Global Organic Yeast Market Size, Share, And Business Benefits By Type (Yeast Extracts, Inactive Dry Yeast), By Form (Dry, Liquid), By Application (Food and Beverages, Animal Feed, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 163541

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

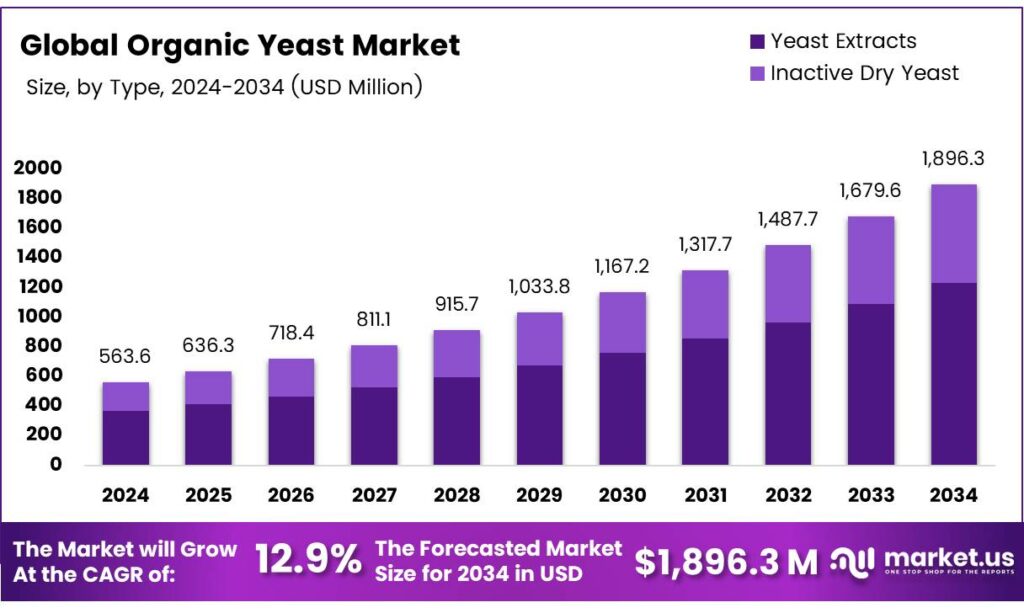

The Global Organic Yeast Market size is expected to be worth around USD 1896.3 million by 2034, from USD 563.6 million in 2024, growing at a CAGR of 12.9% during the forecast period from 2025 to 2034.

Organic yeast is cultivated and processed using raw materials sourced from organic origins. EU organic regulations permit a limited list of processing aids maximum of 5% to ensure consistent production and cultivate the desired yeast strain. In contrast to conventional yeast production, which relies on ammonia or similar compounds as a nitrogen source, organic yeast uses plant-derived nitrogen. The fermentation media, composed of various plant-based ingredients, provide the yeast with all the essential nutrients it needs for growth.

Yeast is a unicellular microorganism that has been utilized for thousands of years in the production of food and beverages. Today, it is industrially produced for applications in baking, winemaking, and beyond. Yeast requires specific nutrients for growth, including a source of sugar and nitrogen, along with vitamins, minerals, and trace elements. These one-celled fungi, typically 5–10 μm in size, are usually spherical, cylindrical, or oval and are valued for their ability to ferment carbohydrates in various substrates.

Yeasts are generally regarded as unicellular fungi and are significantly larger than bacteria. They are ubiquitous, found in soil, orchards, vineyards, the air, and the intestinal tracts of animals. As heterotrophs, yeasts utilize organic compounds for energy and do not require sunlight. Their primary carbon sources include sugars such as glucose and fructose, disaccharides like sucrose and maltose, and, in some species, pentose sugars, alcohols, or organic acids.

- Yeasts are obligate aerobes or facultative anaerobes—unlike bacteria, none grow strictly anaerobically and thrive between 10–37 °C, optimally at 30–37 °C, with stress above 37 °C, death above 50 °C, and survival (with declining viability) under freezing; they prefer neutral or slightly acidic pH. Exposing yeast to a 7% salt solution before bulk fermentation triggers glycerol buildup in the cell wall, which transfers to dough and bread during baking to enhance texture and moisture retention.

Key Takeaways

- The Global Organic Yeast Market is projected to grow from USD 563.6 million in 2024 to USD 1896.3 million by 2034 at a 12.9% CAGR.

- Yeast Extracts dominate the By Type segment with 65.9% share in 2024, driven by demand for natural umami in clean-label products.

- Dry form leads the By Form segment with 75.4% share in 2024, valued for stability and ease in baking and dry mixes.

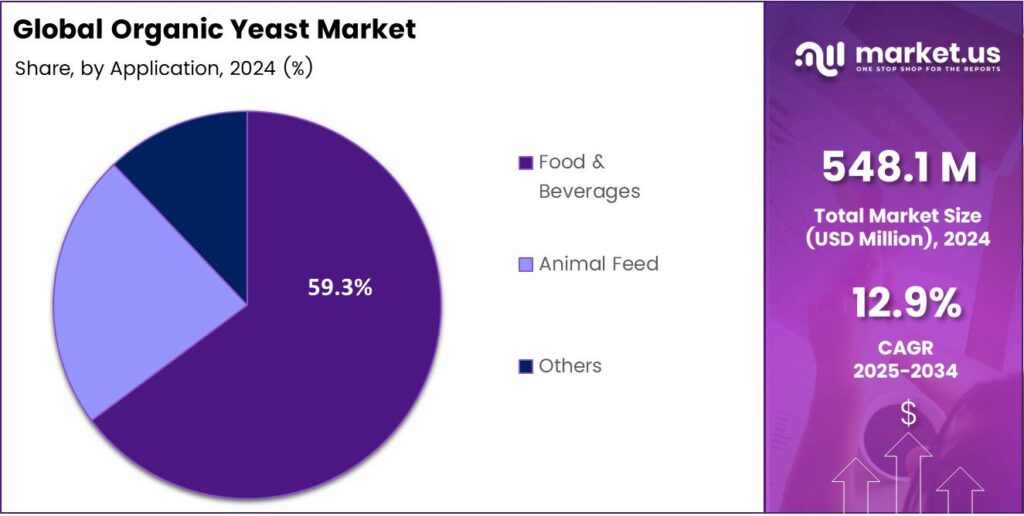

- Food and Beverages hold a 59.3% share in the By Application segment in 2024, fueled by organic trends in breads, beers, and probiotic snacks.

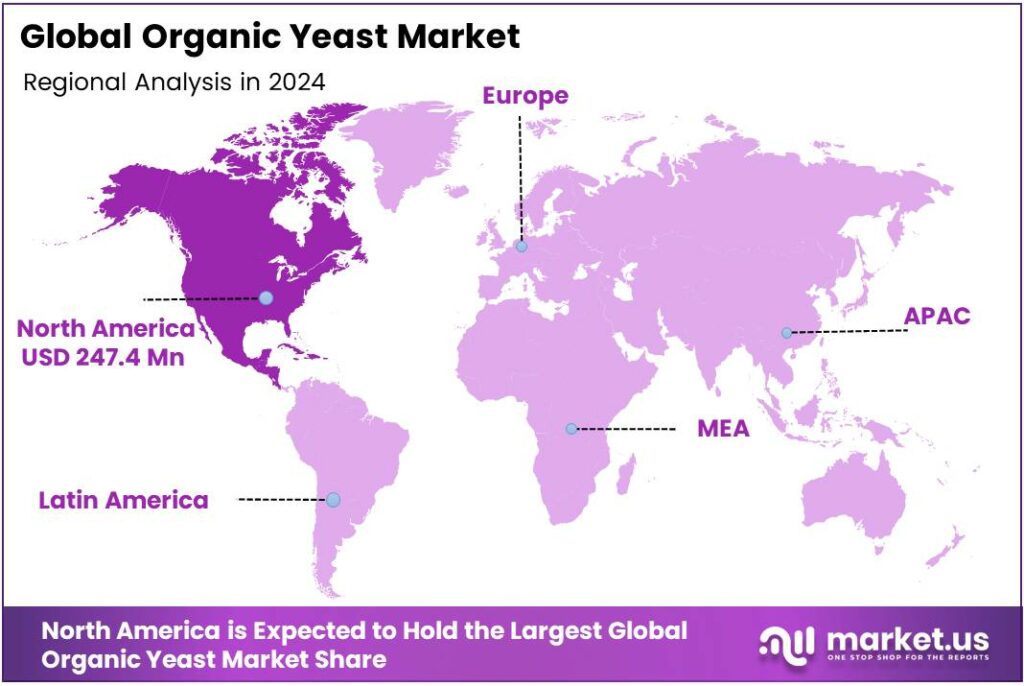

- North America commands 43.9% market share, USD 247.4 million in 2024, led by clean-label awareness and sustainable practices.

By Type

Yeast Extracts dominate with 65.9% due to their versatile use in enhancing flavors and nutrition in processed foods.

In 2024, Yeast Extracts held a dominant market position in the By Type Analysis segment of the Organic Yeast Market, with a 65.9% share. This sub-segment thrives as manufacturers increasingly seek natural flavor enhancers for clean-label products. Extracting nutrients from organic yeast boosts umami and supports fortification, driving demand in savory snacks and ready meals.

Its solubility and stability further propel growth, outpacing other forms amid rising consumer health awareness. Inactive Dry Yeast captures a significant yet secondary role in the organic yeast landscape. Producers favor it for its long shelf life and ease of incorporation into baking and fermentation processes.

This form retains essential vitamins and proteins, appealing to bakers crafting organic breads and pastries. As sustainability trends rise, they support eco-friendly supply chains, fostering steady expansion in niche markets like gluten-free goods.

By Form

Dry dominates with 75.4% due to its convenience in storage and transportation for global distribution.

In 2024, Dry held a dominant market position in the By Form Analysis segment of the Organic Yeast Market, with a 75.4% share. This form excels in practicality, offering extended stability without refrigeration, which simplifies logistics for food processors worldwide. Its powdered consistency integrates seamlessly into dry mixes and supplements, fueling adoption in baking industries.

Consequently, it leads to organic certifications emphasizing quality preservation during transit. Liquid serves as a vital alternative in the organic yeast form segment, prized for immediate activation in brewing and fresh dough preparations.

While requiring careful handling to maintain viability, it delivers superior fermentation efficiency, enhancing product freshness. Brewers and artisanal producers increasingly turn to it for premium organic beers and wines, bridging gaps in applications needing rapid microbial activity despite storage challenges.

By Application

Food and Beverages dominate with 59.3% due to surging demand for natural ingredients in consumer diets.

In 2024, Food and Beverages held a dominant market position in the By Application Analysis segment of the Organic Yeast Market, with a 59.3% share. This sector surges as organic trends reshape palates, incorporating yeast for leavening and flavor in breads, beers, and fermented foods. Health-conscious consumers propel its use in probiotic-rich yogurts and snacks, amplifying market pull.

Animal Feed emerges as a key pillar in organic yeast applications, enhancing livestock nutrition without synthetic additives. Farmers integrate it to boost gut health and immunity in poultry and cattle, aligning with organic farming mandates. This sub-segment gains traction as regulations tighten on feed quality, promoting better yields and animal welfare, which in turn supports resilient supply chains for organic producers.

Others encompass diverse uses like nutraceuticals and cosmetics, where organic yeast aids in vitamin enrichment and natural preservatives. Though smaller, it innovates in wellness supplements and skincare formulations, capitalizing on yeast’s bioactive compounds. As cross-industry adoption grows, this area quietly expands, offering untapped potential for organic yeast in emerging bio-based products and therapies.

Key Market Segments

By Type

- Yeast Extracts

- Inactive Dry Yeast

By Form

- Dry

- Liquid

By Application

- Food and Beverages

- Animal Feed

- Others

Emerging Trends

Growing Demand for Clean-Label and Certified Organic Yeast

Organic food brands are using organic yeast extracts to cut salt by 10–30% while preserving flavor via natural umami and kokumi. This aligns with the WHO’s <5g salt/day (<2,000mg sodium) recommendation, as most people consume double that, raising heart disease risk.

This aligns with government-backed nutrition goals and evolving organic rules that explicitly include yeast within the EU’s organic product scope, giving formulators regulatory clarity. Demand tailwinds are strong on the market side. The EU Organic Action Plan targets 25% of farmland under organic, a policy that expands the supply base and nudges retail demand for organic, clean-label products where organic yeast fits naturally.

- The global organic retail market reached about €135–136 billion, showing sustained consumer appetite for organic foods that avoid synthetic additives and MSG. In the U.S., USDA ERS reports organic retail food sales of USD 63.8 billion, with produce remaining the largest category; this is exactly where salt-reduced, flavor-forward organic ready-meals, soups, snacks, and plant-based items can use organic yeast to improve taste.

Drivers

Rising Consumer Demand for Organic Products

One of the key drivers behind growth in organic yeast is the steep rise in consumer demand for organic, clean-label food ingredients. In the United States, Organic retail food sales grew from approximately US USD 11 billion to an estimated USD 52 billion. The influx of shoppers seeking organic, minimally processed, and additive-free foods means food manufacturers are increasingly for ingredients like organic yeast that align with that trend.

- Another dimension of this demand is the increasing share of organic products in mainstream grocery channels. The United States Department of Agriculture (USDA) notes that certified organic cropland increased 79%, pointing to broadening organic agriculture capacity.

Government initiatives and regulatory frameworks also support this trend. The USDA’s organic program (the National Organic Program) provides certification, labelling, and enforcement, which helps consumers trust the organic claim and enables manufacturers to position their products accordingly.

Restraints

Higher input costs and tighter compliance raise organic-yeast prices

Volatile sugar feedstocks and stricter compliance across organic supply chains. Yeast makers rely on sugar or molasses as fermentation feedstock. Sugar prices have swung sharply, whipsawing production budgets. The FAO Sugar Price Index dropped 21.3% year-on-year in September 2025 after earlier spikes, underscoring volatility that complicates contracting and inventory planning for organic processors.

- The International Sugar Organization projected a 2024/25 global sugar deficit of 3.58 million tonnes, a setup that keeps supply risks and price risks elevated for feedstock buyers. Short-term swings were visible through early 2025 as well, with FAO-tracked sugar prices +6.6% in February after a 6.8% month-on-month drop, illustrating how fast cost assumptions can change.

Strengthening the Organic Enforcement rule entered full compliance, expanding oversight, traceability, and certification coverage for businesses handling organic products. While these safeguards build trust, they also add audits, documentation, and supplier vetting steps that raise operating costs for importers, distributors, and processors buying organic yeast.

Opportunity

Growing consumer demand for organic and clean-label products

- One of the key growth drivers for organic yeast is the rising tide of consumer demand for organic, clean-label, sustainable food ingredients. In the U.S., the organic food market hit USD 63.8 billion in 2023, part of total certified organic product sales reaching USD 69.7 billion, marking a year-on-year increase of about 3.4%.

This surge reflects that shoppers are increasingly looking beyond conventional ingredients and are willing to pay a premium for foods that are labeled organic, non-GMO, and free from synthetic additives. Food manufacturers respond to that shift by reformulating products with ingredients like organic yeast, since it meets the clean-label ethos.

Minimally processed and recognised under many organic certification regimes, giving brands a functional tool to meet taste, texture, and label demands simultaneously. The broader backdrop includes government support and regulation: for instance, the United States Department of Agriculture (USDA), through its National Organic Program (NOP), defines organic standards and pulses consumer trust in organic claims.

Regional Analysis

North America leads with a 43.9% share and a USD 247.4 Million market value.

In 2024, North America held a dominant 43.9% share, valued at approximately USD 247.4 million, in the global organic yeast market. The region’s leadership is driven by strong consumer awareness about clean-label and organic ingredients, as well as rapid adoption of sustainable food manufacturing practices.

The United States stands at the forefront, supported by the USDA National Organic Program (NOP) and growing retail demand for certified organic food products. According to the Organic Trade Association (OTA), U.S. organic food sales, underscoring a steady shift toward healthier and naturally sourced ingredients.

North American food manufacturers increasingly use organic yeast in bakery, beverages, and plant-based formulations to replace artificial enhancers, aligning with the natural flavor and nutrition trend. Government initiatives, such as the USDA’s Strengthening Organic Enforcement Rule, have further strengthened consumer trust in organic certification, encouraging large food processors to expand their organic product lines.

Rising investments in biotechnology and fermentation-based ingredients also play a key role, with several North American companies focusing on bio-based food systems. As consumers increasingly value transparency and ethical sourcing, the region’s strong retail networks, advanced production facilities, and regulatory clarity continue to position North America as the primary hub for organic yeast production and consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Lesaffre is strengthening its organic portfolio through significant capital investment. Directly responding to clean-label demand. The company also secured the SUSTY sustainable yeast certification for a key plant, enhancing its environmental credentials. Its strategy focuses on integrating organic production with verifiable sustainability, appealing to the core organic consumer and securing its supply chain for future market growth.

Angel Yeast is a dominant force, particularly in Asia. Its strategy focuses on expanding into high-growth segments like yeast extracts and human nutrition, where organic is a key differentiator. The company actively publicizes its compliance with international organic standards (EU & USDA) to build global trust. By vertically integrating and targeting B2B health ingredient markets.

Lallemand Inc. differentiates itself through a strong science-backed and specialized approach. While a major player in conventional yeast, its recent developments in organic are closely tied to its core strengths in probiotics, wine fermentation, and animal nutrition. The company focuses on creating high-value, application-specific organic yeast and bacterium blends.

Top Key Players in the Market

- Lesaffre Group

- Angel Yeast Co. Ltd.

- Lallemand Inc.

- Koninklijke DSM N.V.

- Kerry Group plc

- Biorigin

- Biospringer

- Synergy Flavors

- AB Mauri

- Levapan S.A.

- Ohly GmbH

- Oriental Yeast Co. Ltd.

- Givaudan

- Kothari Fermentation and Biochem Ltd.

Recent Developments

- In 2025, Lesaffre formed a joint venture by acquiring a stake in Biorigin, a Brazilian yeast products manufacturer from Zilor Group, to enhance yeast derivative solutions for food and feed markets, including potential organic variants. This builds on DSM-Firmenich’s yeast extract business, integrating processing technologies and strengthening savory ingredient production.

- In 2025, Angel Yeast Co. Ltd., China’s largest yeast producer, will emphasize sustainable and innovative yeast-based nutrition, with indirect ties to organic principles through plant-derived and eco-friendly products. The company highlighted AngeoPro, a fermentation-derived yeast protein for sustainable nutrition.

Report Scope

Report Features Description Market Value (2024) USD 563.6 Million Forecast Revenue (2034) USD 1896.3 Million CAGR (2025-2034) 12.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Yeast Extracts, Inactive Dry Yeast), By Form (Dry, Liquid), By Application (Food and Beverages, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Lesaffre Group, Angel Yeast Co. Ltd., Lallemand Inc., Koninklijke DSM N.V., Kerry Group plc, Biorigin, Biospringer, Synergy Flavors, AB Mauri, Levapan S.A., Ohly GmbH, Oriental Yeast Co. Ltd., Givaudan, Kothari Fermentation and Biochem Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Lesaffre Group

- Angel Yeast Co. Ltd.

- Lallemand Inc.

- Koninklijke DSM N.V.

- Kerry Group plc

- Biorigin

- Biospringer

- Synergy Flavors

- AB Mauri

- Levapan S.A.

- Ohly GmbH

- Oriental Yeast Co. Ltd.

- Givaudan

- Kothari Fermentation and Biochem Ltd.