Pharmacy Benefit Management Market By Service (Specialty Pharmacy, Benefit Plan Design & Consultation, Drug Formulatory Management, and Others), By Business Model (Employer-sponsored Programs, Government Health Programs, and Health Insurance Management), By End-user (Pharmacy Benefit Management Organization, Retail Pharmacies, Mail Order Pharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139966

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Pharmacy Benefit Management Market Size is expected to be worth around US$ 994.2 billion by 2034 from US$ 571.1 billion in 2024, growing at a CAGR of 5.7% during the forecast period 2025 to 2034.

Growing prescription drug costs and increasing demand for cost-effective medication management have fueled the expansion of pharmacy benefit management (PBM) services. PBMs negotiate drug prices, manage formularies, and implement cost-containment strategies to optimize prescription plans for insurers, employers, and patients.

A 2020 study by the Kaiser Family Foundation found that the cost of approximately 17% of Medicare Part D and Part B prescription drugs rose by more than 7.5% compared to the previous year, highlighting a significant increase in medication expenses. Advancements in artificial intelligence and data analytics have improved claims processing, fraud detection, and personalized medication adherence programs.

The rise of specialty drugs for chronic diseases has driven PBMs to develop value-based contracts and rebate negotiations. Digital transformation, including e-prescribing and automated pharmacy management, has streamlined prescription fulfillment and reduced medication errors. The expansion of mail-order pharmacy services has increased convenience while lowering costs.

Partnerships with pharmaceutical companies and healthcare providers continue to evolve, creating more competitive pricing structures. Regulatory changes require PBMs to enhance transparency and adapt pricing models to ensure compliance. As healthcare systems focus on accessibility and affordability, PBMs play a vital role in balancing cost control with high-quality patient care.

Key Takeaways

- In 2024, the market for Pharmacy Benefit Management generated a revenue of US$ 571.1 billion, with a CAGR of 5.7%, and is expected to reach US$ 994.2 billion by the year 2034.

- The service segment is divided into specialty pharmacy, benefit plan design & consultation, drug formulatory management, and others, with specialty pharmacy taking the lead in 2024 with a market share of 41.8%.

- Considering business model, the market is divided into employer-sponsored programs, government health programs, and health insurance management. Among these, health insurance management held a significant share of 47.3%.

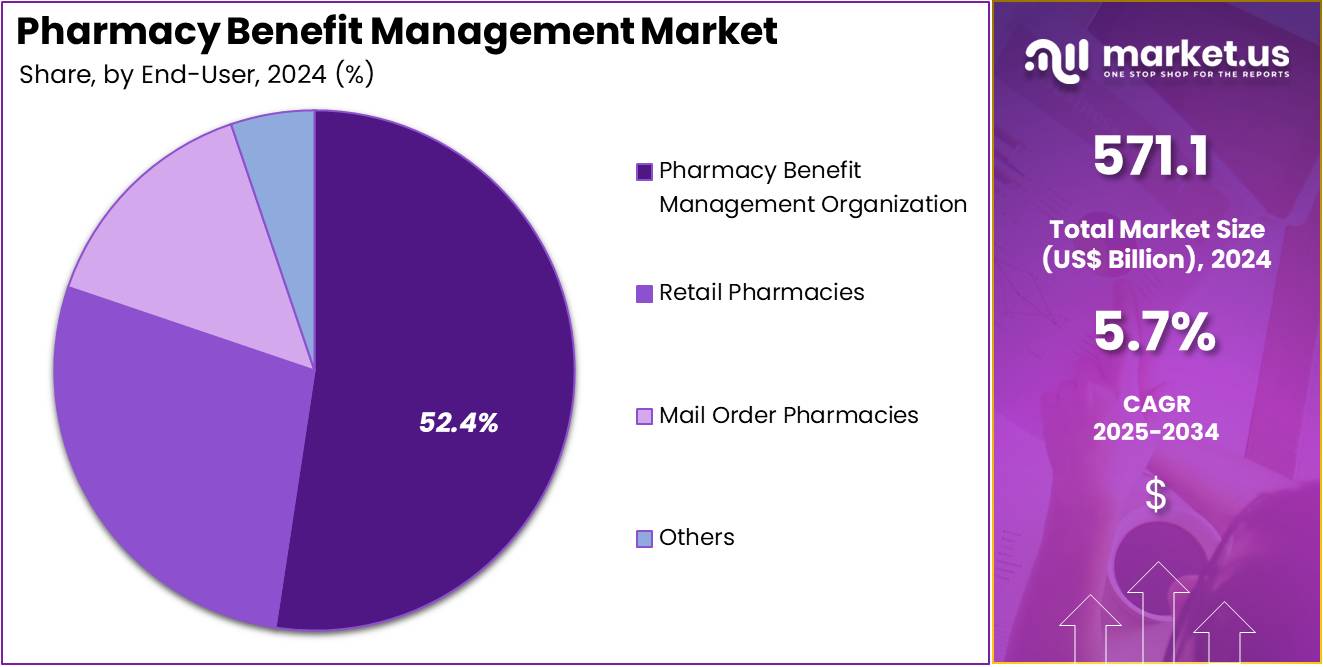

- Furthermore, concerning the end-user segment, the market is segregated into pharmacy benefit management organization, retail pharmacies, mail order pharmacies, and others. The pharmacy benefit management organization sector stands out as the dominant player, holding the largest revenue share of 52.4% in the Pharmacy Benefit Management market.

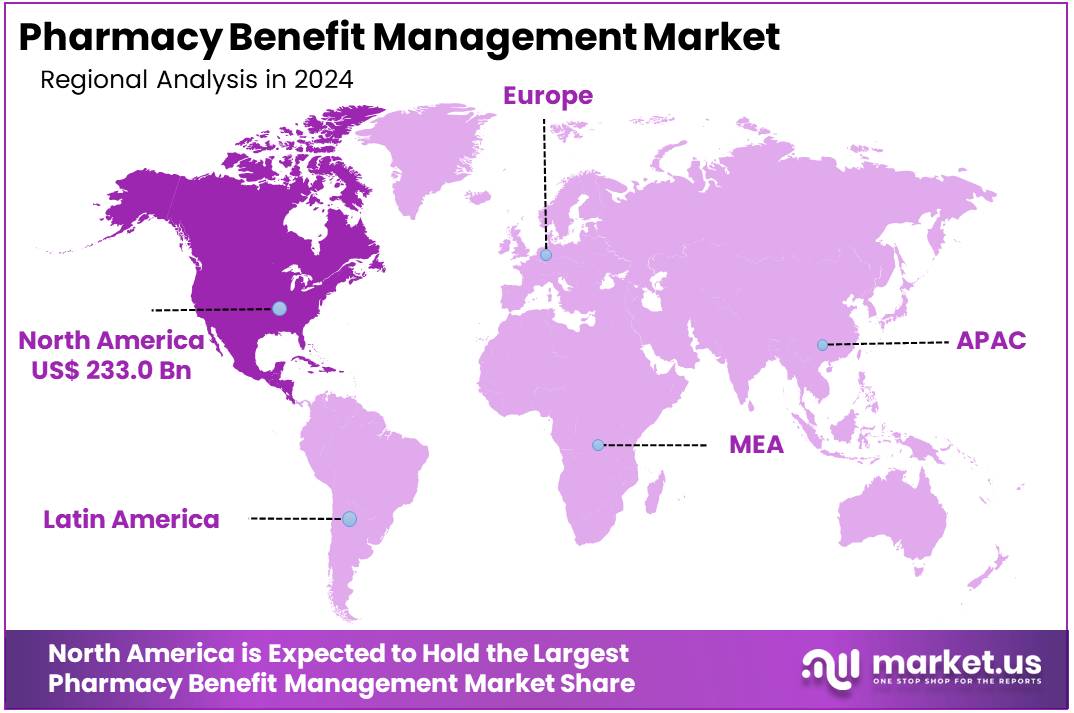

- North America led the market by securing a market share of 40.8% in 2024.

Service Analysis

The specialty pharmacy segment led in 2024, claiming a market share of 41.8% owing to the increasing demand for specialized medications, such as those used to treat chronic conditions, rare diseases, and cancer. These medications often require higher levels of care, personalized support, and adherence management, which specialty pharmacies are equipped to provide.

The rise in biologics and specialty drugs, along with the increasing complexity of treatments, is anticipated to further propel this segment. Additionally, the growing trend towards value-based care and outcomes-focused treatment is expected to drive healthcare systems to increasingly rely on specialty pharmacies for managing high-cost, high-complexity therapies, fueling the segment’s expansion.

Business Model Analysis

The health insurance management held a significant share of 47.3% due to the increasing number of people enrolled in employer-sponsored and government health programs. These programs are expanding to cover more comprehensive pharmacy benefits, as the demand for affordable healthcare solutions continues to rise.

In particular, the expansion of government-sponsored health insurance initiatives, such as Medicaid and Medicare, is expected to drive the need for more robust pharmacy benefit management services. Health insurance providers are focusing on cost control, formulary management, and improving health outcomes, which will likely contribute to the continued growth of this segment.

End-user Analysis

The pharmacy benefit management organization segment had a tremendous growth rate, with a revenue share of 52.4% as more organizations look to improve drug cost management and patient outcomes. PBM organizations are increasingly being sought to negotiate drug pricing, manage formularies, and ensure medication adherence, particularly as healthcare systems aim to reduce overall pharmaceutical spending.

The rise in chronic diseases and the increasing complexity of drug regimens are expected to drive the need for PBM organizations. Additionally, as health insurance models evolve, the role of PBMs in managing benefits for both public and private insurers will likely expand, supporting further market growth.

Key Market Segments

By Service

- Specialty Pharmacy

- Benefit Plan Design & Consultation

- Drug Formulatory Management

- Others

By Business Model

- Employer-sponsored Programs

- Government Health Programs

- Health Insurance Management

By End-user

- Pharmacy Benefit Management Organization

- Retail Pharmacies

- Mail Order Pharmacies

- Others

Drivers

Surge in Pharmaceutical Prices Driving the Pharmacy Benefit Management Market

Rising pharmaceutical costs are expected to drive the pharmacy benefit management market by increasing the demand for cost-containment strategies. A report from Pharmaceutical Technology revealed that drug prices in the U.S. saw a 4% increase in 2021, marking a shift from previously slower price growth trends. Additionally, SingleCare Administrators projected that the cost of individual prescription medications would rise by 5% that same year.

With rising drug expenses, insurers and employers are relying on pharmacy benefit managers (PBMs) to negotiate better pricing. PBMs use formulary management and rebate strategies to control costs for prescription medications. Mail-order pharmacy services are gaining traction as a cost-effective alternative to retail drugstores. Specialty drug pricing, particularly for biologics and gene therapies, is increasing the need for structured reimbursement models.

The expansion of preferred pharmacy networks is helping insurers secure competitive drug prices. Increased utilization of generic medications is improving cost savings for patients and healthcare providers. Transparency reforms in drug pricing are influencing contract negotiations between PBMs and pharmaceutical manufacturers. Digital prescription platforms are enhancing access to lower-cost medications through automated discount programs.

The shift toward value-based care models is promoting outcome-driven drug pricing strategies. Continued legislative scrutiny on drug costs is likely to shape the future of PBM regulations and reimbursement policies.

Restraints

Regulatory Scrutiny is Restraining the Pharmacy Benefit Management Market

Increasing government oversight is limiting the growth of the pharmacy benefit management market by tightening compliance requirements. Legislators are pushing for greater transparency in drug pricing to curb excessive markups and hidden fees. PBMs are facing scrutiny over the use of spread pricing, where they charge insurers more than they reimburse pharmacies for the same drug.

Concerns over rebate structures and their impact on consumer drug costs are prompting calls for stricter regulations. Policymakers are advocating for direct-to-consumer pricing models to reduce PBM control over medication costs. The U.S. Federal Trade Commission (FTC) launched an investigation into PBM practices in 2022 to assess their impact on prescription drug affordability.

State governments are implementing new policies to regulate PBM operations, including licensing requirements and reporting obligations. These regulatory pressures are increasing compliance costs for PBMs and may lead to industry consolidation as smaller firms struggle to adapt. Addressing regulatory concerns while maintaining cost-saving mechanisms is critical for sustaining market growth.

Opportunities

Introduction of Consumer-Friendly Tools and Platforms

Increasing digital solutions for price comparison and medication management are expected to create new opportunities in the pharmacy benefit management market. In January 2023, Optum Rx introduced Price Edge, a tool designed to help consumers identify the most cost-effective prescription prices. The platform compares a patient’s on-benefit price with available discounts to ensure they secure the lowest possible rate.

The rise of mobile apps and online portals is improving transparency in prescription drug pricing. Real-time benefit verification tools are allowing patients to view medication costs before filling prescriptions. AI-driven decision support systems are enabling PBMs to optimize formulary management based on patient outcomes. Digital therapeutics integration is enhancing medication adherence by providing personalized reminders and virtual support.

The adoption of blockchain technology is strengthening data security in drug pricing negotiations and reimbursement transactions. Expanded telehealth services are improving patient access to lower-cost medications through remote consultations. Consumer-centric tools are reshaping the PBM landscape by fostering price competition and cost savings. The demand for personalized pricing models is likely to accelerate the development of digital PBM solutions in the coming years.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly shape the pharmacy benefit management market. On the positive side, rising healthcare expenditures and the increasing complexity of prescription drug benefits drive demand for efficient pharmacy benefit management services. Growing healthcare awareness and a shift towards value-based care models create opportunities for improved cost control and access to medications.

However, economic recessions, budget cuts, or financial crises can limit healthcare spending, reducing investments in pharmacy management solutions, especially in government-funded healthcare systems. Geopolitical factors, such as international trade tensions or regulatory changes, could disrupt supply chains and increase the cost of pharmaceutical products, impacting the affordability of medications.

Additionally, variations in drug pricing policies across different regions create challenges in maintaining consistent benefit management practices. Despite these challenges, the continued focus on improving healthcare efficiency, reducing costs, and enhancing patient outcomes will likely fuel growth in the market.

Trends

Integration of AI & ML Driving the Pharmacy Benefit Management Market

The integration of artificial intelligence (AI) and machine learning (ML) is a growing trend driving the pharmacy benefit management market. High demand for streamlined operations, cost reduction, and improved decision-making processes has led to the adoption of these technologies in managing pharmacy benefits. AI and ML are expected to significantly enhance predictive analytics, allowing pharmacy benefit managers to more accurately forecast drug utilization patterns and control expenditures.

The rise of AI-powered automation in claims processing is anticipated to reduce human errors and inefficiencies, further improving overall workflow efficiency. As healthcare systems seek to provide better services while managing costs, the demand for AI and ML-driven solutions is likely to continue increasing. Capital Rx, a key player in the U.S. pharmacy benefits sector, leverages artificial intelligence (AI) and machine learning (ML) to streamline claims processing.

By automating these workflows, the company aims to minimize human error, lower medical costs, and improve the efficiency of coverage procedures. As AI and ML integration becomes more widespread, the market will likely experience substantial growth and innovation.

Regional Analysis

North America is leading the Pharmacy Benefit Management Market

North America dominated the market with the highest revenue share of 40.8% owing to increasing prescription drug utilization and the rising demand for cost-effective medication access. A March 2021 report from the National Association of Insurance Commissioners highlighted that 66 PBM companies in the U.S. served over 270 million Americans, underscoring their integral role in the healthcare system.

The expansion of employer-sponsored health plans and government-backed insurance programs contributed to the growing reliance on PBM services. Technological advancements, including AI-driven formulary management and real-time prescription tracking, improved operational efficiency and cost transparency. The integration of PBMs with telehealth platforms enhanced patient convenience by streamlining prescription fulfillment and medication adherence programs.

Additionally, increasing scrutiny on drug pricing led to stronger collaborations between PBMs, insurers, and pharmaceutical manufacturers to negotiate lower costs. The rise of specialty medications for chronic conditions further propelled demand for optimized drug benefit plans, reinforcing the market’s expansion across the U.S. and Canada.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding healthcare coverage and increasing pharmaceutical expenditures. Rapid urbanization and rising income levels in countries like China, India, and Japan are expected to boost demand for medication cost management solutions. Government initiatives promoting universal healthcare and insurance penetration are likely to encourage the adoption of PBM services.

The growing prevalence of chronic diseases is anticipated to drive the need for structured drug benefit programs, improving affordability and accessibility. Collaborations between global PBM providers and regional insurers are projected to enhance service offerings and operational efficiency. The digitalization of healthcare systems, including the implementation of electronic prescriptions and automated claims processing, is expected to streamline pharmaceutical transactions.

Increasing consumer awareness about medication affordability and adherence programs is likely to further support market expansion. Additionally, regulatory developments aimed at improving drug price transparency and reimbursement frameworks are anticipated to strengthen the industry’s growth across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the pharmacy benefit management market focus on leveraging technology and data analytics to optimize drug pricing, improve medication adherence, and enhance cost efficiency. Companies invest in formulary management, rebate negotiations, and specialty pharmacy services to deliver affordable and accessible prescription drugs.

Strategic partnerships with healthcare providers and insurers help expand service offerings and increase market penetration. Geographic expansion into regions with rising healthcare expenditures supports further growth. Many players also emphasize digital health solutions, such as e-prescriptions and automated claims processing, to streamline operations and improve patient outcomes.

CVS Caremark is a leading company in this market, offering integrated pharmacy benefit solutions that focus on cost reduction and patient-centric care. The company invests in innovative drug management strategies and digital tools to enhance prescription fulfillment and adherence. CVS Caremark’s commitment to affordability, accessibility, and advanced healthcare solutions establishes it as a key player in the industry.

Recent Developments

- In December 2023, CVS Health announced the upcoming launch of CVS CostVantage, a new pharmacy benefit management (PBM) service designed for commercial payors. Set to roll out in 2025, the initiative aims to facilitate a seamless transition for businesses managing prescription drug coverage.

- In November 2023, OptumRx, the pharmacy benefits arm of UnitedHealth, announced plans to designate eight widely used insulin products as preferred options on its standard formulary. This decision is expected to enhance affordability and accessibility for commercially insured individuals in the U.S.

- In October 2021, First Medical Health Plan, Inc. extended its collaboration with Abarca Health LLC for an additional three years to continue providing pharmacy benefit management services. The renewed agreement introduced a new financial model aimed at optimizing cost efficiency and service delivery.

Top Key Players in the Pharmacy Benefit Management Market

- Prime Therapeutics

- OptumRx

- First Medical Health Plan, Inc

- CVS Health

- Change Healthcare

- Catamaran Corporation

- Aetna

- Accredo

Report Scope

Report Features Description Market Value (2024) US$ 571.1 billion Forecast Revenue (2034) US$ 994.2 billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (Specialty Pharmacy, Benefit Plan Design & Consultation, Drug Formulatory Management, and Others), By Business Model (Employer-sponsored Programs, Government Health Programs, and Health Insurance Management), By End-user (Pharmacy Benefit Management Organization, Retail Pharmacies, Mail Order Pharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Prime Therapeutics, OptumRx, First Medical Health Plan, Inc, CVS Health , Change Healthcare, Catamaran Corporation, Aetna, and Accredo. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmacy Benefit Management MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Pharmacy Benefit Management MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Prime Therapeutics

- OptumRx

- First Medical Health Plan, Inc

- CVS Health

- Change Healthcare

- Catamaran Corporation

- Aetna

- Accredo