission, which can be leveraged by companies producing PDCB-based products.

Drivers

Government Support and Export Growth: Key Drivers for Para-Dichlorobenzene

A significant factor propelling the growth of para-dichlorobenzene (PDCB) in India is the robust support from the government, particularly through initiatives aimed at enhancing the chemical manufacturing sector. This support has not only bolstered domestic production but also facilitated a steady increase in exports, positioning India as a key player in the global PDCB market.

In 2018, India’s exports of para-dichlorobenzene were valued at approximately USD 40.05 million, with a volume of about 41,665 metric tonnes. These figures underscore the growing demand for PDCB in international markets, reflecting the country’s competitive manufacturing capabilities and the effectiveness of government policies in promoting chemical exports.

The Indian government’s “Make in India” initiative has been instrumental in fostering a conducive environment for the chemical industry. By encouraging domestic manufacturing and reducing import dependencies, this initiative has led to increased production capacities and enhanced export potential for chemicals like PDCB.

Furthermore, the Chemical and Allied Export Promotion Council (CAPEXIL), established by the Ministry of Commerce, plays a pivotal role in promoting the export of chemical products, including PDCB. With over 3,500 members across India, CAPEXIL facilitates market access, provides information on international standards, and supports exporters in navigating global trade dynamics.

Restraints

Health Risks and Regulatory Challenges of Para-Dichlorobenzene (PDCB)

Para-dichlorobenzene (PDCB), commonly found in mothballs, deodorizers, and fumigants, poses significant health risks, particularly concerning neurotoxicity. Prolonged exposure to PDCB can lead to serious neurological effects, including leukoencephalopathy, cognitive decline, ataxia, and peripheral neuropathy. These conditions arise due to the chemical’s lipophilic nature, allowing it to accumulate in fatty tissues, including the brain, leading to demyelination and neuronal damage .

The toxicity of PDCB is not limited to accidental ingestion; chronic exposure, even at low levels, can be harmful. For instance, a study found that 98% of U.S. adults had detectable levels of PDCB in their urine, indicating widespread environmental exposure . This ubiquitous presence raises concerns about its cumulative effects on public health.

In response to these health concerns, regulatory bodies have implemented measures to limit PDCB exposure. For example, the California Environmental Protection Agency has identified PDCB as a chemical of concern due to its potential health impacts and has taken steps to reduce its presence in consumer products. Such regulations aim to protect public health by minimizing exposure to harmful substances.

Despite these efforts, challenges remain in fully addressing the risks associated with PDCB. The chemical’s widespread use in household products and its persistence in the environment complicate efforts to reduce exposure. Additionally, there is a need for more comprehensive studies to better understand the long-term health effects of PDCB and to develop safer alternatives.

Opportunity

Growth Opportunities for Para-Dichlorobenzene (PDCB) in Emerging Markets

Para-Dichlorobenzene (PDCB) continues to find diverse applications across various industries, including household products, agriculture, and chemical manufacturing. In emerging markets, particularly in Asia-Pacific and Latin America, the demand for PDCB is experiencing growth due to factors such as urbanization, industrialization, and increased consumer awareness of hygiene and pest control.

In India, for instance, the government’s initiatives to promote sustainable agriculture and improve pest management practices are driving the adoption of PDCB-based products. The Ministry of Agriculture and Farmers Welfare has been actively involved in reviewing and regulating pesticide usage to ensure safety and efficacy. As of February 2023, the ministry had banned or phased out 46 pesticides and four pesticide formulations for import, manufacture, or use in the country, reflecting a commitment to enhancing agricultural practices and protecting public health .

To capitalize on these opportunities, stakeholders in the PDCB industry can focus on expanding their presence in emerging markets, developing products that cater to local needs and preferences, and collaborating with government agencies to ensure compliance with regulatory standards. Investing in research and development to create safer and more effective PDCB formulations can also enhance product appeal and market competitiveness.

Regional Insights

APAC leads with 43.80% share, worth USD 173.5 Mn in 2024.

In APAC, para-dichloro benzene (p-DCB) demand is anchored by large chemical hubs, integrated chlor-alkali capacity, and steady pull from downstream uses in pesticides, deodorant blocks, and PPS intermediates. In 2024, the region held a dominant market position, capturing more than a 43.80% share valued at USD 173.5 Mn. China’s scale in chlorination and benzene derivatives supports competitive costs and reliable bulk supply, while India’s diversified agro-inputs sector sustains year-round offtake for pesticide and storage-protection applications.

Buyers in 2024 favored APAC suppliers for short lead times and consistent crystalline quality, helped by dense port networks and contract manufacturing clusters. Compliance focus also tightened: producers invested in closed-loop handling, emissions control, and wastewater treatment to align with stricter plant audits, improving acceptance among multinational customers. In 2025, the regional outlook remains firm, with incremental capacity debottlenecking, improved rail-port logistics, and continued substitution toward higher-purity grades in specialty synthesis.

Price discipline is expected as feedstock benzene and chlorine availability stays adequate, reducing volatility and supporting stable quarterly contracts. The combination of scale, feedstock integration, and disciplined EHS practices positions APAC to sustain leadership, while localized application support—especially for pesticide formulations and PPS polymer chains—keeps utilization healthy across major markets.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, LANXESS maintained a strong position in the para-dichloro benzene market, leveraging its expertise in specialty chemicals and integrated production facilities. The company supplies high-purity p-DCB for engineering plastics such as polyphenylene sulfide (PPS) and other industrial applications. With a global presence and advanced R&D capabilities, LANXESS focuses on process efficiency, emissions control, and compliance with strict environmental standards. Its established supply chain and technical support services strengthen customer loyalty, positioning the company to capture steady demand through 2025 in both domestic and export markets.

Kureha, a Japanese chemical manufacturer, holds a notable market share in para-dichloro benzene production, particularly for high-performance applications. In 2024, its p-DCB output supported advanced PPS resin manufacturing, serving automotive, electronics, and industrial segments. Known for precision manufacturing and quality consistency, Kureha benefits from Japan’s reputation in specialty chemicals. The company emphasizes sustainable operations, including waste minimization and efficient energy use. With a focus on high-purity products and niche markets, Kureha remains a preferred supplier for industries demanding stringent quality standards, positioning itself for continued growth into 2025.

Sumitomo, a diversified Japanese conglomerate, is actively engaged in para-dichloro benzene production for both domestic and international markets. In 2024, the company prioritized high-purity supply for PPS production, agricultural chemicals, and odor-control applications. Sumitomo’s competitive advantage lies in its vertically integrated operations, secure raw material sourcing, and strong export channels across APAC. It continues to enhance production efficiency through technology upgrades and stringent quality controls. The company’s strategic expansion in developing markets and adherence to environmental compliance strengthen its long-term position, ensuring stable demand from key industrial customers into 2025.

Top Key Players Outlook

- LANXESS

- Arkema

- KUREHA

- SUMTOMO

Recent Industry Developments

In 2024, LANXESS posted €6.37 billion in total sales and achieved an EBITDA pre-exceptionals of €614 million, up nearly 20% from the prior year—despite a 5.2% dip in revenue due to lower selling prices amid weaker demand.

In FY 2024, Kureha earned consolidated net sales of ¥162,015 million, down about 8.97 % from the prior year, while net income slipped to ¥7,800 million, falling roughly 19.9 % compared to FY 2023.

Report Scope

Report Features Description Market Value (2024) USD 396.3 Mn Forecast Revenue (2034) USD 676.9 Mn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Solid, Liquid, Gas), By Purity (High Purity, Low Purity), By Application (Pesticides, Fungicides, Herbicidal, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LANXESS, Arkema, KUREHA, SUMTOMO Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Para Dichloro Benzene MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Para Dichloro Benzene MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- LANXESS

- Arkema

- KUREHA

- SUMTOMO