Global Ozempic Market By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 2025

- Report ID: 141449

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

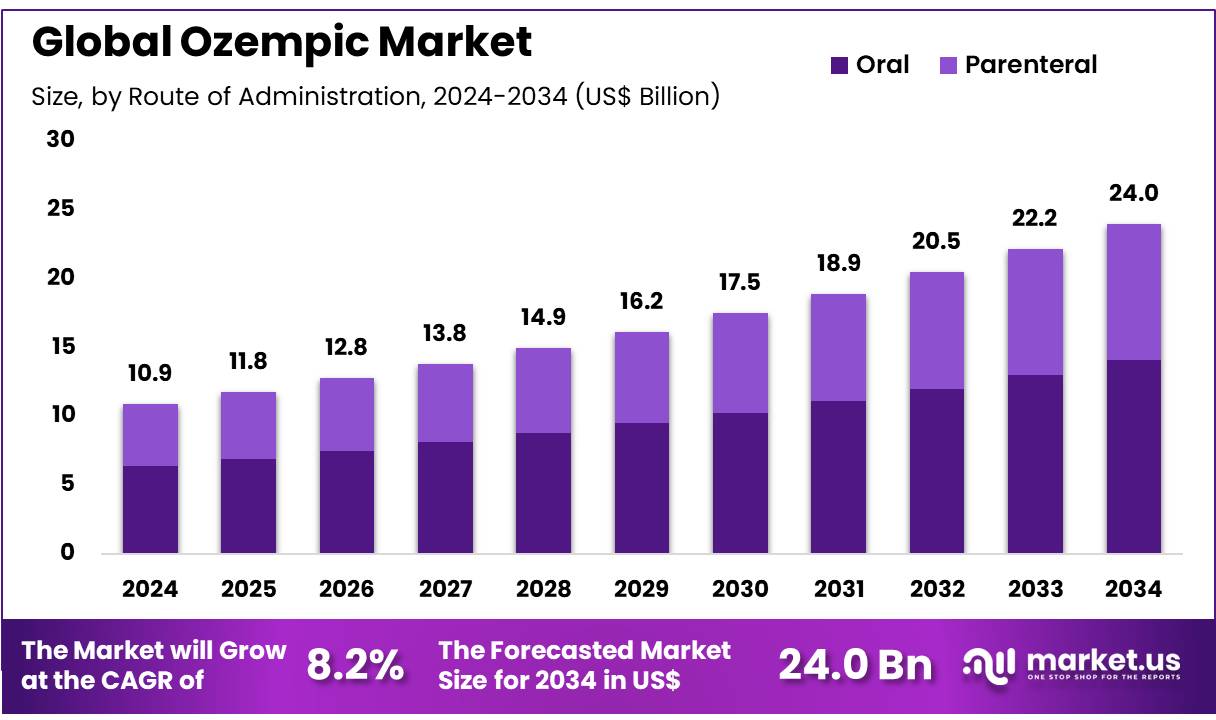

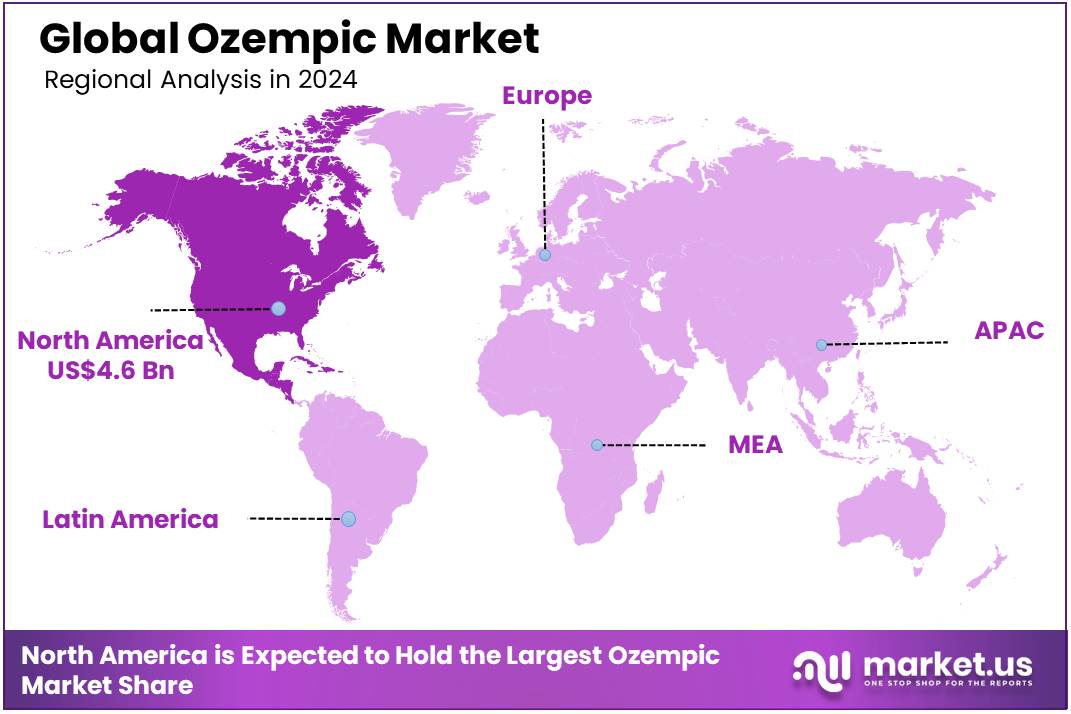

Global Ozempic Market size is expected to be worth around US$ 24.0 billion by 2034 from US$ 8.2% billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.3% share with a revenue of US$ 4.6 Billion.

Growing demand for effective treatments for type 2 diabetes and obesity is driving expansion in the Ozempic market. The increasing prevalence of diabetes and obesity-related complications is fueling the adoption of Ozempic, a glucagon-like peptide-1 (GLP-1) receptor agonist that helps regulate blood sugar levels and support weight management.

According to a May 2022 report from the World Health Organization, over 60% of adults and approximately 30% of children in Europe are classified as overweight or obese. These conditions rank among the top risk factors for non-communicable diseases, significantly contributing to public health burdens across the region. The rising awareness of GLP-1 receptor agonists as a dual-purpose therapy for diabetes and weight loss is expanding Ozempic’s market presence.

The growing preference for once-weekly injectable treatments is improving patient adherence and convenience, strengthening demand for Ozempic among healthcare providers and patients. Increasing clinical research and real-world data supporting the cardiovascular benefits of Ozempic are boosting its adoption for reducing heart disease risks in diabetic patients. Expanding insurance coverage and reimbursement policies for GLP-1 therapies are creating new opportunities for market growth.

The rising influence of telemedicine and digital health platforms is improving access to Ozempic prescriptions and patient education. Increasing pharmaceutical investments in developing next-generation GLP-1 therapies are driving market competition and innovation. The growing trend of off-label use for weight management is further accelerating Ozempic’s demand beyond its primary diabetes indication. Expanding marketing efforts and endorsements from healthcare professionals are increasing patient awareness and uptake.

Rising collaborations between pharmaceutical companies and research institutions are fostering advancements in GLP-1-based therapies. The continuous development of alternative formulations, including oral GLP-1 receptor agonists, is shaping the competitive landscape. With the increasing need for effective metabolic disorder treatments and ongoing product innovations, the Ozempic market is expected to witness sustained growth in the coming years.

Key Takeaways

- In 2024, the market for ozempic generated a revenue of US$ 8.2% billion, with a CAGR of 8.2%, and is expected to reach US$ 24.0 billion by the year 2033.

- The route of administration segment is divided into oral and parenteral, with oral taking the lead in 2023 with a market share of 58.7%.

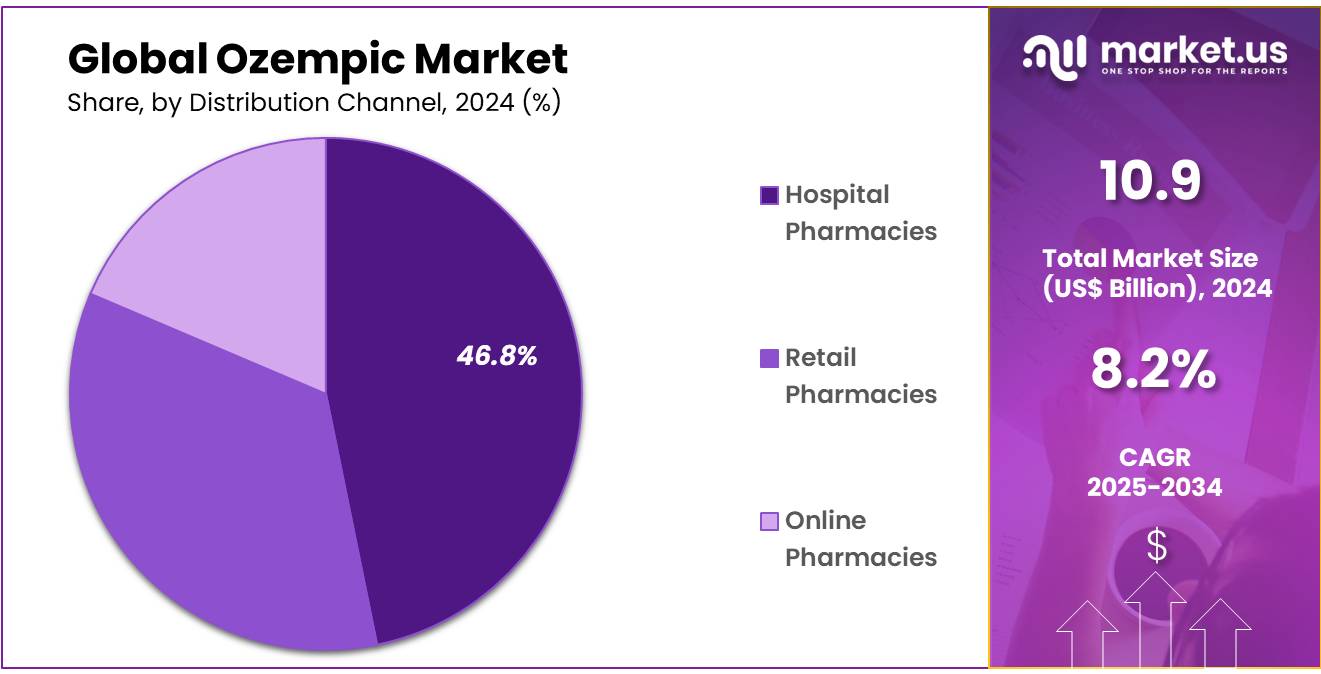

- Considering distribution channel, the market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, hospital pharmacies held a significant share of 46.8%.

- North America led the market by securing a market share of 42.3% in 2023.

Route of Administration Analysis

The oral segment led in 2023, claiming a market share of 58.7% owing to increasing consumer preference for convenient and non-invasive treatment options. Oral administration offers a more user-friendly alternative to injectable forms of medication, which enhances patient adherence and compliance. As awareness of the benefits of oral medications for managing type 2 diabetes increases, the demand for oral formulations of Ozempic is projected to rise.

Moreover, advancements in drug delivery technologies are anticipated to make the oral form of Ozempic more effective and reliable, driving further adoption. The rising focus on patient-centric healthcare solutions and the increasing convenience associated with oral medications are expected to significantly contribute to the growth of this segment.

Distribution Channel Analysis

The hospital pharmacies held a significant share of 46.8% as hospitals continue to serve as primary centers for diabetes management and treatment. Hospitals are anticipated to increase their reliance on medications like Ozempic due to the rising prevalence of type 2 diabetes and the need for more effective management options.

Hospital pharmacies are likely to expand their offerings of specialized drugs to meet patient needs and improve outcomes, thus driving growth. As healthcare systems increasingly focus on providing comprehensive diabetes care, hospital pharmacies will play a critical role in ensuring timely access to Ozempic for patients. Additionally, collaborations between pharmaceutical companies and hospitals are expected to strengthen the availability and distribution of Ozempic, further driving growth in this segment.

Key Market Segments

Route of Administration

- Oral

- Parenteral

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Growing Prevalence of Obesity Driving the Ozempic Market

Rising obesity rates are expected to drive the expansion of the Ozempic market as more individuals seek effective weight management solutions. A 2023 report from the World Obesity Atlas predicts that by 2035, more than 4 billion people worldwide will be classified as overweight or obese (BMI ≥25kg/m²). Among them, nearly 2 billion individuals, including both adults and younger populations, are expected to fall into the obesity category (BMI ≥30kg/m²), highlighting a growing global health challenge.

As obesity-related complications such as type 2 diabetes and cardiovascular diseases increase, demand for effective treatments is anticipated to grow. Ozempic, originally developed for diabetes management, has gained traction for its ability to aid weight loss by regulating appetite and improving metabolic function. Physicians increasingly prescribe this medication to patients struggling with obesity-related health risks.

With growing awareness about the long-term impact of excess weight on overall health, more individuals are seeking prescription-based solutions. The rise of non-invasive pharmaceutical interventions for weight loss further strengthens the market.

Healthcare providers recognize Ozempic as a viable option for individuals facing difficulties with conventional weight-loss methods. Clinical studies continue to demonstrate its effectiveness in managing both diabetes and obesity, further reinforcing its adoption. Increased investment in obesity management programs is expected to support market expansion. The pharmaceutical sector is witnessing rising research and development efforts aimed at improving GLP-1 receptor agonists, leading to a more competitive and evolving treatment landscape.

Restraints

High Cost as a Restraint in the Ozempic Market

Rising medication costs are expected to limit the widespread adoption of Ozempic, creating a financial burden for patients and healthcare systems. The high retail price of Ozempic, which can exceed USD 900 per month without insurance, makes it inaccessible for many individuals. Even with insurance coverage, high copayments and limited reimbursement policies may hinder patient affordability.

Many healthcare providers hesitate to prescribe the medication due to cost-related adherence issues, as patients often discontinue use when facing financial constraints. In regions with limited healthcare subsidies, individuals with lower incomes struggle to afford long-term use of GLP-1 receptor agonists. The competitive market for weight management and diabetes treatment includes alternative therapies that may be more affordable.

While Ozempic demonstrates significant efficacy, cost concerns pose challenges in market penetration, particularly in low- and middle-income countries. To expand accessibility, pharmaceutical companies and policymakers must work toward pricing strategies that balance innovation with affordability.

Opportunities

High Occurrence of Diabetes as an Opportunity in the Ozempic Market

Increasing diabetes prevalence is expected to create significant opportunities for the Ozempic market as healthcare systems prioritize effective disease management solutions. The International Diabetes Federation projects that by 2030, the number of adults aged 20-79 living with diabetes will climb to 643 million, underscoring the urgent need for enhanced prevention and management strategies to mitigate the rising impact of the disease.

As a GLP-1 receptor agonist, Ozempic plays a crucial role in improving glycemic control and reducing diabetes-related complications. Physicians increasingly recommend it as part of a comprehensive approach to managing type 2 diabetes, particularly in patients at risk of cardiovascular disease. The drug’s ability to promote weight loss further enhances its appeal, as obesity remains a leading risk factor for diabetes.

Pharmaceutical companies continue to invest in research to expand indications and improve patient accessibility. Government initiatives aimed at improving diabetes care are expected to drive market expansion by increasing medication availability.

As awareness about diabetes management grows, more patients are likely to seek prescription-based solutions like Ozempic. The shift toward personalized medicine and long-term disease control is anticipated to accelerate the adoption of advanced GLP-1 therapies in diabetes care.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the Ozempic market. On the positive side, rising global demand for effective treatments for type 2 diabetes and obesity has fueled the growth of Ozempic as a leading medication. Additionally, expanding access to healthcare and increasing healthcare spending, particularly in emerging markets, has boosted demand for diabetes medications.

However, the market faces challenges due to high prices, which can limit affordability in lower-income regions. Geopolitical tensions and regulatory changes in different countries may also affect the supply chain and availability of the medication.

For example, supply disruptions resulting from global trade restrictions or regulatory hurdles may slow market growth. Despite these challenges, the continued focus on addressing diabetes and obesity, along with ongoing clinical advancements, presents a strong outlook for Ozempic’s market expansion.

Latest Trends

Increasing Use of Weight-Management Driving the Ozempic Market:

The increasing use of Ozempic for weight management has become a major trend driving the medication’s market. High levels of obesity globally and the growing awareness of its link to various chronic conditions have led to a rise in demand for weight-loss medications. Ozempic, originally developed for type 2 diabetes, has gained significant attention due to its off-label use for weight management. The trend is expected to continue as more individuals seek effective, medically approved treatments for obesity.

The medication’s role in addressing weight issues, along with its proven effectiveness in managing blood sugar levels, has positioned it as a popular solution for those struggling with weight control. According to a November 2023 report from Germany’s regulatory authority, BfArM, the growing demand for Ozempic, particularly for weight management, has caused strain on its availability in European healthcare systems, demonstrating the high demand for such treatments.

Regional Analysis

North America is leading the Ozempic Market

North America dominated the market with the highest revenue share of 42.3% owing to the rising prevalence of type 2 diabetes and increasing awareness of GLP-1 receptor agonists for effective blood sugar management. According to the CDC’s National Diabetes Statistics Report 2022, more than 130 million adults in the U.S. are affected by diabetes or prediabetes, with marginalized communities disproportionately impacted due to healthcare disparities.

The expanding adoption of Ozempic as both a diabetes treatment and a weight management solution fueled demand across diverse patient groups. Physicians increasingly prescribed the drug for its dual benefits of glycemic control and weight loss, enhancing its market penetration. Direct-to-consumer marketing strategies and endorsements by healthcare professionals contributed to increased patient awareness. Insurance coverage expansions and reimbursement support further improved accessibility.

Additionally, research highlighting the cardiovascular benefits of GLP-1 receptor agonists encouraged broader acceptance among physicians and patients, reinforcing North America’s growing demand for advanced diabetes therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising type 2 diabetes cases and increasing healthcare accessibility. Expanding urbanization and lifestyle changes in countries like China, India, and Japan are likely to contribute to higher obesity and diabetes rates, boosting demand for advanced treatment options. Government initiatives promoting diabetes awareness and early intervention are anticipated to drive prescription rates.

Collaborations between international pharmaceutical companies and regional healthcare providers are expected to improve product availability and affordability. The growing middle-class population, with increased healthcare spending, is likely to accelerate adoption. Expanding insurance coverage and reimbursement programs for diabetes management are projected to enhance patient access.

Additionally, the rising integration of digital health platforms and telemedicine for chronic disease management is expected to further support market growth across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Ozempic market focus on expanding production capacity and improving supply chain efficiency to meet rising demand for diabetes and weight management treatments. Companies invest in clinical research to explore new therapeutic applications and enhance formulation effectiveness.

Strategic collaborations with healthcare providers and digital health platforms help increase patient access and adherence. Emphasis on direct-to-consumer marketing and physician education strengthens brand recognition and prescription rates. Many players also prioritize regulatory approvals in new markets to drive global expansion.

Novo Nordisk is the leading company in this market, manufacturing Ozempic as a GLP-1 receptor agonist for type 2 diabetes management. The company focuses on continuous innovation, expanding treatment indications, and ensuring widespread accessibility. Novo Nordisk’s commitment to research and patient-centric solutions solidifies its position as a key player in the diabetes care industry.

Top Key Players

- Novo Nordisk

- Mylan

- Hanmi Pharmaceutical

- Gmax Biopharm

- Eli Lilly

- Boehringer Ingelheim

- Biolingus

- AstraZeneca

Recent Developments

- In October 2024, Mylan finalized an agreement with Novo Nordisk to resolve a legal dispute over drug patents in the United States. As part of the settlement, Mylan and India-based Natco Pharma secured exclusive rights to introduce a generic alternative to semaglutide, positioning them as the first companies authorized to bring a lower-cost version to the US market. This move is expected to expand access to diabetes and weight management treatments while increasing competition in the pharmaceutical sector.

- In September 2023, Novo Nordisk informed Australia’s Therapeutic Goods Administration and the Ozempic Medicine Shortage Action Group that supply constraints would persist into 2024. The company attributed the shortage to soaring demand, particularly for lower-dose formulations, as off-label prescriptions surged beyond its approved indications.

Report Scope

Report Features Description Market Value (2024) US$ 8.2% billion Forecast Revenue (2034) US$ 24.0 billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Route of Administration (Oral and Parenteral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novo Nordisk, Mylan, Hanmi Pharmaceutical, Gmax Biopharm, Eli Lilly, Boehringer Ingelheim, Biolingus, and AstraZeneca. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novo Nordisk

- Mylan

- Hanmi Pharmaceutical

- Gmax Biopharm

- Eli Lilly

- Boehringer Ingelheim

- Biolingus

- AstraZeneca