Global Omega 3 Prescription Drugs Market By Drug Type (Vascepa, Lovaza, Omytrg and Others), By Indication (Severe Hypertriglyceridemia, Cardiovascular Risk Reduction, Cancer and Others), By Patient Type (Adult and Geriatric), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172626

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

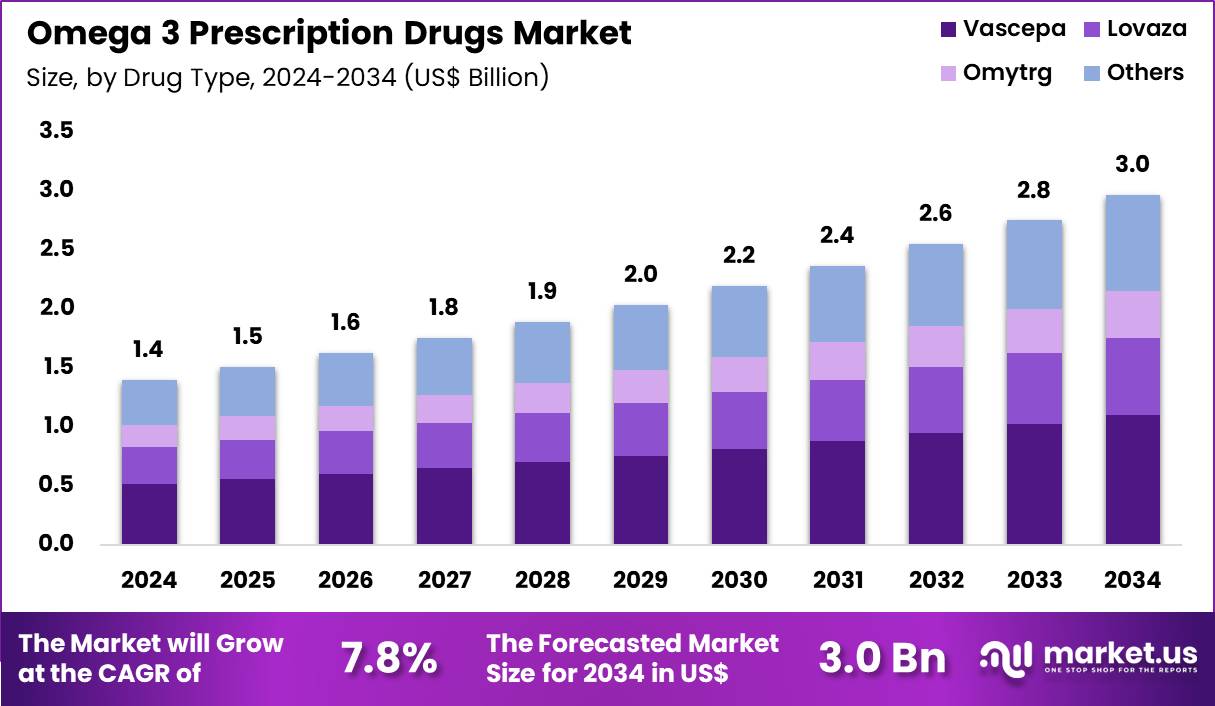

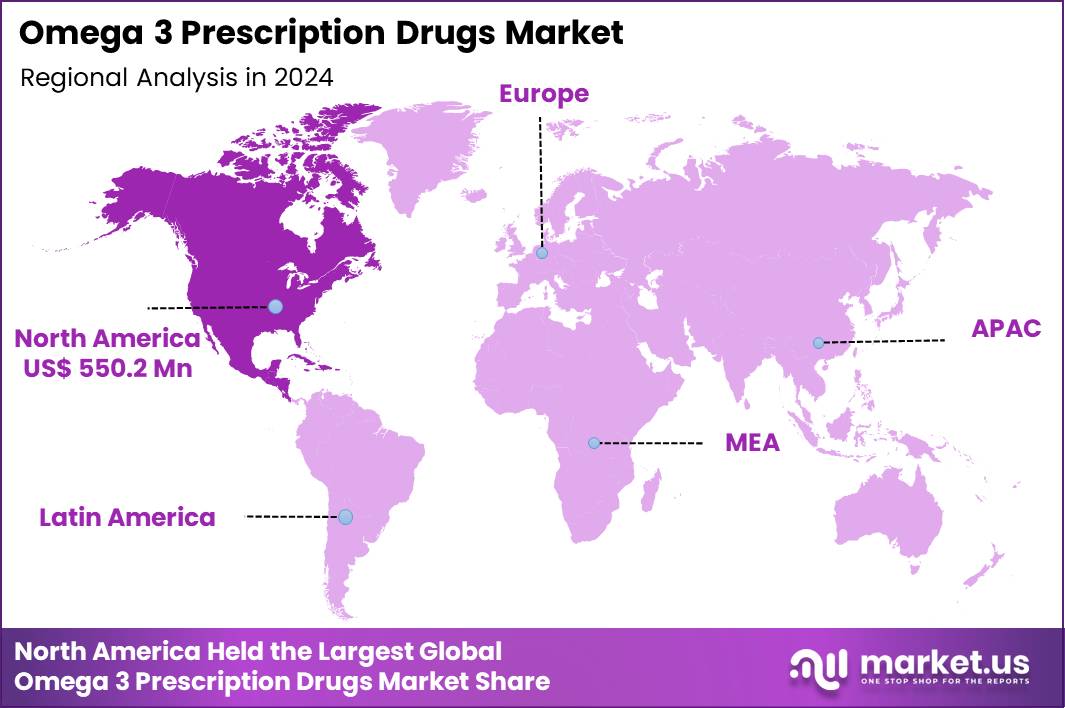

The Global Omega 3 Prescription Drugs Market size is expected to be worth around US$ 3.0 Billion by 2034 from US$ 1.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 550.2 Million.

Growing recognition of omega-3 fatty acids’ cardiovascular benefits propels pharmaceutical companies to advance prescription formulations that deliver high-purity eicosapentaenoic acid and docosahexaenoic acid for targeted lipid management. Cardiologists increasingly prescribe these drugs to lower triglyceride levels in patients with hypertriglyceridemia, reducing the risk of atherosclerotic events when combined with statin therapy. These medications support secondary prevention in individuals with established cardiovascular disease, mitigating residual risk beyond cholesterol control.

Clinicians utilize omega-3 prescriptions as adjunctive therapy for persistent hypertriglyceridemia despite lifestyle modifications, addressing mixed dyslipidemia profiles effectively. These agents demonstrate utility in managing severe hypertriglyceridemia to prevent pancreatitis episodes in high-risk patients. In July 2024, Amarin announced that National Medical Products Administration had granted regulatory clearance for VASCEPA in Mainland China.

The authorization permits its use alongside statins to reduce cardiovascular risk in adults with elevated triglycerides and additional risk factors. Commercial rollout and reimbursement efforts will be led by Amarin’s regional partner EddingPharm, including pursuit of inclusion on China’s National Reimbursement Drug Listing. The approval opens access to a market with a large cardiovascular disease population and includes milestone payments and ongoing royalties tied to sales performance.

Pharmaceutical developers seize opportunities to formulate combination products integrating omega-3 components with novel lipid-modifying agents, enhancing efficacy in complex dyslipidemia cases. Companies explore expanded indications for omega-3 prescriptions in metabolic syndrome management, targeting inflammation and endothelial dysfunction alongside triglyceride reduction. These therapies create pathways for perioperative risk mitigation, stabilizing plaque vulnerability in patients awaiting coronary interventions.

Opportunities emerge in pediatric applications for rare genetic hypertriglyceridemias, providing purified alternatives to dietary fish oil supplements. Firms pursue fixed-dose combinations with fibrates or PCSK9 inhibitors, streamlining regimens for patients with refractory lipid disorders. Enterprises invest in outcome-based studies to solidify roles in primary prevention for high-risk cohorts with multiple comorbidities.

Industry leaders refine highly concentrated ethyl ester formulations to minimize gastrointestinal side effects, improving tolerability in long-term cardiovascular risk reduction protocols. Developers incorporate advanced purification processes that eliminate environmental contaminants, ensuring safety for extended use in secondary prevention strategies. Market participants launch generic versions of established omega-3 prescriptions, broadening access while maintaining bioequivalence standards.

Innovators investigate synergistic effects with anti-inflammatory biologics, exploring adjunctive roles in plaque regression therapies. Companies prioritize patient adherence programs tied to prescription omega-3s, integrating digital monitoring for sustained triglyceride control. Ongoing research emphasizes mechanistic insights into omega-3-mediated gene expression changes, guiding personalized applications in atherothrombotic risk management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.4 Billion, with a CAGR of 7.8%, and is expected to reach US$ 3.0 Billion by the year 2034.

- The drug type segment is divided into vascepa, lovaza, omytrg and others, with vascepa taking the lead in 2024 with a market share of 37.1%.

- Considering indication, the market is divided into severe hypertriglyceridemia, cardiovascular risk reduction, cancer and others. Among these, severe hypertriglyceridemia held a significant share of 43.6%.

- Furthermore, concerning the patient type segment, the market is segregated into adult and geriatric. The adult sector stands out as the dominant player, holding the largest revenue share of 66.3% in the market.

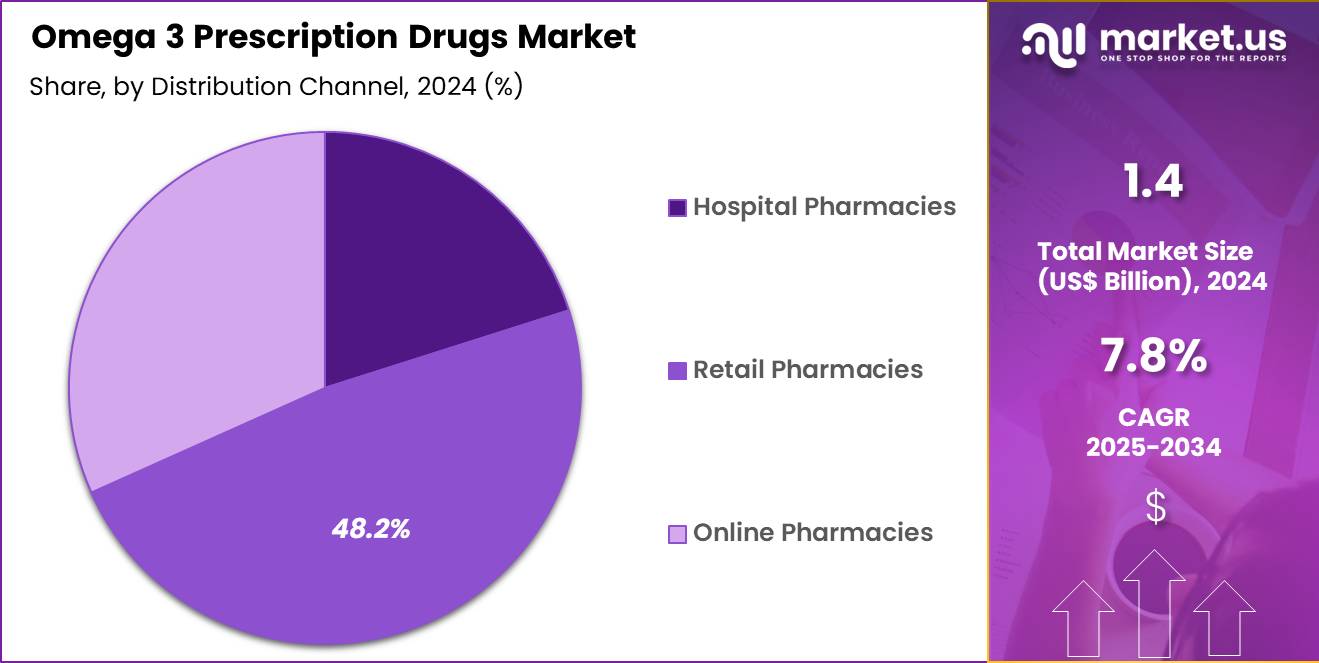

- The distribution channel segment is segregated into hospital pharmacies, retail pharmacies and online pharmacies, with the retail pharmacies segment leading the market, holding a revenue share of 48.2%.

- North America led the market by securing a market share of 39.3% in 2024.

Drug Type Analysis

Vascepa accounted for 37.1% of the Omega 3 Prescription Drugs market, supported by its differentiated clinical positioning and strong physician acceptance. Cardiologists widely prescribe Vascepa due to its purified EPA formulation, which demonstrates triglyceride reduction without raising LDL cholesterol levels. Regulatory approvals for cardiovascular risk reduction strengthen its credibility beyond lipid management.

Growing awareness of residual cardiovascular risk among statin treated patients expands its prescribing base. Clinical guideline inclusion supports consistent uptake across cardiology practices. Manufacturers continue targeted physician education programs that reinforce evidence driven prescribing. Long term outcome data increases prescriber confidence in chronic use.

Favorable safety and tolerability profiles encourage adherence among high risk patients. Expanding insurance coverage improves patient access in key markets. As a result, Vascepa is projected to maintain leadership due to strong clinical differentiation and outcome focused positioning.

Indication Analysis

Severe hypertriglyceridemia represented 43.6% of the Omega 3 Prescription Drugs market, driven by rising diagnosis rates of lipid metabolism disorders. Physicians increasingly screen patients for elevated triglyceride levels due to stronger links with pancreatitis and cardiovascular complications. Lifestyle related factors such as obesity, diabetes, and metabolic syndrome accelerate patient pool expansion. Omega 3 prescription therapies offer targeted triglyceride reduction, which positions them as first line options for severe cases.

Clinical urgency associated with pancreatitis risk supports prompt treatment initiation. Treatment guidelines emphasize pharmacological intervention when triglyceride levels exceed critical thresholds. Improved diagnostic testing availability increases early identification of severe cases. Long term management strategies favor prescription grade omega 3 drugs over supplements.

Physician preference for standardized dosing supports prescription demand. Consequently, severe hypertriglyceridemia is anticipated to remain the dominant indication due to its clinical urgency and clear treatment pathways.

Patient Type Analysis

Adult patients accounted for 66.3% of the Omega 3 Prescription Drugs market, reflecting the high prevalence of lipid disorders in working age populations. Adults face increasing exposure to sedentary lifestyles, poor dietary habits, and stress related metabolic conditions. Early onset dyslipidemia drives sustained pharmacological management over extended periods. Physicians focus on early intervention in adults to reduce long term cardiovascular complications.

Prescription omega 3 drugs align well with preventive cardiology strategies in this age group. Higher treatment compliance among adults supports consistent prescription refills. Employer sponsored insurance coverage improves affordability and access for adult patients. Adults often receive combination therapy with statins, increasing overall omega 3 utilization. Regular health screenings promote timely diagnosis and treatment initiation. Therefore, the adult segment is likely to sustain dominance due to preventive care focus and long term disease management trends.

Distribution Channel Analysis

Retail pharmacies held a 48.2% share of the Omega 3 Prescription Drugs market, supported by their widespread accessibility and established patient trust. Patients prefer retail outlets for chronic medication refills due to convenience and shorter wait times. Strong distribution networks ensure consistent availability of branded omega 3 prescriptions. Retail pharmacists actively support medication counseling, which improves adherence in long term lipid management.

Expansion of chain pharmacies increases geographic penetration across urban and semi urban areas. Integration of electronic prescriptions accelerates dispensing efficiency. Insurance networks often favor retail pharmacy reimbursement structures, improving patient affordability.

Loyalty programs encourage repeat purchases and sustained therapy continuation. Extended operating hours improve access for working adults. As a result, retail pharmacies are projected to remain the leading distribution channel due to convenience driven demand and strong dispensing infrastructure.

Key Market Segments

By Drug Type

- Vascepa

- Lovaza

- Omytrg

- Others

By Indication

- Severe Hypertriglyceridemia

- Cardiovascular Risk Reduction

- Cancer

- Others

By Patient Type

- Adult

- Geriatric

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising prevalence of cardiovascular diseases is driving the market

The omega 3 prescription drugs market benefits substantially from the rising prevalence of cardiovascular diseases, which heightens the need for therapies that reduce triglyceride levels and mitigate associated risks. Physicians prescribe omega 3 formulations, such as icosapent ethyl, to patients with elevated triglycerides as an adjunct to diet and statins for cardiovascular protection. Clinical guidelines recommend these drugs for individuals with persistent hypertriglyceridemia despite lifestyle modifications, supporting market demand.

Ongoing epidemiological studies link high triglycerides to increased coronary events, reinforcing the role of prescription omega 3 in preventive cardiology. Pharmaceutical companies emphasize evidence from large-scale trials demonstrating cardiovascular event reduction with high-dose omega 3. Healthcare systems prioritize accessible treatments for at-risk populations, including those with diabetes or metabolic syndrome. Public health campaigns raise awareness of heart disease risks, encouraging earlier intervention with approved medications.

Global aging demographics contribute to a larger patient pool susceptible to cardiovascular conditions. According to the American Heart Association’s 2025 Heart Disease and Stroke Statistics Update, coronary heart disease caused 371,506 deaths in 2022. This mortality figure illustrates the urgent clinical need that propels adoption of omega 3 prescription drugs in comprehensive management strategies.

Restraints

Increased generic competition is restraining the market

The omega 3 prescription drugs market encounters limitations due to increased generic competition, which erodes pricing power for branded products and reduces overall revenues. Generic versions of omega 3 ethyl esters enter the market following patent expirations, offering lower-cost alternatives to patients and payers. Branded manufacturers face pressure to defend market share through legal actions or product differentiation, yet generics often capture significant volume.

Payers favor generics in formularies, restricting reimbursement for higher-priced originals and impacting prescription trends. Physicians may opt for generics in cost-sensitive environments, particularly for long-term therapy. Supply chain efficiencies enable generic producers to undercut prices while maintaining quality standards. Regulatory equivalence ensures generics meet bioequivalence criteria, facilitating swift market entry.

Economic factors, such as healthcare budget constraints, amplify the shift toward affordable options. According to Amarin Corporation’s annual report filed with the SEC, VASCEPA revenue potential suffered due to generic competition in the 2022-2024 period. These competitive dynamics collectively challenge profitability and innovation incentives for branded omega 3 drugs.

Opportunities

Expanding clinical evidence for additional therapeutic benefits is creating growth opportunities

The omega 3 prescription drugs market gains from expanding clinical evidence supporting benefits beyond lipid management, such as in autoimmune and oncologic conditions. Researchers investigate omega 3’s anti-inflammatory properties for potential roles in reducing autoimmune disease incidence through sustained supplementation. Clinicians explore adjunctive use in rheumatology to complement standard therapies and improve patient outcomes.

Pharmaceutical developers pursue label expansions based on emerging trial data, targeting new indications. Regulatory bodies review supplemental applications for broader claims, potentially increasing prescription volumes. Healthcare providers integrate omega 3 into multidisciplinary protocols for chronic disease management. Patient advocacy groups promote awareness of non-cardiovascular applications, fostering demand. Global collaborations advance mechanistic studies to validate these expanded uses.

According to a 2024 rheumatology review published on PubMed, omega-3 fatty acid supplementation may provide sustained protection against developing new autoimmune diseases. This evolving evidence base positions omega 3 drugs for diversified applications and enhanced market positioning.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces bolster the omega 3 prescription drugs market as escalating healthcare budgets and mounting cardiovascular disease rates worldwide prompt pharmaceutical companies to ramp up production of EPA and DHA formulations for effective lipid management. Leading firms aggressively pursue clinical expansions and marketing campaigns, tapping into heightened consumer awareness of heart health benefits to capture expanding segments in aging populations.

Stubborn inflation and global economic slowdowns, however, drive up raw material costs for fish-derived actives and synthetic precursors, compelling manufacturers to tighten supply chains and prompting hospitals to limit bulk orders amid fiscal constraints. Geopolitical strains, particularly U.S.-China trade disputes and regional instabilities in key fishing zones, routinely interrupt ingredient sourcing from Peru and Chile, fostering production delays and price volatility for suppliers dependent on international fisheries.

Current U.S. tariffs impose a 100 % duty on branded imported pharmaceuticals, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic healthcare channels. These tariffs also incite reciprocal barriers from trading partners that constrain U.S. exports of advanced omega 3 therapies and disrupt multinational supply alliances. Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Evolving role of omega-3 fatty acid therapy in lipid management is a recent trend

In 2025, the omega 3 prescription drugs market has noted an evolving role of omega-3 fatty acid therapy in lipid management, particularly for addressing residual cardiovascular risks in statin-treated patients. National Lipid Association sessions highlighted icosapent ethyl’s contributions to early LDL-C reduction and emerging therapeutic strategies. Clinicians increasingly incorporate high-purity omega 3 formulations into guidelines for patients with persistent hypertriglyceridemia.

Developers focus on combination approaches with novel lipid-lowering agents to optimize efficacy. Regulatory discussions emphasize safety profiles in long-term use amid growing clinical interest. Pharmaceutical education programs update providers on evidence-based applications for omega 3 in preventive care. Patient outcomes data from real-world studies reinforce therapy’s value in high-risk cohorts.

Collaborative research explores synergies with anti-inflammatory mechanisms for broader cardiometabolic benefits. According to highlights from the National Lipid Association 2025 conference, sessions underscored the evolving role of omega-3 fatty acid therapy, specifically icosapent ethyl. This trend reflects a shift toward integrated lipid strategies, enhancing the relevance of prescription omega 3 in contemporary practice.

Regional Analysis

North America is leading the Omega 3 Prescription Drugs Market

North America accounted for 39.3% of the overall market in 2024, and the Omega 3 Prescription Drugs market expanded steadily as clinicians intensified lipid-management strategies for high-risk cardiovascular patients. Cardiologists increasingly prescribed EPA-based therapies to manage severe hypertriglyceridemia and residual cardiovascular risk beyond statin treatment.

Strong clinical acceptance followed updated treatment guidelines emphasizing triglyceride reduction as part of secondary prevention. Hospital formularies and retail pharmacies improved access to branded and authorized prescription formulations, supporting adherence. The American Heart Association reported in 2023 that about 25% of U.S. adults have triglyceride levels at or above 150 mg/dL, underscoring a large treatment-eligible population.

Growing focus on preventive cardiology further strengthened demand. Ongoing physician education improved appropriate patient selection. These factors collectively drove market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to witness sustained expansion during the forecast period as the Omega 3 Prescription Drugs market benefits from rising dyslipidemia prevalence and increasing cardiovascular risk across aging populations. Physicians increasingly incorporate prescription-grade omega-3 therapies into lipid-lowering regimens for patients with poor response to lifestyle modification alone.

Expanding access to specialist care improves diagnosis and long-term lipid management. Governments emphasize cardiovascular prevention through national health programs, indirectly supporting therapeutic uptake. Local pharmaceutical manufacturing improves affordability and availability of prescription formulations.

The Japan Ministry of Health, Labour and Welfare reported over 22 million patients receiving treatment for dyslipidemia in its 2022 Patient Survey, highlighting strong clinical demand. Increasing awareness of triglyceride-driven risk supports prescribing confidence. These developments position the market for continued growth across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the omega 3 prescription drugs market drive growth by differentiating purified, high-dose formulations that demonstrate clear cardiovascular risk-reduction benefits supported by robust clinical evidence. Companies expand demand through lifecycle management, including label extensions, physician education, and outcomes-driven positioning within cardiometabolic care pathways.

Commercial teams secure access by aligning with payer formularies and guideline committees while reinforcing adherence through simplified dosing and patient-support programs. Innovation efforts focus on improving bioavailability, minimizing gastrointestinal side effects, and ensuring pharmaceutical-grade purity to distinguish therapies from supplements.

Geographic expansion targets regions with rising dyslipidemia prevalence and improving reimbursement for preventive cardiology. Amarin exemplifies leadership with its flagship icosapent ethyl therapy, a focused cardiovascular strategy, global regulatory experience, and disciplined commercial execution that sustains adoption among cardiologists and primary care providers.

Top Key Players

- Amarin Corporation

- Waylis Therapeutics

- Mankind Pharma

- GLW Pharma GMBH

- CSPC Pharmaceutical Group Limited

- Woodward Pharma Services LLC

- PuraCap Pharmaceutical LLC

- ChartwellPharma

- WILSHIRE PHARMACEUTICALS, INC.

- Amneal Pharmaceuticals LLC

- Sofgen

- Camber Pharmaceuticals

- Sun Pharmaceutical Industries

- Dr. Reddy’s Laboratories

- Grupo Ferrer Internacional, S.A.

- Hikma Pharmaceuticals

- Zydus Lifesciences

Recent Developments

- In September 2024, Amarin Corporation shared new clinical evidence on the cardiovascular benefits of VASCEPA and VAZKEPA, drawing from analyses of the REDUCE-IT program. The findings highlighted risk reduction in patients with diabetes and a history of coronary artery bypass grafting, along with data suggesting that eicosapentaenoic acid may limit lipoprotein(a) oxidation in high-glucose conditions. These insights reinforce the role of the therapy in managing residual cardiovascular risk among statin-treated, high-risk populations worldwide.

- In July 2024, Amarin confirmed that Portugal’s national health authorities approved reimbursement for VAZKEPA to lower cardiovascular event risk in adults with elevated triglyceride levels and established cardiovascular risk factors. The decision by the Portuguese Ministry of Health represents the eighth European reimbursement for the therapy and enables its commercial availability in Portugal beginning August 2024. Given the substantial cardiovascular disease burden among middle-aged and older adults in the country, the approval supports Amarin’s broader strategy to expand patient access across Europe.

Report Scope

Report Features Description Market Value (2024) US$ 1.4 Billion Forecast Revenue (2034) US$ 3.0 Billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Vascepa, Lovaza, Omytrg and Others), By Indication (Severe Hypertriglyceridemia, Cardiovascular Risk Reduction, Cancer and Others), By Patient Type (Adult and Geriatric), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amarin Corporation, Waylis Therapeutics, Mankind Pharma, GLW Pharma GMBH, CSPC Pharmaceutical Group Limited, Woodward Pharma Services LLC, PuraCap Pharmaceutical LLC, ChartwellPharma, WILSHIRE PHARMACEUTICALS, INC., Amneal Pharmaceuticals LLC, Sofgen, Camber Pharmaceuticals, Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, Grupo Ferrer Internacional, S.A., Hikma Pharmaceuticals, Zydus Lifesciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Omega 3 Prescription Drugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Omega 3 Prescription Drugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amarin Corporation

- Waylis Therapeutics

- Mankind Pharma

- GLW Pharma GMBH

- CSPC Pharmaceutical Group Limited

- Woodward Pharma Services LLC

- PuraCap Pharmaceutical LLC

- ChartwellPharma

- WILSHIRE PHARMACEUTICALS, INC.

- Amneal Pharmaceuticals LLC

- Sofgen

- Camber Pharmaceuticals

- Sun Pharmaceutical Industries

- Dr. Reddy’s Laboratories

- Grupo Ferrer Internacional, S.A.

- Hikma Pharmaceuticals

- Zydus Lifesciences